Accounts and finances of a company can always be trickier, the operations involving various attributes, numerous parameters, and an ever-changing live environment, the financial operations of a company can be the sole reason without proper management can make the future of the company go downhill. Therefore, every company operates a dedicated finance department which is considered the greatest individuals and the visionaries of the company. The functioning of the financial aspects often the company is done with utmost care and planning which has well-drafted propaganda on how the company could achieve its profits.

Finance operations of the company are done in various terms and operational methodologies of the world which differ in every corner and the functioning will be different. However, there are more similarities in their functioning than dissimilarities. Where the major aim is attaining profit and would be adaptable to achieve it at any cost because the future of the company depends on it.

Odoo is an Enterprise and resource planning software which has been developed in the wake of the century and has been providing its uses with beneficial results in the company operations. Operating from a single platform the accounting management Odoo is interconnected with all the modules of operations and will be managed most efficiently and reliably.

[wpcc-iframe loading=”lazy” width=”727″ height=”409″ src=”https://www.youtube.com/embed/Ei6-7gzW8-U” frameborder=”0″ allow=”accelerometer; autoplay; encrypted-media; gyroscope; picture-in-picture” allowfullscreen=””]

This blog will provide insight into

Accounts Receivable for Customer

The accounts revocable for the purchases made from the customer are depicted in the receivable accounts of the company. The user can define the accounts receivable for each customer operation on the platform.

The accounts receivable operations on the customers can be described with an example.

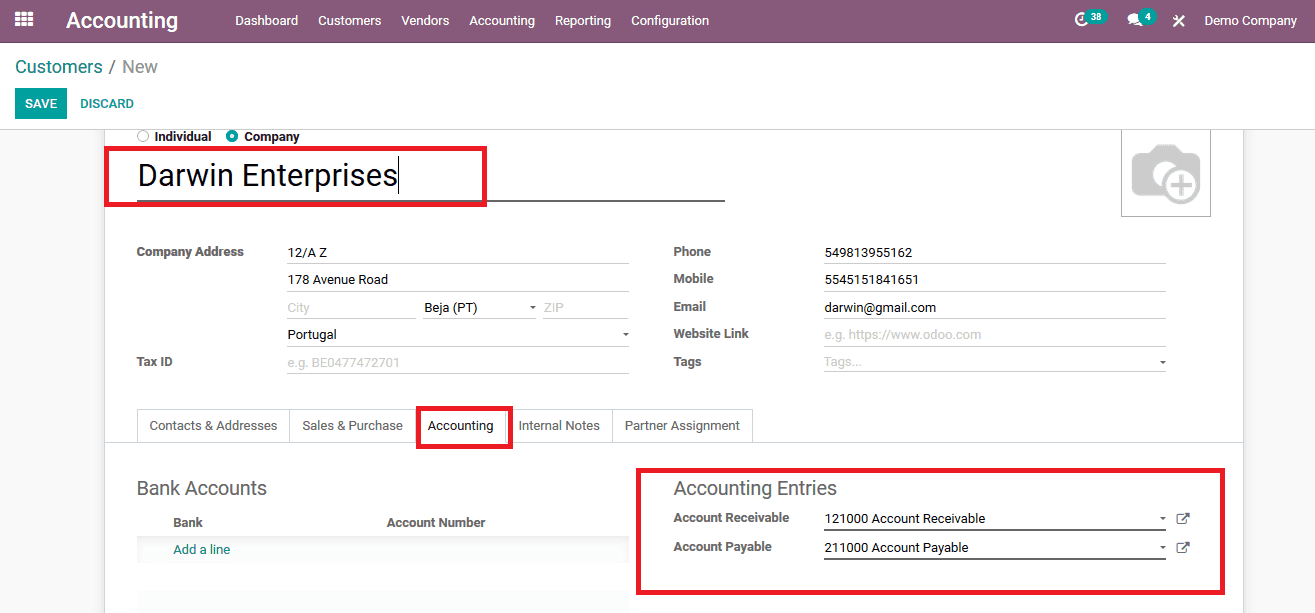

Step 1: Create a customer for the operation and assign the details. Under the accounting menu, the receivable and payable accounts are described as per the default ones set by the platform.

