The term ‘Petty cash‘ comes from ‘petty,’ which means little or secondary value. ‘Petty cash is a small sum of money held on the premises of a business to cover minor monetary needs. Office supplies, cards, flowers, and other similar items are examples of these payments. Petty cash is kept in a petty cash drawer or box close to where it is required the most.

The corporation may need to move funds from the bank to the petty cash account. In such circumstances, a bank-to-petty-cash transaction occurs. We can easily handle similar activities with Odoo. Such transactions are classified as Internal Transfers in Odoo. Because of what happens within the firm. As a result, by establishing an internal transfer from bank to petty cash, money can be transferred from bank to petty cash.

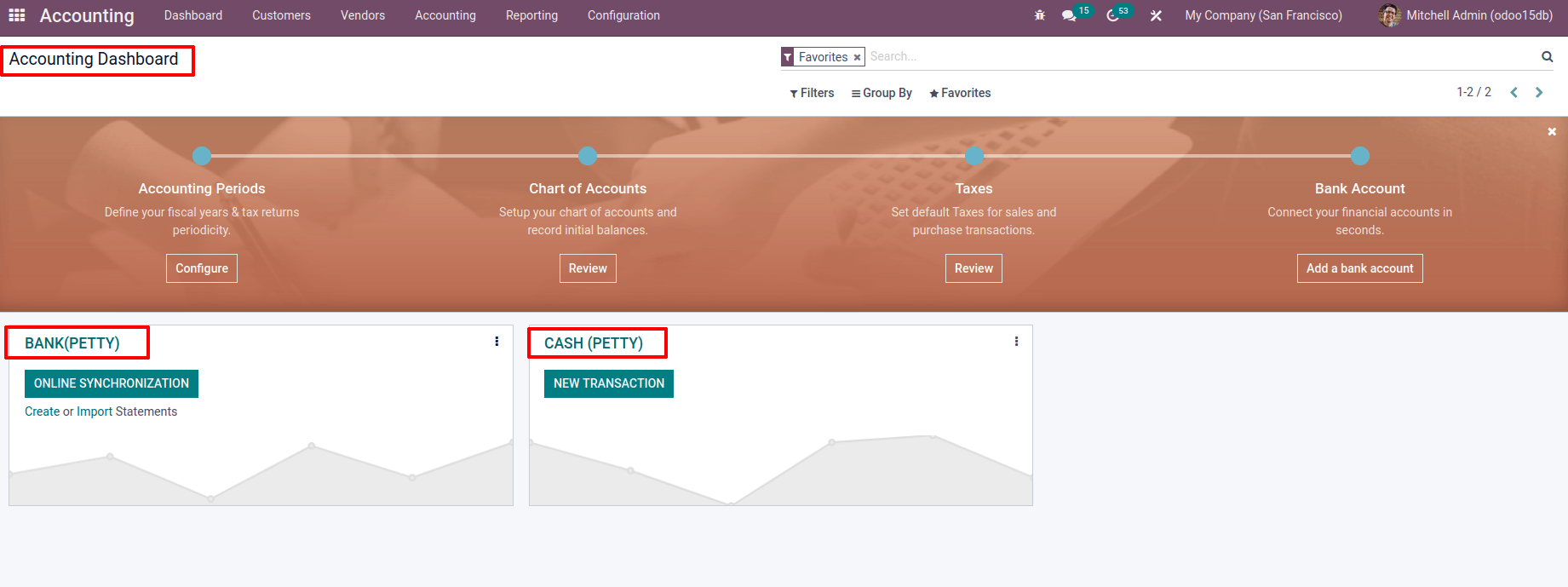

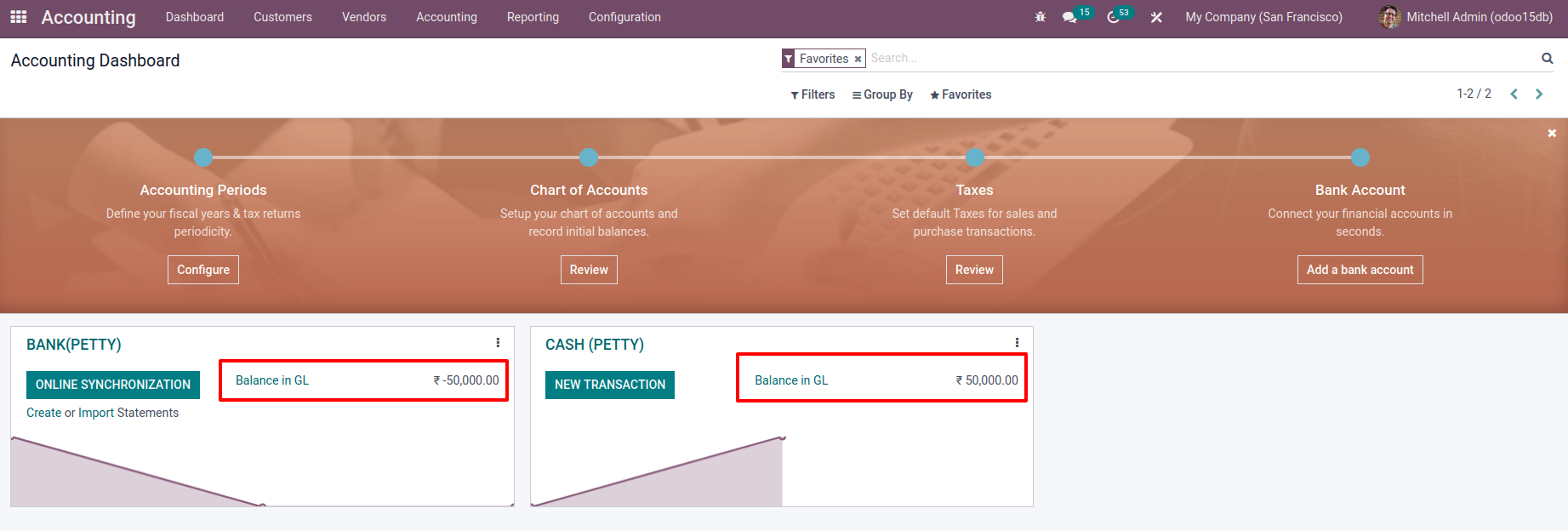

A bank journal and a petty cash journal are both available. We are transferring funds from the bank to the petty cash account. Let’s move on to the Accounting Dashboard now. There are two journals on the show, as mentioned. The first is BANK, and the second is PETTY CASH.

