Odoo the Open ERP is striving to develop new features and functionalities each year. Odoo has clients all around the globe of which each of the clients is from different locations and their requirements may be different. The tax constraints, rules, and regulations for each country will vary. Hence, the Odoo platform is to be configured with features to benefit country-specific users.

Odoo provides different fiscal localization packages, which define the necessary configuration of taxes, fiscal positions, chart of accounts, and configuration of specific certificates for the accounting module, which are all required to make the ERP usable for the specific country. Typically, the first step in making a localization is to set up the country’s chart(s) of Accounts with the associated dependencies like Account types and taxes.

On each version, Odoo will add new localization packages and fresh features.

Configuration

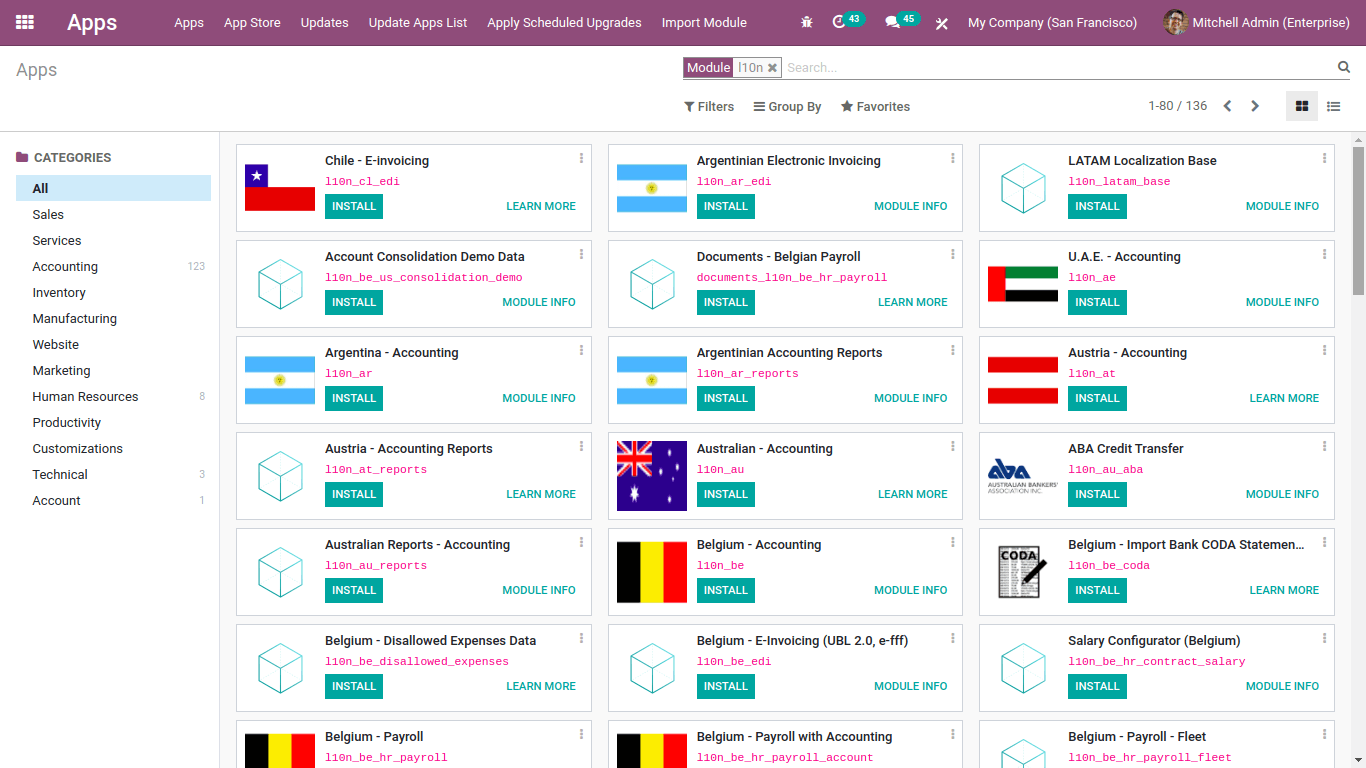

While creating the new database, Odoo will automatically install the localization package based on the country mentioned. Or you can install the required packages from Apps and do the configuration part as depicted in the following image.

New localization packages can be installed from Apps. Search for l10n, you can view the localization packages that Odoo offers.

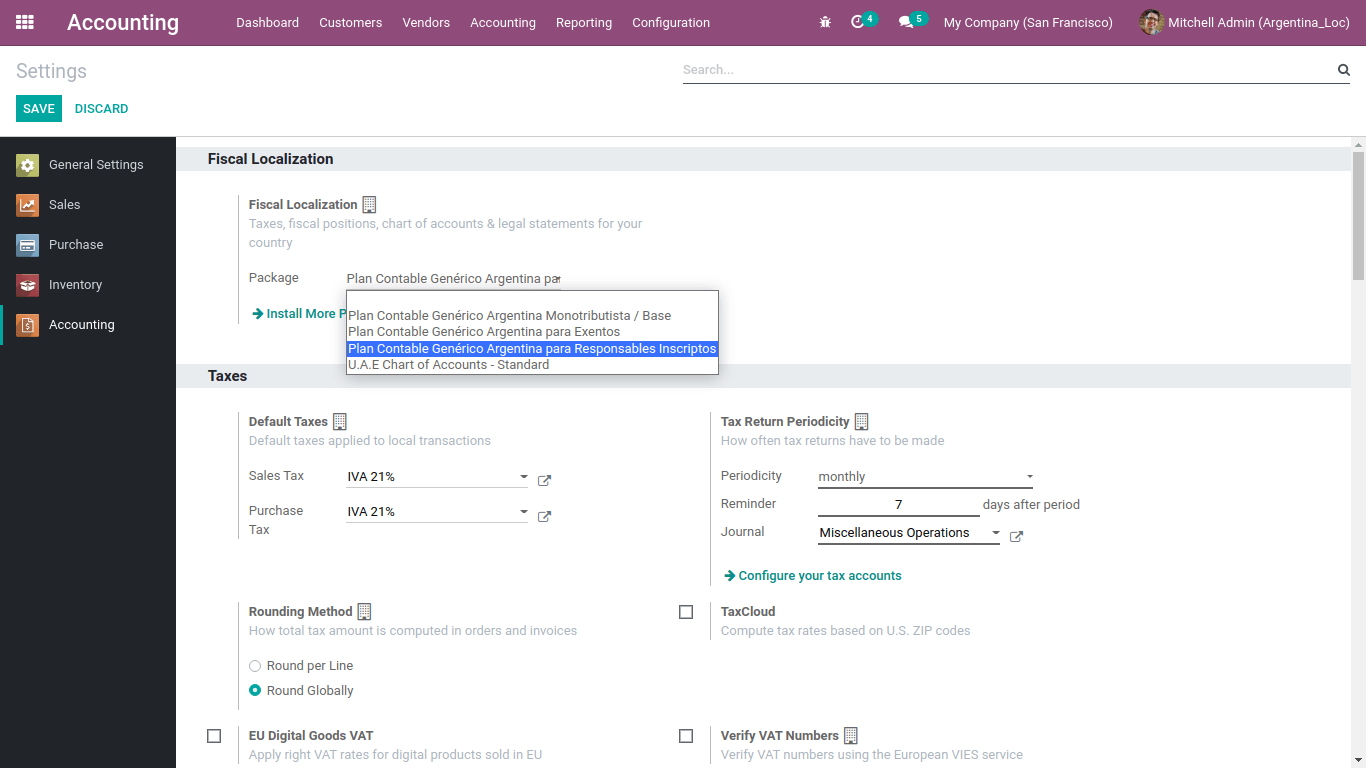

Let’s install Argentina- Accounting (l10n_ar) and go to Accounting module > Configuration > Settings > Fiscal Localisation and choose the localization from the drop-down list and save it.

Until you post any entries, you can always install and add another package.

Argentina Localization

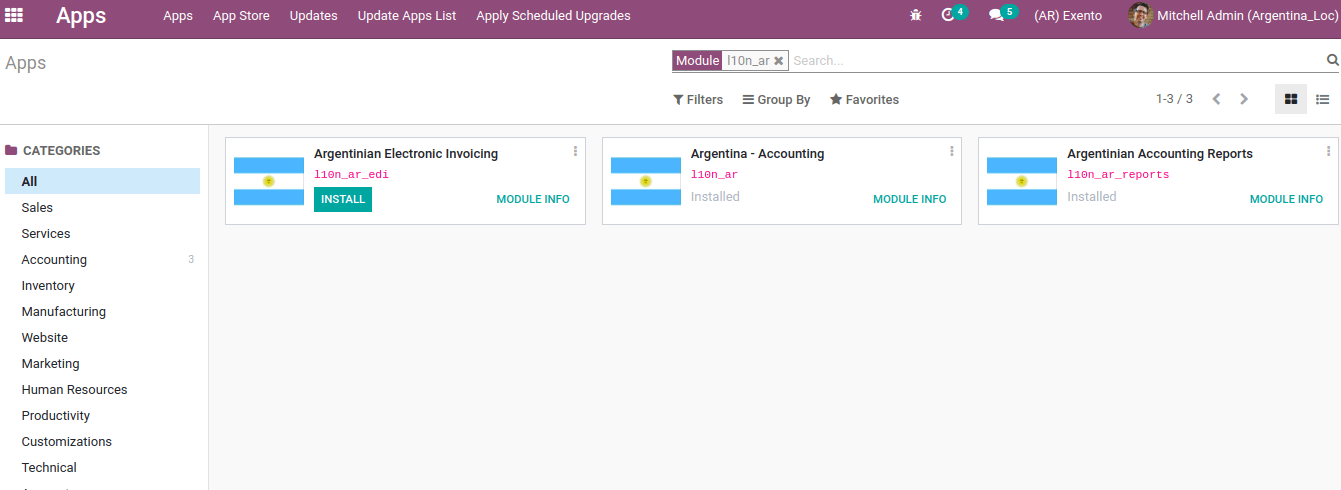

Argentinian localization mainly includes three modules:

1. Argentina – Accounting [ l10n_ar ]

These modules provide the minimal accounting configurations required to operate your company in the Argentinian localization satisfying the rules and regulations of AFIP ( Administración Federal de Ingresos Públicos )

The following image depicts the Argentinian localization modules available in the Odoo platform.

2. Argentinian Accounting Reports [ l10n_ar_reports ]

This module provides a VAT book and VAT summary reports. The VAT book details VAT records on both sales and purchases journal entries while the VAT summary report, which provides the detailed invoice analysis.

3. Argentinian Electronic Invoicing [ l10n_ar_edi ]

This module contains all the standards to generate the electronic invoices from web services, based on the AFIP rules.

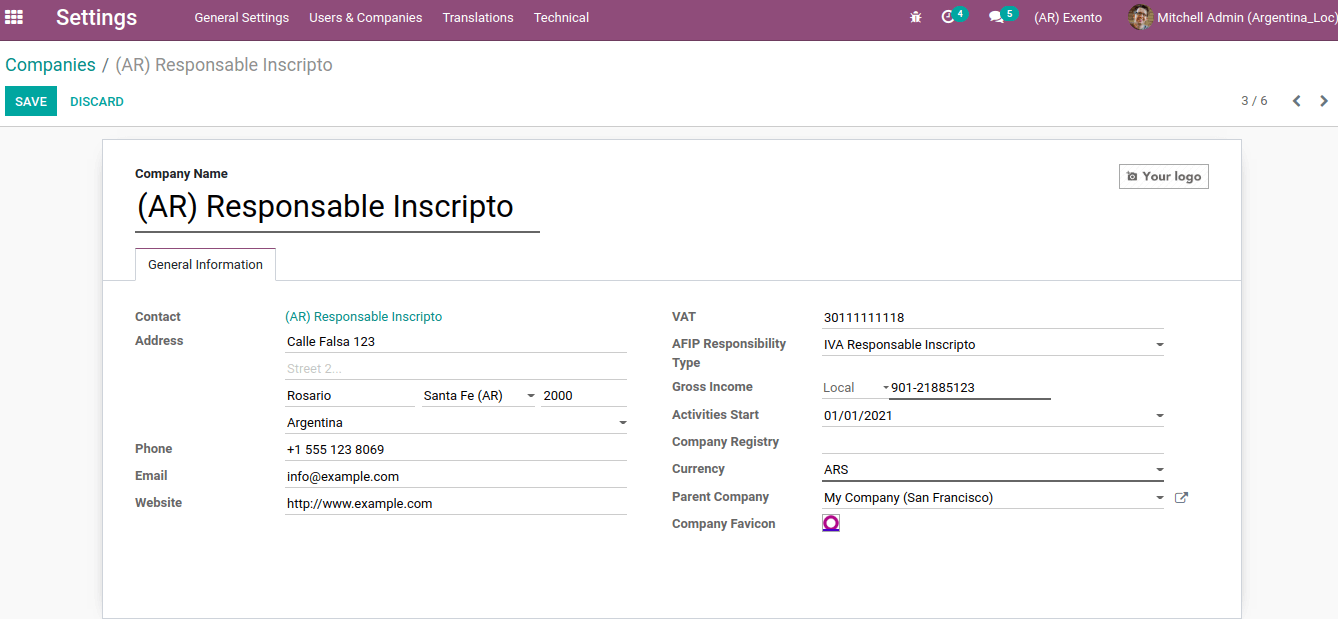

Configuring Company

After installing the localization, the company details also should be configured to optimize the use as depicted in the following image.

