Retailers need help sensing US sales taxes due to the variety of tax rates in each state. Most merchants working in the country deal with several sales tax regulations and rules. A few states, such as New Hampshire, Delaware, Oregon, and more, are exceptions from the sales tax. Sales tax permits are easily acquired in a state if you have a sales tax nexus. The collection of sales tax is tricky for most vendors in the United States. You can efficiently compute sales tax as per your desired state in the US using Odoo ERP support. Odoo 16 Accounting module runs the tax calculation and makes it easy to evaluate the company’s performance through tax reports.

This blog emphasizes using Kansas(US) Sales Tax within the Odoo 16 Accounting module.

Tax account configuration, computing tax rates based on TaxCloud, fiscal country setup, and currency management of your organization are made accessible within the Odoo 16 Accounting application. We can also manage a company’s payments, bills, and invoices in the Accounting module. Let’s view the usage of Kansas(US) Sales Tax in the Odoo 16 Accounting.

Overview of Kansas(US) Sales Tax

The average state sales tax rate of Kansas is 6.5%. Local government imposes a charge of up to 4% as a sales tax in Kansas. Kansas’s maximum sales tax rate is 11.5% in several cities, such as Coffeyville, Leavenworth, and more. Some services and tangible products are taxable in Kansas(US). Construction materials, meals, drinks, and computer software are exceptions from sales tax.

It is possible to register sales tax within the Kansas Department of Revenue. Before registration, you must submit some essential information. It includes location information, tax type, business info, annual sales estimation, etc. As per buyer destination, sellers in Kansas apply sales tax. You must file sales tax quarterly, monthly or yearly in the specific state.

To Create Kansas(US) Company Data in Odoo 16

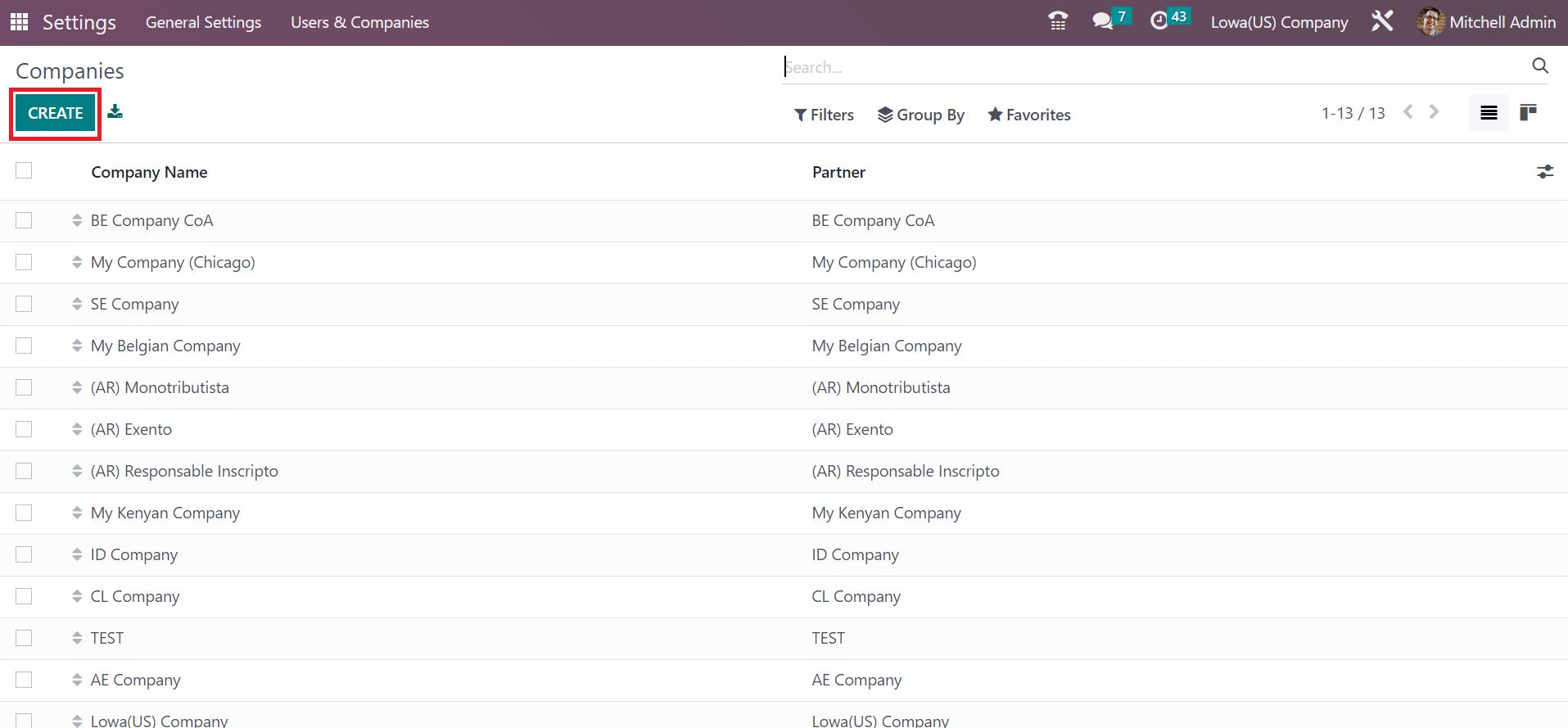

In Odoo 16, users can manage multi-companies based on business requirements or needs. For generating company facts, click the Companies menu in Odoo 16 Settings. On the Companies page, you can find reports of each company separately. By choosing the CREATE symbol, we can develop new firm information in Odoo 16.