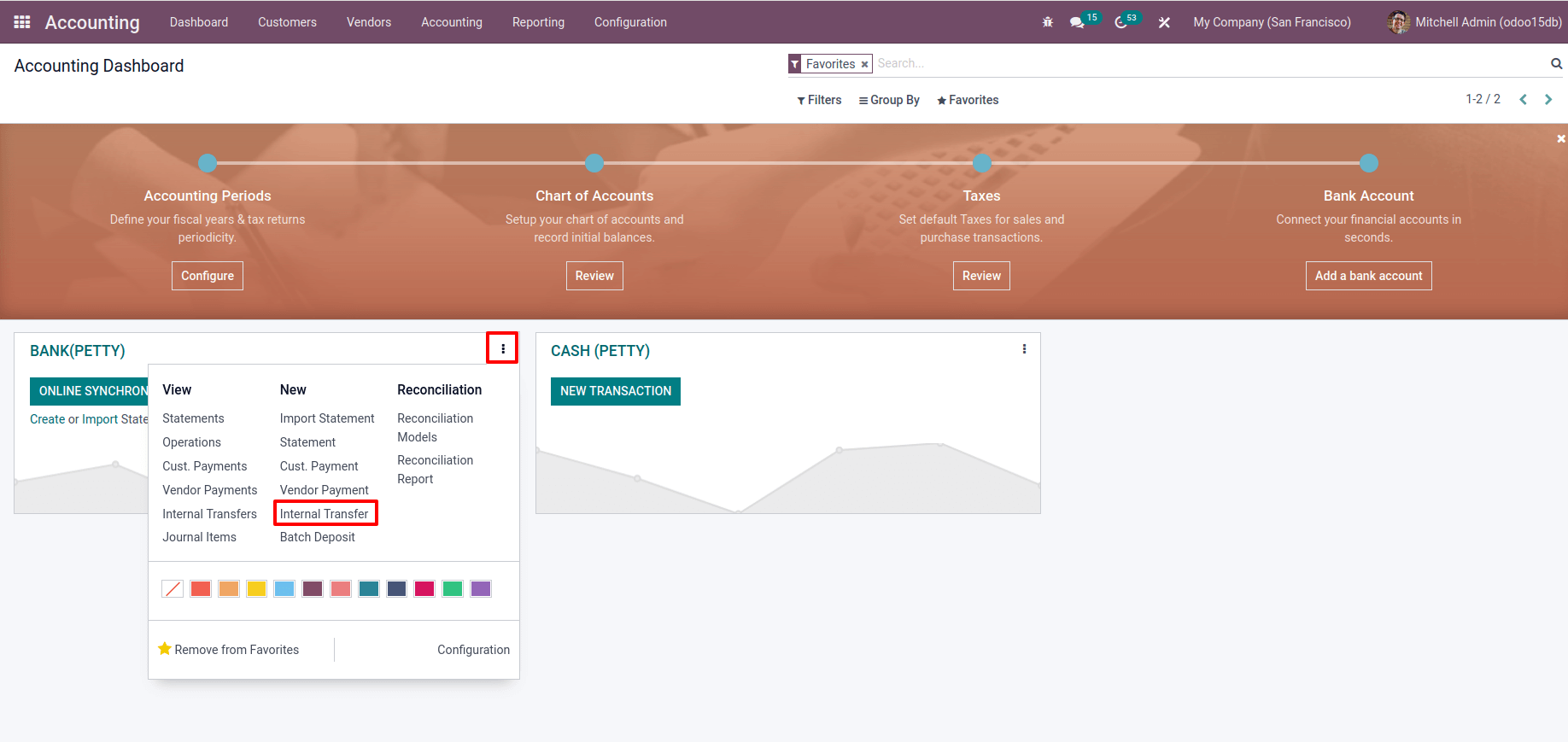

We transfer money from the company’s bank account to the petty cash account. As a result, it’s classified as an internal transfer. So, let’s do a bank internal transfer. To do so, go to the bank journal. Select Internal Transfer from the drop-down menu. Then fill in the transfer information

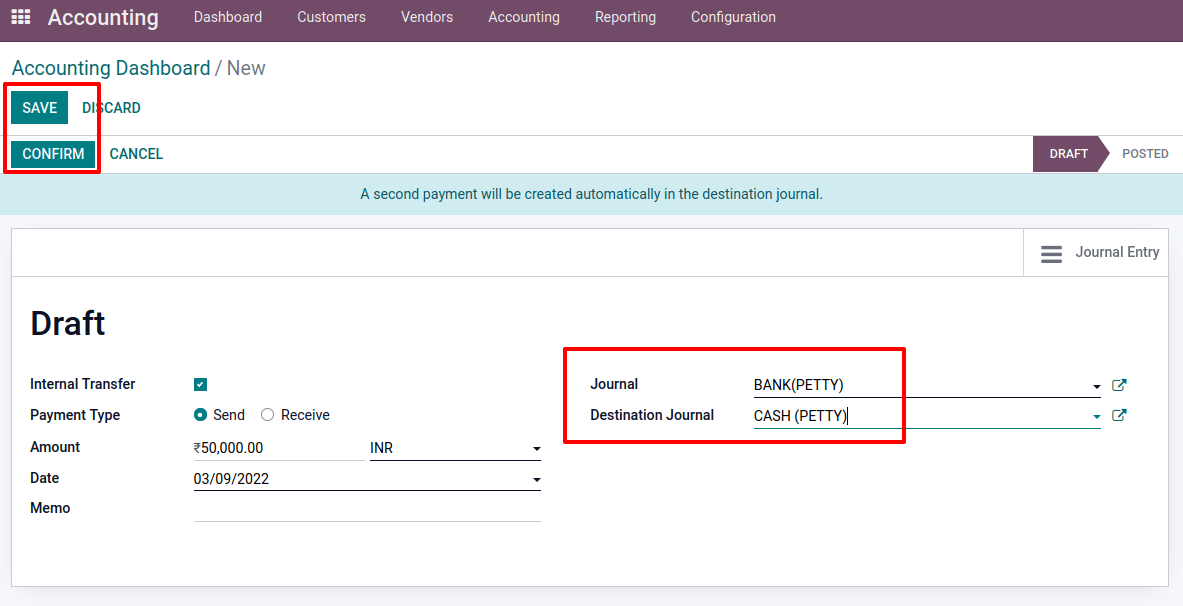

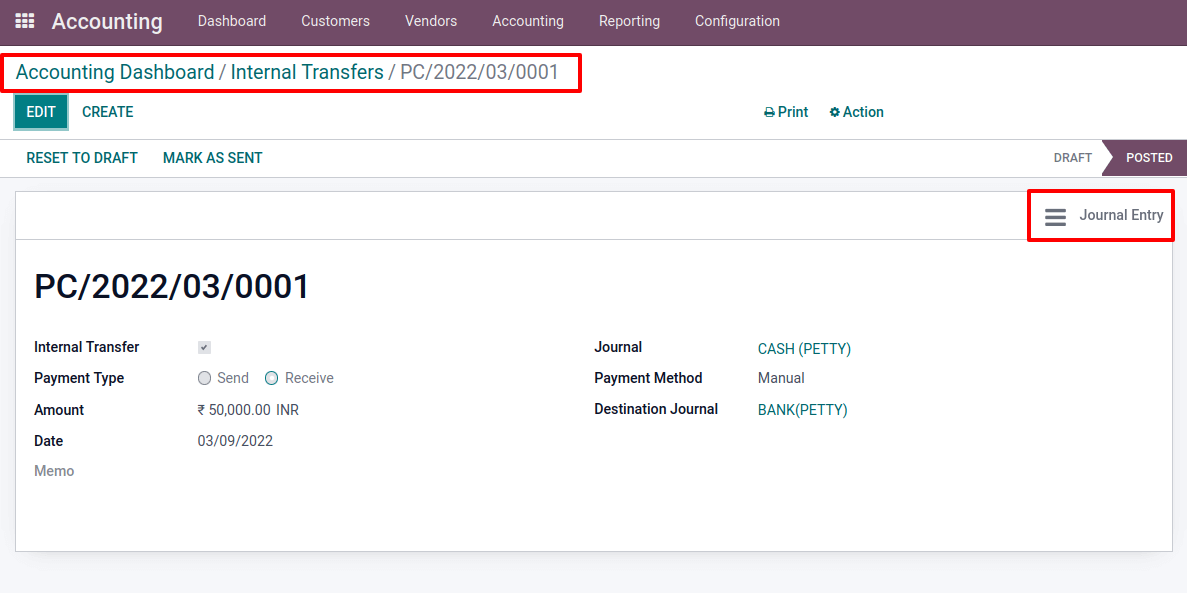

Internal Transfer should be checked. Add the amount that will be transferred from the bank account. Add the transfer date and select Bank as the journal type. The cash transfer from the bank to the petty cash is shown here. As a result, make the destination journal PETTY CASH. It is possible to include a note in the given Memo field. The transaction will then be Saved and Confirmed. Now the Internal transfer is in the POSTED stage.

