Several states in the US levy taxes differently for each business or venture. Each state’s sales tax is applied chiefly to the goods/services total cost. Some states in the United States covers local sales tax rate on the top. So, consumers must pay local and state sales tax rates once they go shopping. Business owners need help in computing taxes according to each location. You can remove all worries by running ERP software and easily configuring tax rates. We can compute the sales tax rates for a state within the taxes feature of the Odoo 16 Accounting module.

This blog provides the steps to manage Hawaii(US) Sales Tax in Odoo 16 Accounting.

Management of Budgets, Assets, Vendor, Payments, Products, and more in a firm made easy through Odoo ERP software. Based on localization, users can quickly compute any tax rates within Odoo 16 Accounting module. Let’s view the advanced way to configure sales tax in Hawaii(US) in Odoo 16.

Precis of Hawaii(US) Sales Tax for Users

Hawaii sales tax is considered as 4% for consumers. A sales tax of up to 0.5% is collected as local sales tax by the local governments in Hawaii. Cities such as Mililani, Waipahu, Kaneohe, Honolulu, and more contain a sales tax rate of 4.5%. GET(General Excise Tax) is a tax for doing business in Hawaii and applied for a seller. Some of the activities related to GET for farming, construction, wholesaling, business interest income, etc., per the Hawaii taxation department. A seller has the right to impose GET on customers once they purchase. GET will be due on all business transactions if you sold to another venture. It is treated similarly to sales tax in Hawaii.

Most providing services and tangible products in Hawaii are subjected to General excise tax. To access a sales tax permit in Hawaii, you must note some details. It includes accounting period, corporate entity type, personal identification info, accounting method, and more. Registering on Hawaii GET Permit is essential if you want to collect sales tax. Registration is made accessible within the Hawaii Tax Online website portal.

How to Create Hawaii(US) Company Data in Odoo 16?

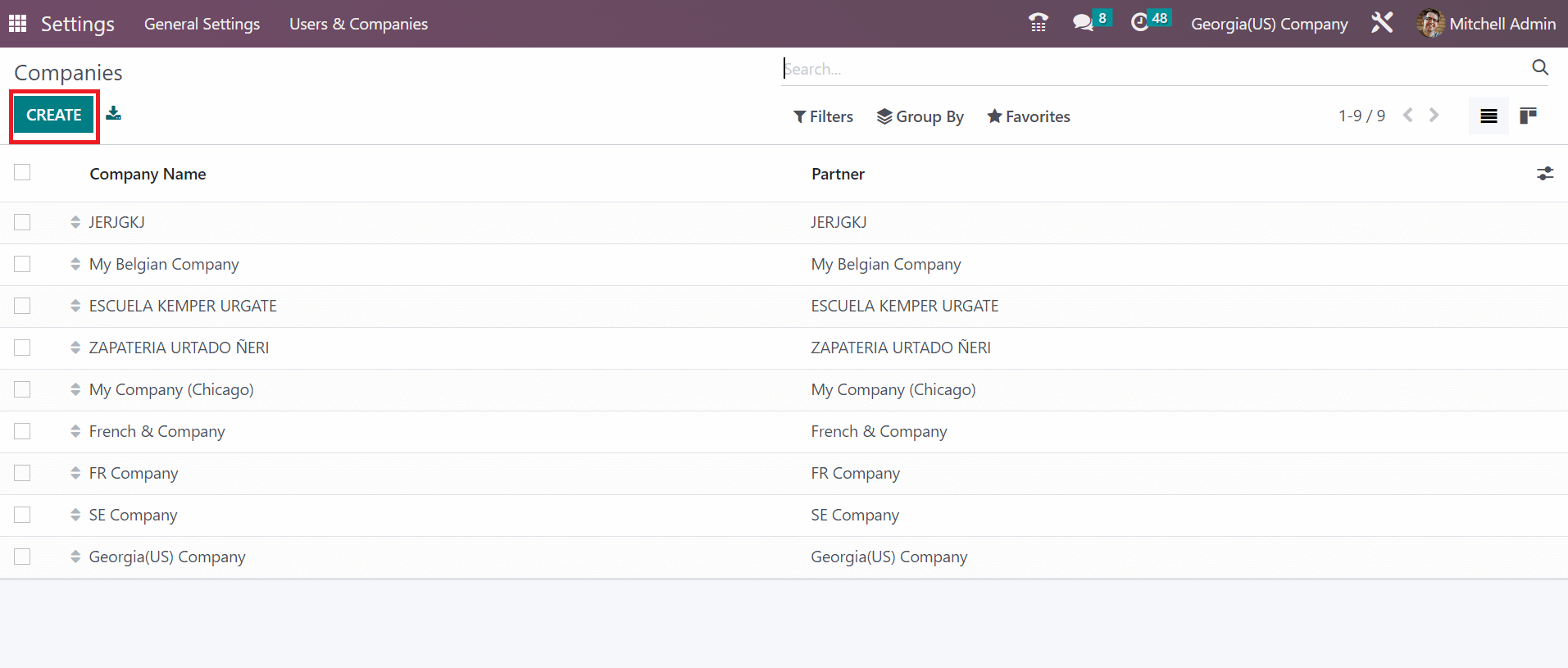

Users can generate new company data efficiently within the Odoo ERP. For formulating new company facts, click the Companies menu in the Users & Companies tab and record all companies that are acquirable to you. To initiate company statistics, snap the CREATE icon in the Companies window, as considered in the screenshot below.

