Odoo is a popular enterprise resource planning (ERP) software that provides a comprehensive suite of business applications to manage various aspects of an organization’s operations, including accounting and finance. One of the key financial statements that Odoo can generate is the cash flow statement, which provides a summary of an organization’s cash inflows and outflows over a specified period.

The cash flow statement is an important tool for financial analysis as it helps businesses to monitor their liquidity and cash position. The statement is divided into three sections:

1.Cash and cash equivalents, the beginning of period

2.Net Increase in cash and cash equivalents

3.Cash and cash equivalents, closing balance

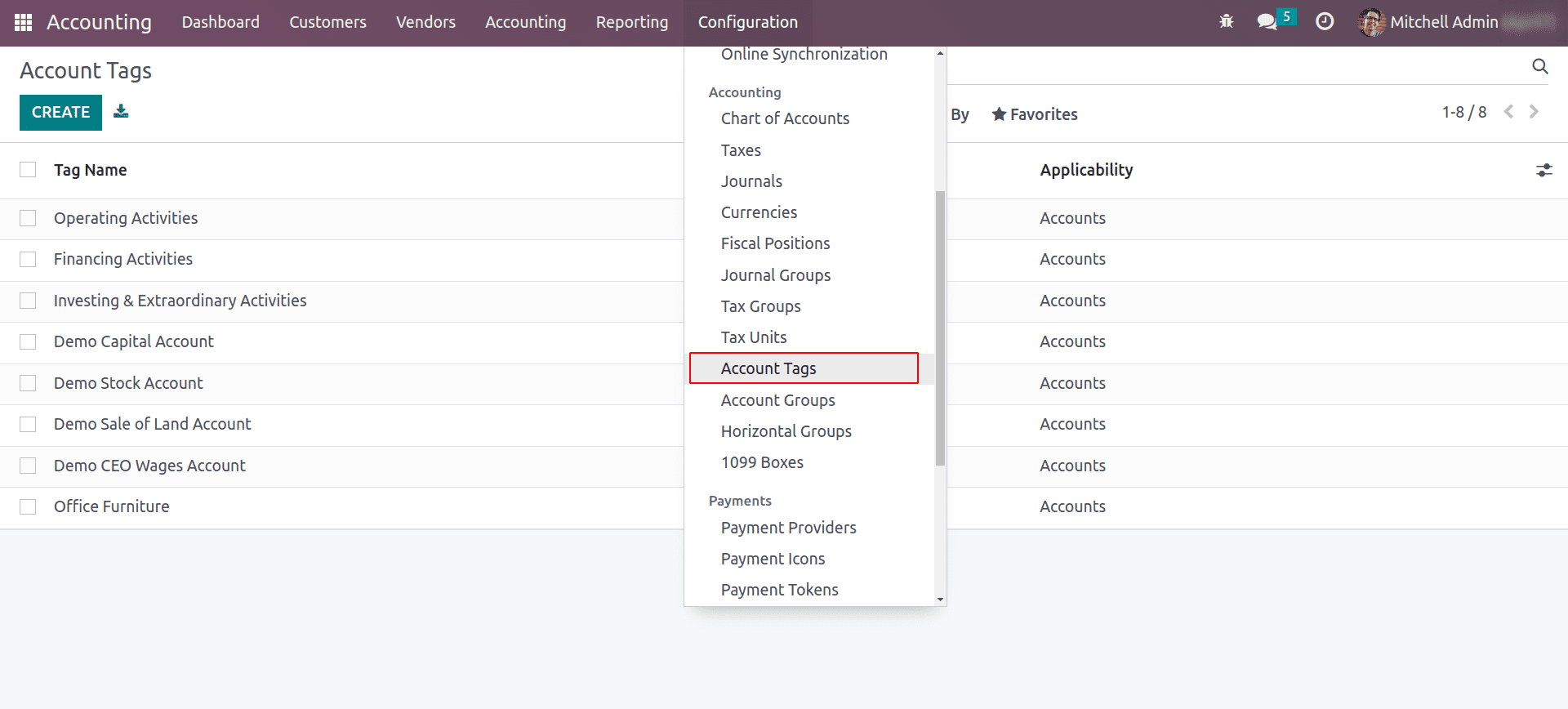

Before getting into the details of the cash flow statement, let’s take a look at account tags. This account tag plays a vital role in recording respective cash amounts at different activities.

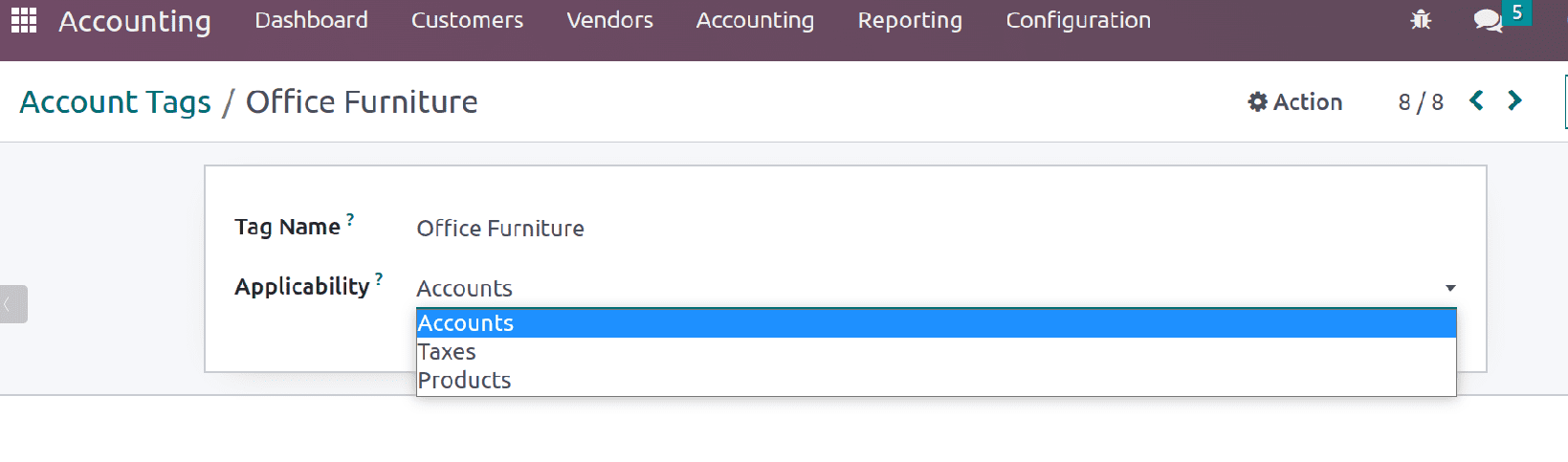

Firstly, Activate the developer mode. The under configuration menu of accounting, we will have ‘Account Tags’.

Account tags are labels that you can use to categorize and organize your online accounts. For example in your database you have configured many charts of accounts that are used for various purposes, there will be expense accounts to record direct expenses and indirect expenses or there will be some project expenses accounts.