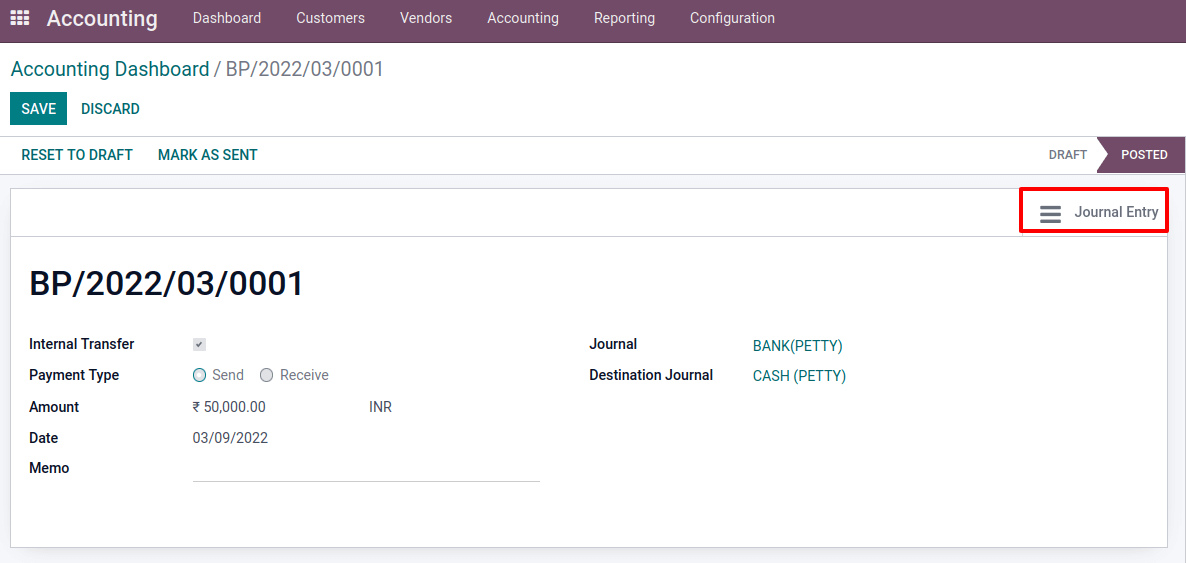

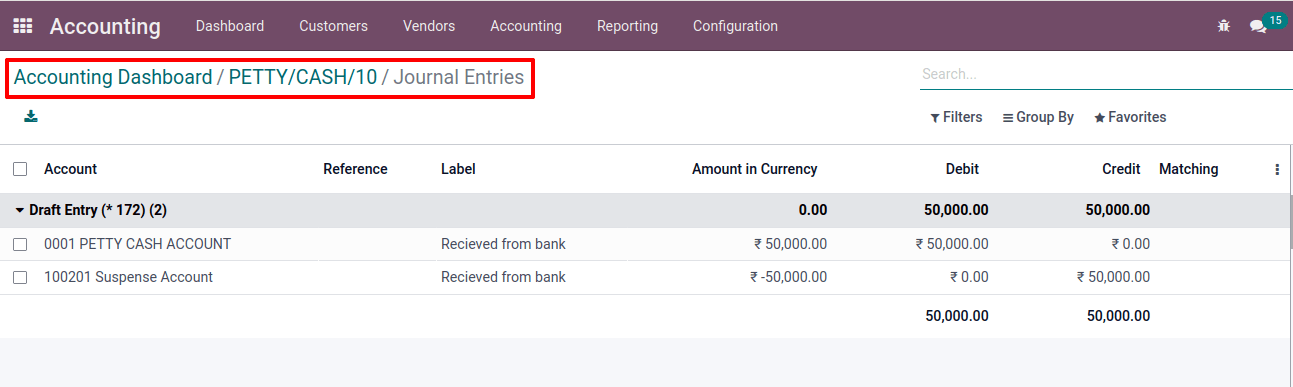

After confirming the transaction, a smart tab Journal entry is created there. Let’s check the Ledger posting by opening it. Open the smart tab

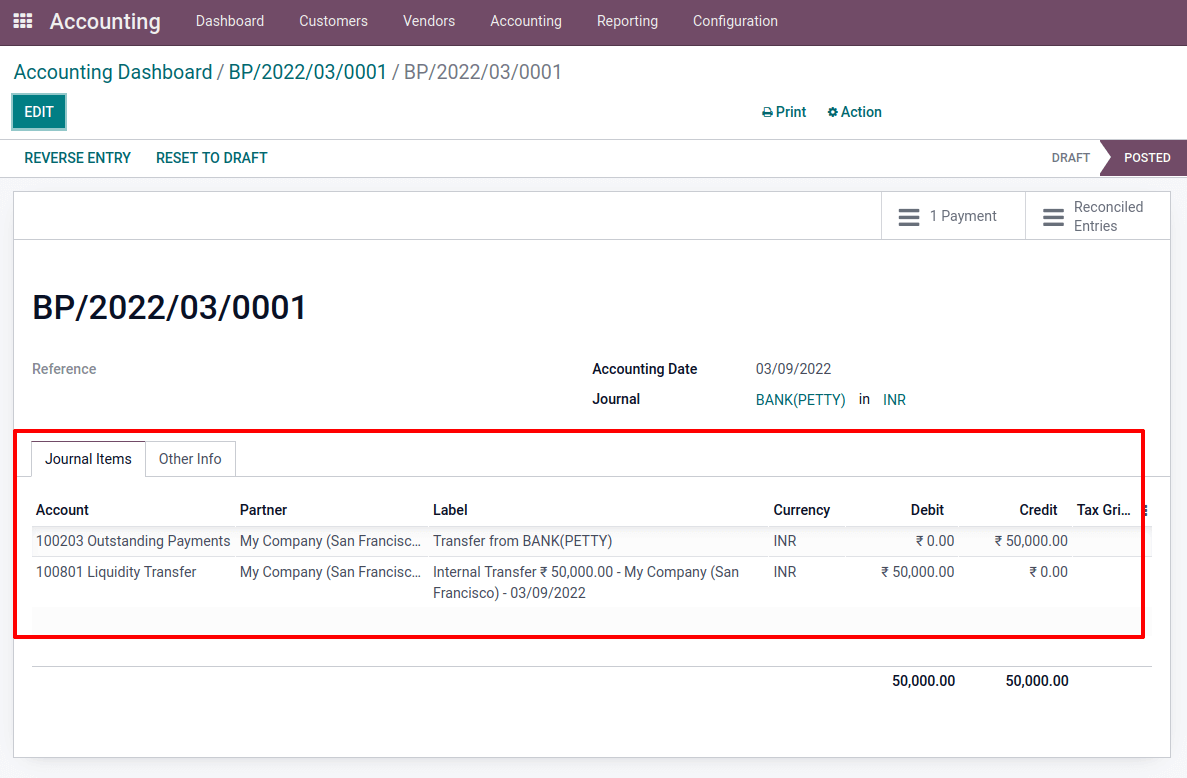

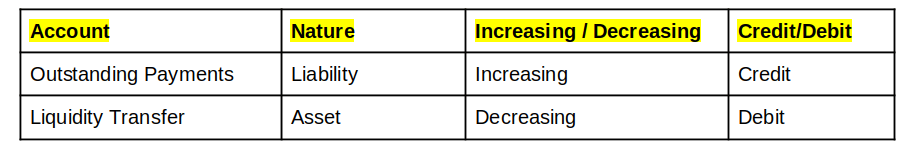

Two accounts are affected, as shown here. The Outstanding Payments account is one, and the Liquidity Transfer Account is the other. The transferred funds were moved from the Outstanding Payments account to the Liquidity Transfer account. The company considered the Outstanding Payments account as Liability; when the liability increases Outstanding Payments account is Credited. And Liquidity Transfer Account is the Current Asset; when the current asset increases, there occurs Debit.

Internal transfers are transactions in which funds are transferred from one account to another without cash or checks. The Liquidity Transfers account is an intermediary account for internal transfers between bank and cash accounts.

