ERP localization is a feature that is used to help users from different countries to explore the ERP to its maximum. With localization, people from different countries will be able to localize the ERP product to suit the laws and systems of their land. ERP localization is highly beneficial and crucial when ERP deals with accounting and related financial operations. As the tax regime of different countries is different a localized ERP will automate tax calculation and management for that particular country.

Odoo is an open-source software solution that can be used effectively for all countries. To ensure effective support to the users across the globe Odoo has initiated localization features. The best cloud-based ERP tool, Odoo promotes localization in accounting and other modules to suit the business requirements of the customers. With this ERP solution, it becomes easy and simple to manage the fiscal position, tax, and journal entries.

In this blog, we can take a glance at Fiscal localization packages in Odoo. Fiscal localization can be defined as an Odoo module that has been developed and enhanced for a specific country. Once the country is chosen the packages get installed. It will help the users to make use of the benefits of pre-configured taxes, fiscal positions, a chart of accounts, and legal statements in the database.

Continuous measures of the Odoo team to improve and enhance localization in their apps is an important factor that benefits the consumers.

Odoo enables users to install and manage localization easily. It helps to automate the installation of localization packages that are suitable for the company. The country selected at the creation of the database. With this, the user can easily manage taxes and fiscal position for that particular company.

Here, let us see how to manage fiscal position with localization.

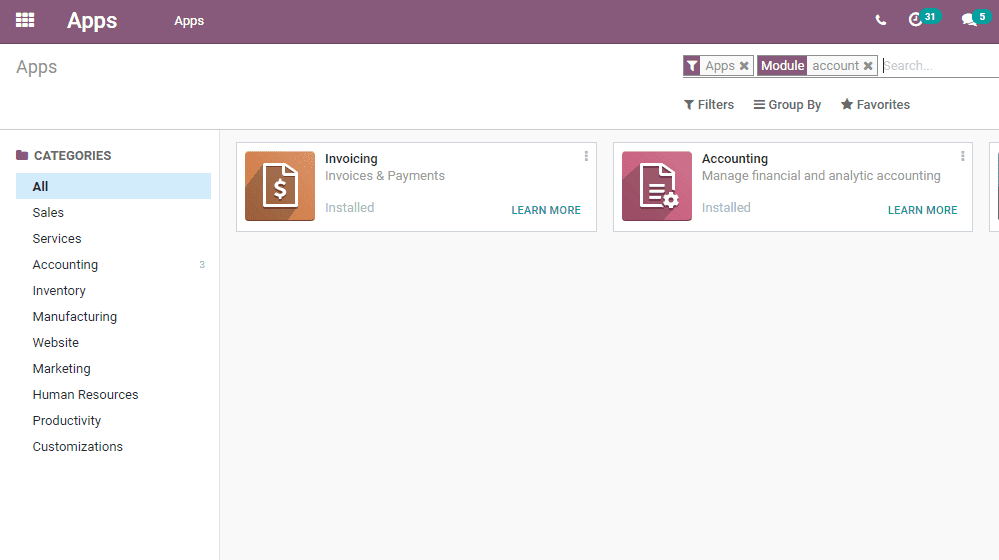

For this first Install Odoo Accounting

After that, a user can enter the Accounting module to manage the fiscal position.

