The added money once we purchase several commodities or services is a sales tax. It is essential to check out the state government to determine the sales tax charged to you. The percentage of the taxed purchase price is termed a sales tax. Excise tax, Income tax, and more are different types of sales tax relied on in the United States. Usually, a merchant or business pays tax to the federal authority of a particular country. The US states with low sales tax are Hawaii, Wyoming, Alabama, and more. Users can manage the tax computation of an organization by running Odoo ERP software into their system.

This blog mention the sales tax computation of Maryland(US) using Odoo 16 Accounting.

Accounting application helps users to configure customer addresses, cash rounding, invoice online payment, vendor bills, etc. Tax configuration according to every state in a country becomes a more straightforward task in your business with the Odoo ERP. Let’s view the sales tax computation of Maryland(US) in Odoo 16.

Maryland Sales Tax Brief for Users

The state sales tax of Maryland is considered as 6%. Few cities in Maryland cover high tax rates, including Rockville, Silver Spring, Baltimore, Gaithersburg, and more. The state charge taxes for clothing, OTC Drugs, and prepared foods. We can view some exceptions in the prescription drugs and groceries in the specific state. There is no local sales tax permit in Maryland, is not a member of the sales and use tax agreement.

For registering a sales tax permit, the user can apply online from the controller of Maryland. We must focus on some information for the state’s registration of sales tax permits. It includes business type, start date, owner details, the reason for application, and more. It is possible to remit sales tax based on quarterly, monthly, annual, etc.

To Develop Maryland(US) Company Information in Odoo 16

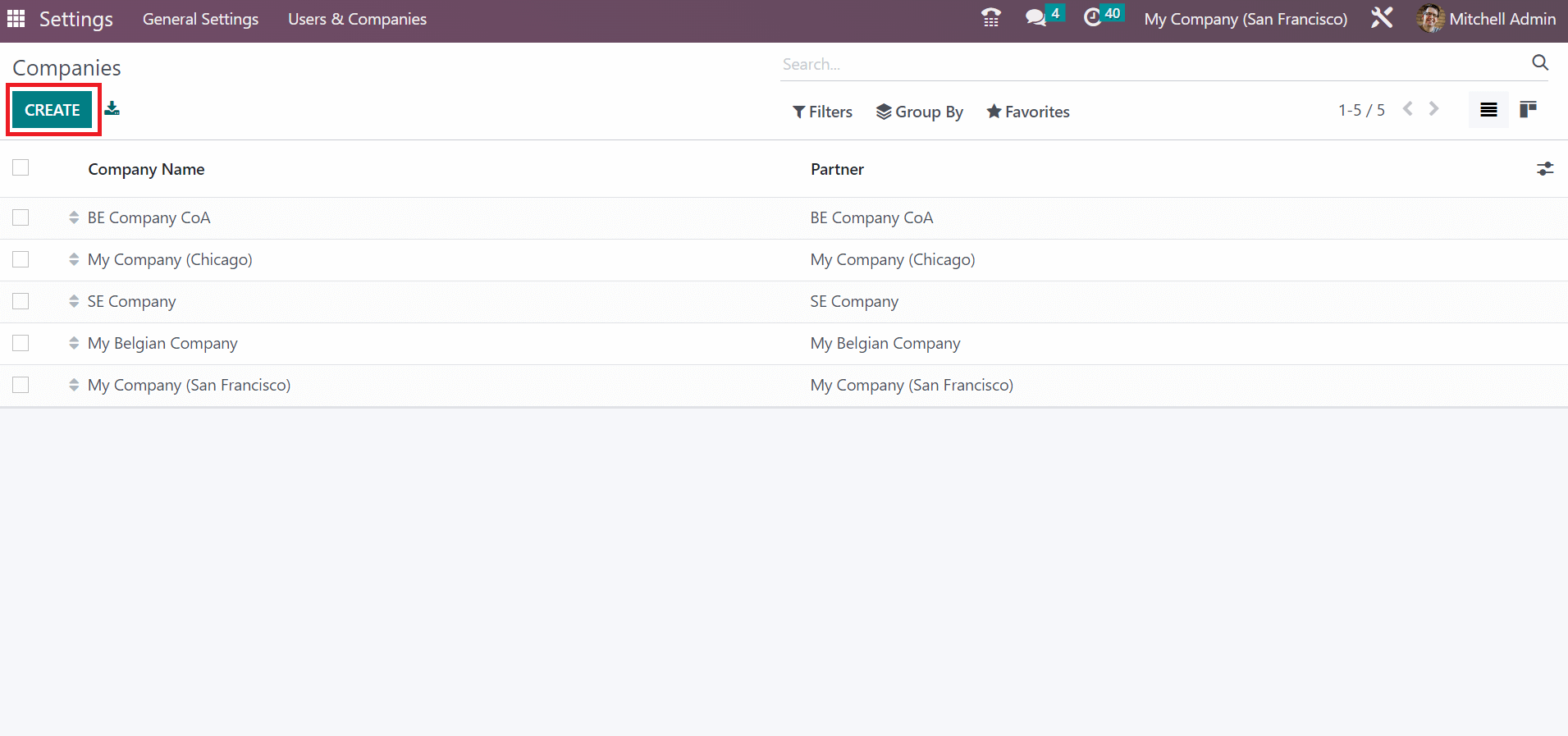

After choosing the Companies menu, we can specify the company data within the Odoo 16 Settings window. The record of each company is acquirable to a user in the Companies window. You can generate new firm details once clicking on the CREATE icon, as presented in the screenshot below.