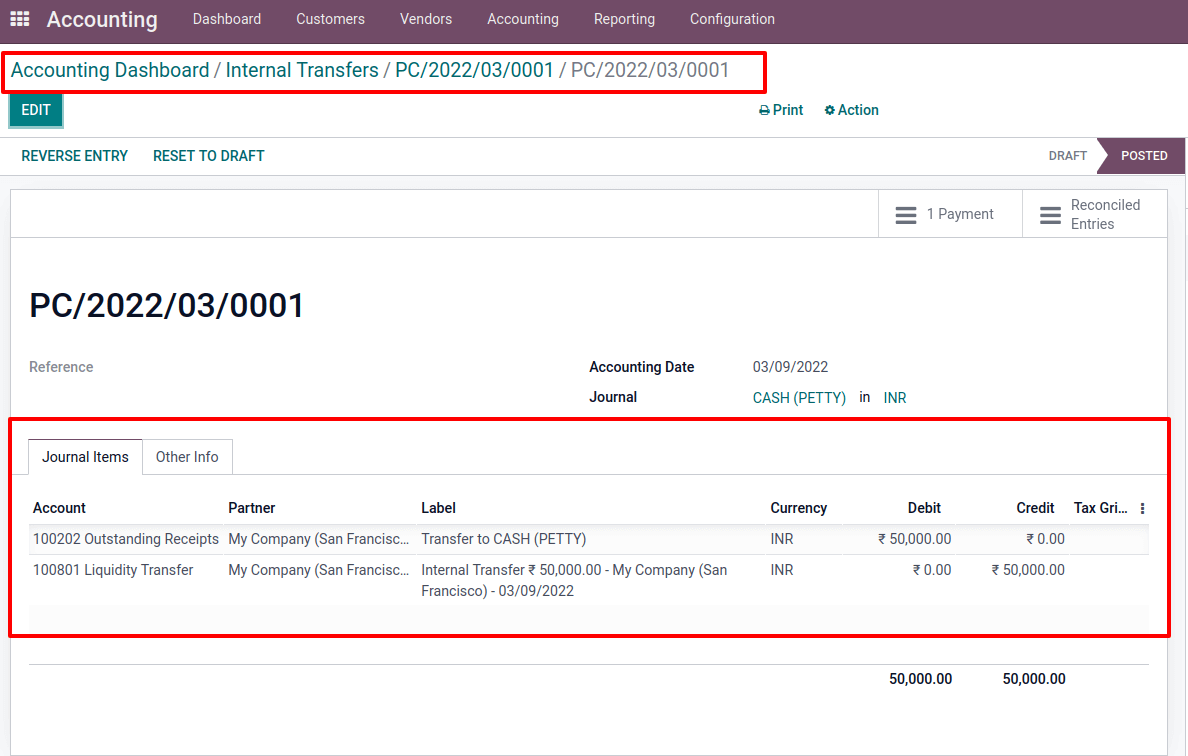

While doing so, check the PETTY CASH journal for a corresponding internal transfer. In addition, a smart tab Journal entry has been added. To see the ledger posting, open the smart tab.

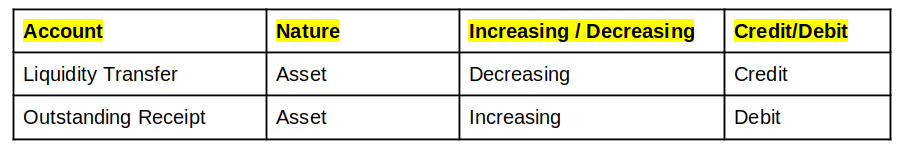

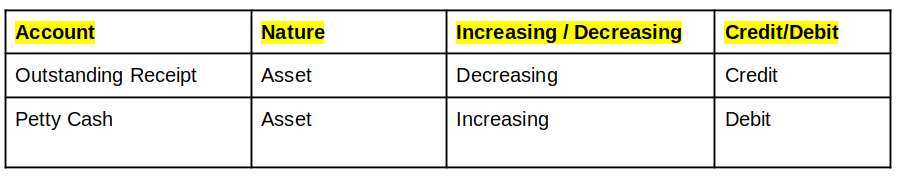

Outstanding Receipt and Liquidity Transfer are the accounts that are affected. Liquidity Transfer to Outstanding Receipt account cash flow The Outstanding Receipt Account is an asset, so when the asset value grows, there is a debit. Liquidity Transfer is also referred to as a Current Asset; thus, credit is created as it lowers.

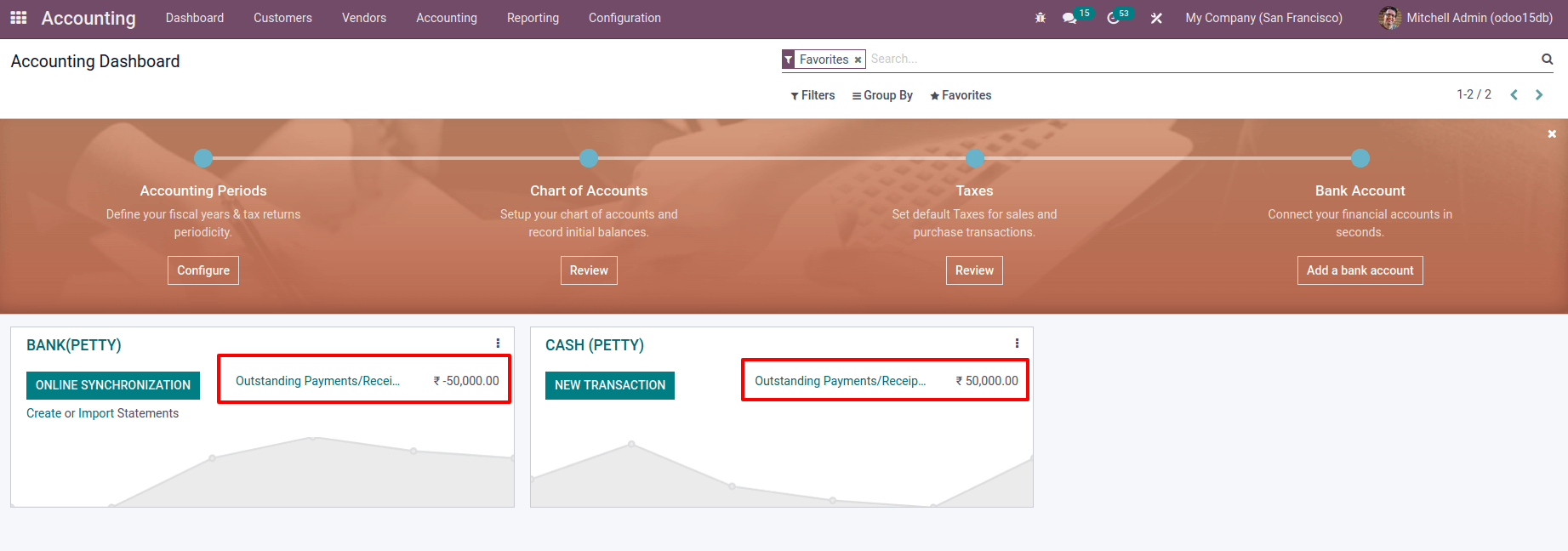

From the Accounting Dashboard, we can see an amount of -50000 in the Bank’s Outstanding Payment account, with the same amount credited to PETTY CASH’s Outstanding Receipt account.

