It often happens that while working on a project with a client, your employees have to spend their personal money on the project or the company has to spend some of the client’s expenses. Therefore, the company has to re-invoice this expense to the client. Take the example of an employee or company, who pays for hotels, travel, etc to work for a client. This expense, however, is not invoiced to the client. But must be added along in the customer’s next invoice. If the cost is incurred by the employee’s own money, it should be refunded by the company at its expense. In odoo, we can re-invoice based on the cost of the expense or if you want any additional charges for your expense you can re-invoice based on the sales price.

Configuration

Install the Expense module so as to manage different expenses.

For that Go to Apps -> Expenses.

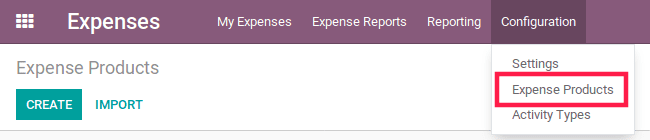

After installing it, the user can configure the specific products defining expense types.

Go to Expense App -> Configuration -> Expense product

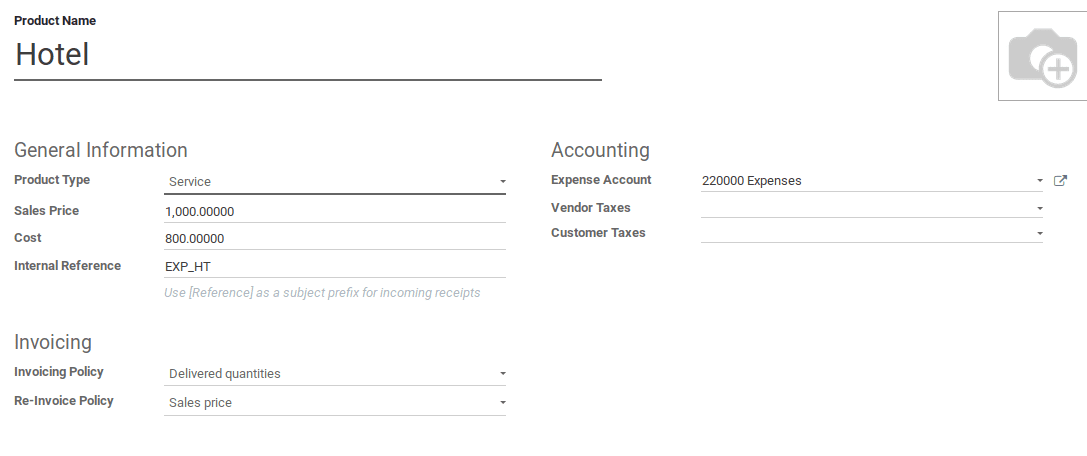

Here, I need to re-invoice the expense in sales price because I want an additional charge for my expense, so I choose a re-invoice policy as the sales price.

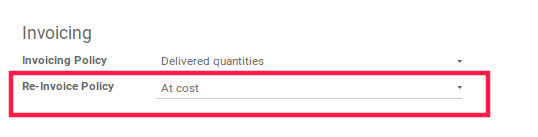

If you want to re-invoice based on cost, you can select the cost in re-invoicing policy in the Expense product.

After creating the product, the employee can log into their portal and record expenses and submit to the manager.

