Inventory management is an important aspect of running a business, and it is an asset to your firm. When a product enters or exits your stock, the inventory value may change depending on the product configuration. The value of the inventory fluctuates frequently based on new stock. The computation of inventory is influenced by the overall benefit of income, net profit, and sold product price. Odoo 16 incorporates inventory valuation and costing methods as its two primary preferences for your inventory valuation.

Inventory valuation is a fundamental accounting method that determines the value of stock on hand. A company’s overall value is then calculated after the inventory valuation amount has been determined.

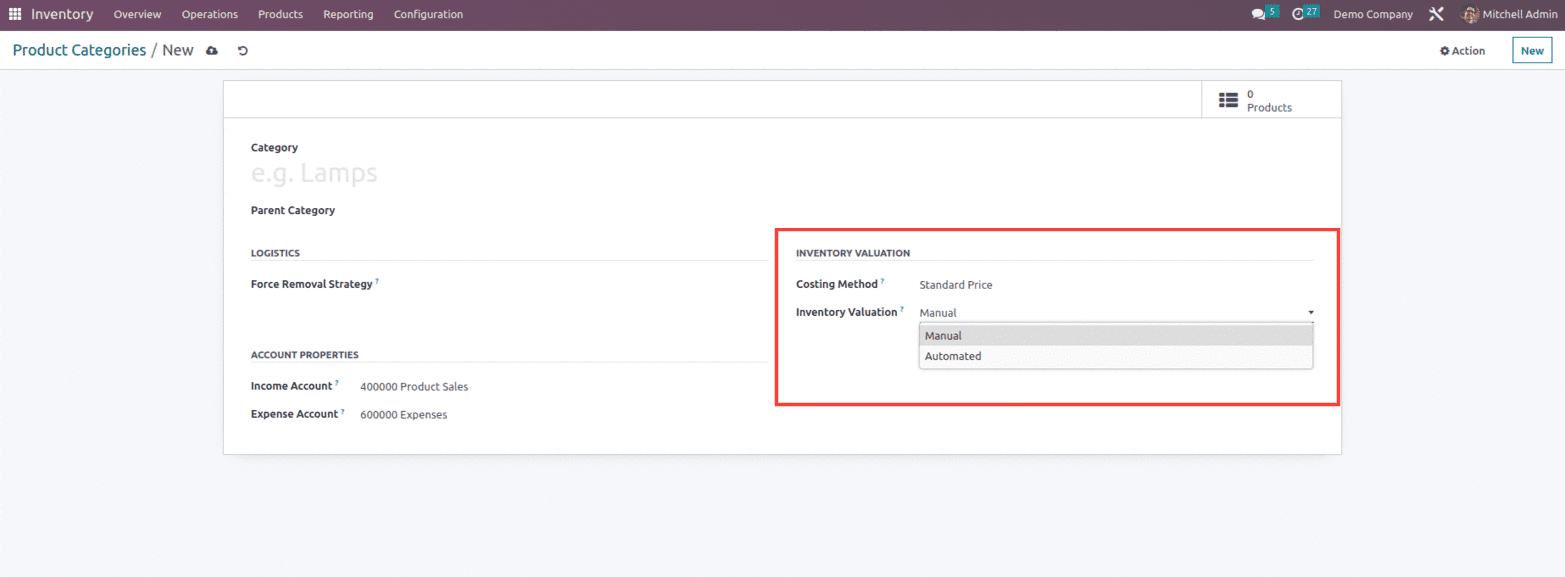

Odoo employs manual inventory valuation by default. According to this process, warehouse staff count what is in stock while the accounting team publishes journal entries based on the company’s actual physical inventory. This approach is reflected in Odoo by setting the Inventory Valuation field to Manual and the Costing Method field to Standard Price by default in each product category, as shown below.

