A retirement saving plan provided to American employees from US companies is a 401(K) Plan. As per the latest retirement account report by the investment, more than 60 million workers are under 401(k) plans in several companies. So, it is a vital part of the employee payslip in a firm. Most organizations face difficulty managing the 401(k) plan on employees’ payslips. Using Odoo ERP software, we can easily manage the specific plan on a salary slip quickly. Odoo 16 Payroll module is the best way to create a 401(k) plan as the salary rule for an employee salary structure.

This blog gives you an idea about developing a 401(k) plan inside an employee salary slip using Odoo 16 Payroll module.

We can configure different salary rules inside a salary slip of an employee with the help of the salary structure feature. Management of work entries, contracts, salary attachments, and other rules of an employee accessed easily within the Odoo 16 Payroll. Let’s view the steps of defining a 401(k) plan on an employee salary slip.

Brief of 401(k) plan in US Employees Salary Slip

Employers can contribute income and match contributions based on the company-sponsored retirement plan, a 401(k) plan. Many benefits are available to workers, such as contribution limits, shelter from creditors, and tax breaks using the 401(k) plan. A laborer can save more money in a year through this plan than IRA. A contribution limit of $20500 covers 2022 for a 401(k) plan. It is possible to consolidate previous 401(k) into new employers’ retirement plans. The contribution of employees is accessible through Roth and Traditional 401(k) plans.

One of the benefits of utilizing this plan for employees is tax savings. Employee contributions are pre-tax in traditional 401(k) plans means easy to decrease taxable income. The gross income is reduced from employees using traditional 401(k) plans. Hence, the taxable income of laborers from the total cost of contributions in a year acts as a tax deduction for that year. In contrast, Roth 401(k) plans are obtained with after-tax income, and there will not be tax deductions on that particular year. After deducting income taxes, contributions from employees pay in the Roth 401(k) plan. It is easy to withdraw money during retirement, and no additional taxes are applied. All the employees did not get the Roth account option. Employees can choose one or a traditional 401(k) plan if Roth is offered.

To Develop a 401(k) plan as Salary Rule for an Employee in Odoo 16

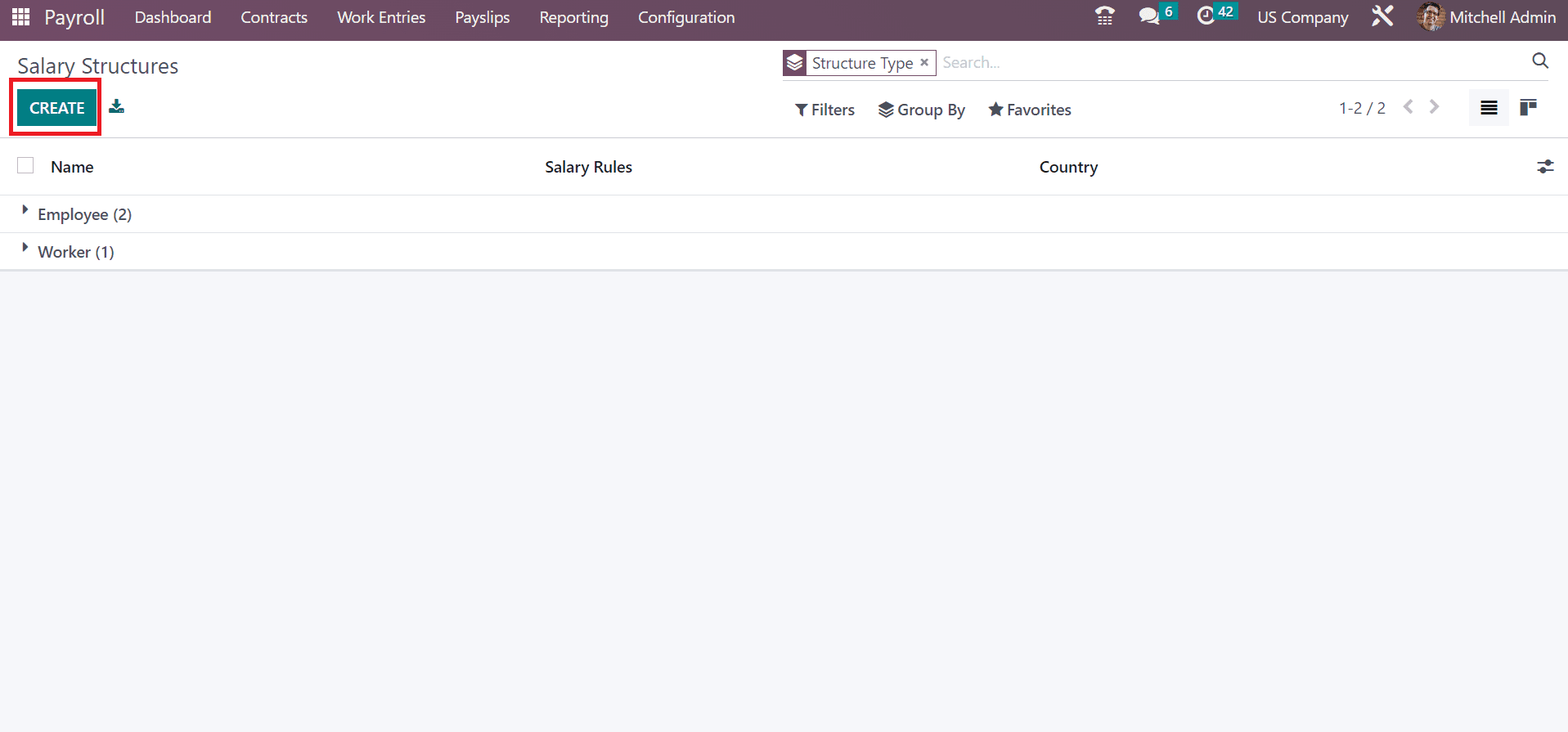

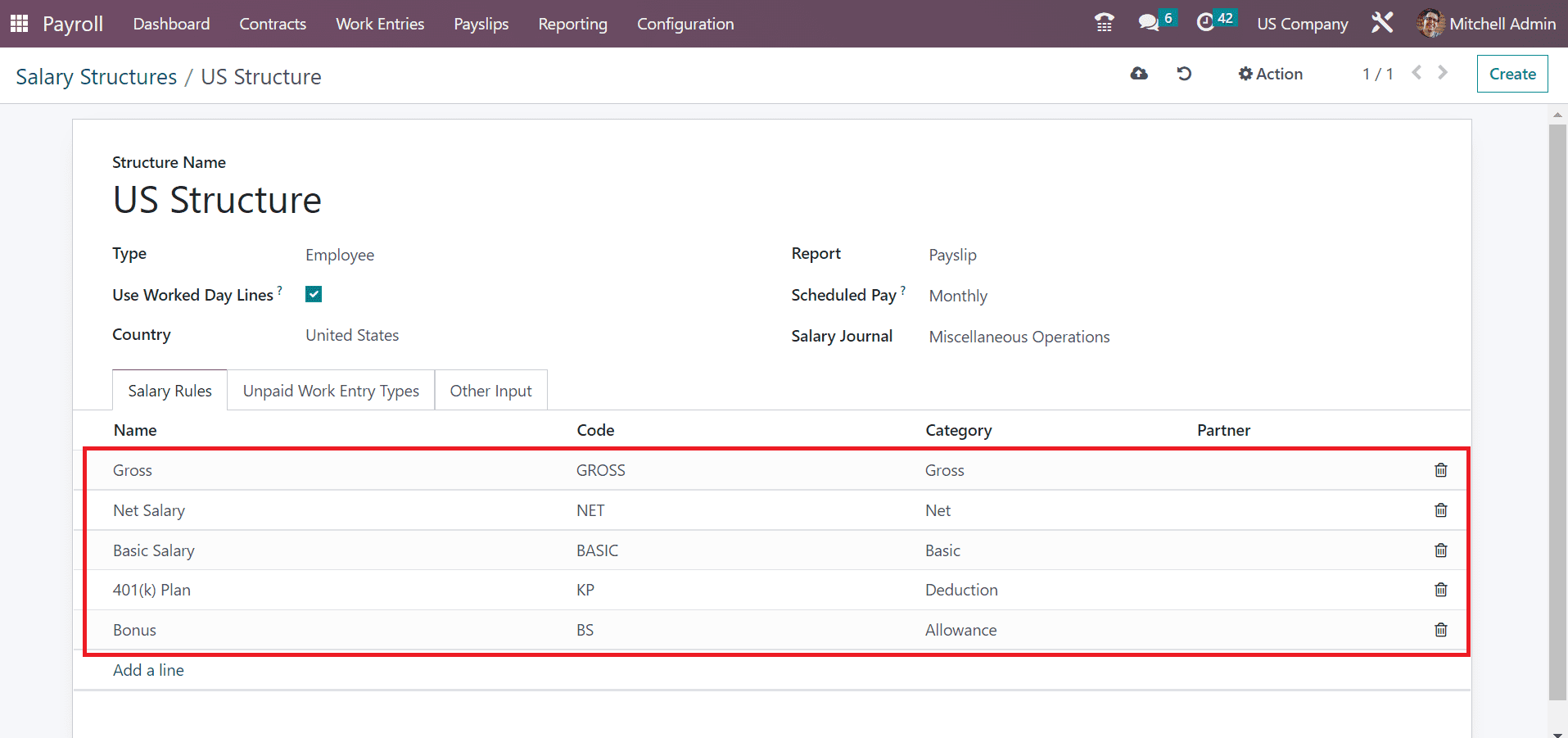

Before generating a salary rule, we must develop a salary structure for an employee in a US Company. Users can obtain the Structures menu below the Salary section of Configuration. The information such as Country, Name, and Salary Rules are acquired quickly within the Salary Structures window. To produce a new structure, select the CREATE button in the Salary Structures window, as cited in the screenshot below.