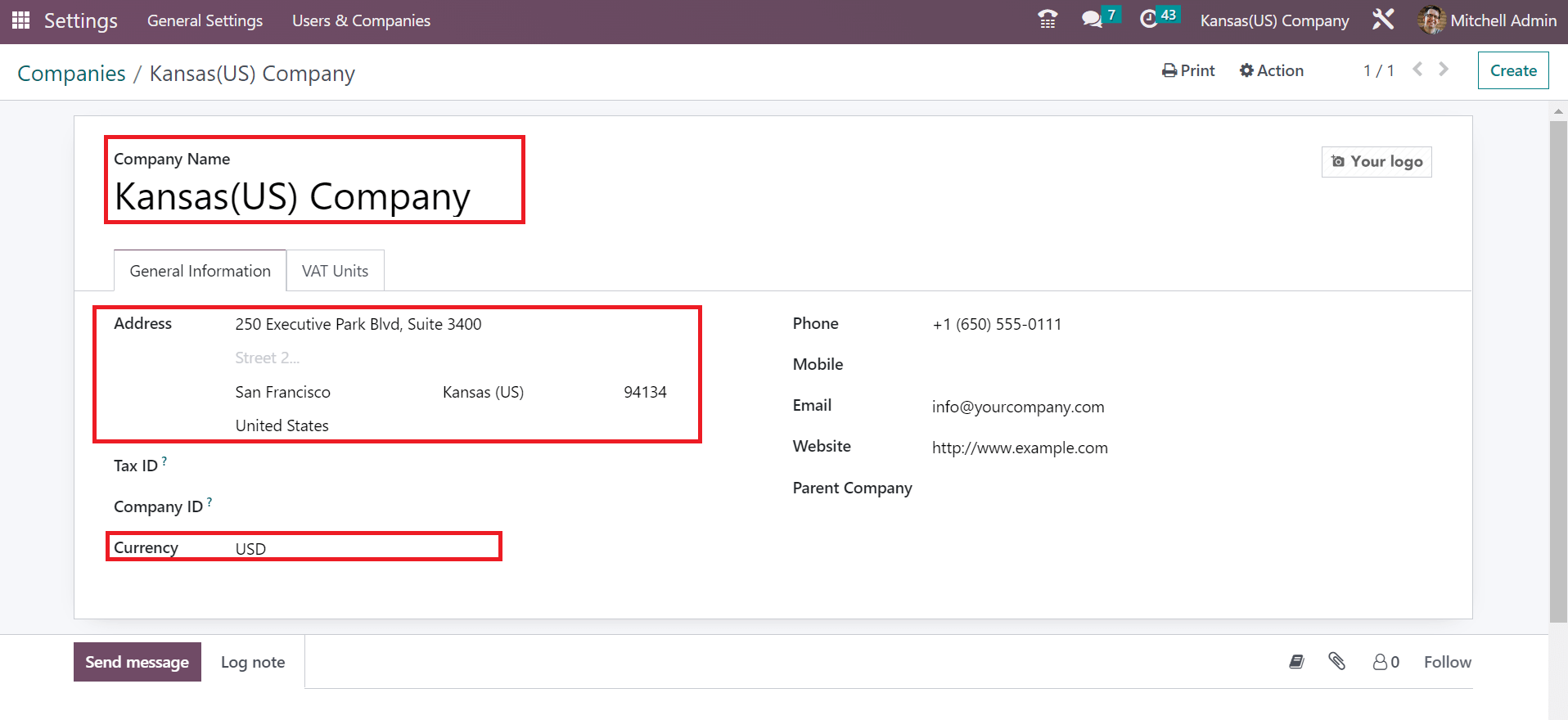

You can add Kansas(US) Company in the Company Name field on the open screen. Afterward, set the street name, state, pin code, and country on the Address under the General Information section, as illustrated in the screenshot below.

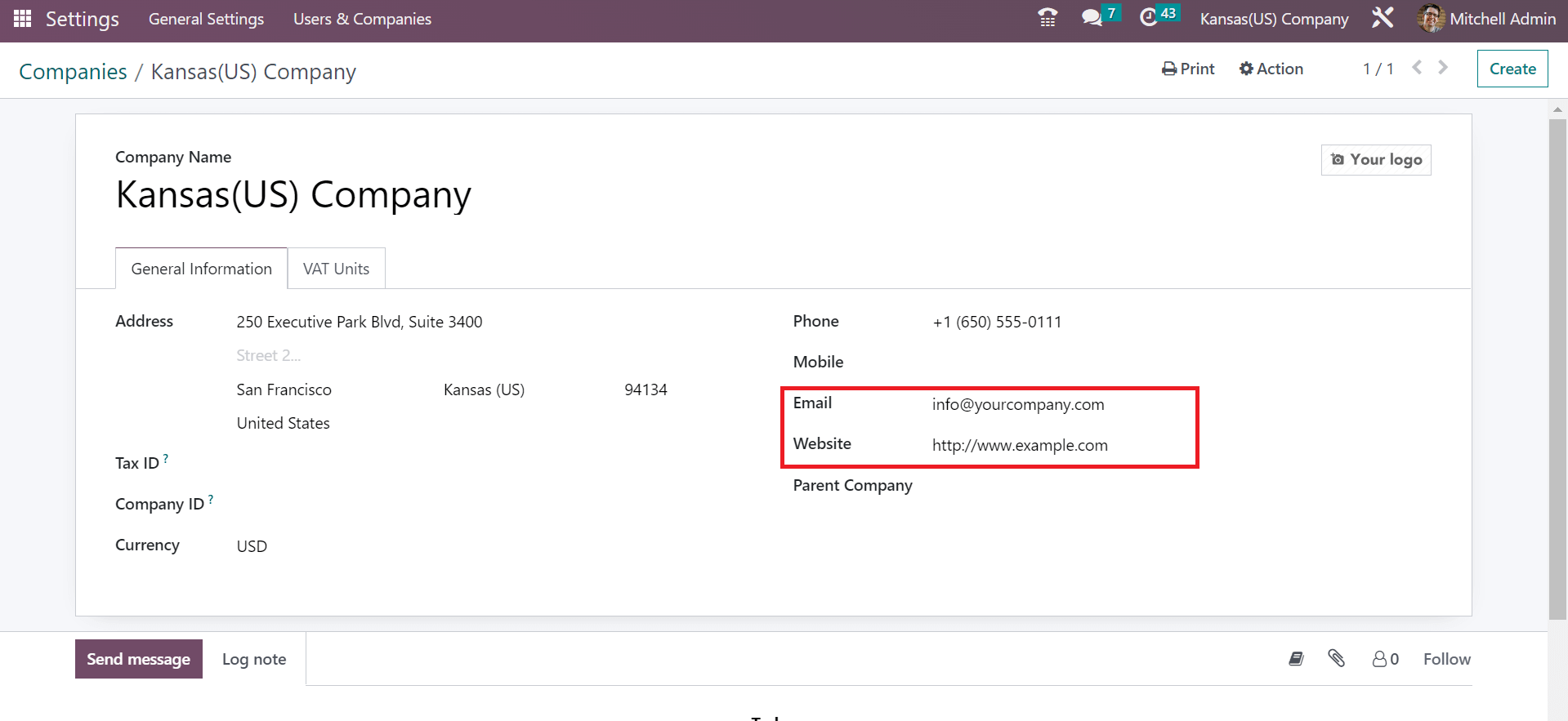

Here, we mention Kansas(US) as the state and the United States as the Country for Kansas(US) Company. Also, you must specify bank notes related to your company in the Currency field as USD. Enter the electronic mail id of your company in the Email option and the link related to the company’s official site in the Website option, as demonstrated in the screenshot below.

After manually saving the details, let’s move to Odoo 16 Accounting application and produce Kansas sales tax.