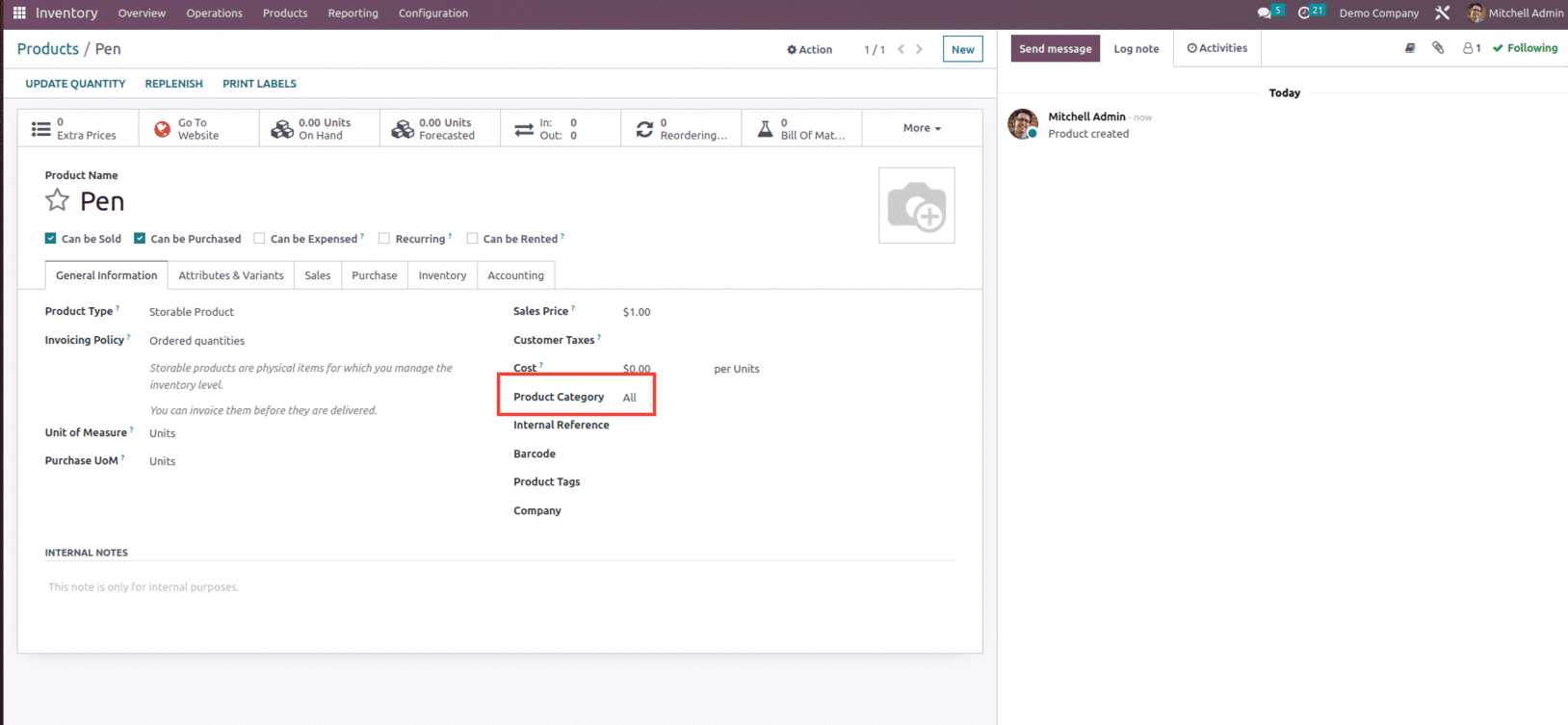

Now let’s understand the basics of Odoo Inventory valuation by moving products In and Out of the stock. For that, let’s create a new product, Pen, for which the category is also set as shown below.