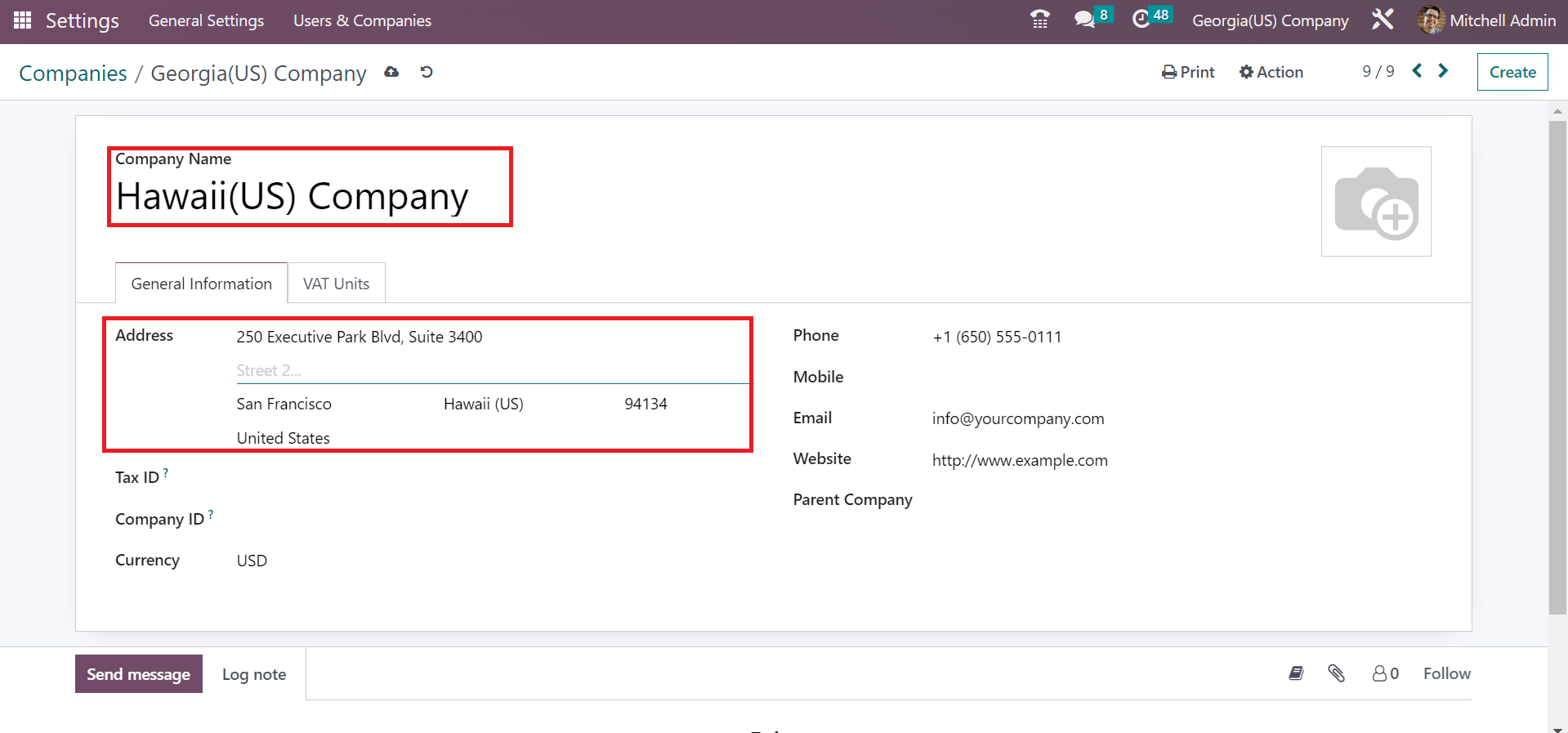

You can enter the Company Name as Hawaii(US) Company on the open page. In the Address field, apply Hawaii(US) in the State option and United States as the Country. Additionally, you can specify Pincode, street address, and more related to your company inside the General information tab.

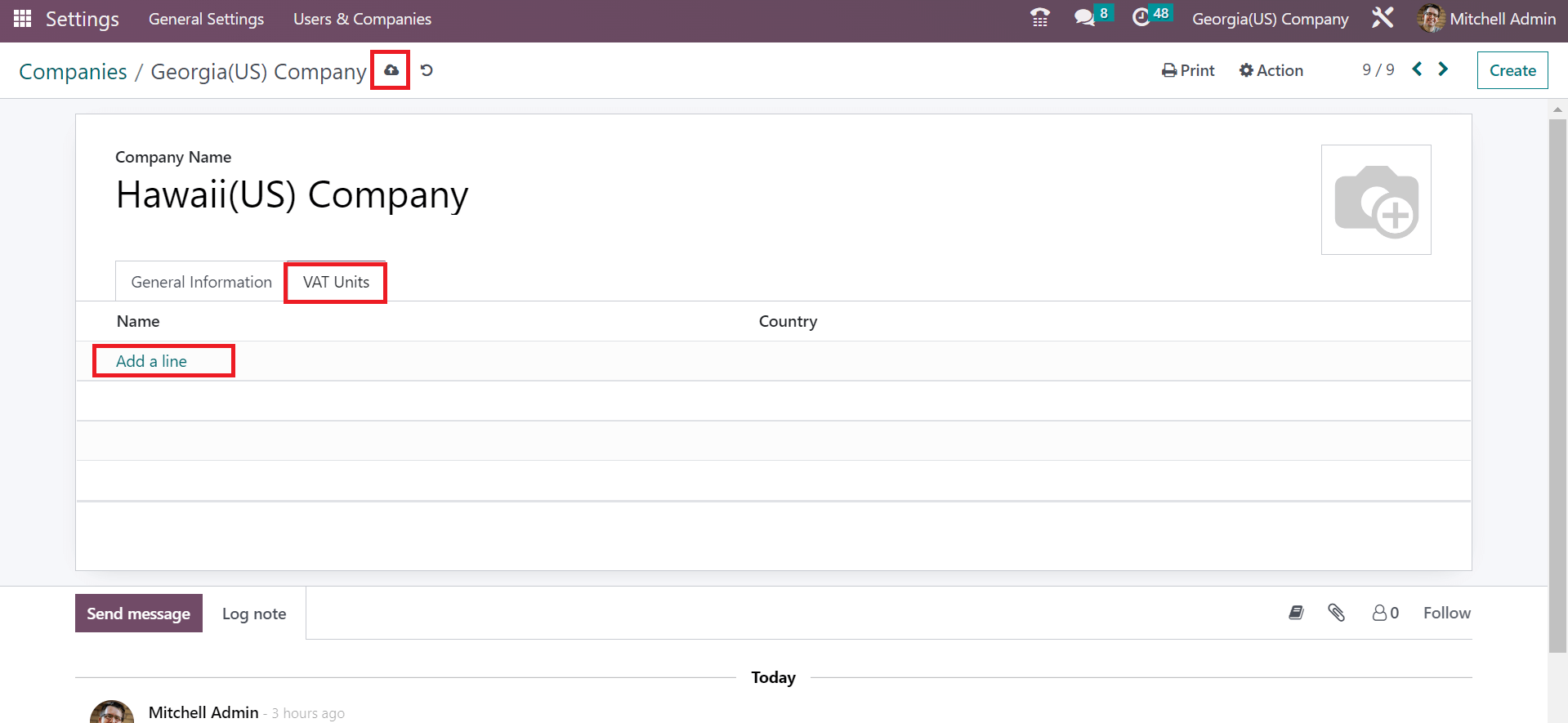

To add any VAT units of your company, choose the Add a line option inside the VAT Units section. Choose the save manually option at the top to secure your company details.