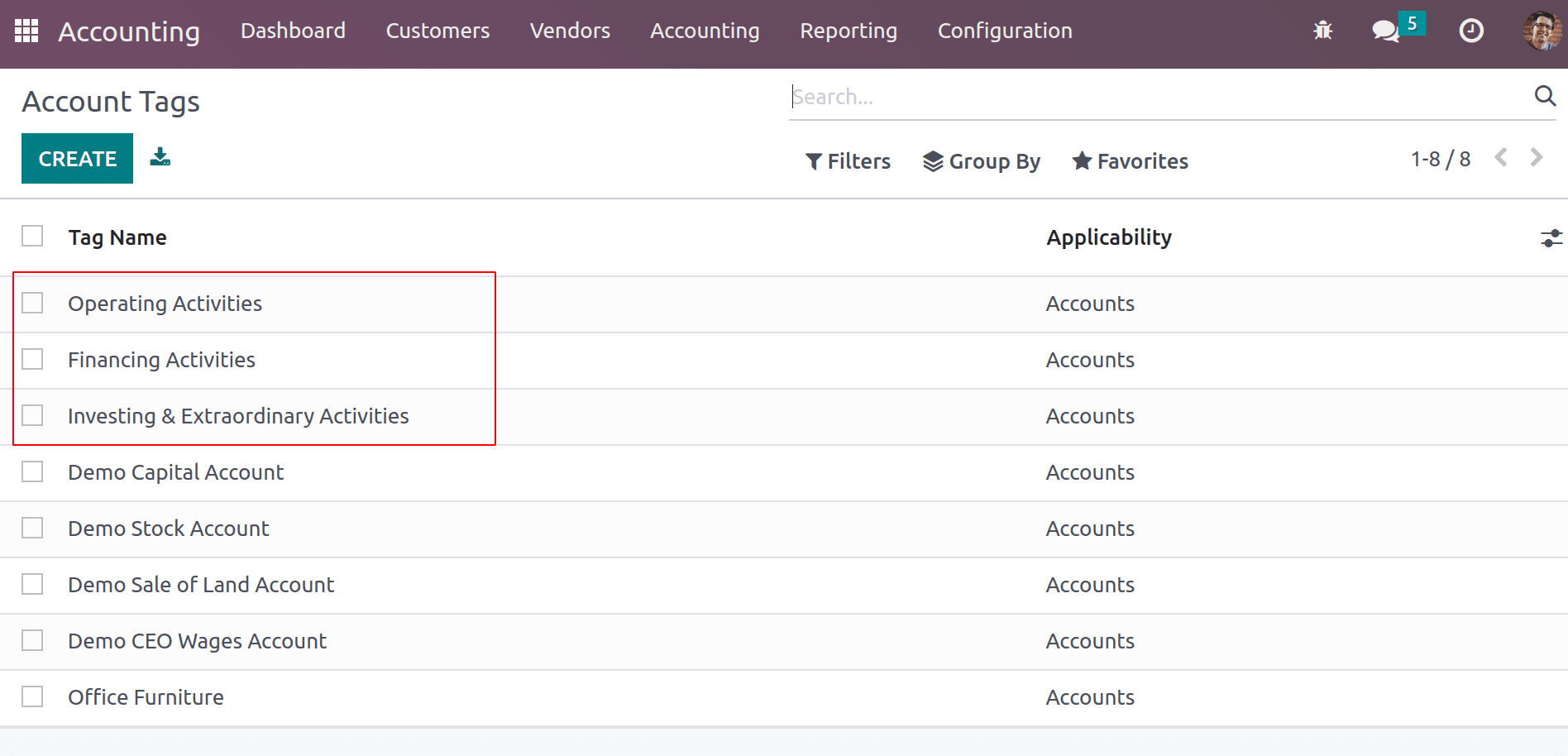

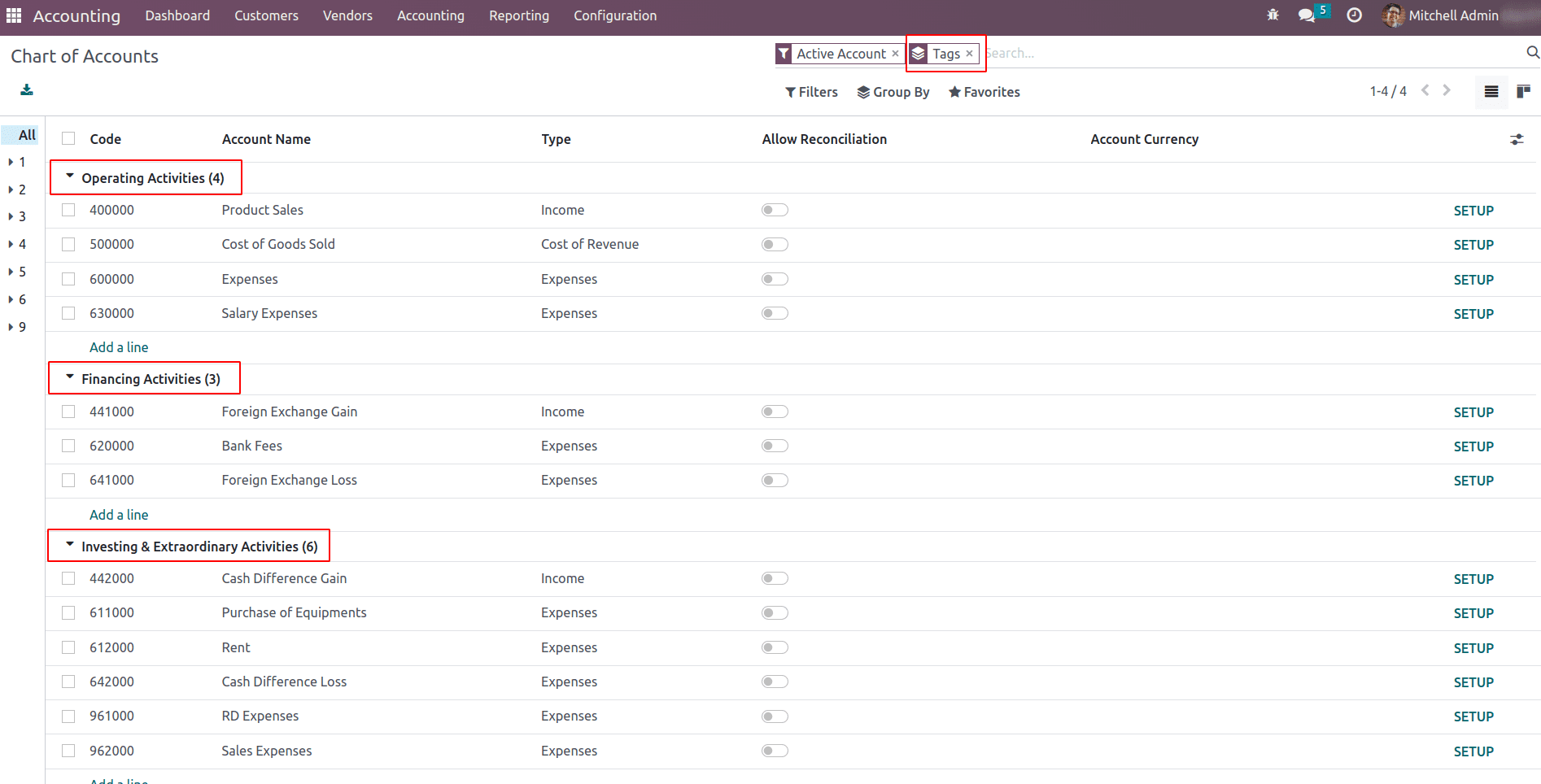

These three tags Operating Activities, Financing Activities, and Investing & Extraordinary Activities create three sections under the cash flow statement.

Thus adding tags to your accounts will help to classify the accounts and it will help to identify accounts that are being used for operational activities or non-operational activities.

These account tags can be applied to ‘Accounts’, ‘taxes’, and ‘Products’. For tags, they are used as tax grids which will decide how the entry will record in the tax report.

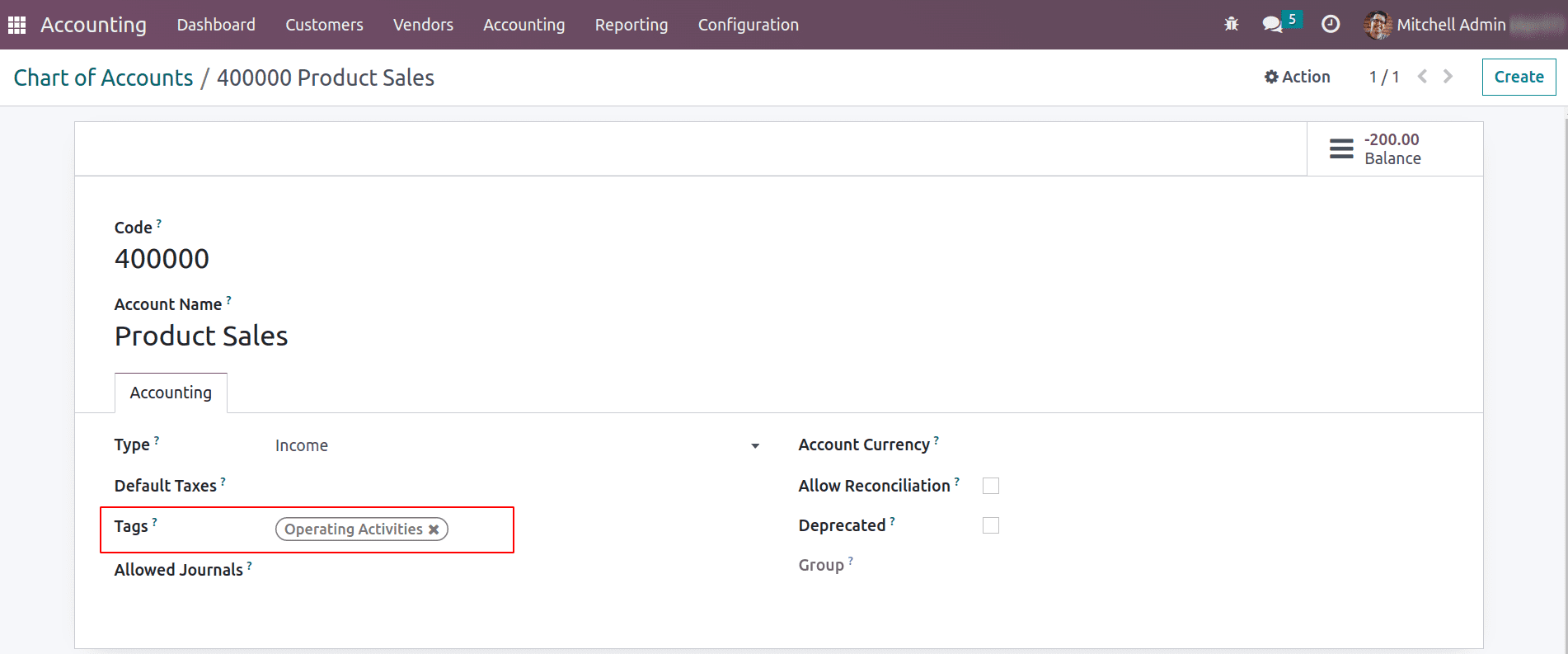

These account tags can be set to the chart of accounts of the company. Thus a cash entry that affects the account will add to the cash flow statement under the respective section.

Go to Accounting > Configuration > Charts of Accounts, for each chart of accounts tags can be applied.

One can group the chart of accounts by tags.