There are some new fields introduced while creating the company.

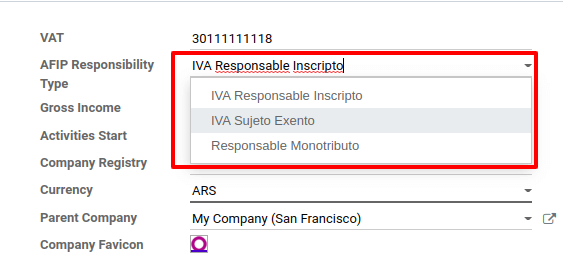

1. AFIP Responsibility Type

This is the term used to identify the type of responsibility that a person or legal entity could have. It impacts the type of operations and requirements. That means AFIP responsibility reflects the company’s responsibility and structure.

The following are the AFIP responsibilities available in the Argentinian localization:

A. ICA Responsable Inscripto (Responsible VAT Registered)

You need to mention the company with the government as involved in production and sales. A special VAT identification number will be issued for companies registered for VAT. So the VAT number will be included in the sales invoice and will be used to reverse charge on sales when the trading is done between two countries within the EU.

B. Responsable Monotributo

C. IVA Sujeto Exento ( VAT Exempt Subject )

2. Gross income

This field is required in order to print the invoice report properly

– Exempt

– Local

– Multilateral

3. Activities start

Start date of the financial entries

As we are clear on configuring the company operations for the Argentinian localization let now move on to understand the configuration aspects of the chart of accounts.

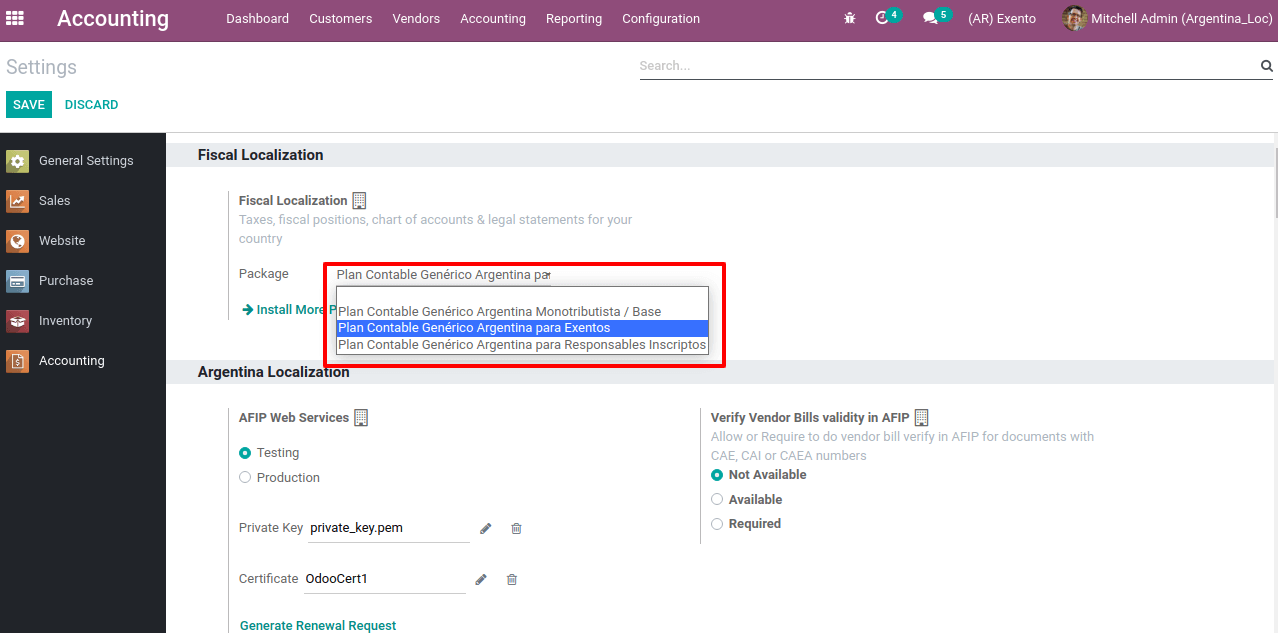

Configuring Chart of Account

Based on the AFIP responsibility type, there are three charts of account packages as depicted in the following image:

The base companies may not need as many accounts as the companies that have given more specific fiscal requisites.

– Monotributista (149 accounts).

– Responsables Inscriptos (166 Accounts).

– IVA Exempto (159 accounts).

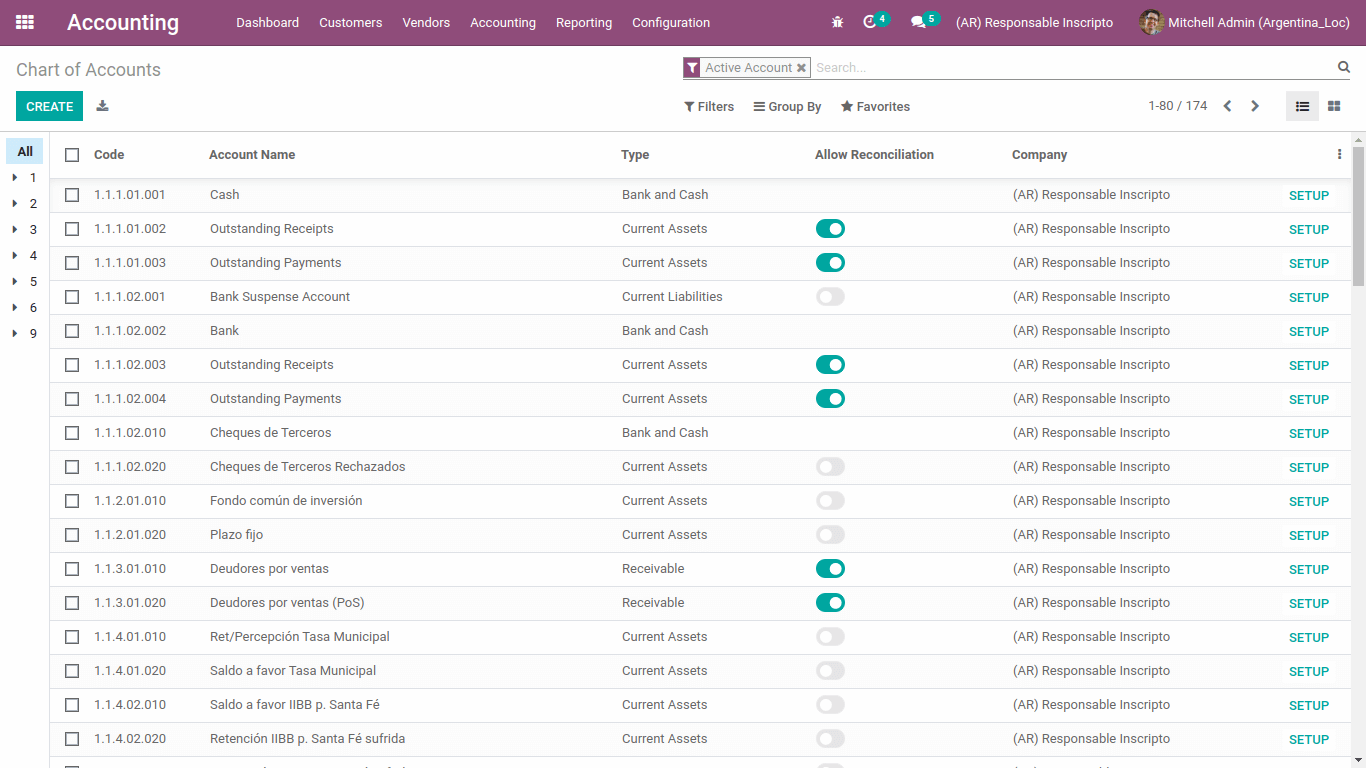

Additionally, the following image depicts the chart of accounts configuration window of the Odoo ERP.

Configuring Master Data

1. Electronic invoice credential

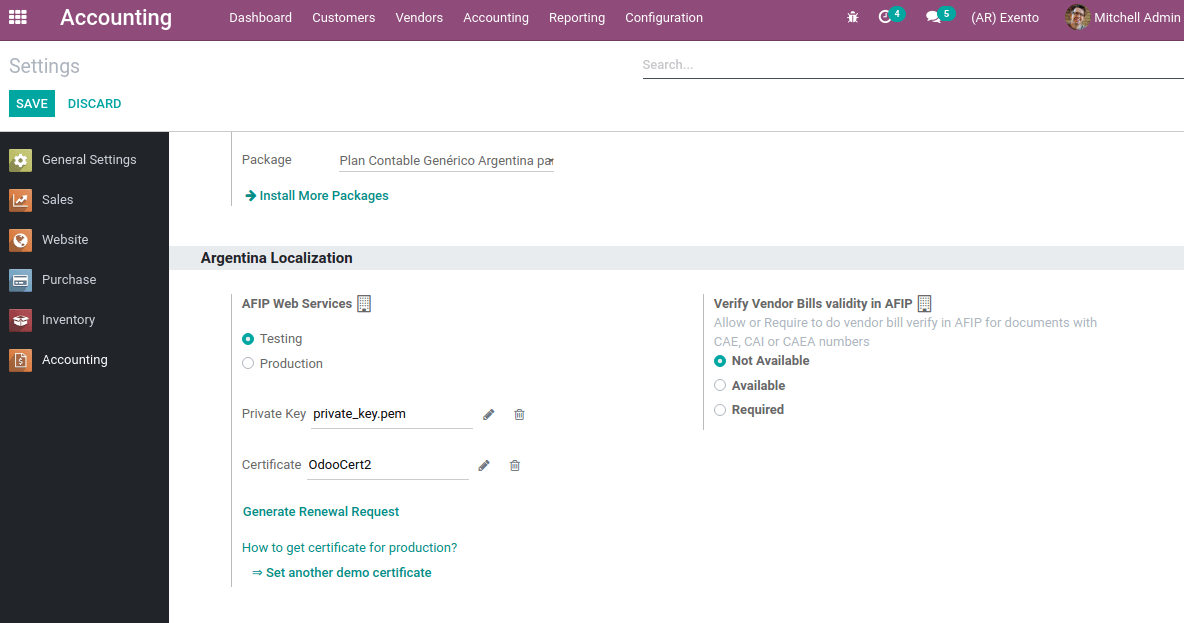

On installing the module l10n_ide, a new feature will appear in the configuration settings of the accounting module. This will help to generate the electronic invoices from web services.

The AFIP web services provide two environments: one for testing and the other is production as depicted in the following image.

Testing is also known as homologation where companies can test their invoice creation in AFIP until they are ready to use the production environment. In the production environment, companies can create real invoices in AFIP.

The instance certificate of the testing environment is not valid for production, since these two environments are entirely isolated from each other’s functionalities.

To have a communicate with web services while creating electronic invoices and other services, we require a certificate for AFIP and the private key. You can also generate certificates from the link ‘Generate renewal request’.