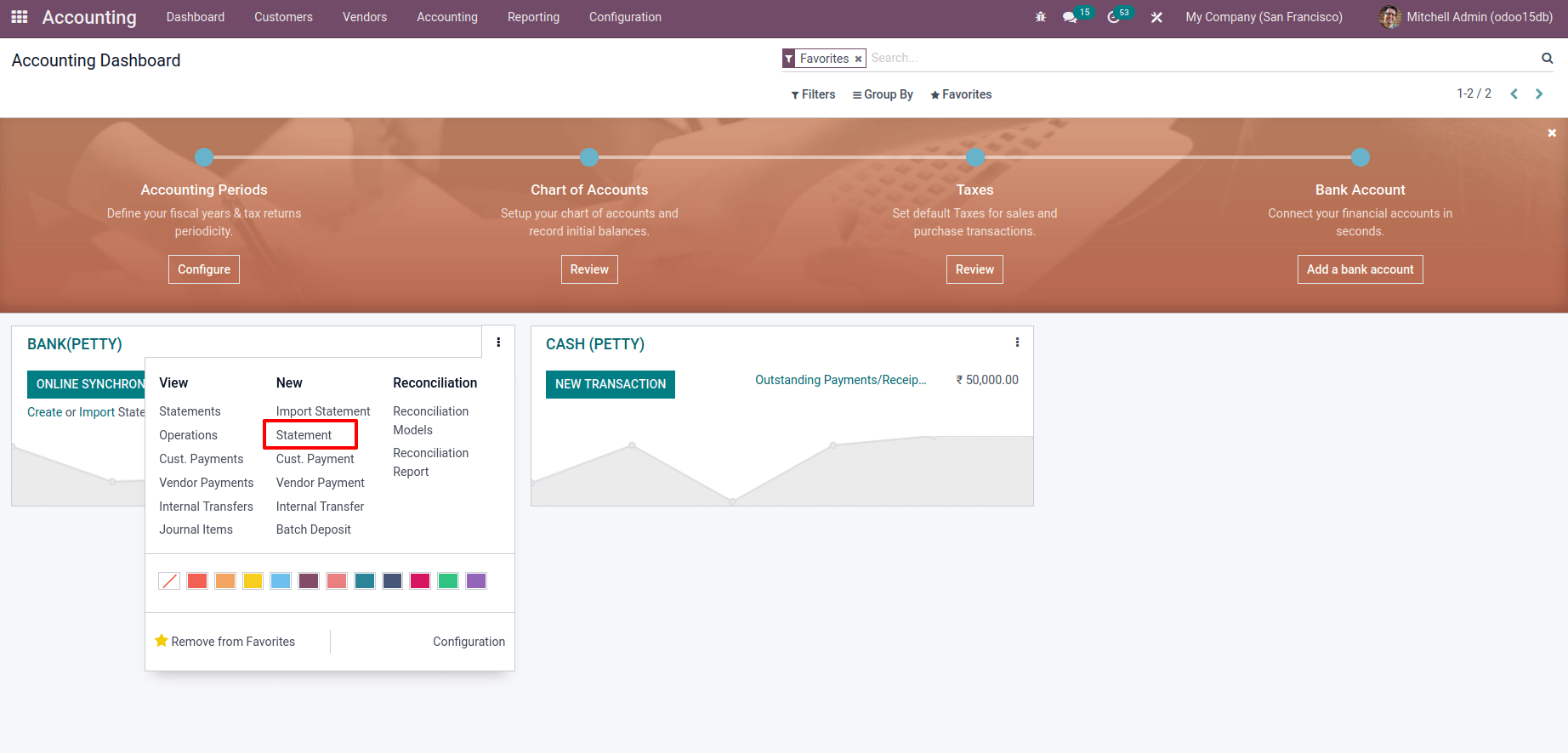

After that, go to the Bank and create a Bank Statement. From there, select the option to create a Statement.

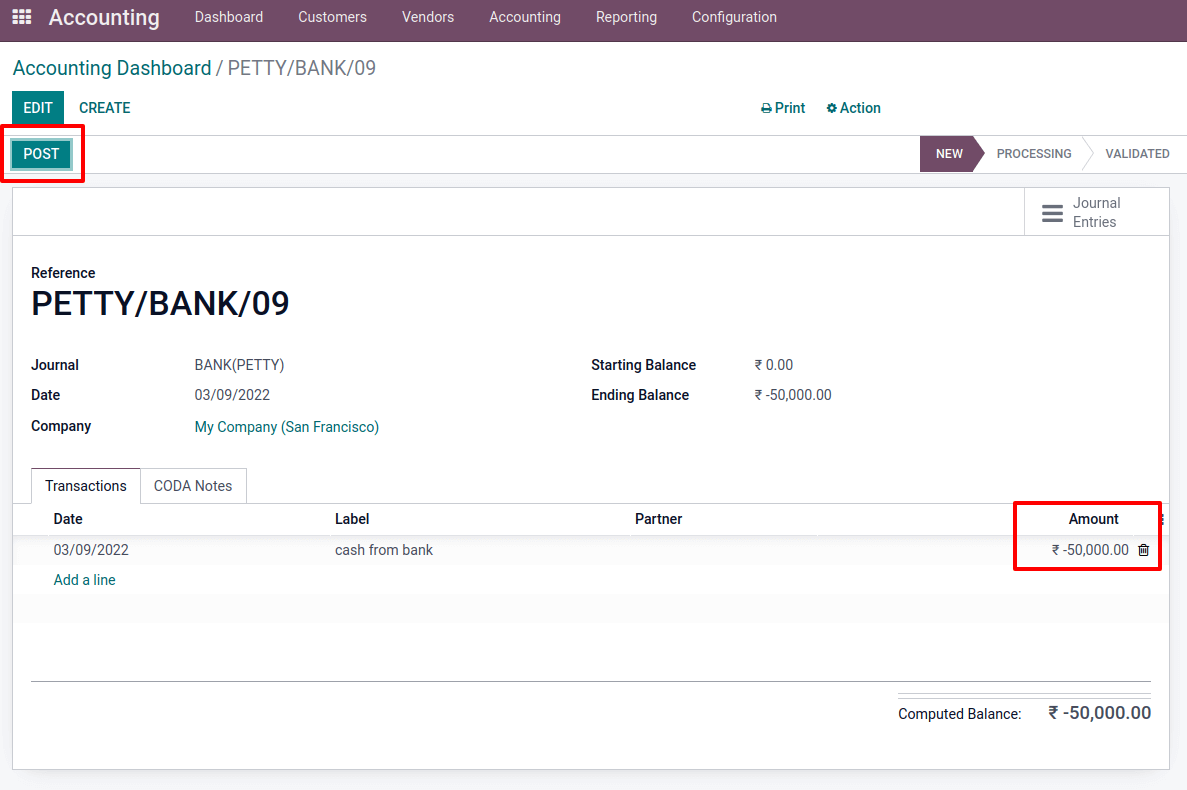

Add a reference and mention the journal, date, and firm when writing a statement. Add the date, label, and amount to the transaction line. In this case, we added a negative value of 50000. The ending balance should then be updated. Then, before posting, we’ll want to save it

