The tax paid to a government body for selling certain services and commodities is referred to as a Sales tax. Most sales tax is applied to the cost of goods/services at retail stores in the US, and it varies based on locality. Around 45 states in the US cover the sale taxes, and five states are excluded from it. Consumers must pay the local or state tax rate when buying or purchasing products. Arizona adopted a general state transaction privilege tax in 1993, and the rate has enriched to 5.6%. Using the Odoo ERP software, we can compute sales tax according to a particular state in a country. Odoo 16 Accounting module assist users in specifying tax rate and apply on customer invoices.

This blog emphasizes the steps to generate Arizona Sales Tax within Odoo 16 Accounting.

The accounting application in Odoo 16 is beneficial for managing taxes, bills, invoices, payments, and more for customers. Users can set the US company information and apply specific taxes as per their state in Odoo 16 Accounting. Let’s see the process to generate Sales tax for a company in Arizona(US) within the Odoo 16.

Arizona (US) Sales Tax Information for Users

Most services in Arizona are untaxable and tangible products are taxable under a few exceptions for medicine, groceries, etc. The state of Arizona’s Revenu Department helps to register sales tax permits for individuals. Before registering for a sales tax permit, you must take care of some necessary details. It includes ownership type, physical business location, legal business name, employee information, Identification number, and more.

Recently, the sales tax rate in Arizona has been 5.6%. It can be high as 11.2% depending on the local municipalities. Arizona transaction privilege tax(TPT) is a tax applied on a vendor for dealing business in Arizona, also referred to as a Sales tax. A business owner acts as an agent of Arizona state for collecting TPT from purchasers and pass to the revenue department. According to different localities, the combined TPT rates in Arizona range from 5.6 to 11.2 percent. Failure to apply the sales tax leads to interest charges and penalties for owners.