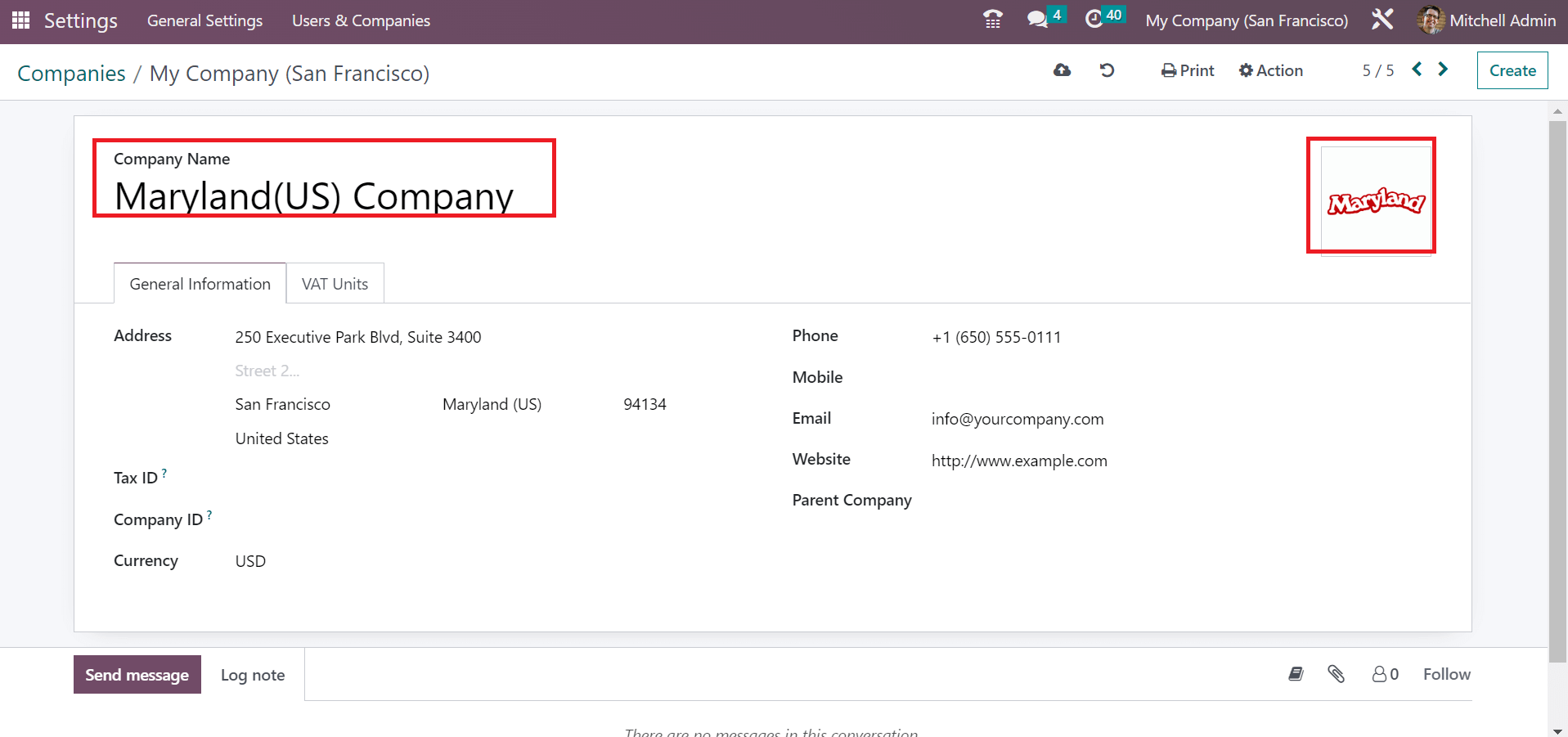

Users can mention the Company Name as Maryland(US) Company. Also, upload the company logo after selecting the Edit icon on the right end, as illustrated in the screenshot below.

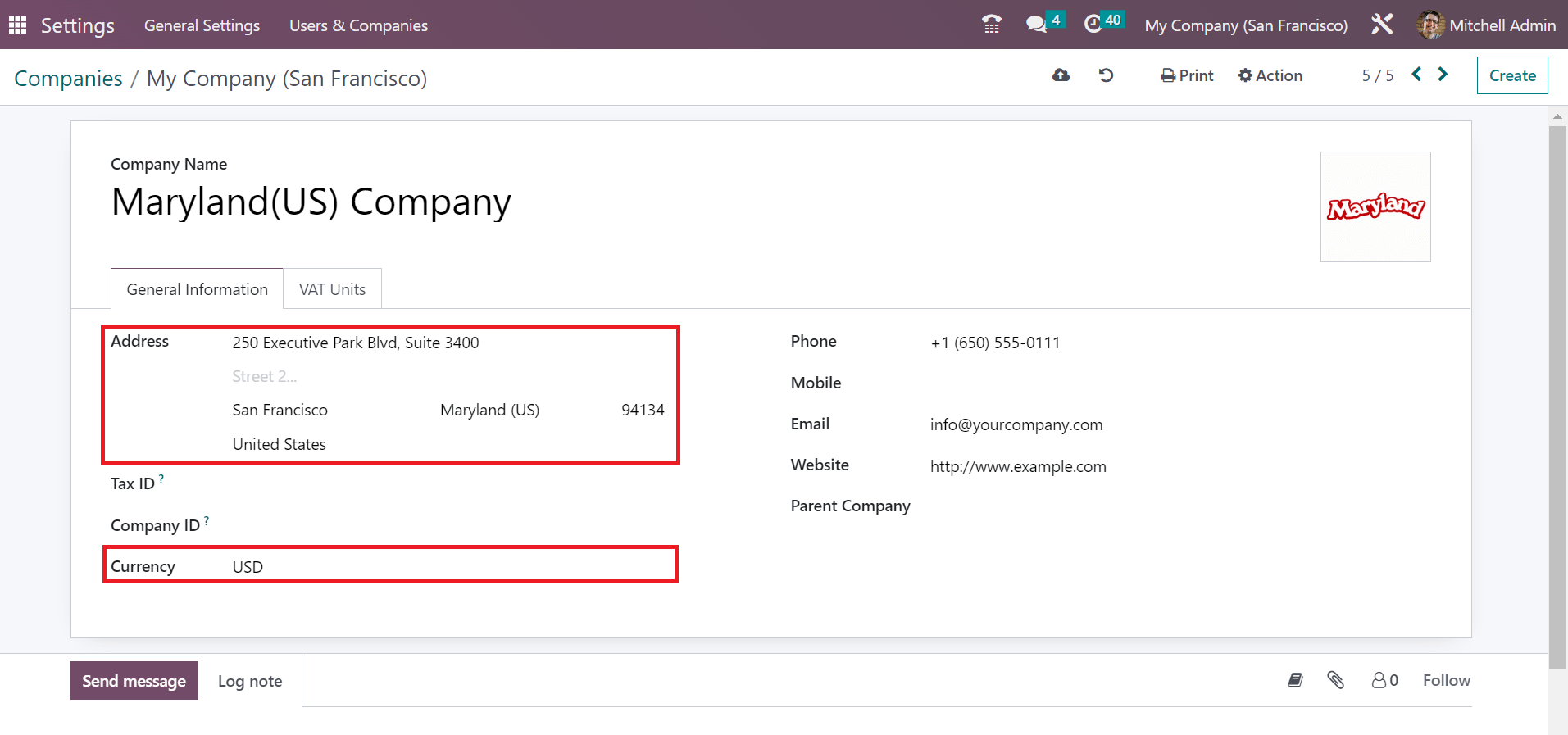

In the Address option under General Information, enter street 1 or 2 names, city, country, and state. We stated Maryland(US) as the state and added the United States in the Country option. Moreover, choose your company currency as per the country

Save your company data manually after applying essential details.

