As a revolutionary change, GST was introduced in India. A variety of indirect taxes, such as state income tax, service tax, excise tax, etc., were thus replaced by a single unified tax system named GST. It is applicable to all goods and services and thus derived the name Goods and Service Tax.

The biggest benefit is that it pushes all enterprises to operate within the scope of this tax. The single tax structure and keeping all taxes from having a cascading effect. Because this tax scheme is applicable across the country, it avoids restrictions on the flow of goods between states.

GST includes three types of taxes:

1. Central Goods and Service Tax (CGST)

2. State Goods and Service Tax (SGST)

3. Integrated Goods and Service Tax (IGST)

For purchases made within a single jurisdiction, Central GST (CGST) is paid by the central government and State GST (SGST) by the state governments. The Central Government levies an Integrated GST (IGST) for inter-state sales and manufactured goods or services. The different GST slabs are 0%, 3%, 5%, 12%, 18% and 28%.

Let us see how the GST can be managed and configured using Odoo.

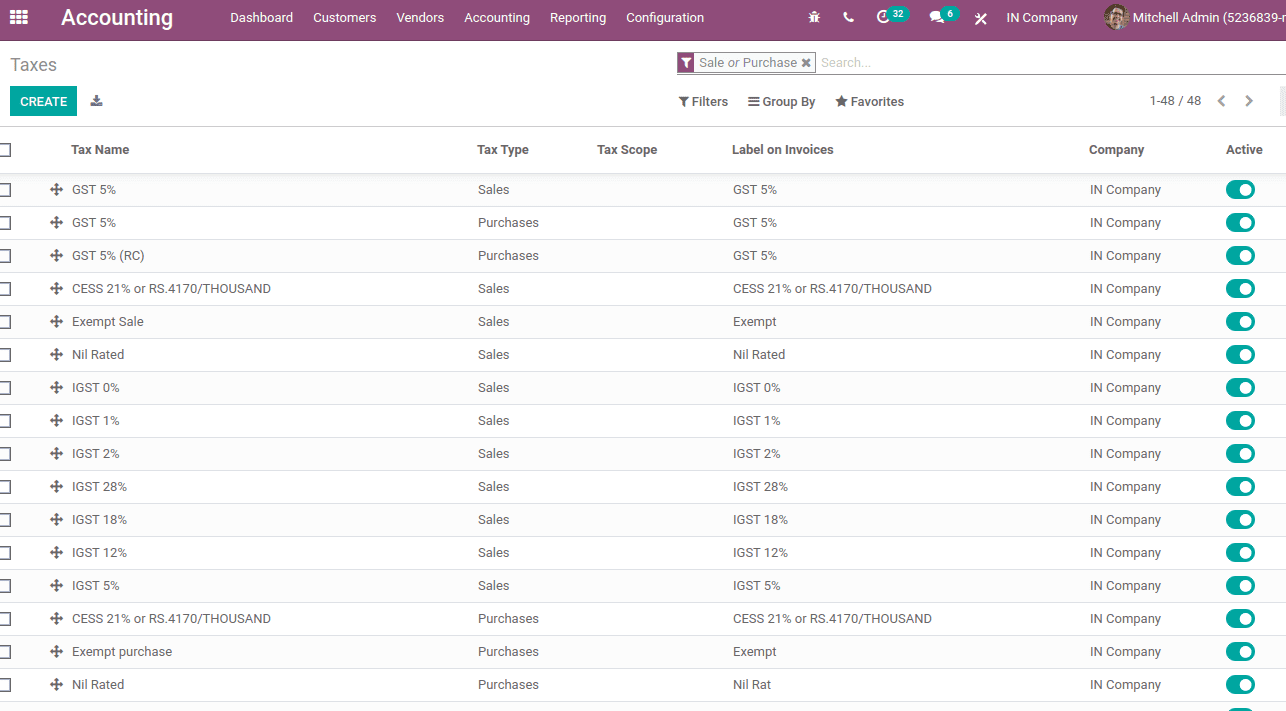

To configure tax, go to Accounting module > Configuration > Taxes > Create.

Here we can see all the GST taxes are there required for indian accounting. Click on the create button, which redirects to tax creation form and thus new taxes can be set up.

5% GST includes 2.5% SGST and 2.5% CGST, where CGST and SGST are the child taxes. So firstly, we have to create the child taxes SGST and CGST.

