The business management aspects of a company have never been easier with the ever-changing business parameters, constraints of operation, and the regulations imposed by the governing authorities the functioning of the business should be precise and effective. In today’s fast-moving world the need for dedicated tools to cope with the business as well as its functioning need the need of dedicated and well-defined functional tools of operation is vital. This is where the advantages of the Odoo ERP come into play offering dedicated, complete, and reliable business management and ist control for the entire operation.

With the dedicated infrastructure of modular operations bringing in application-specific modules of functioning the Odoo platform is the best tool for the management of any type of business operations. Moreover, with the advanced operational capabilities, the Odoo ERP can be made used to run a business of any form, format, scale, and type of functioning. In addition, the localization elements of Odoo will make sure that the Odoo platform is being configured for the business operation of a specific region of functioning.

The Localization aspects will help to configure the Accounting, which will help to define the necessary configuration of taxes, fiscal positions, chart of accounts, and configuration of specific certificates for the accounting module, which are all required to make the ERP usable for the specific country. In regards to the localization aspects, there are dedicated modules that can be installed in the Odoo platform which will bring the specifics as well as the operational aspects of functioning for the business which is in operation in the respective country.

This blog will describe how the Australia localization works in Odoo 15.

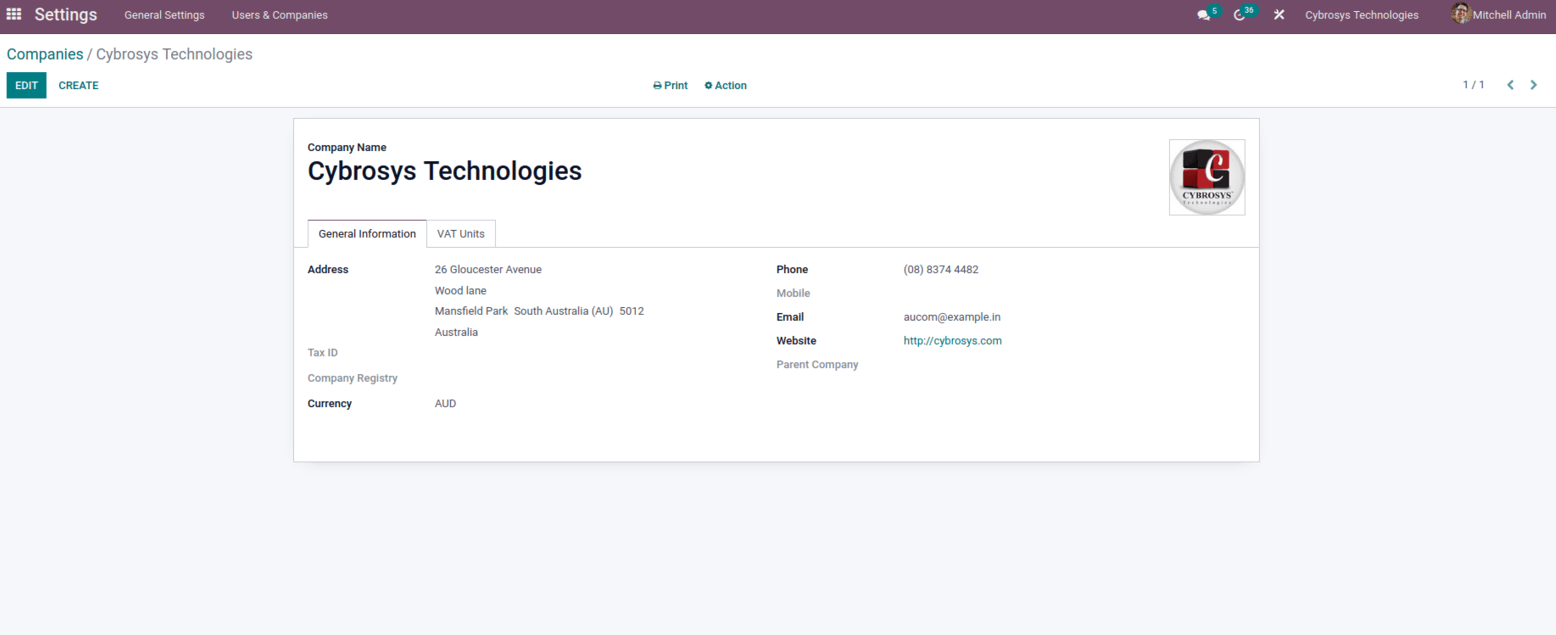

Firstly let’s see how to set up a company for a particular country. For that, the user needs to go to the General settings of Odoo from there under the Users & Companies option one gets the option to create one or more companies.