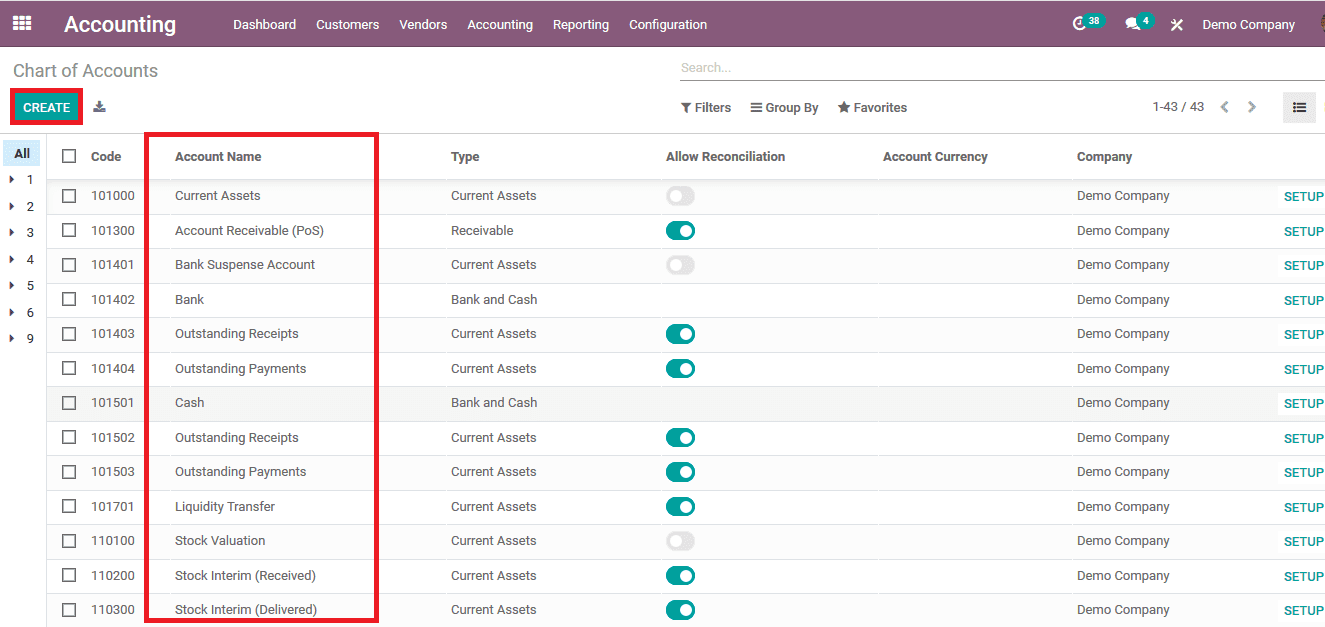

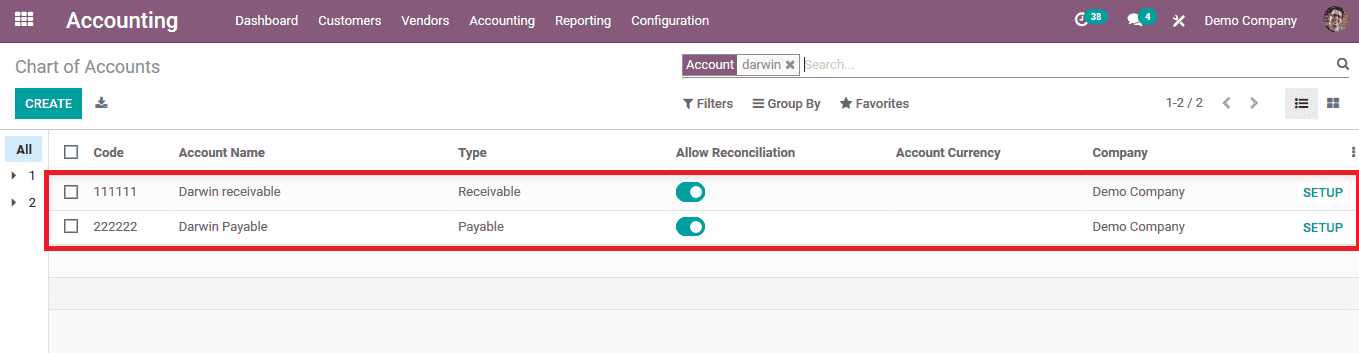

Step 2: Let’s create a new chart of accounts for the respective customer, in the chart of accounts menu. Also Here all the charts of accounts described in the platform are listed out. The user can create and manage as many charts of accounts in the platform.