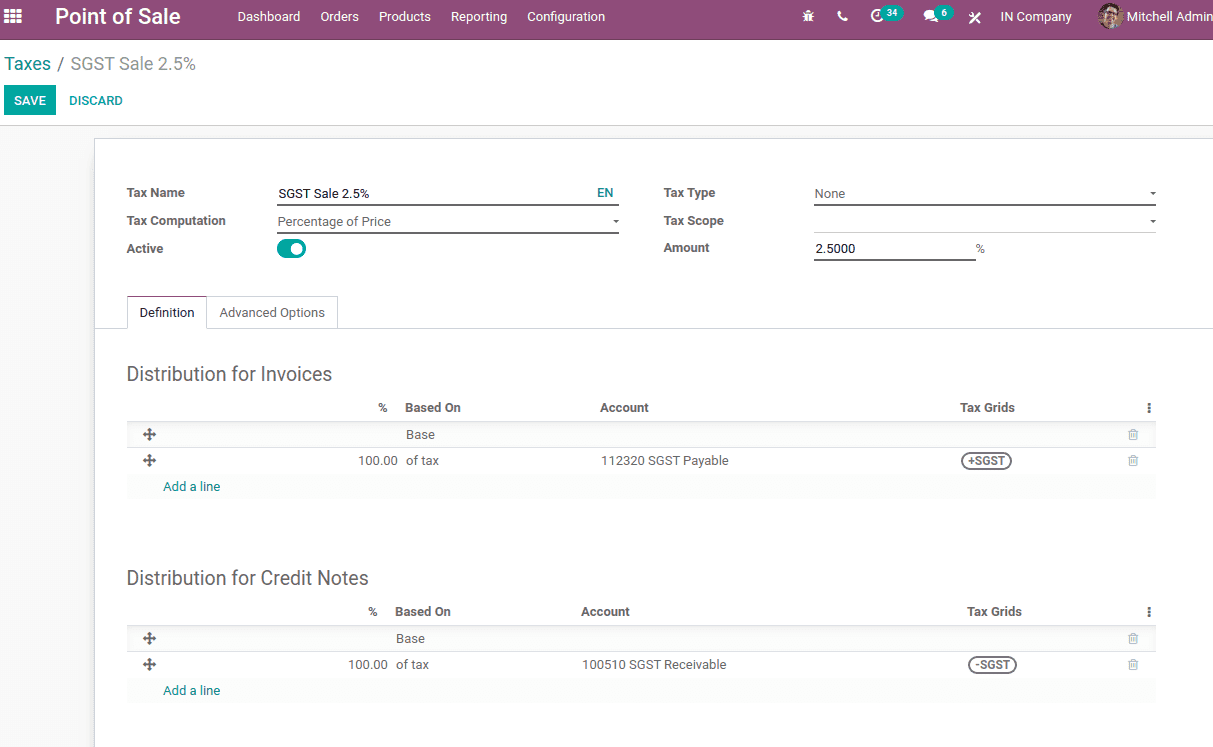

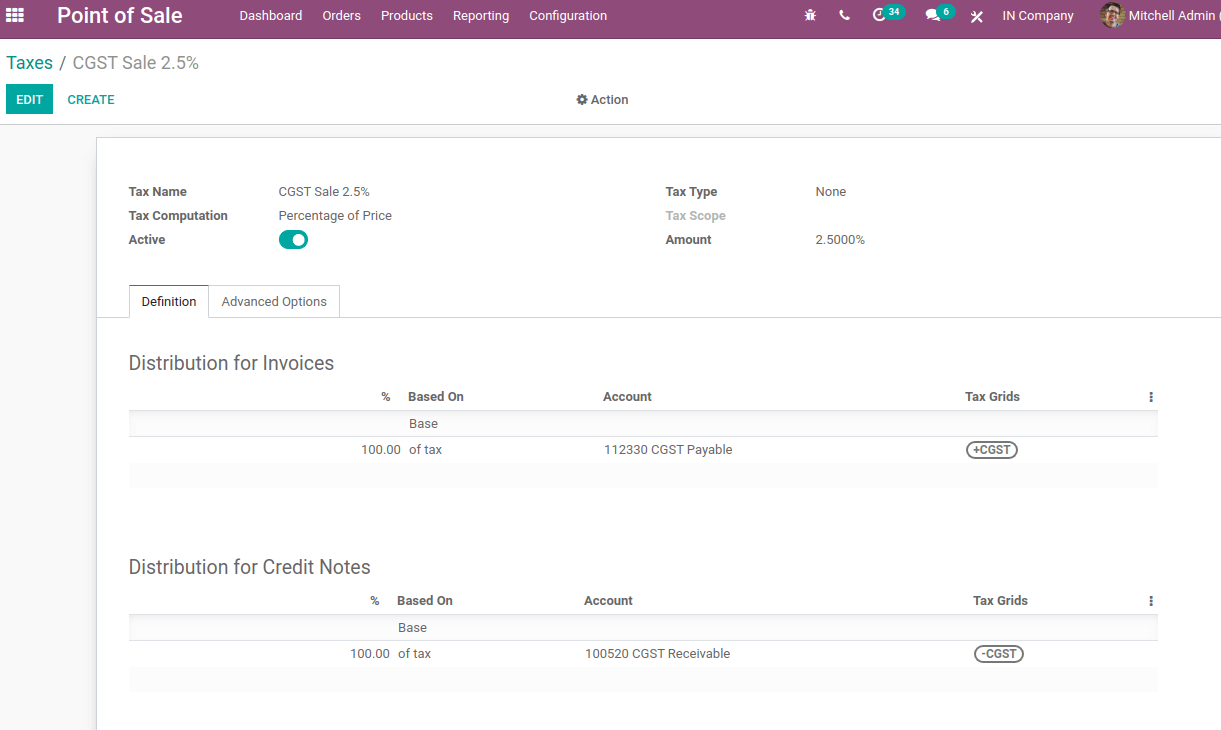

Add the tax name to the specific field.

Tax scope refers to where the tax is selectable, that is in sales, purchase, or none. ‘None’ means Tax can not be used on its own, but it can also be used in a group and hence scope is ‘None’ in this case.

Tax computation decides how tax is added to the tax scope.