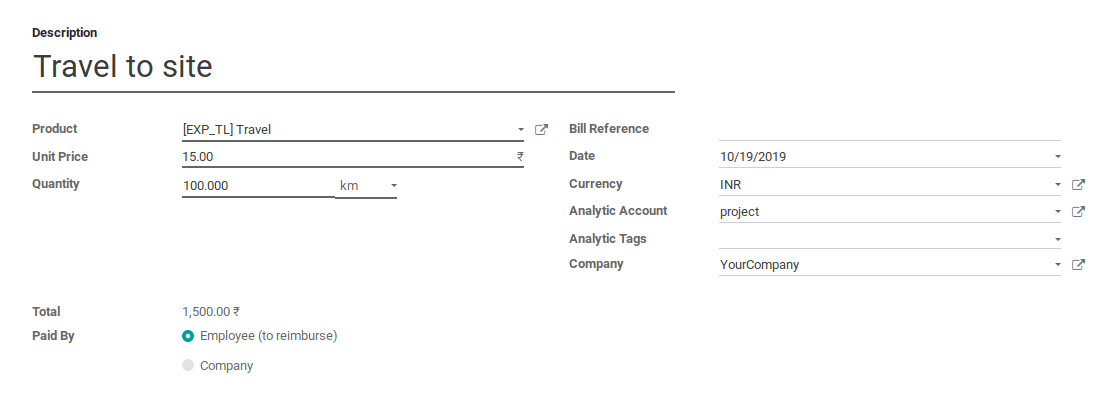

Two Expense Type is supported in Odoo

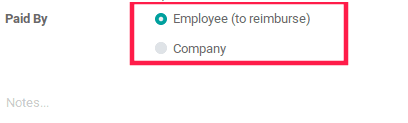

1. Expenses paid by an employee using their personal money.

2. Expenses paid using the company’s credit card.

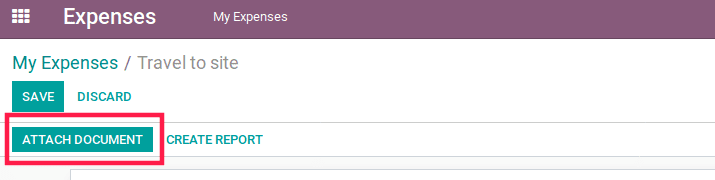

Moreover, one can also attach documents to the expense.

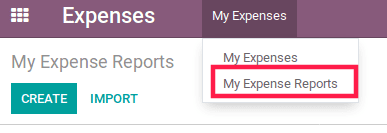

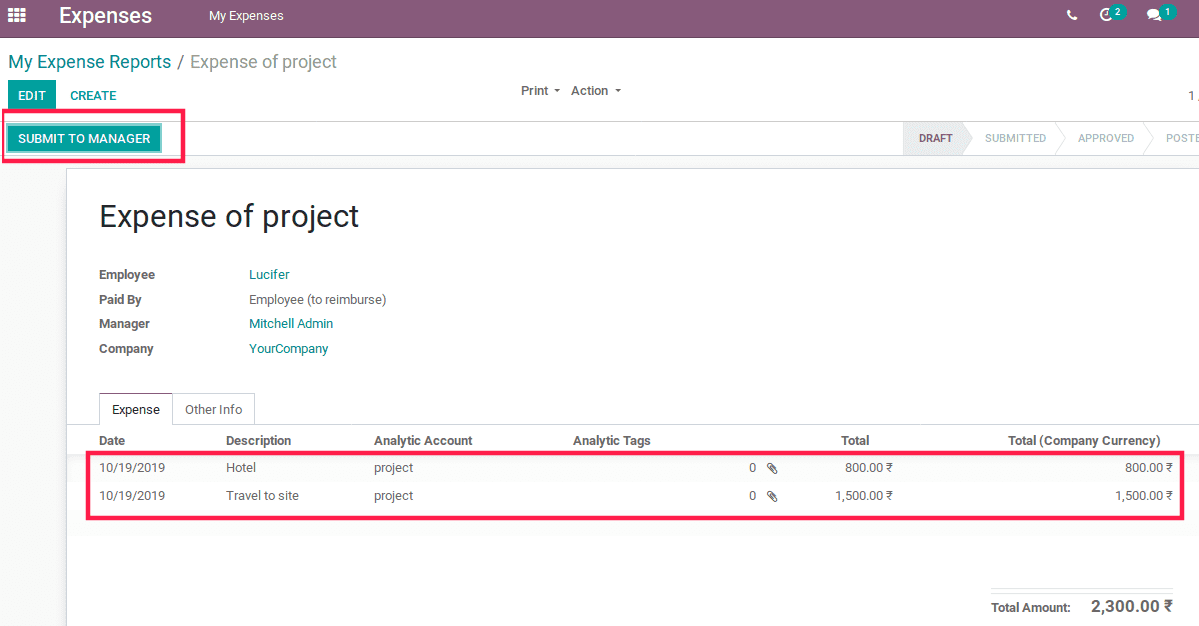

After recording all the expenses, you can submit to the manager by clicking My Expense Report in

By creating an expense report you can add all the expense and submit to the manager.

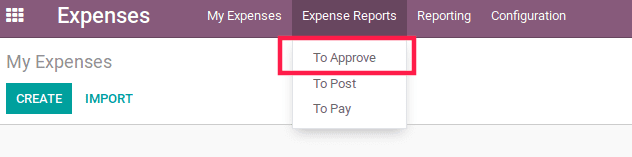

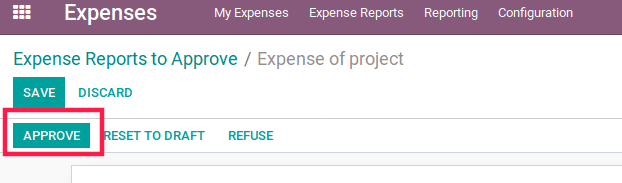

Later managers can approve the expenses by clicking.