Set your Arizona(US) Company Information in Odoo 16

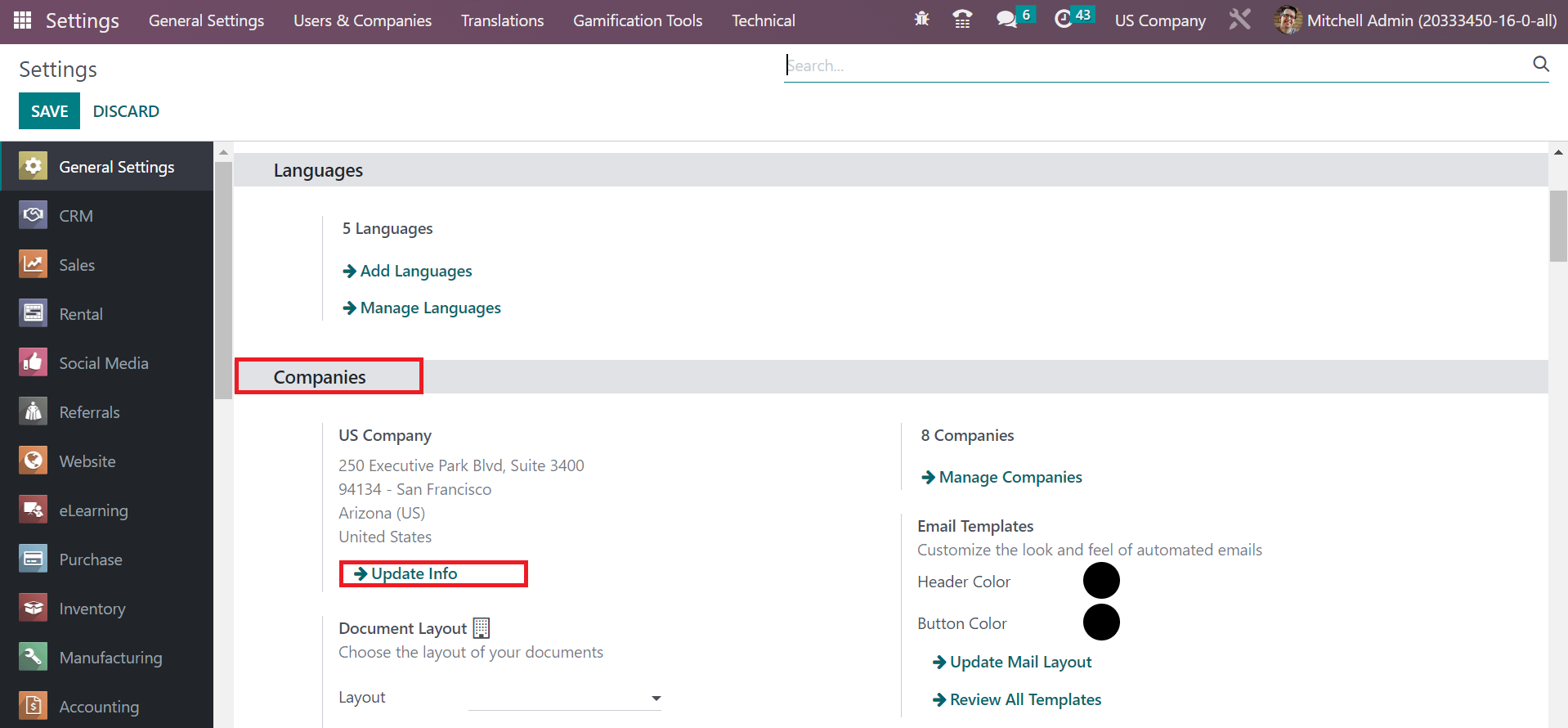

To add the company details, select the General Settings tab in Odoo 16. Click the Update Info option under the Companies section on the Settings page, as cited in the screenshot below.