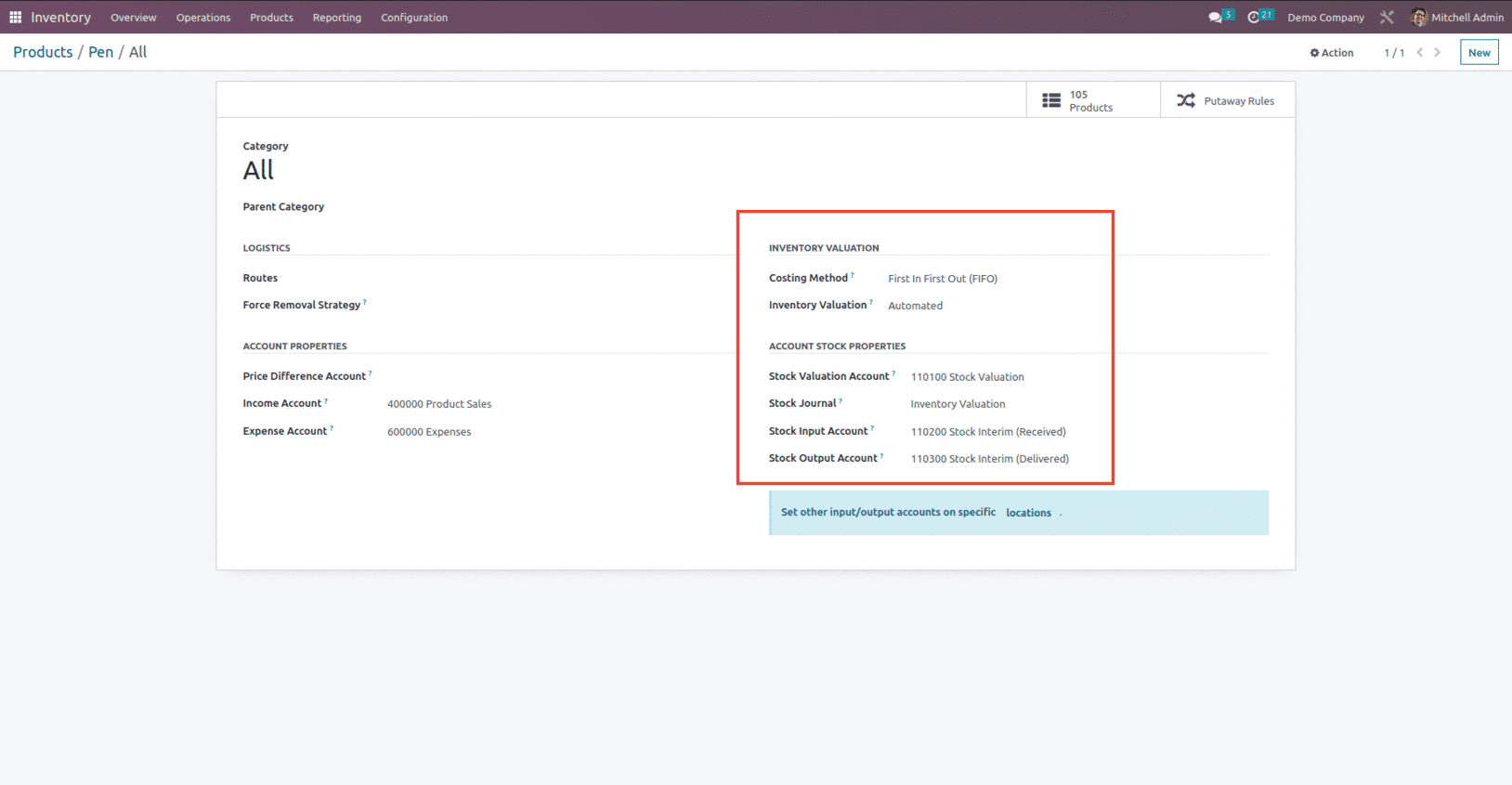

And within the product category, let’s set the costing method as “First In, First Out (FIFO) and Inventory Valuation as Automated. When Inventory valuation is set as Automated, some additional Account Stock Properties are also created, as shown below.

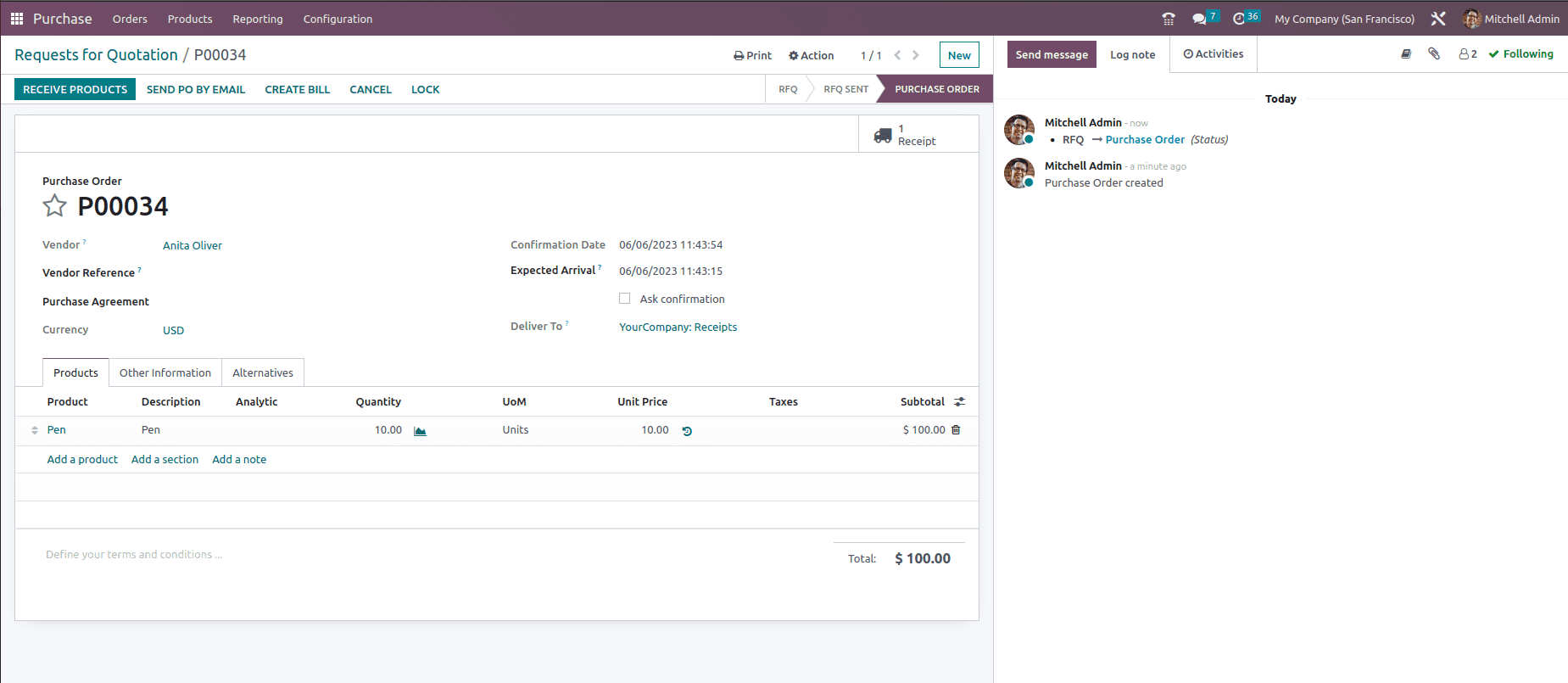

Now let’s create a purchase order for ten units of the product with a unit price $10 and confirm the order as shown below.