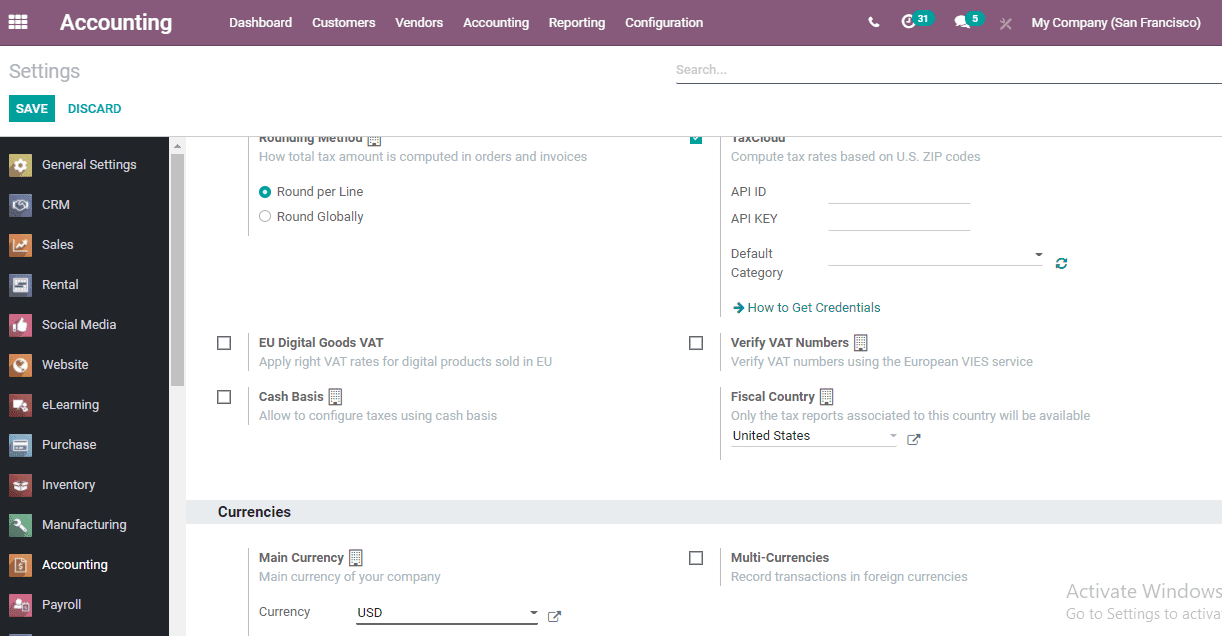

First, we have to manage localization in the settings. For this go to Accounting > Configuration > Settings

Here, the user can find a tab denoting fiscal country. In the above image, the country chosen is the United States. We can change the country by selecting the country from the dropdown menu.

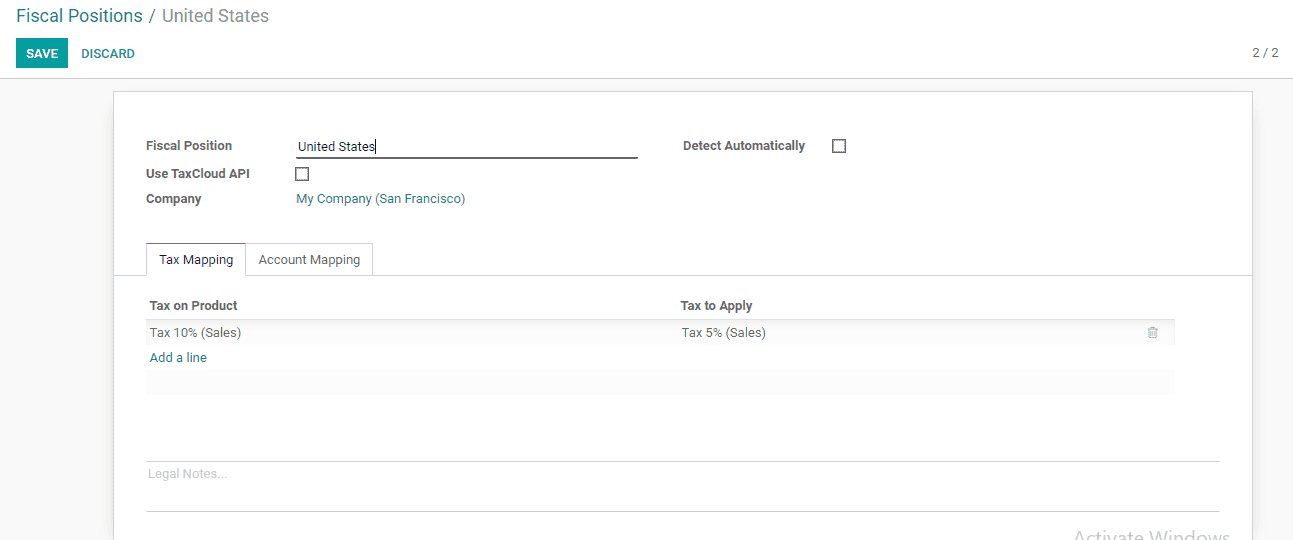

After selecting the country go to Accounting > Configuration > Accounting > Fiscal Position