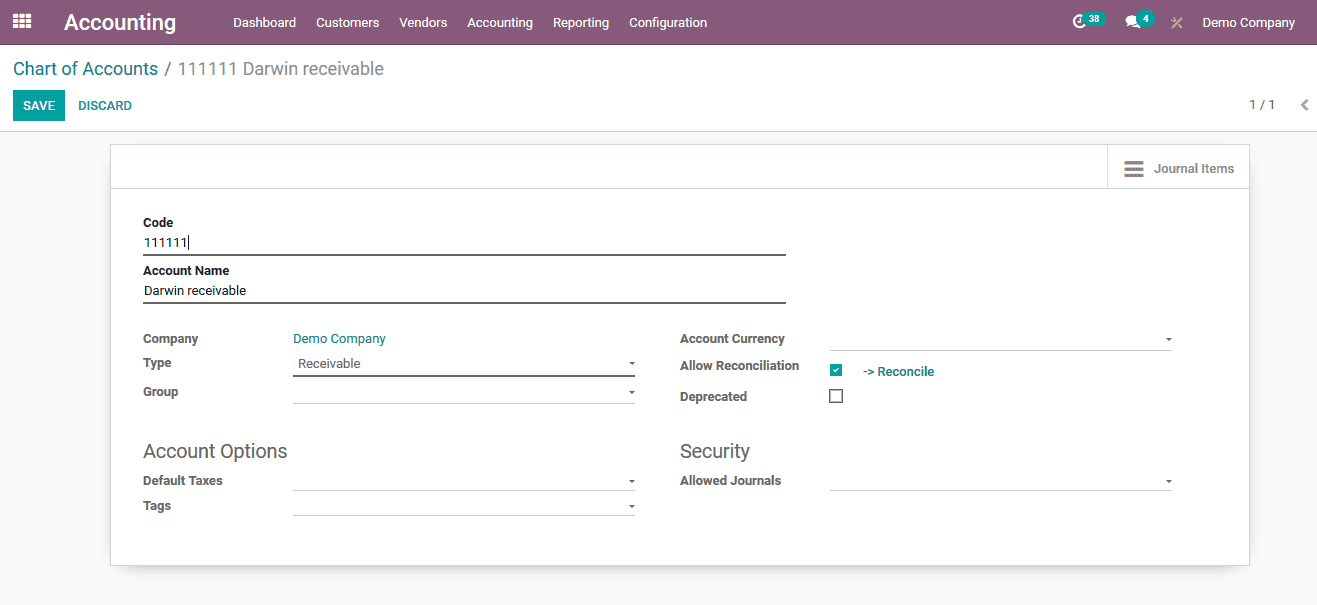

Step 3: The user can select the create option to create a new one and in the window describe the code and assign the account name. The type can be specified as receivable.

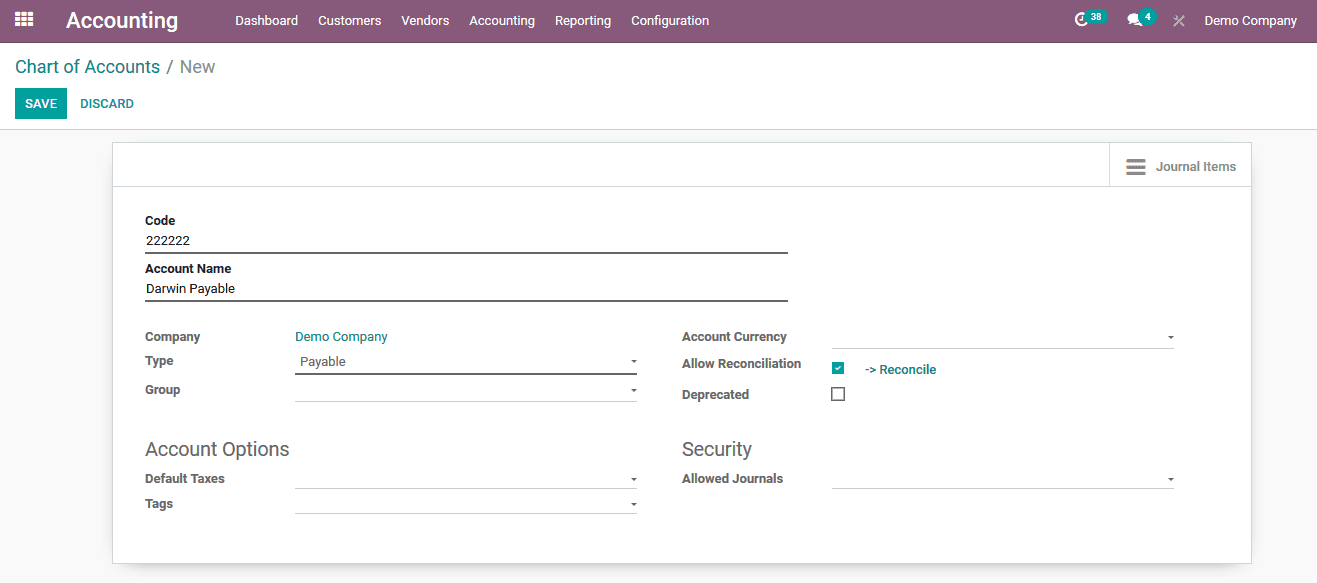

Step 4: As a receivable chart of accounts has been described let’s create one for the payable operations similarly as done in the previous step but assigning the type as payable one.