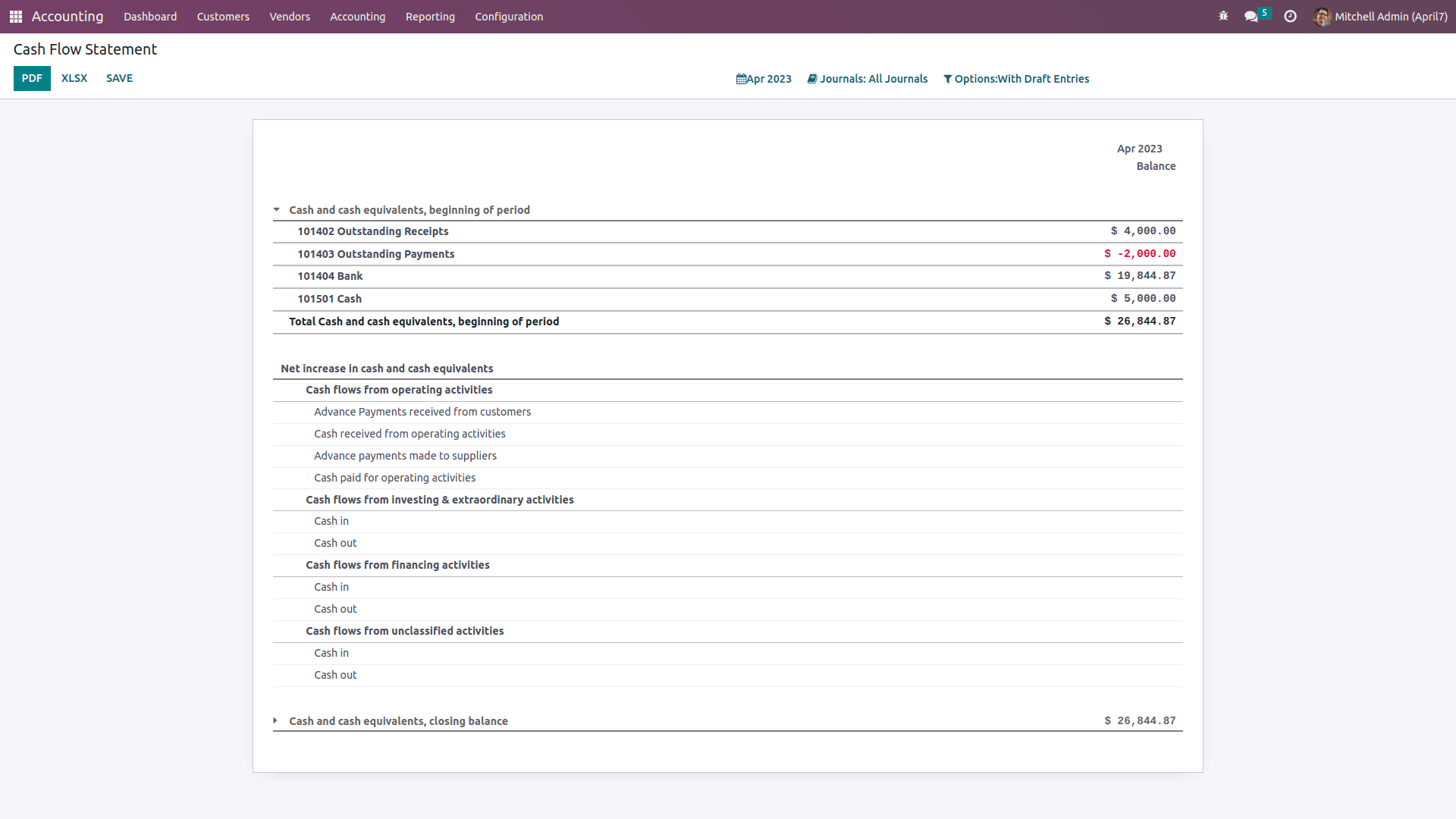

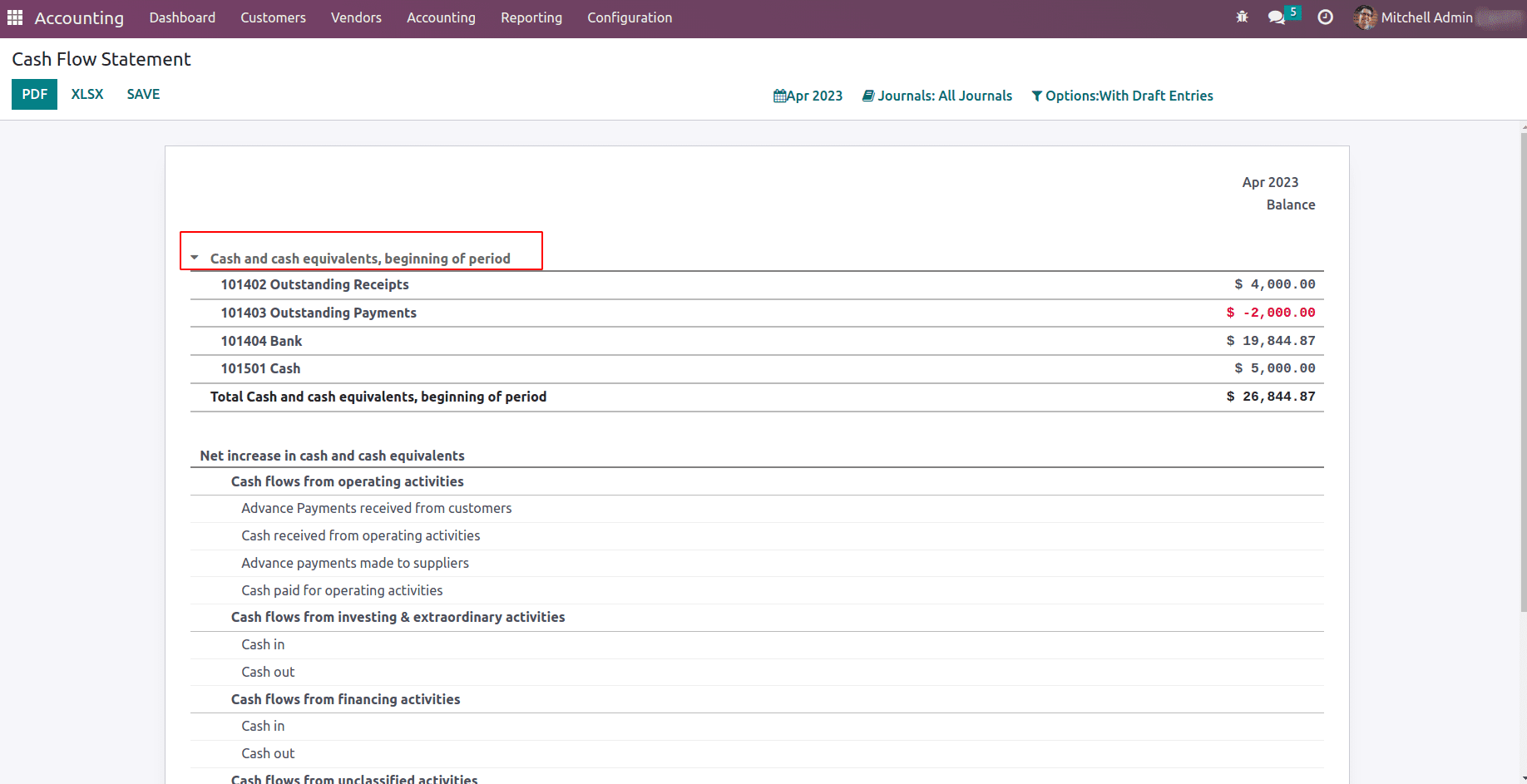

Cash and cash equivalents, the beginning of period

The ‘Cash and cash equivalents, the beginning of period’ defines the total amount of cash and cash equivalents that a company had on hand at the start of the accounting period. Cash and cash equivalents are defined as highly liquid assets that can be readily converted into cash. When a company starts, there are certain initial configurations to set up such as the accounting method following is Anglo-Saxon or continental, its COA, Journals, taxes, etc. Once all these are set up, we will add the opening balance. Thus we may have to update the current cash balance, bank balance, and other cash equivalents. This will appear in the section ‘Cash and cash equivalents, the beginning of period’ of cash flow statement.

Here is the initial cash balance, bank balance, and the amount from the outstanding receipts account that exists under the initial section where the cash and cash equivalents are recorded. This amount represents the ending balance of the previous accounting period, and it serves as the starting point for the current period’s cash flow statement.

It’s important to note that the beginning balance may not be the same as the ending balance of the previous period’s cash flow statement. This is because cash and cash equivalents can fluctuate throughout the accounting period due to various factors such as business operations, investment activities, and financing activities.

Now let us look into the next section ‘Net Increase in cash and cash equivalents’.

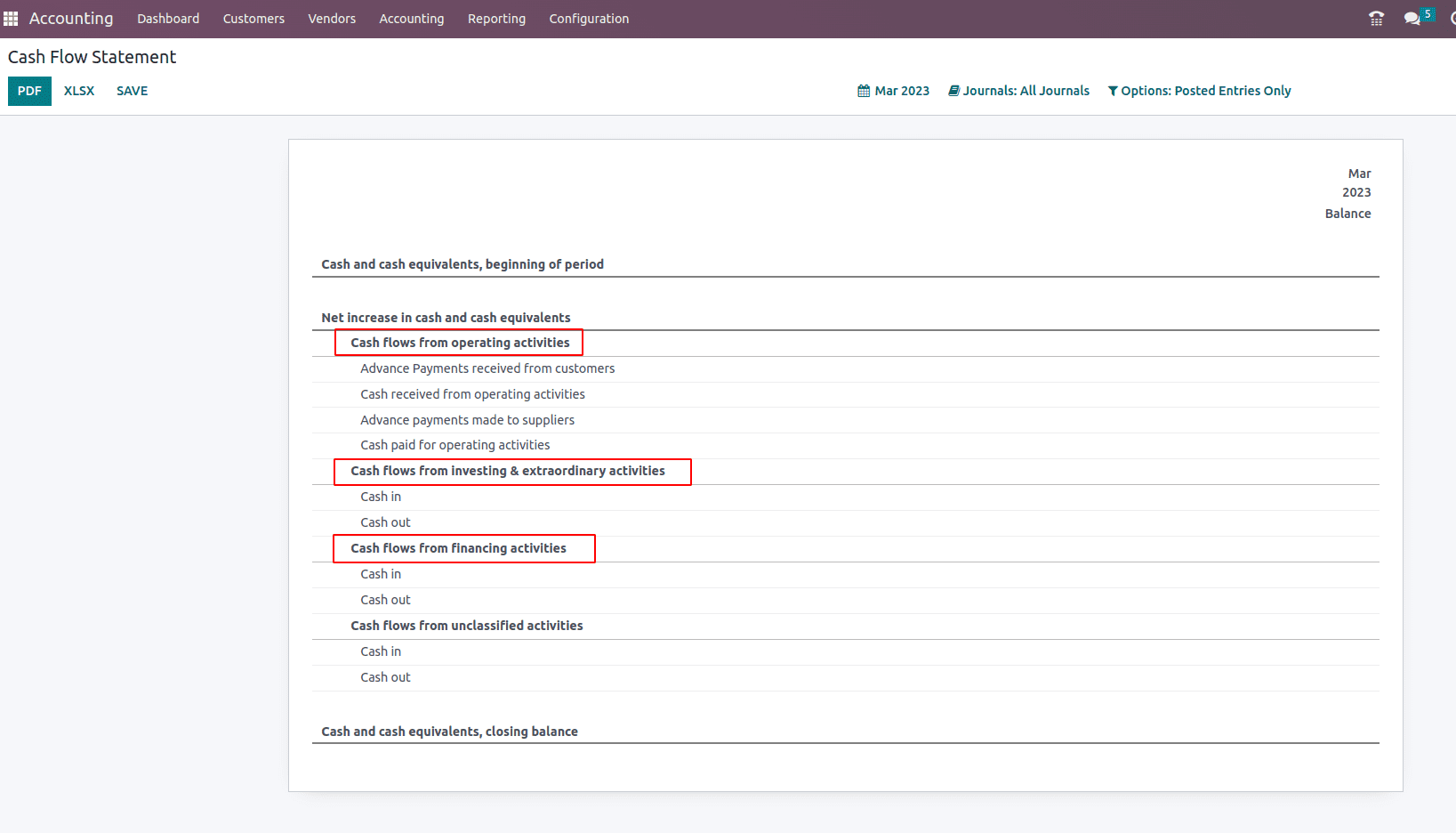

Net Increase in cash and cash equivalents

In Odoo 16, the Net Increase in Cash and Cash Equivalents is a line used to assess the overall change in a company’s cash position during the accounting period. Understanding the Net Increase in Cash and Cash Equivalents is an essential component of financial analysis since it presents an overview of an organization’s cash status. This knowledge can enable stakeholders to make knowledgeable choices about financing, investments, and other commercial operations.

This ‘Net increase in cash and cash equivalents is divided into three sections:

1.Cash flows from operating activities: cash flows from operating activities refer to cash inflows and outflows linked to the company’s basic business operations.

2.Cash flows from investing & extraordinary activities: refer to the cash inflows and outflows related to the purchase or sale of long-term assets and investments. These activities are typically associated with the company’s investments in property, plant, and equipment, as well as investments in other companies or securities. Extraordinary activities refer to significant and unusual transactions or events that are outside the normal course of business including a merger or acquisition, a major legal settlement, a natural disaster, or a significant restructuring of the company.

3.Cash flows from financing activities: relate to the cash inflows and outflows associated with the company’s finance activities, such as debt repayment and capital raising. Owners, lenders, and other investors are all involved in these activities.

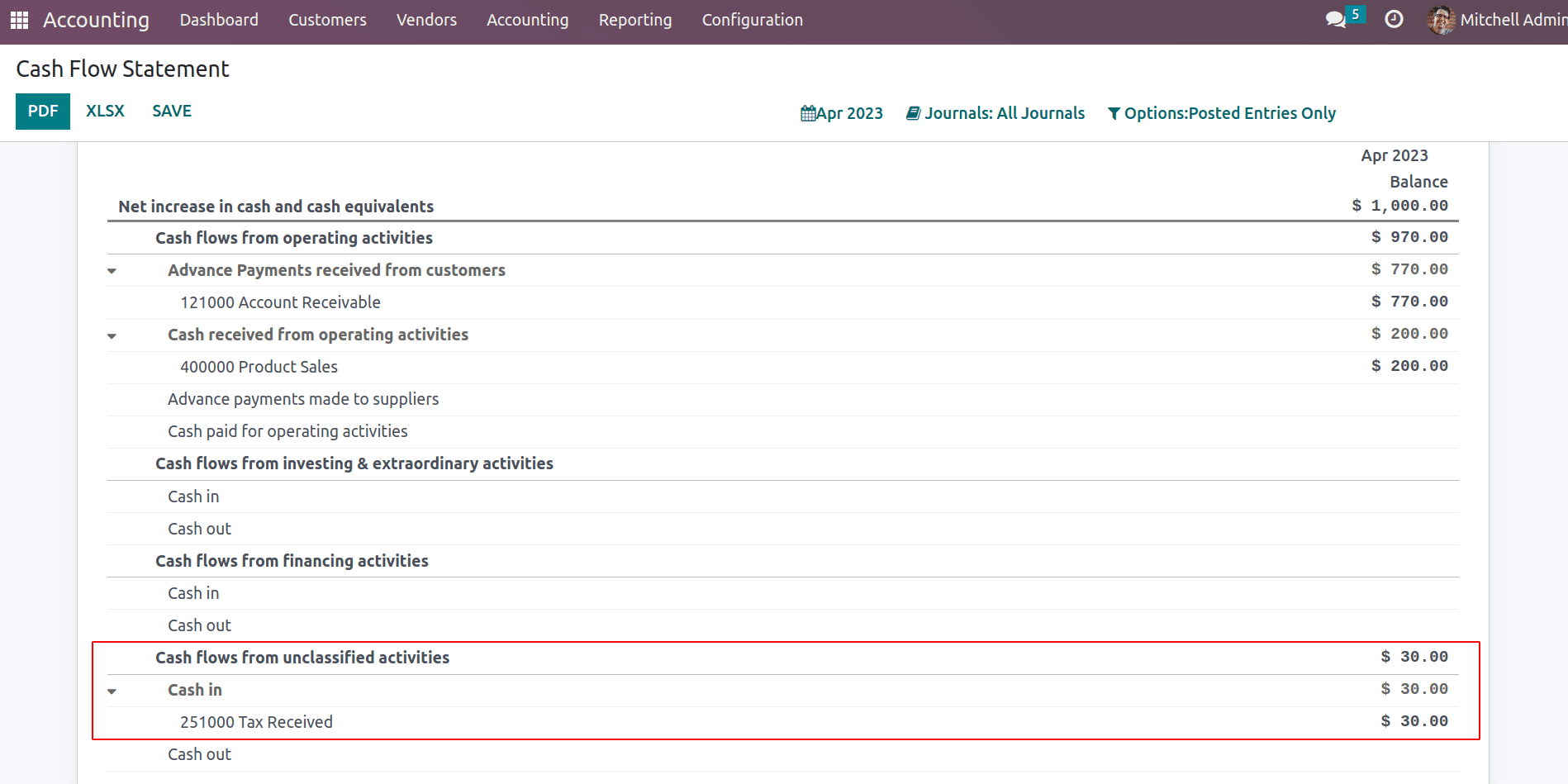

4.Cash flows from unclassified activities: When cash inflows or outflows cannot be defined as operating, investing, or financing operations, the section Cash flows from unclassified activities is impacted.