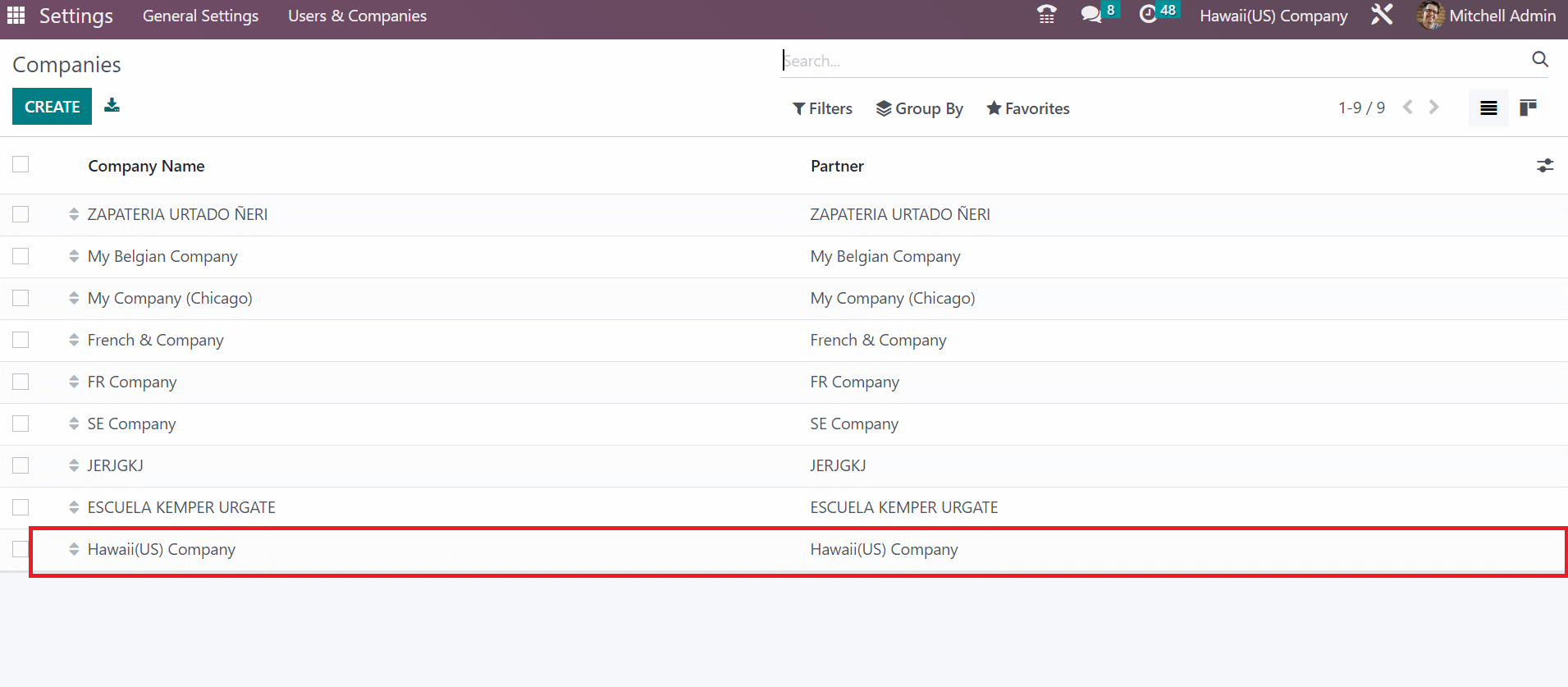

After saving manually, we can see the created company record in the Companies page.