Maryland(US) Tax Computation in the Odoo 16 Accounting

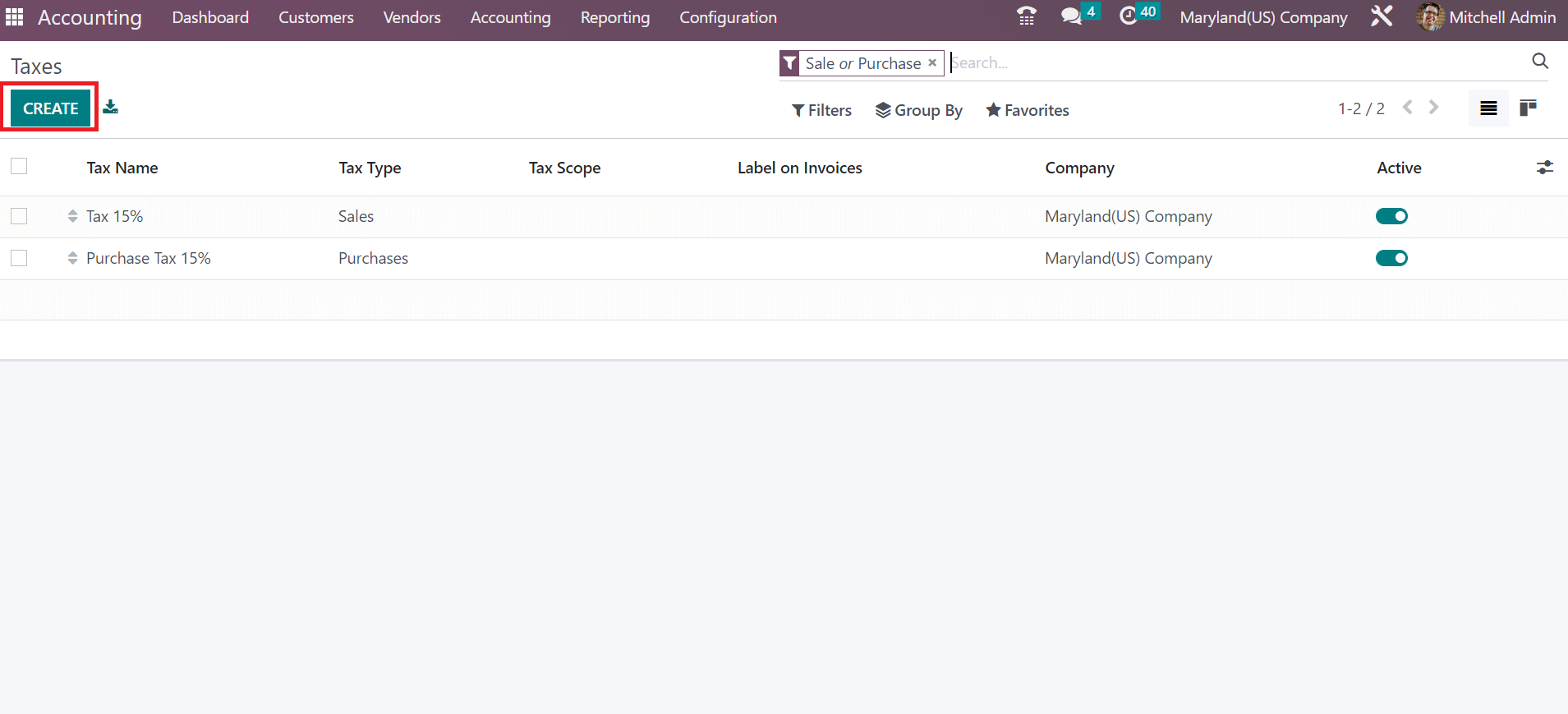

Users can attain the Taxes menu within the Configuration tab of the Accounting module. A list of each tax, including Tax name, Company, Tax scope, and more, is obtainable in the Taxes window. As mentioned in the screenshot below, we can define a recent tax for your company after pressing the CREATE button.

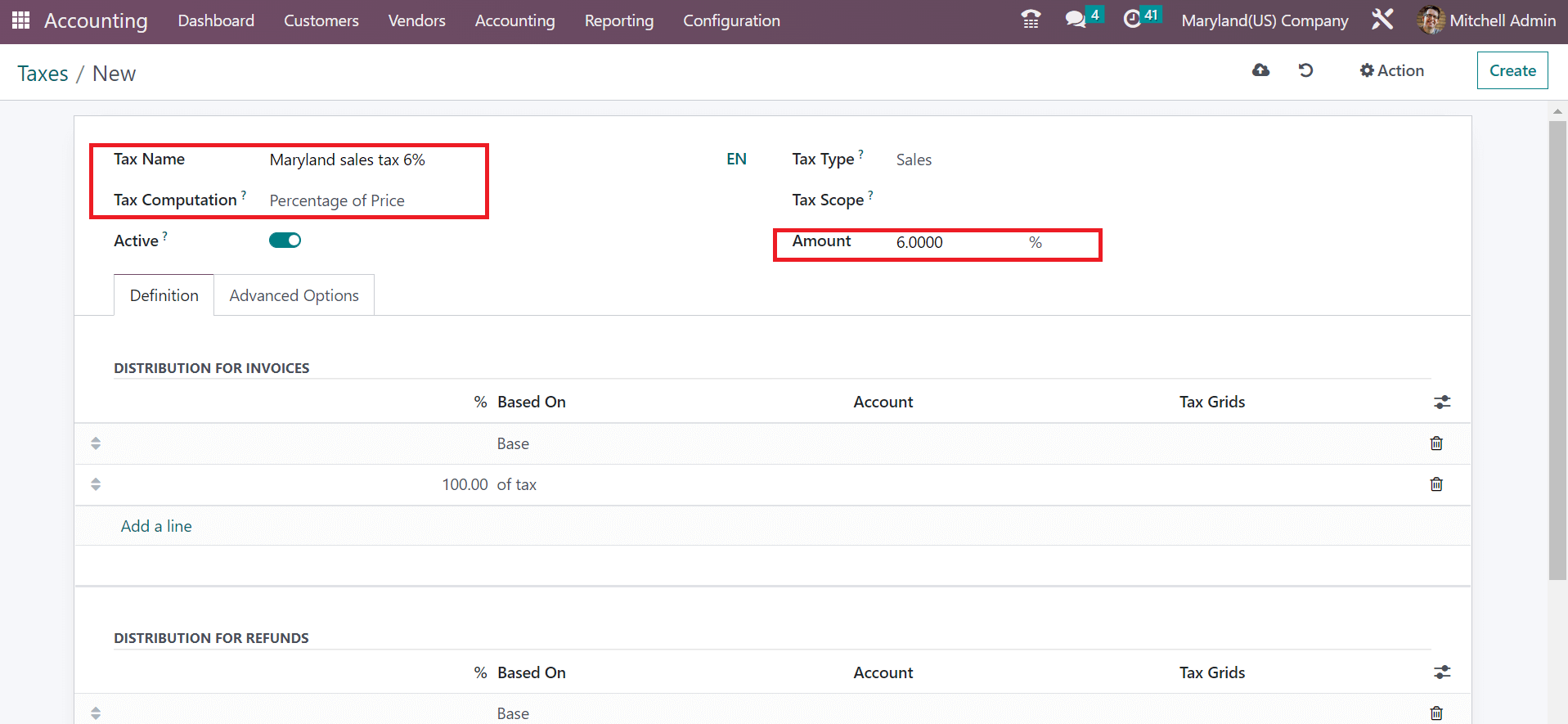

Add Maryland sales tax 6% as the Name on the open page. Next, we can set a computation method for sales tax calculation in Maryland. After picking your computation method, enter 6% in the Amount option as specified in the screenshot below.