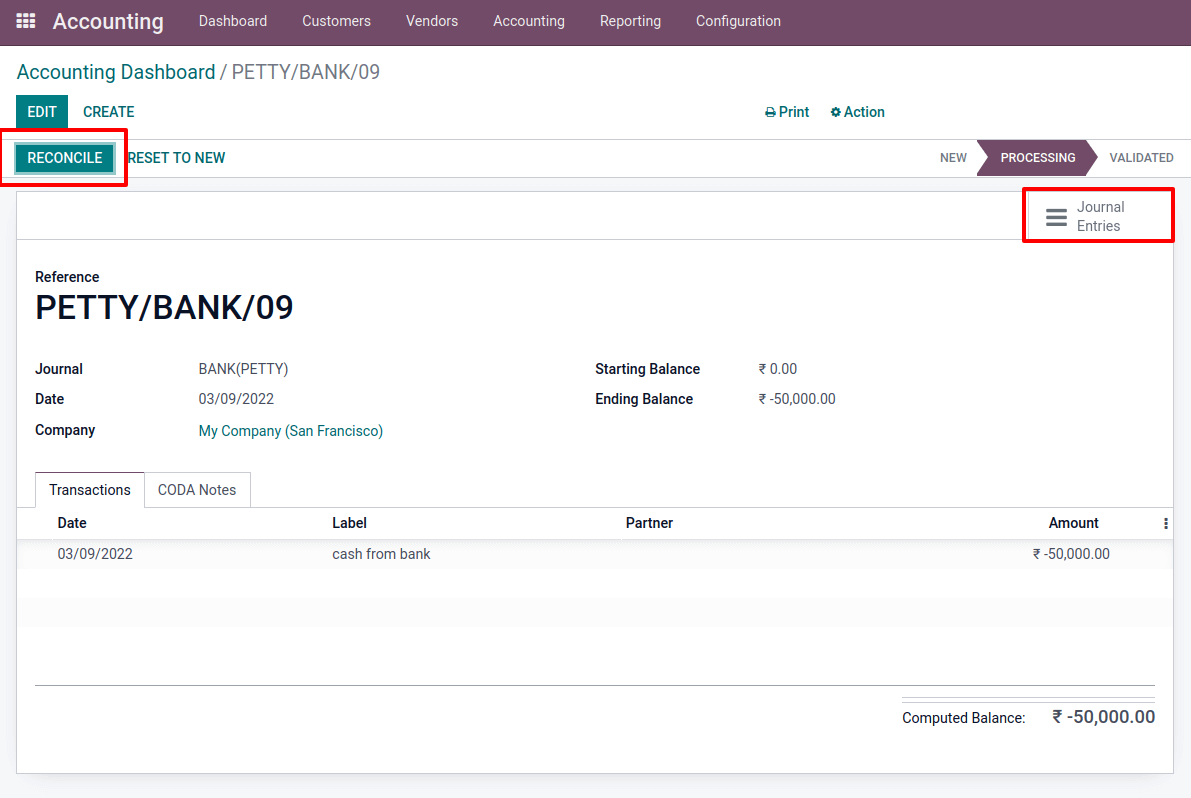

Following the posting of the statement, a new button, RECONCILE appears. The statement and our transfer can then be reconciled. There is a smart tab Journal Items presented before that, so let’s verify the ledger posting.

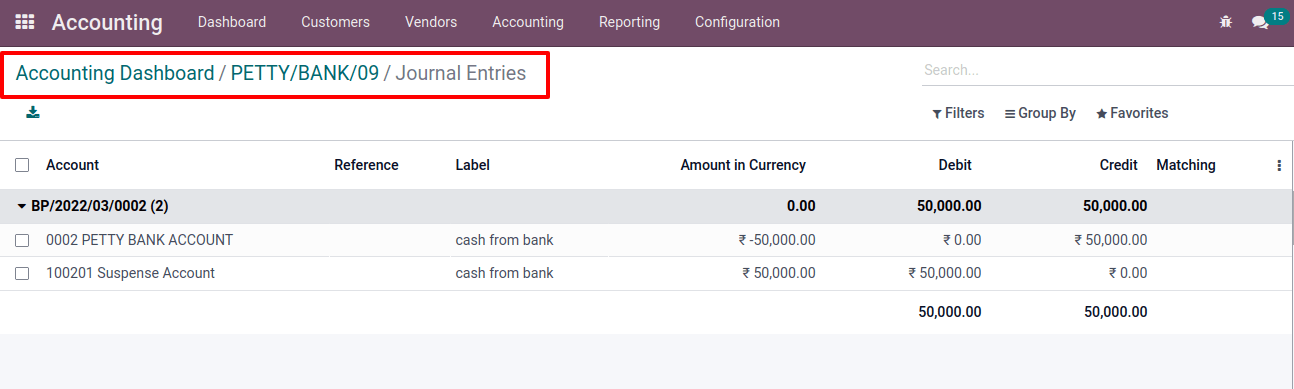

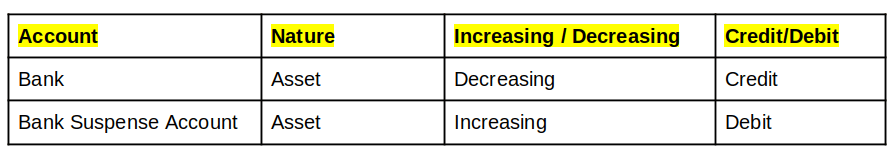

During the creation of a bank statement, an entry is created between the bank account (which is an asset in nature) to a bank suspense account ( Asset in nature). The entry was made in the bank suspense account while creating a bank statement. Its counterpart must go to the bank, so the bank account is affected here. The Bank suspense account is used to save all entries in the statement. Once the reconciliation process was completed, this was only connected to the bank account. As a result of the asset demise, the bank account has been credited. A debit occurs when the asset in a bank’s suspense account increases.

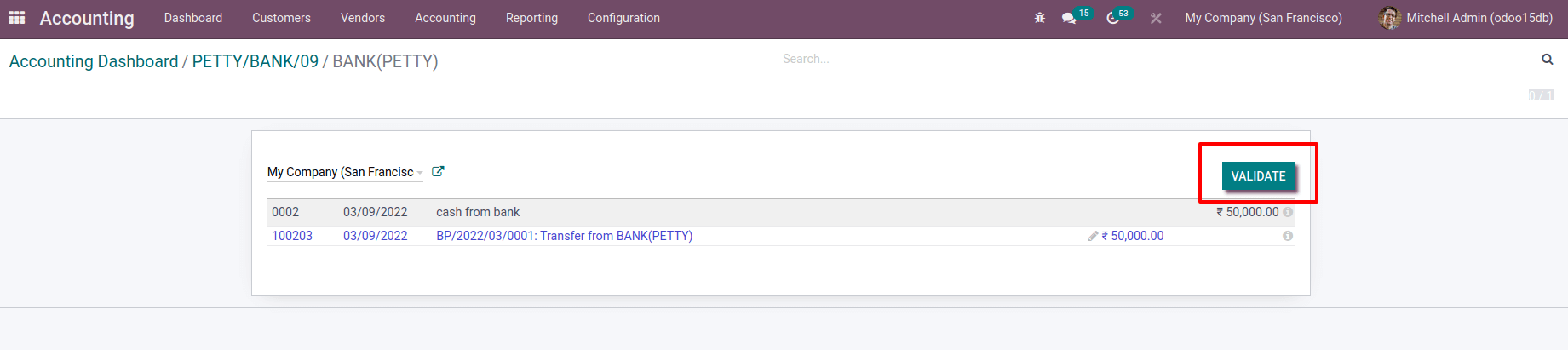

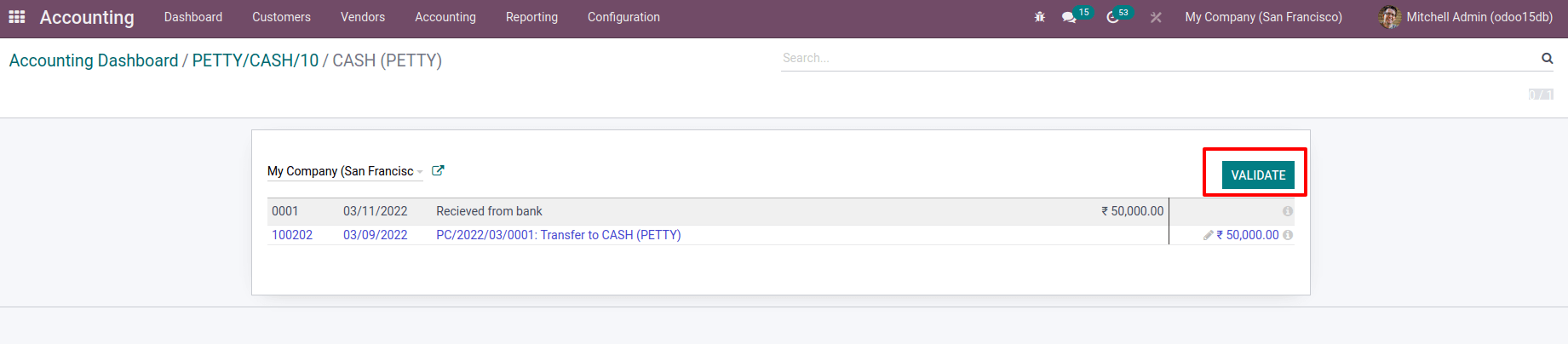

When creating the RECONCILE button. After that, a list of payments is shown to us. Choose the Internal transfer that we established earlier from the list, then click the VALIDATE button to finish.