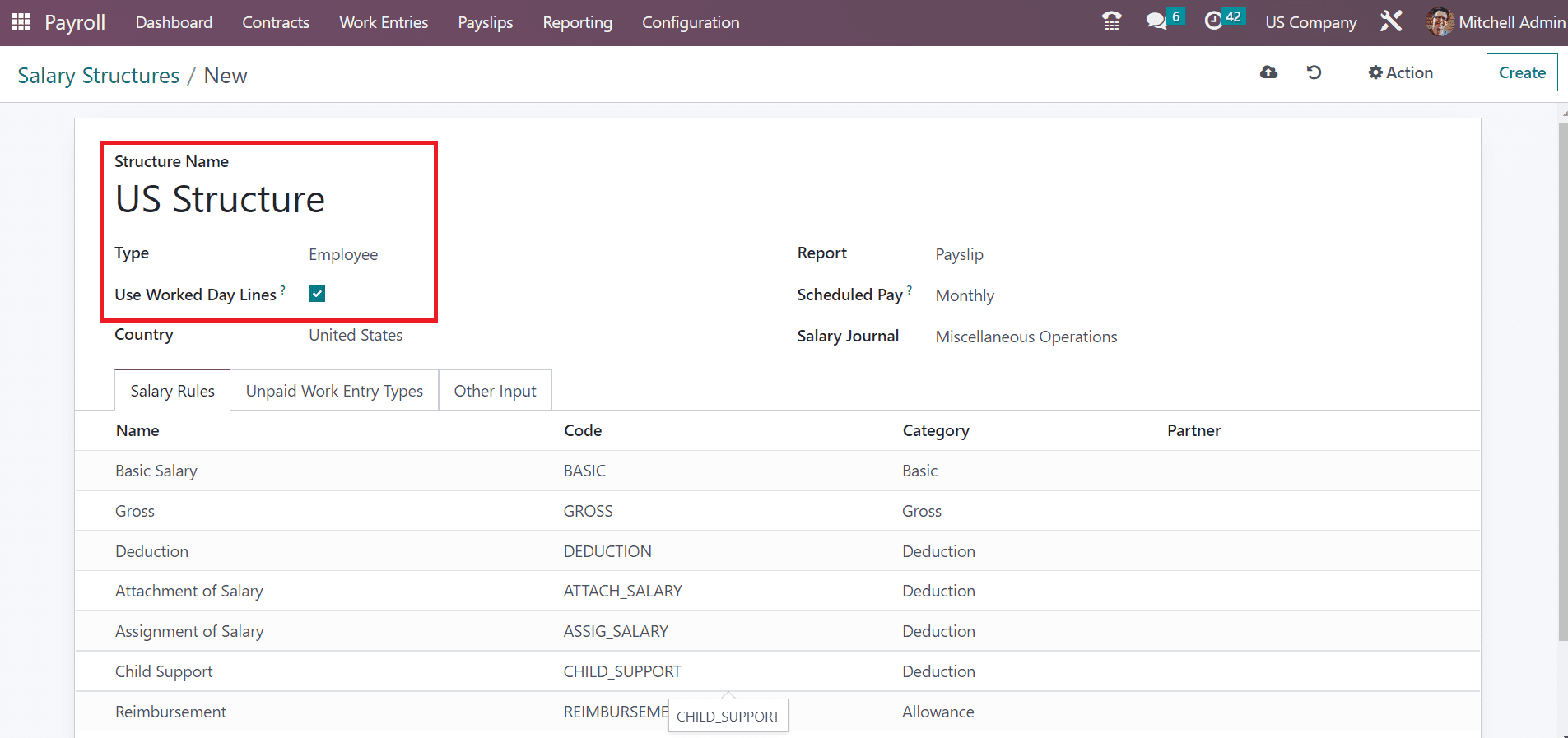

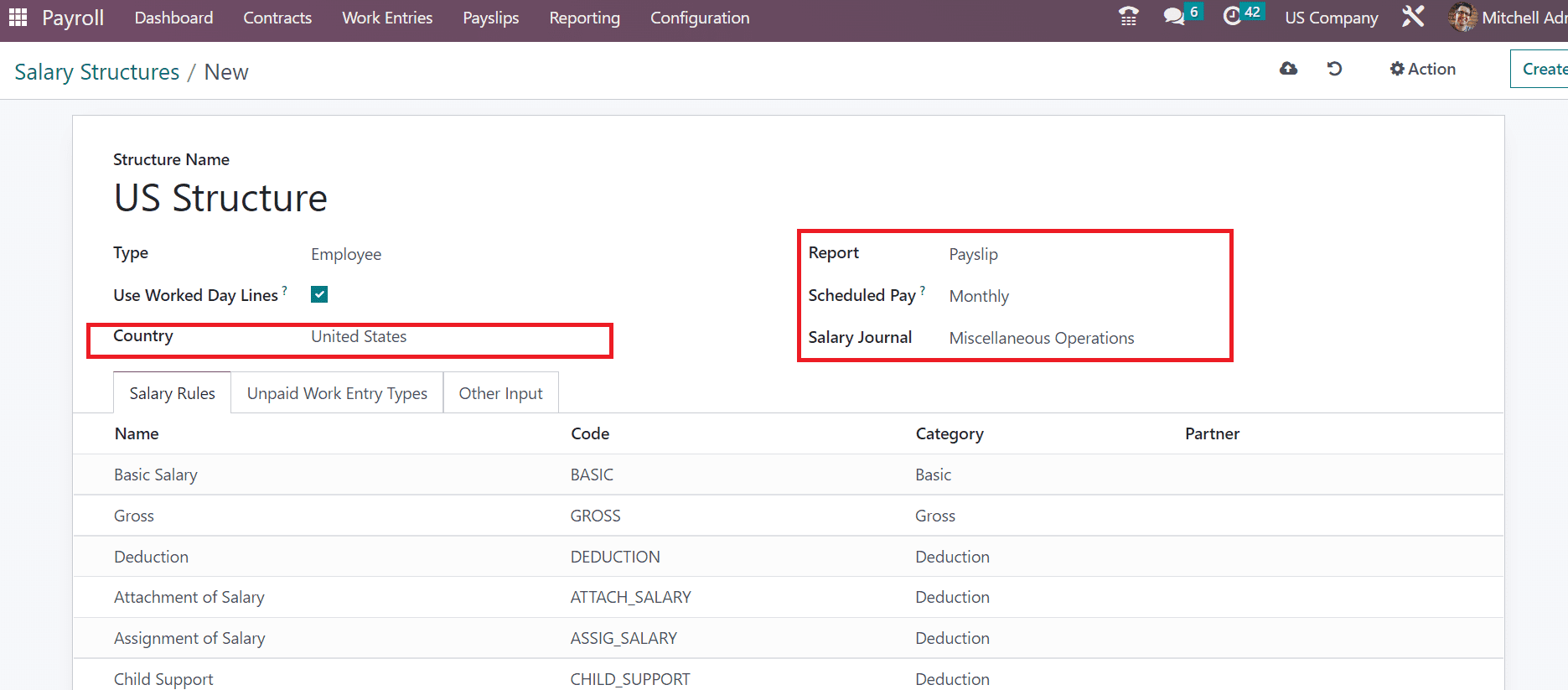

On the open page, enter US Structure in the Structure Name field. It is possible to set Worker or Employee as the Type of Salary Structure. We choose the Employee option as Type and enable the Use Worked Day Lines option to display on payslips.

Next, we can pick the United States as the Country for employee payslips. Moreover, set the Report as Payslip and enter the Monthly option for the Scheduled Pay of the employee. Users can also select a salary journal for laborers as Miscellaneous Operations, as defined in the screenshot below.

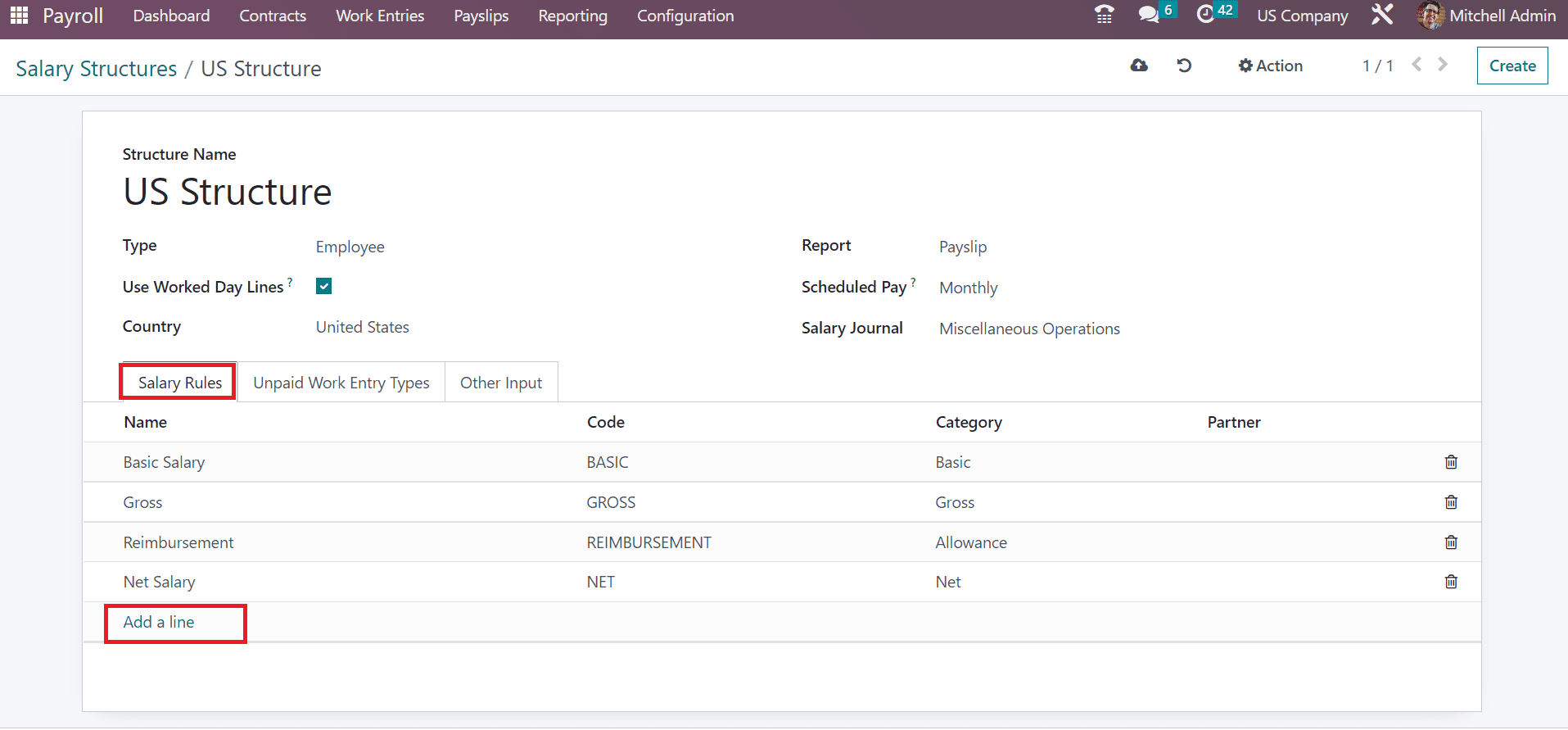

To apply each salary rule for an employee, you can click the Add a line icon inside the Salary Rules section, as indicated in the screenshot below.