Now back in the charts of accounts menu the recently created two accounts are being depicted. In case the user can’t find it the filtering and group by options can be used to get hold of it.

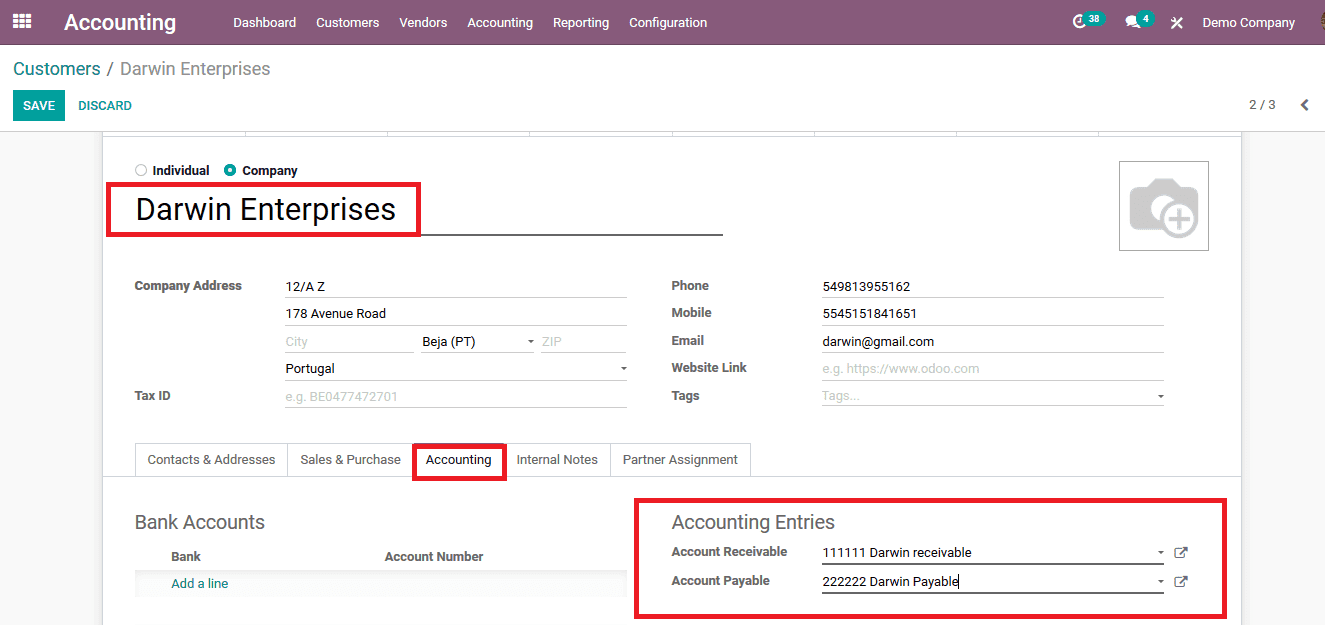

Step 5: Assign the created chart of accounts to the customer details. To do so back in the customer menu select the accounting tab and assign the receivable and payable accounts as created respectively in the previous steps.