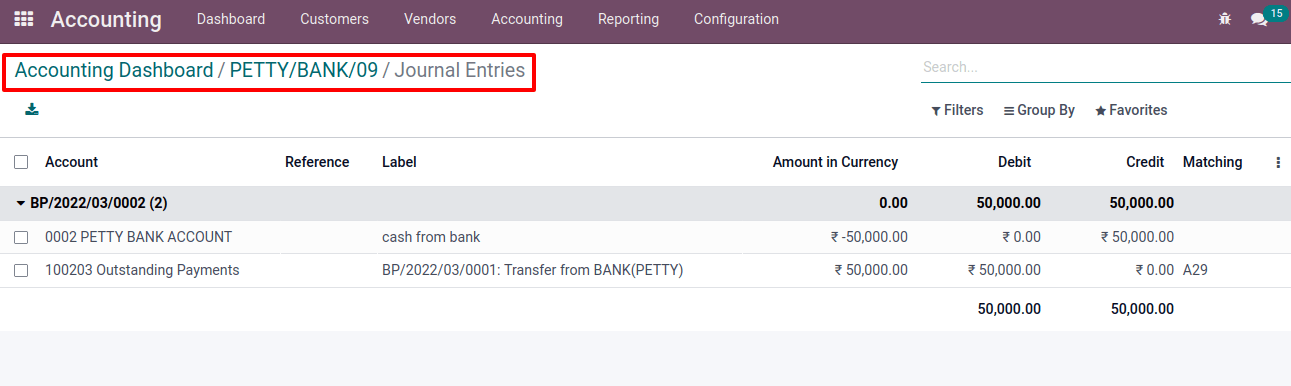

After you’ve confirmed it, double-check the journal entries. There are changes made to the accounts that are affected.

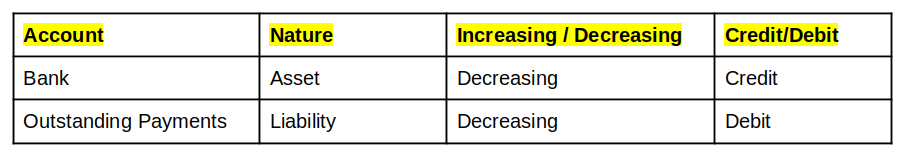

A debit occurs in the Outstanding Payments account after reconciliation. The sum in the bank’s suspense account has now been erased. And the funds are transferred to Petty Cash. As a result, due to asset declines, the bank account was credited, and due to liability decreases, the outstanding payments account was debited.

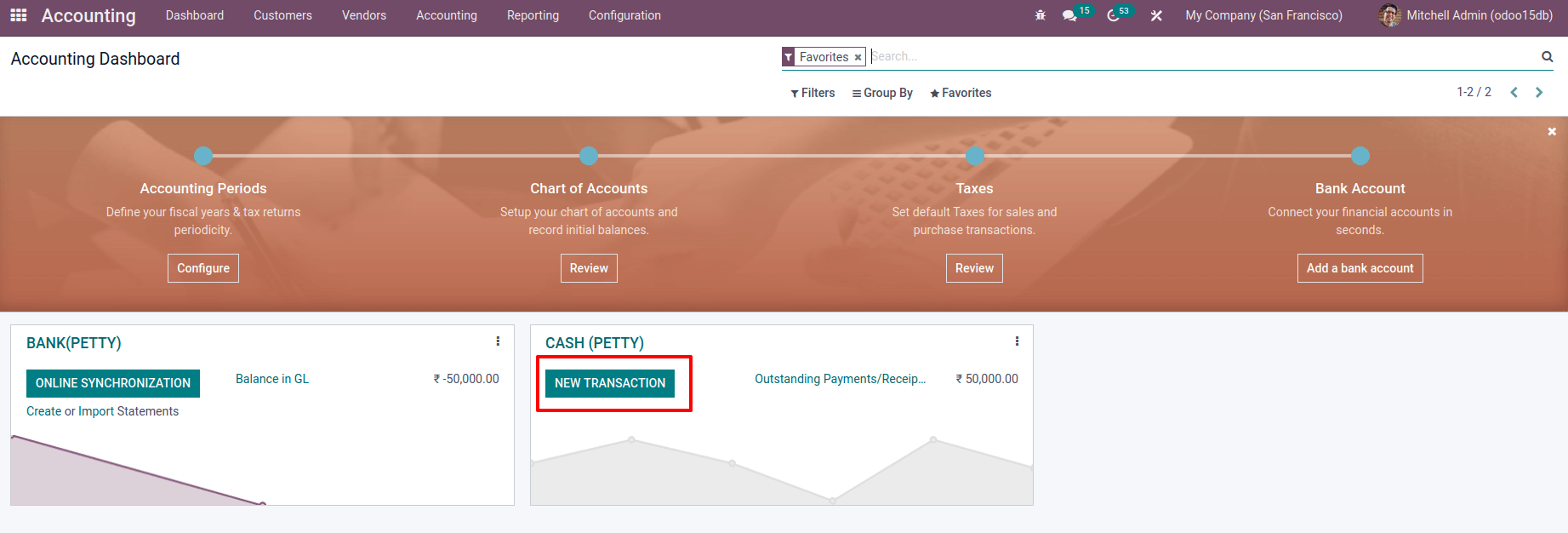

The payment has now been transferred from the bank. After that, we’ll create a new Petty Cash transaction. So go to the Accounting Dashboard and click on NEW TRANSACTION.

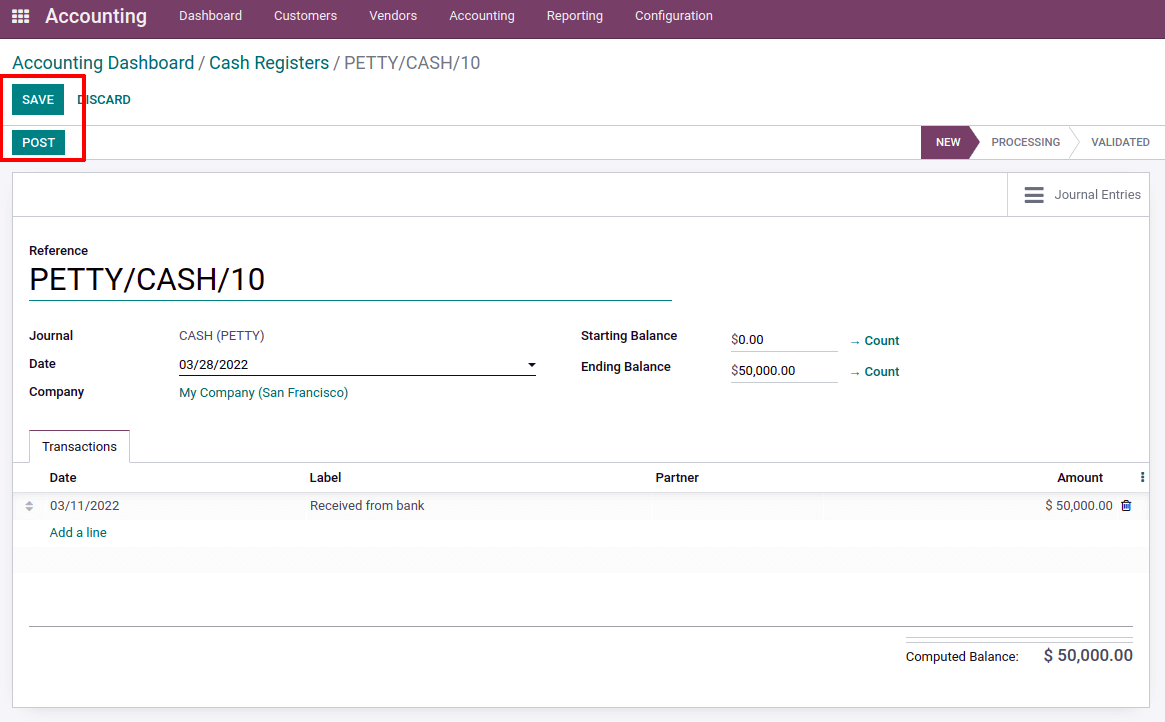

A new transaction was created here. In the transaction line, enter the amount of 50,000.00. The transaction is then saved and posted.