Kansas(US) Sales Tax Computation in Odoo 16 Accounting

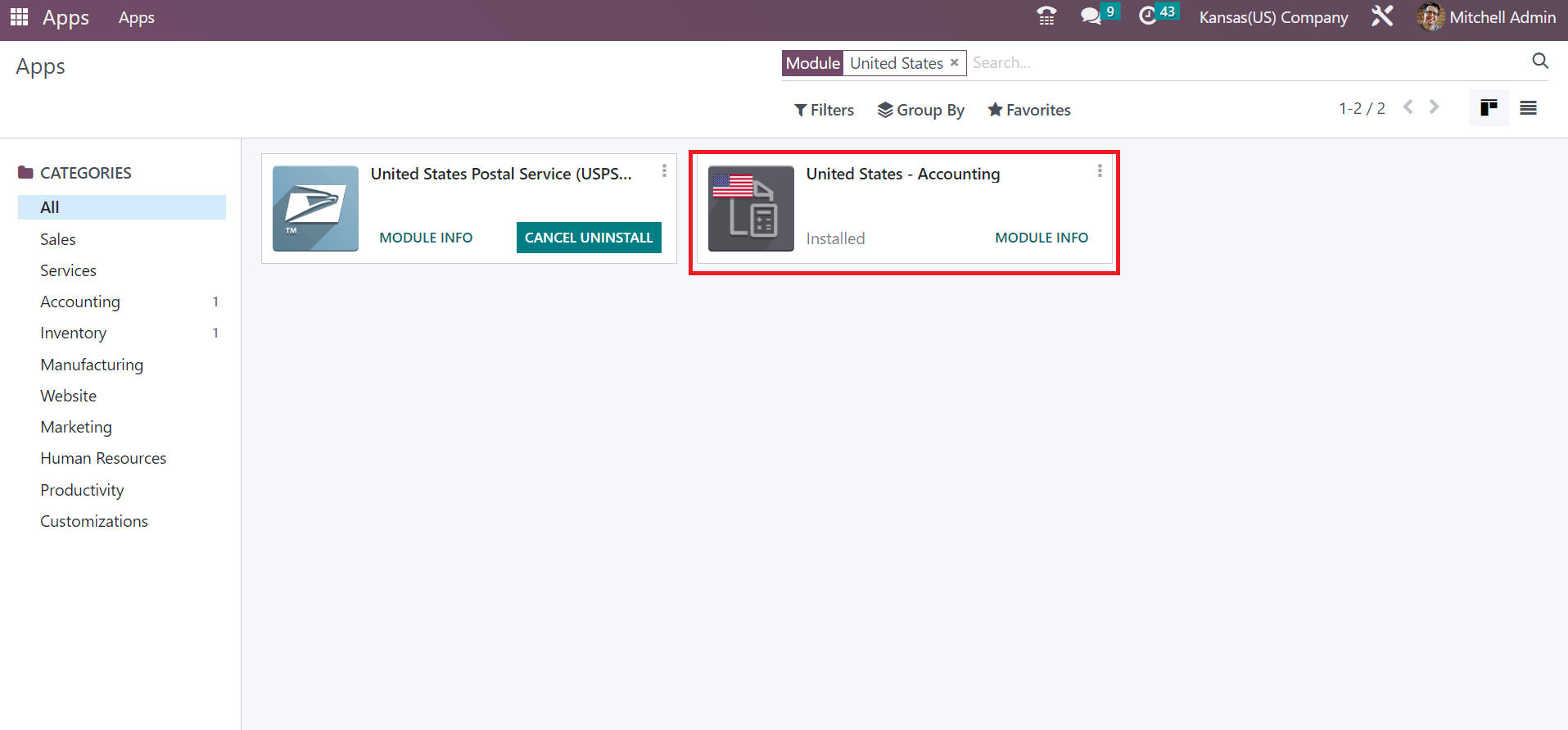

Several localization modules exist in the Odoo 16 that pre-load default taxes. It is essential to install a localization module of the US from the Odoo Apps. In the Apps window, install United States – Accounting, as notified in the screenshot below.

