Localization is more than just translating. This enables the companies to use country specific elements like currency, taxes, chart of accounts, etc. to keep the business process flexible. The new localization package also enables clients to optimize ERP priority for companies in Germany and to comply entirely with relevant tax and banking laws and policies.

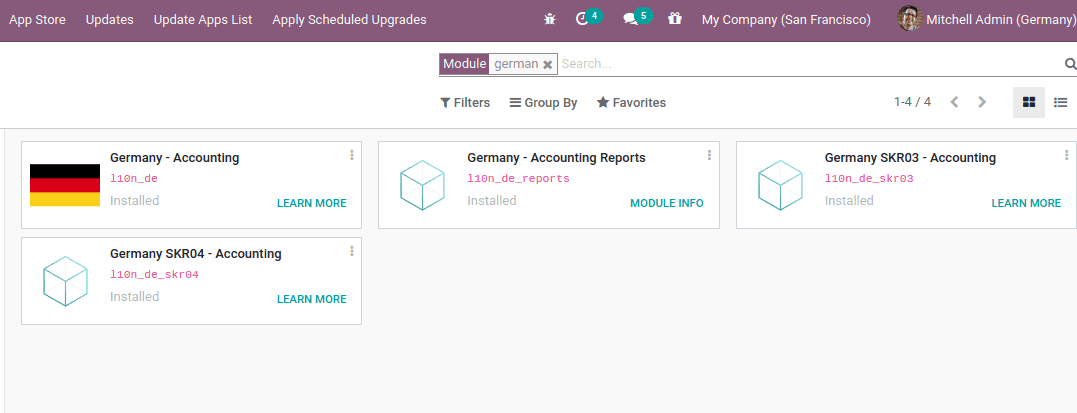

Install the german localization package from the odoo apps.

The modules involved in the German Accounting package are:

1. Germany – Accounting (l10n_de): This module contains a German chart of accounts based on the SKR03.

2. Germany – Accounting Reports (l10n_de_reports): Accounting reports for Germany Contains Balance sheet, Profit and Loss, VAT, and Partner VAT reports, also adds DATEV export options to the general ledger

3. Germany SKR03 – Accounting (l10n_de_skr03): This module contains a German chart of accounts based on the SKR03

4. Germany SKR04 – Accounting (l10n_de_skr04): This module contains a German chart of accounts based on the SKR04

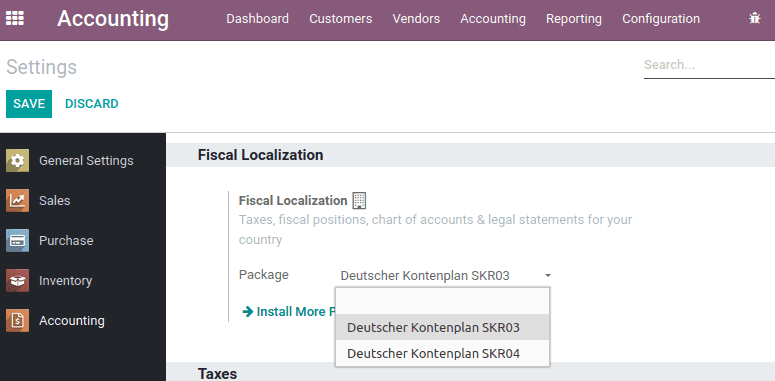

German localization provides two charts of accounts SKR03 and SKR04. Both are supported by Odoo. By default, the chart of account SKR03 is taken into account. So, one has to confirm which chart of the account package needs to be used for the company and choose it from accounting configuration settings before making any accounting entry.

SKR03 and SKR04 are two charts of accounts that can be used in all industrial areas. The main difference between them lies in the accounts structure. SK03 is basically used at small businesses and start-ups because this chart of accounts is based on the business process the company follows, not the financial statements. This is much easier to understand for young companies.

When it comes to SK04, they are especially used where financial processes and statements have great importance and need to publish the balance sheets, income statements, profit and loss reports, etc. Companies having a turnover of more than 600,000 euros are mainly using this chart of accounts.

One must ensure that the chart of accounts is selected for the company before making any accounting entry. From the accounting configuration settings, the accounting package can be chosen. But once an accounting entry like an invoice or bill is generated it is not possible to change the package

So the important point to be noted is that to ensure the chart of accounts for the company has to be decided and chosen before making any accounting entry. Once an entry is created then it cannot be changed further.

Also, there may be additional accounts required for the business process. So that can be manually created as per requirement.

Configuring the company and a partner can be done by following the same procedure as in the default Odoo. Also, add the VAT if the contact or company is subjected to pay tax to the government.

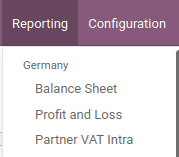

German Accounting Reports

The accounting reports by German accounting packages in Odoo enterprise involves,

– Balance Sheet

– Profit & Loss

– Tax Report (Umsatzsteuervoranmeldung (Advance VAT return))

– Partner VAT Intra

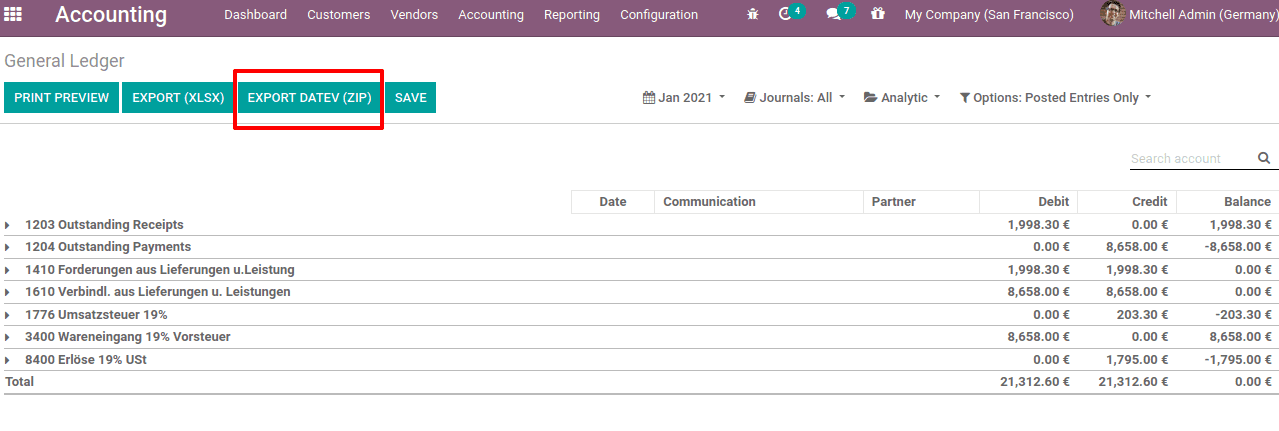

Export from Odoo to Datev

The accounting entries can be exported from Odoo to Datev. Odoo enterprise database with german localization facilitates this feature. For that go to Accounting -> Reporting -> Audit Reports -> General ledger.

Click on ‘Export Datev (ZIP)’ to export the details into zip format.