2. Partner

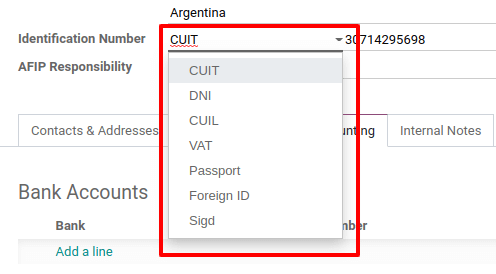

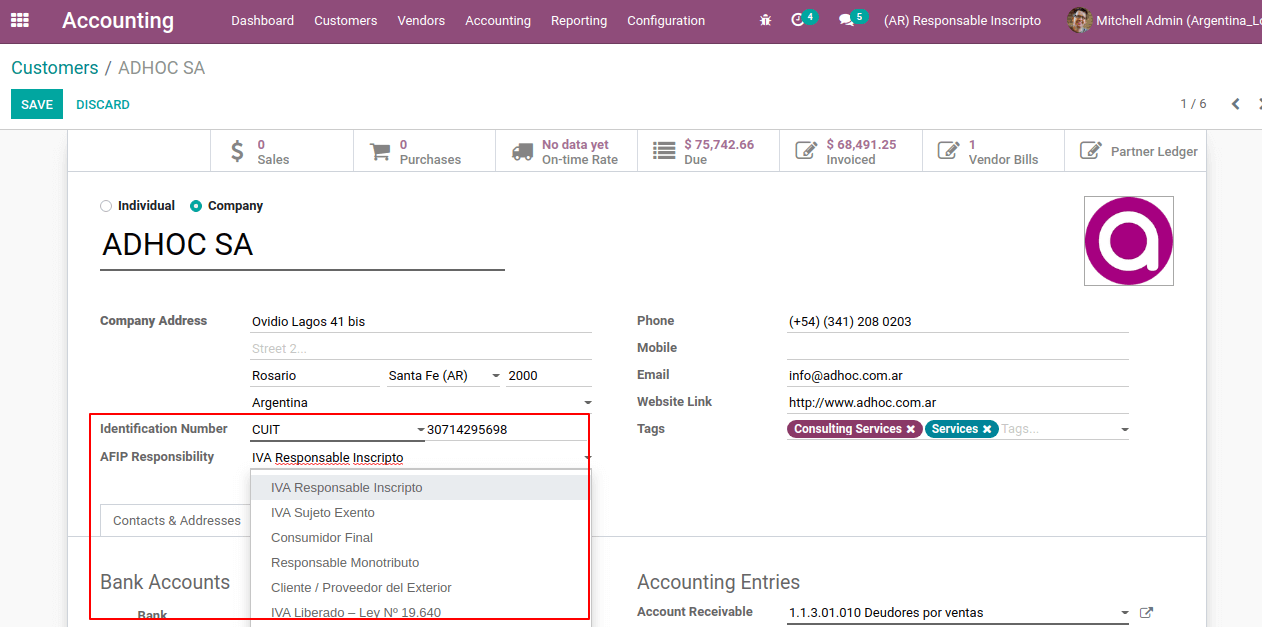

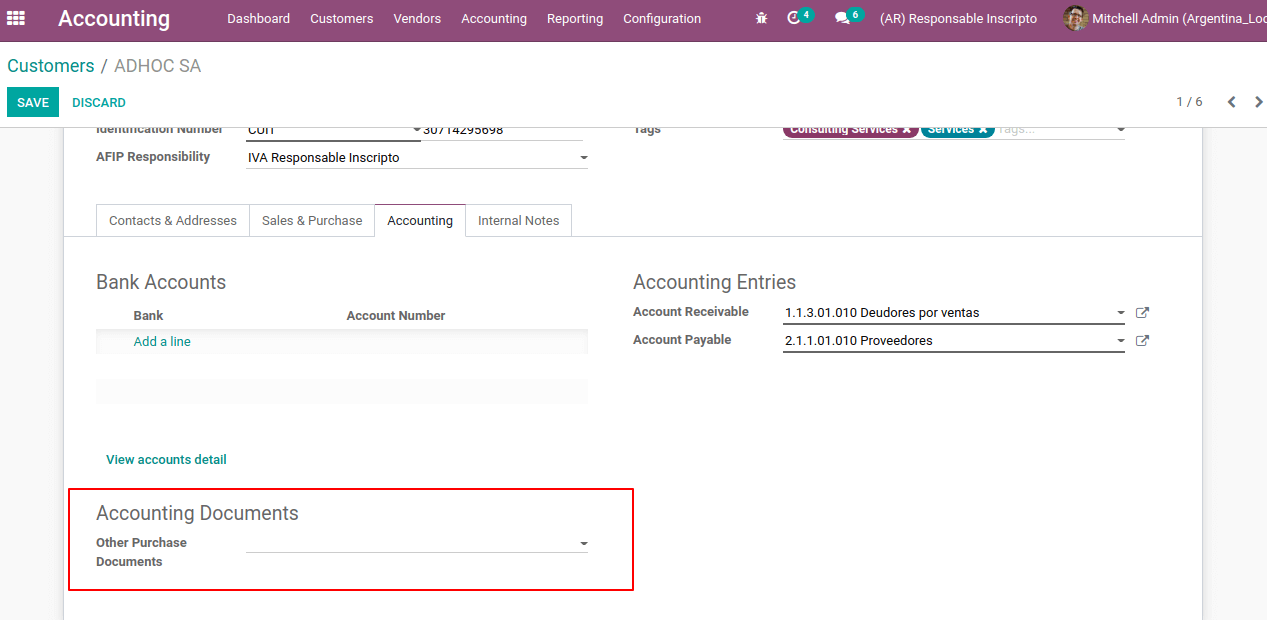

In the partner form, two more new fields are introduced: Identification Number and AFIP Responsibility as depicted in the following screenshot.

Identification Number in the partner form provides essential information about the transaction.

In Argentina, the document type associated with transactions between customers and vendors is defined on the basis of the AFIP Responsibility type therefore, it should be specified in the partner form as depicted in the following image.

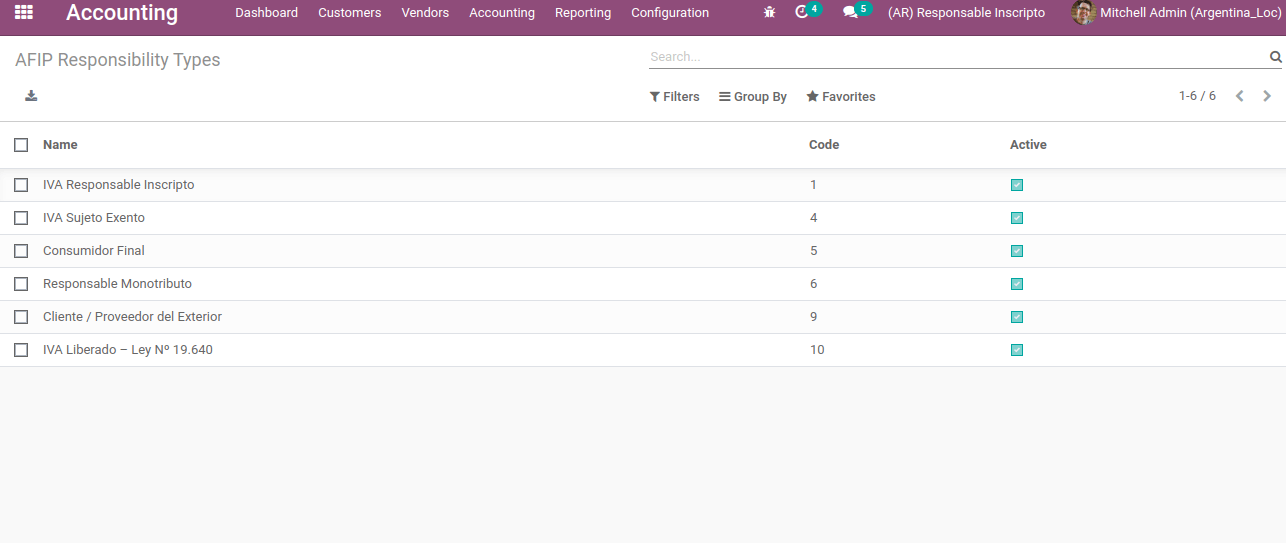

In addition you can find all the responsibility types under Accounting > Configuration > AFIP > Responsibility Types.

As of now, you will be clear on the chart of accounts configuration of the Argentenian localization. Now let’s move on to understanding the tax aspects of the localization.

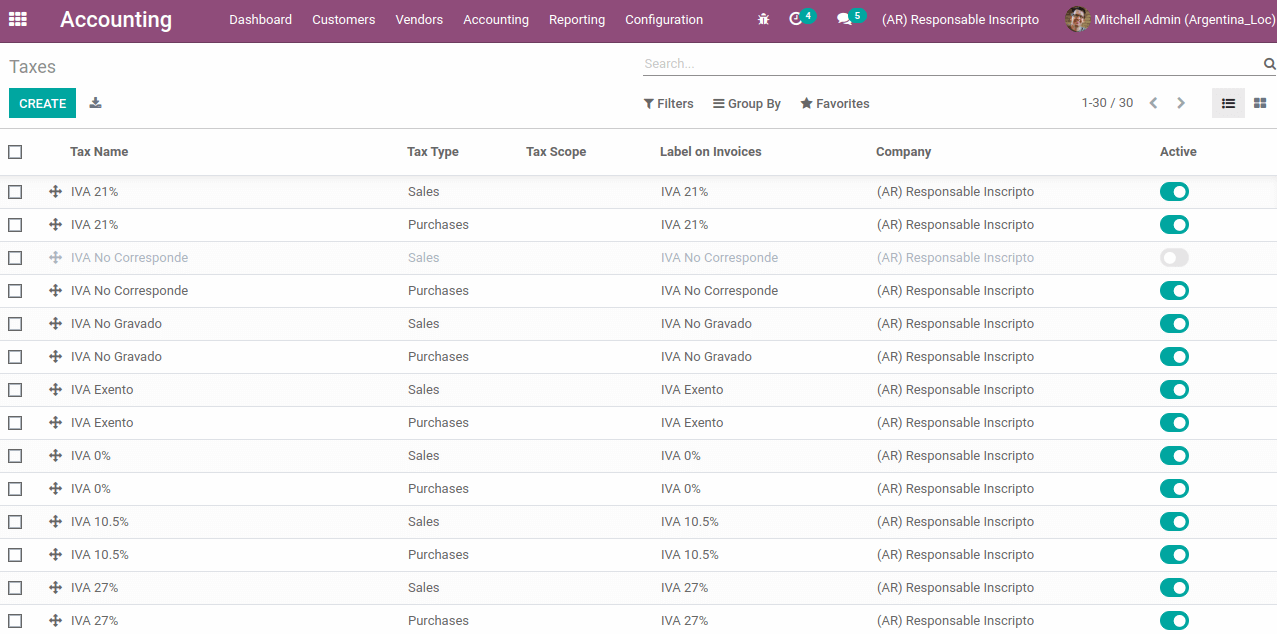

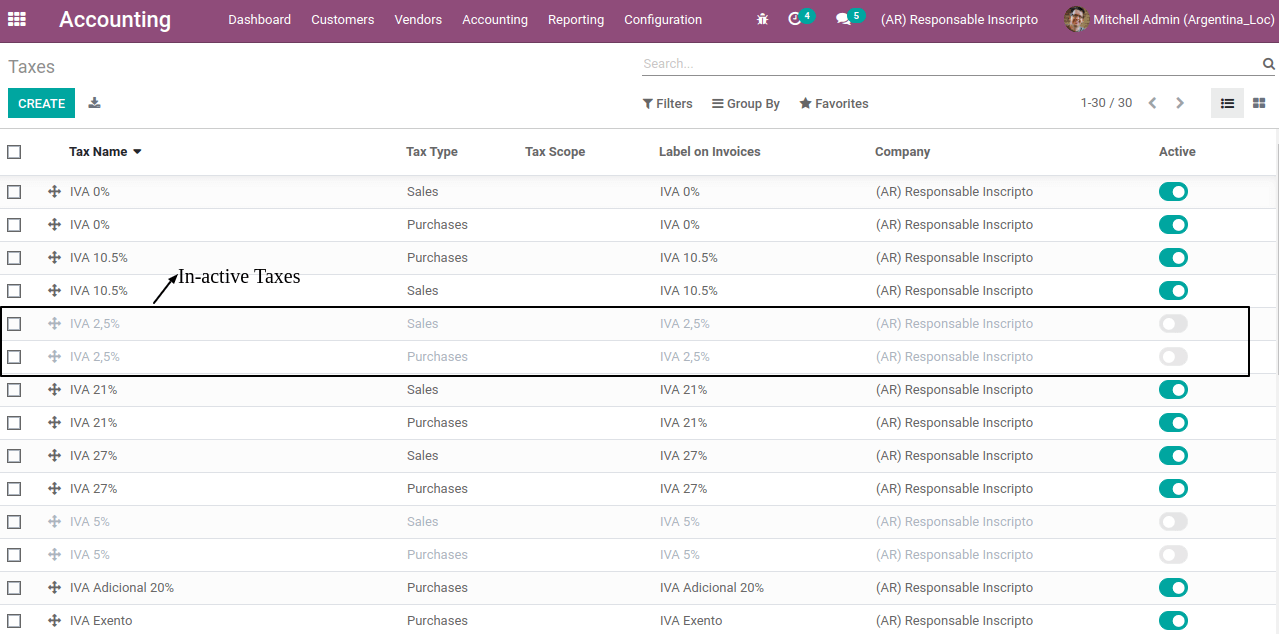

3. Taxes

Taxes required to operate the company are automatically generated at the time of installing the localization. The following image depicts the Taxes menu of the Odoo platform.