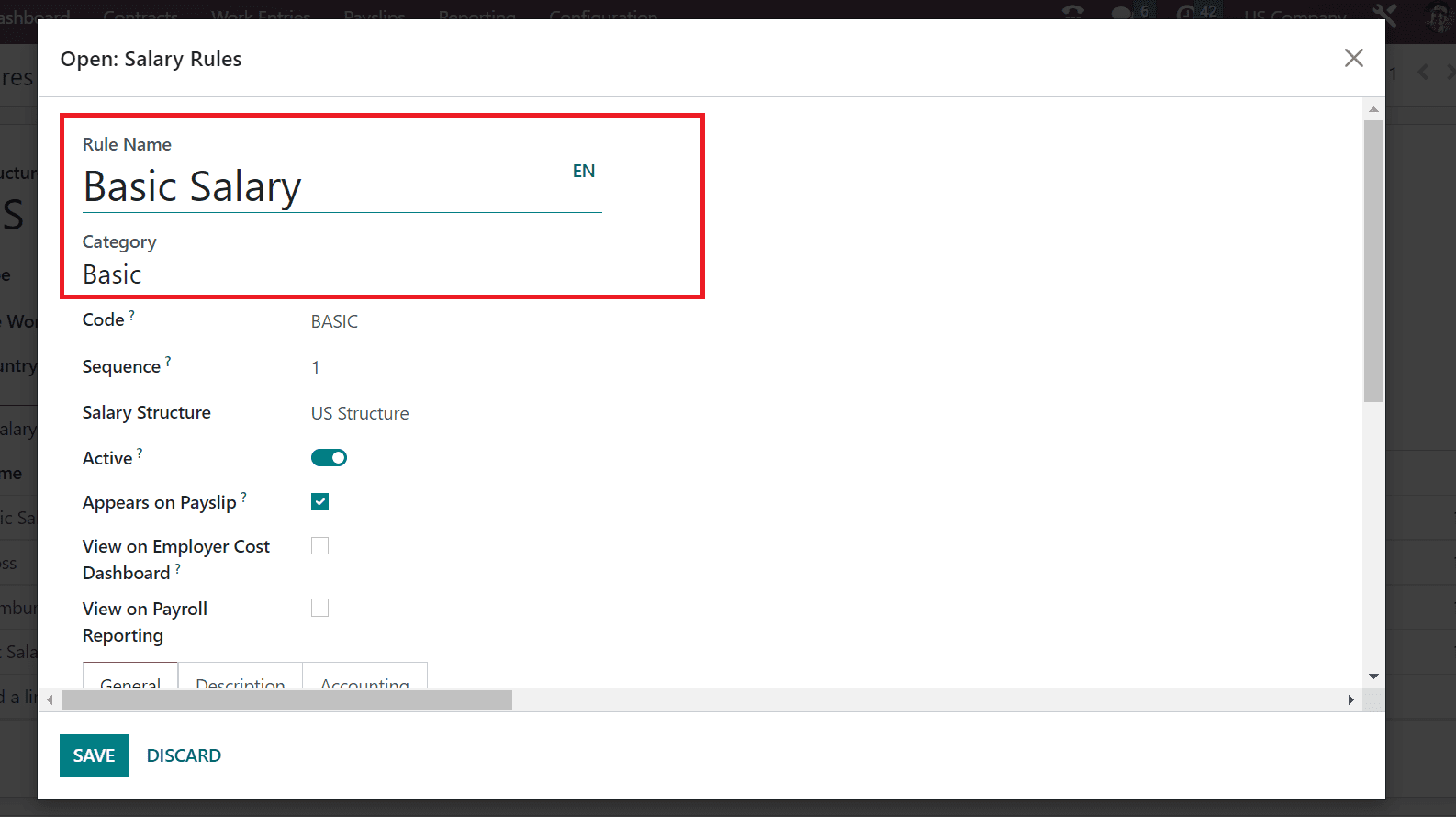

Firstly, let’s add the basic wages of employees as a salary rule. In the Open: Salary Rules window, apply Basic Salary as Rule Name and pick the Category as Basic.

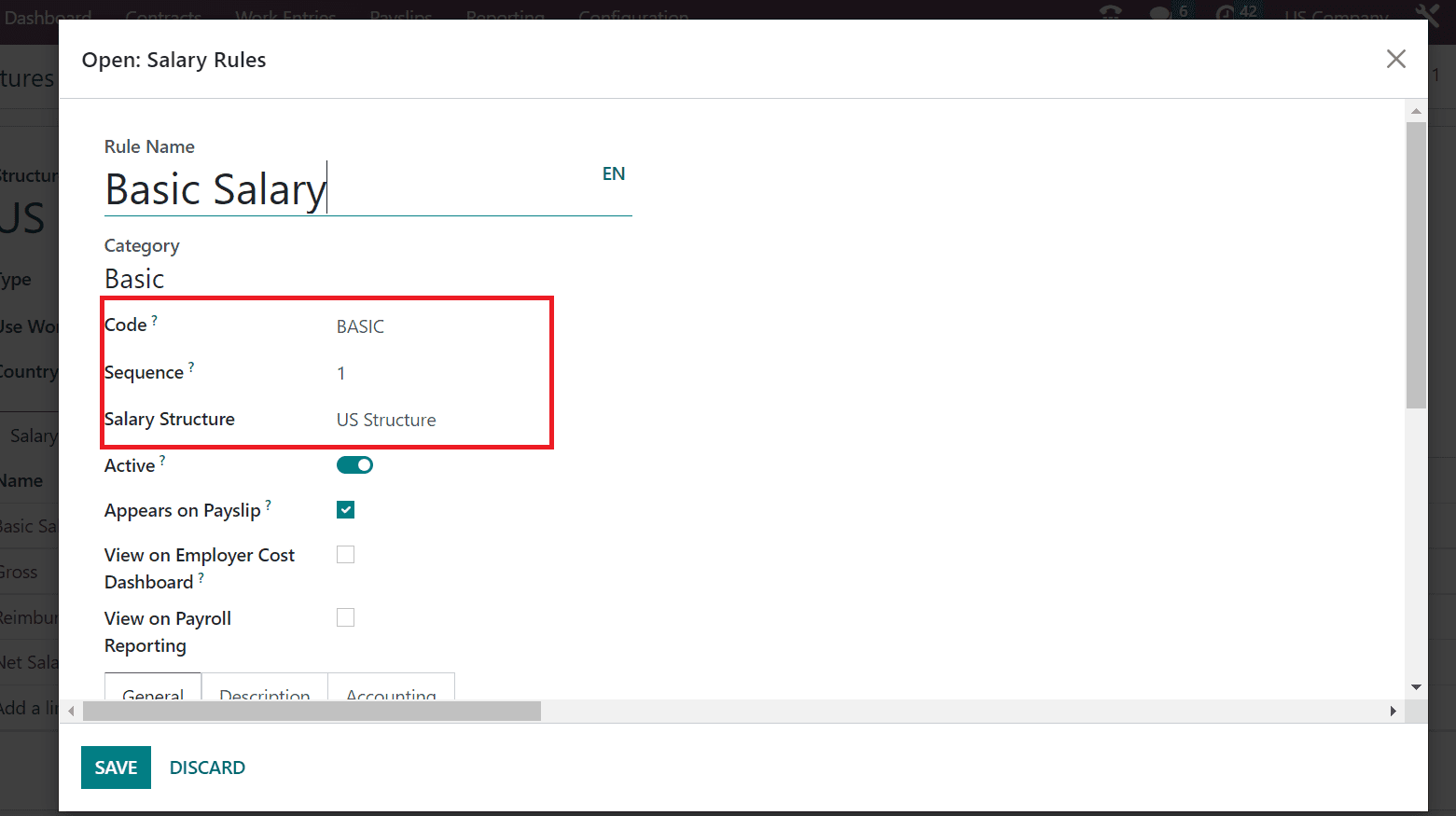

In the Code field, add BASIC as the reference code of the Basic Salary rule. Also, you can mention a sequence number as 1 in the Sequence option and set US Structure as your Salary Structure.

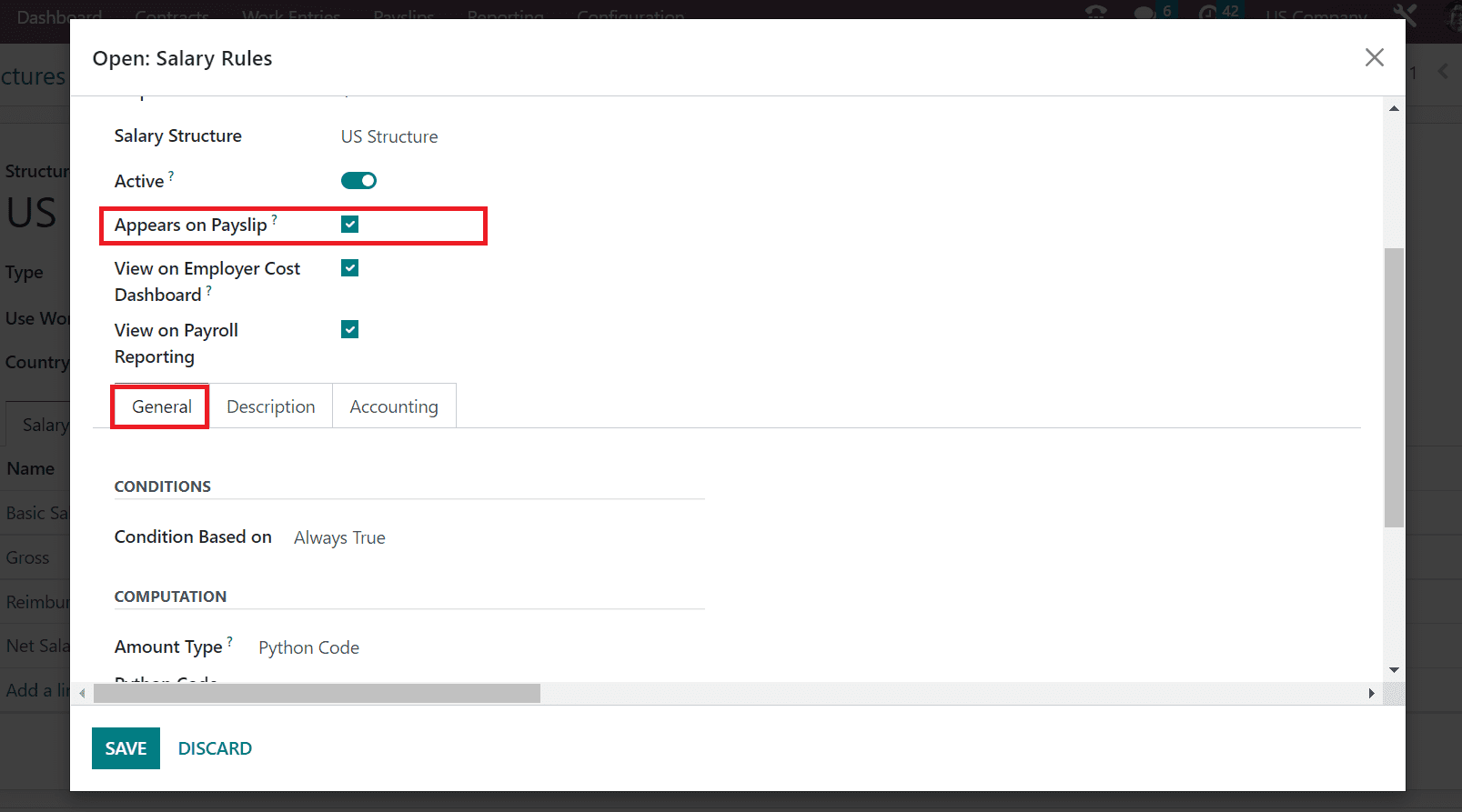

To make the visibility of the rule on salary slips, you must activate the Appears on Payslip option. Below the General tab, we manage the calculation and Condition of the Basic salary rule.