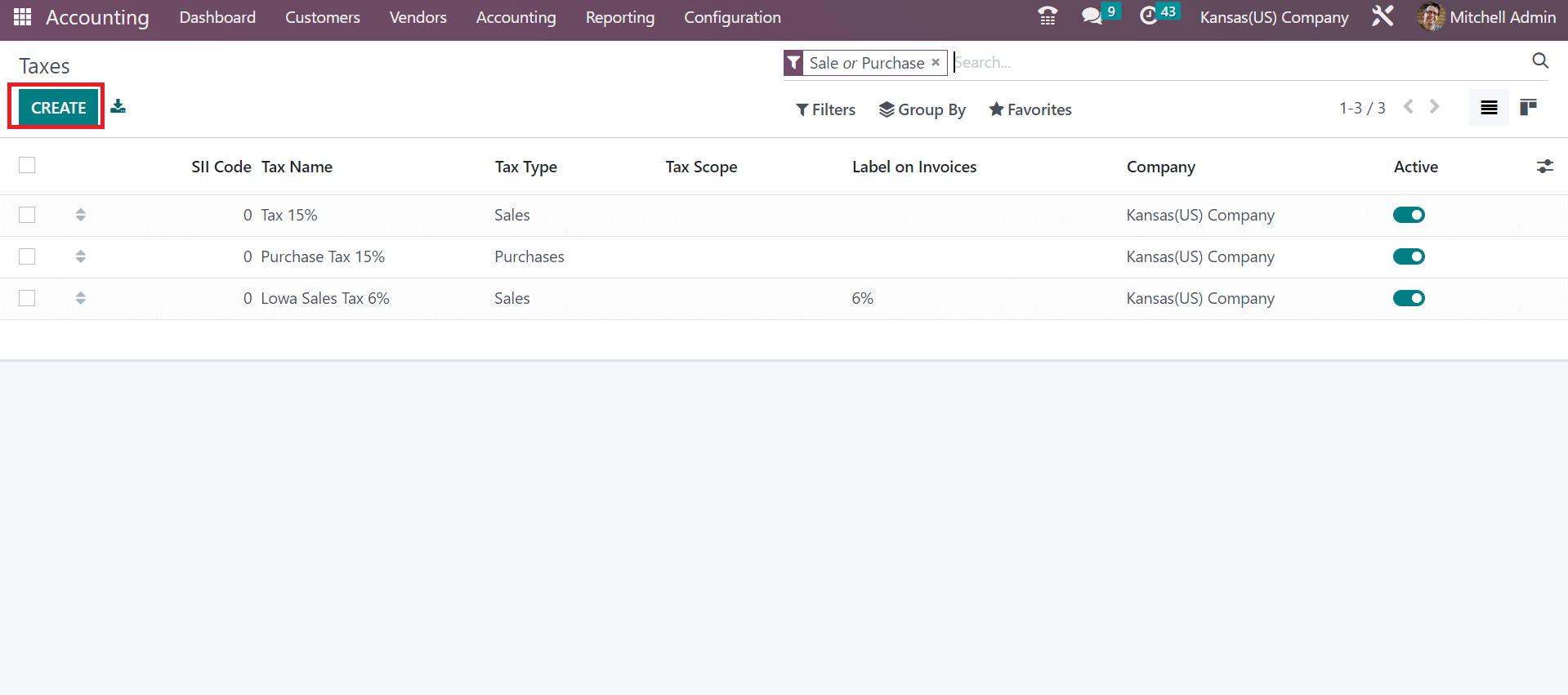

After installing the module, it is easy to manage taxes based on each state in the United States. Users can acquire the Taxes menu from the Configuration feature of Odoo 16 Accounting. A list of all configured taxes is obtainable to a user in the Taxes window. Users can form Kansas sales tax after clicking on the CREATE icon, as indicated in the screenshot below.

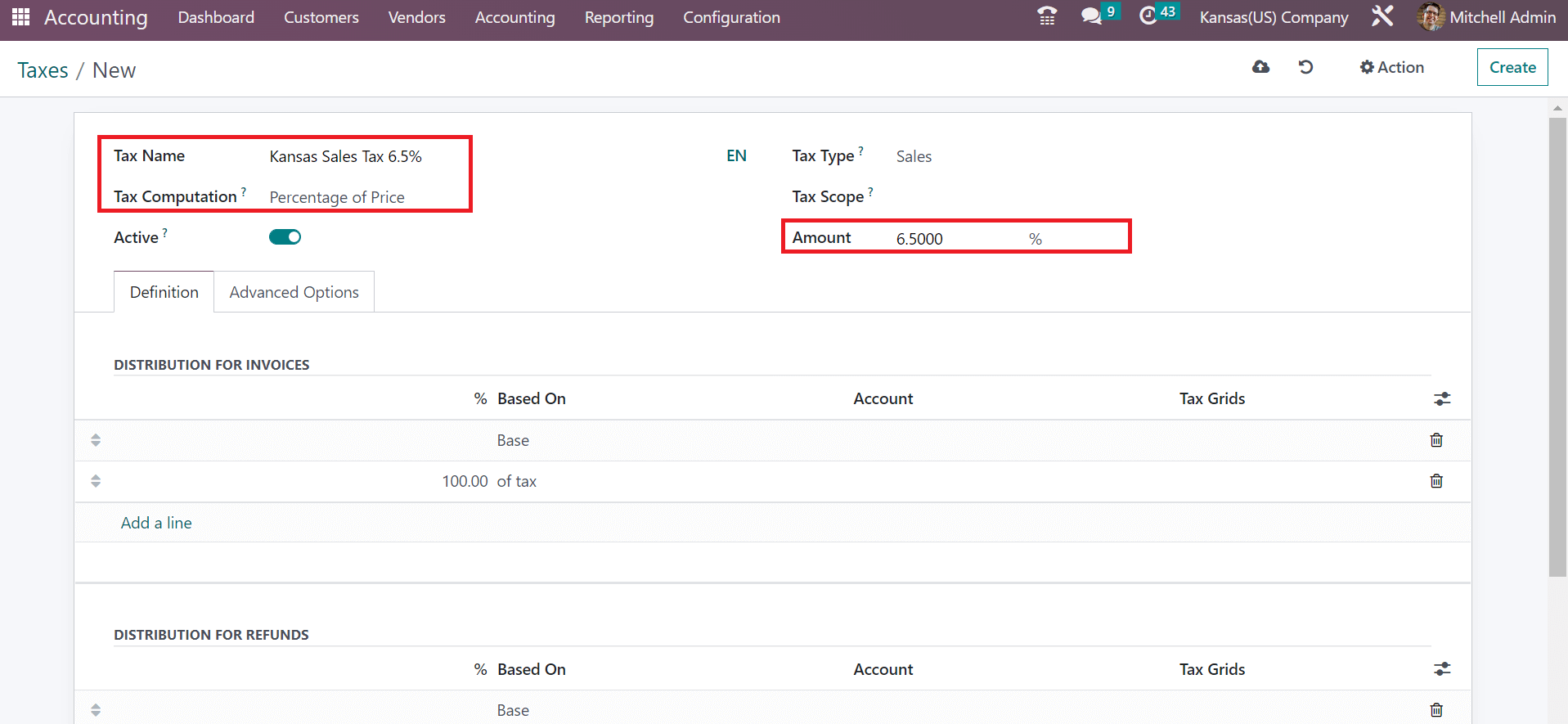

Apply the name of tax as Kansas Sales Tax 6.5% in Tax Name. Users can set the tax amount as a cost percentage once selecting the Percentage of Price in the Tax Computation field.