Hawaii Sales Tax Formulation in Odoo 16 Accounting

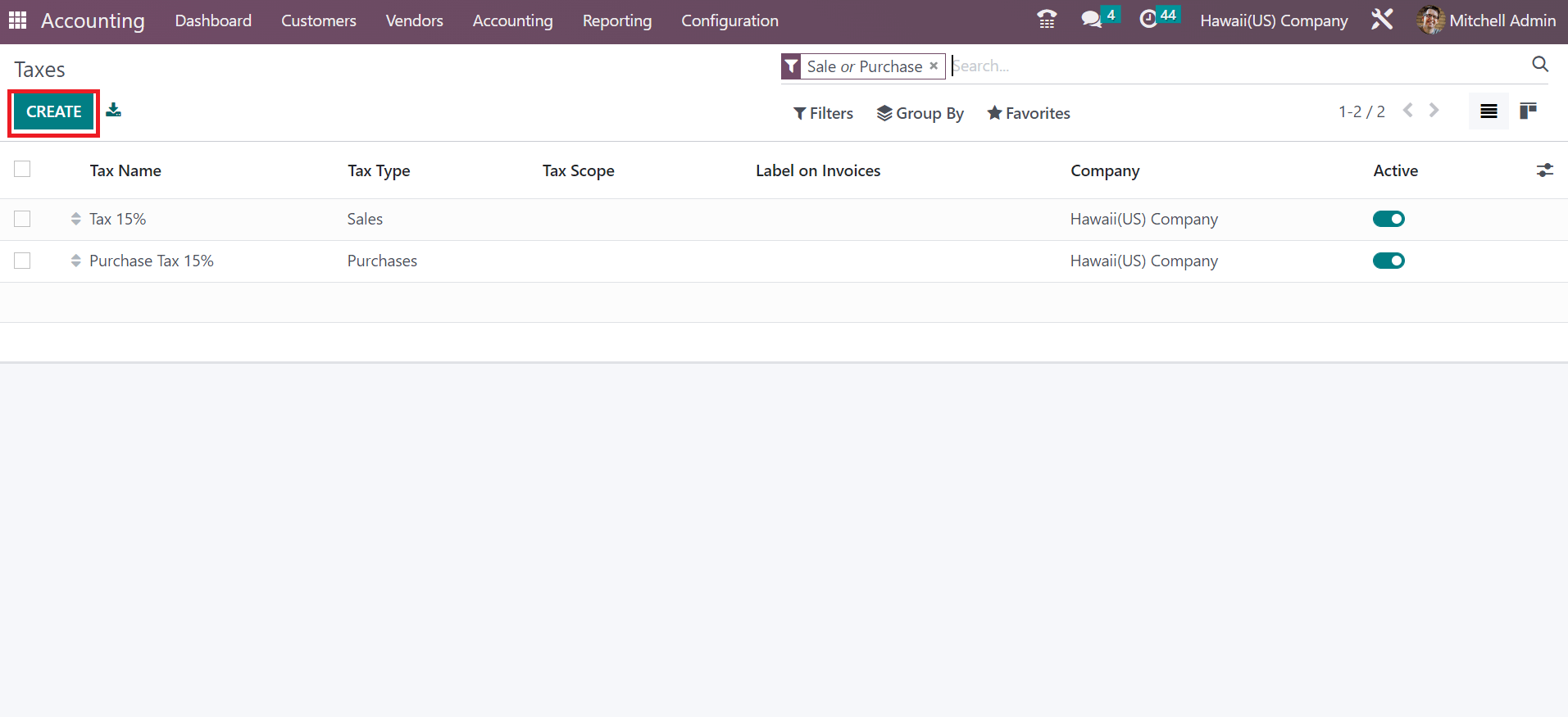

After setting the company details, we can develop the tax rate for Hawaii by choosing the Taxes menu in Configuration. The List view of the Taxes window depicts information about every tax, such as Tax scope, Active, Tax Name, etc. Users can click the CREATE icon to produce a new tax for Hawaii state, as cited in the screenshot below