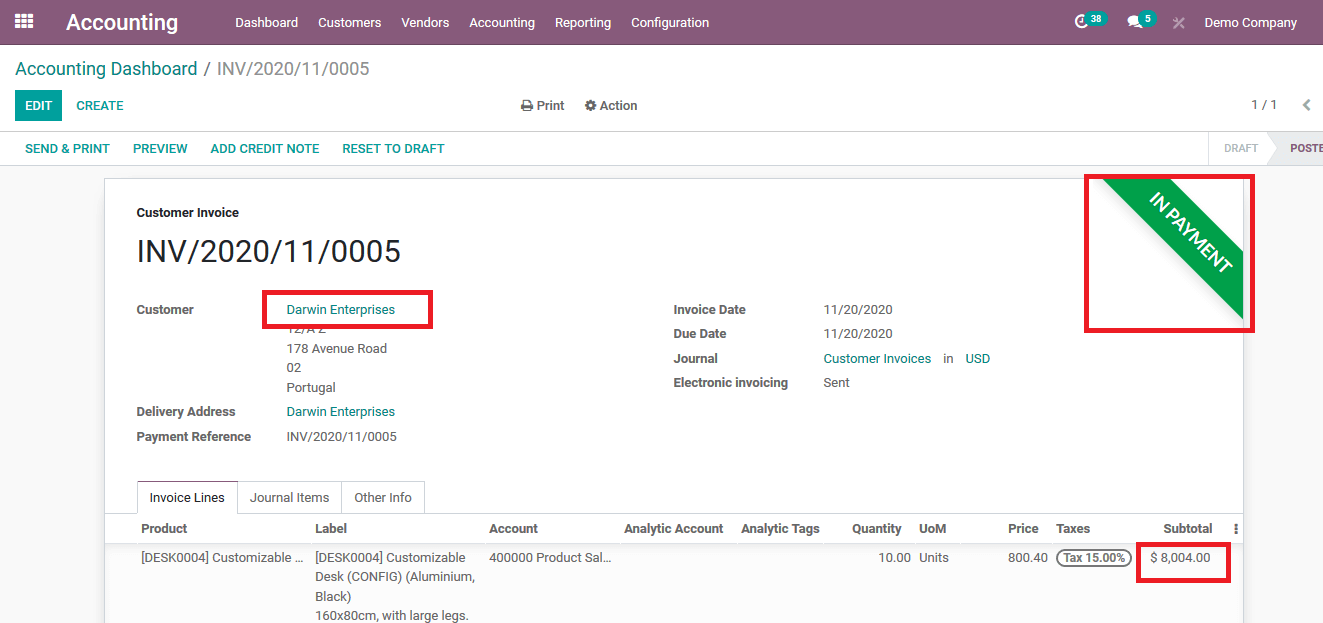

Step 6: To demonstrate the operation of the accounts receivable let’s create a customer invoice from the accounting module overview dashboard. Select the create option and provide the respective customer details and allocate a product to be attached with the invoice. Once the invoice is drafted it is posted and set to the customer and upon reception of the payment, the status of the operations is changed to paid by registering the payment in the platform.

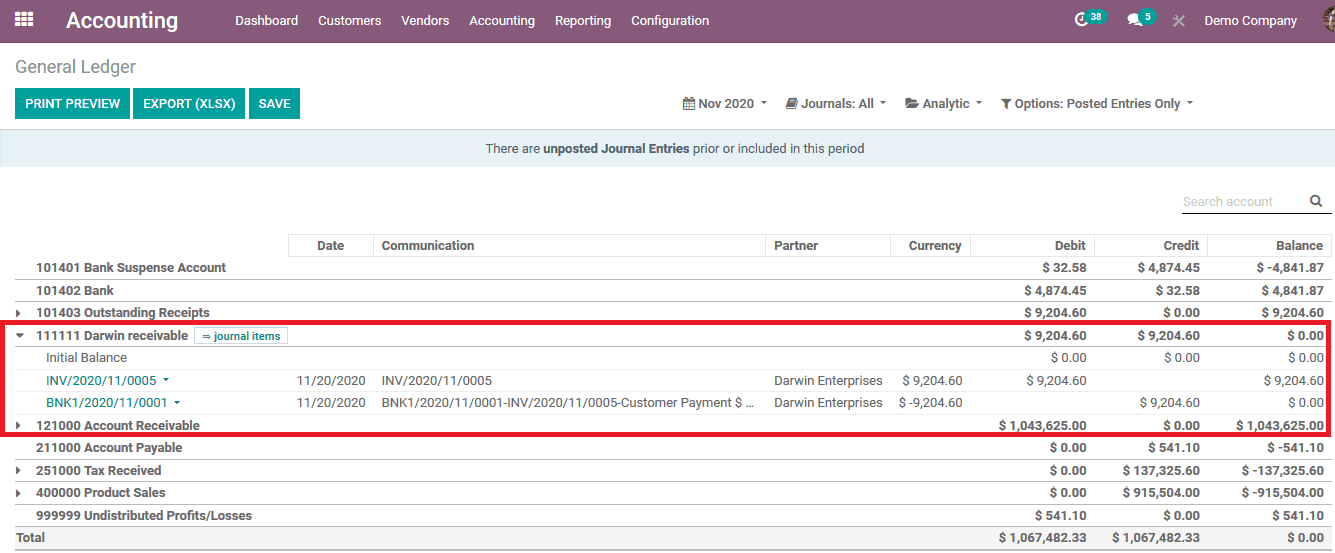

Step 7: Under the general ledger reporting menu the receivable operation for the respective customer is depicted under the receivable chart of accounts described under the customer menu.