Cash flows from operating activities

Cash flows from operating activities refer to the inflows and outflows of cash and cash equivalents directly related to a company’s core operations. This section of the cash flow statement shows the cash generated or used by the company’s day-to-day business activities, such as sales, purchases, and expenses. Examples of cash inflows from operating activities include cash received from customers, interest income, and Advance payments, while cash outflows include payments to suppliers, wages and salaries, and interest paid. The cash flows from operating activities section provides valuable information about a company’s ability to generate cash from its primary business activities and is an essential component of the cash flow statement.

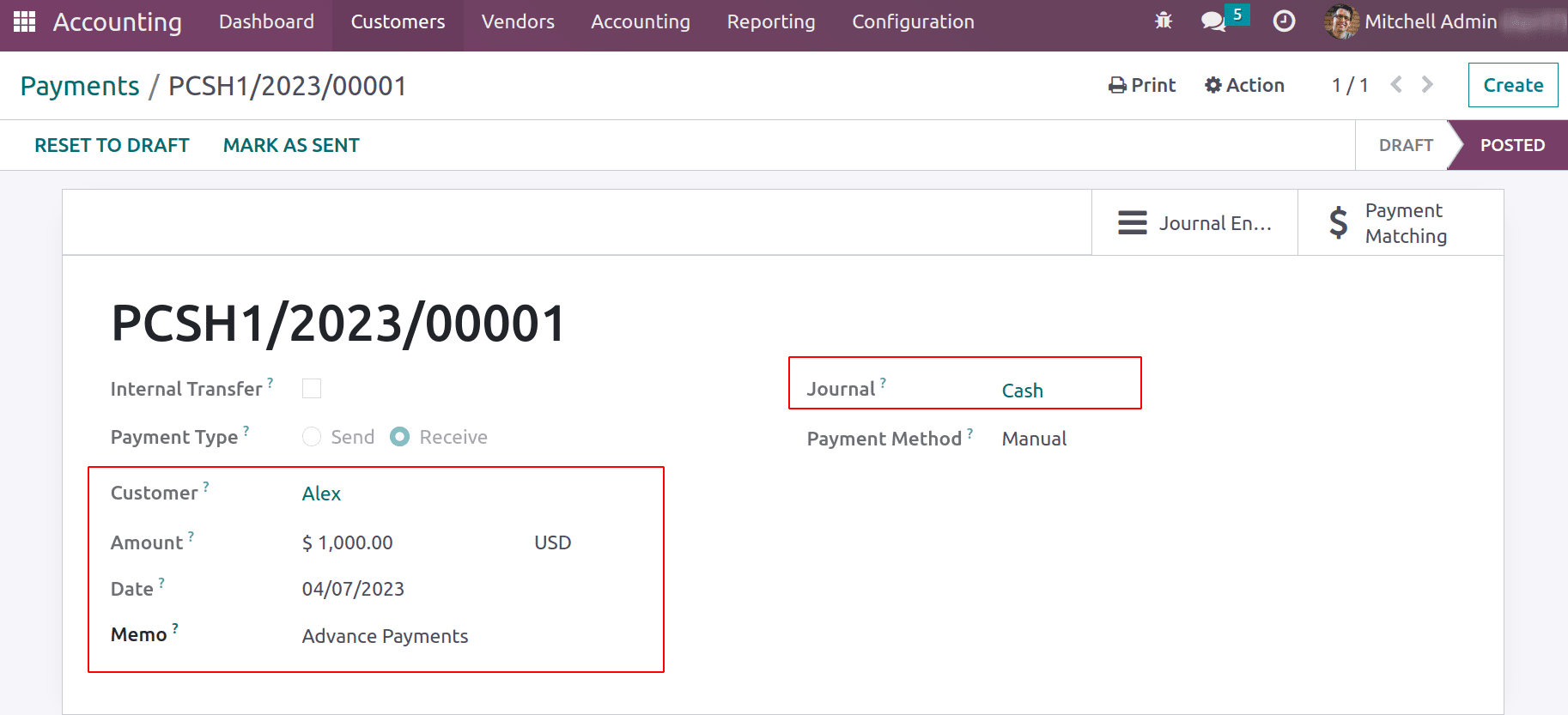

Suppose a customer made an Advance payment of $1000,

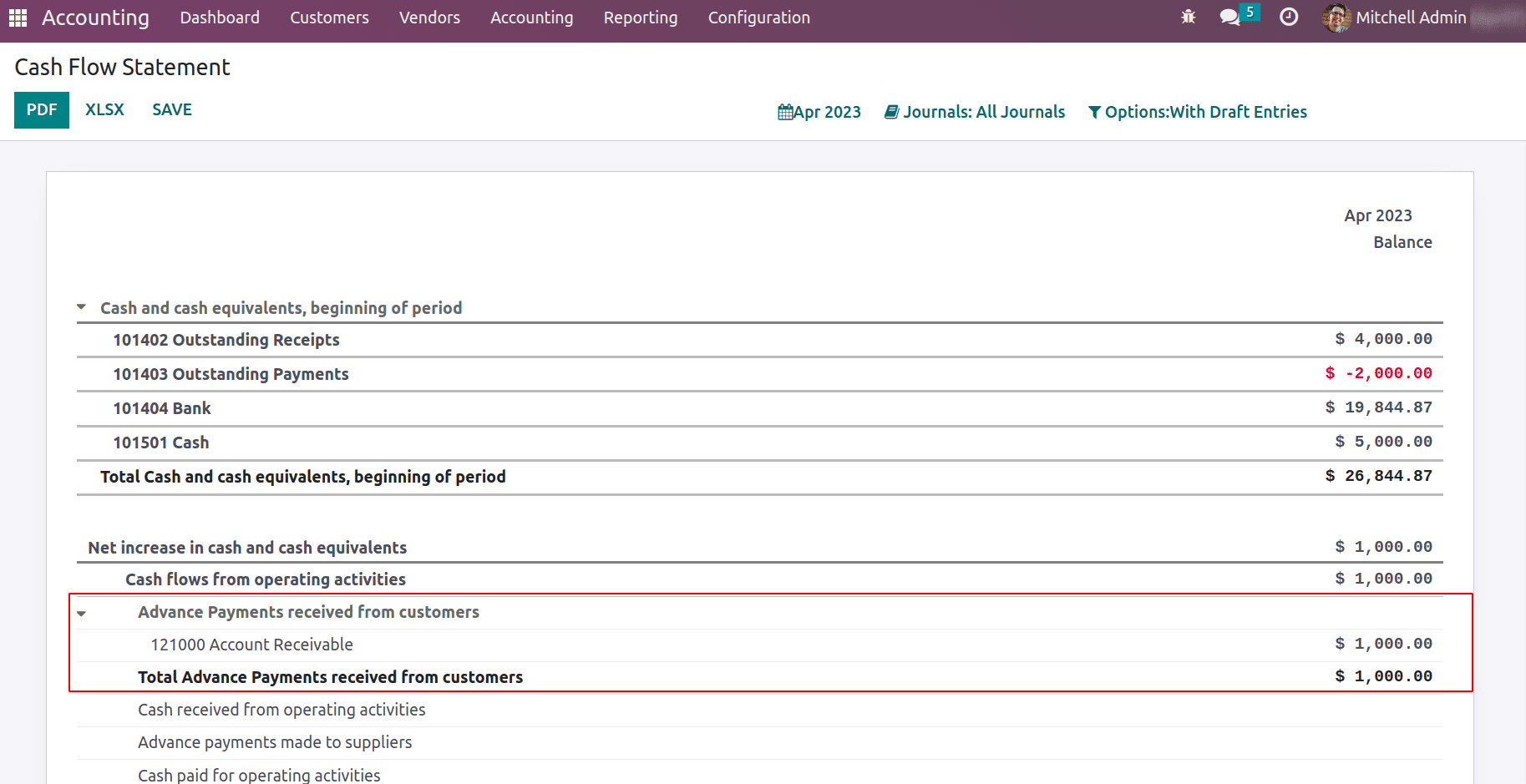

This advance amount is recorded as the cash amount received from the customer and can be seen as the ‘Advance amount received from the customer which is $1000.

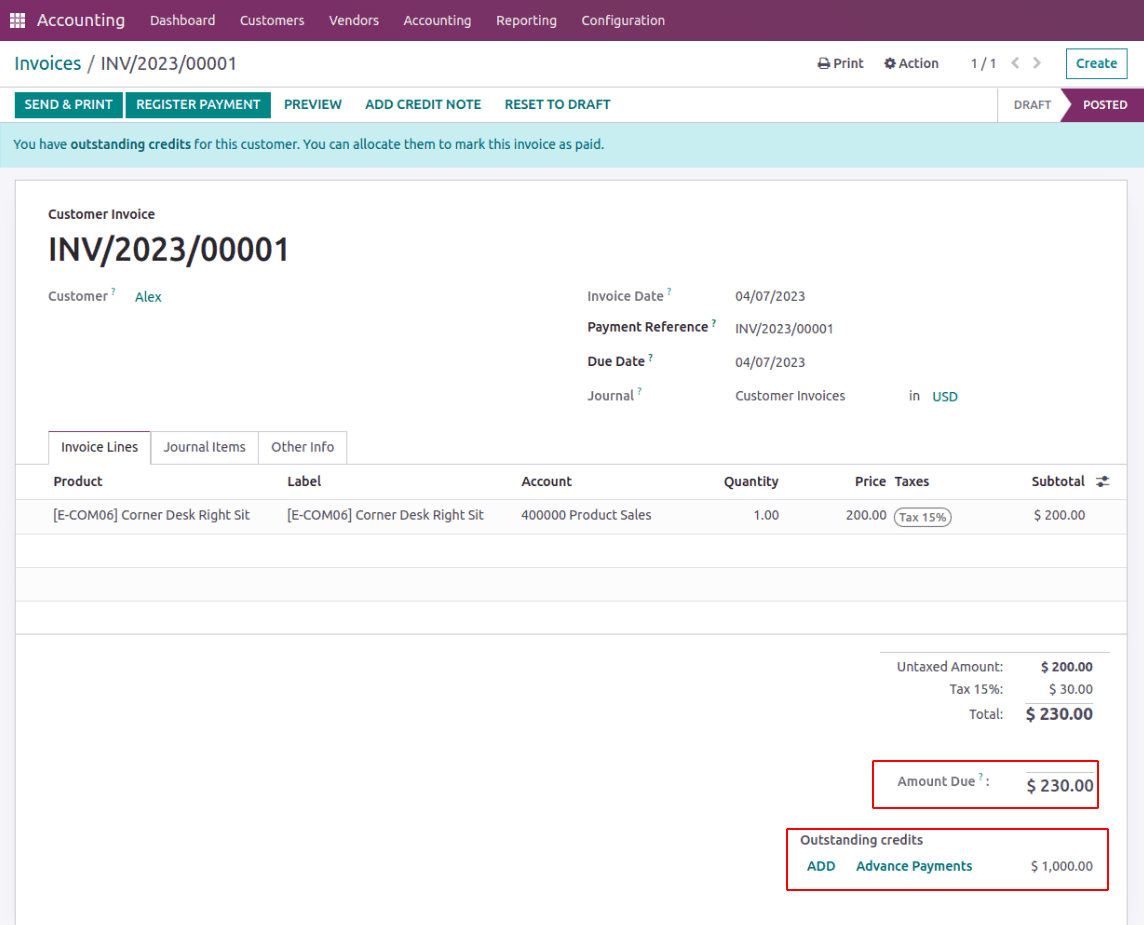

Later if any invoice has been generated for the customer with a payment amount of $230, which can be paid with the advance amount. The advance payment can be shown as outstanding credits, and the ADD button adds the advance payment to the invoice.