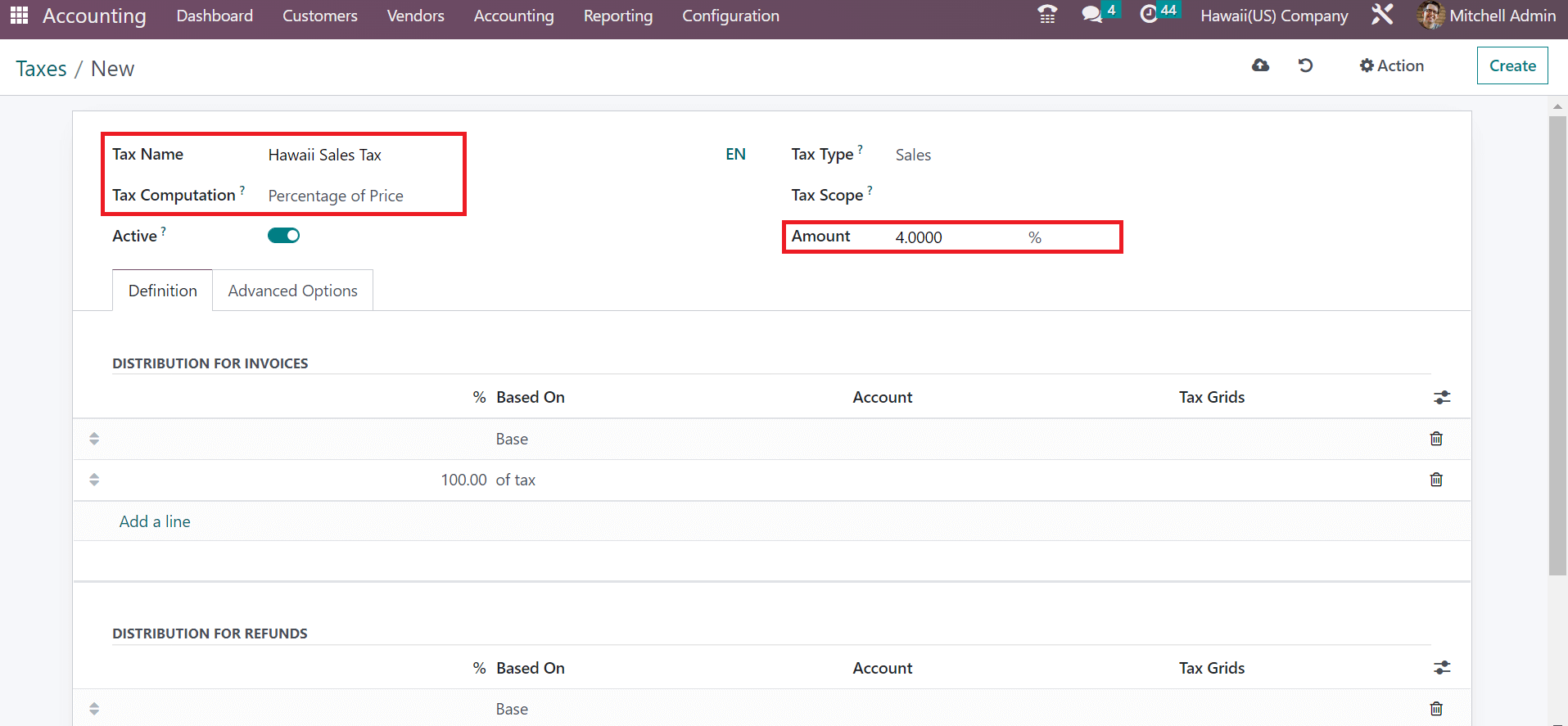

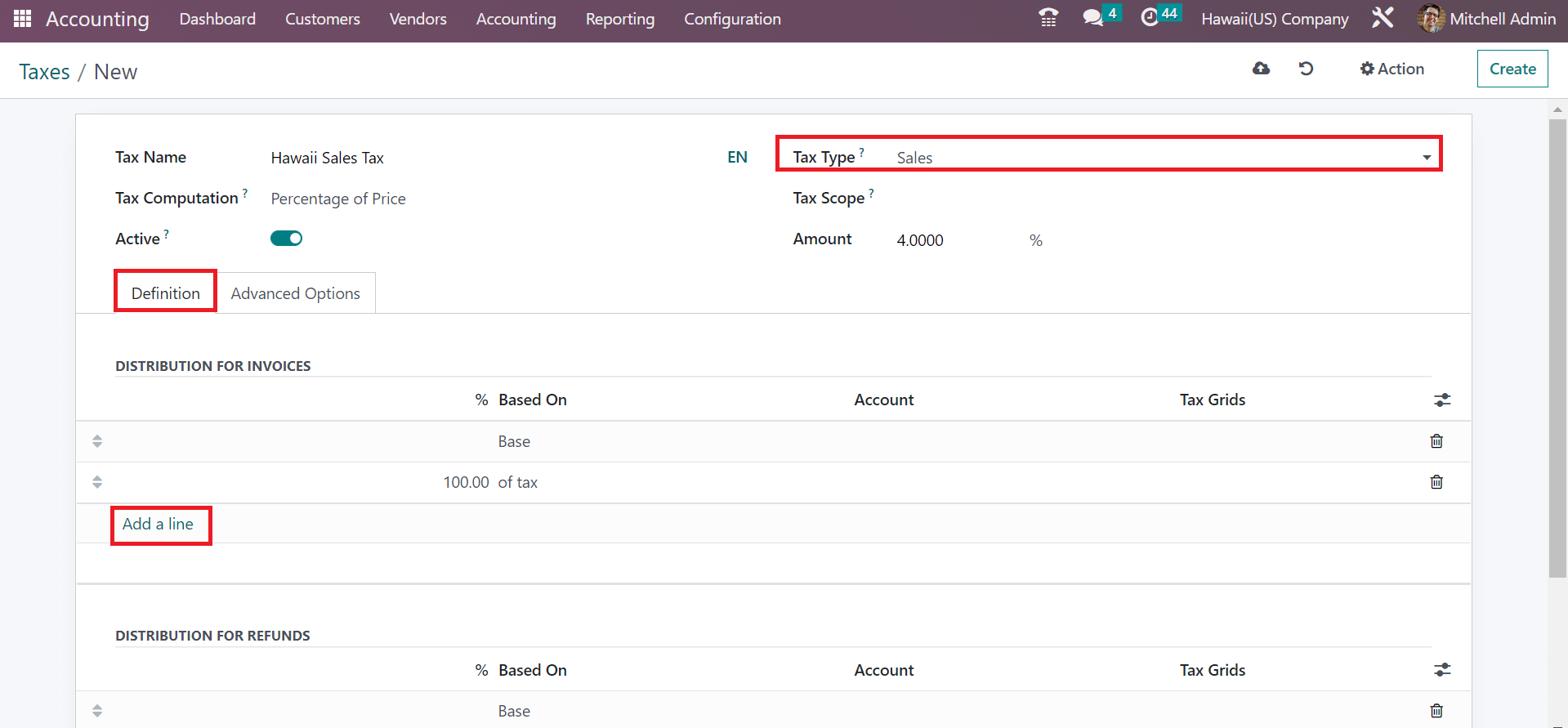

A new page opens before the user specifies Hawaii Sales Tax 4% in the Tax Name field. We can make tax computations as per the percentage of the price. So, you can select the Percentage of Price option in the Tax Computation field. In the Amount option, the user can apply the percentage related to Hawaii sales tax as 4%.

Purchase, Sales, and None are the tax types available in Odoo. It is possible to pick up the Sales option for your Hawaii sales tax inside the Tax Type field. To specify more tax distributions, pick the Add a line option inside the Definition tab, as portrayed in the screenshot below.

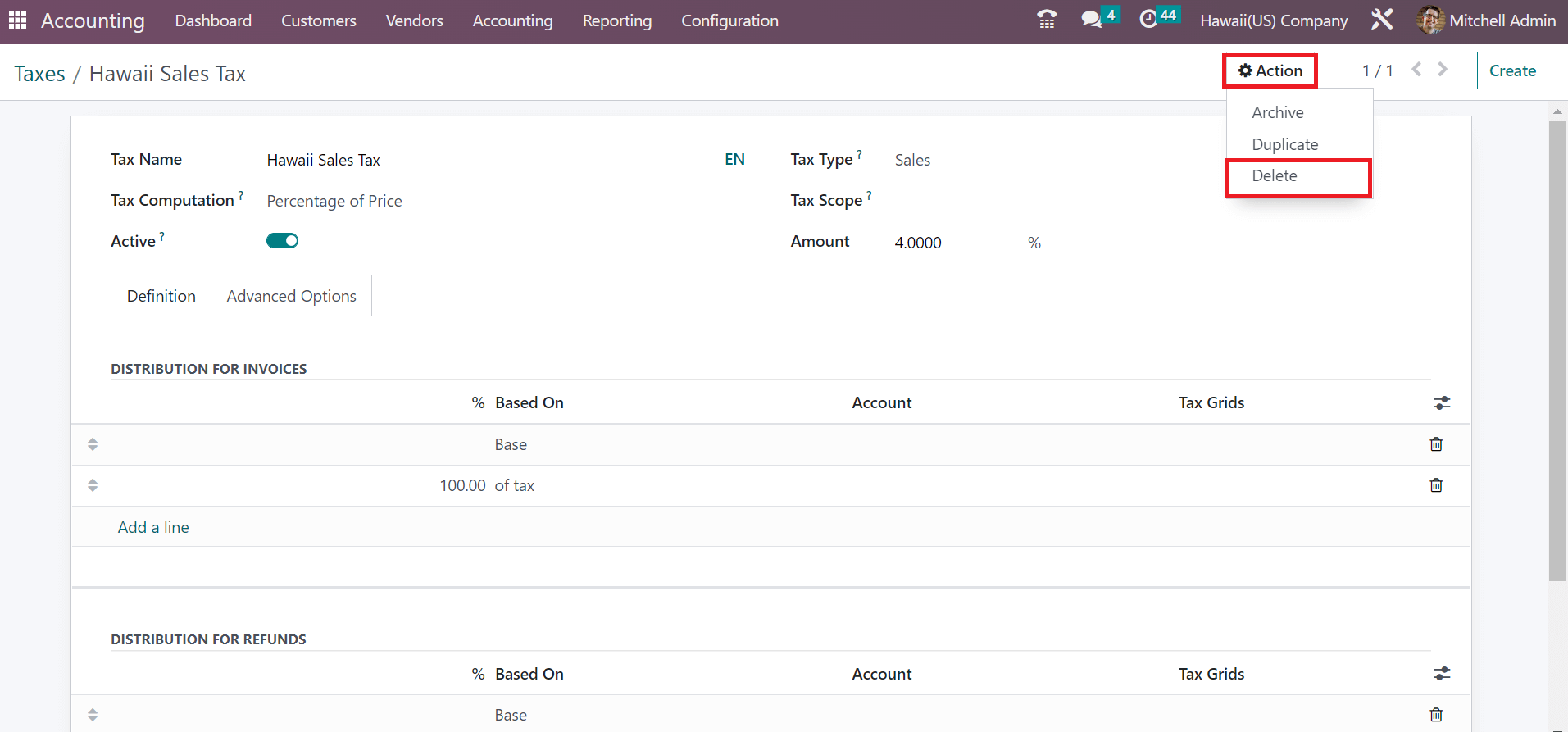

Your created record of Hawaii sales tax is saved manually in Odoo 16. To remove the specific sales tax, click the Delete icon under the Action tab, as marked in the screenshot below.