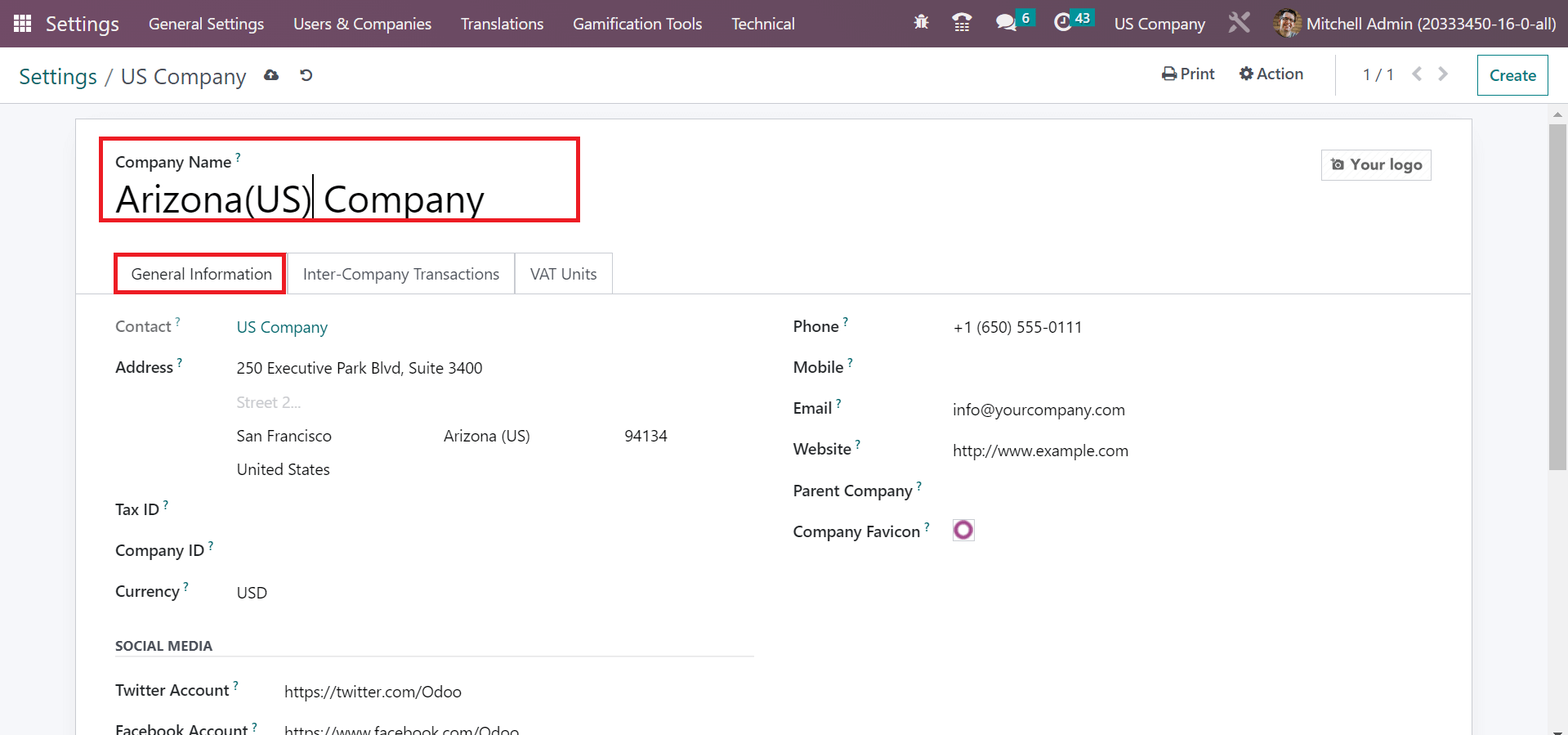

Mention the Company Name as Arizona(US) in the open window. Moreover, you can apply more details of the company below the General Information tab, as pointed out in the screenshot below.