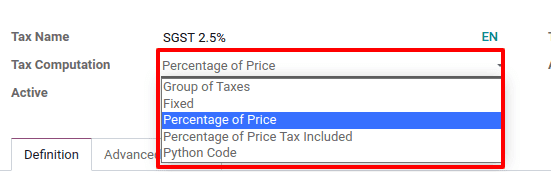

Tax computation can be :

1. Group of taxes

2. Fixed

3. Percentage of Price

4. Percentage of Price Tax Included

5. Python code

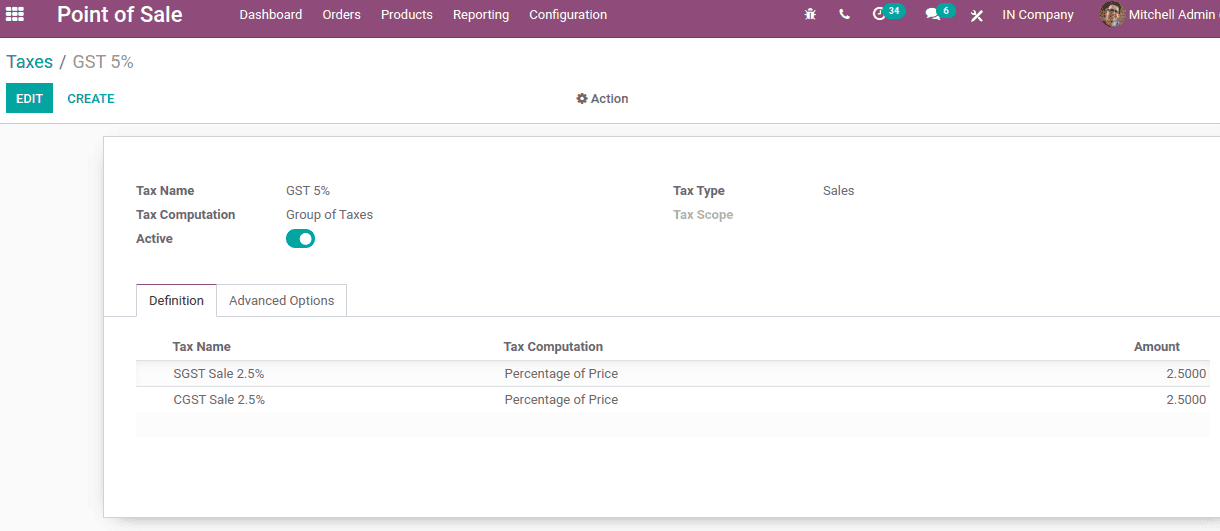

Group of taxes is used where a tax is a blend of different taxes. For example, GST includes SGST and CGST. So tax computation for GST will be a group of taxes.