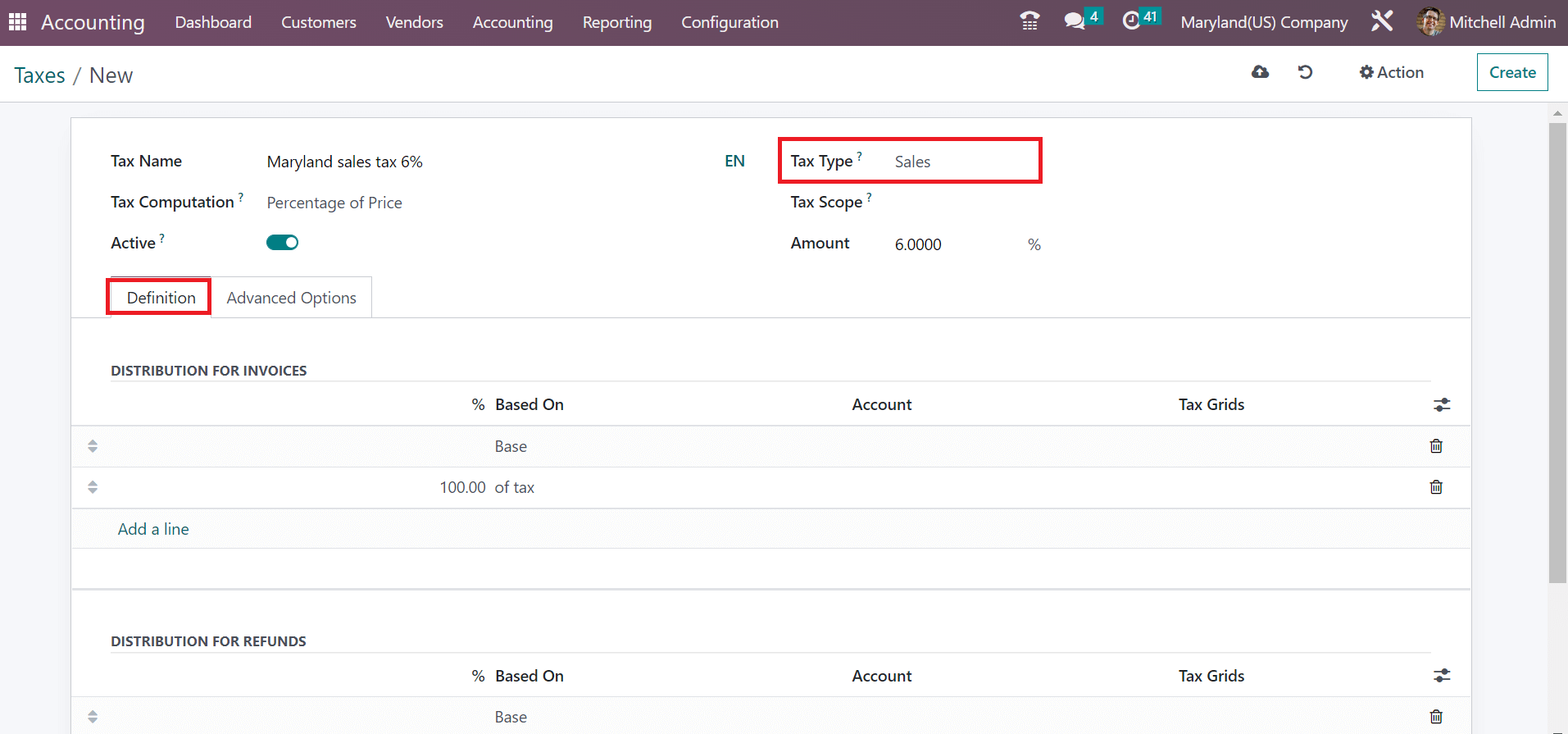

Here, we add 6% because the sales tax rate of Maryland is covered as 6%. It is easy to set your tax category in the Tax Type option. We selected Sales as the Tax Type and quickly distributed taxes under the Definition section, as demonstrated in the screenshot below.

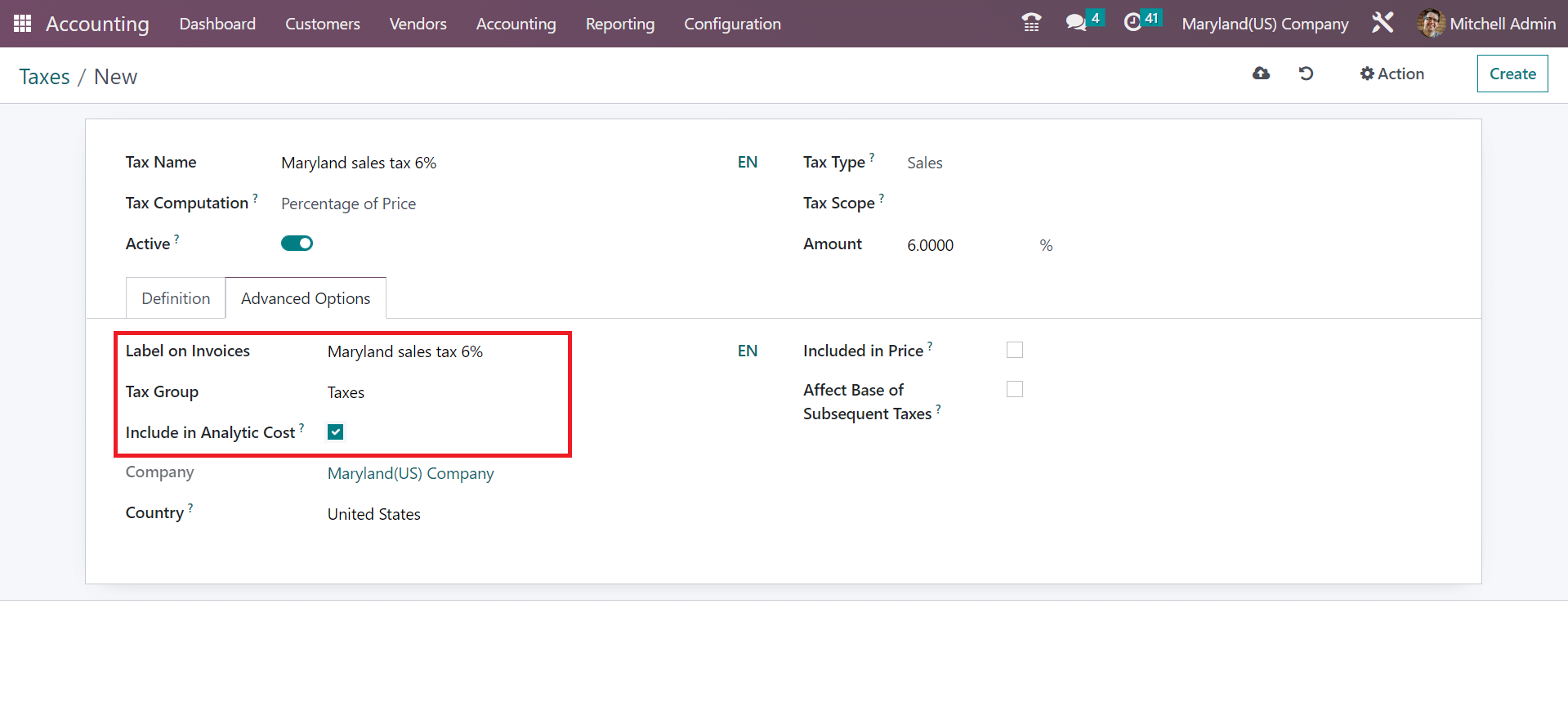

In the Advanced Options section, we can choose the tax group and add an invoice label. Your applied label is visible on invoices for customers. The computed tax amount is applied to the same analytic account after enabling the Include in Analytic Account option.

You can manually save the information once you enter all Maryland sales tax data 6%.