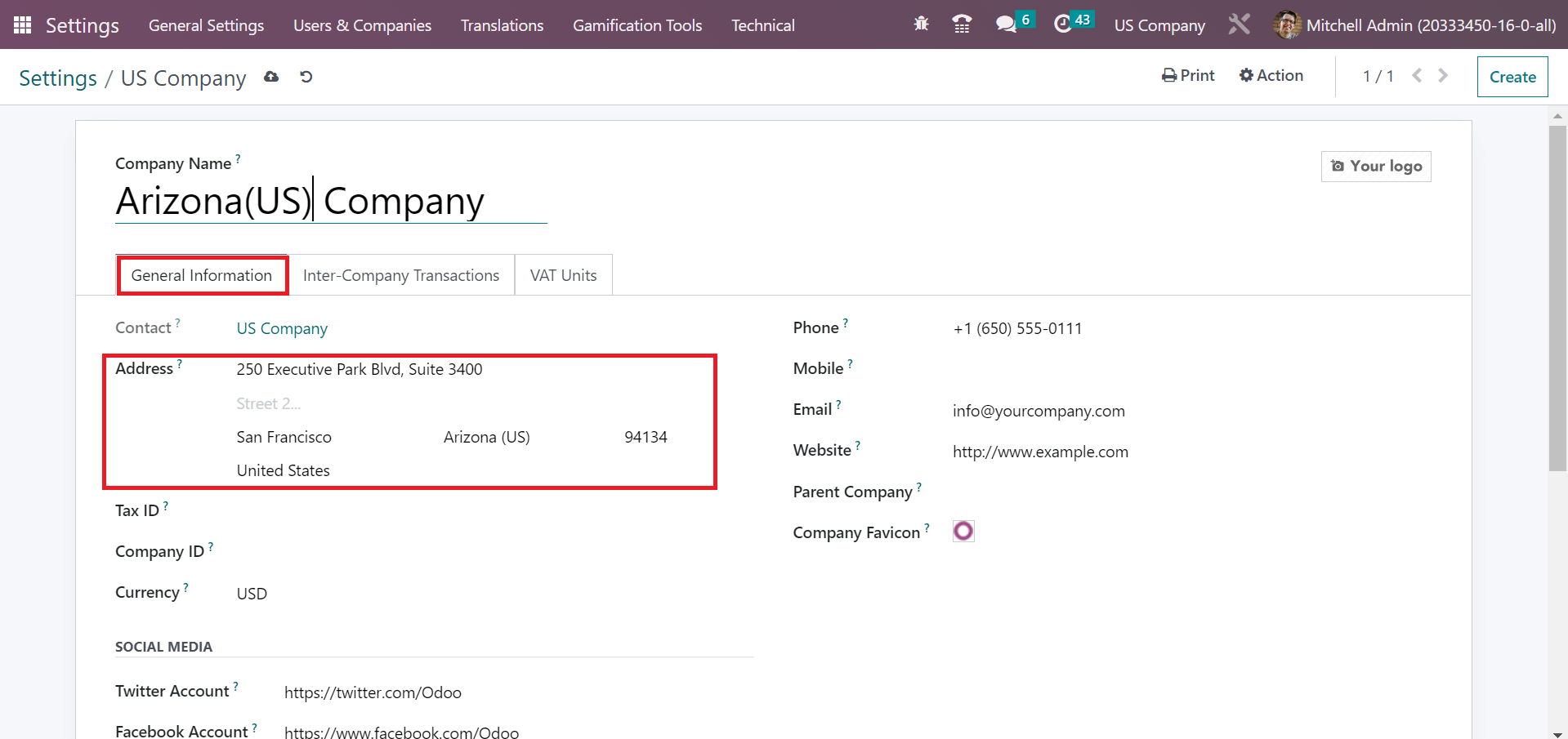

In the Address field, add the state name as Arizona(US) and choose the Country as US. Users can also apply the street address and pin code within the Address field, as depicted in the screenshot below.

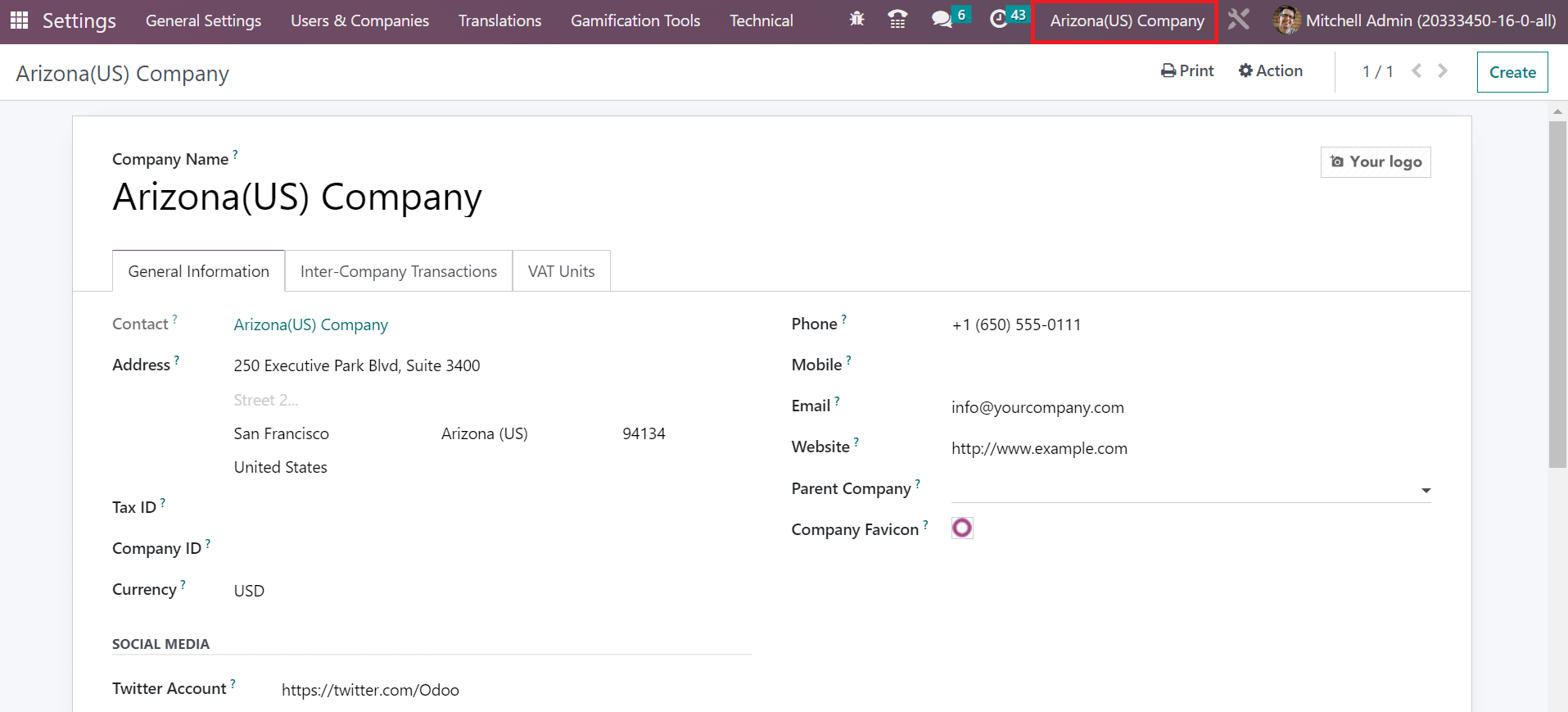

Your added details are saved spontaneously, and you can view the Company Name as Arizona(US) at the top bar of Odoo 16.