In Argentina there are different types of taxes:

– VAT: Similar to normal VAT and the percentage calculated on price.

– Perception: Advance payment of tax applied on invoice

– Retention: Advance payment of tax applied on payments

– Otros

There are some other special taxes that are inactive at the time of installation itself as depicted in the following image. This is because those taxes are not commonly used for all sorts of companies.

So before creating a new tax for your company, one must confirm that tax is not available in the inactive taxes. Let’s now move on to understand the document types configuration under the localization.

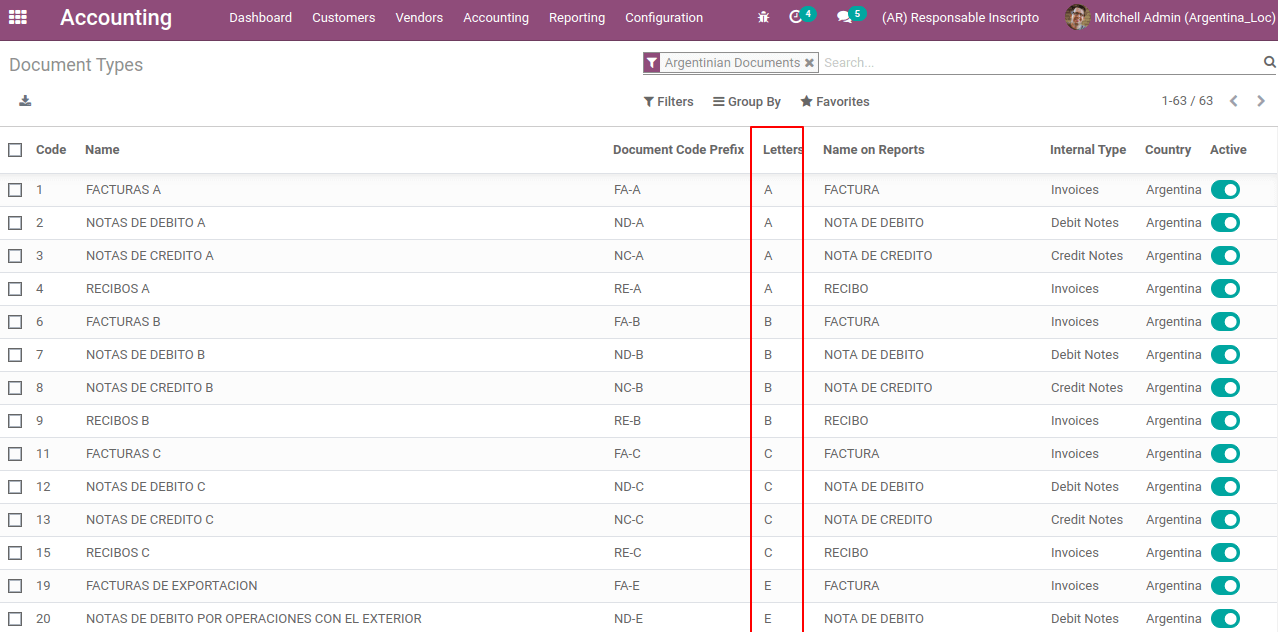

4. Document Types

In Latin American countries, the accounting transaction documents like invoices and bills are classified based on document types. These document types are visible on the reports, which makes it easier to identify the other invoices. Each type of document may have a particular sequence per journal in which it is allocated.

Therefore, when we install a localization for a country, the document types applicable to the country will be automatically created. So there is no need to create the document types manually.

You can find all the existing document types for this localization under Accounting > Configuration > AFIP > Document Types.

Some of the document types may be inactive at the time of installation they can be activated when required.

Also, for each type of document, there are certain letters marked. These letters are actually used to identify what kind of transaction it is and also to define the document presented to the government. It depends on the operation, the responsibility of both the user and receiver of the document.

– Invoice related to B2B transaction defined by the document type “A”

– Invoice related to B2C transaction defined by the document type “B”

– Invoice related to exportation, defined by the document type “E”

Document types other than the invoice, credit/debit notes can be also set for the partners. In the partner form, under the accounting tab, you can mention the other purchase documents as depicted in the following image.

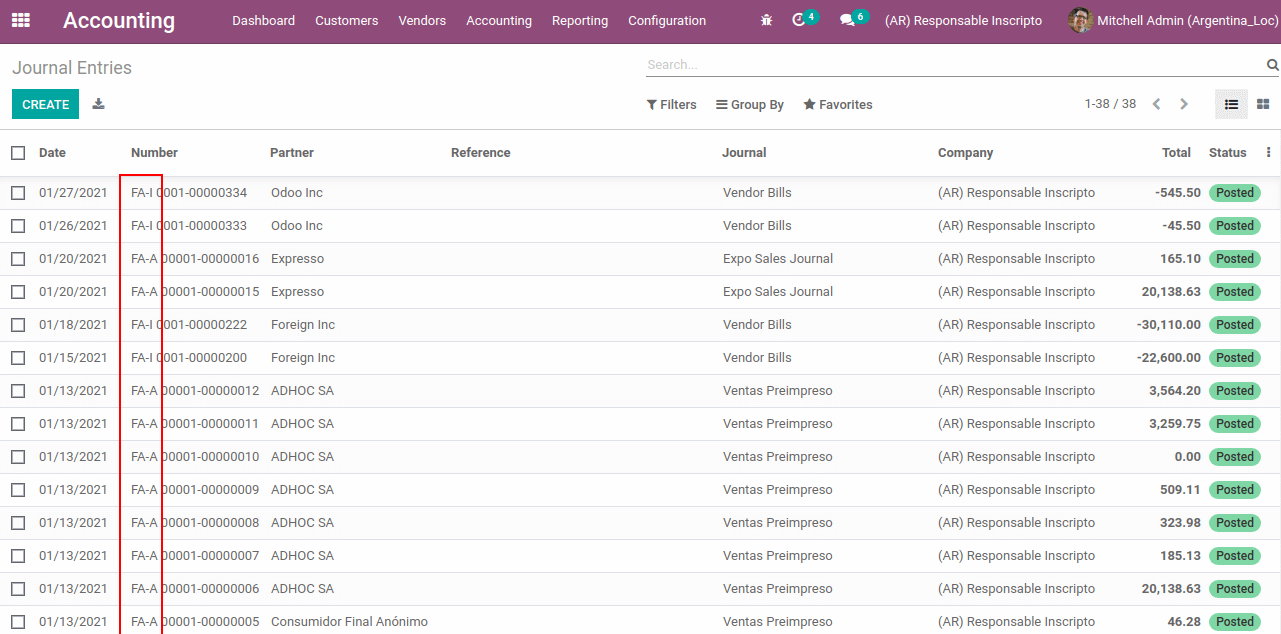

For each document type, the letters used to identify is different. These letters are used in invoices and journals to easily identify the type of documents as shown in the Journal entries menu of the Odoo accounting module.

As we are clear on document types, let’s now move on to understand the Customer invoice operation for Argentinian localization.

Customer Invoice

When it comes to invoicing for each type of journal the document type will be different and hence the letters too. Let us look at the invoices with different document types.

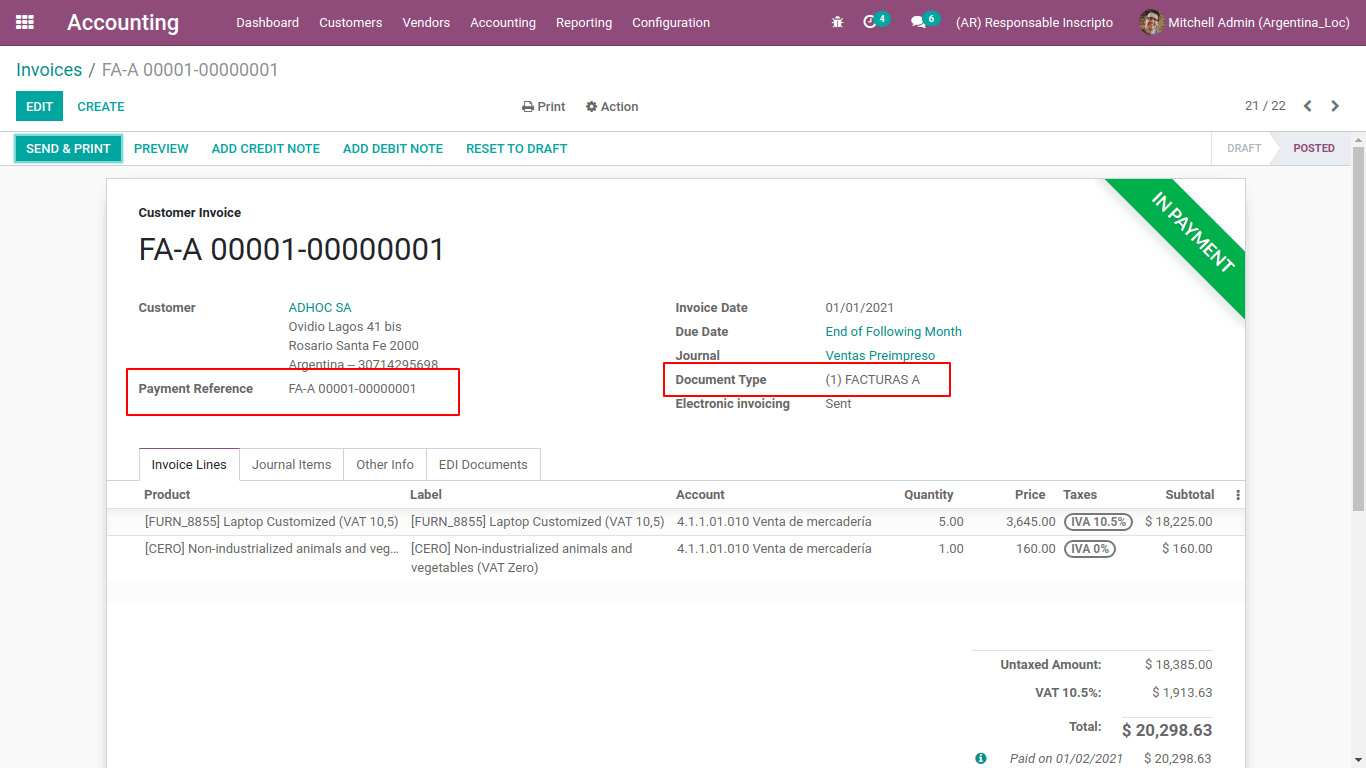

Customer Invoice with prefix A, where the prefix A is depicted in the Payment Reference as well as the Document Types.