On adding payment, invoice status will move to ‘In Payment’. Now let us look at the cash flow statement.

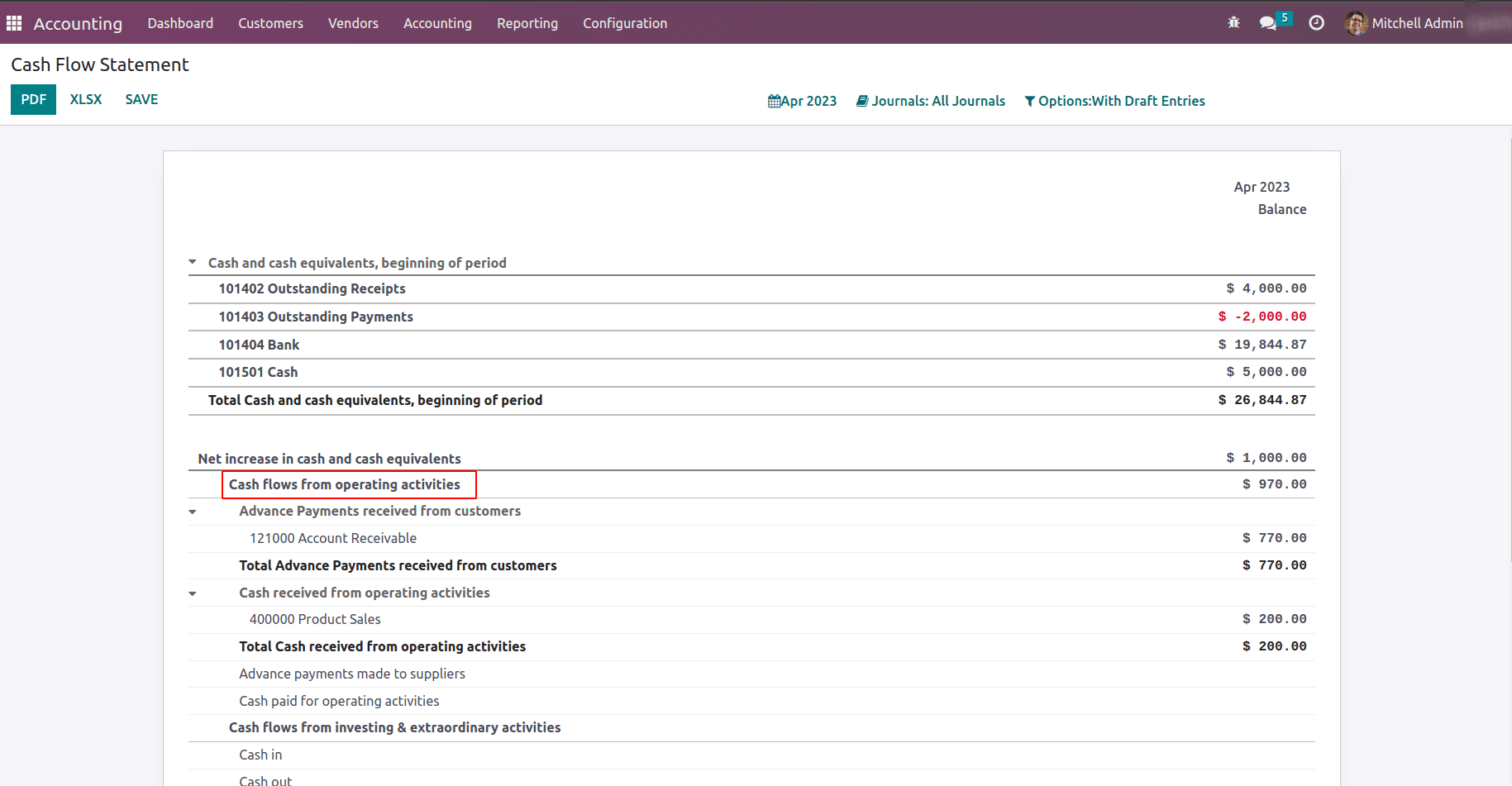

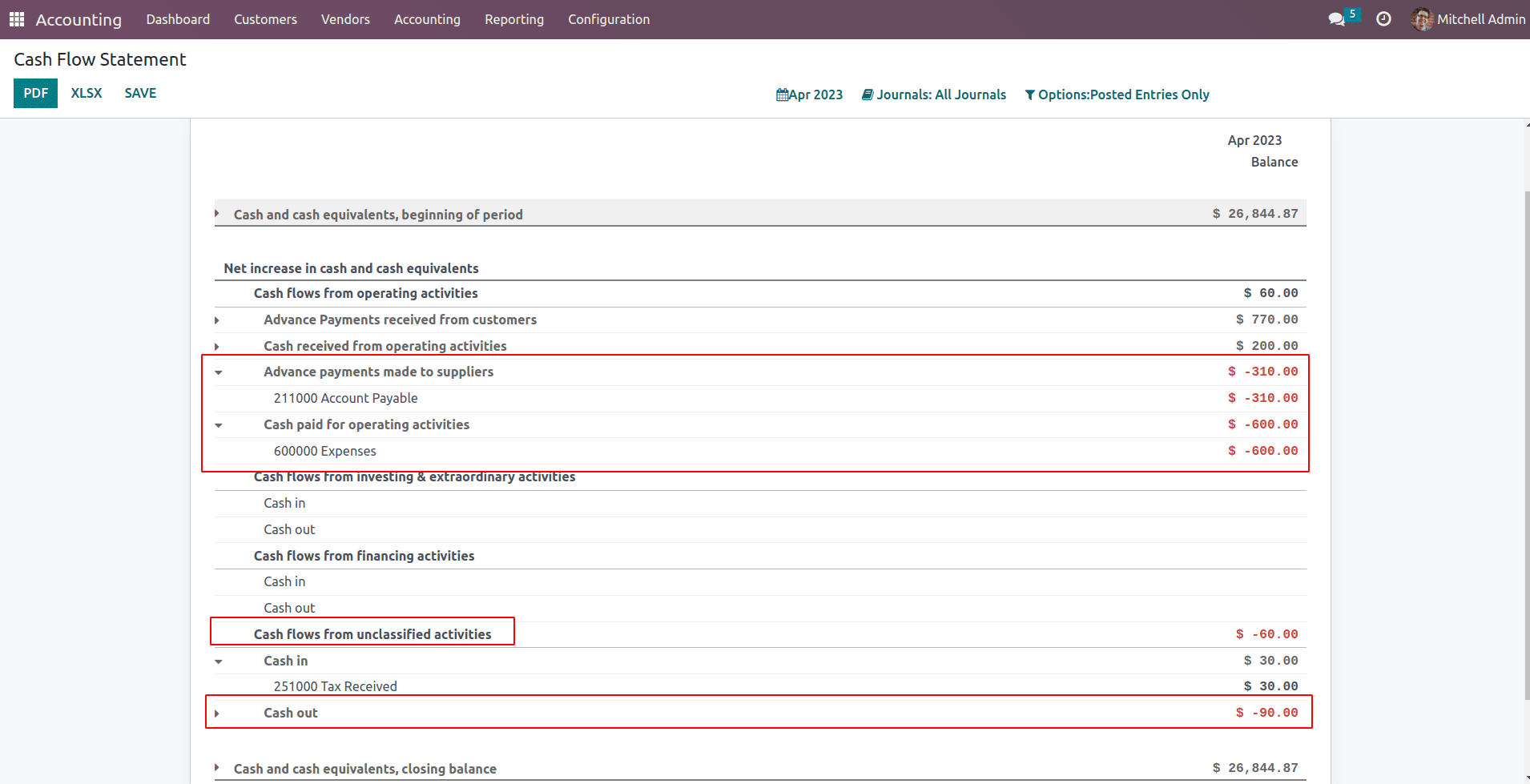

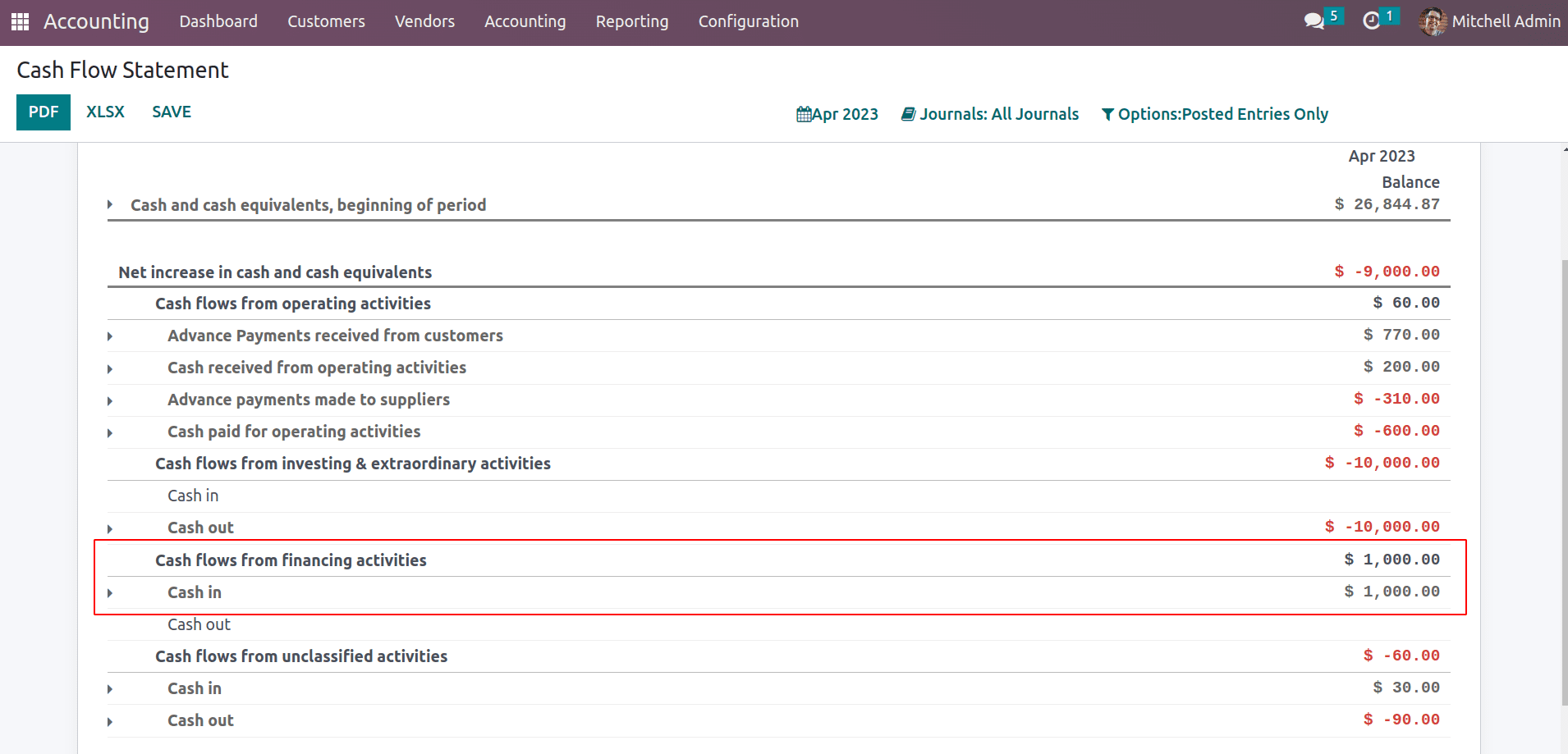

Now $230 is taken for customer invoice payment. Thus advance payment received from the customer now becomes $770. The cash received from operating activities becomes $200 and the tax amount of $30 will be recorded as the cash-in under the ‘Cash flows from unclassified activities’.