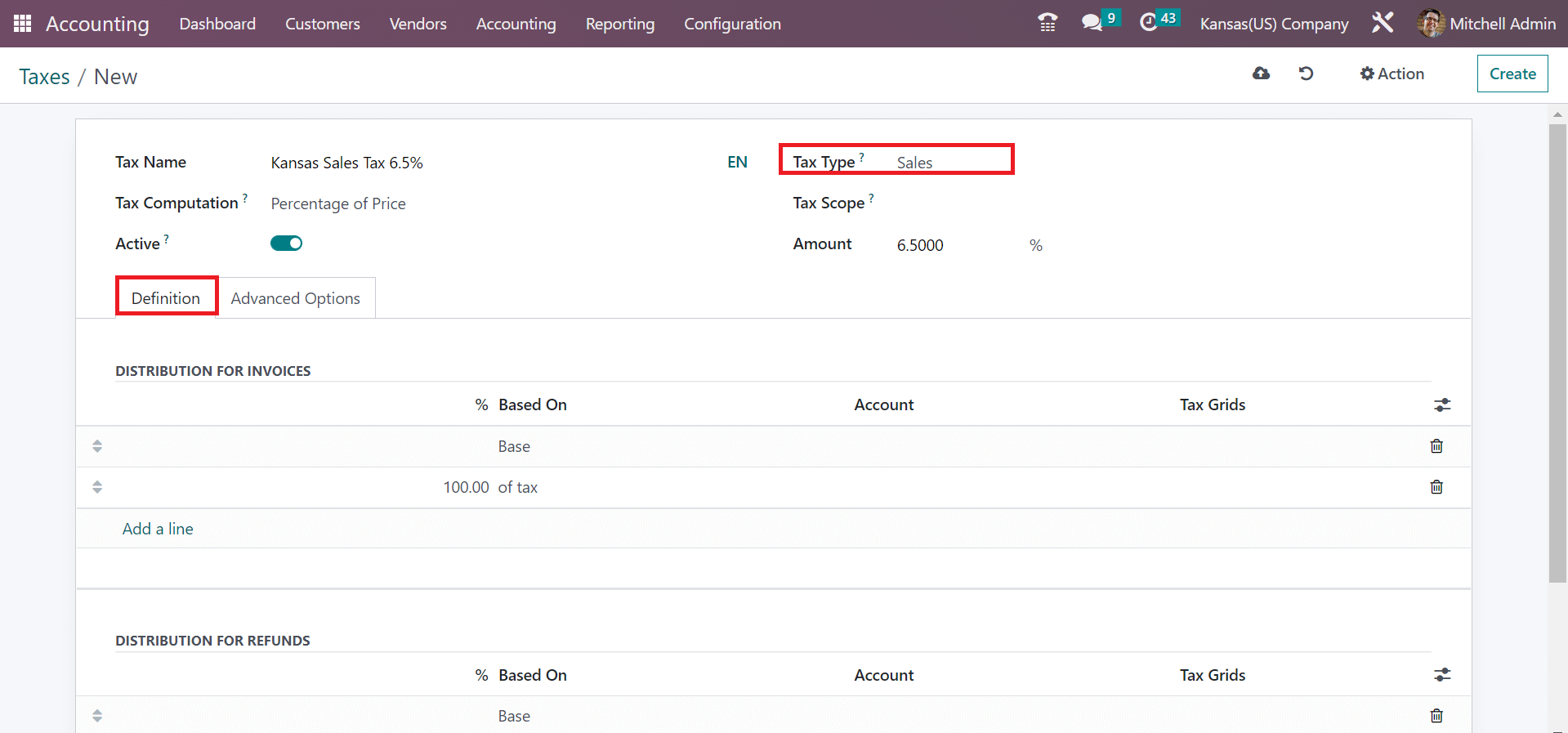

Add the tax amount in percentage format within the Amount option, as shown in the screenshot above. For example, if you want a 6.5% percent sales tax, you must enter 6.5 in the Amount field. Moreover, you can pick your tax category as None, Purchase, or Sales. We selected Sales as the Tax Type of Kansas Sales Tax of 6.5%.

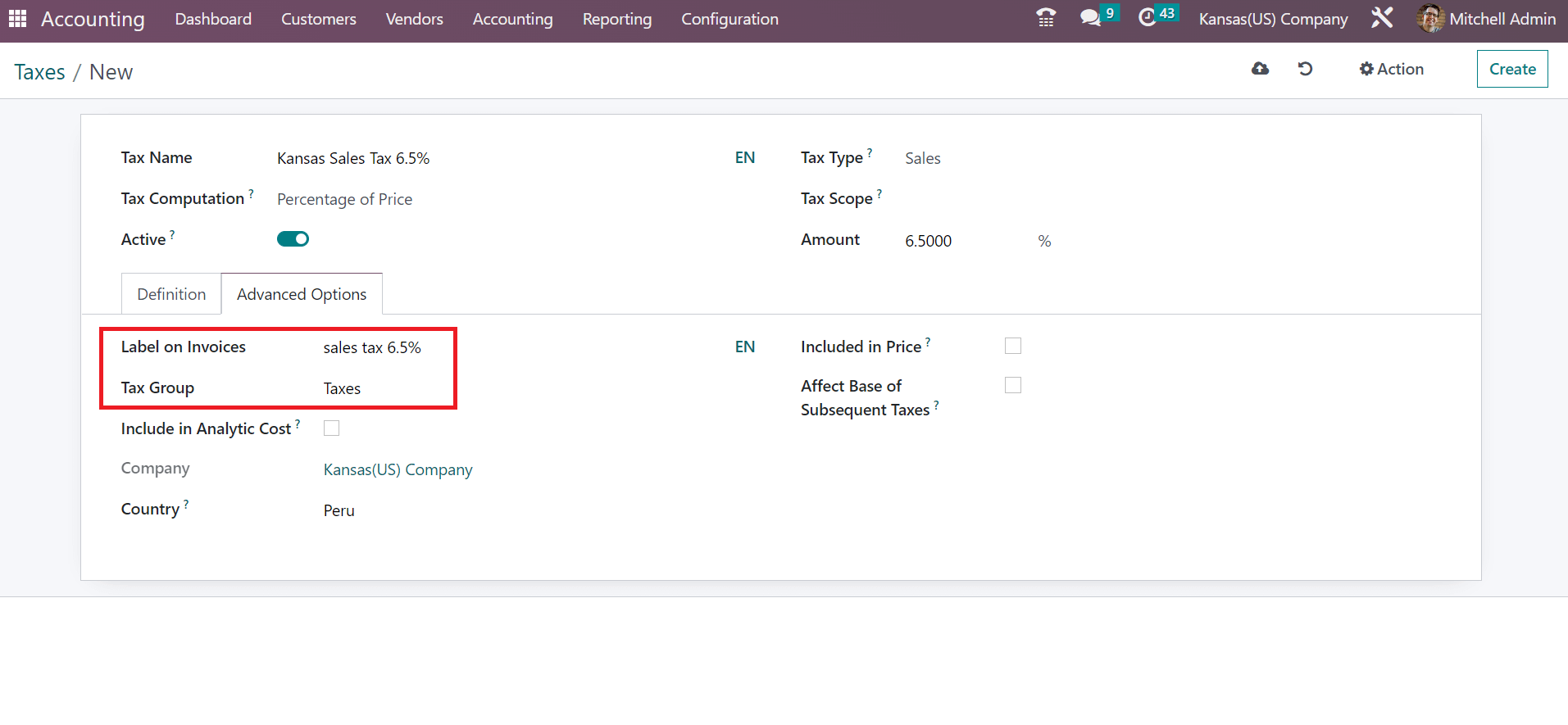

Users can outline tax distribution on various accounts below the Definition section. Click the Add a line option under each section to add a new entry. Below the Advanced Options, specify the label visible on the invoice for your tax within Label on Invoices. It is possible to group taxes on sale orders and invoices after allowing the Tax Group field. We picked the Taxes option as a Tax Group for the Kansas Sales Tax of 6.5%, as represented in the screenshot below.

Statistics about your sales tax are saved manually in the Odoo 16. Next, we can apply the created sales tax rate on an invoice in the Accounting application.