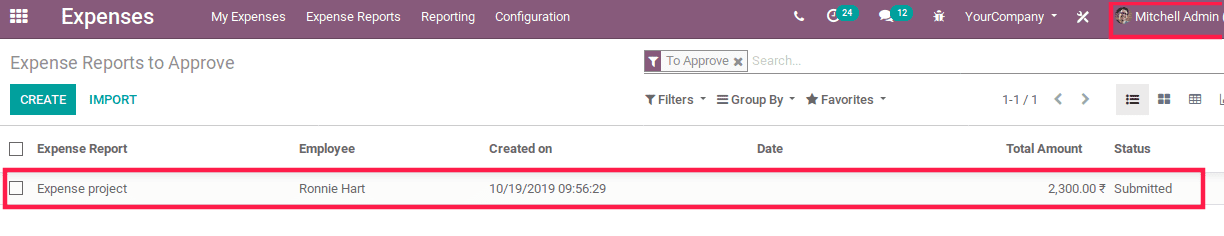

You can see the list of expenses to approve.

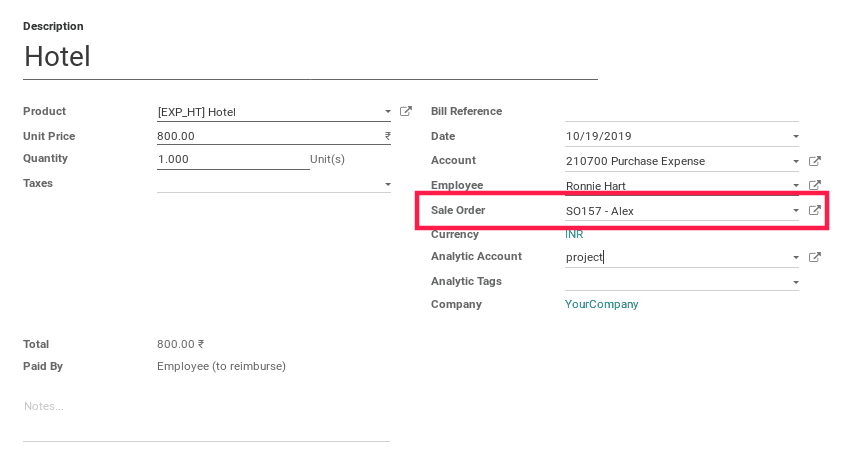

Manager can add the corresponding sale order before approving the expense for re-invoicing the expense to the client.

Manager can approve by clicking the “Approve” button.

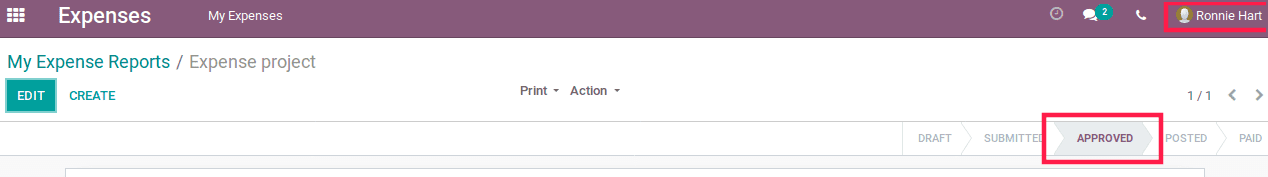

After approved by the manager, we can see the corresponding expense in an approved state in the employee’s portal.

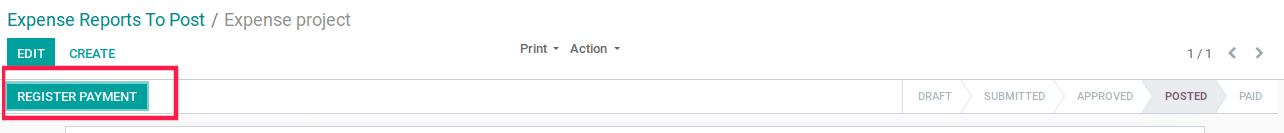

The account advisor can post and register the payment in case of reimbursement to the employee.

