The replacement of the existing tax system VAT by the Goods and Service Tax (GST ) was one of the finest movements by the government of India. The public still has confusion, doubts, and clarifications regarding the implementation and function of the GST. Most of the companies have already upgraded their ERP software and accounting system to accommodate the GST.

Three types of GST:

CGST: Central Goods and Service Tax

IGST: Integrated Goods and Service Tax

SGST: State Goods and Service Tax

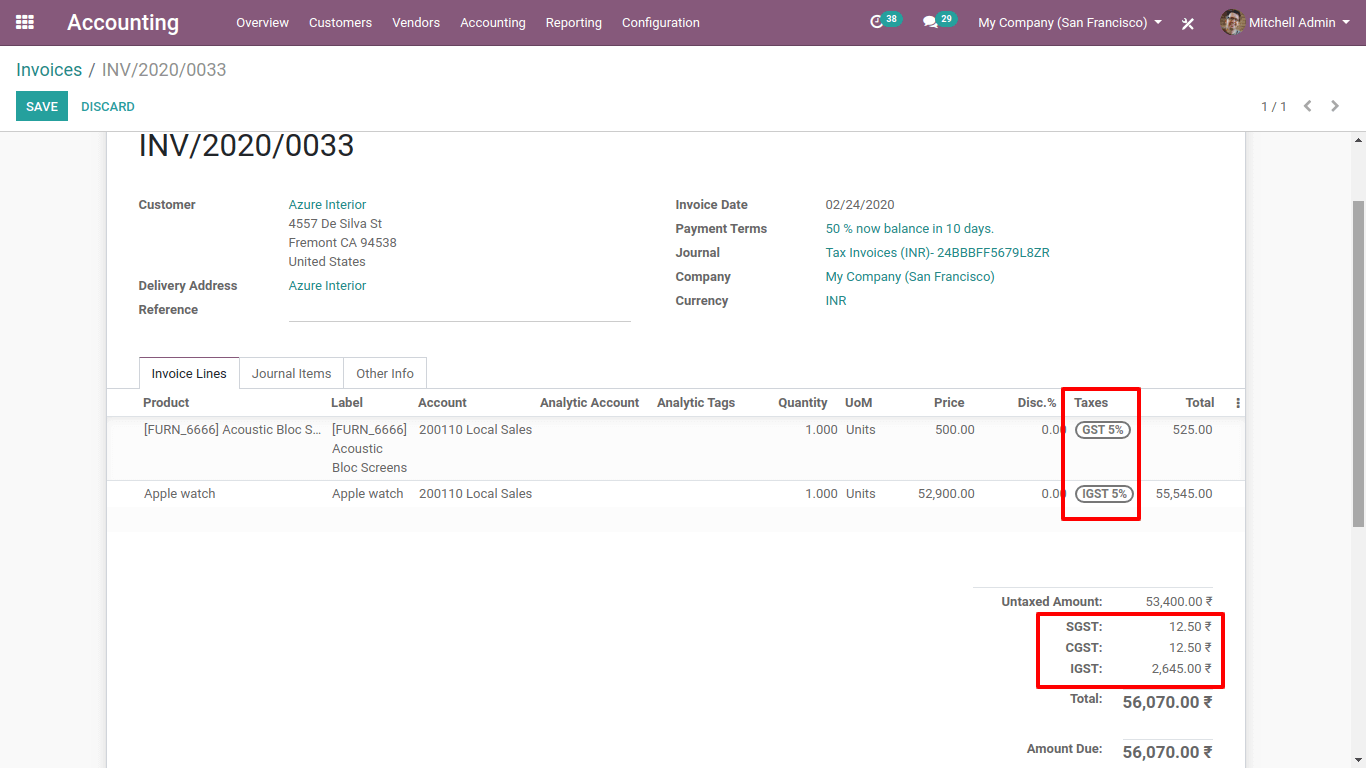

When we make a sale within a state, the tax is partitioned between State and Central governments, that is, CGST + SGST. Now when we make a sale to another state the tax goes to Central IGST.

Presently we have 6 GST slabs like, 0%, 3%, 5%, 12%, 18% and 28%.

Here we discuss the configuration of GST in Odoo

Odoo has a good and efficient system to manage taxes. Here we are able to manage different types of taxes. The configuration of GST is easy with Odoo.

First and foremost, we need to create these taxes.