To Apply Hawaii Sales Tax on a Customer Invoice

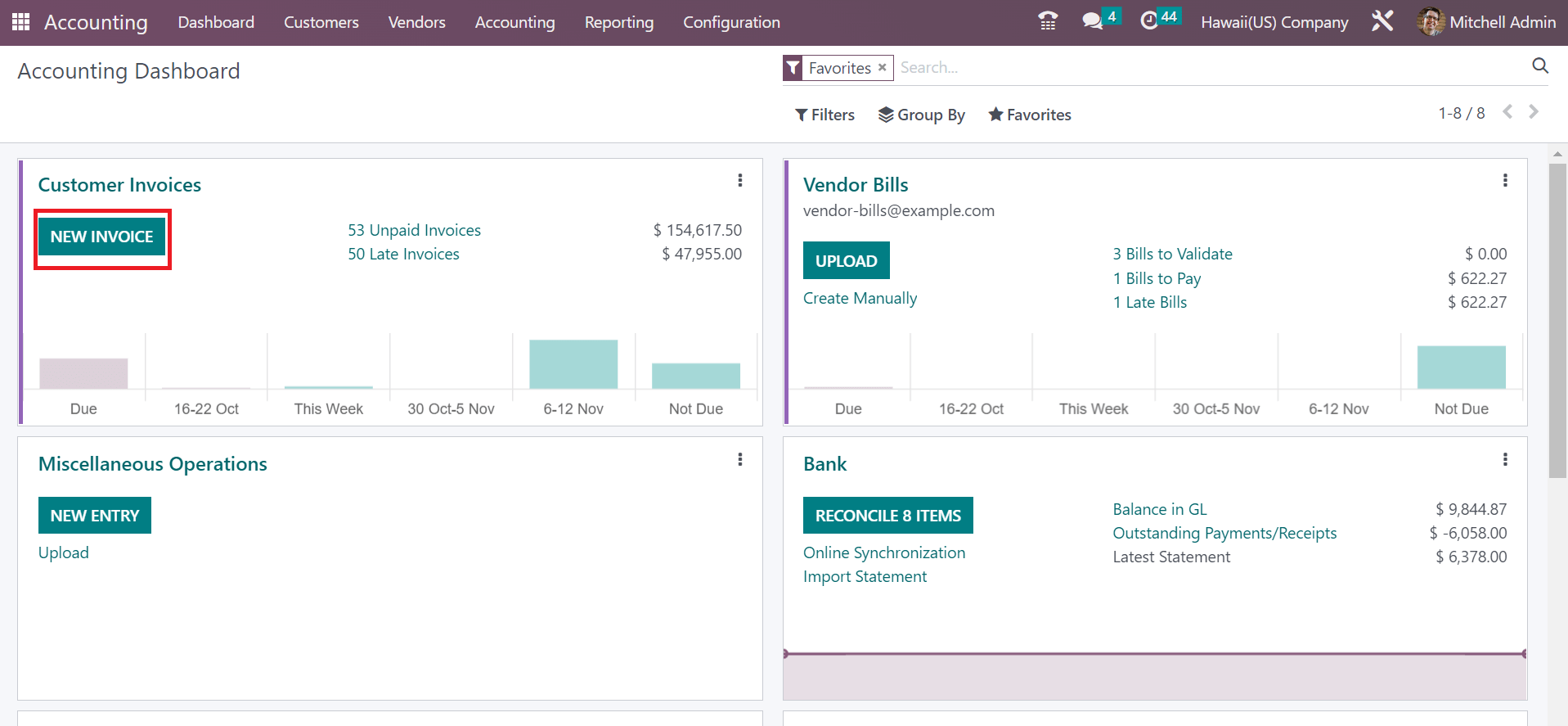

Users can quickly mention the sales tax in a customer invoice in the Odoo 16 Accounting application. Choose the NEW INVOICE icon under the Customer Invoices in the Accounting Dashboard screen, as represented in the screenshot below.