Steps to Apply Kansas Sales Tax on a Customer Invoice in Odoo 16

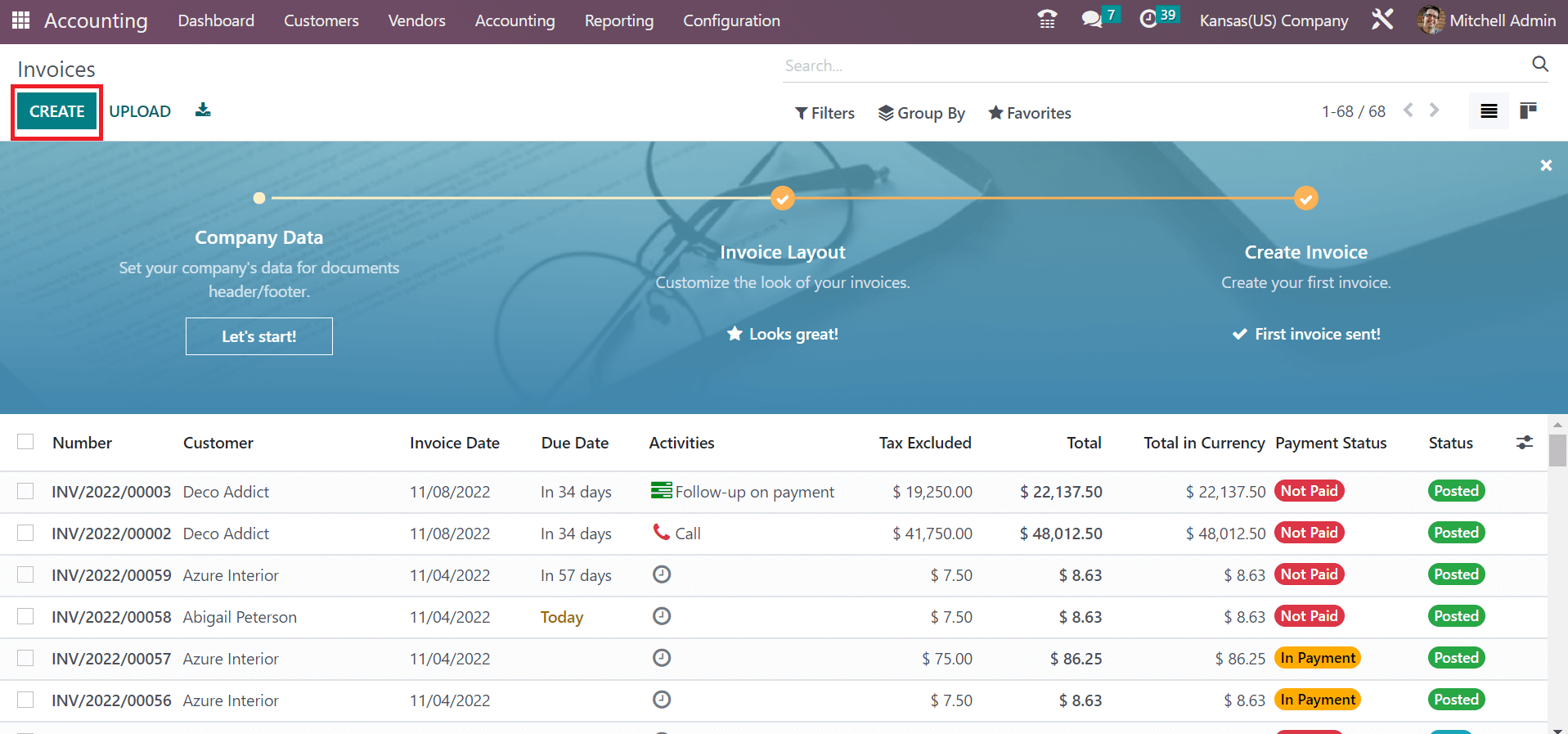

Invoice creation for a customer is an easy process using Odoo 16 Accouting. Users can obtain the Invoices menu from the Customers tab, and all created invoices’ history is accessible. We can see the customer name, status, number, and due date of each invoice separately in the Invoices window. To develop a customer invoice, you can choose CREATE button as stated in the screenshot below.