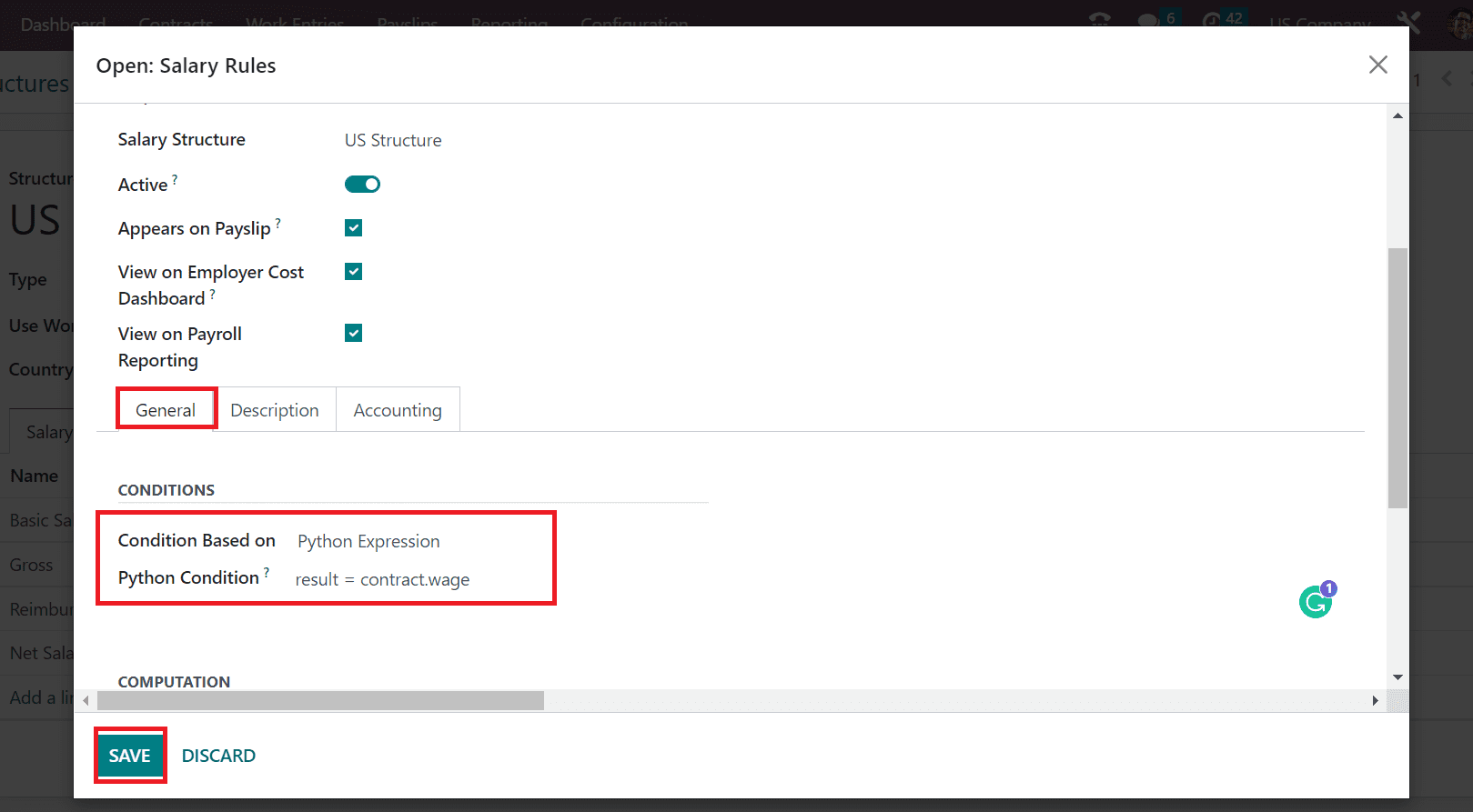

We can set the Condition as per the python code for the basic salary rule. Choose the Condition Based on as Python Expression below the CONDITIONS section. Later, you can specify the calculation of the rule in the Python Condition option, as depicted in the screenshot below.

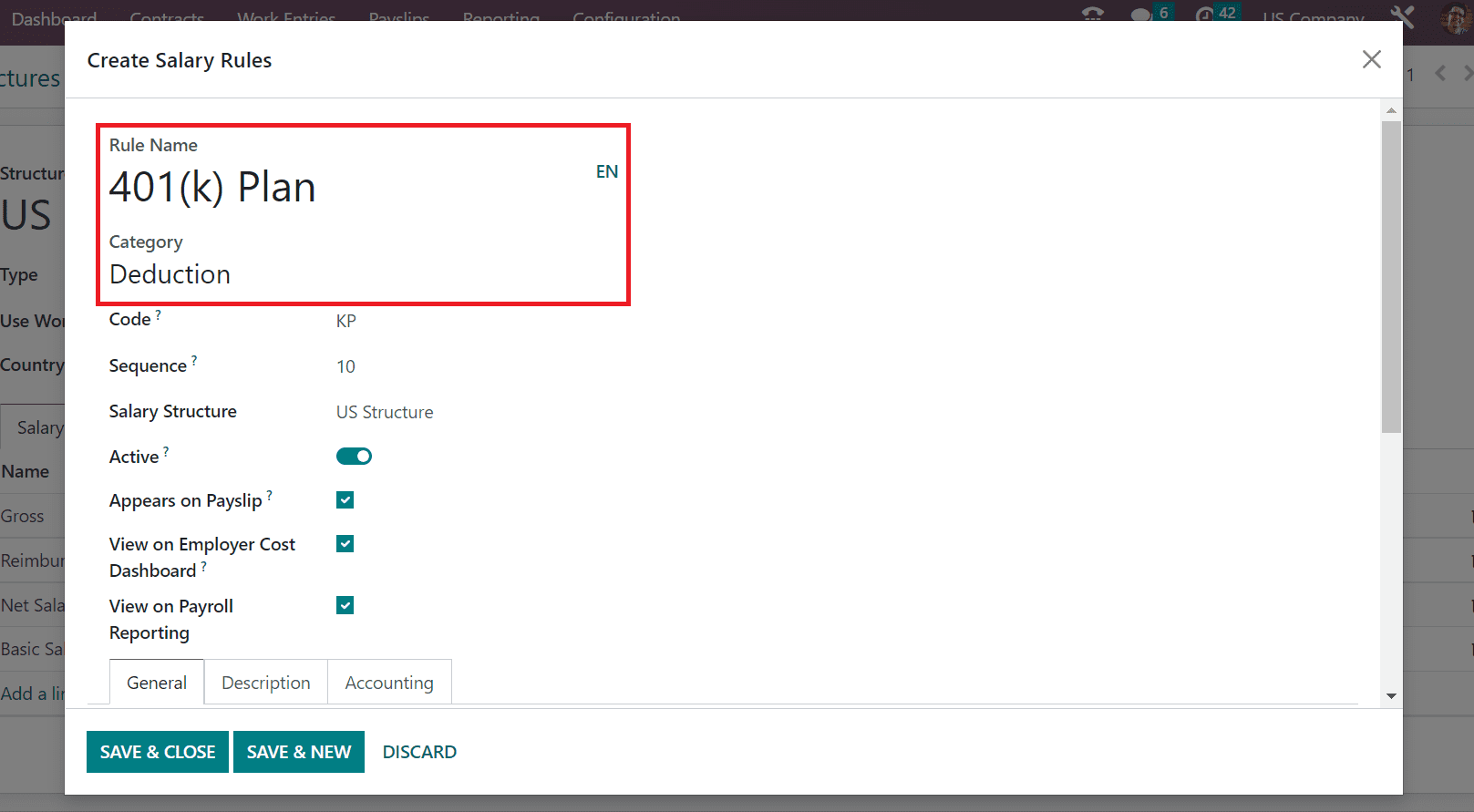

Press the SAVE button after mentioning the Basic salary rule data for an employee. Next, we can mention the 401(k) plan as a salary rule once choosing the Add a line option. Add 401(k) Plan as the Rule Name in the Create Salary Rule window and apply the Category for your rule as a deduction, as demonstrated in the screenshot below.