To Formulate Arizona Sales Tax in the Odoo 16 Accounting

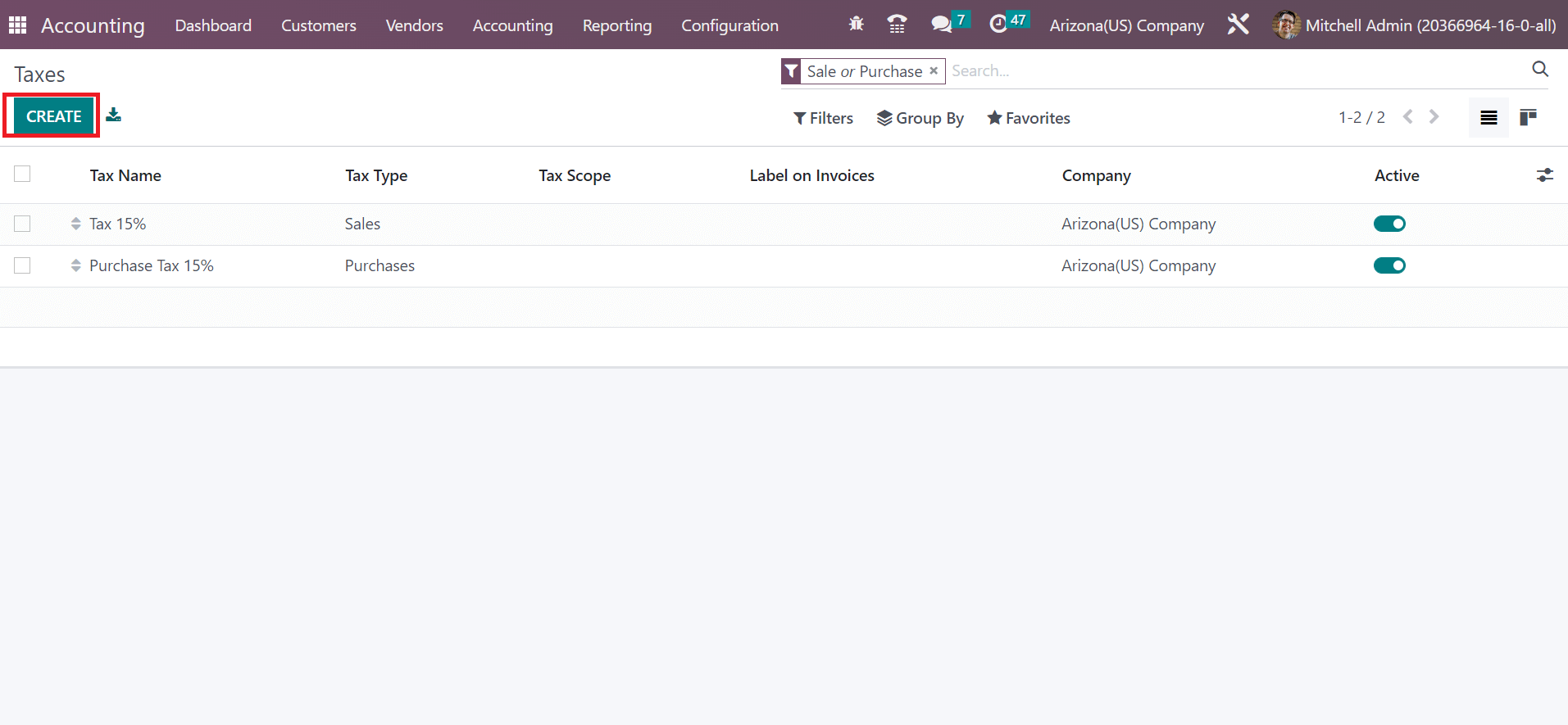

As mentioned before, the sales tax of Arizona is considered as 5.6%. To apply this tax, choose the Taxes menu within the Configuration tab of Odoo 16 Accounting. Users can get the list of all taxes within the Taxes window and click the CREATE button to generate a new tax for Arizona, as presented in the screenshot below.