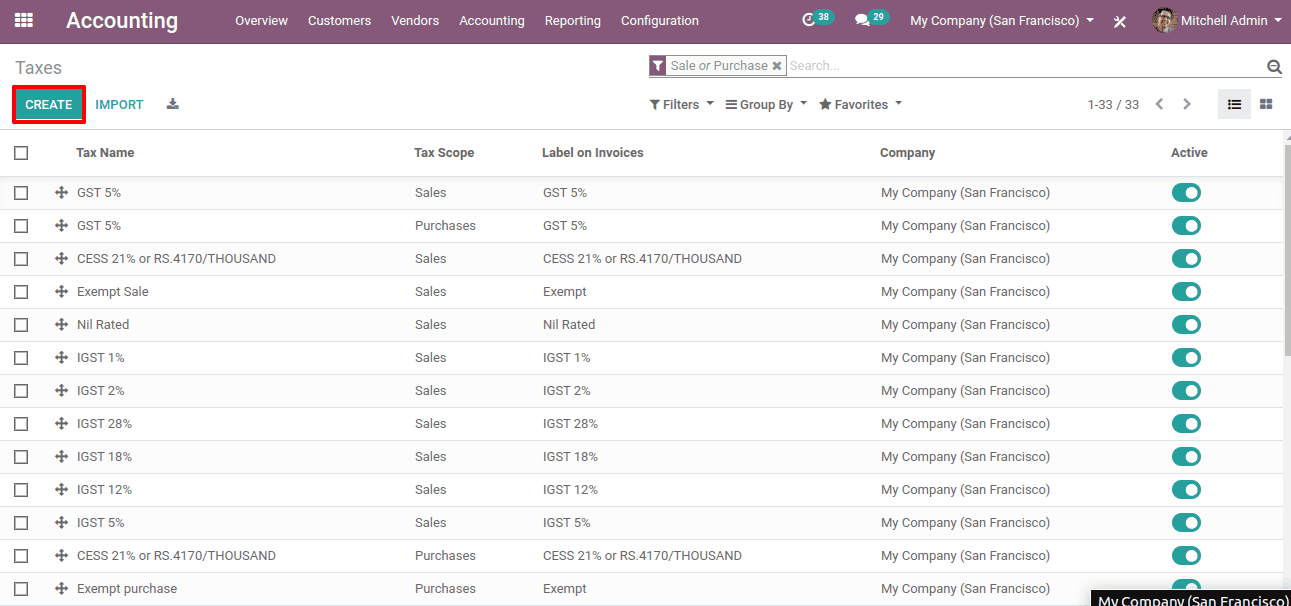

For that go to Accounting -> Configuration -> Invoicing -> Taxes

Click on the “Create” button to create a tax.

Here we shall create an intrastate sales tax, which means sales within a state. Here both SGST and CGST are applied.

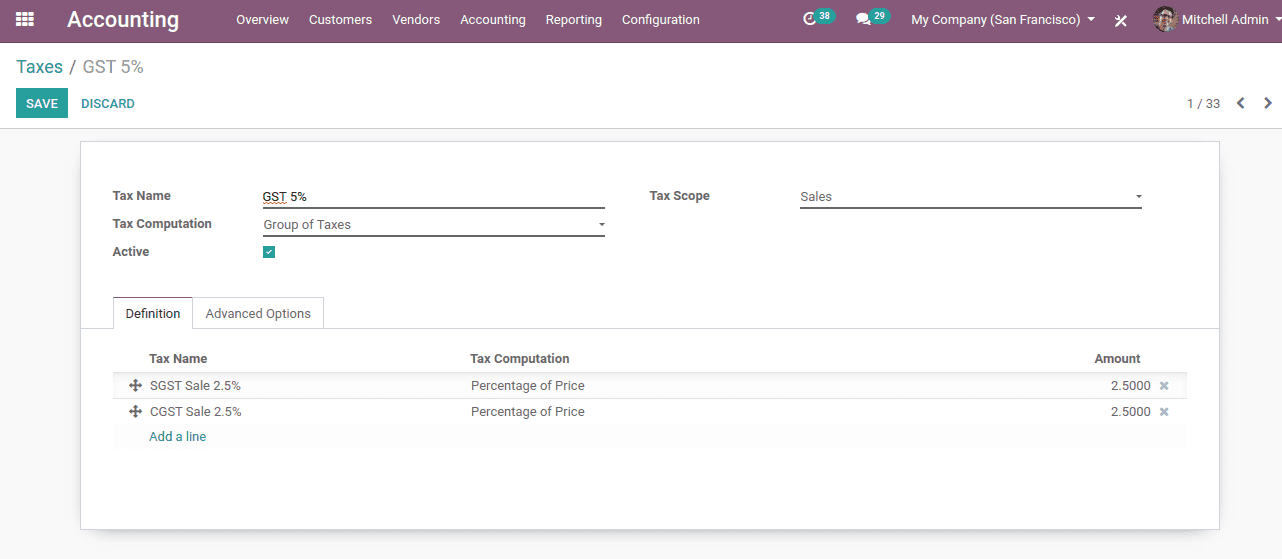

This is the form to create a tax.