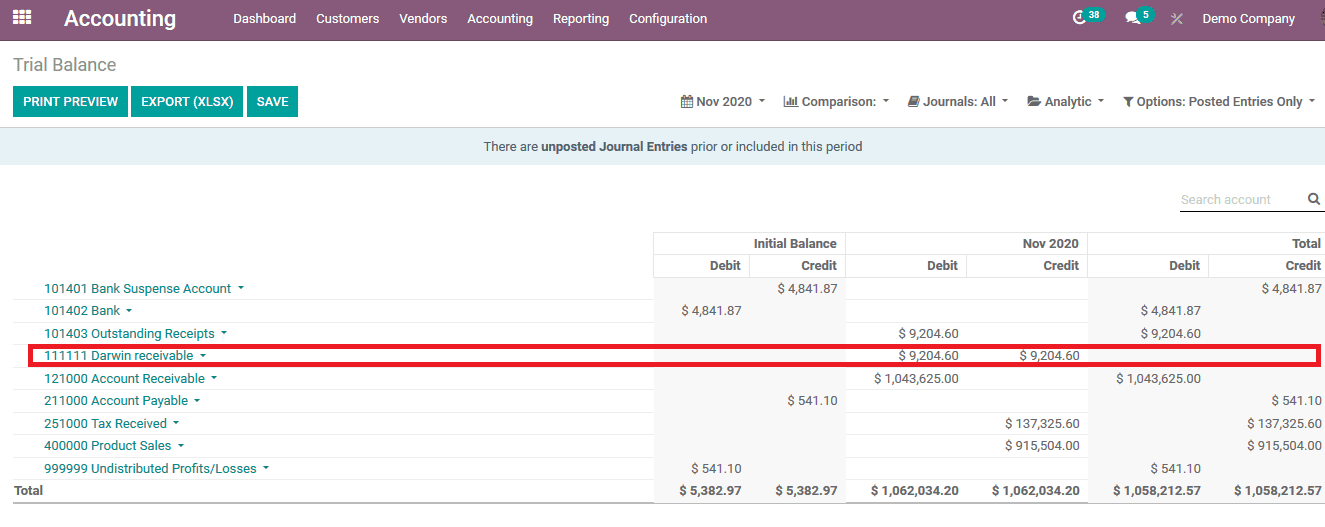

The Odoo platform also offers a trial balance report menu while allowing the users to derive the accounting reports on the chart of accounts of the platform.

Accounts Payable for Vendors

Likewise receiving the amount for the sales of the products from a company there is also the liability of paying the vendors for the purchase of products and services from them. The Odoo platform has provided the user with the ability to describe the accounts payable for the company operations similar to the accounts receivable.

As done for the accounts receivable explanation in this blog the operation can be explained with the help of an example.

Step 1: Create a vendor and define the details allocated with it. The accounts receivable and payable will be auto allocated as per the default options being derived.

Step 2: Create a chart of accounts for the payable as done in the above section of this blog. Assign the type of the chart of account is payable.

Step 3: Allocate the respective payable chart of accounts to the vendor description similarly done for the receivable account.