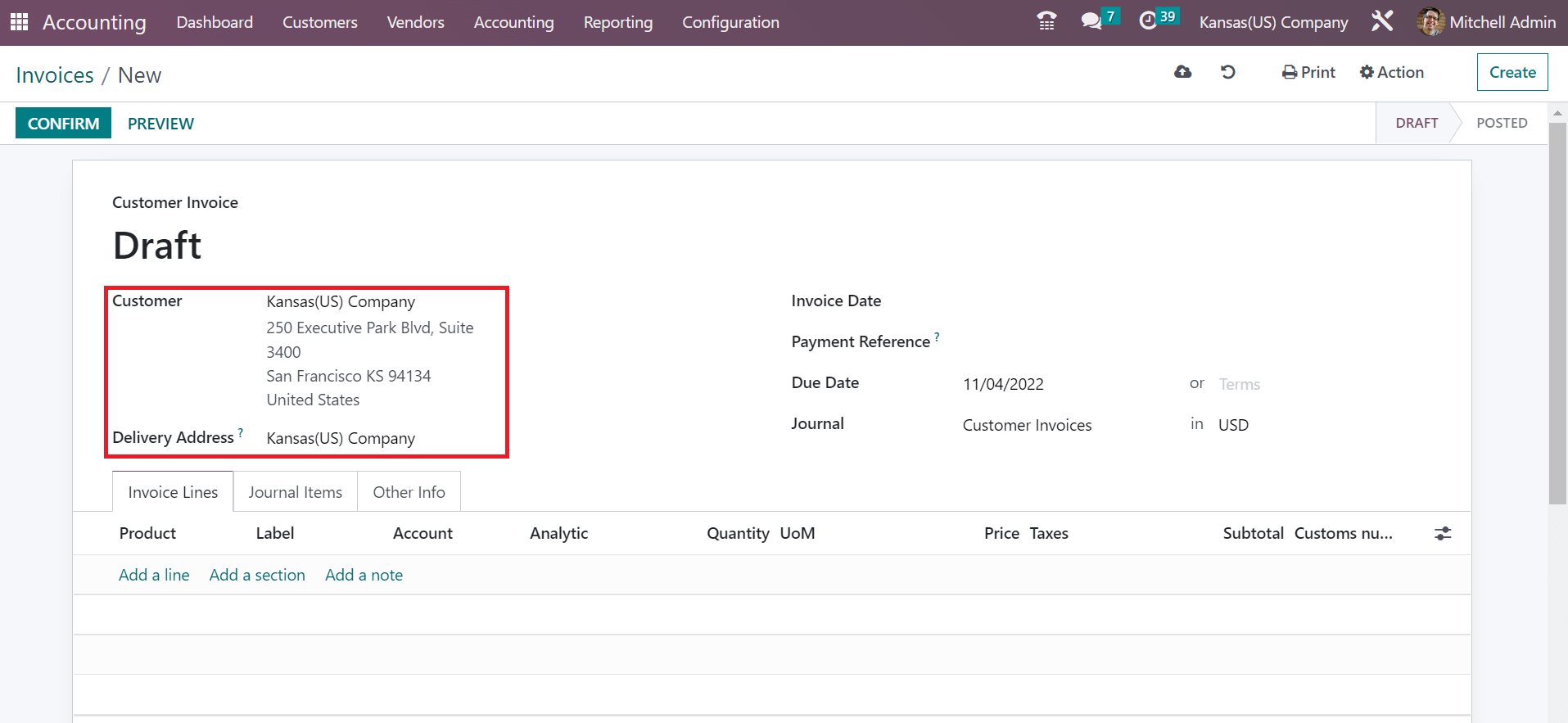

We can select the partner as Kansas(US) Company in the Customer field in the Invoices window. The delivery address for your buyer is visible below the Customer option, as defined in the screenshot below.

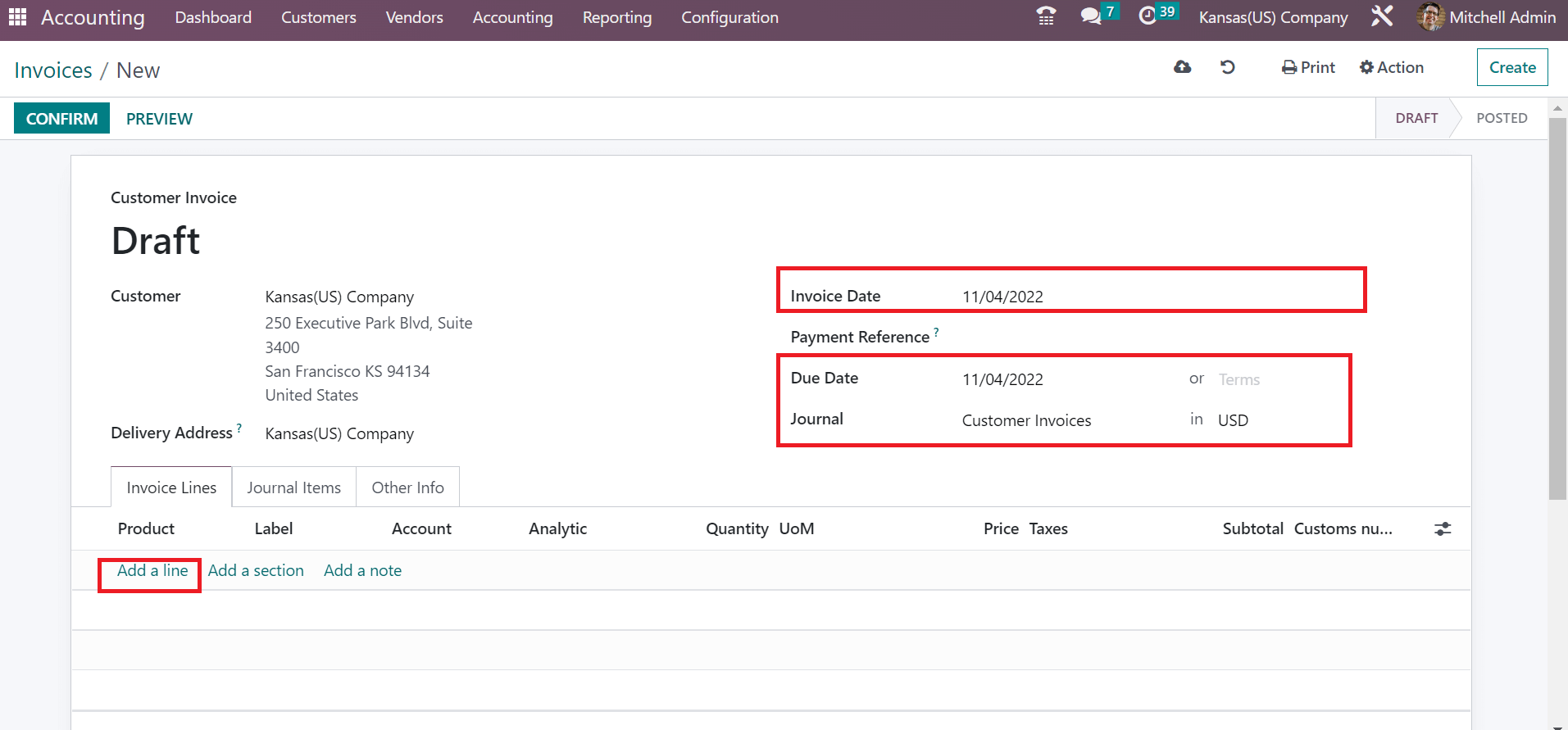

You can add the customer invoice date and day end on the Due Date option. Moreover, pick your journal for the invoice and select the currency. After applying standard details, the user can choose the product by pressing the Add a line under the Invoice Lines section, as signified in the screenshot below.