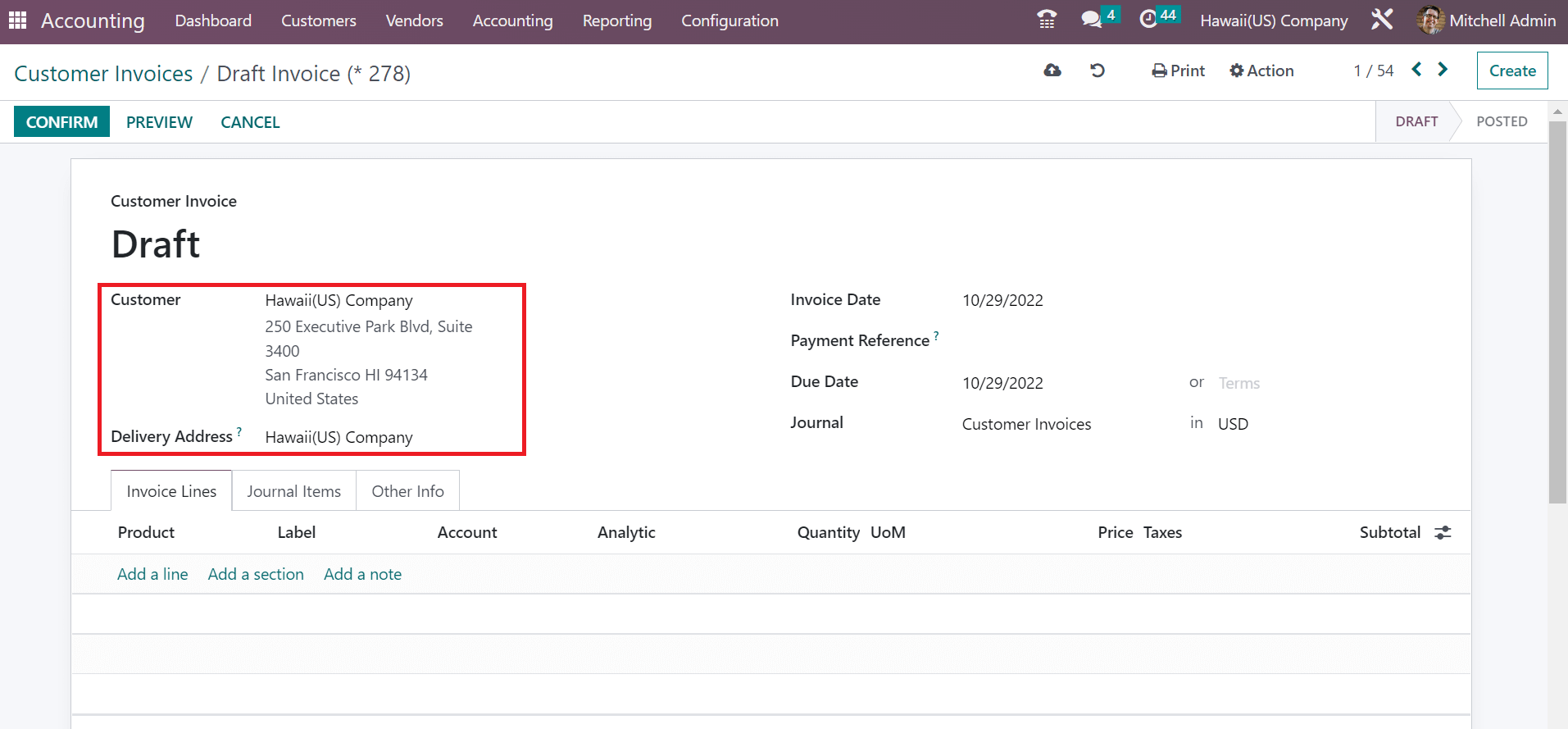

You can select Hawaii(US) Company as the Customer on the open screen. The respective address of your chosen Customer is automatically visible in the Delivery Address field, as presented in the screenshot below.

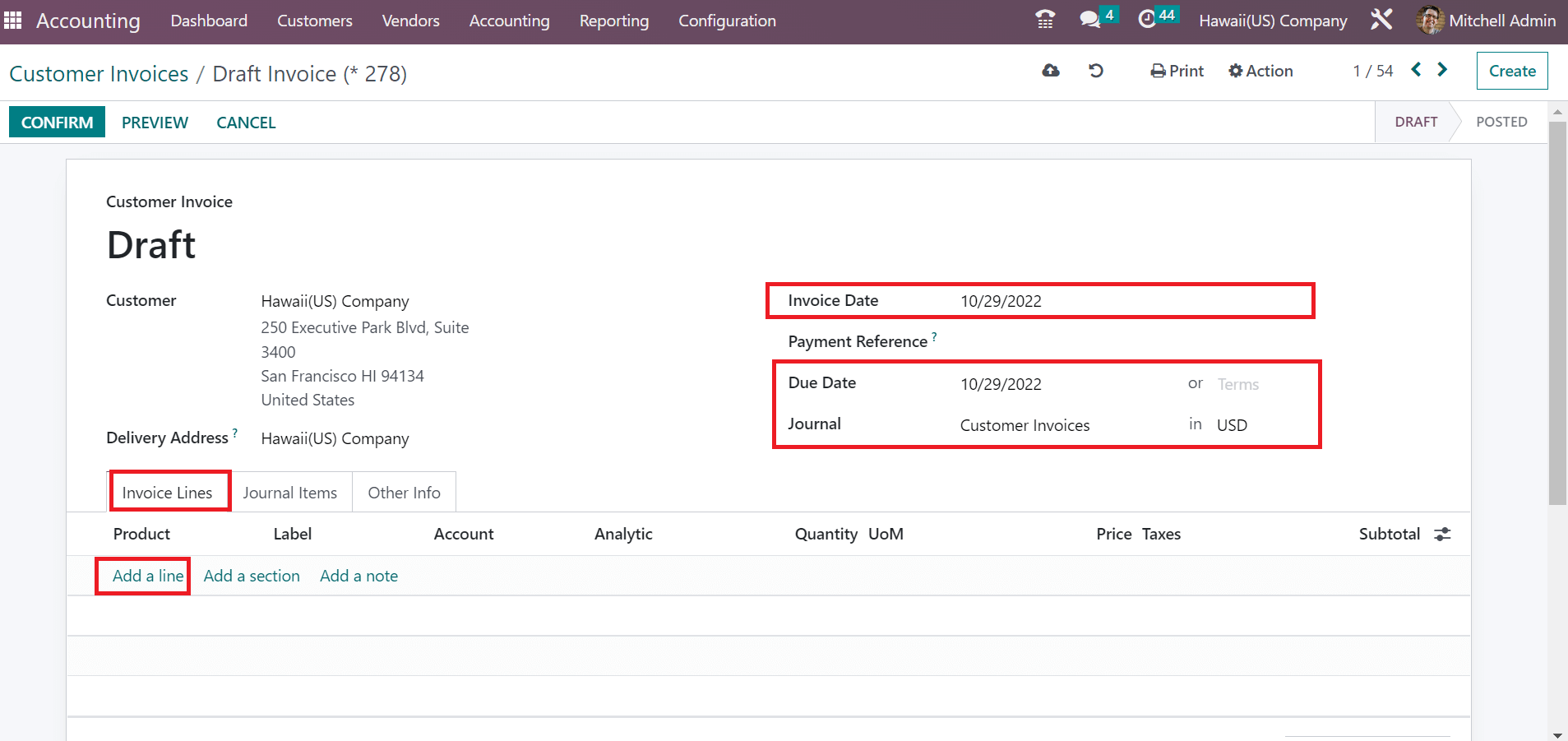

Mention the payment start date in the Invoice Date field. Also, add the date the invoice falls due in the Due Date field. It is essential to pick a journal for your invoice and apply currency data as defined in the screenshot below.