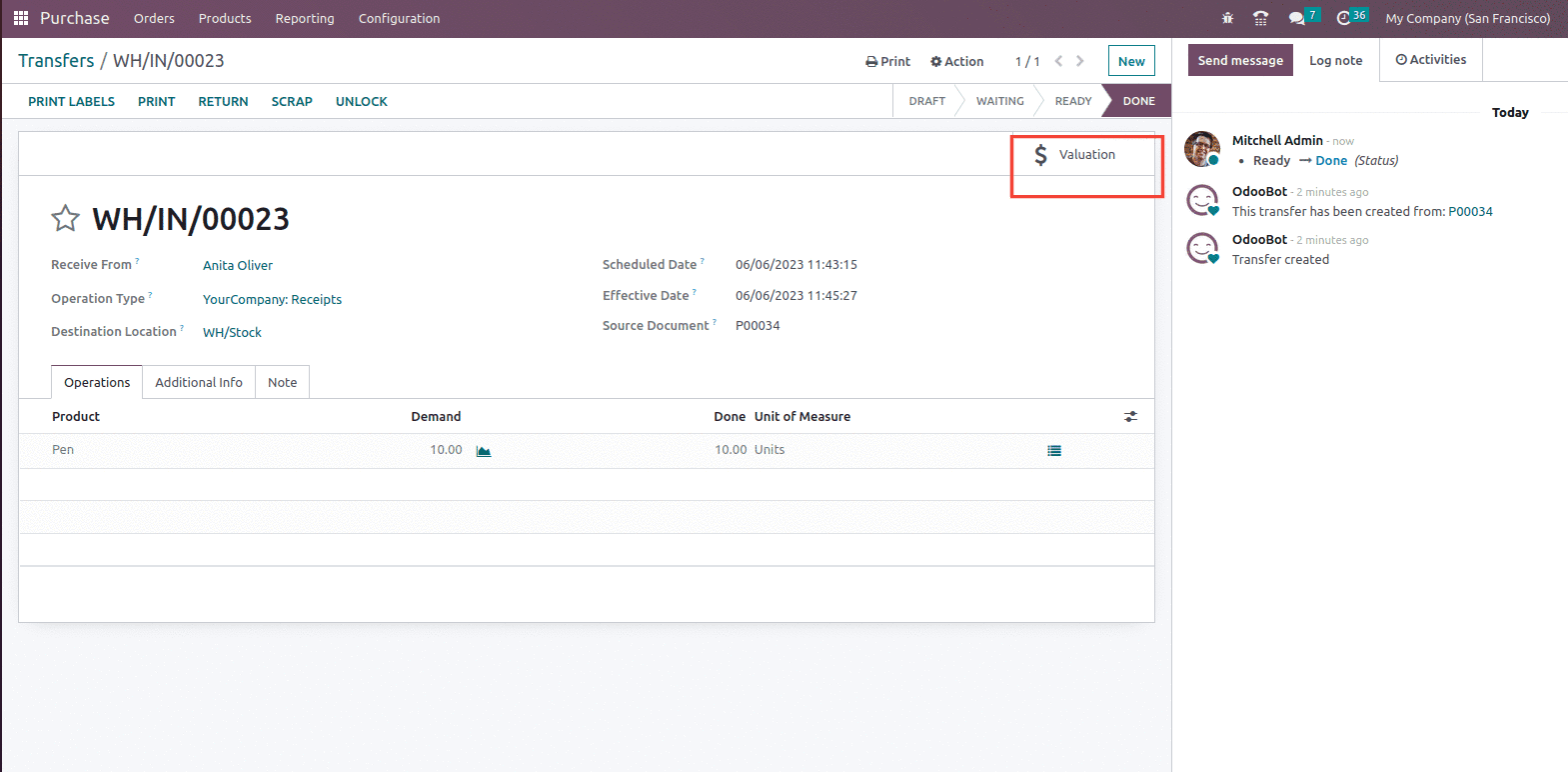

After confirming the order, validate the receipt and check the valuation button to view how the value of inventory was impacted inside the receipt form, as shown below.