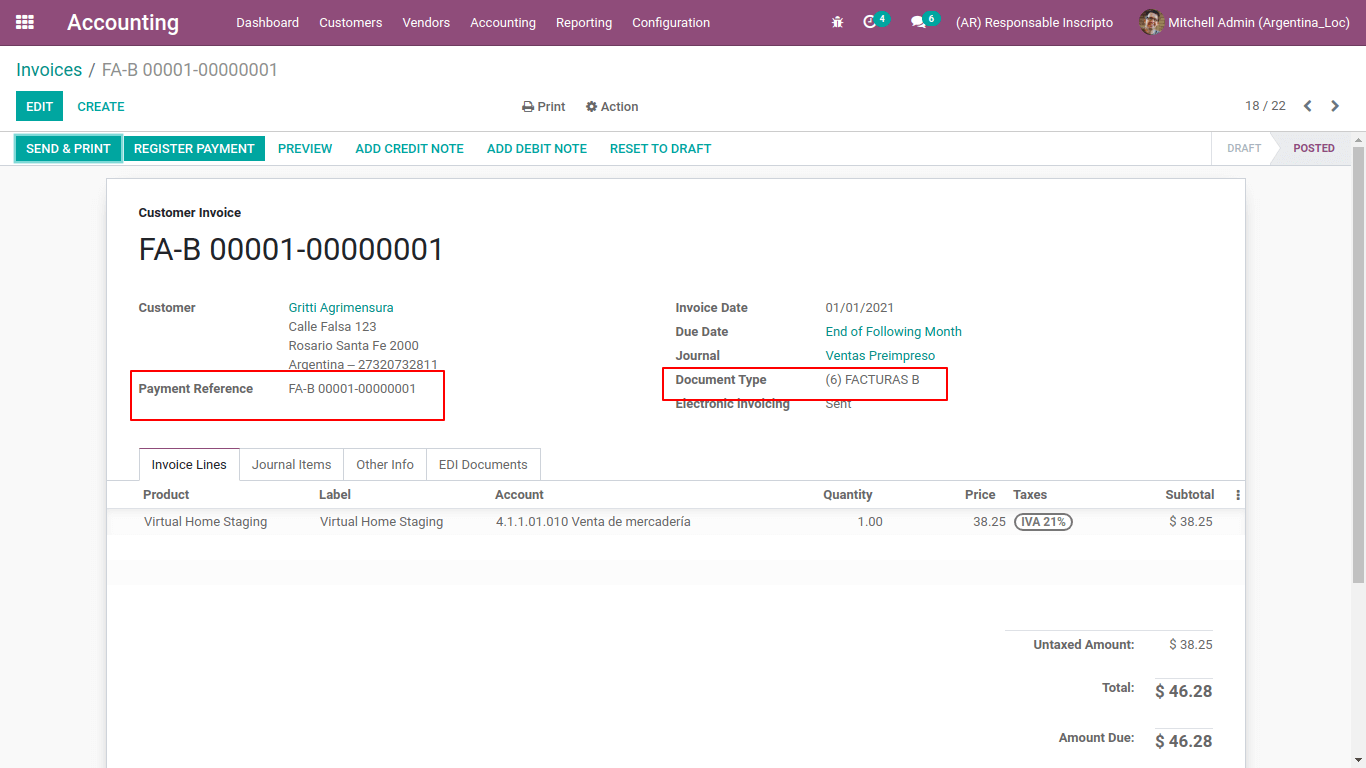

Customer Invoice with prefix B, where the prefix B is depicted in the Payment Reference as well as the Document Types.

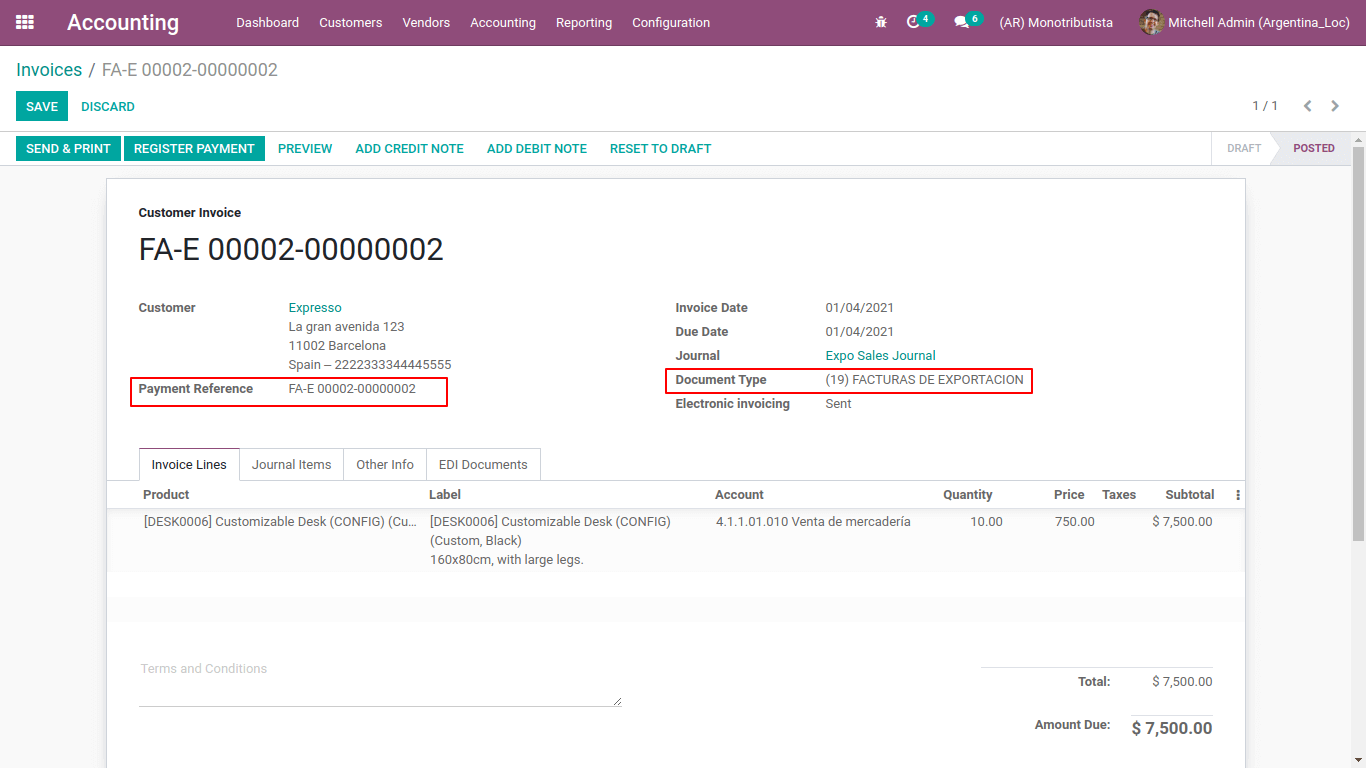

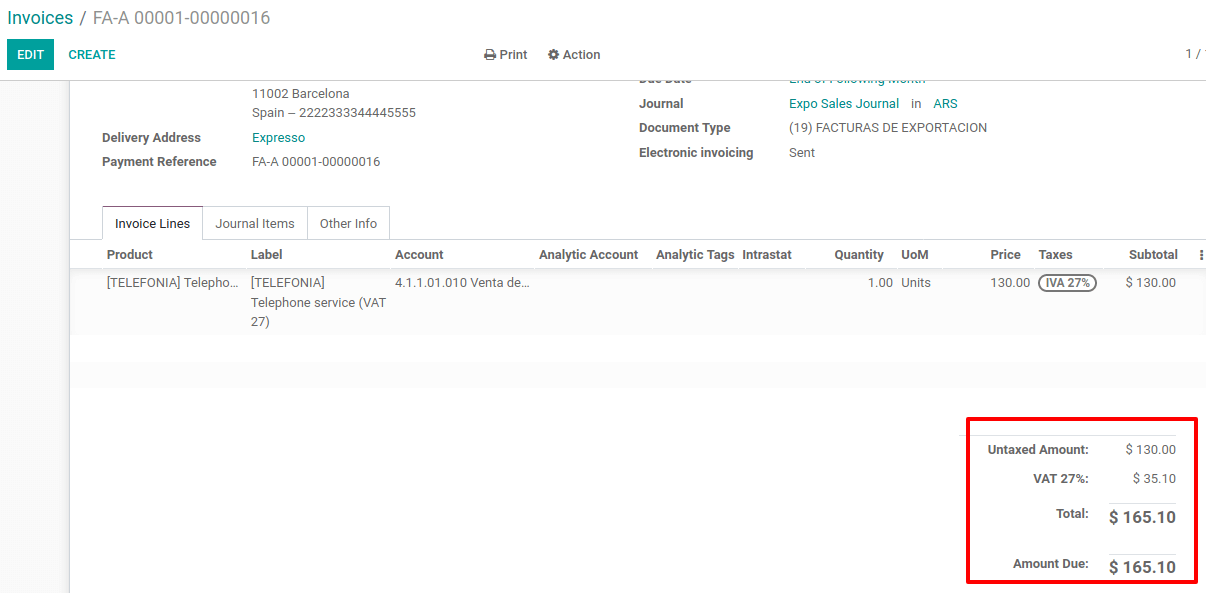

Exportation Invoice with prefix E, where the prefix E is depicted in the Payment Reference as well as the Document Types.

The first two invoices with the prefix A & B, it uses the same journal. Thus the document type is automatically detected based on the responsibility type of the partner. Additionally, the document type can be manually assigned.

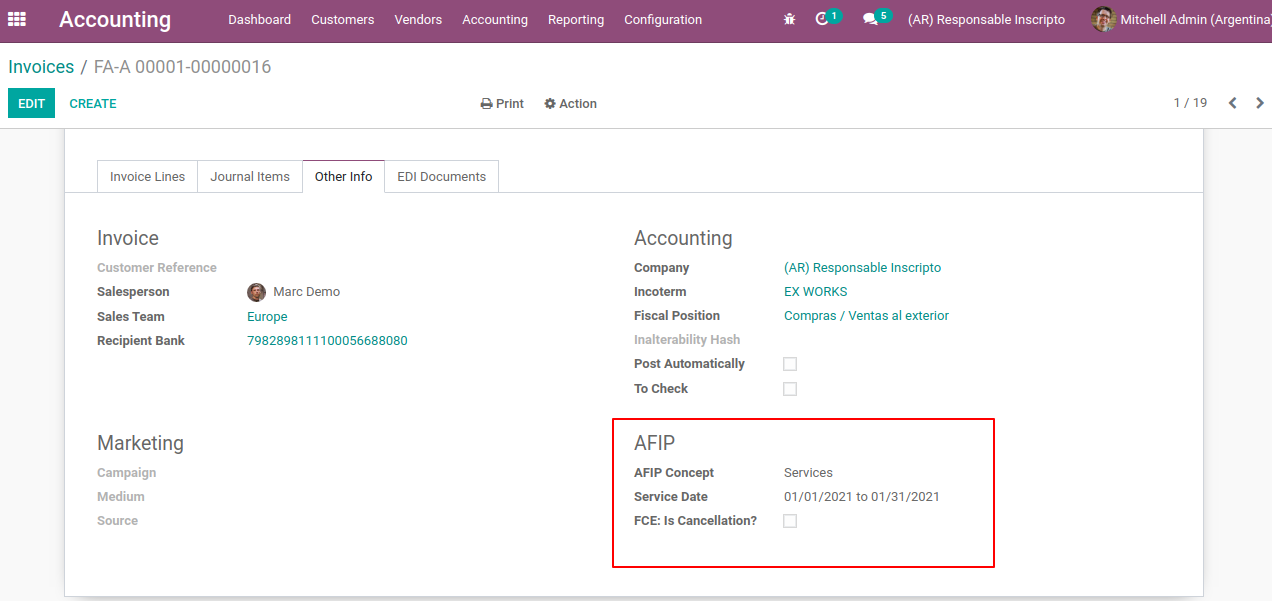

Under the ‘other Info’ tab, the details regarding the product to invoice will be there.

AFIP concept defines the product type to invoice, whether a service or products or products / Definitive export of goods etc.

For the service product invoice the Service Date is also updated there.

FCE: Is Cancellation, when informing a debit/credit note in AFIP it is required to send information about the original document that has been explicitly rejected by the buyer.

Furthermore, in the invoices related to the exportation document, incoterm is mandatory.

Electronic invoicing elements

In the case of electronic invoicing, if all the information in the invoice is correct then it can be posted in the default method as Odoo follows. If any issue is identified, we will raise an error message and the invoice will remain in the draft stage until the issue is resolved.