Add details like Company Name, Address, Tax ID, Company Registry, Currency, Phone, Website, Email, Company logo, and other details.

In Australia localization, the Company Registry contains a unique nine-digit number which is an Australian Company Number (ACN), and that is generally shown on all company documents.

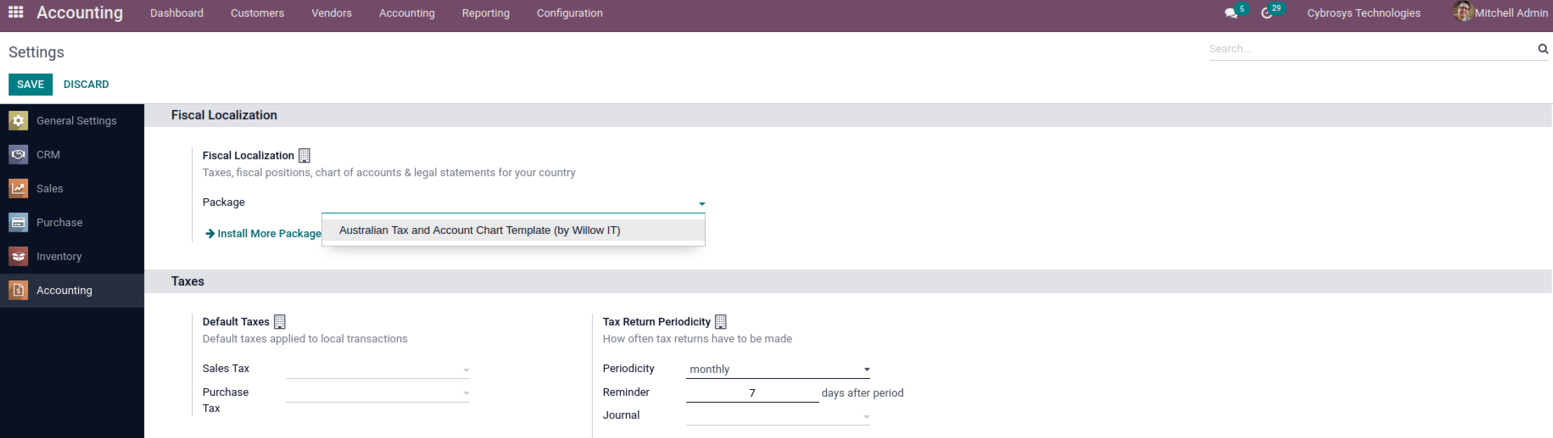

Once the company is created the next thing we can notice Fiscal Localization option in the Accounting settings which allows the user to select the corresponding package according to the localization.