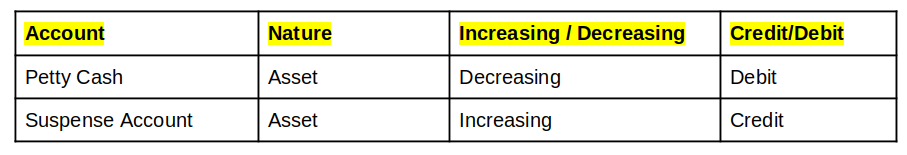

Check the Journal entry before reconciling them, as previously stated. Journal Entries has a smart tab. Check the affected accounts by clicking on it. As previously stated, there is an entry in the suspense account. All entries in the suspense account were reflected while creating a statement. In the Petty Cash account, a counter portion was added.

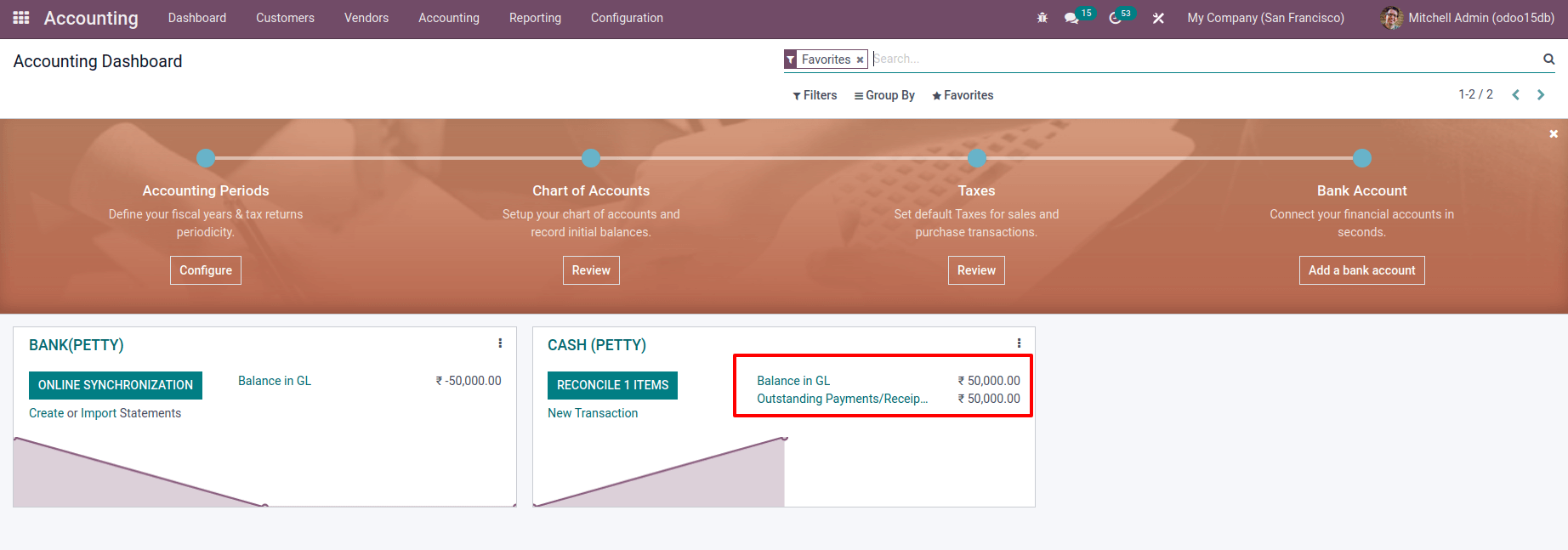

Look for the CASH (PETTY) petty cash journal in the Accounting dashboard. In the ledger, there is a sum. And an amount in the Outstanding Receipt. There is one item that needs to be reconciled. Let’s reconcile it.

Choose the payment from the list. After choosing a transaction let’s Reconcile it.

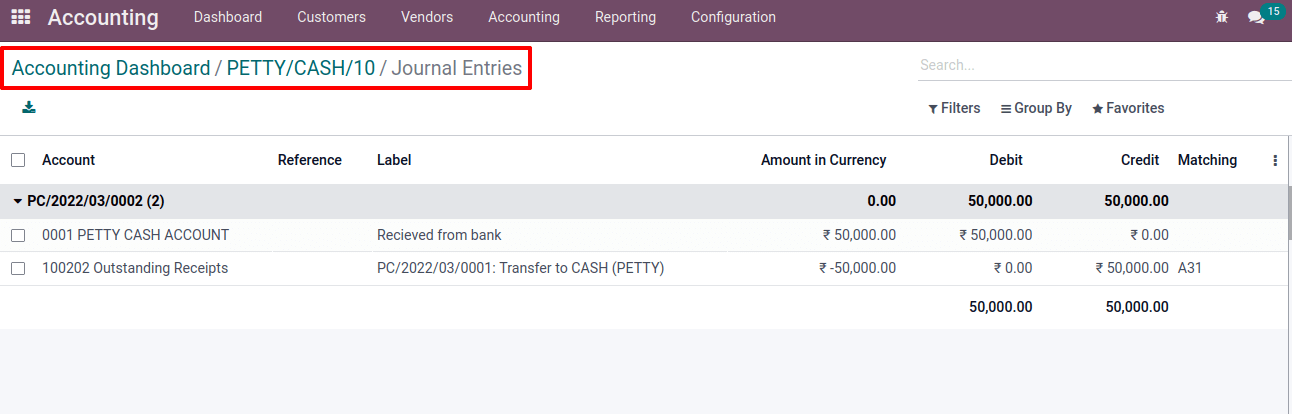

The money has now been sent from the bank to the Petty Cash account. So, let’s have a look at the journal entry to see what the end conclusion is. The entry was transferred to petty cash following a reconciliation. The suspense account item was subsequently erased. With money moved from accounts receivable to petty cash.

When looking at the Dashboard, there is a -50,000.00 in Bank and a 50,000.00 in Petty Cash. This indicates that the money is deducted from the bank account and credited to the Petty Cash account.

Ledger posting during the Internal transfer

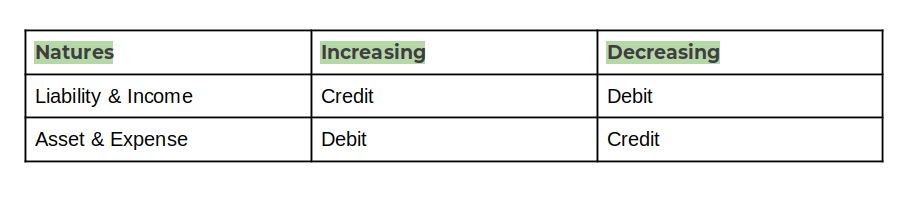

First let’s check the Accounting Natures in Odoo. There are 4 accounting natures in Odoo. They are Liability, Income, Asset, and Expense.

When an Internal Transfer happens, the affected accounts in the Bank journal are Outstanding Payments and Liquidity Transfer Account.

After the Internal Transfer while checking the Petty Cash journal the affected accounts are Liquidity Transfer Account and the Outstanding Receipt Account.

When preparing a bank statement, keep the following in mind: Affected are the Bank Account and the Bank Suspense Account.

After Reconciling the entry with the statement, Bank Account and Outstanding Payments are affected.

While creating a new transaction in Cash, Petty Cash account and Suspense account are reflected.

After reconciling the entries with the amount moves from Outstanding Receipt to Petty Cash

In, conclusion, the petty cash is a much-needed entity while the functioning of the business and with the Odoo platform you can effectively manage them with the right financial management prospects.