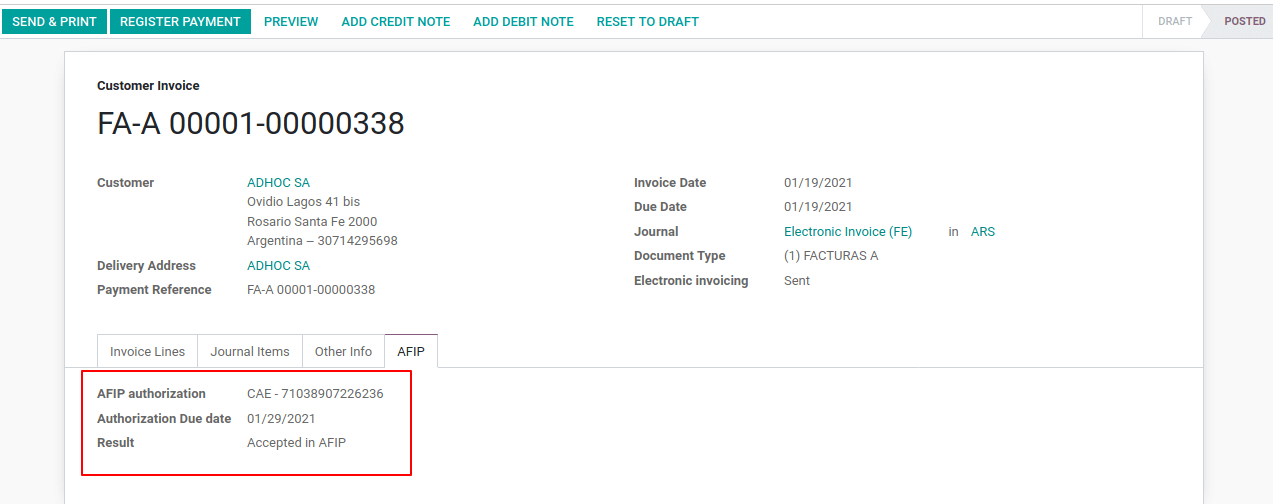

Additionally, the AFIP information and validation status of the posted invoice can be available in the AFIP tab of the invoice as depicted in the following image.

The details such as AFIP Authorisation, Authorisation Due date, and AFIP request result are updated under the AFIP tab.

AFIP authorization is the CAE number assigned.

Authorization due date is the due date of the invoice given by AFIP. Normally the expiration date will be 10 days after the CAE-Number is generated.

Result refers to the AFIP request result. It can be accepted in AFIP or Accepted with Observations.

Invoice Taxes

The VAT tax may have different behavior depending on the responsibility type.

A. Tax Excluded

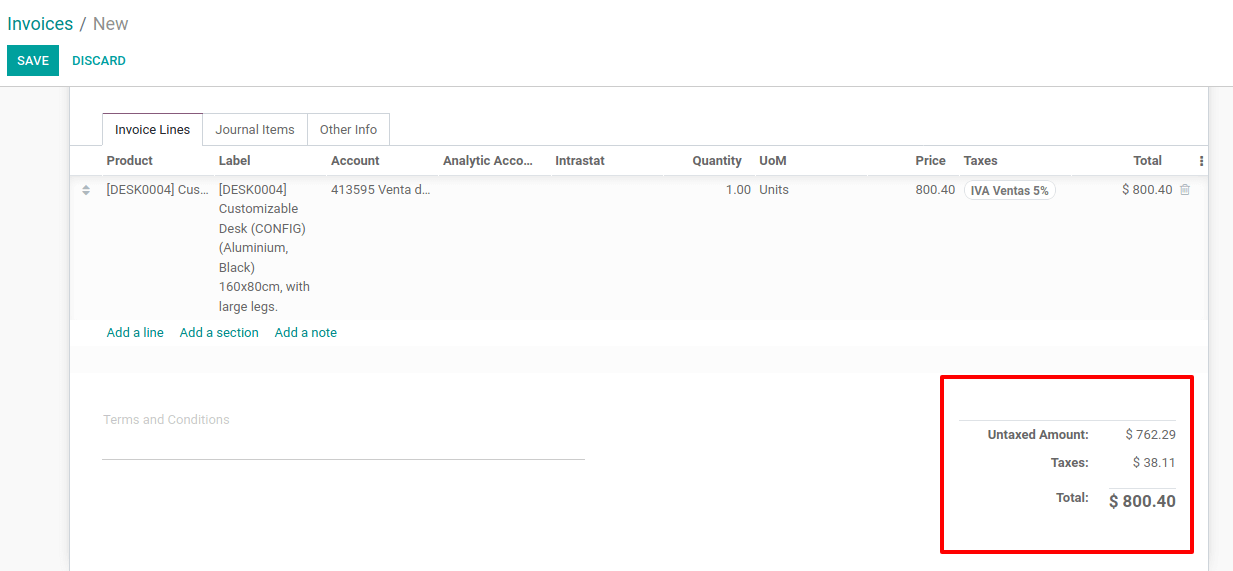

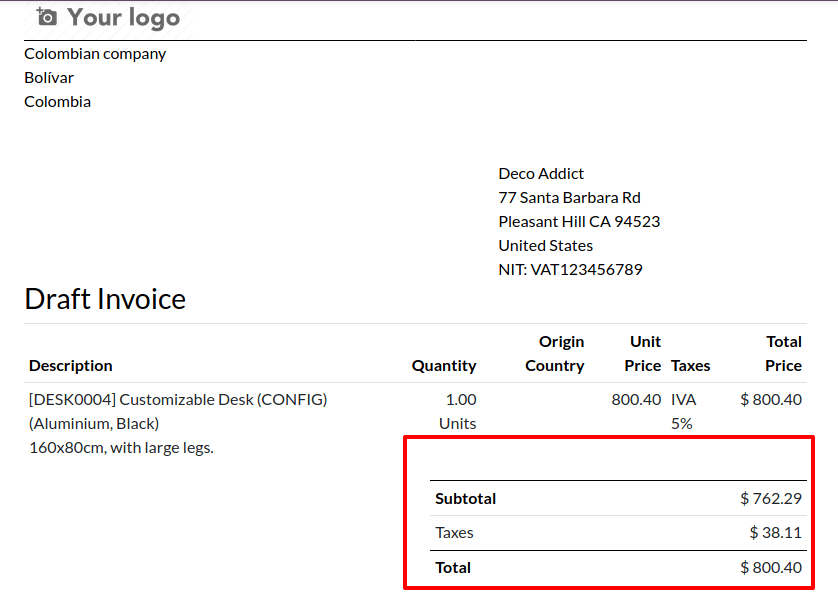

In tax excluded price, the tax amount is separately calculated and added with product price as depicted in the following image.

The PDF invoice report also displays the tax amount separately. This can be applied to customers whose responsibility type is Responsable Inscripto.

B. Tax included

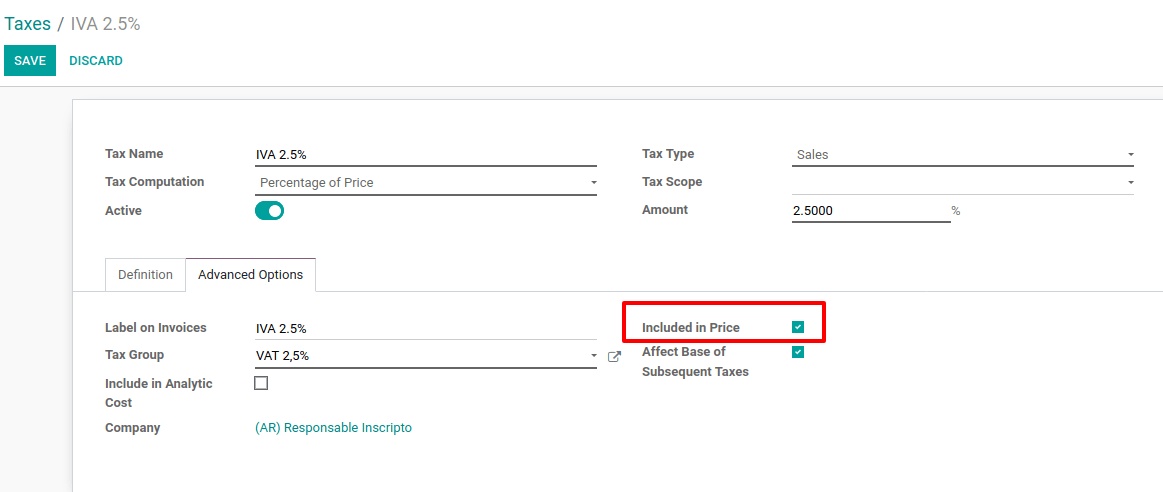

For tax included, the product price includes the tax amount also. This configuration can be achieved while creating a tax, in the ‘advanced Option’ tab you can enable the feature ‘tax included in the price’ as depicted in the following image.

Therefore, when an invoice is created the tax amount is included in the total as shown in the following screenshot.

This can be applied to customers having responsibility type,

– IVA Sujeto Exento

– Consumidor Final

– Responsable Monotributo

– IVA liberado

The invoice pdf as depicted below also shows the price subtotal, tax, and total on tax include basis.

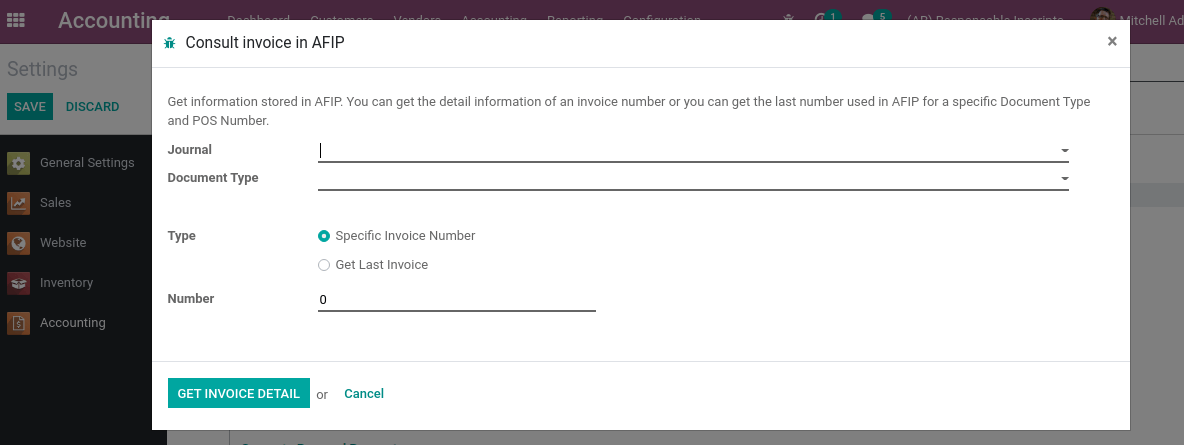

Consult invoice in AFIP Reports

Using this feature you can acquire detailed information on invoice number which is already sent to the AFIP and also the last number of specific document type used in AFIP and POS Number etc. This is actually used at the time of troubleshooting and auditing. Go to Accounting Module > Accounting > Consult invoice in AFIP Reports.

Add the journal, Document type, mention whether the specific invoice number or last invoice details to collect, add the number (number of invoices) and click on ‘GET INVOICE DETAILS’ to download details.

Vendor Bills

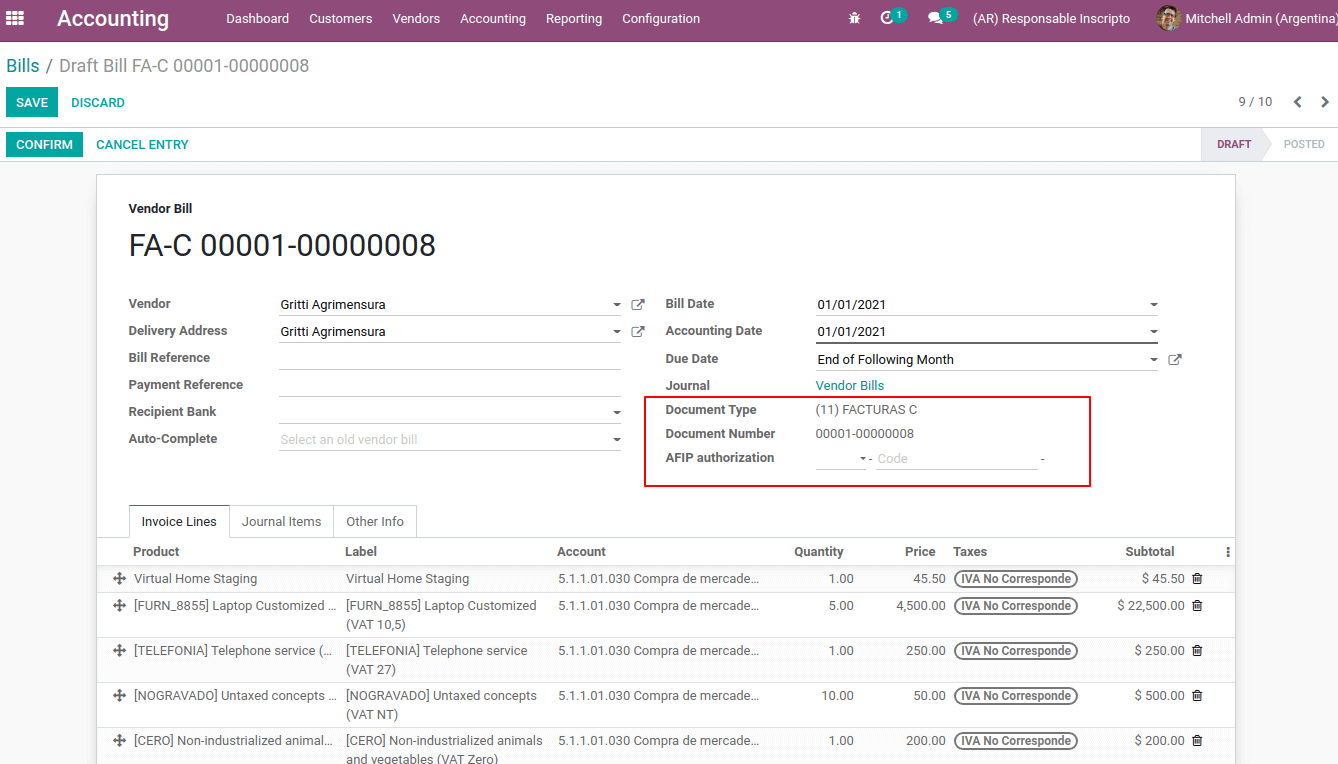

Similar to the customer invoice, the document type for the journal vendor bill will automatically be created and the vendor bill is like Document prefix-letter-Document Number.