Percentage of price means tax will be a percentage amount of price. In this case of child tax, we need to calculate 2.5% of the amount as SGST. so tax computation should be ‘Percentage of price’.

Fixed means the tax will be a fixed amount, not a percentage value, or based on price. Percentage of Price Tax Included where the tax amount is a division of the price.

Under the Definition tab, the distribution of tax invoice and refund invoices are managed and also set accounts for tax distribution.

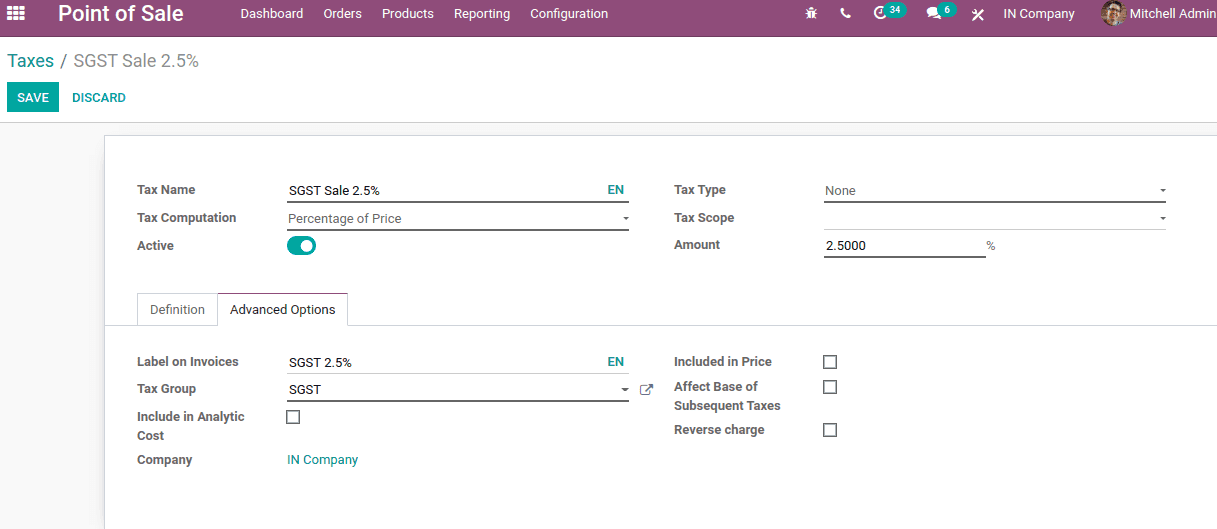

Under the Advanced Options tab, the label that should be displayed on the invoice can be set.

If the total amount to display is tax included, ‘included in the price’ should be enabled. If ‘Affect Base of Subsequent Taxes’ is set, taxes that are computed after this one will be computed based on the tax price included. Choose the ‘tax group’ and make ‘include in analytic cost’ if the amount determined by this tax is allocated to the same analytic account as the invoice line. Tick ‘Reverse charge’ if this tax is a reverse charge (This is only for Indian accounting).

Similarly, create the second child tax CGST.

Now create the GST 5%, comprise 2.5% SGST and 2.5% CGST.

Here the ‘Tax Computation’ is the Group of taxes, since it includes both CGST and SGST.

Create IGST as similar to creating SGST/CGST.