Maryland Sales Tax applied on a Customer Invoice in the Odoo 16

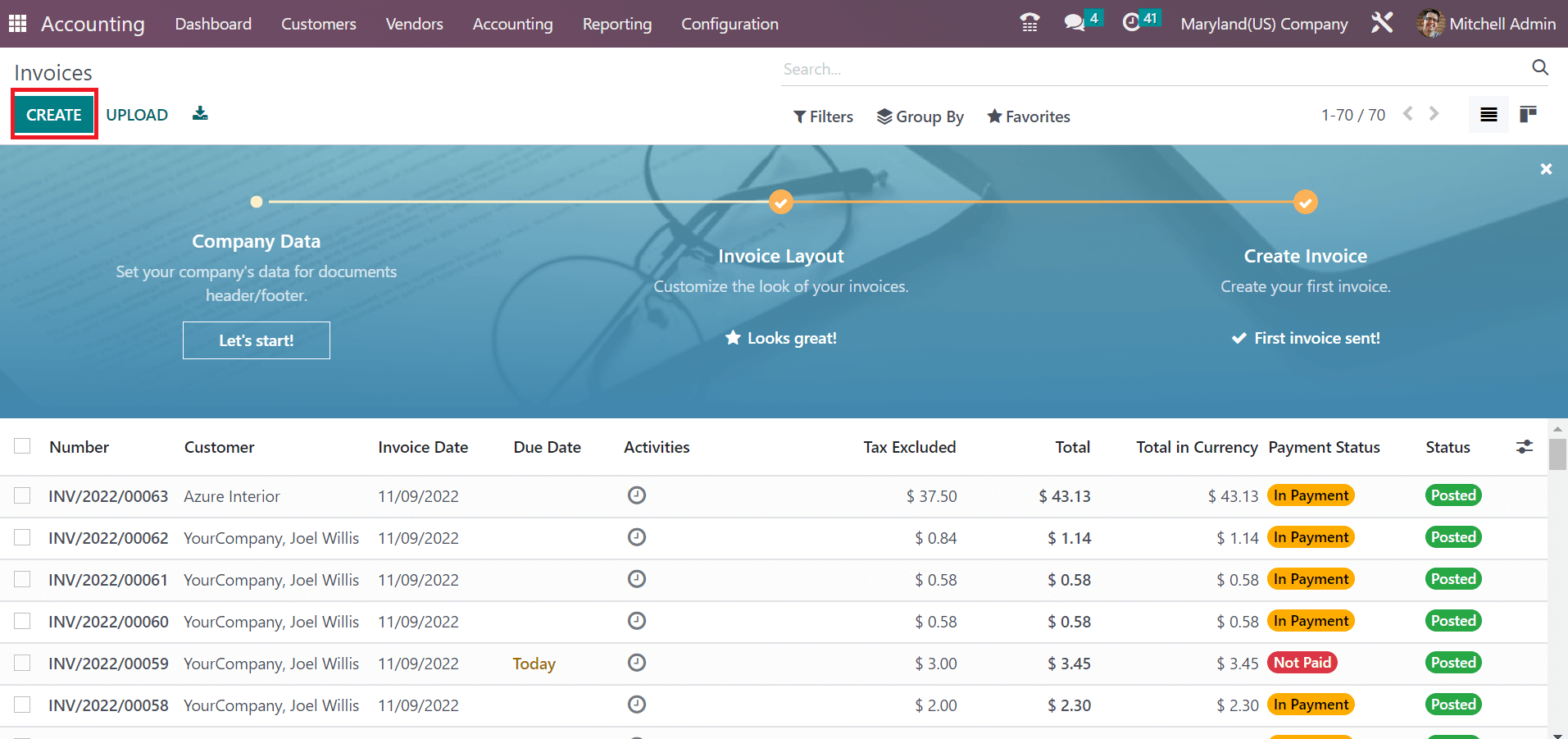

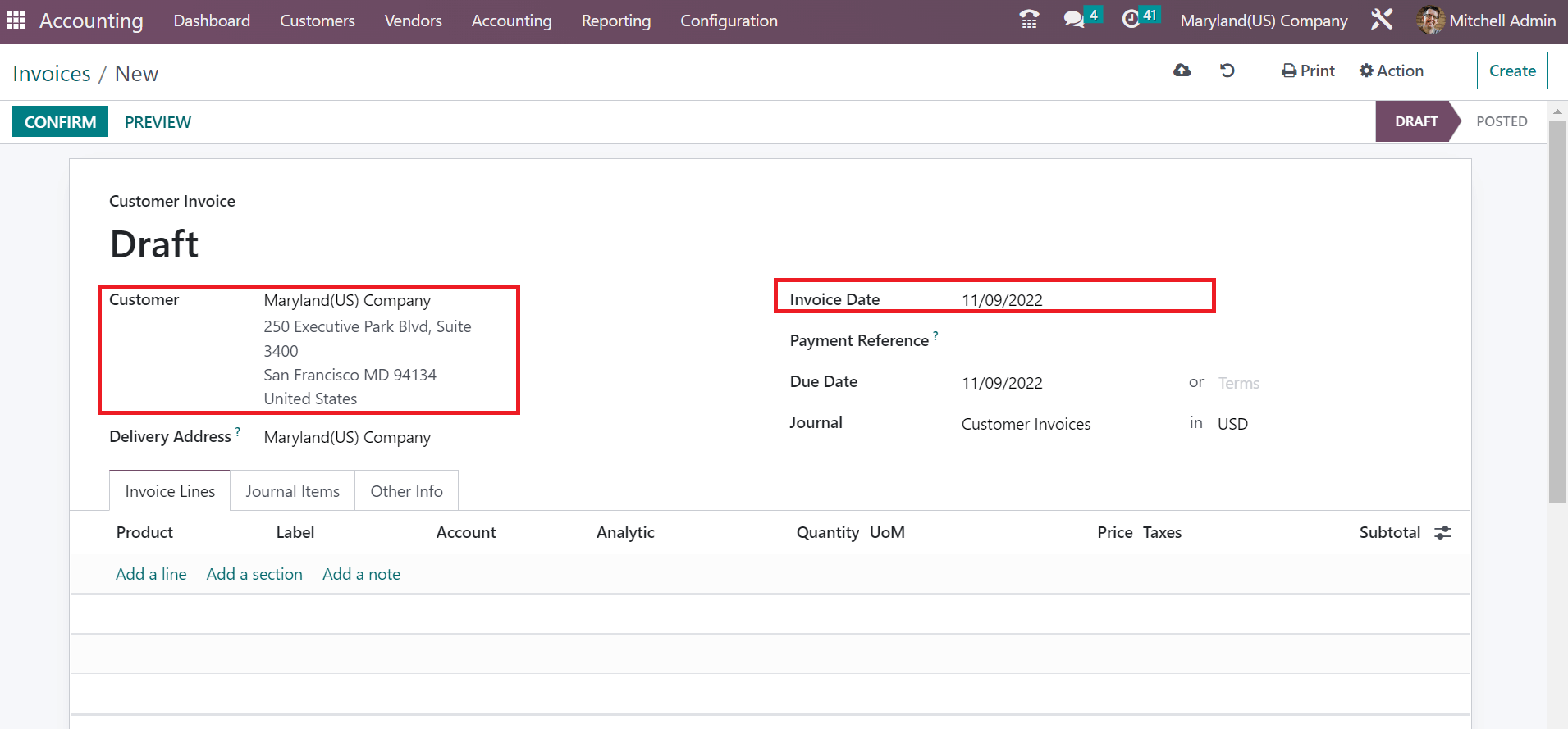

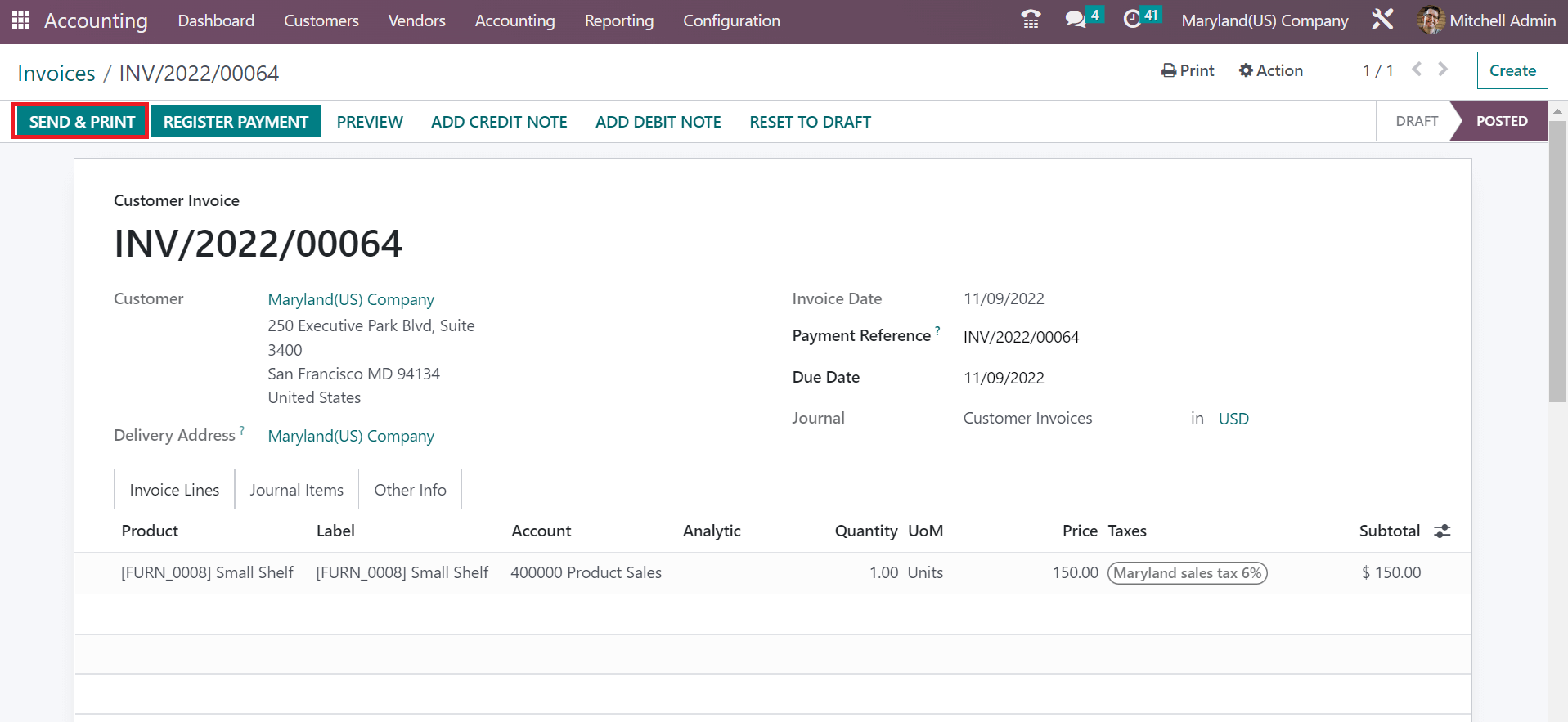

History of all created invoices is acquirable to a user after picking the Invoices in the Customers tab. You can view data concerning each invoice, such as Due Date, Customer, Status, etc. For developing an invoice, you can choose the CREATE icon on the Invoices screen, as noted in the screenshot below.