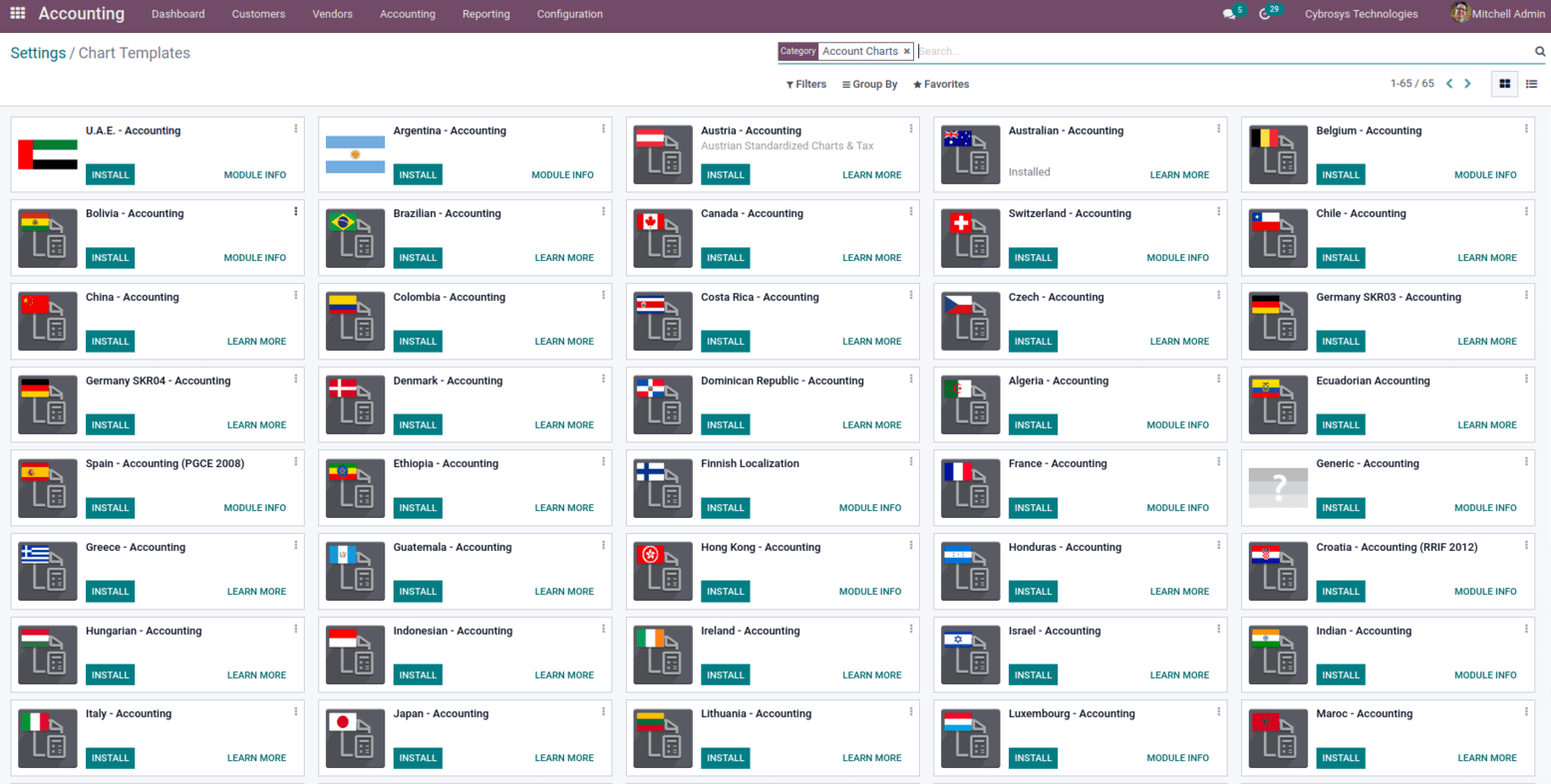

The user can select the package from here or below there is an option to install more packages that will redirect to the Settings/ Chart Templates, from here also the User can Install the package based on the Localization.