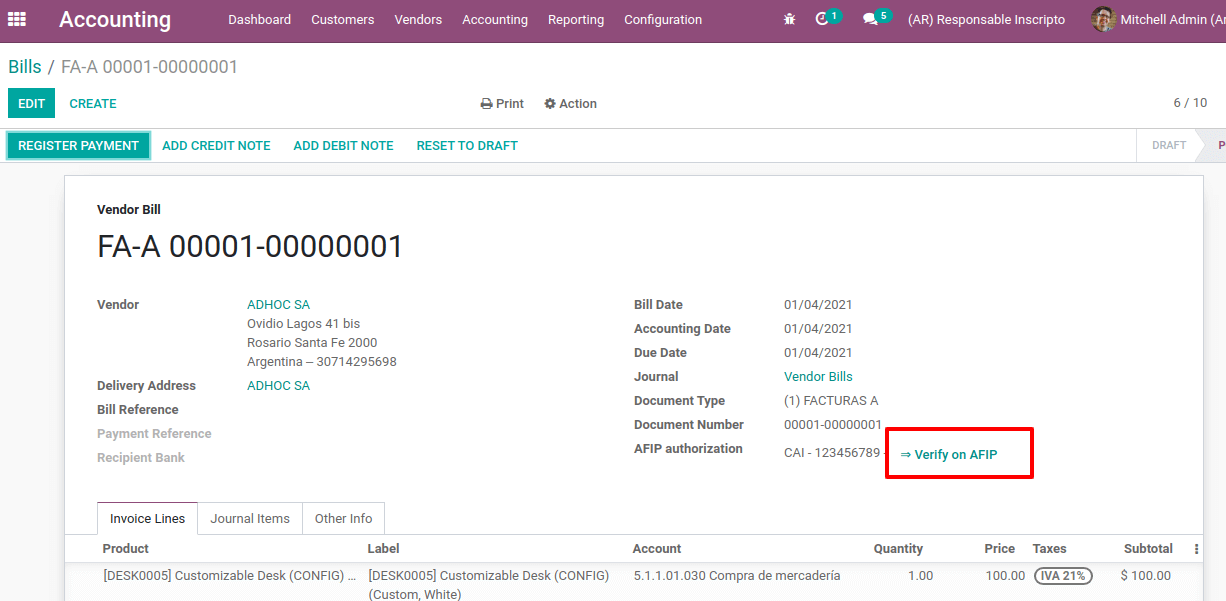

Validate Vendor Bill number in AFIP

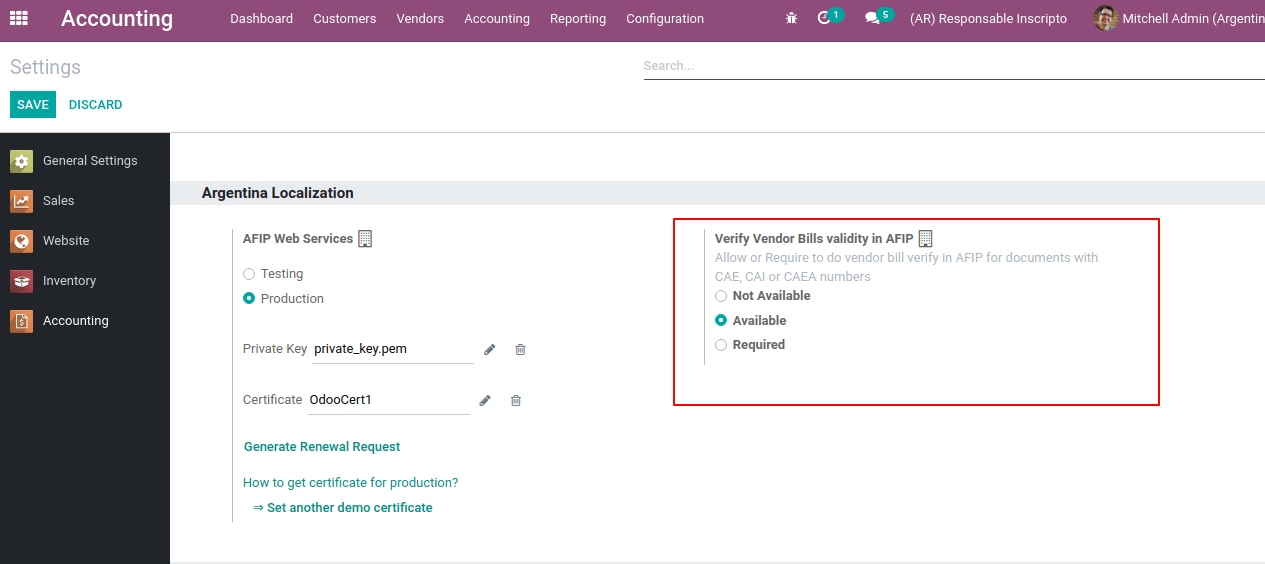

Most businesses have some internal policies and procedures to check that the vendor bill is connected to a relevant AFIP document with CAE, CAI, or CAEA numbers. This can be set from Accounting configuration settings, Accounting Module > Configuration > Settings.

Three available options to verify vendor bill are:

Not Available: this is the default value where no verification on vendor bill has to be done

Available: Will provide an option ‘verify on AFIP’ in the vendor bill so that they can manually verify as depicted in the following image.

Required: The vendor will be automatically validated before the bill is posted. This is actually for ensuring that all the purchase bills or the vendor bills are verified and updated in the Purchase VAT Book. So the vendor bills which are not verified cannot be posted to accounting. Also, while verifying AFIP, if it gets rejected those details will be updated in the chatter.

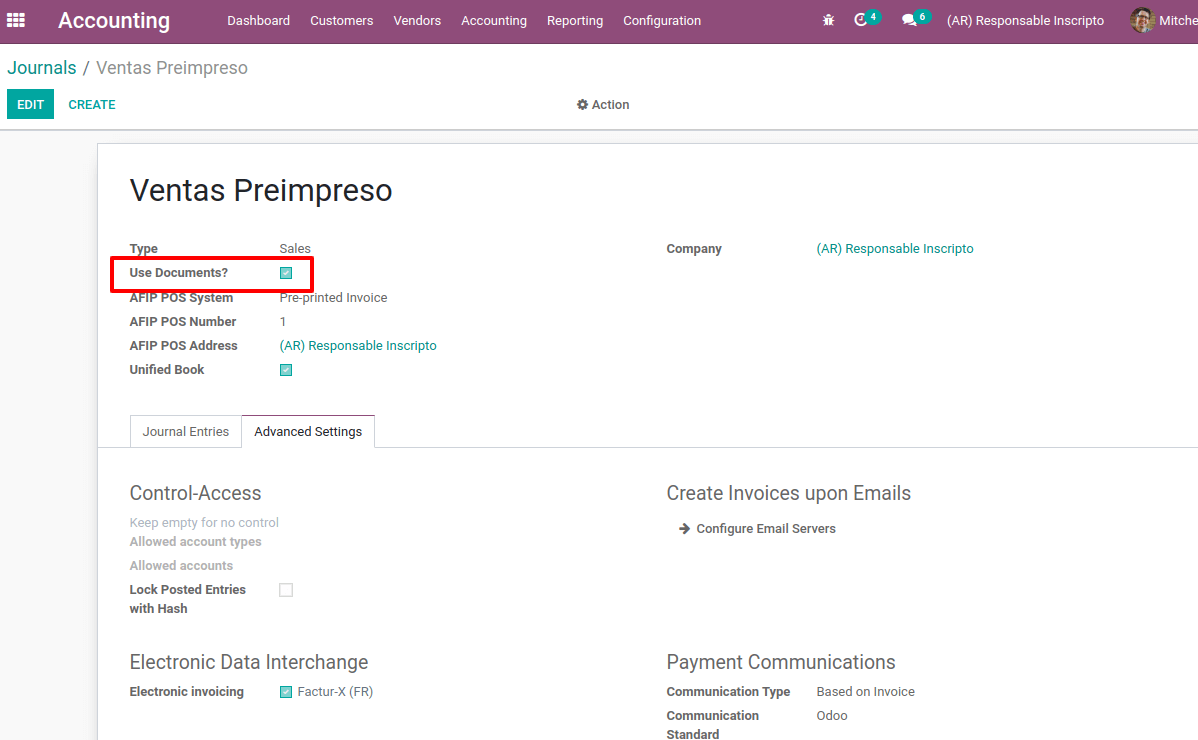

Configuring Journals

In Argentinian localization, depending on its use and internal type, the Journal may have a different approach. Journals can be created from Accounting module > Configuration > Journals > Create.

While creating a journal, the ‘Use Documents’ checkbox is there as in the above image. On activating the ‘Use Document’ for sales or purchase journal, all the related entries of invoicing legal documents like invoice, debit/credit notes are recorded. If it is not checked it will record the accounting entries such as tax payments, receipts, journal entries, etc not related to invoicing legal documents.

AFIP POS System is only visible for journal type ‘Sales’. It records the transaction related to this journal includes:

– Web service-related sequences of document types.

– Defines the electronic invoice file structure and data.

AFIP POS Number to identify the operations of the AFIP POS system.

AFIP POS Address is the address that is used in the invoice reports.

Unified Book, while enabling this, all the documents for this journal will use the same letters. For example

Invoice: FA-A 0001-00000002

Credit Note: NC-A 0001-00000003

Debit Note: ND-A 0001-00000004

Now let’s move on to understand the Argentinian statements and reports in the localization aspect of Odoo.