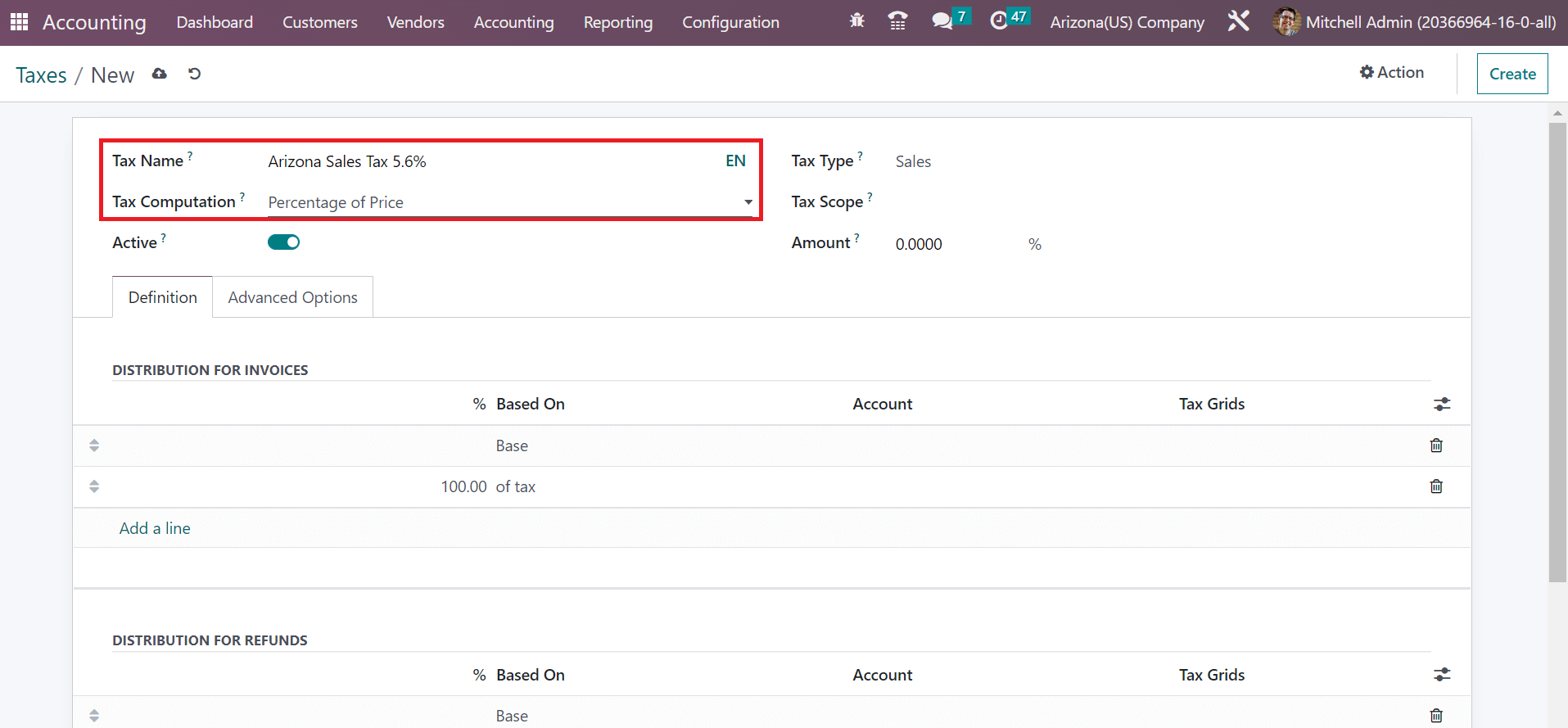

In the new window, enter the Tax Name as Arizona Sales Tax 5.6%, which displays for backend users. Tax computation is made possible through several ways, including Group of Taxes, Python Code, Fixed, and more. Choose Percentage of Price inside the Tax Computation field, as mentioned in the screenshot below.