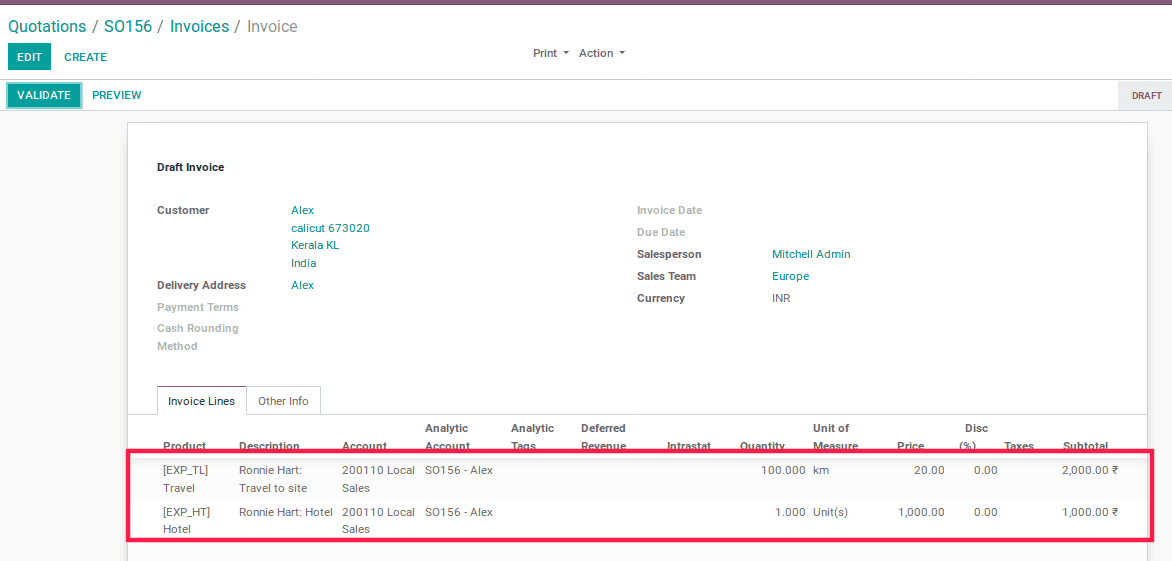

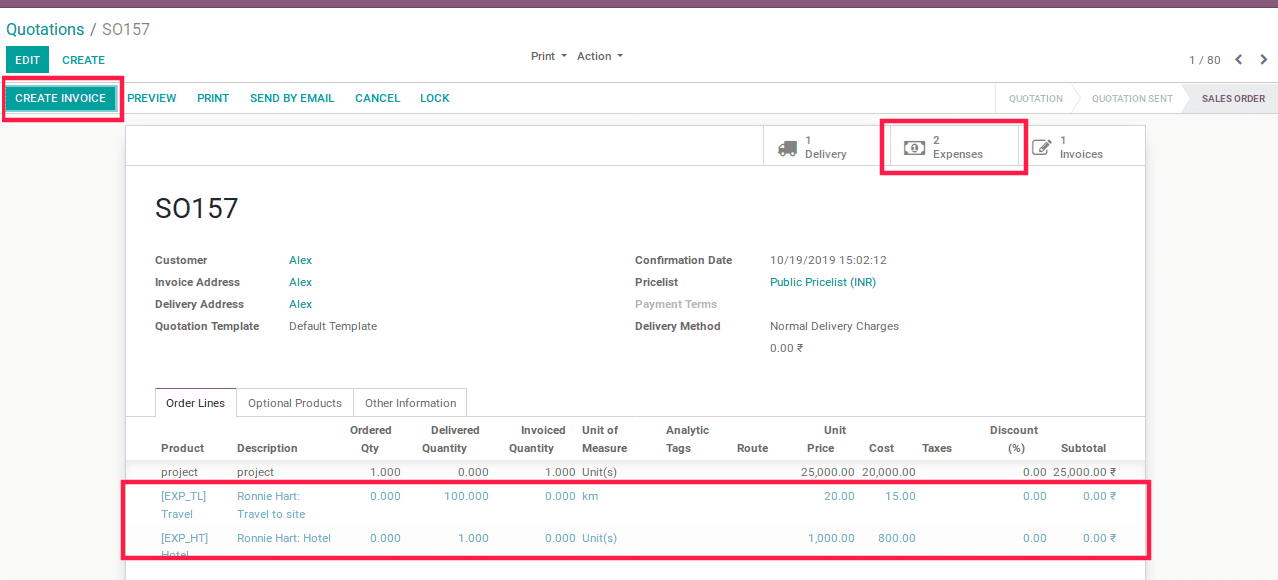

Finally, we can see that the expense is automatically added in the corresponding order line which shows up in blue.

And we can re-invoice it to the customer by clicking the create invoice button and we can see the re-invoiced amount is based on the sales price mentioned before.