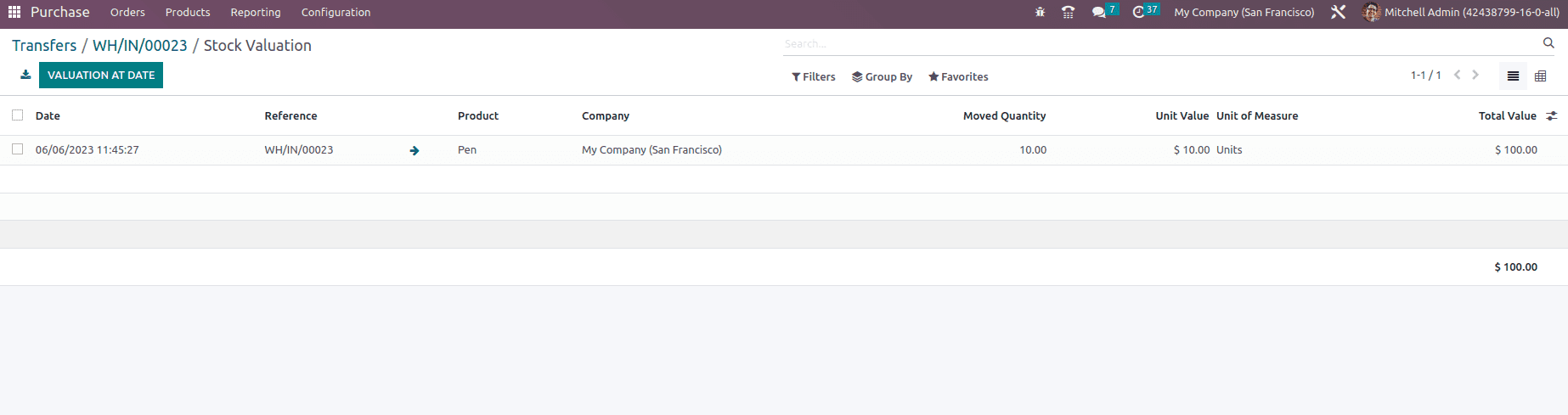

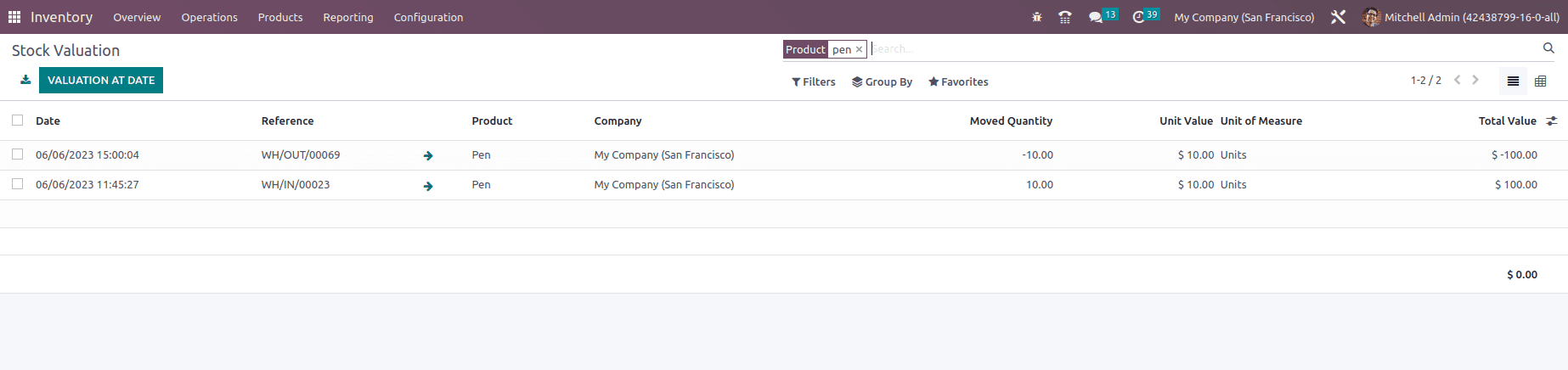

The Valuation button provides details like Date, Reference, Product, Moved quantity, Unit value, UoM and Total value, as shown below.

The Stock Valuation dashboard then displays the valuation of all products in the shipment, together with their quantity and valuation. For example, in the above PO ten units of Pen are purchased with unit price $10, and the total Value column of the dashboard would show a computed valuation of $100.