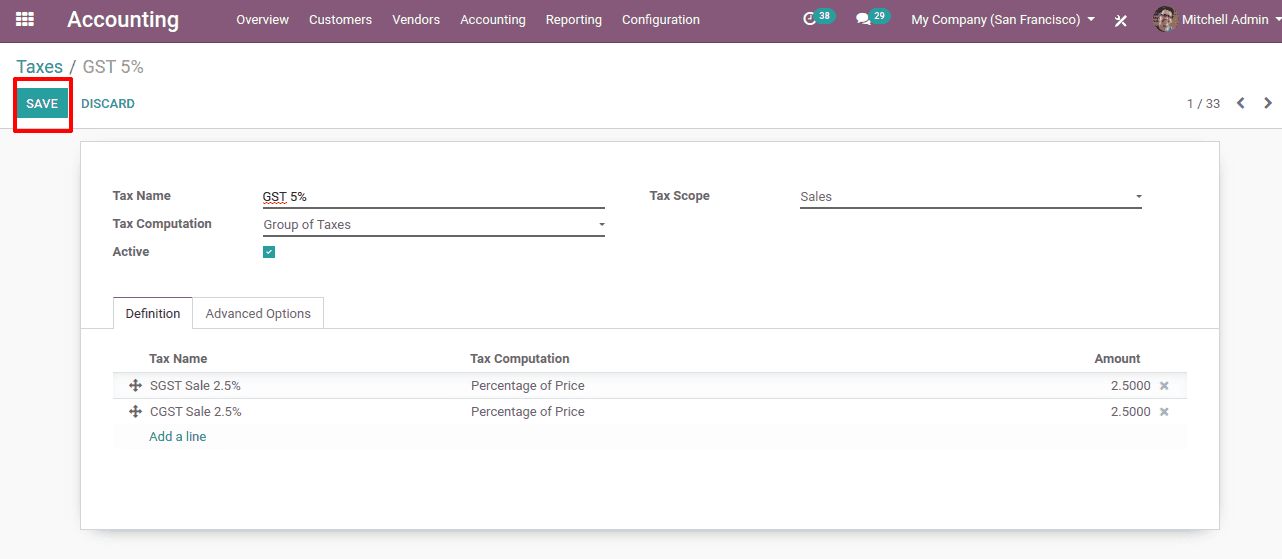

1. Here we created a tax called GST 5%

2. The Tax Scope is Sales

3. The Tax Computation is given ‘Group of Taxes’. And thereby we created the combination of two taxes of SGST 2.5% and CGST 2.5% by clicking on the “Add a line”.

So here we set the SGST and CGST as 2.5%, each as the children tax of the 5% GST.