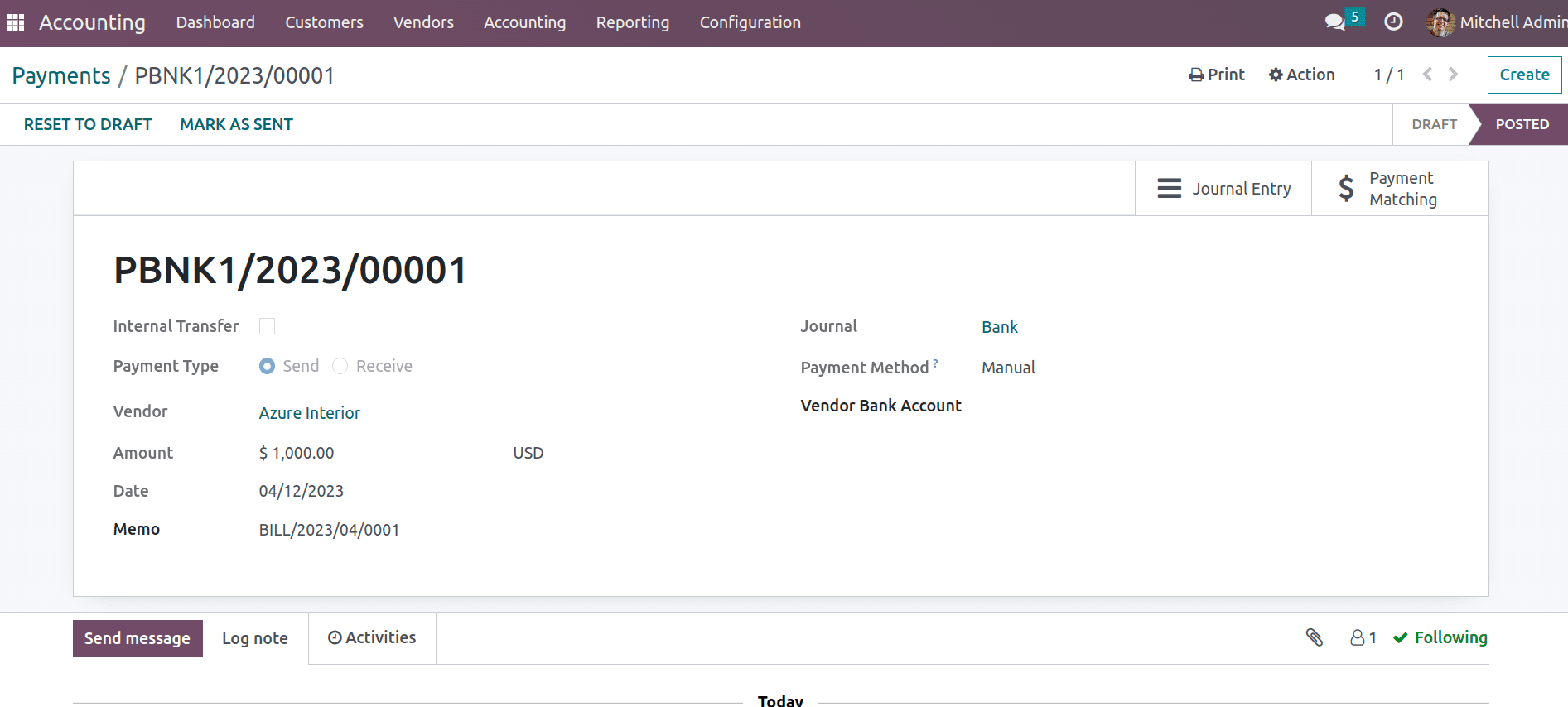

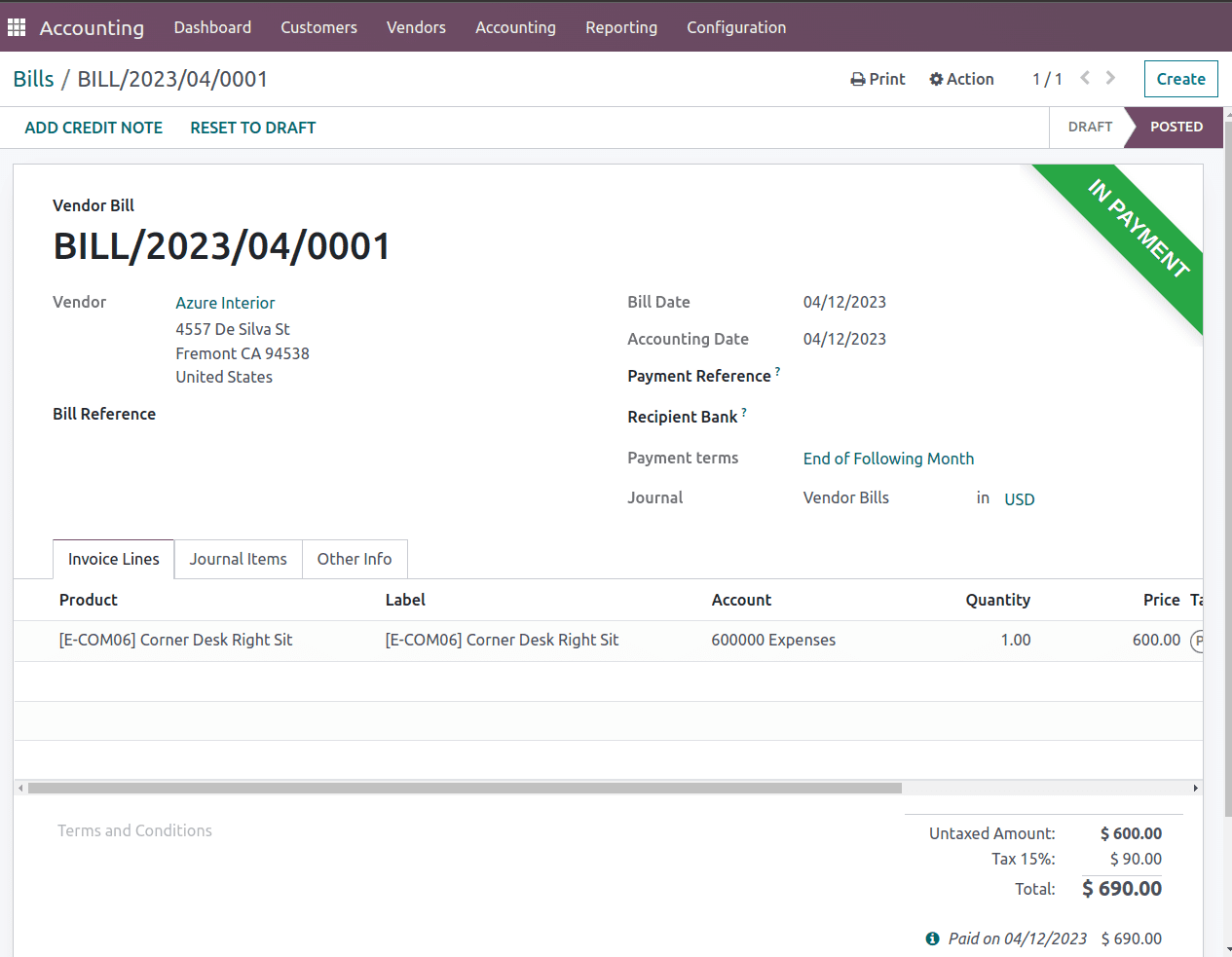

Now take another example of vendor payment which is again an operational activity. The company had purchased products from a vendor, it can be a single purchase or multiple purchases. And vendor payment is added in Odoo, a cash-out from the company.

This will be depicted as an advance payment made to suppliers in the cash flow statement.

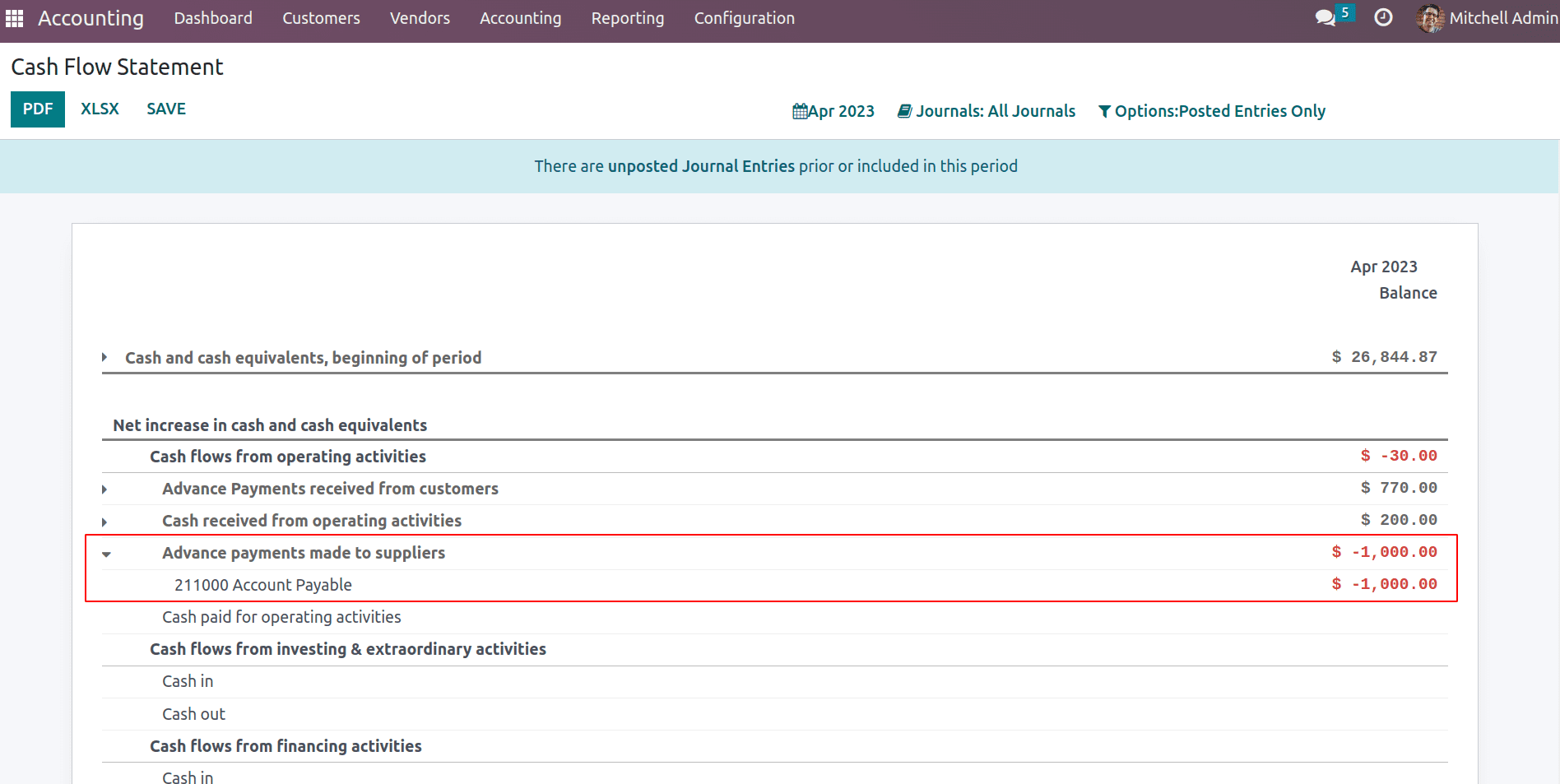

Now the payment is added to the Bill, which records the cash paid for operating activities.