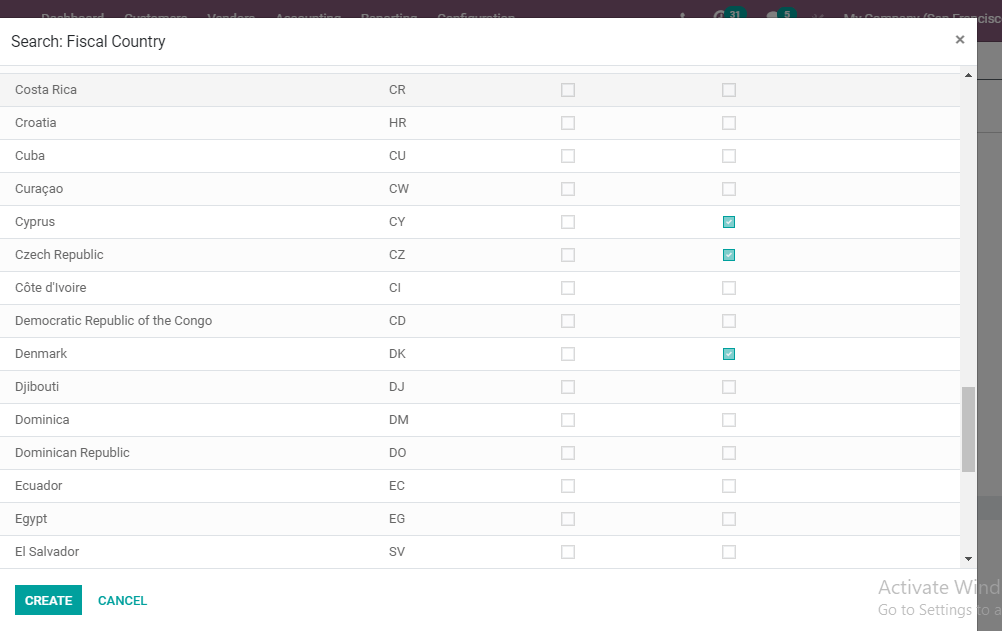

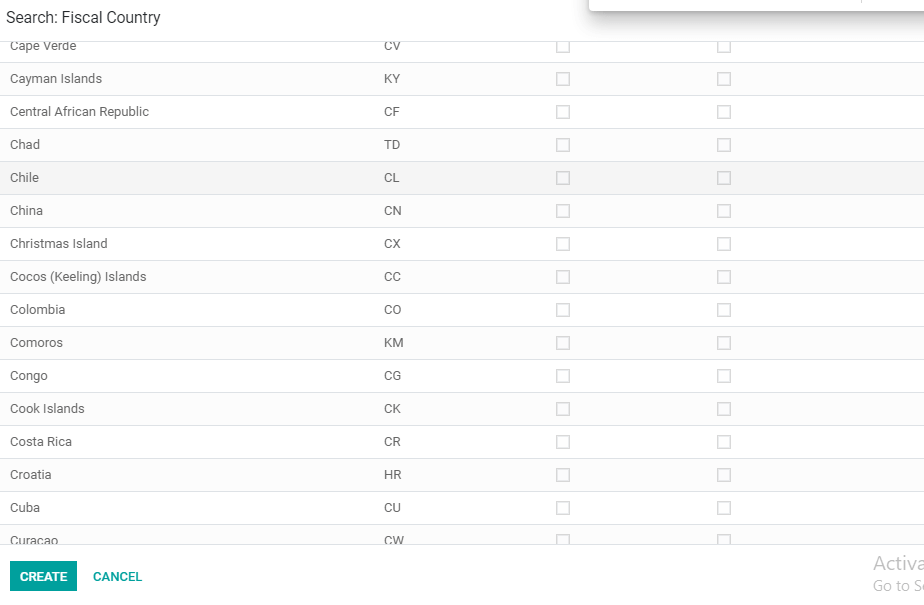

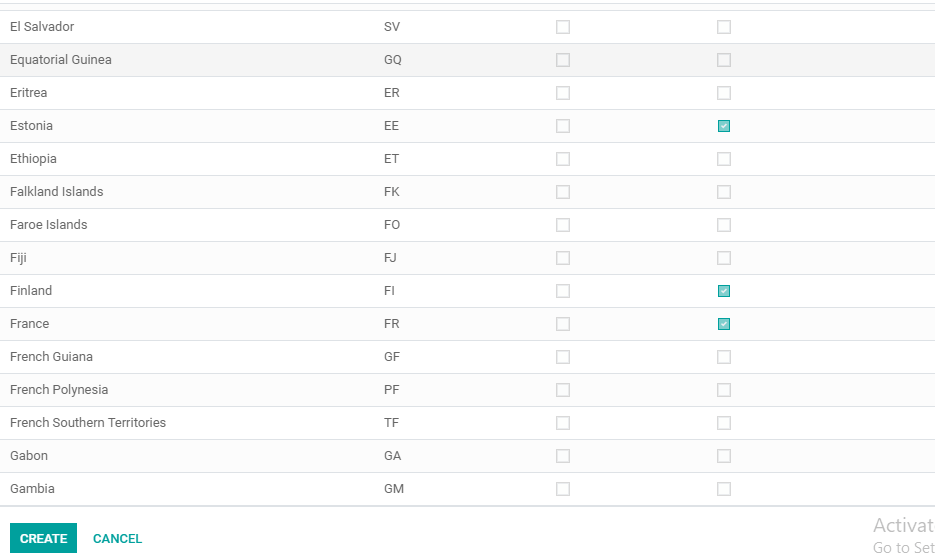

This feature helps a user to manage the fiscal position by selecting the country from the list.

Here, a person can create a new Fiscal Position.

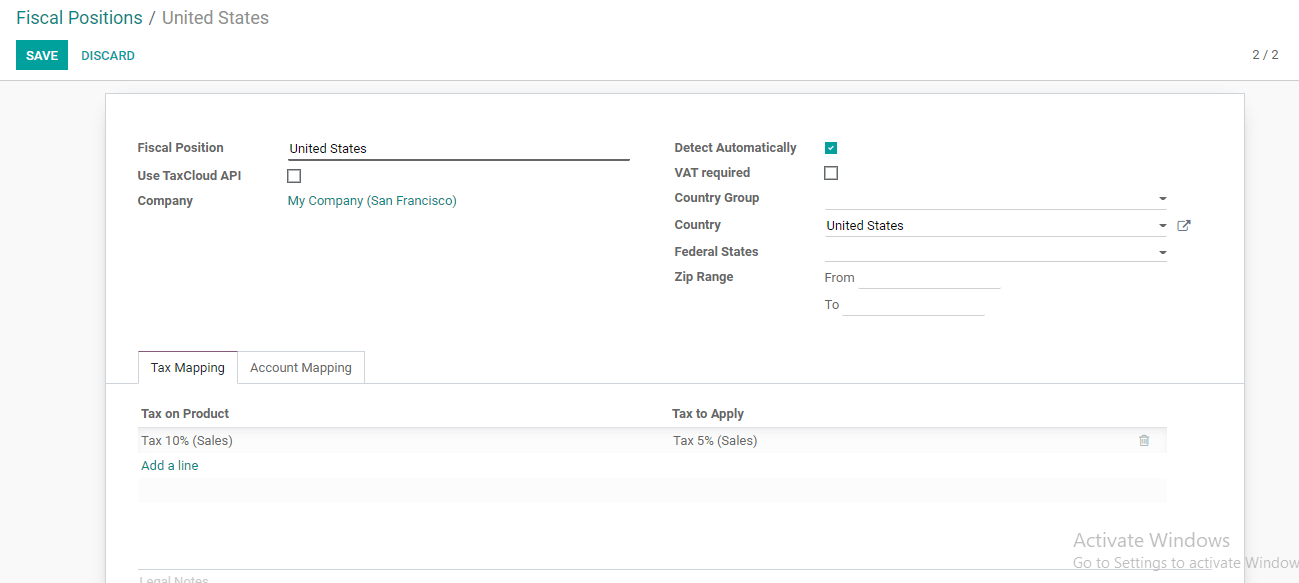

AS we have selected the country as the United States, we can select the Fiscal position as the United States.

The company as My company.

Then go to Tax Mapping Tab

Here, we can add Tax on products and Tax to Apply details.

Here, we have chosen the tax on the product as 10% and tax to apply as tax 5%(sales). That means a product with a 10 % tax will be computed automatically as 5 percent after this.