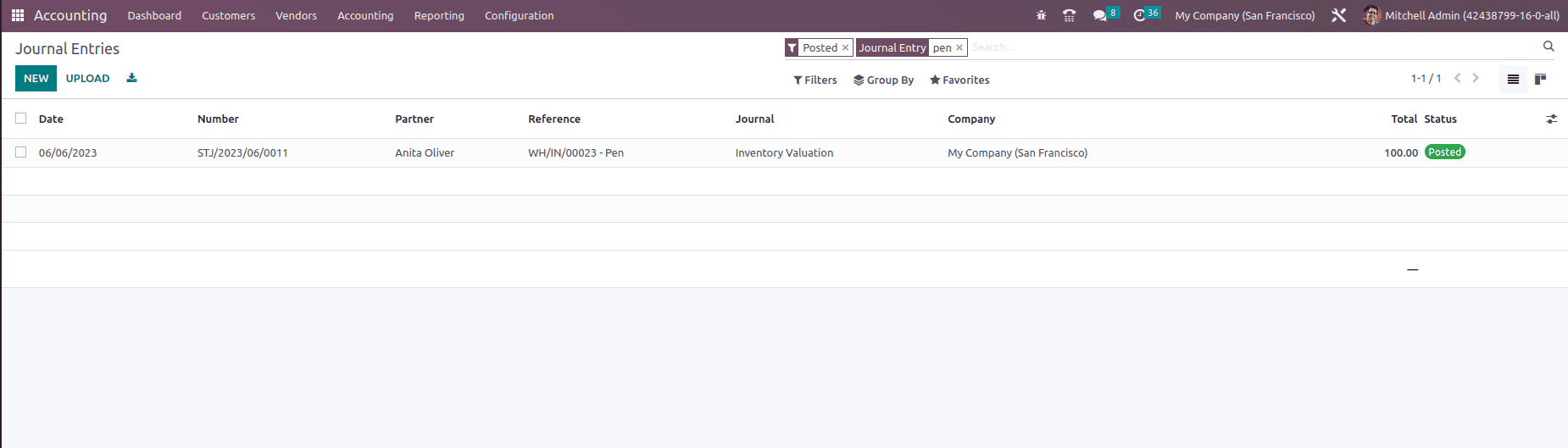

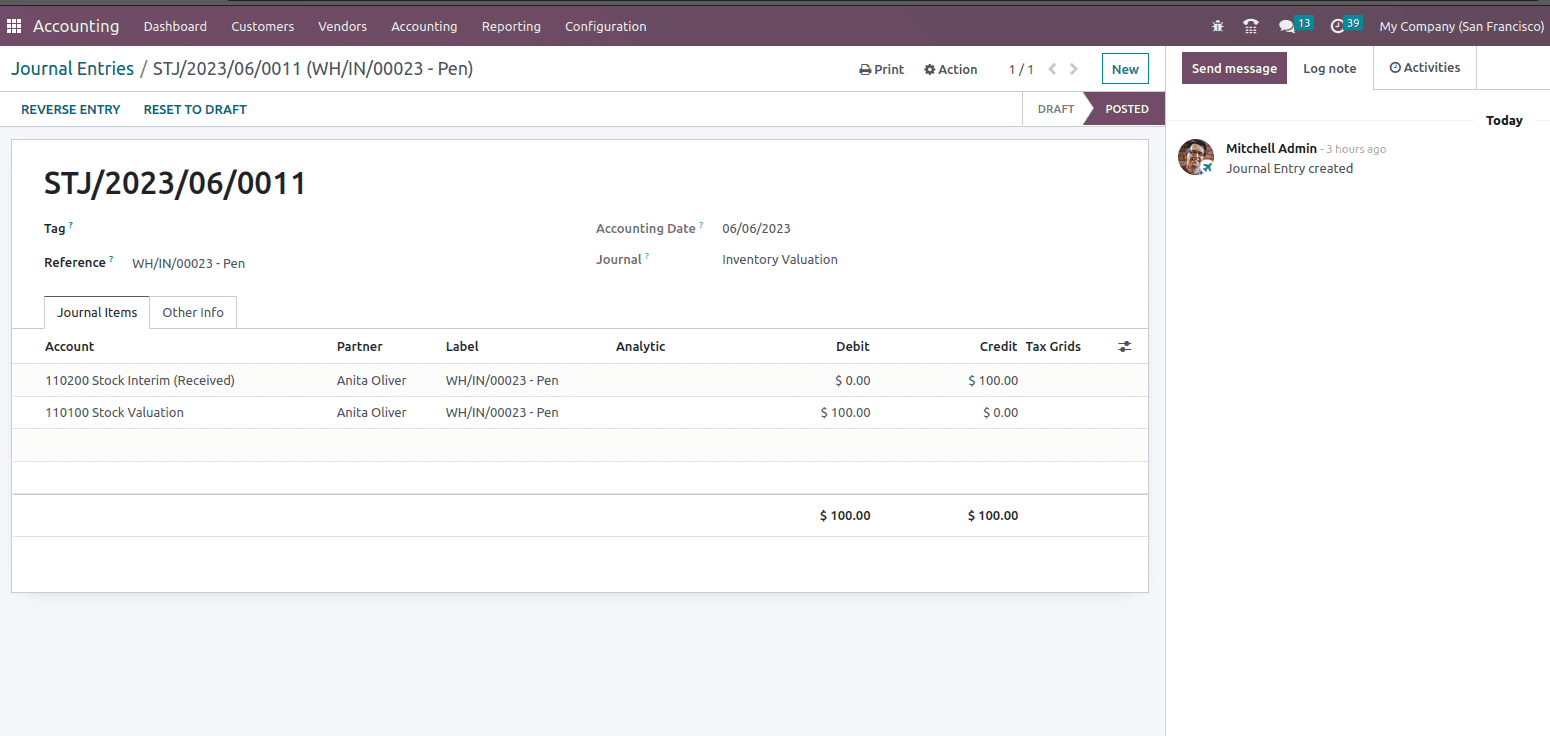

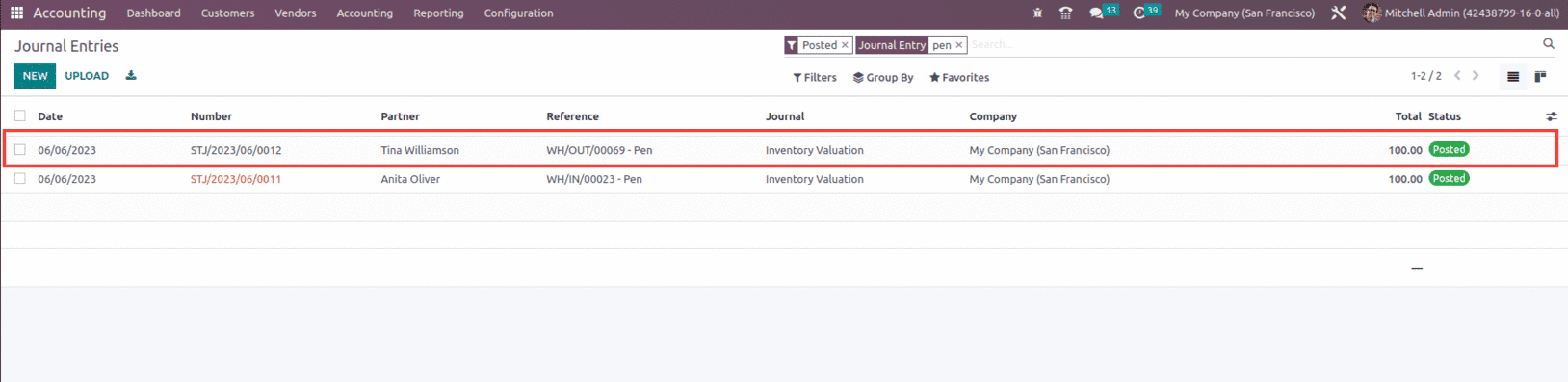

Automatic inventory valuation data are also stored in the Accounting app in Odoo. To find these accounting entries, go to Accounting Journal Entries and check for inventory valuation entries with the STJ prefix in the Journal and Number columns, respectively.