Select Maryland(US) Company as your customer on the new page. All the created information of Maryland company before is available in the Customer field.

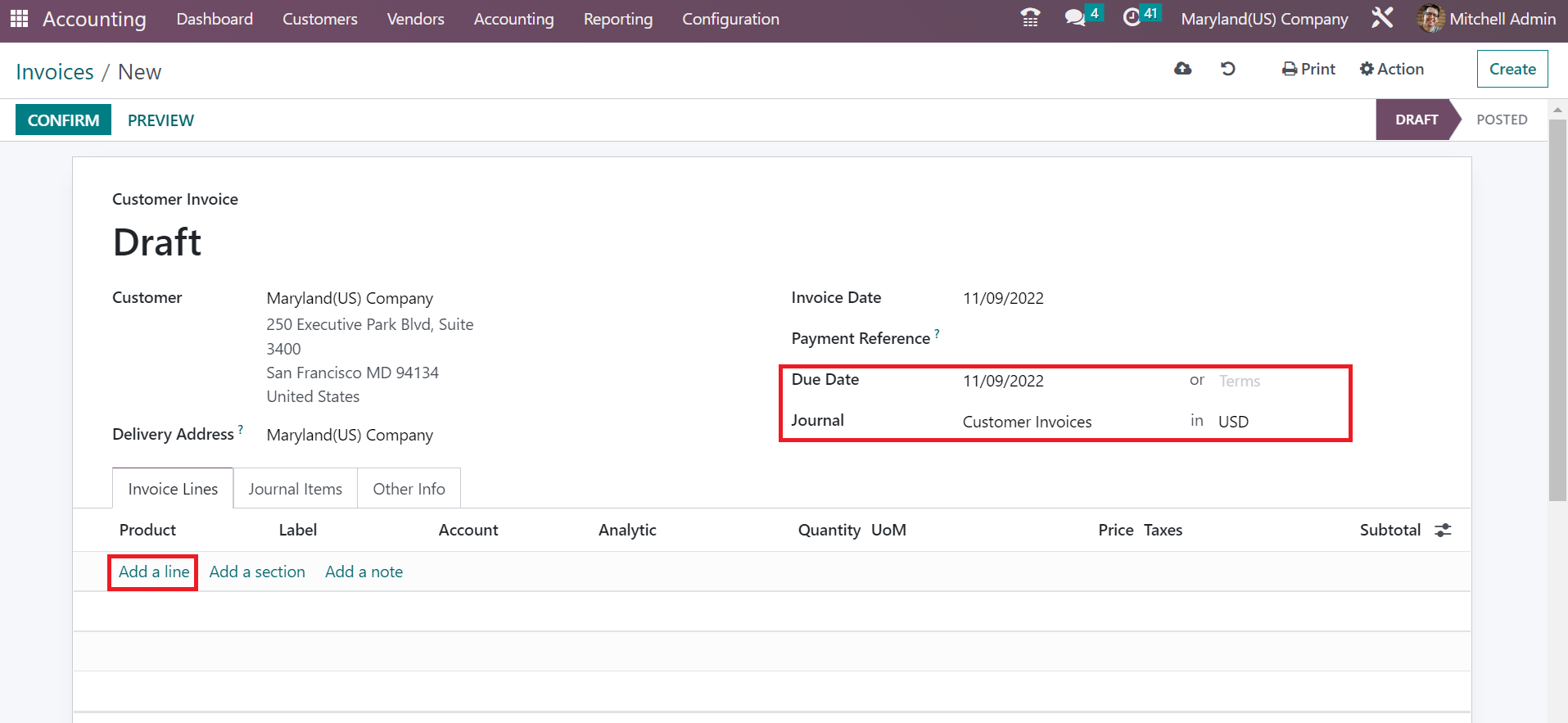

Users can apply the beginning day of the invoice in the Invoice Date option. Later, add the last date in the Due Date option and choose a journal for your invoice. By accessing the Add a line inside Invoice Lines, we can specify the product data for the customer Maryland(US) Company, as cited in the screenshot below.