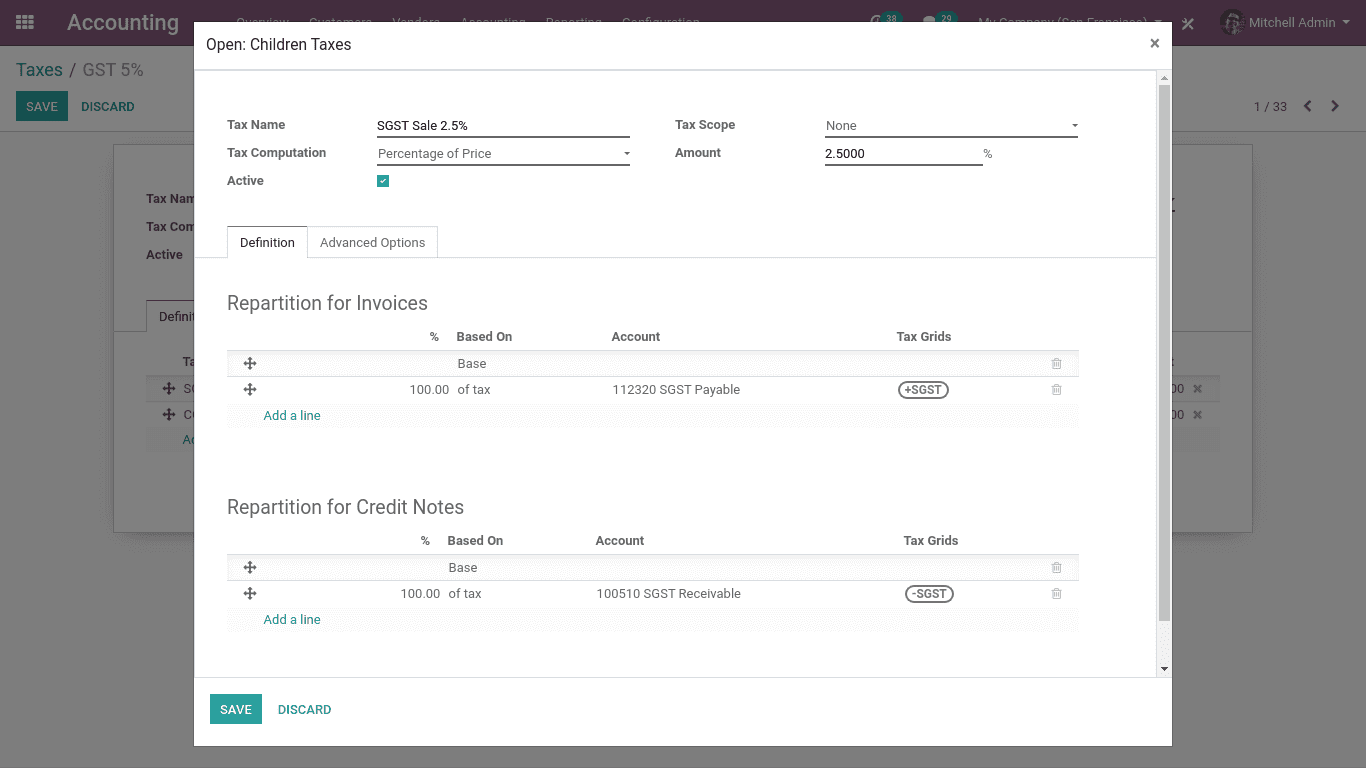

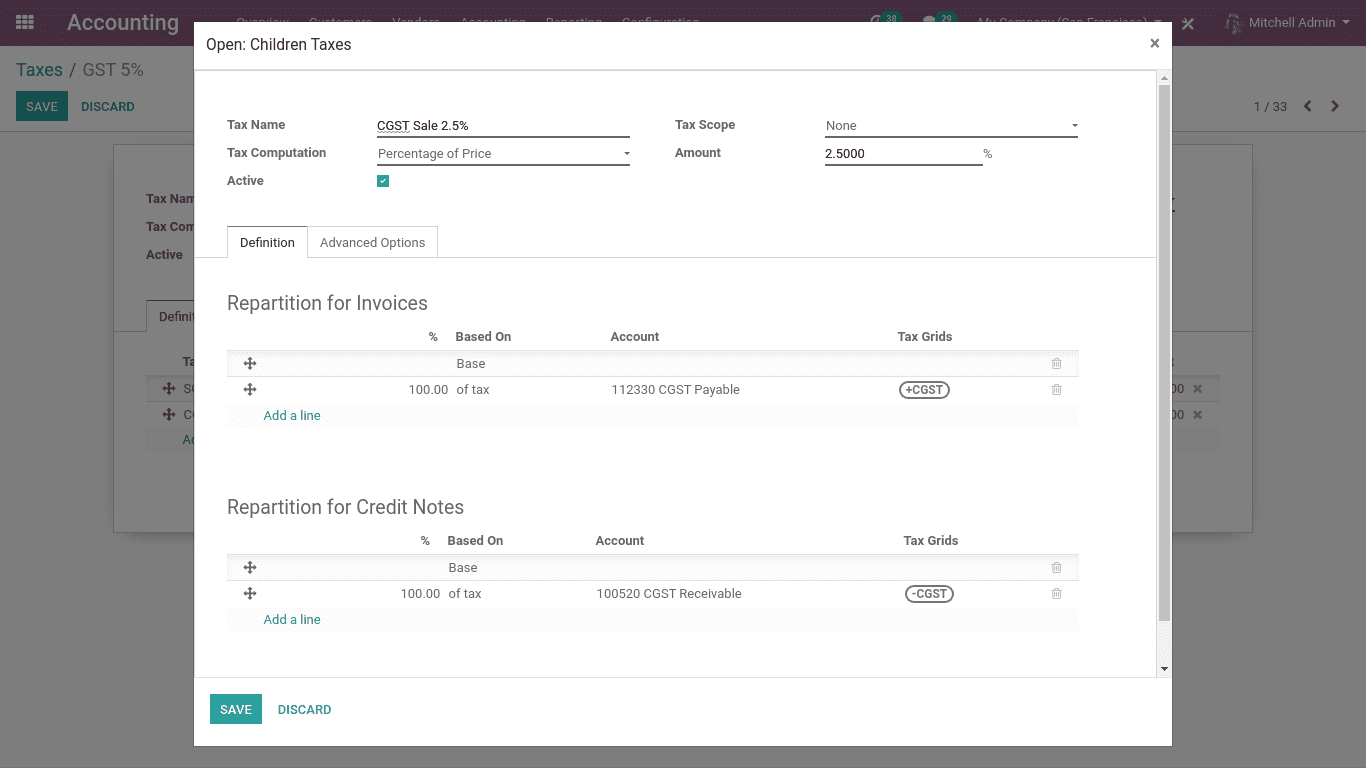

The above two figures are the configuration of SGST 2.5% and CGST 2.5% respectively.

Here when we created the children taxes the Tax Computation is ‘Percentage of Price’.

And the Amount is 2.5.

Now click on the “Save” button.

So here we have created a tax of GST 5%.