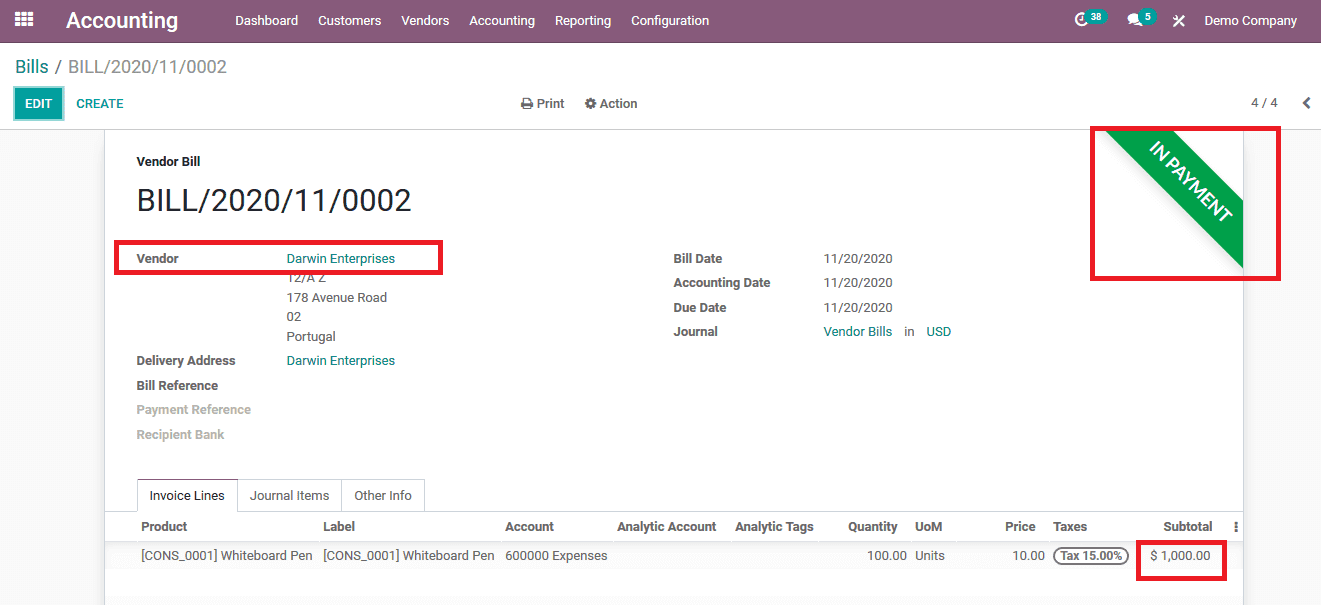

Step 4: To the explanation here the same customer describes the receivable account description as used as a vendor. Now create a bill from the vendor menu on the respective one defined and allocate a product to it. Post the bill and register the payment upon its reception.

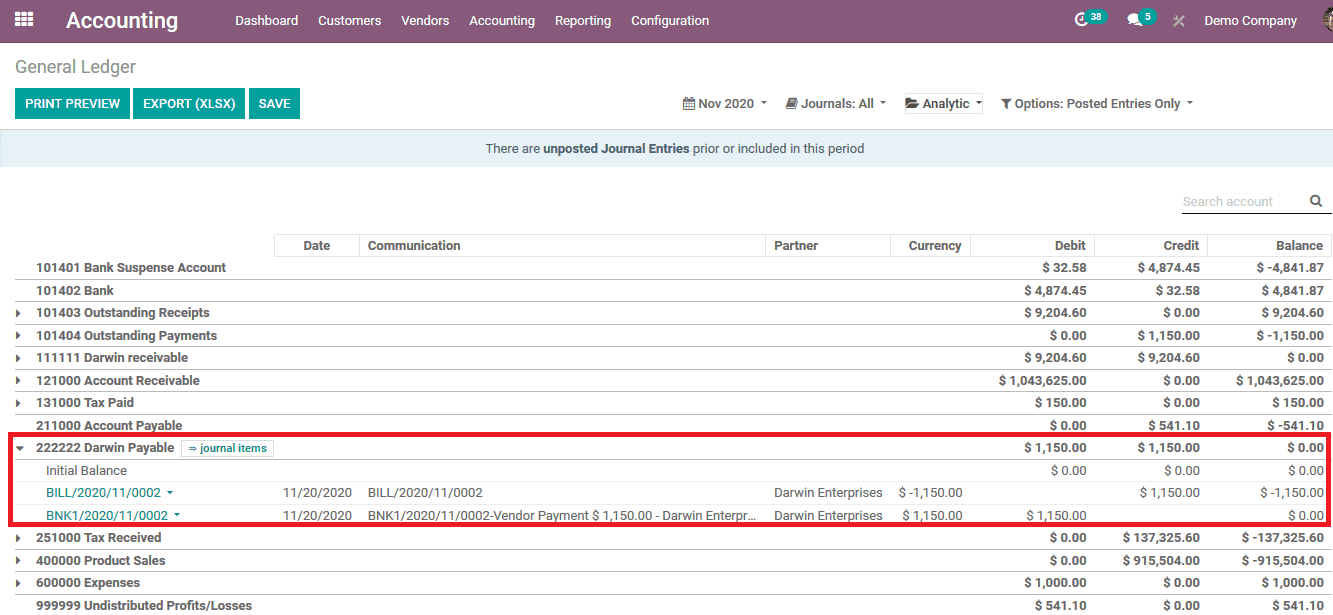

Step 5: Under the general ledger the report of the module the user can view the payable chart of the account and the details allocated with it.