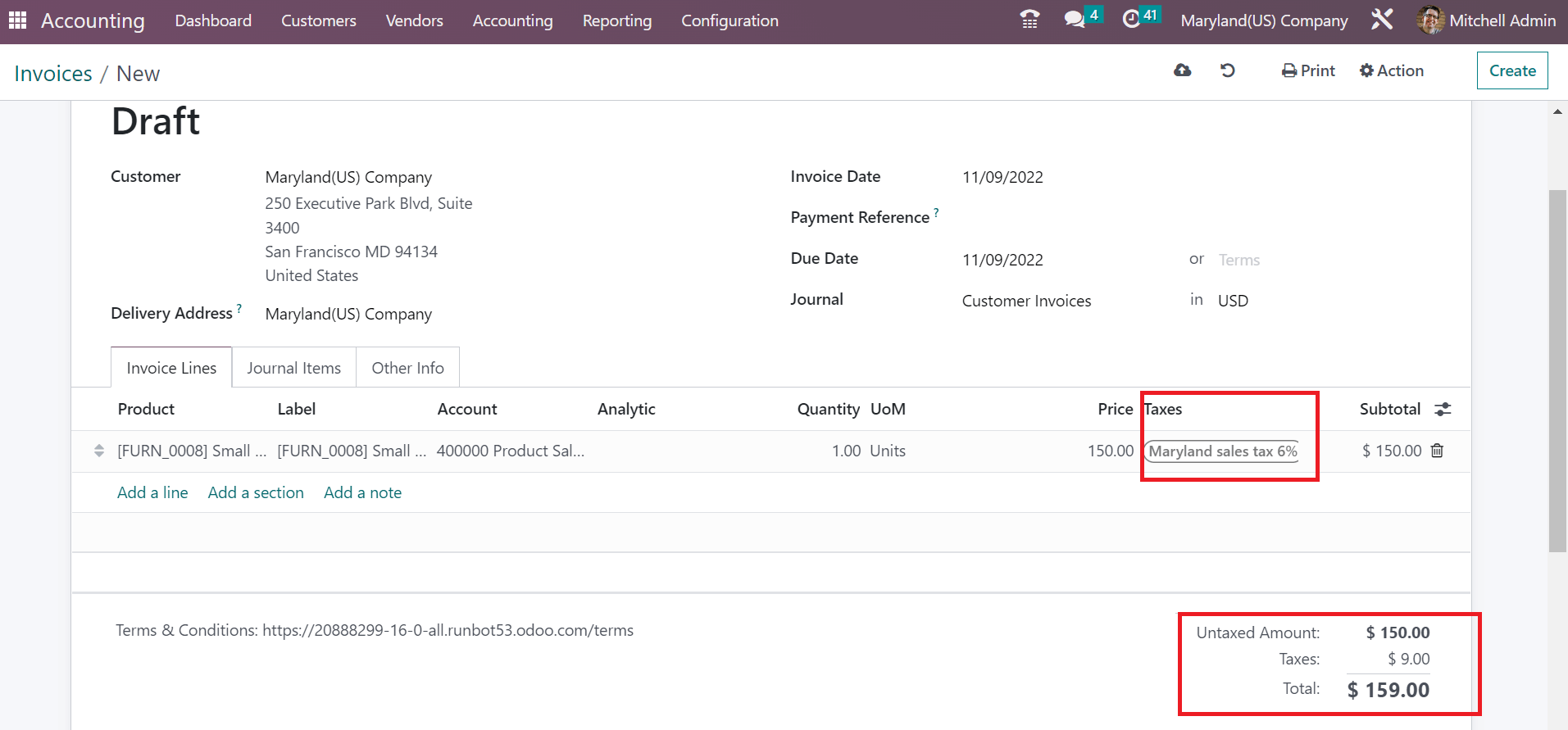

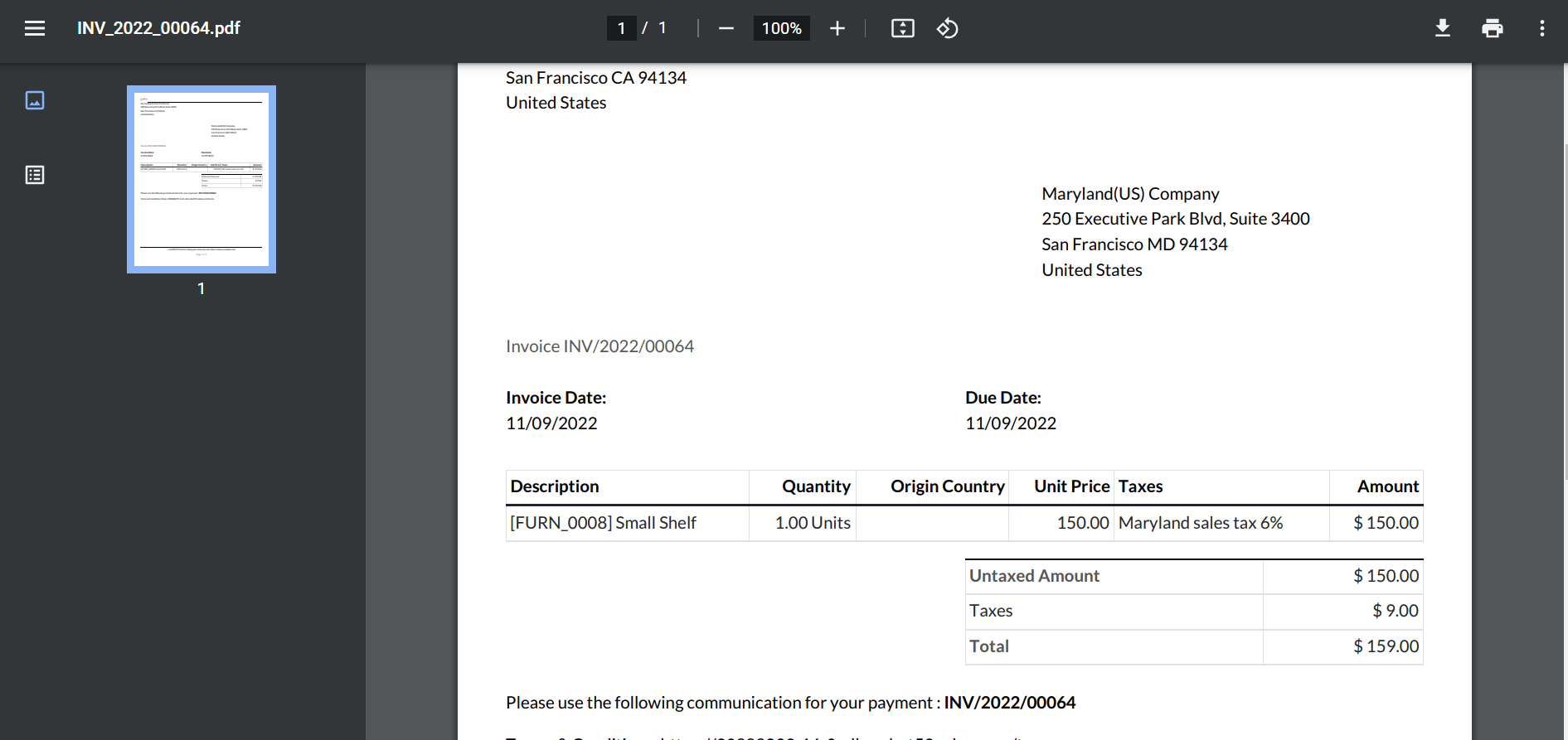

After choosing the item, mention the Maryland sales tax of 6% inside the Taxes field. You can see that a 6% tax is applied to the total product cost means an untaxed amount. The product’s full price is available to the customer once the sales tax is applied to the customer invoice.