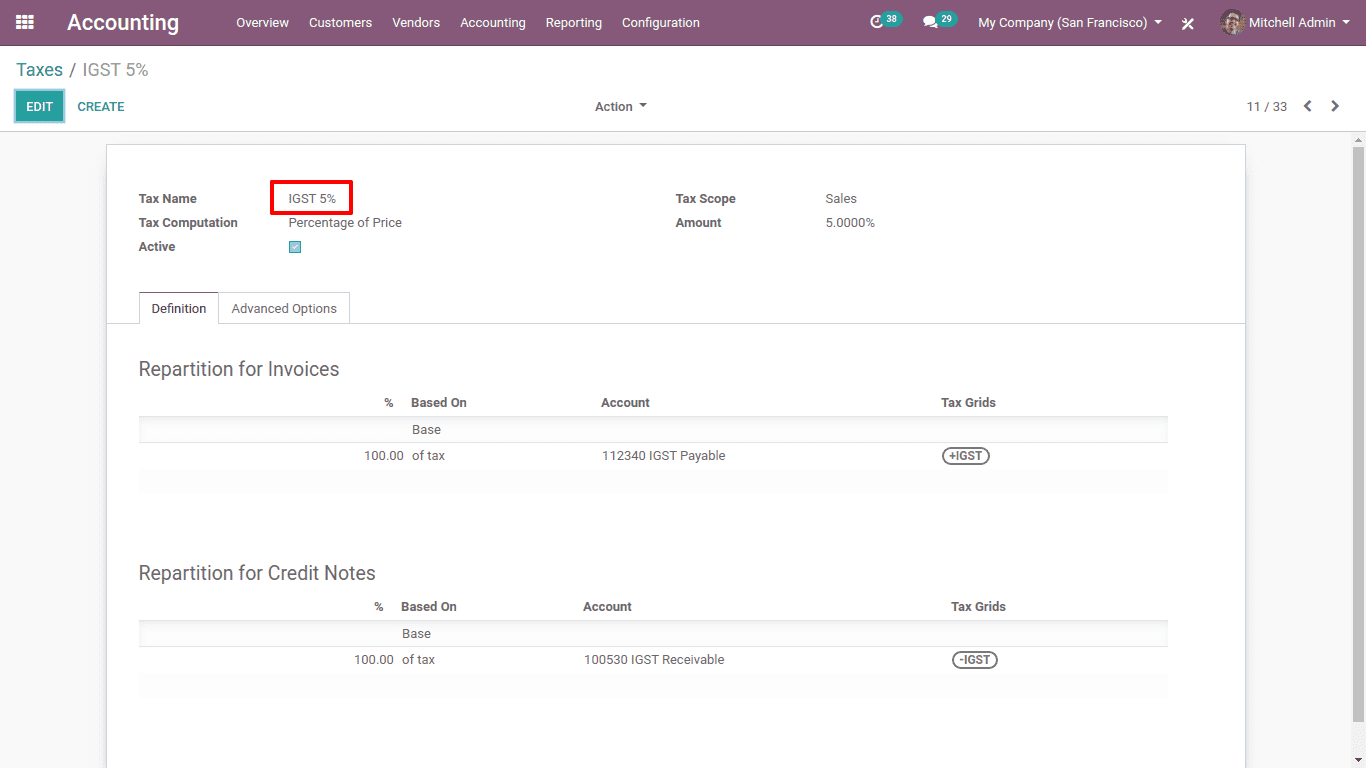

Now we shall create an interstate sales tax of GST 5%. And thereby the tax slab is IGST 5%.

So here, we have created the IGST 5% tax.

Likewise, we can create all the taxes that are needed for the business.

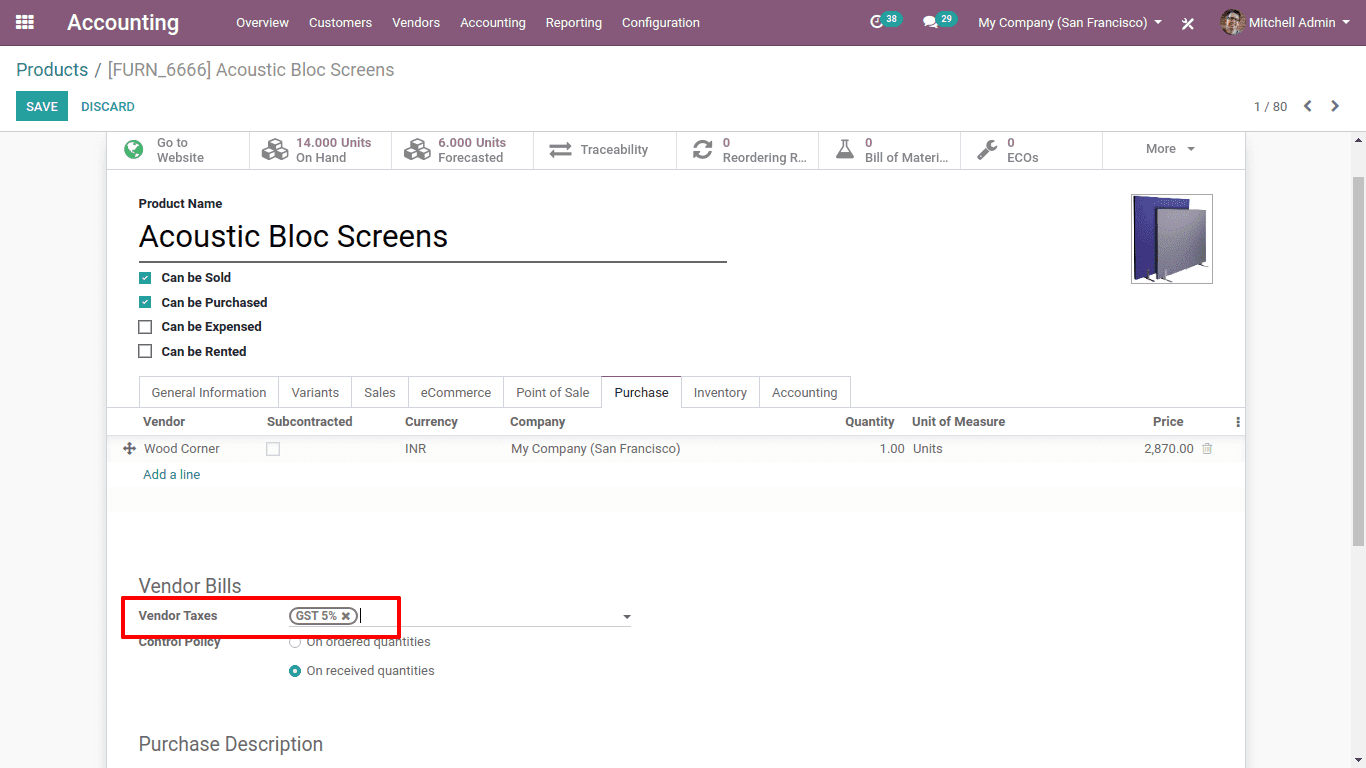

Now we shall use these taxes during sales and purchase.