Thus from the paid $1000, the bill amount is matched. Now see the changes in the cash flow statement. The Advance payment to suppliers is now $310 (ie, $1000 – $690), and cash paid for operating activities is $600. The total bill of $690 is split against operational activities and unclassified activities. Thus $90 is the cash out (tax paid) depicted under the cash flows from unclassified activities.

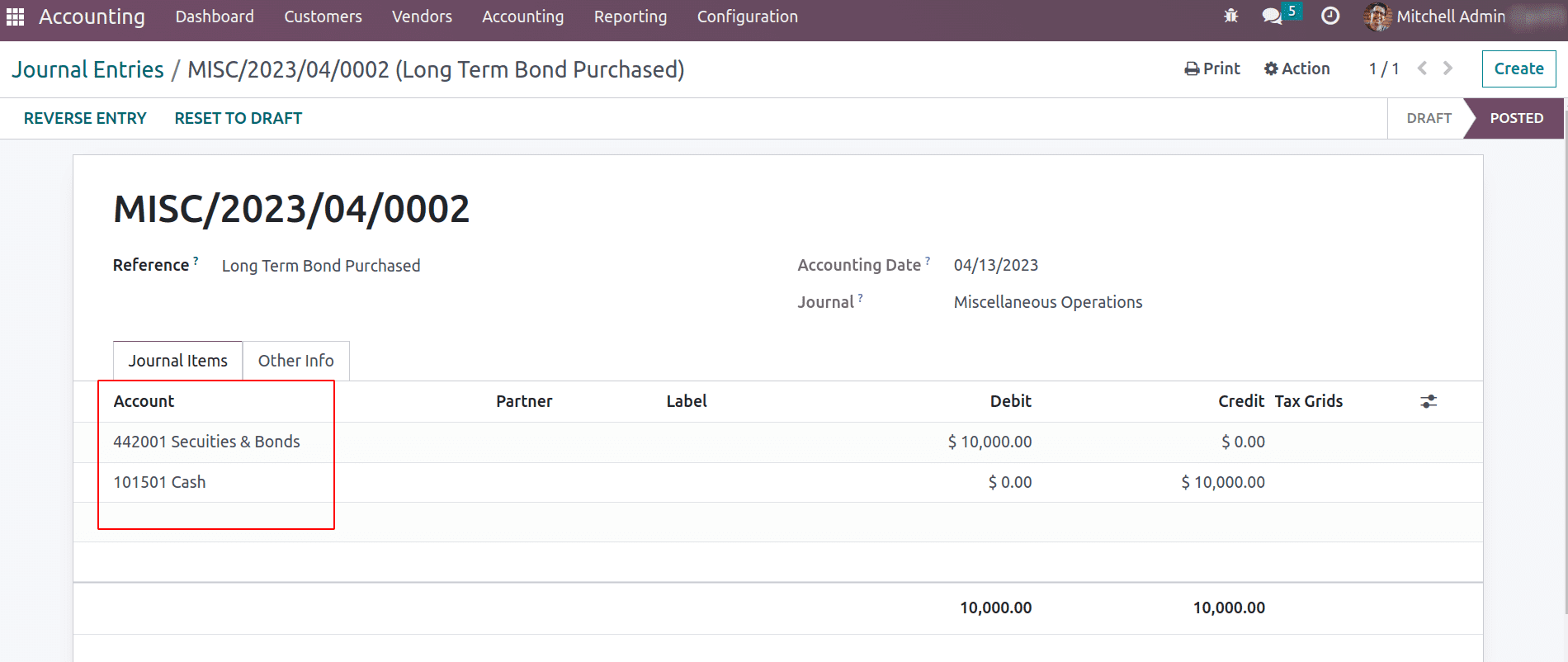

Now let us add a journal entry, for a purchased bond.

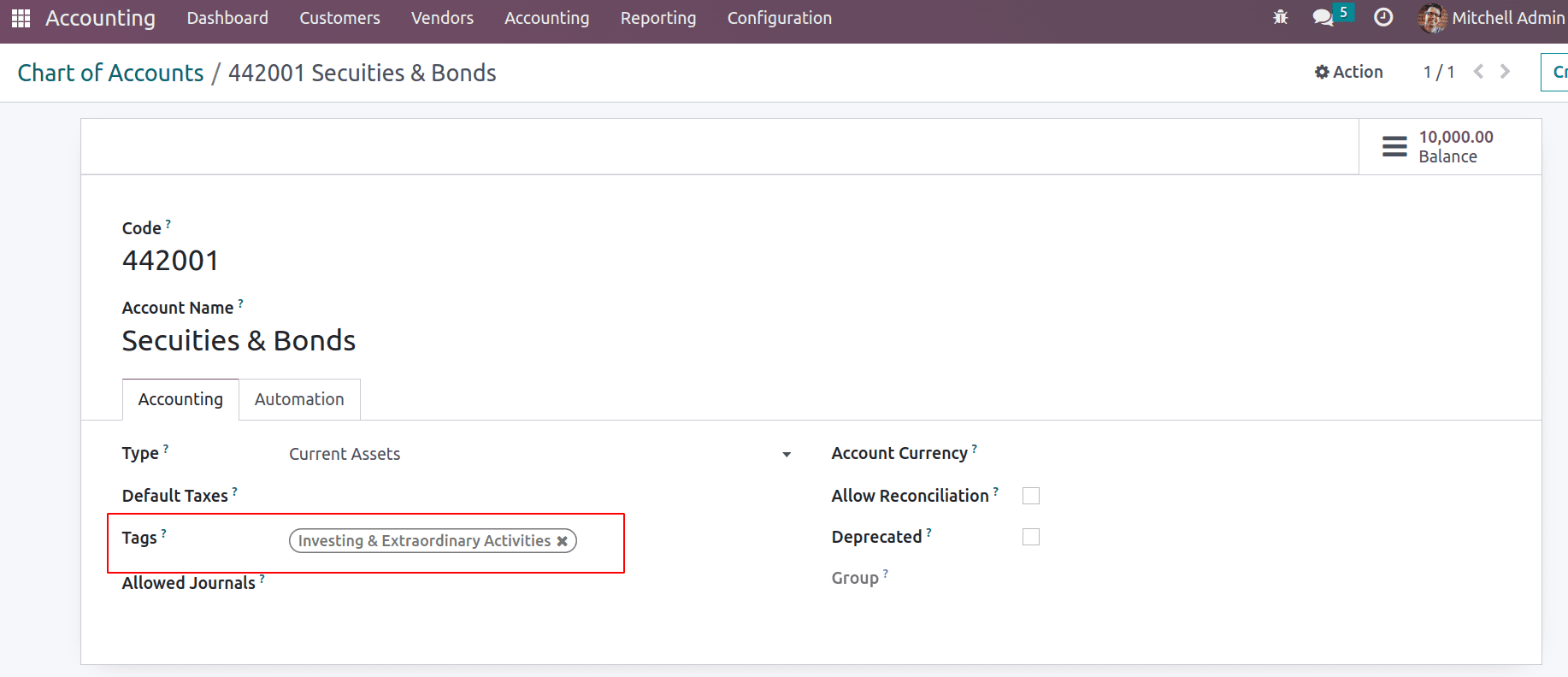

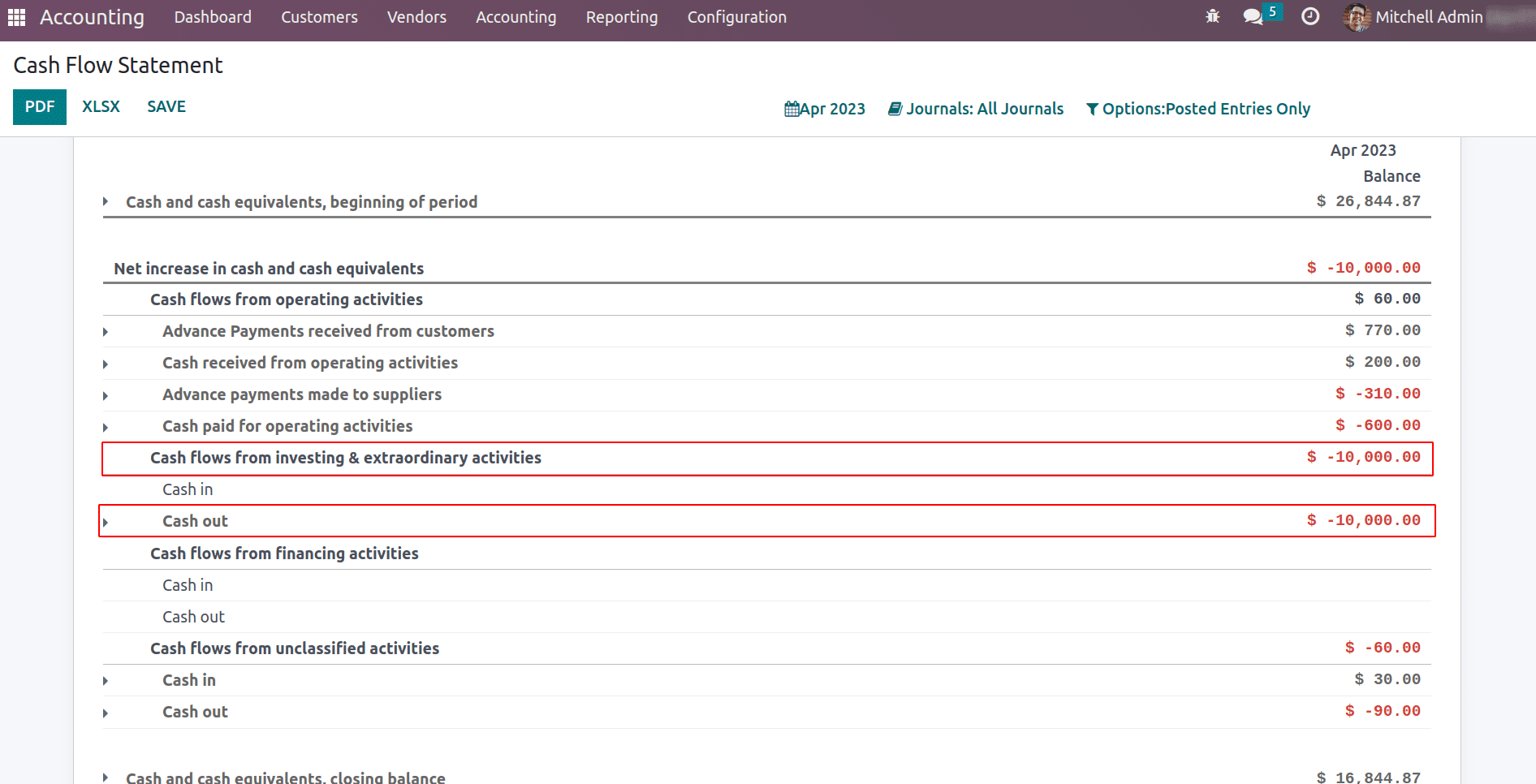

Here the journal entry is posted for a long-term bond purchased, where cash payment is made to purchase the bond. Thus cash, which is in asset nature is credited, and ‘Securities & Bonds’ are debited. The Chart of Accounts ‘Securities & Bonds’ is having the account tag ‘Investing & Extraordinary Activities’.