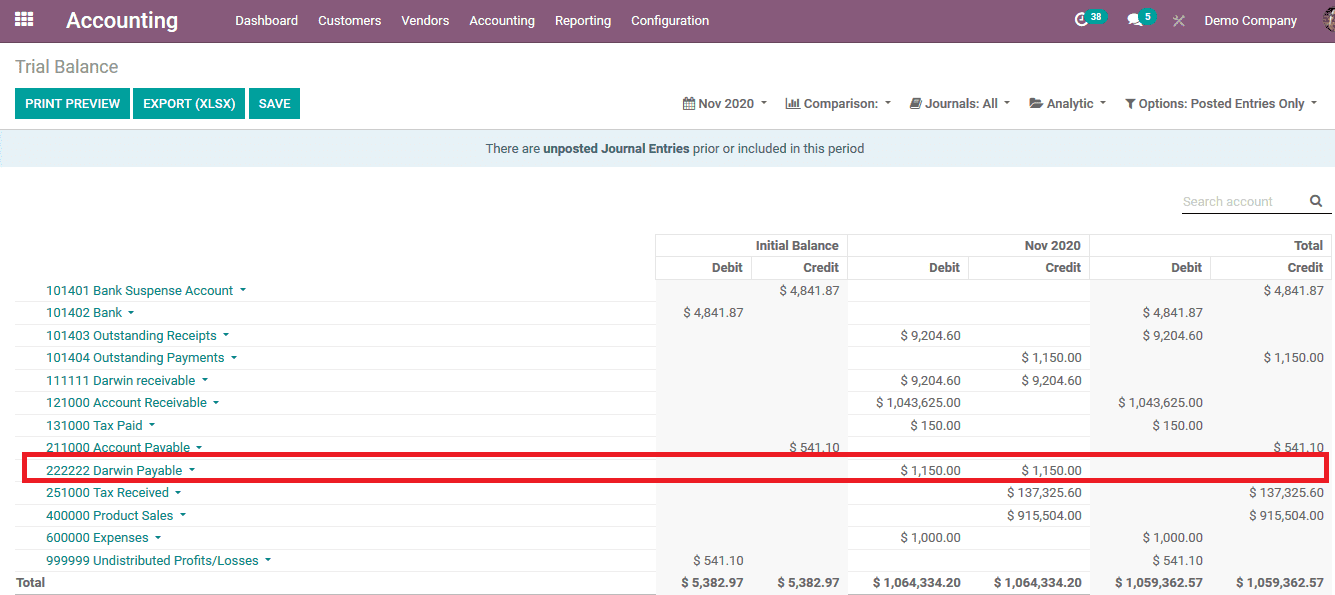

In addition, the Odoo platform offers the trial balance reporting function for the users to describe the required report on the chart of accounts. Here the respective payable chart of account description is available.

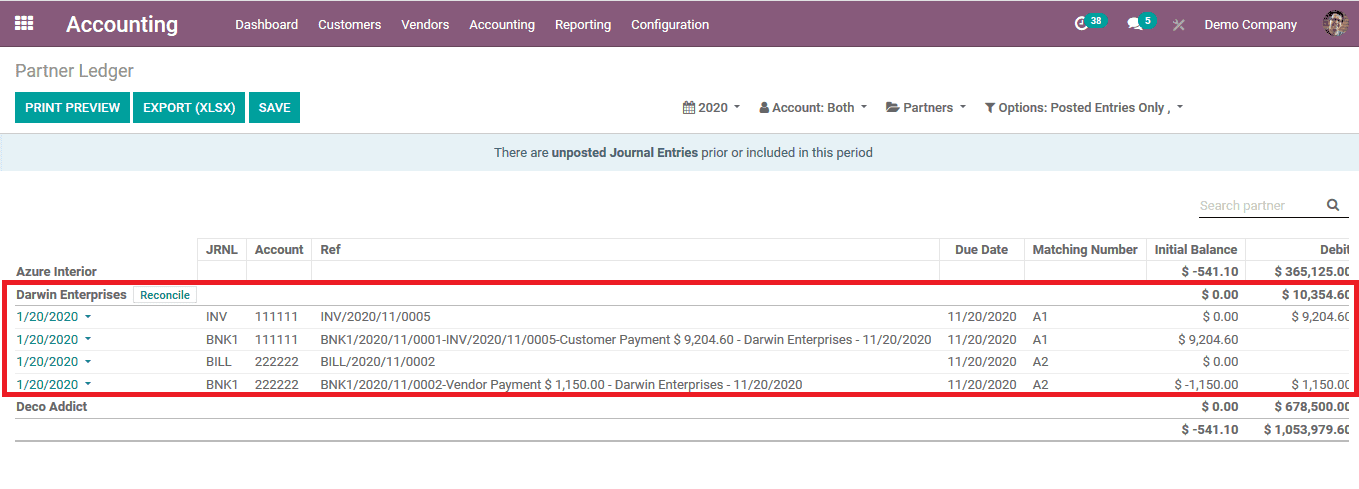

Furthermore, as the customer and vendor are specified as the same one the platform recognizes the one as a porter having business allocation with the companies a vendor as well as a customer. The partner ledger of the platform will describe all the financial operations and the aspects involved.

Also Read: Odoo 14 Accounting