It is to be noted that, the GST 5% is used when most of the customers belong to the same state. Otherwise, we use IGST.

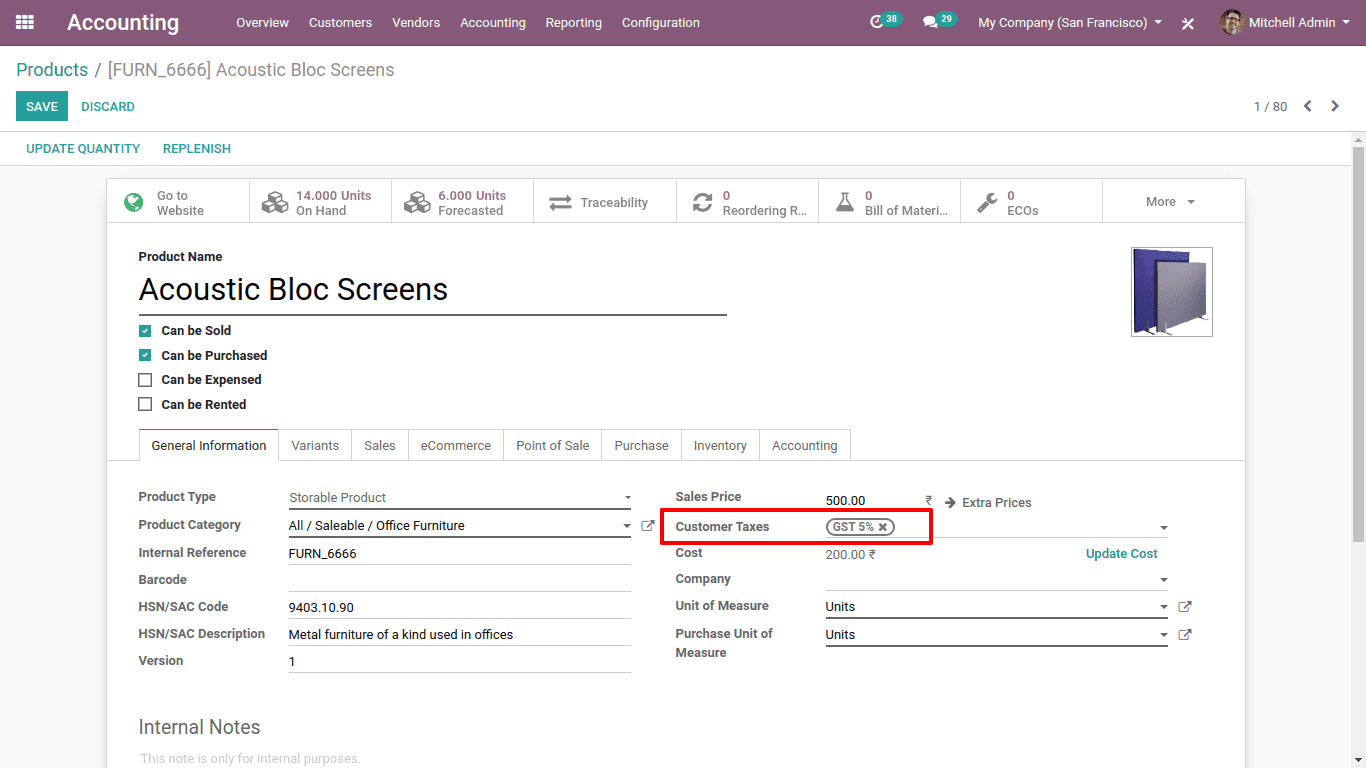

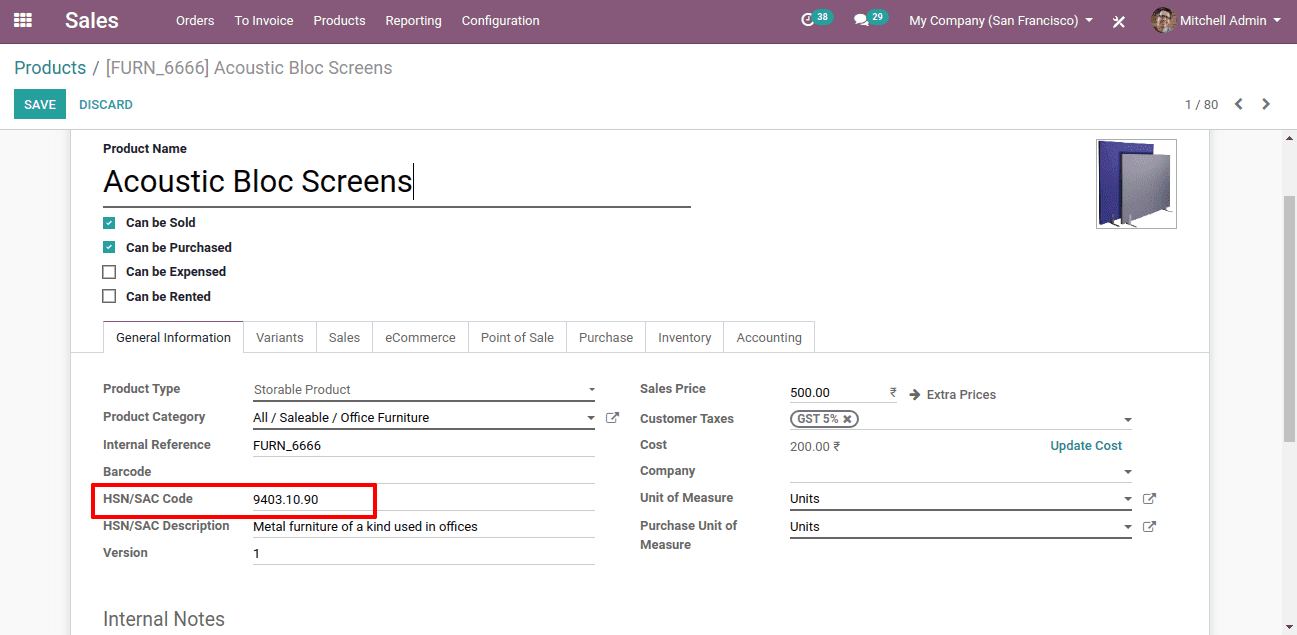

We are able to set these taxes to a product during its creation. Then, when we add the product to the invoice line the tax will be automatically mapped it.

So the taxes have been configured.

Now let’s look at the GST in the invoice.

In the computation of GST, receiving and issuing of invoices are of great importance. Without an invoice, no one can claim the input tax credit.