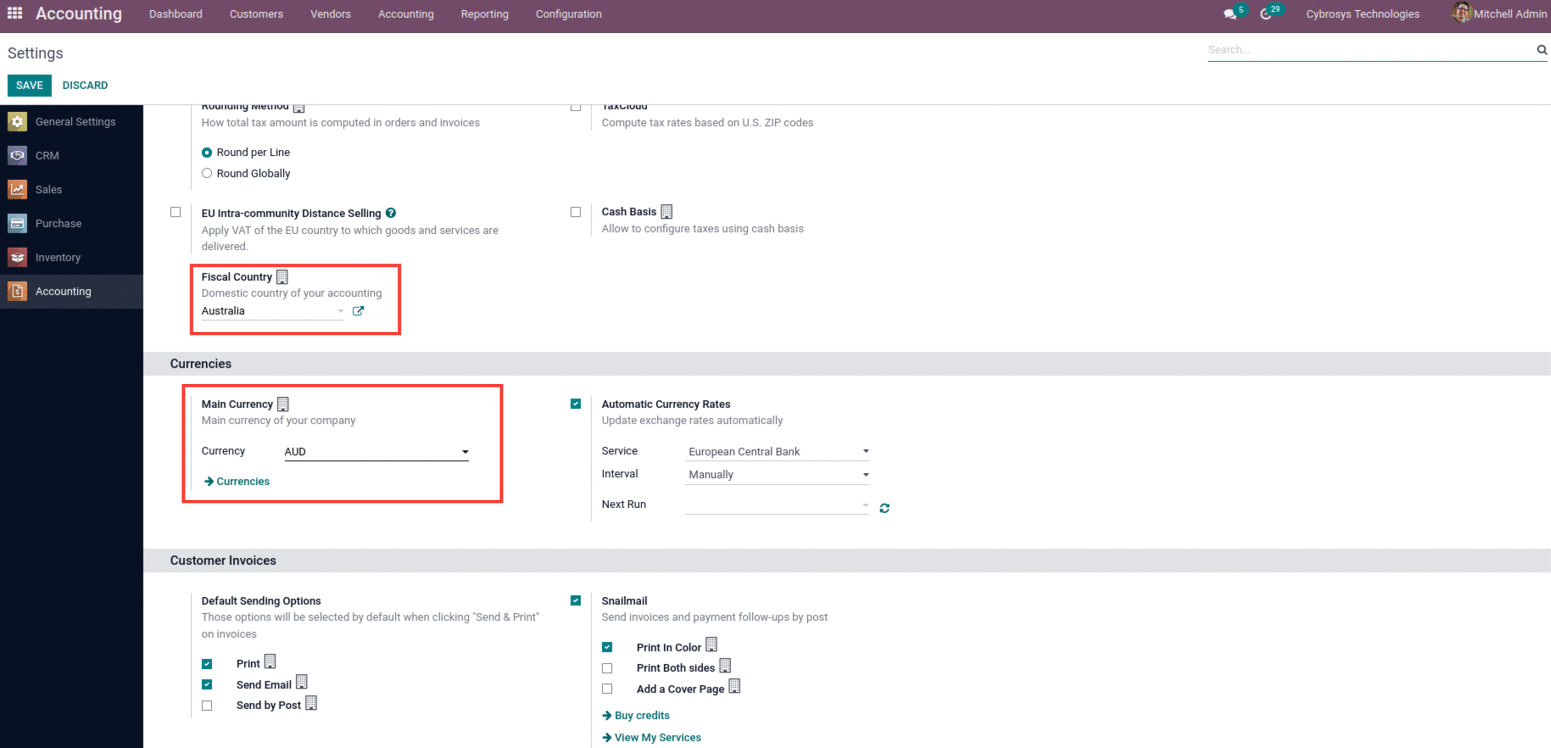

Once the package is installed certain changes occur in the settings of the accounting module such as the Fiscal country ie the domestic country for User accounting will be automatically updated along with that the main currency of the company as shown below.