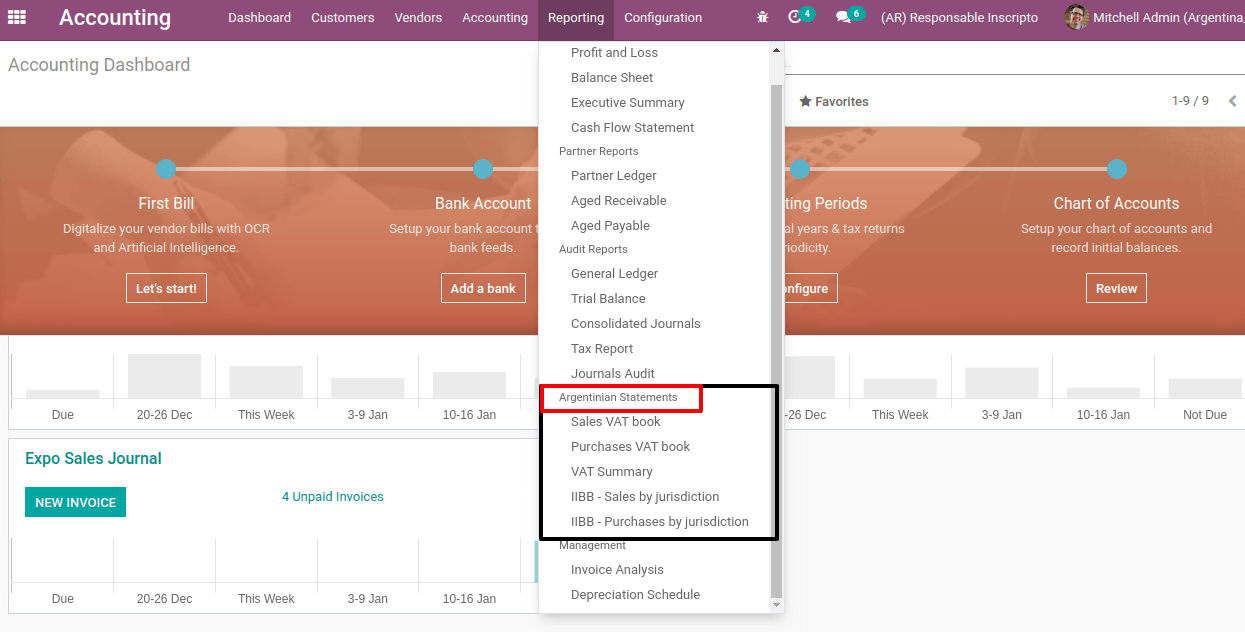

Argentinian Statements and Reports

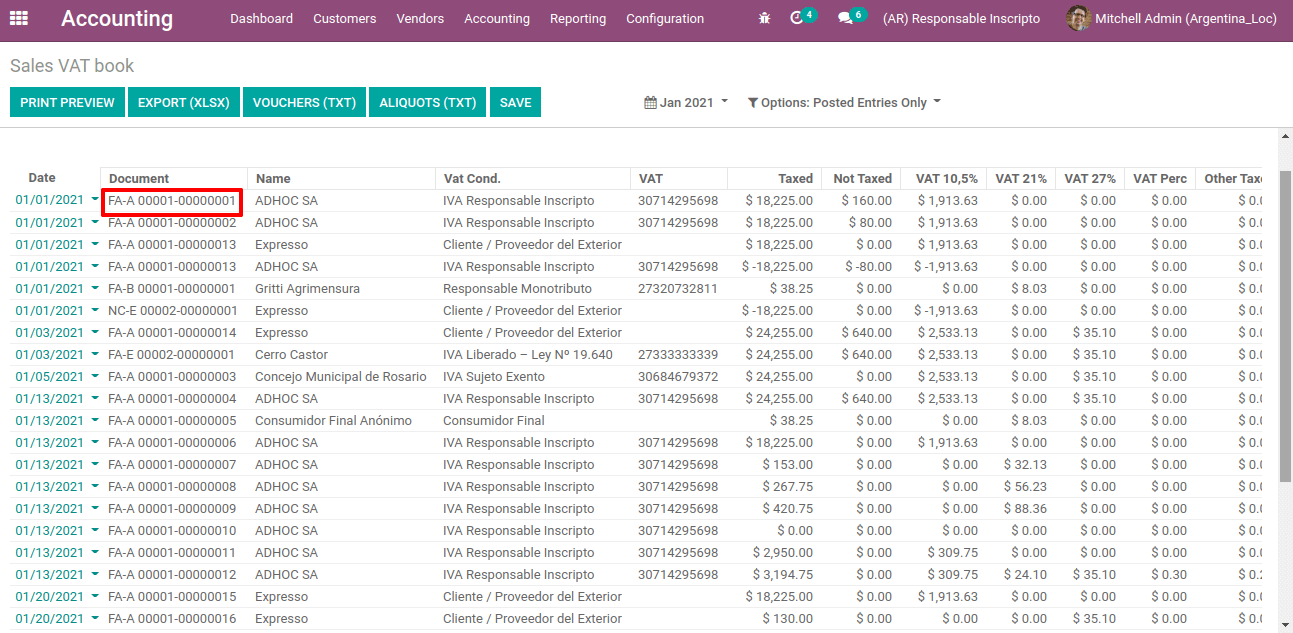

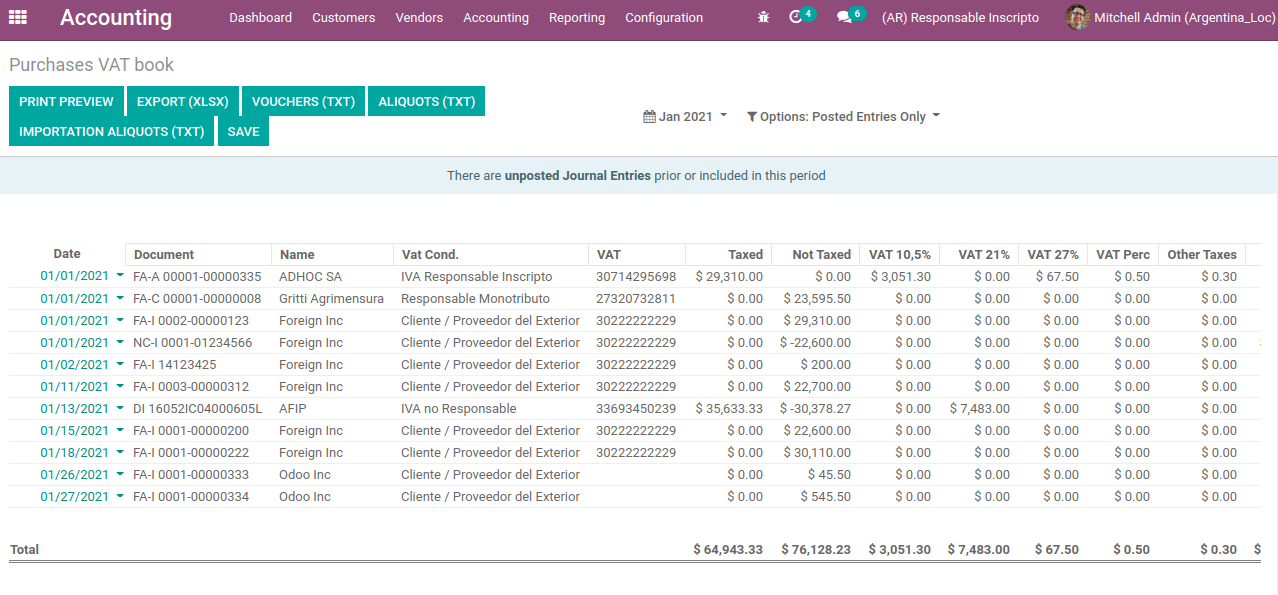

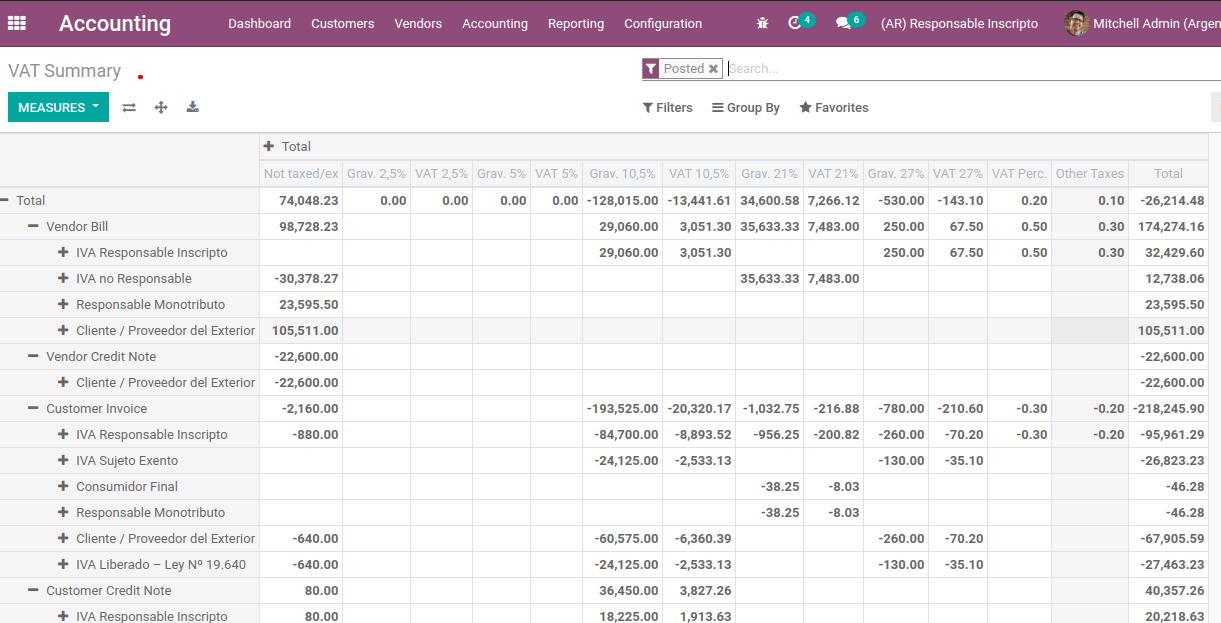

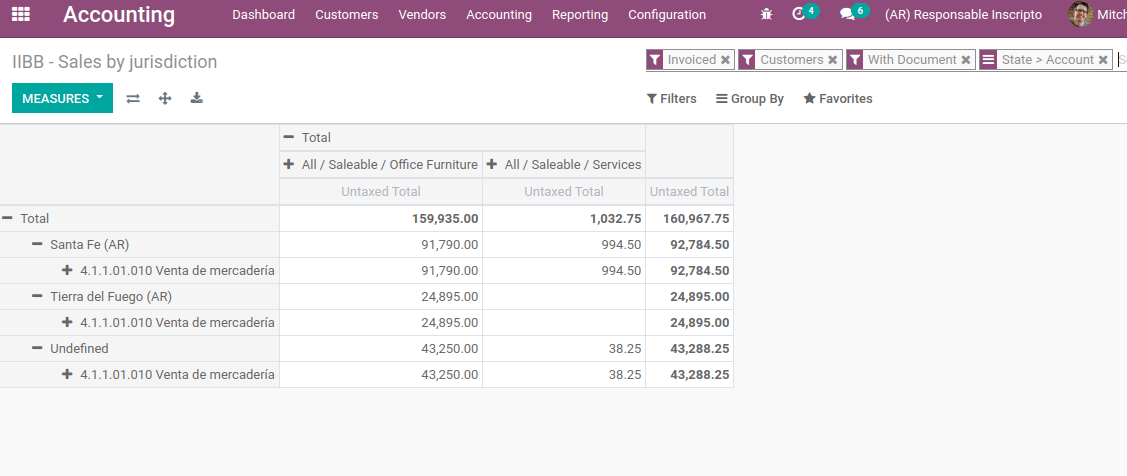

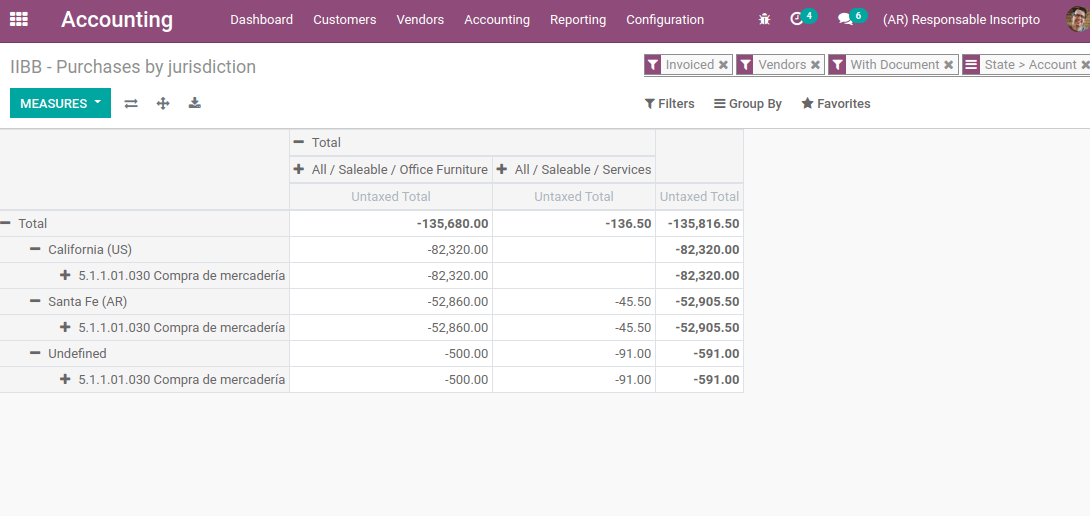

When it comes to the reporting section, this localization provides some kinds of reports such as sales VAT book, Purchase VAT book, VAT Summary, IIBB sales by jurisdiction, and IIBB purchase by jurisdiction.

VAT Sales Report: This gives the VAT of each sale on different taxes and the document type with letter can be also viewed in the report.

VAT Purchase Report

VAT Summary

IIBB sales by jurisdiction

IIBB purchase by jurisdiction

With all the intrusive tools available in Odoo Argentina localization you can run your business effectively as per the terms and conditions set by the authorities in Argentina.