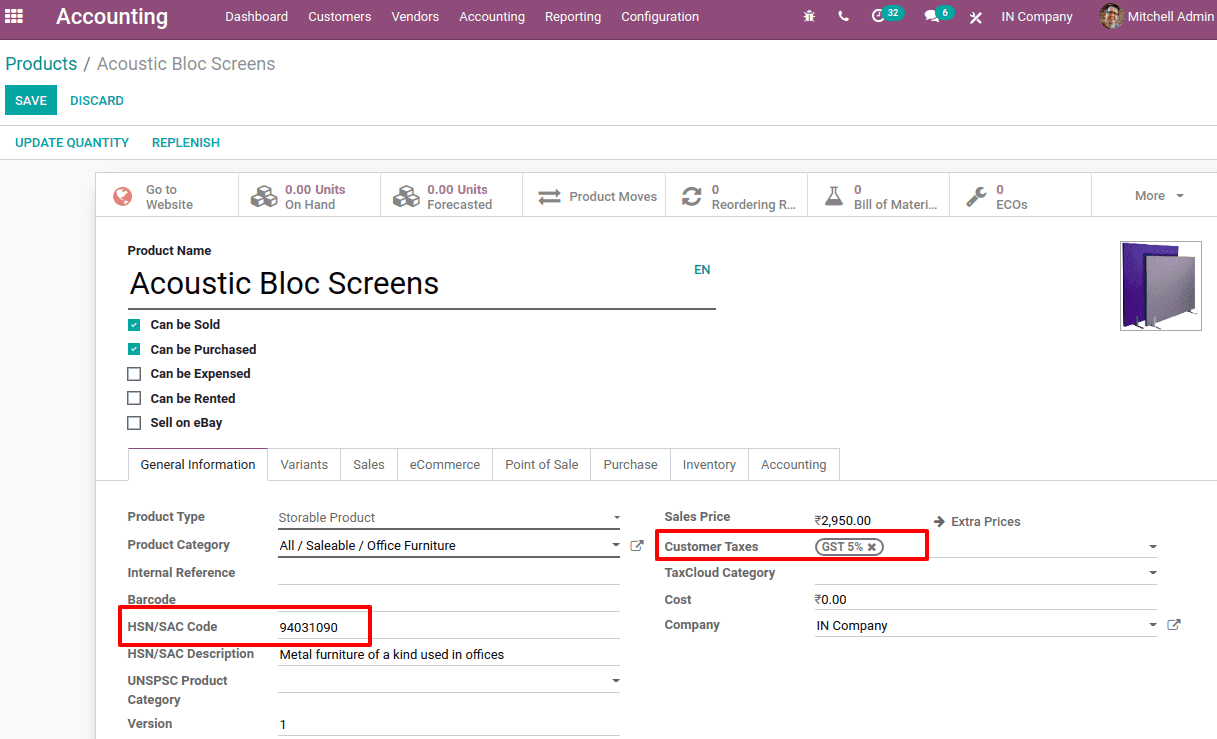

So the taxes are configured and now these taxes can be set to customers and vendors. Take a product, under the General information tab one, can add the custom tax. In the product form, one might insert the HSN code of the product.