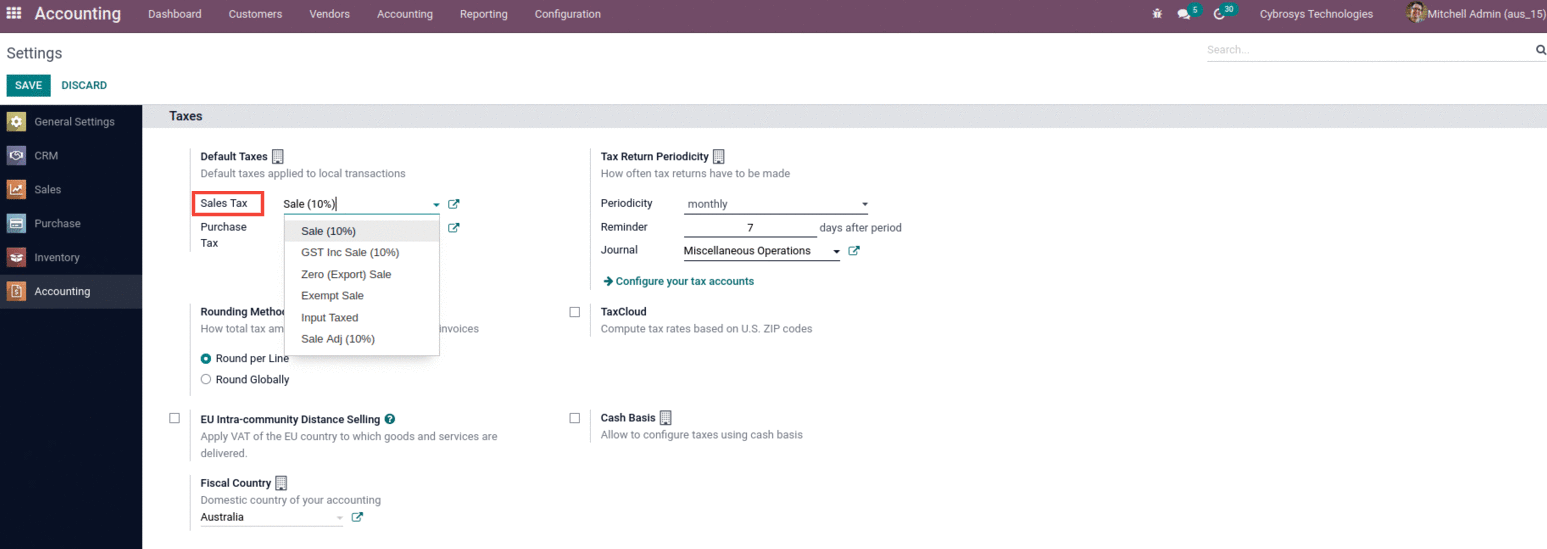

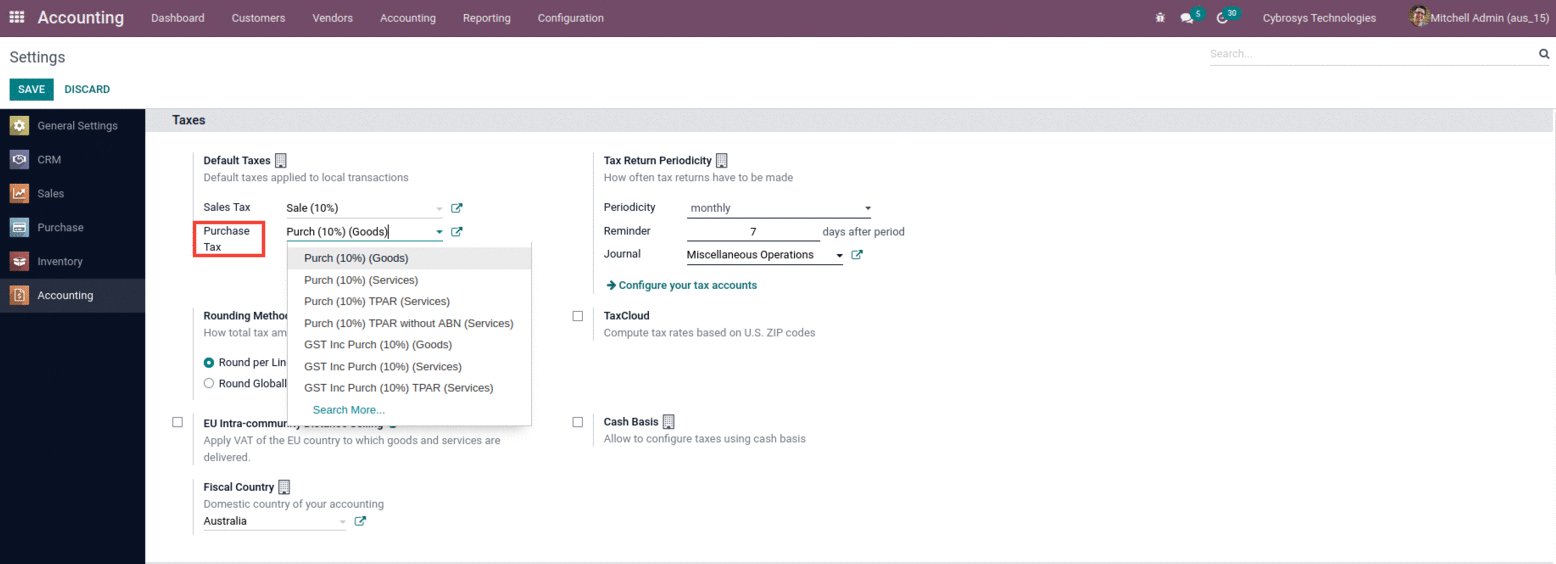

With the installation of the Australia localization, the company’s Default Taxes are automatically set, which are applied to the local transactions, and add to the default sales tax and purchase taxes that come under that particular localization.