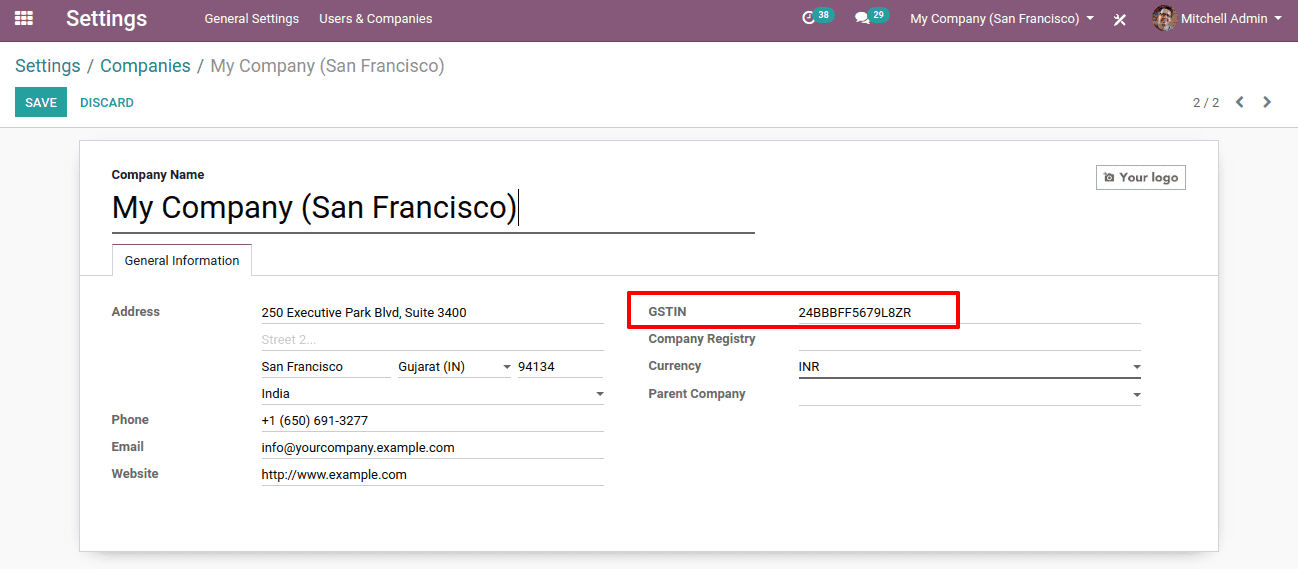

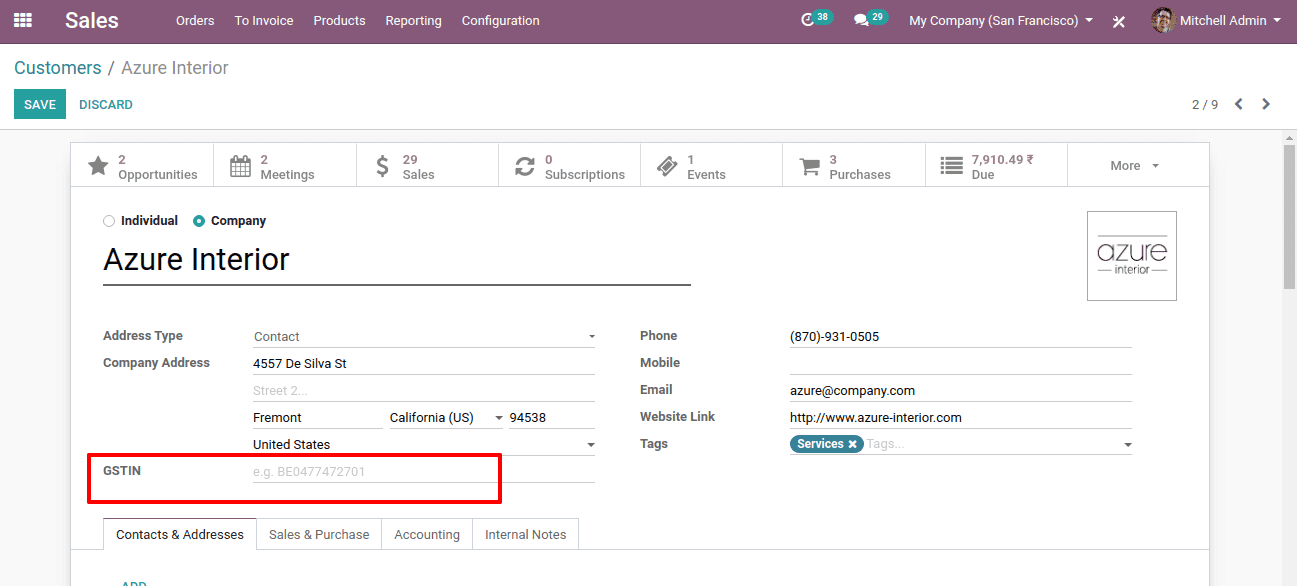

Before receiving and issuing invoices the company and the partner or the customer GSTIN details must be mentioned.

This is the GSTIN details of My Company (San Francisco)

Here we shall mention GSTIN details of the Customer.

Also, we have to mention the HSN details of the products.