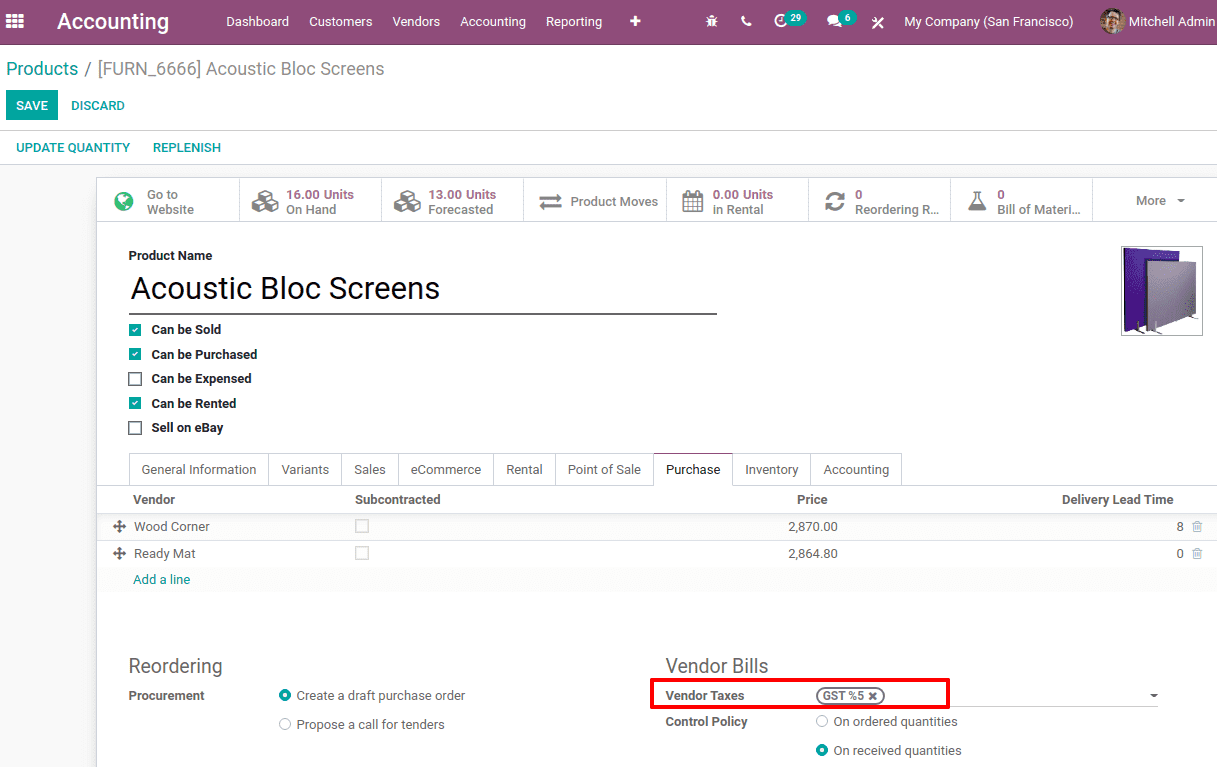

Under the Purchase tab, one can set the default tax which is used when buying the product.

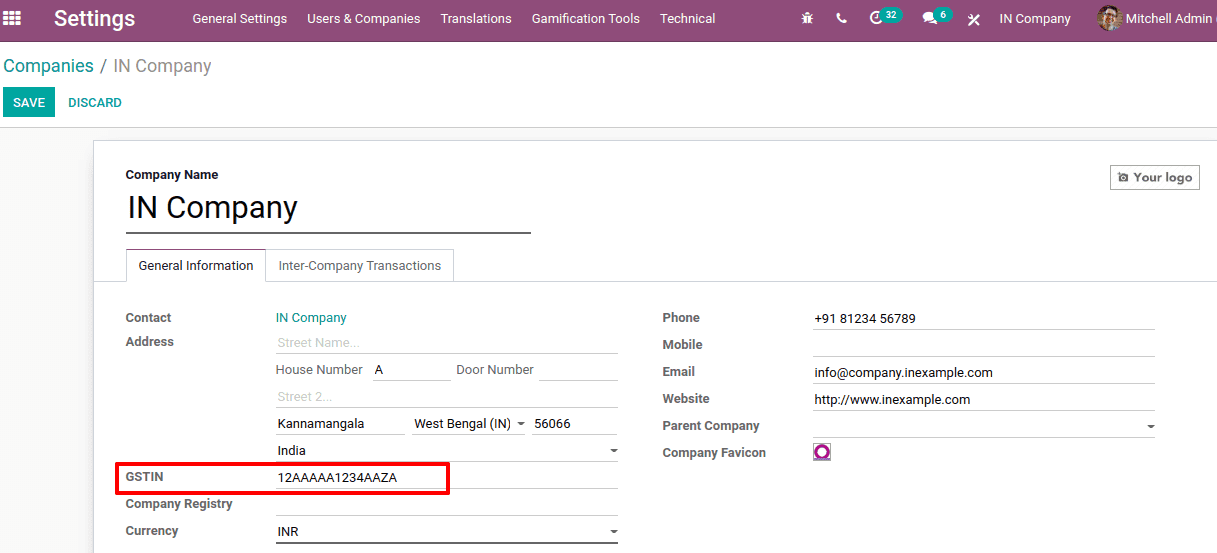

Now let us look at the invoice, where GST is normally shown or visible to the customers. As per law an organization having a turnover greater than 40 lakh must register the company for GST and they will get a GST number. So setting the GST number for the company and partners in the next step.