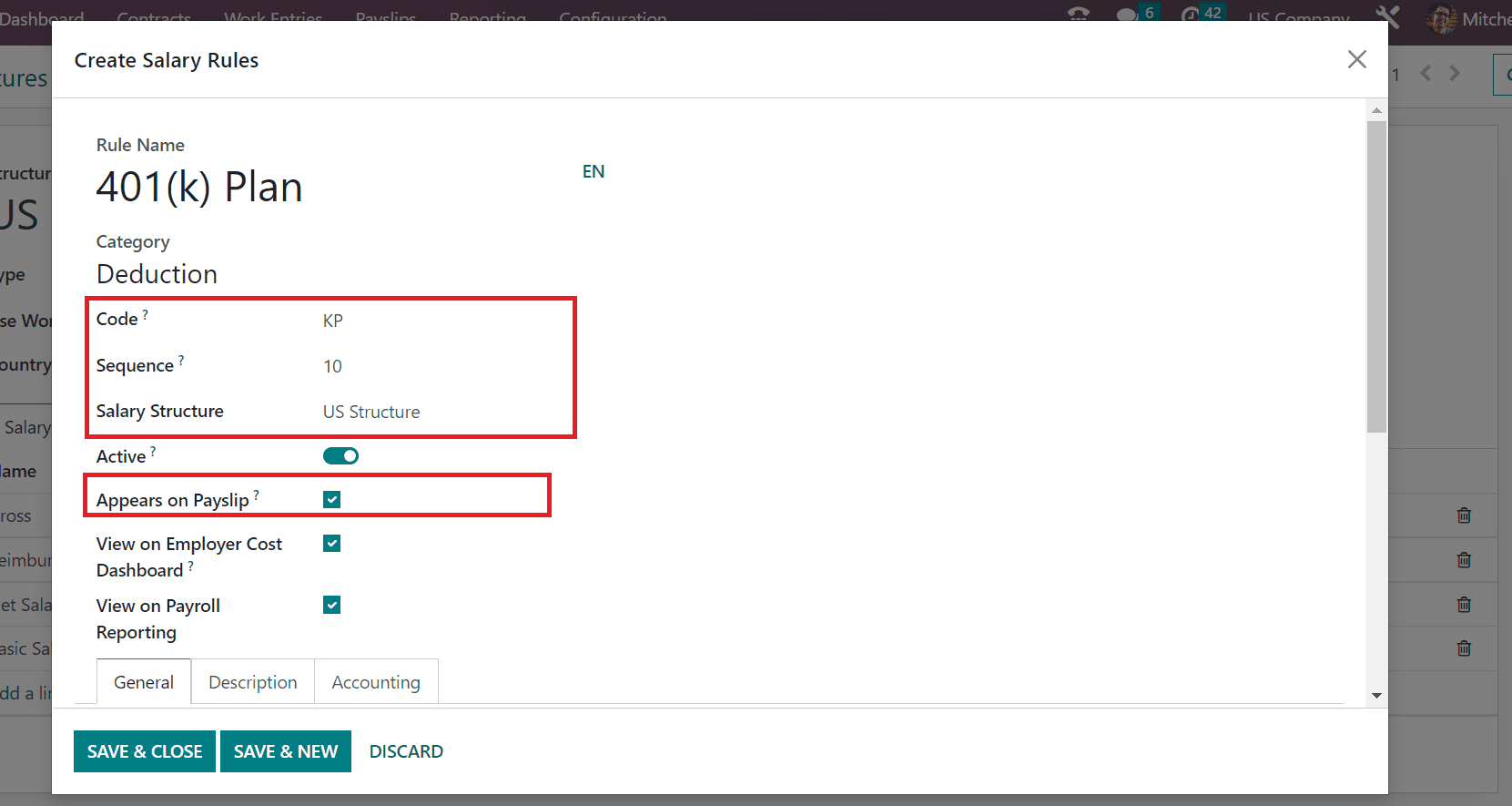

Enter KP as Code for 401(k) Plan rule of an employee and set the Sequence number as 10. Additionally, you can pick US Structure for the Salary structure of employees and enable the Appears on Payslip option for the 401(k) plan rule visibility on a payslip.

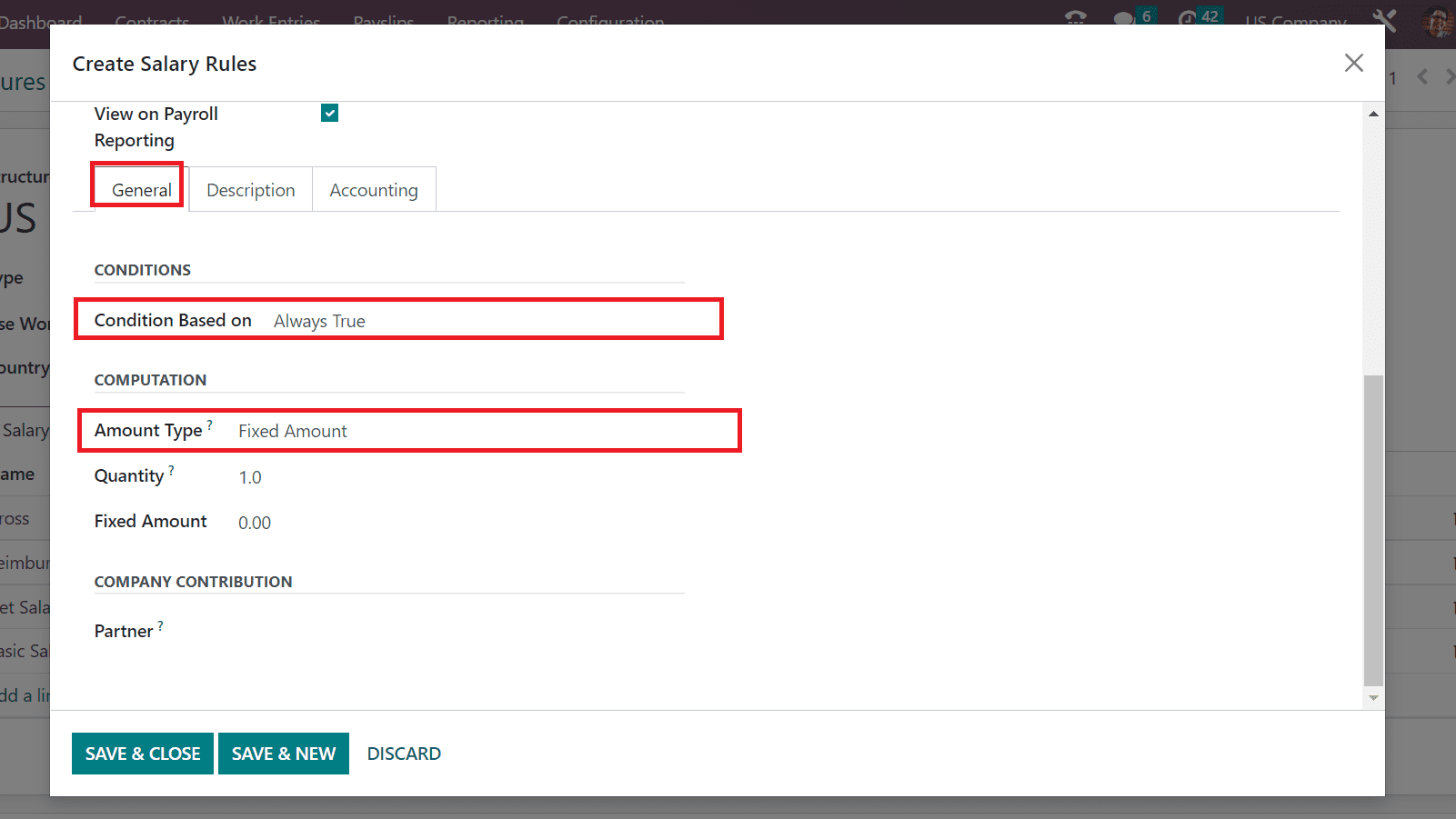

Now, we can mention the conditions for the 401(k) plan salary rule under the General tab. You can choose the Always True option as the Condition and enter the Fixed Amount for computation of the salary rule.

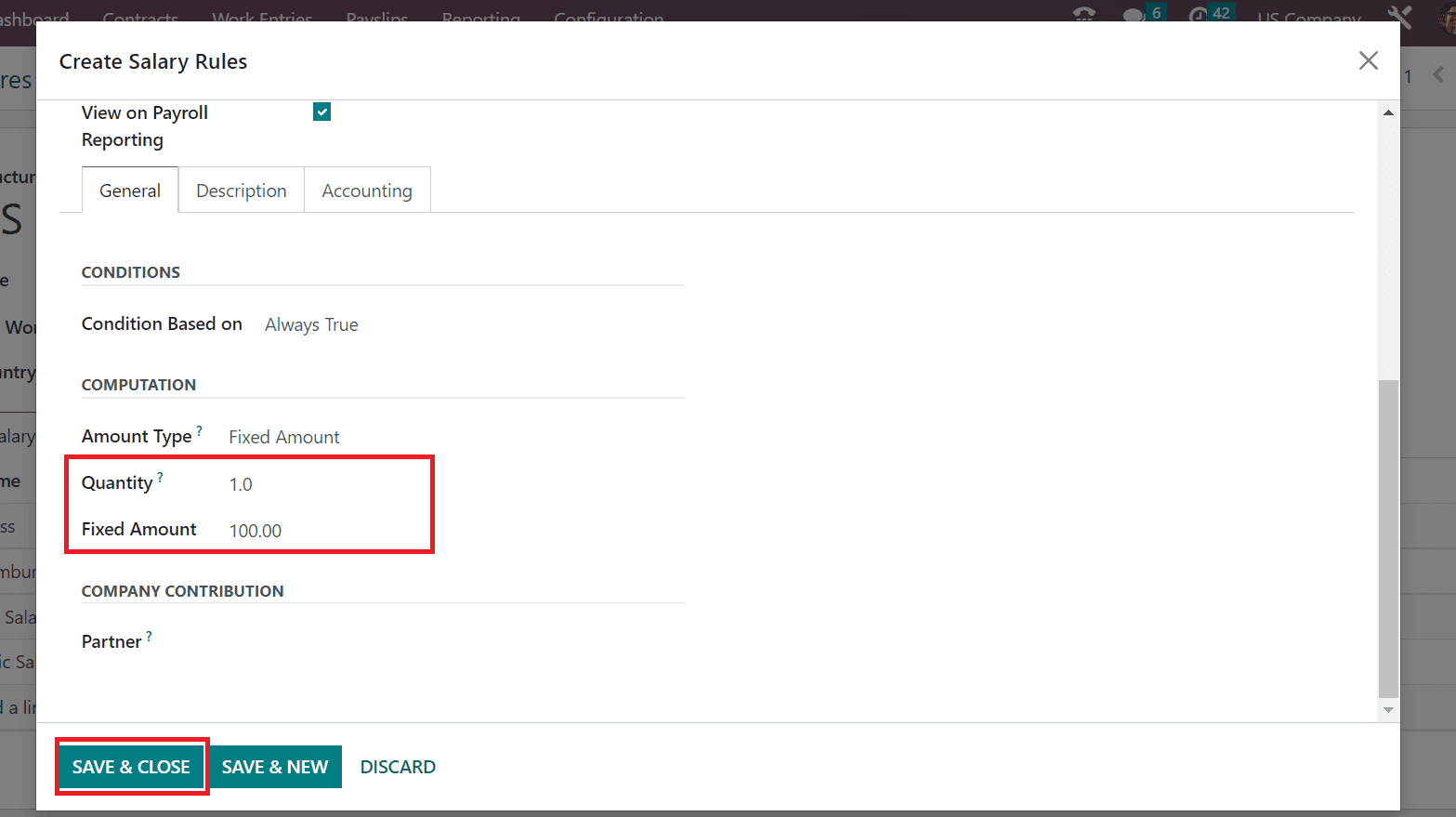

Quantity is used for the calculation of fixed amounts and percentages. After setting the quantity, you can apply the Fixed Amount for the 401(k) plan rule, as represented in the screenshot below.