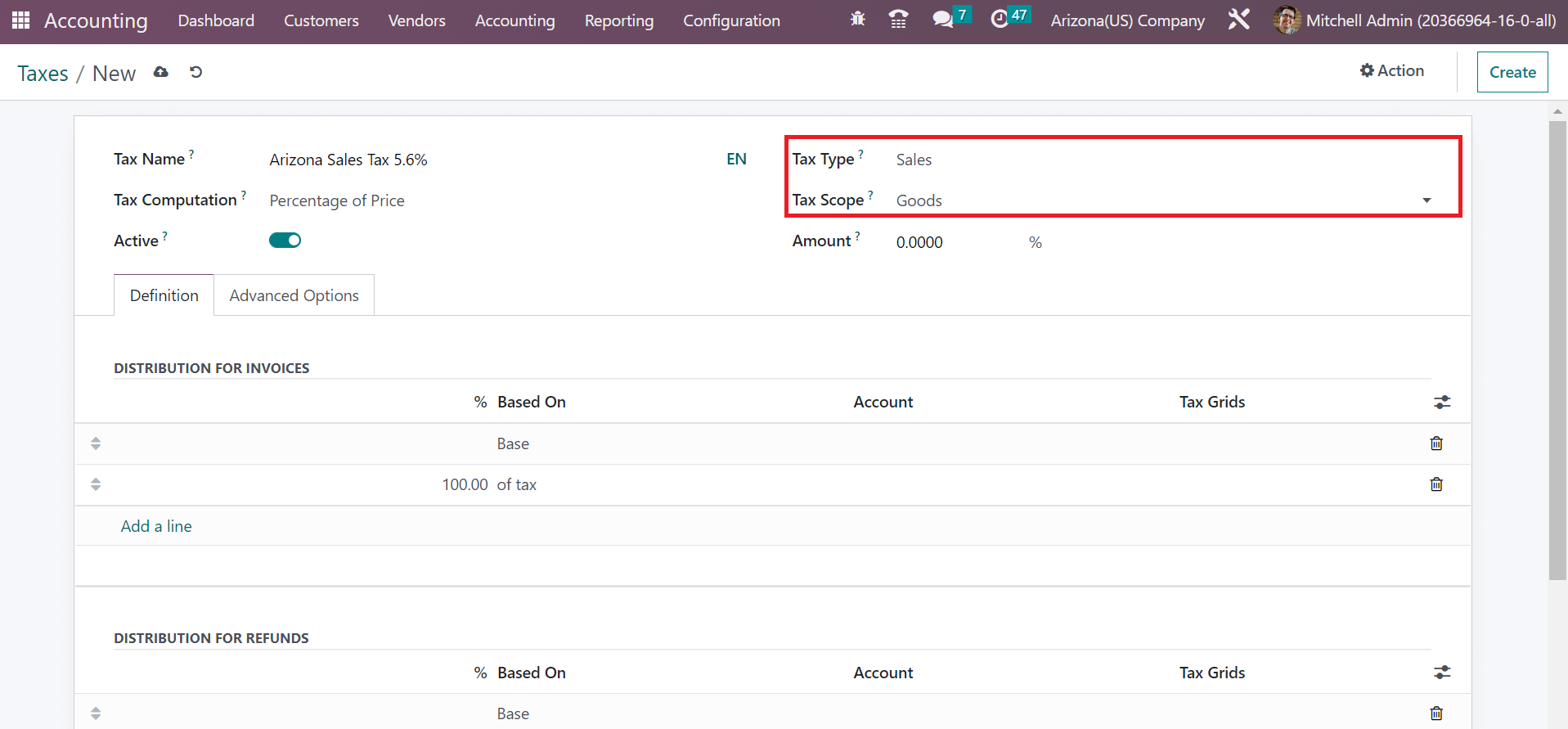

By selecting the Percentage of Price option, we can compute tax by multiplying the tax percentage by the sales price. Tax Type shows where the tax is selectable and divided into Sales, None, etc. Users can pick the Sales option as Tax Type for your Arizona Sales Tax 5.6%, as described in the screenshot below.