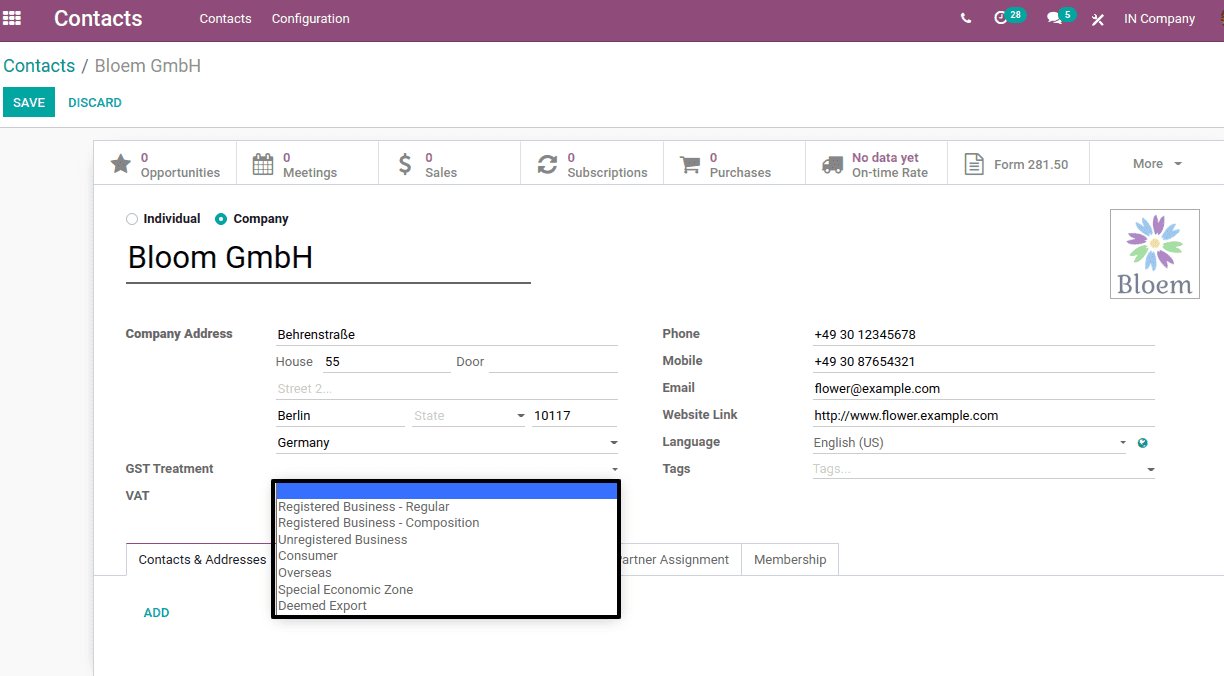

Similarly in the customer form also we have a field for GST treatment.