Thus when this account made any transaction with a cash account, it will depict in the cash flow statement as the cash out under the ‘Cash flows from investing & extraordinary activities’.

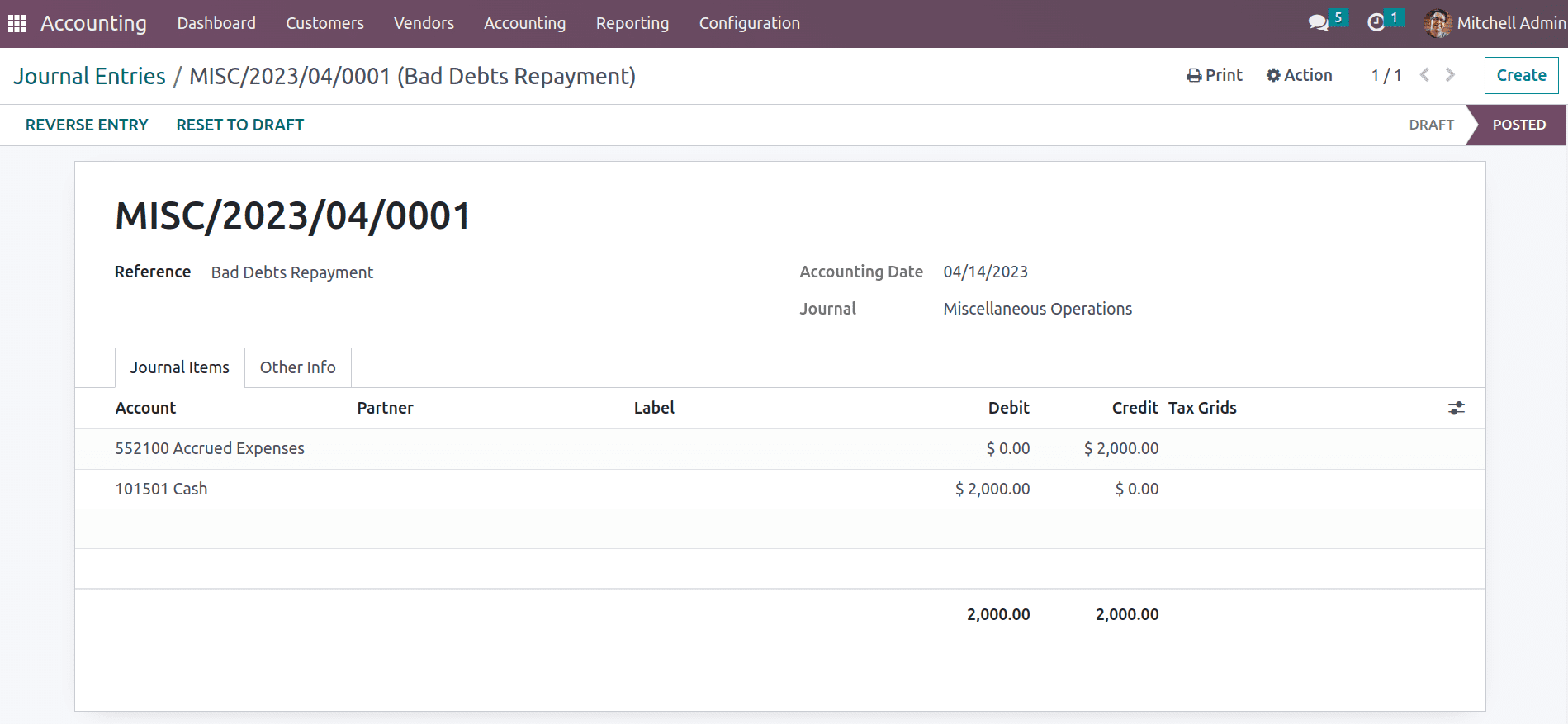

The below screenshot depicts another example of bad debt repayment where a journal entry is posted.

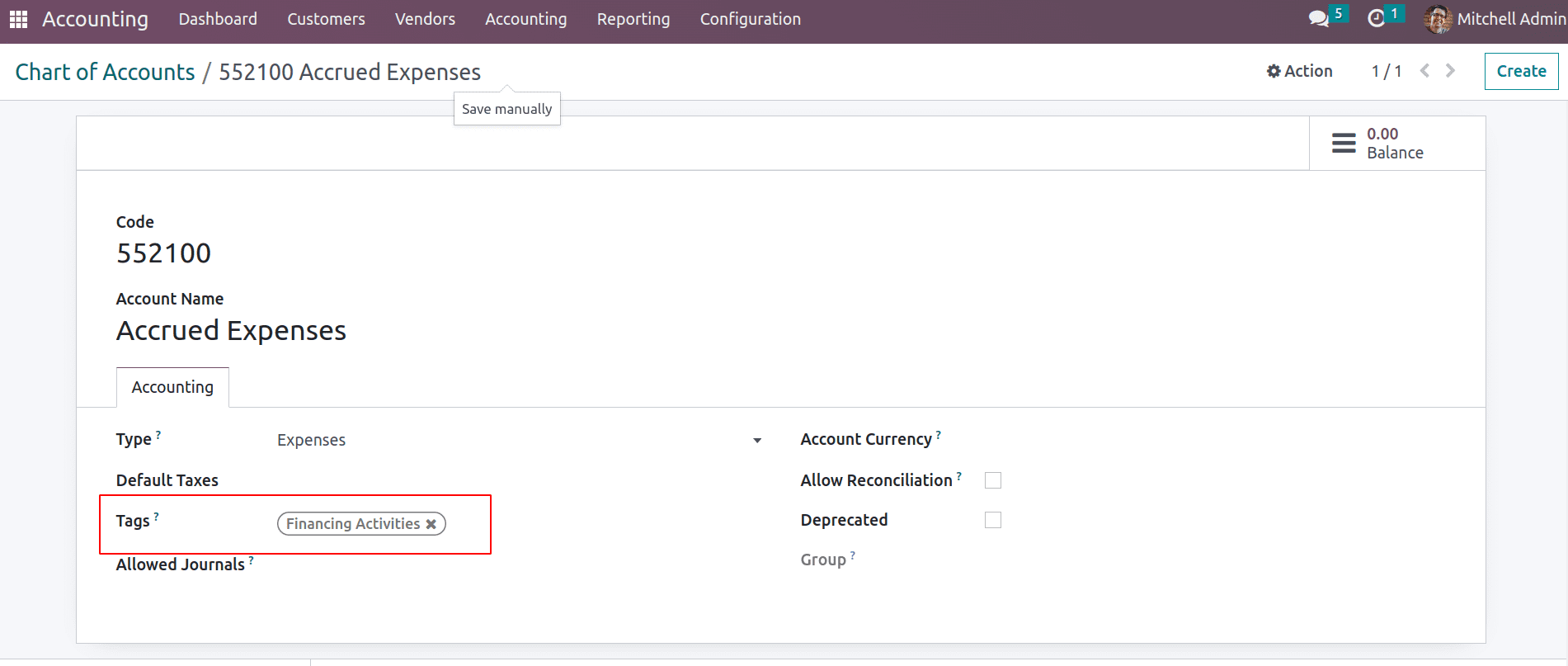

The bad debt is added to an ‘Accrued Expenses’ account whose account tag is ‘Financing Activities’.

Thus in the cash flow statement, this entry will come under cash in the section ‘Cash flows from financing activities’.

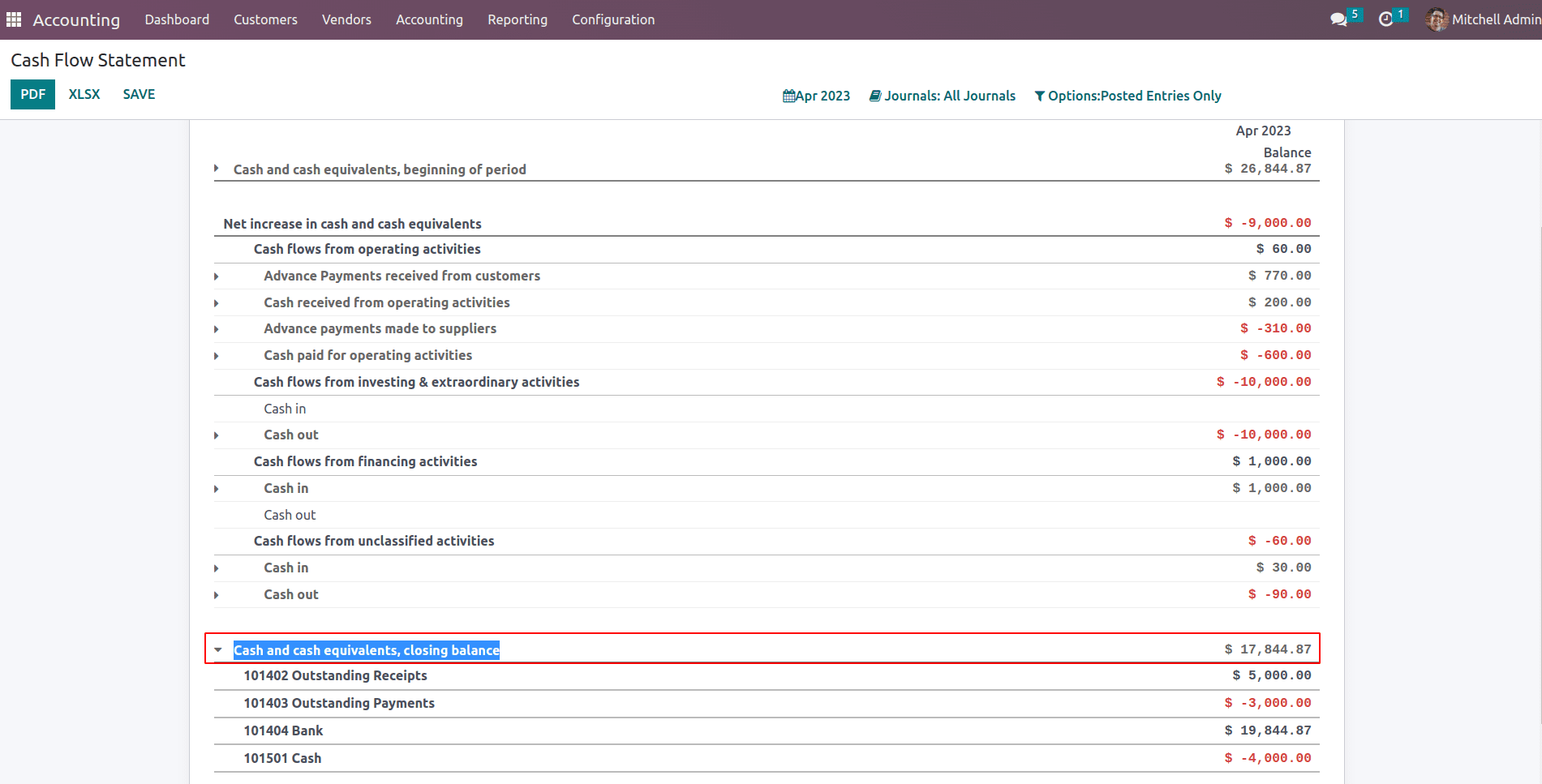

Thus the cash flow statement records all the cash in and out on various activities. The total cash closing balance will be updated under the section ‘Cash and cash equivalents, closing balance’. The closing balance will be the sum of cash and cash equivalents at the beginning period and the net increase in cash and cash equivalents.

By understanding the different sections of a cash flow statement and how to analyze it, businesses can identify potential cash flow problems and take steps to address them. Regularly reviewing and updating the cash flow statement can help businesses to stay on top of their finances and achieve their financial goals. Overall, a cash flow statement is a crucial tool for any business looking to manage its finances effectively and maintain long-term financial stability.