To secure the changes, select the SAVE & CLOSE button, as shown in the screenshot above. Similarly, users can specify the allowance, gross and net categories for each worker’s salary rule. All your developed salary rules are obtainable in the US Structure window.

How to Formulate Payslip for an Employee in Odoo 16 Payroll?

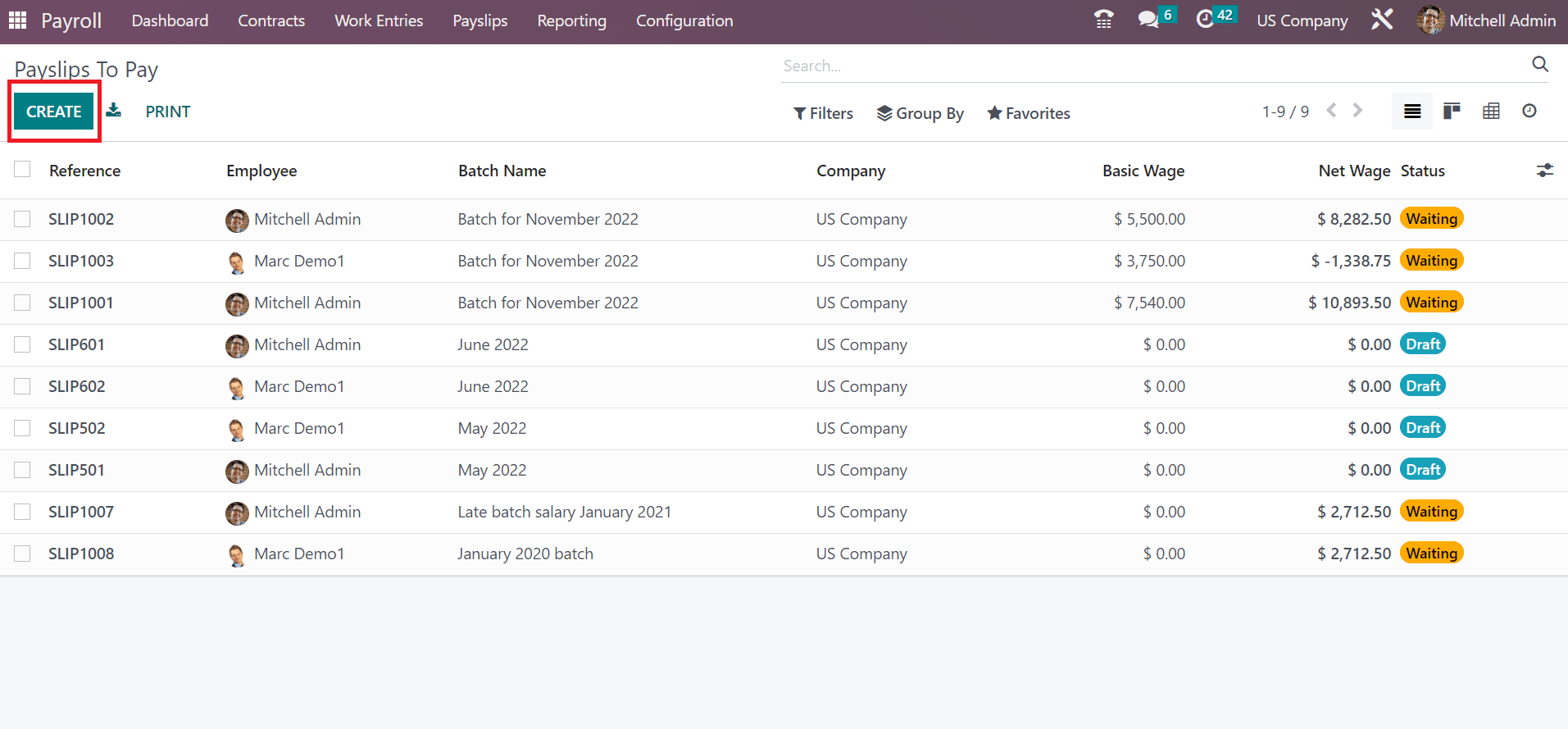

Odoo 16 Payroll module is the best way to impart employees’ payslips in your company. To generate a new payslip, click the To Pay menu below Payslips, and a Payslips to Pay window will appear to you. Each of the created payslips is accessible to the user separately. Select the CREATE icon to process a new payslip based on your created salary structure.