So we have configured all the necessary details for a GST invoice.

Now we shall create an invoice.

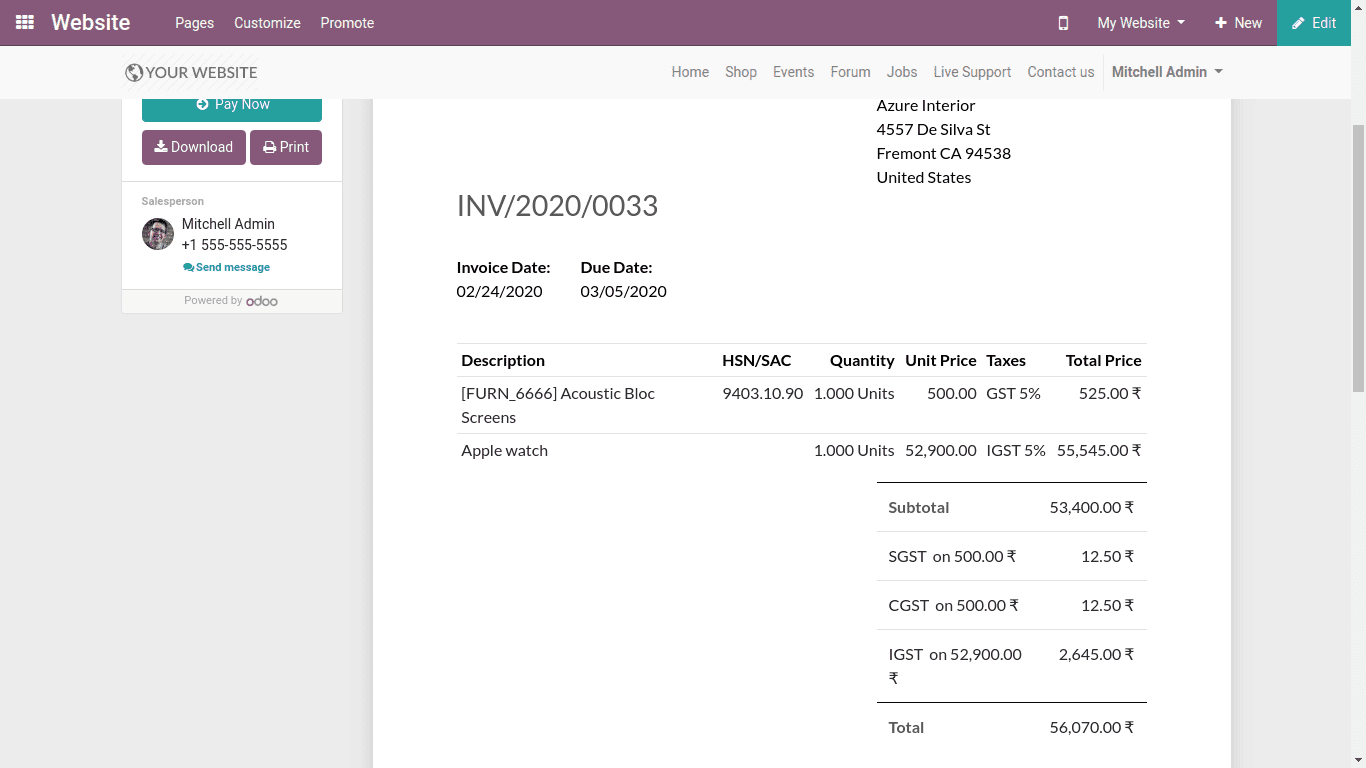

So here we can see the details of GST in the invoice.

Here we can see the customer preview of the invoice. There we can see the GST details of the customer.

Therefore, this is all about the configuration of GST in Odoo 13.