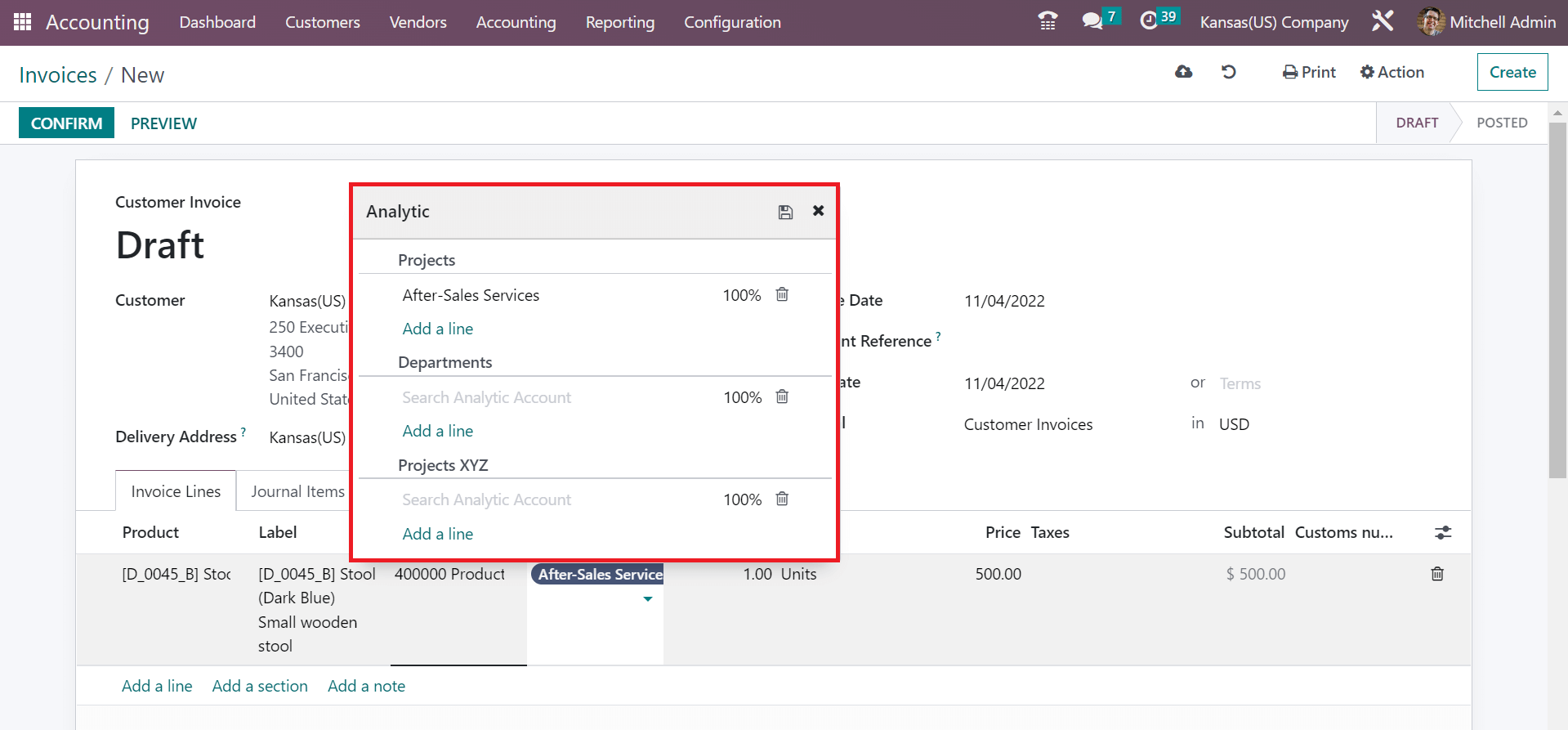

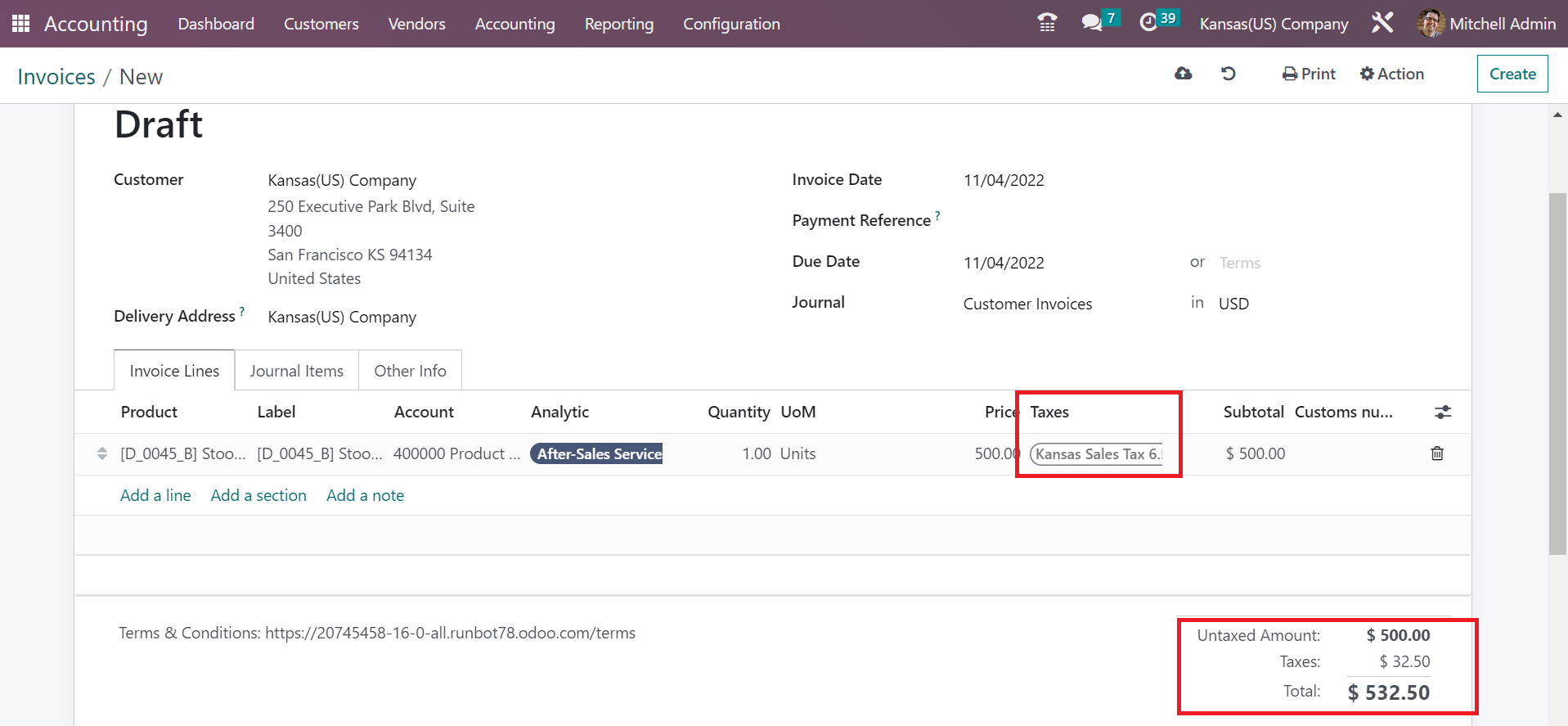

We go for one count of Stool with a price of 500. It is possible to set analytic account for your commodity. By selecting the Analytic section, a pop-up box opens to you, and the user can search it for projects, departments, etc. We pick analytic accounts from the Projects section, as marked in the screenshot below.

After choosing the Analytic account, select Kansas Sales Tax 6.5% under the Taxes section. Later, we can attain the total price of an item at the end applied with your tax rate, as represented in the screenshot below.

We can save details manually in the Odoo 16 and confirm the customer invoice.

Sales tax estimation of your company according to each state facilitated within the Odoo 16 Accounting. You can boost workflow and accounting transactions by running ERP software for your business.

![Odoo Sales Promotion [ odoo v11 ] – CBMS Odoo ERP Odoo Sales Promotion [ odoo v11 ] – CBMS Odoo ERP](https://home.mycbms.com/wp-content/uploads/2024/10/cbodoo-420x345.jpg)