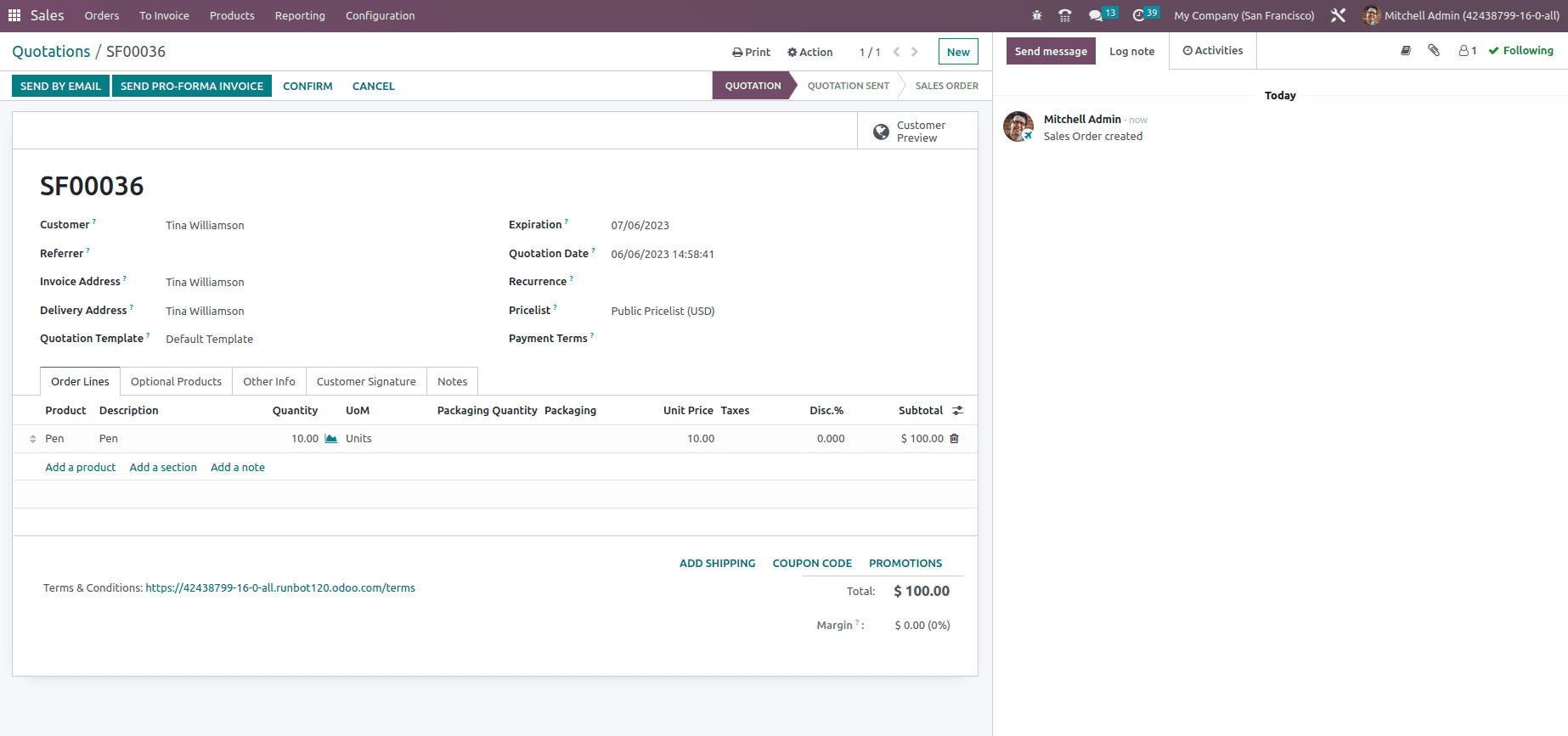

Now let’s check the case while delivering a product to the customers. For that, lets create a sales order with the same product, Pen in the order line and confirm the order as shown below.