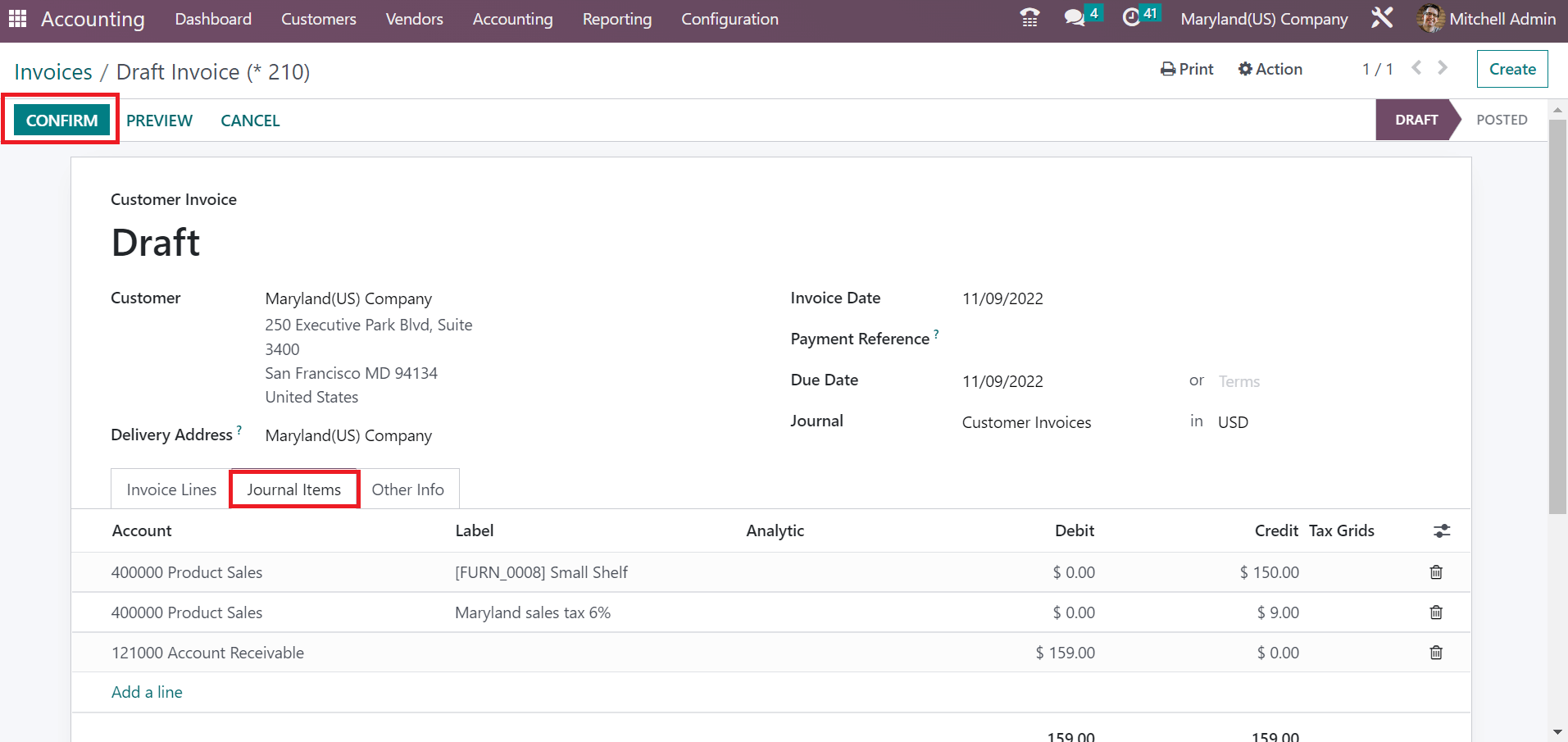

Account regarding your customer invoice is viewable under the Journal Items section. You can access the credited and debited amount details separately, as illustrated in the screenshot below

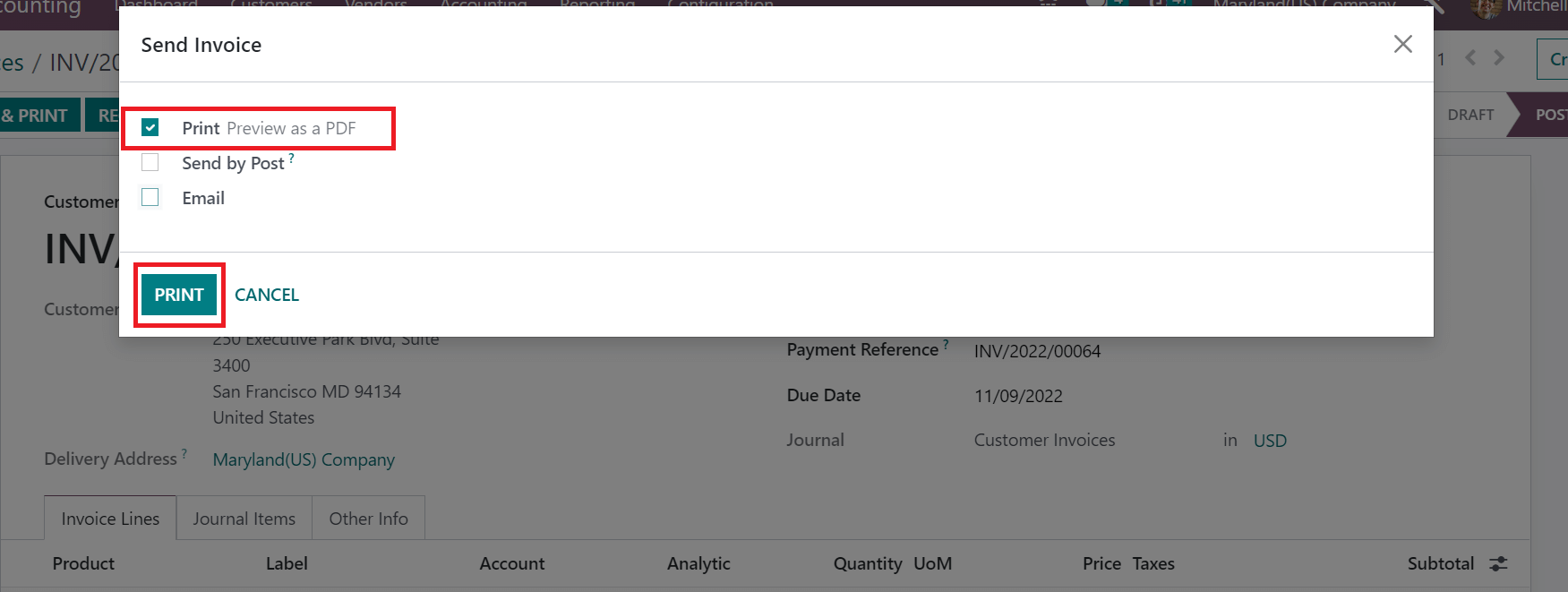

Press the CONFIRM icon to move forward with posting the customer invoice. We can download a document copy by clicking on the SEND & PRINT icon in the Invoices window.

In the Send Invoice page, activate the Print option to acquire the pdf document of the invoice. After enabling, click the PRINT button, as depicted in the screenshot below.

Hence, you will get a printed invoice document on your system, as portrayed in the screenshot below.

The sales tax rate calculation for a business as per each state is made easier within Odoo 16 Accounting. Management of company sales according to taxes secure quickly using Odoo ERP. You can enhance the workflow and productivity of a firm reliably by installing adequate ERP software. Refer to the below link to identify about District of Columbia(US) sales tax in Odoo 16