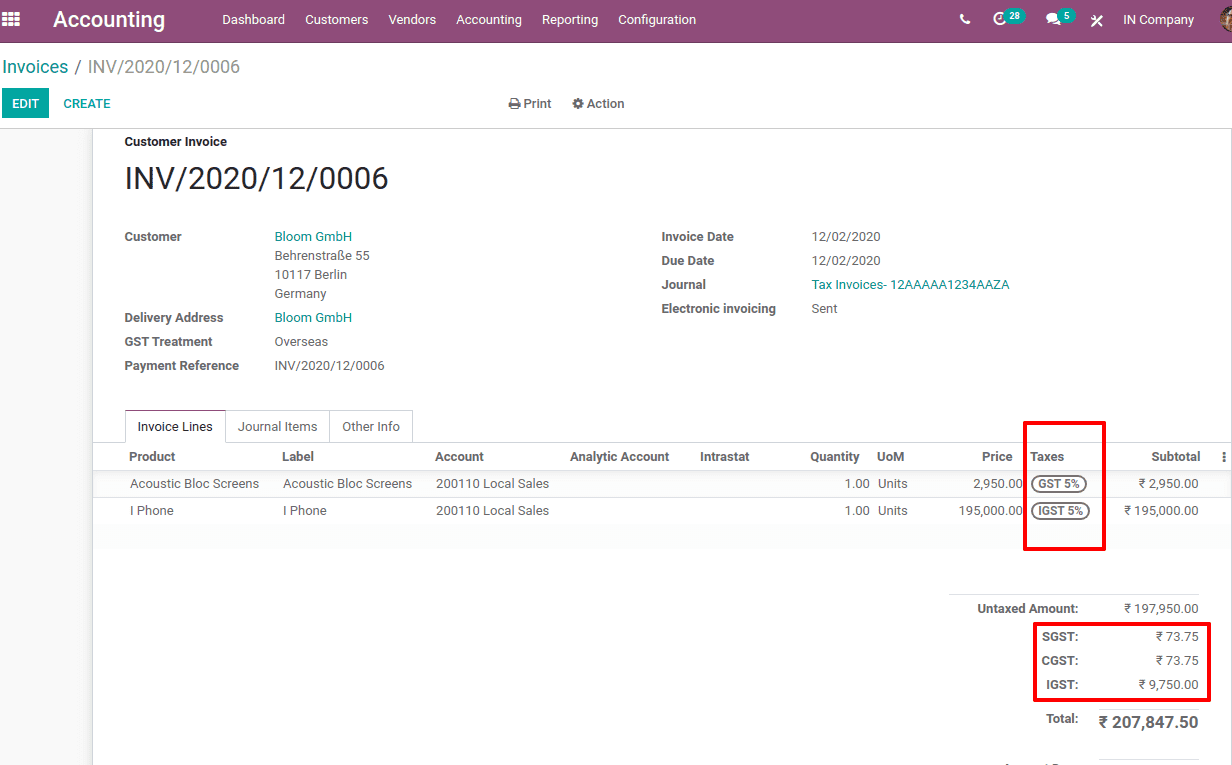

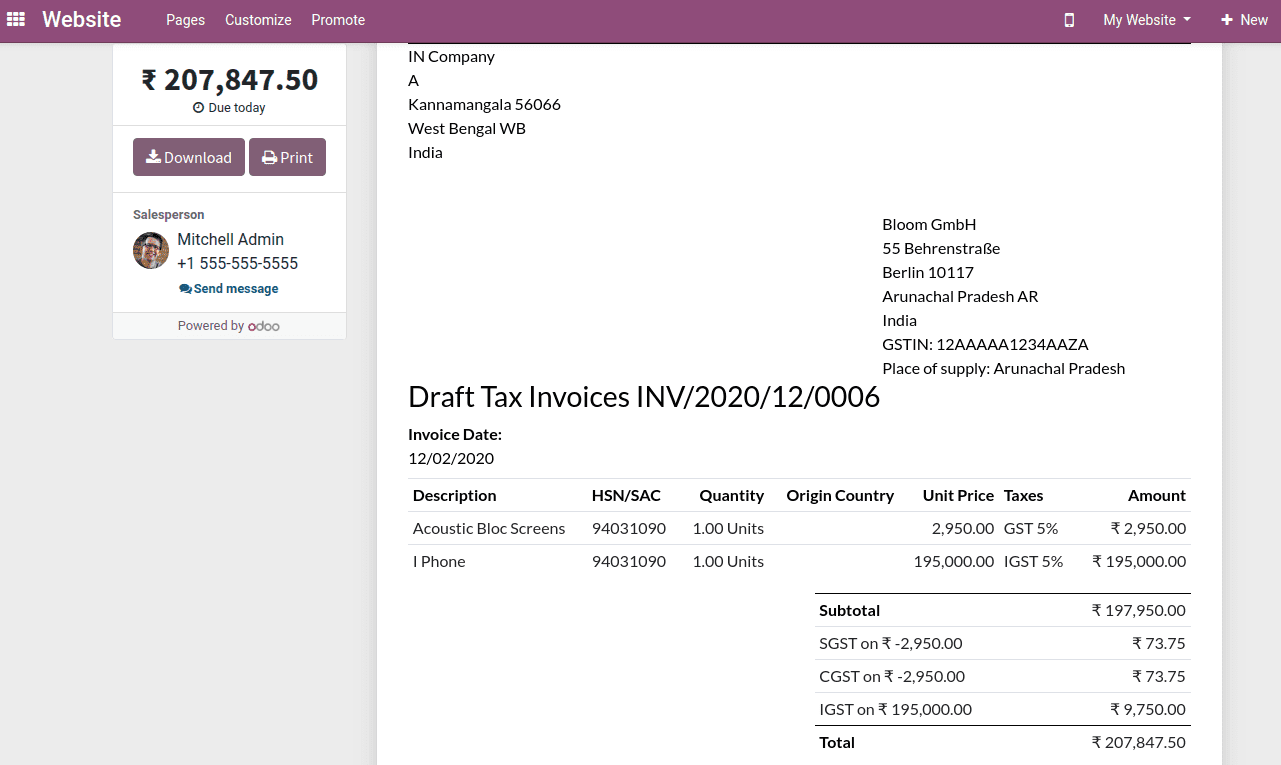

Now create an invoice and confirm. So the tax details can be viewed in the invoice.

In the customer preview also, the individual taxes are detailed.

You can also check How to Manage Indian GST in Odoo 13