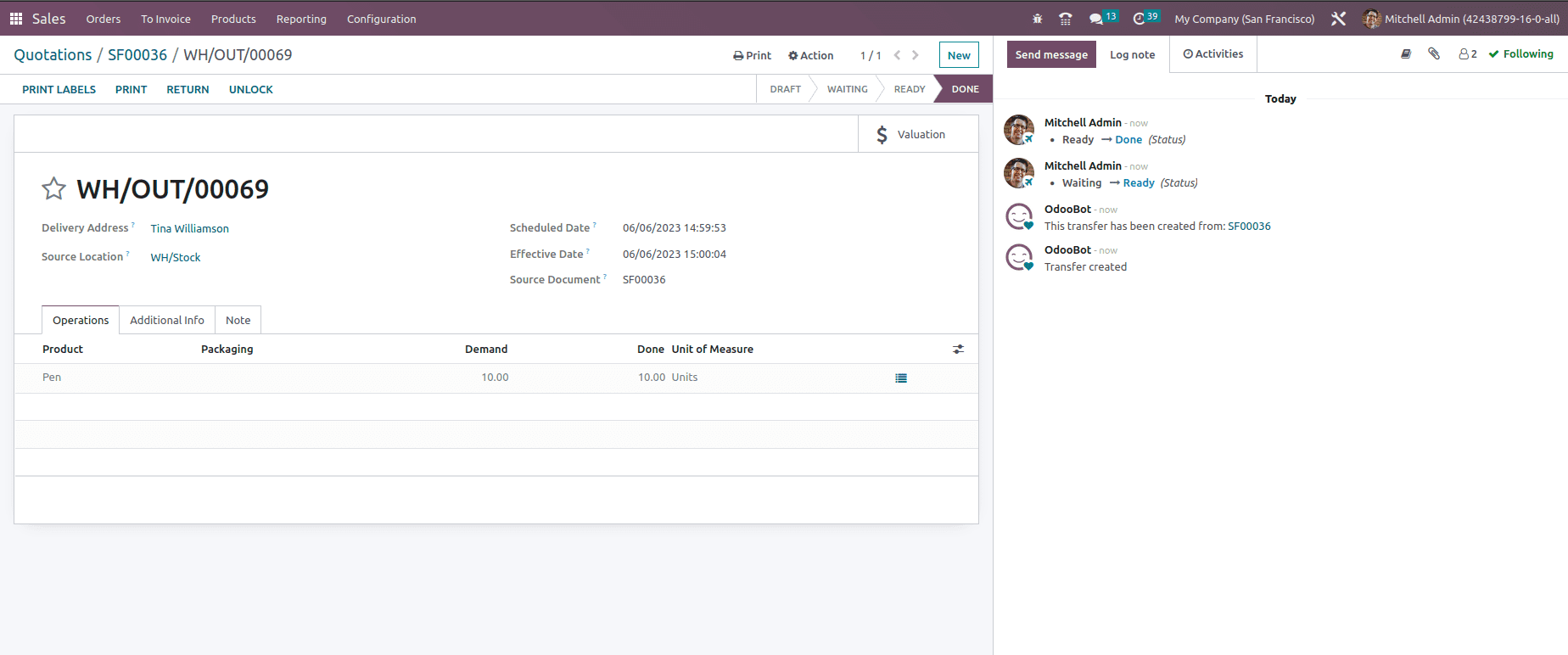

After confirming the order, let’s check the valuation smart button within the form, as shown below.

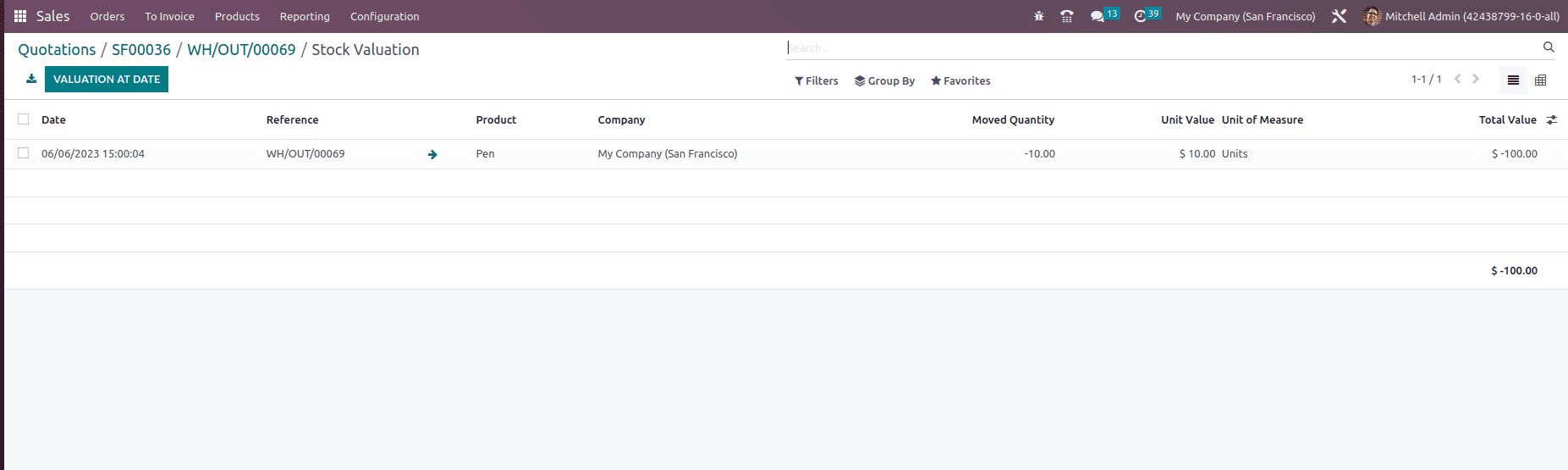

Within the valuation, the user can track the product which include details such as Date, Reference, Product, Moved quantity, Unit value, UoM and Total value as shown below.

In the above valuation report, we can see that we have sold 10 units of Pen at a unit price of $10, which makes a total of $100. Here, the moved value and the total value are computed in negative, as shown above. This is because the products are moved out of stock.

Along with it, the journal entries are also created automatically, as shown below.

So in the case of a Sales order, when we ship a product to the customer, which in turn removes the product from the stock. As a result, the stock valuation decreases, and in the case of a purchase, when we receive the product from the vendor, the stock increases, hence the valuation increases, as seen in the figure below.

This is how Inventory valuation plays an important role in Odoo 16 Inventory management.