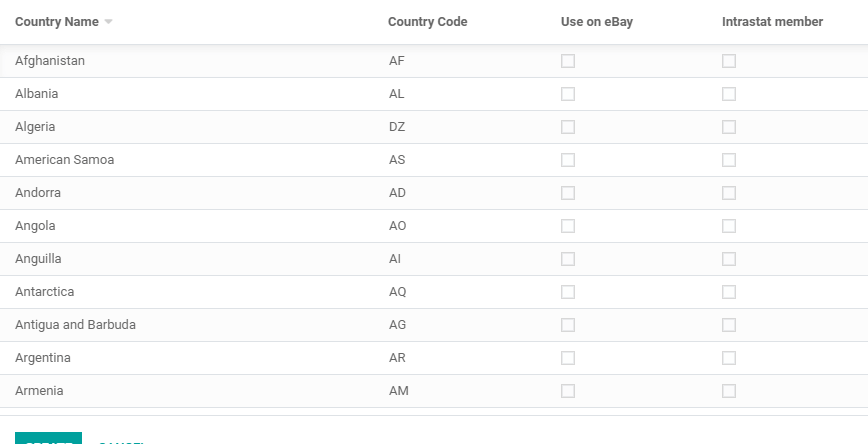

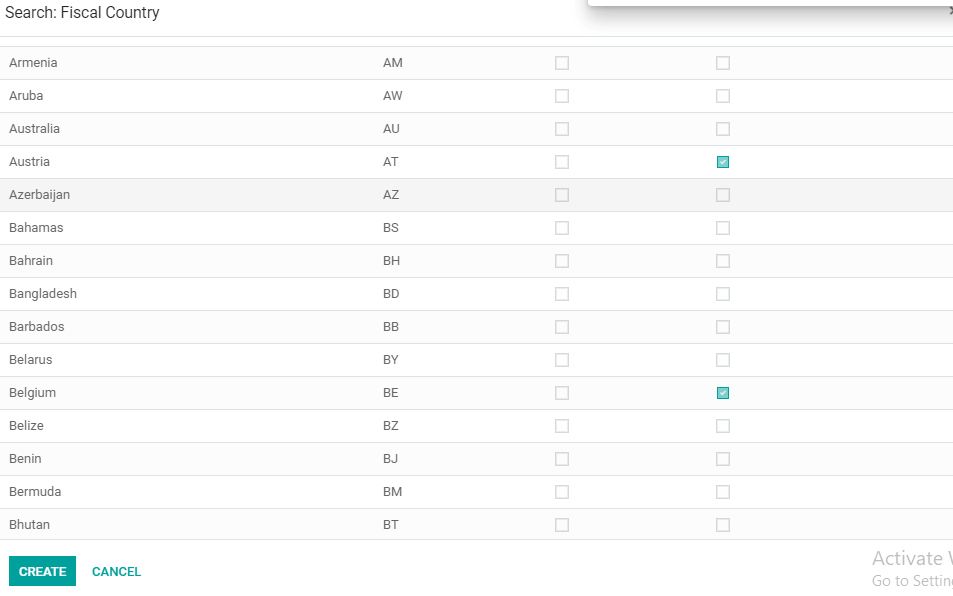

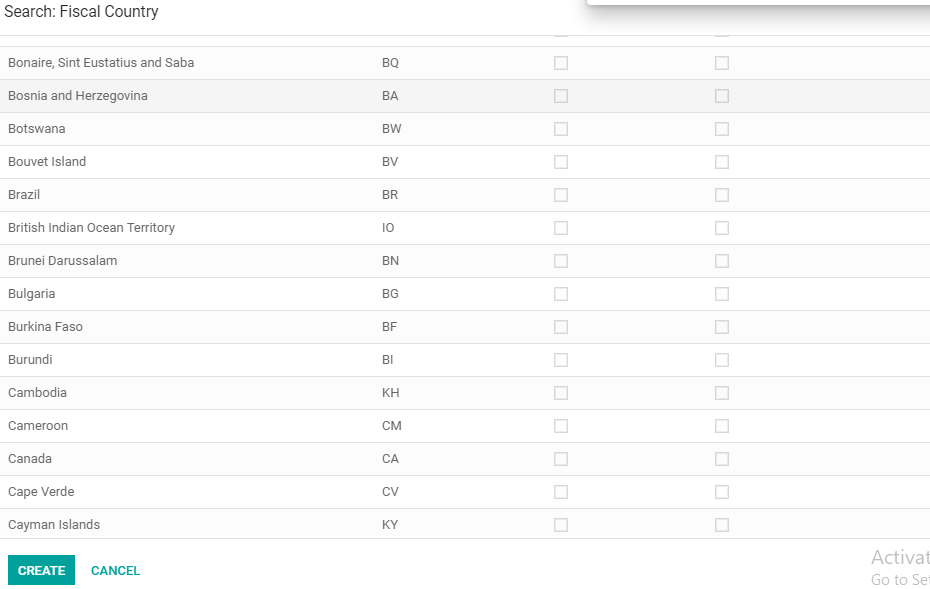

Let us also check the list of countries included here.

This fiscal localization package can be used by the users in multiple ways to manage country wise account details and bank statement records.

Also Read: What is ERP Localization?