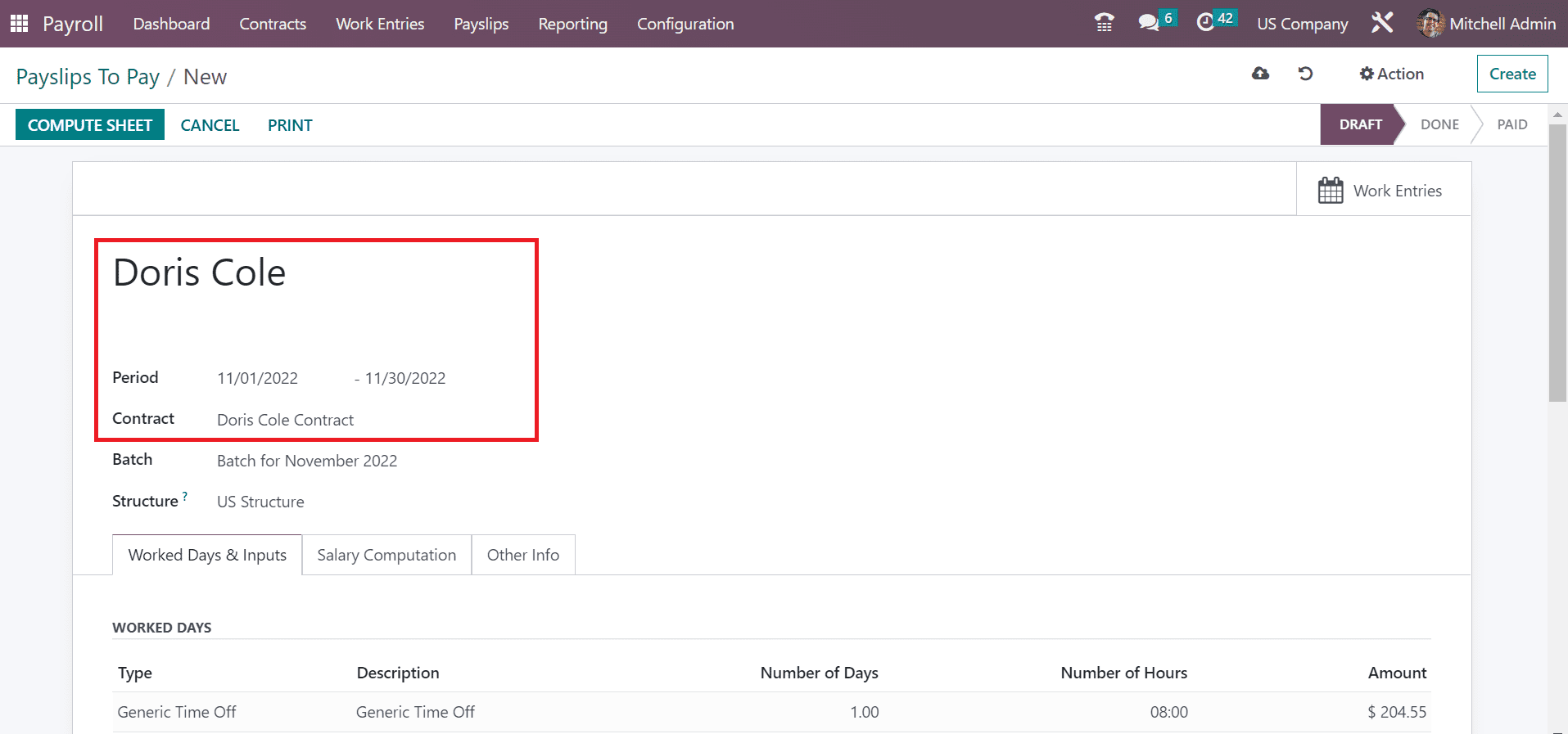

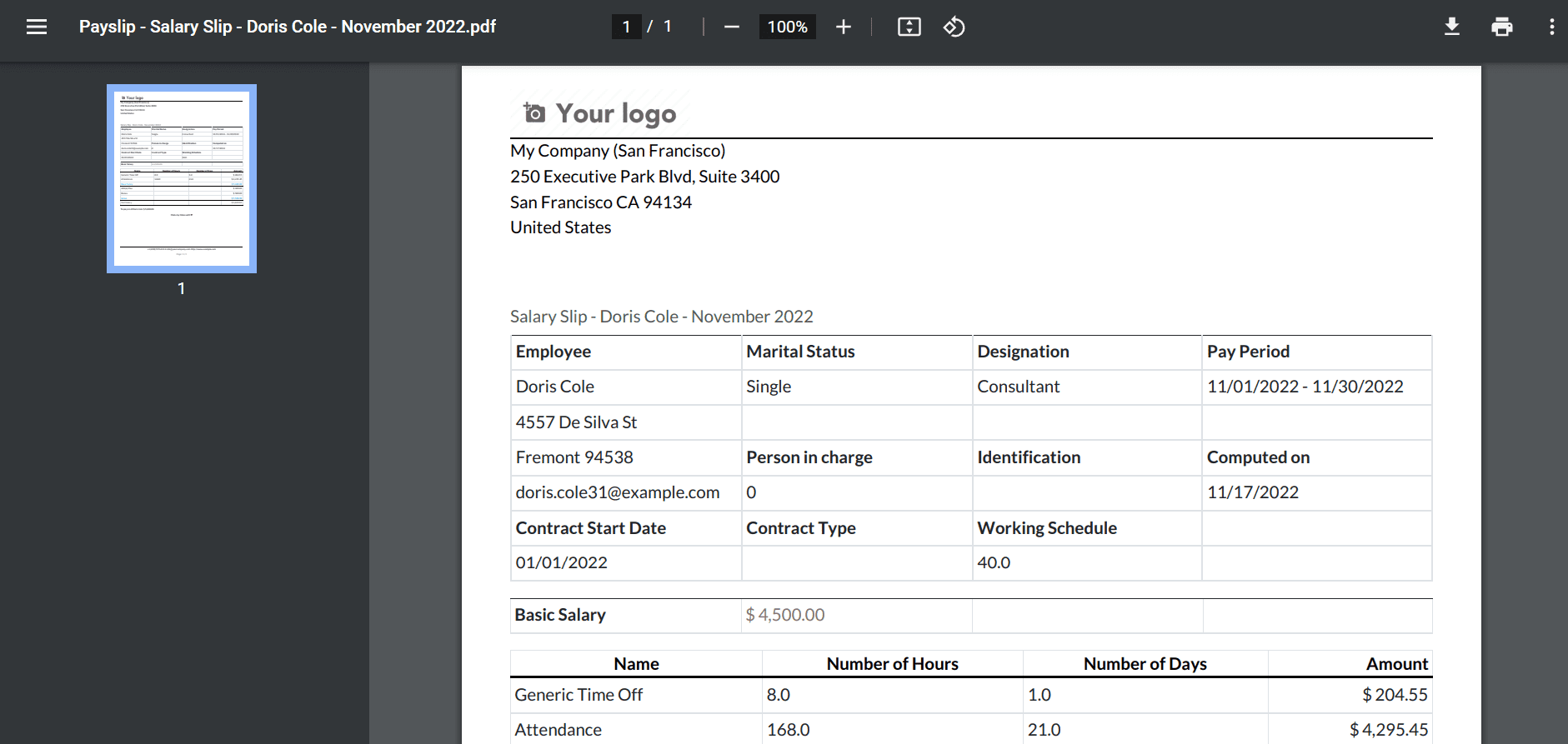

In the New window, choose your Employee as Doris Cole and set the span of employee payslip within the Period field. Additionally, set the created contact for the chosen employee in the Contract field.

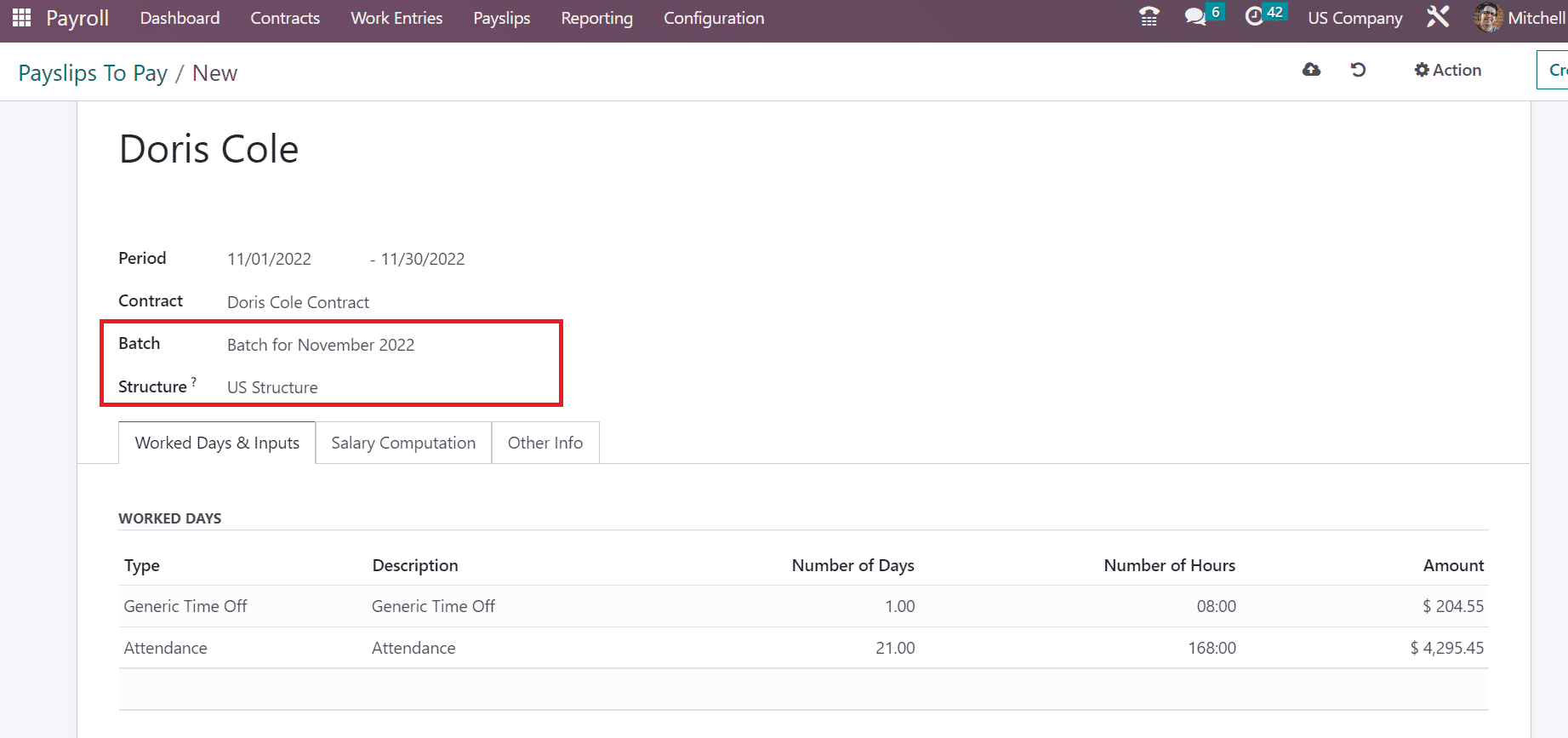

You can pick the batch of a particular month for a laborer in the Batch option. Also, mention your created salary structure US Structure within the Structure field as specified in the screenshot.

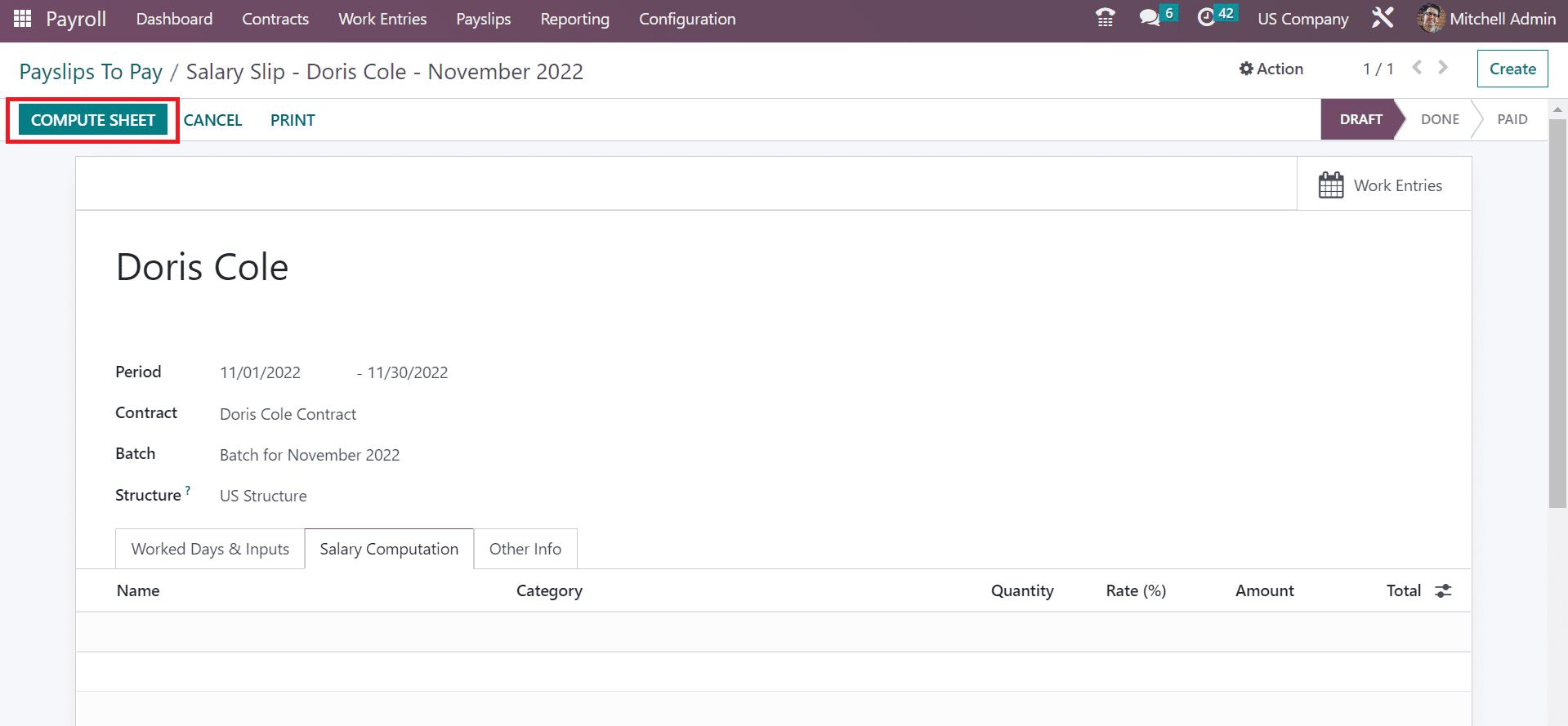

Added details are saved manually in the Odoo 16 compared to the Odoo 15. Next, we can recompute the payslip lines once choosing the COMPUTE SHEET icon, as presented in the screenshot below.