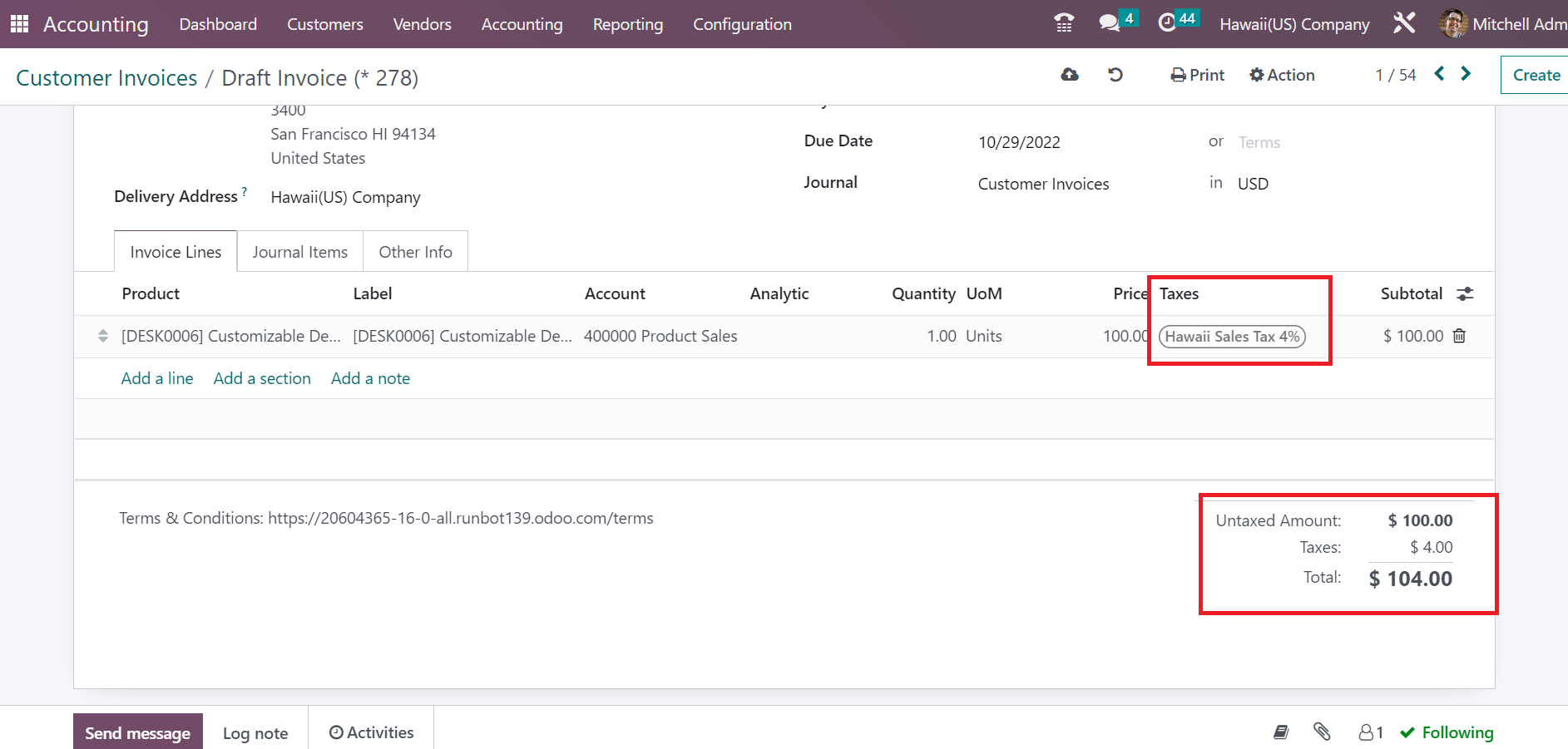

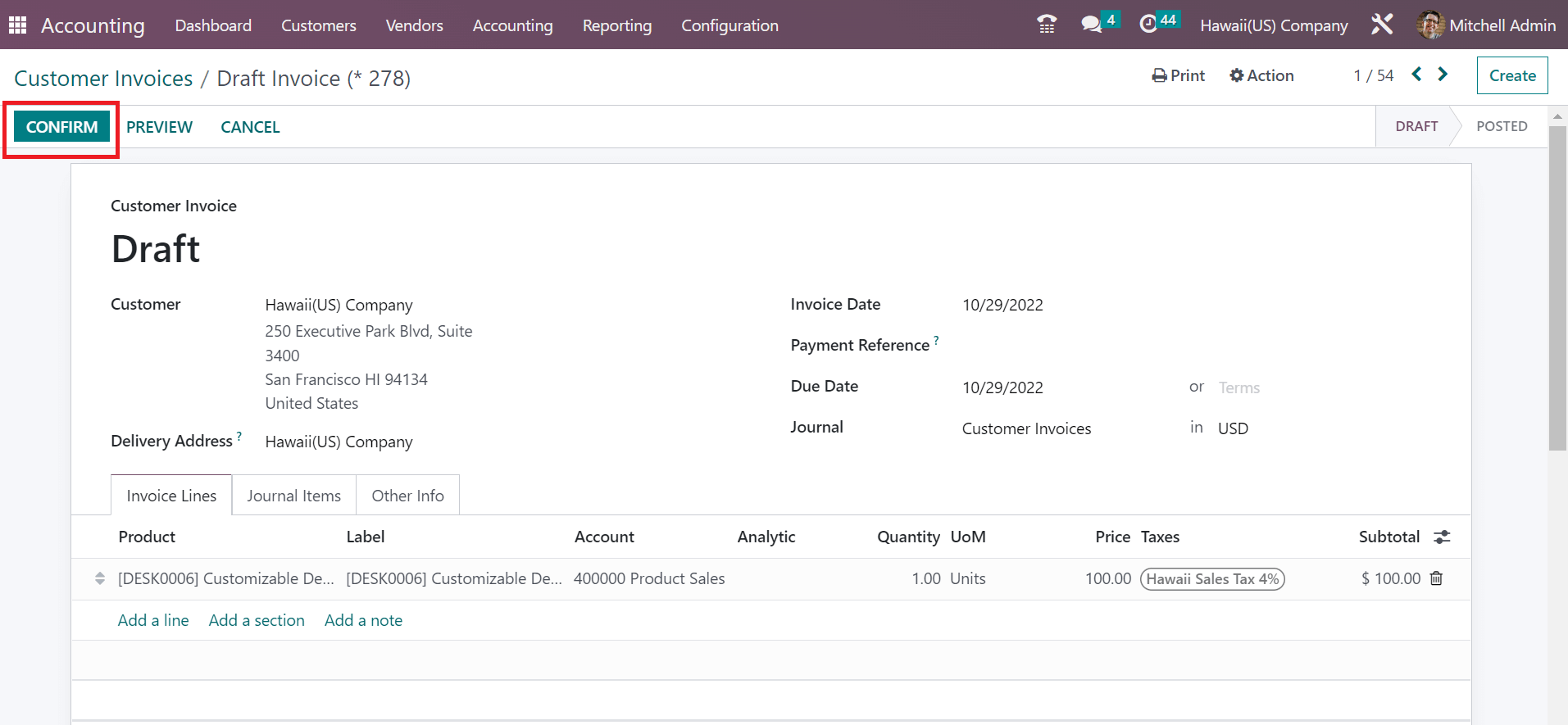

Press the Add a line option below the Invoice Lines tab to brief product information. Select your item, quantity, account, and more in the open space. You must pick Hawaii Sales Tax 4% below the Taxes section, as indicated in the screenshot below.

Here, you can see that a commodity’s total price is the combination of tax rate and untaxed amount. So, it is easy to apply Hawaii sales tax on several products in Odoo 16. After pressing the CONFIRM icon, we can confirm the order and post it easier for customers.

Tax computation based on each company state is made more accessible with Odoo ERP. Users can quickly develop customer invoices using several tax rates in Odoo 16 Accounting. Management of company accounts and workflow increase becomes simple by imparting an Odoo ERP to your business. Refer to the following link to know about California Sales tax computation in Odoo 16