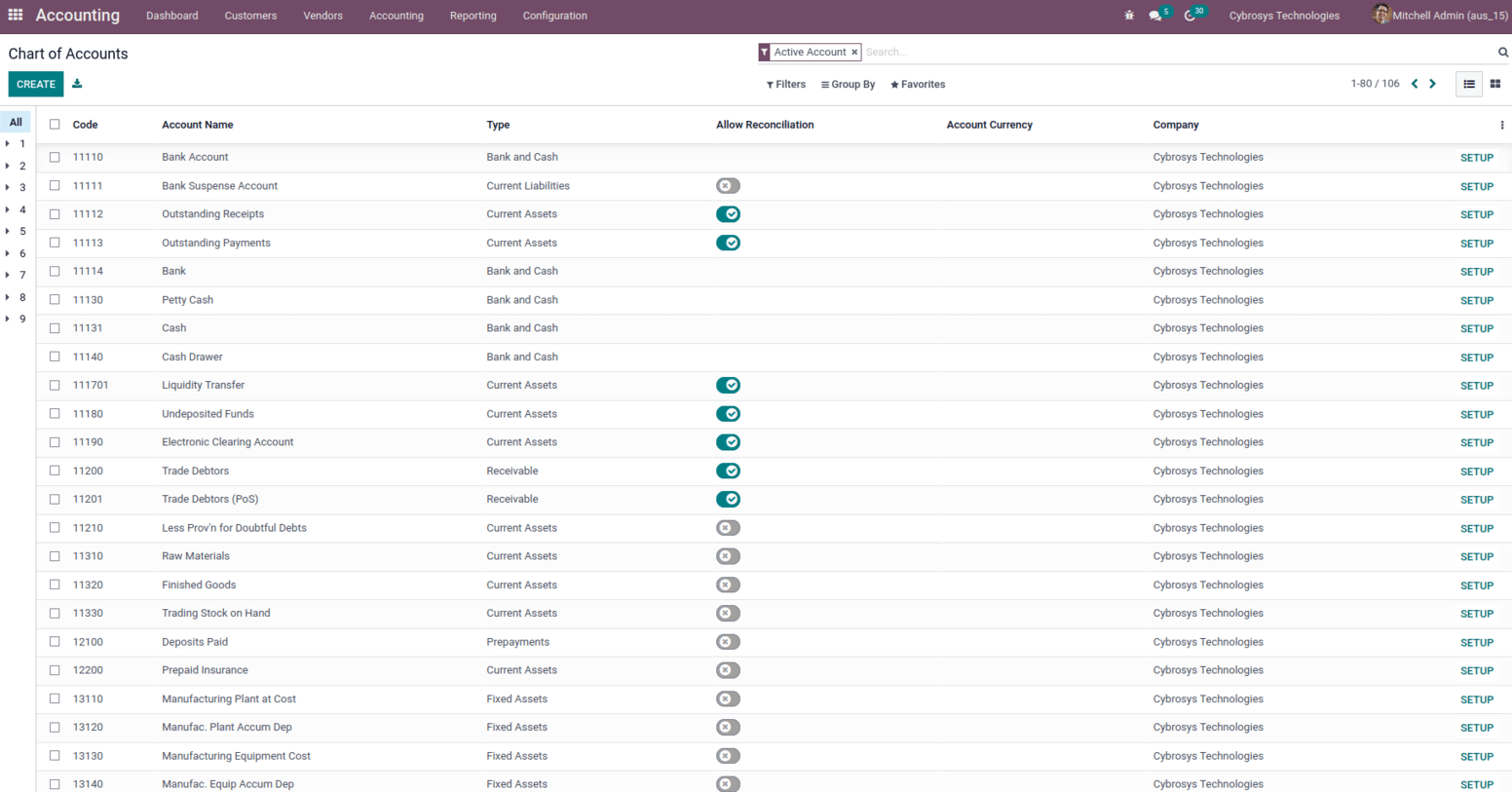

Now let us check the Chart of Accounts which lists all the accounts used to record an organization’s financial transactions installed from the Australia accounting package. For that, go to the Accounting module > Configuration > Chart of Accounts, where one can find the default chart of accounts provided by the Odoo 15 Australia Accounting Localisation package