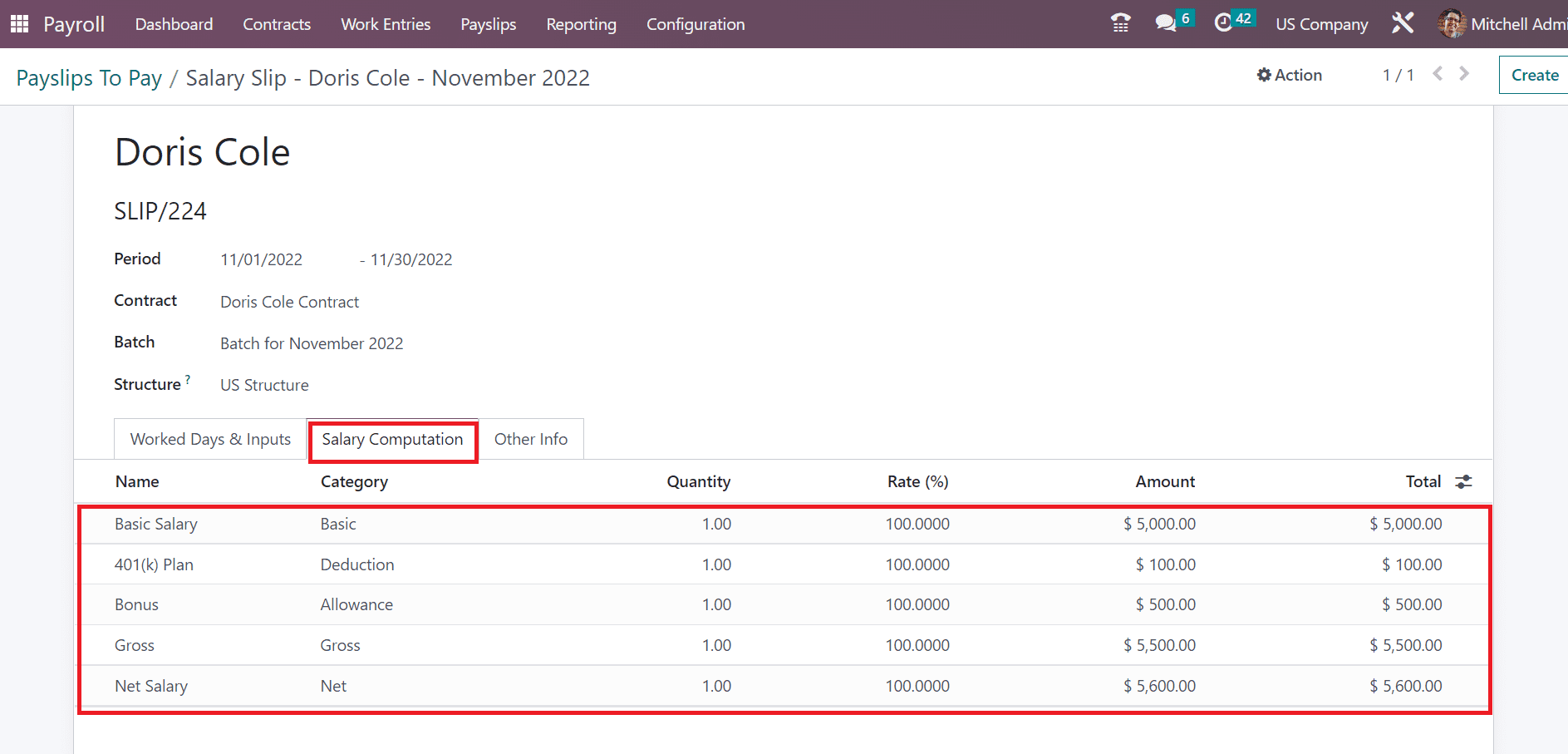

After the sheet computation, we can see the calculation of each salary rule created before under the Salary Computation tab.

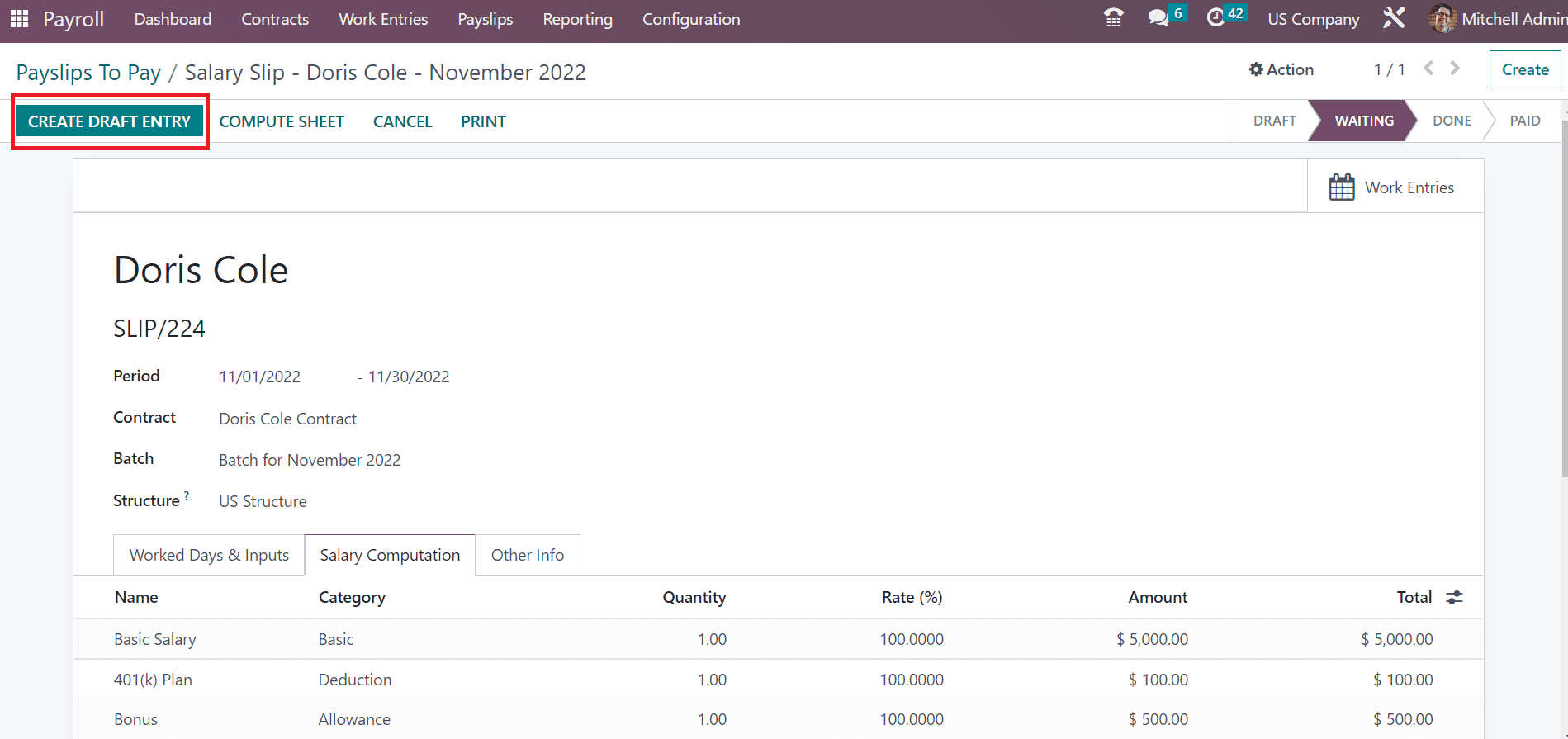

The stage is changed from DRAFT to WAITING in the Payslip to Pay screen. It is possible to produce a draft entry of the payslip after selecting the CREATE DRAFT ENTRY option in the Payslip to Pay window.

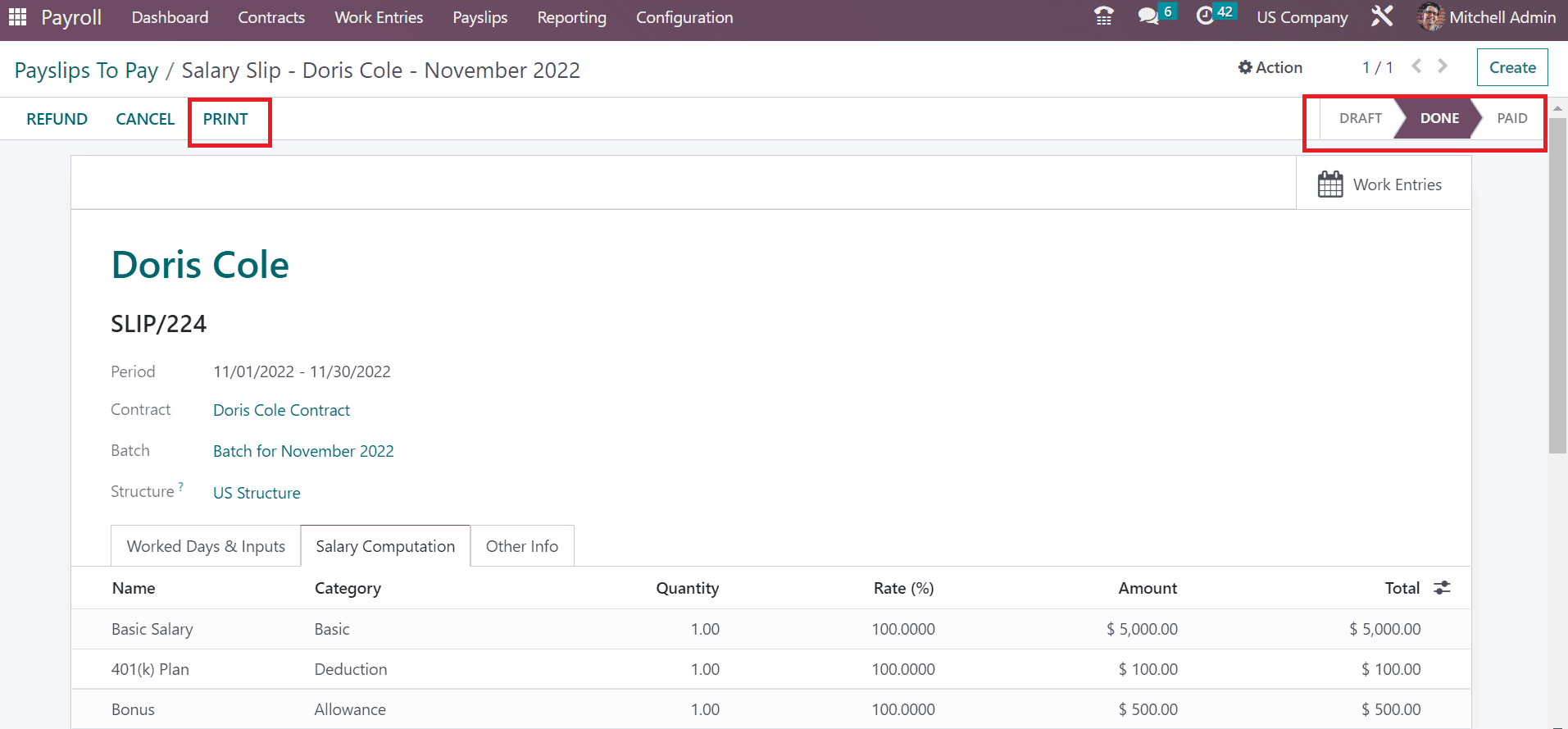

After proceeding with the draft entry, the stage changes to DONE. We can take a printout of the employee payslip once clicking on the PRINT icon, as illustrated in the screenshot below.

The salary slip is downloaded into your system, showing all the salary details for an employee.

The salary slip is downloaded into your system, showing all the salary details for an employee.

Odoo 16 Payroll module assists users in setting up a 401(k) plan in the US within a salary slip of an employee working in a US company. Calculating each head in an employee payslip becomes simpler once ERP software is implemented in your business.