Now let’s check the Taxes for Australia accounting package; go to the Accounting module > Configuration > Taxes. Below are the default taxes created with the installation of the Australia package; besides this, if the user needs to create a new one, the user can create new taxes from the create option.

In Australia, the standard VAT rate is a goods and services tax (GST) of 10% applied to most goods and services, with a few exceptions.

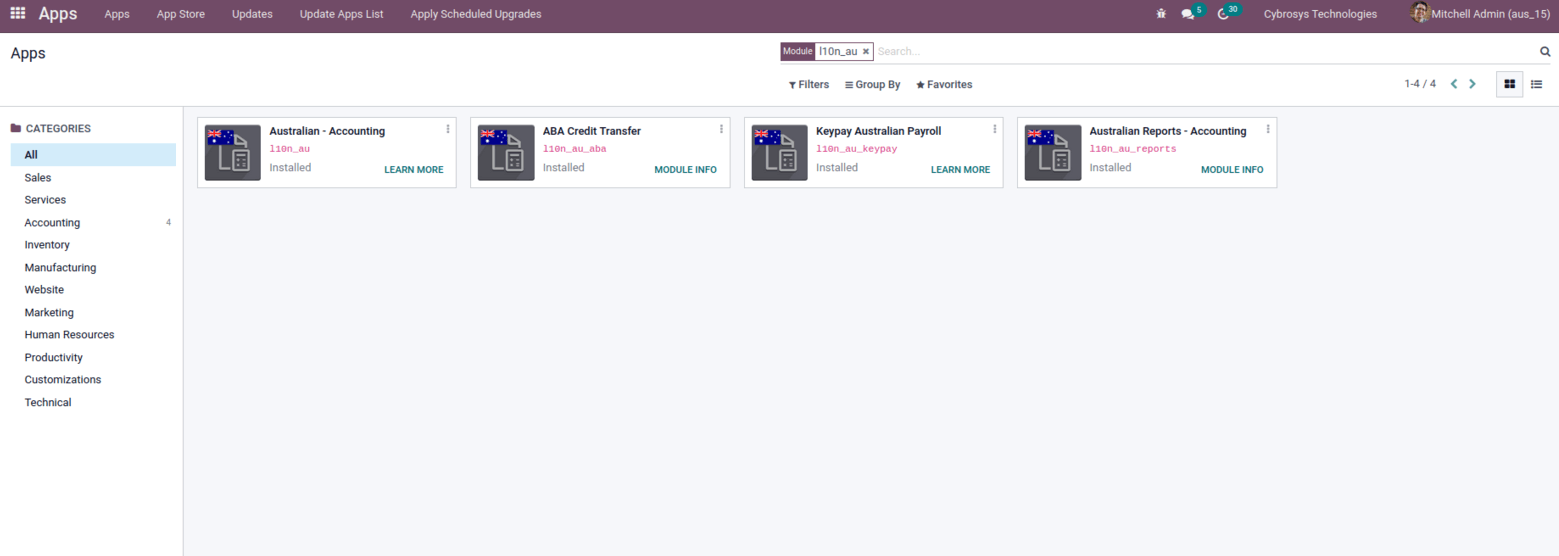

With the Australian – Accounting module, some additional modules are categorised under Australia accounting, listed below.

Australian – Accounting (l10n_au)

The Australian accounting module includes the basic charts and localizations.

Also:

it activates several regional currencies.

Sets up Australian taxes.

ABA Credit Transfer (l10n_au_aba)

This is one of the modules that come with the Australia localization. This module allows the creation of payment batches as ABA (Australian Bankers Association) text files. The generated ‘aba’ file can be uploaded to many Australian banks.

To Setup, go to Accounting -> configuration -> Invoicing -> Journals and create a new journal if needed with the typeset as Bank. Also, make sure that the ABA credit transfer is enabled on the advance setting page and its required few pieces of information like Account Number, BSB number, Financial Institution Code, Supplying User Name, and APCA Identification Number.

KeyPay Australian Payroll (l10n_au_keypay)

KeyPay Payroll Integration This Module will synchronize all payroll journals from KeyPay to Odoo.

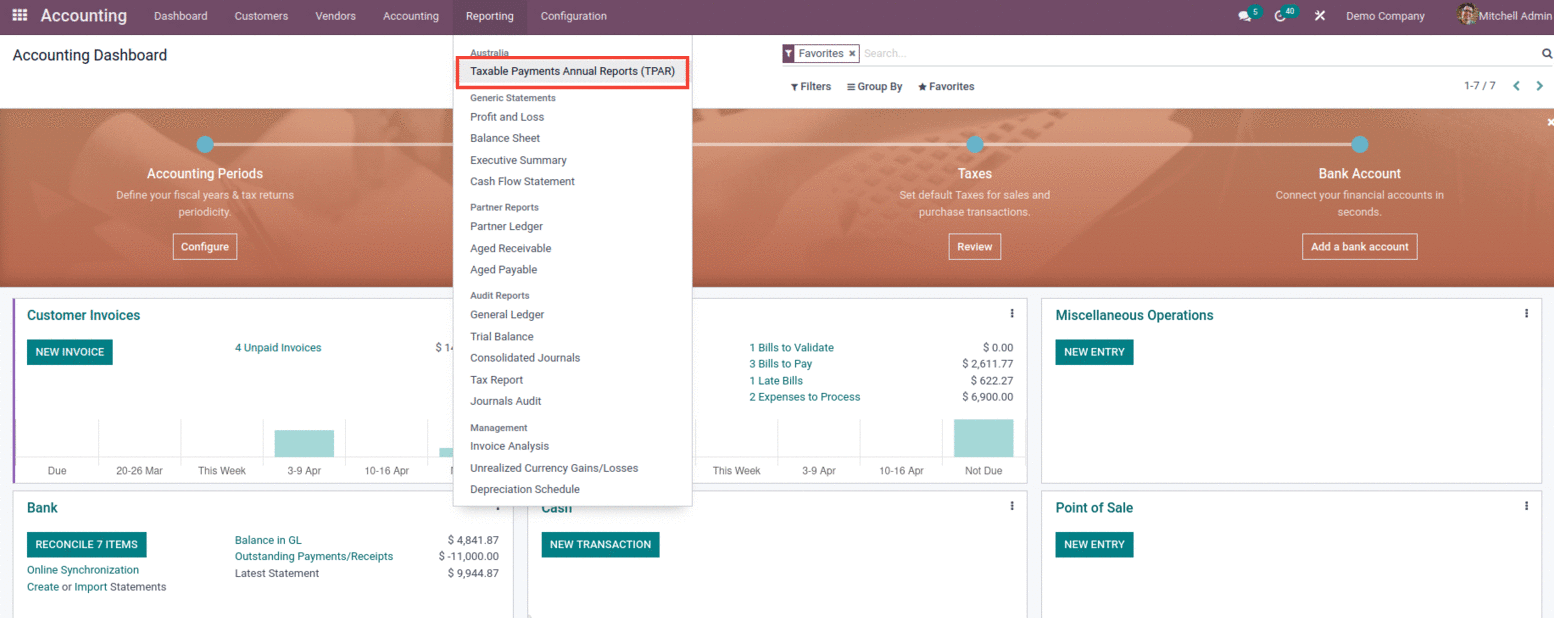

Australian Reports – Accounting (l10n_au_reports)

This module adds Taxable Payments Annual Reports (TPAR) for Australia under the reporting of the accounting module, which allows the Payments made to contractors (or subcontractors) for services or Grants paid by government entities to ABN holders.

The report uses tax tags Service and Tax Withheld tax tags to find adequate journal items. These are set using the fiscal positions and the right type of product (Services).

In conclusion, the Australian Localization elements can be configured in Odoo to effectively run Australia’s business