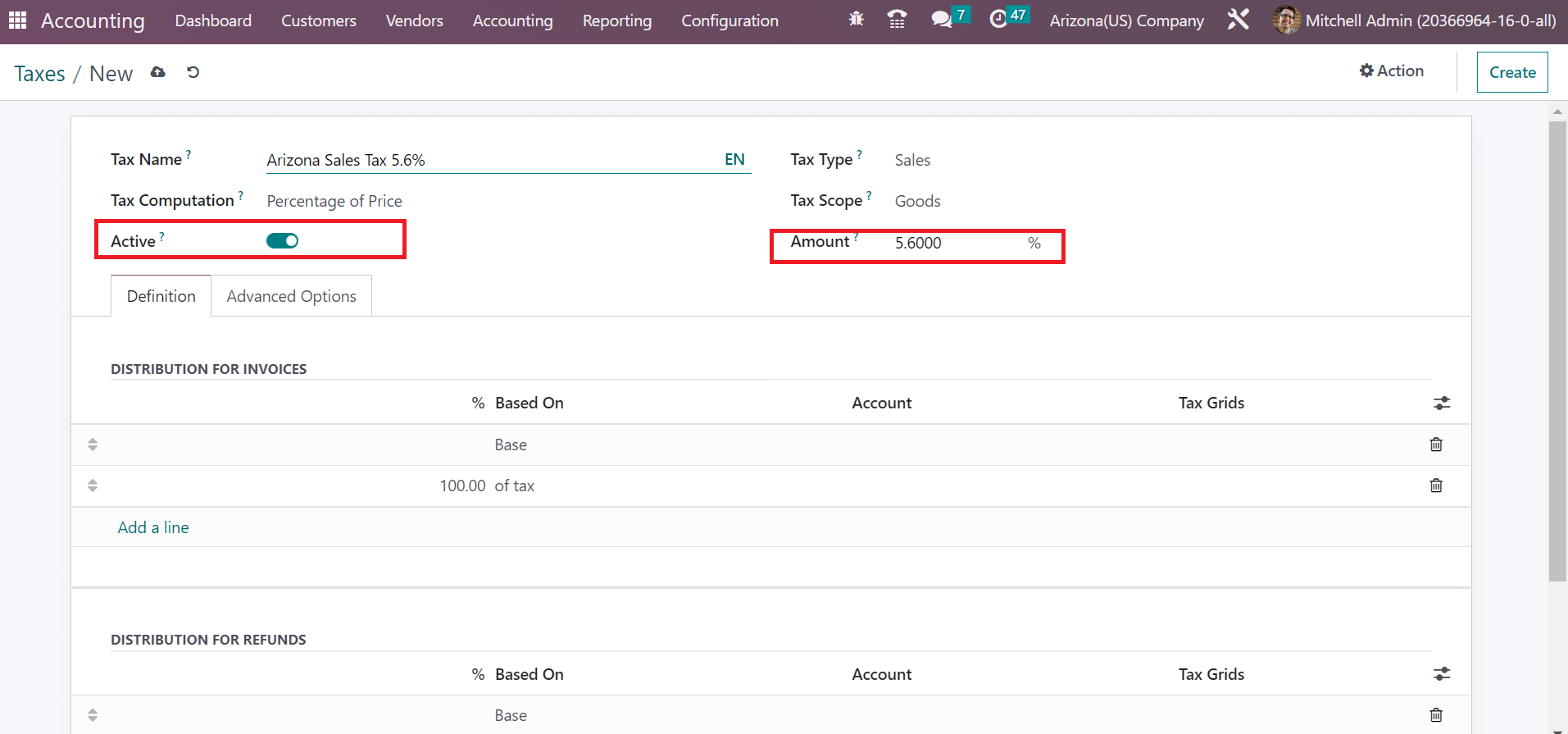

The Tax Scope is described for Goods and Services. Selecting a particular tax scope makes it possible to restrict tax use on the chosen items. We specify the Goods option within the Tax Scope field, as pointed out in the screenshot above. Later, mention the percentage of your tax in the Amount field and enable the Active option, as illustrated in the screenshot below.

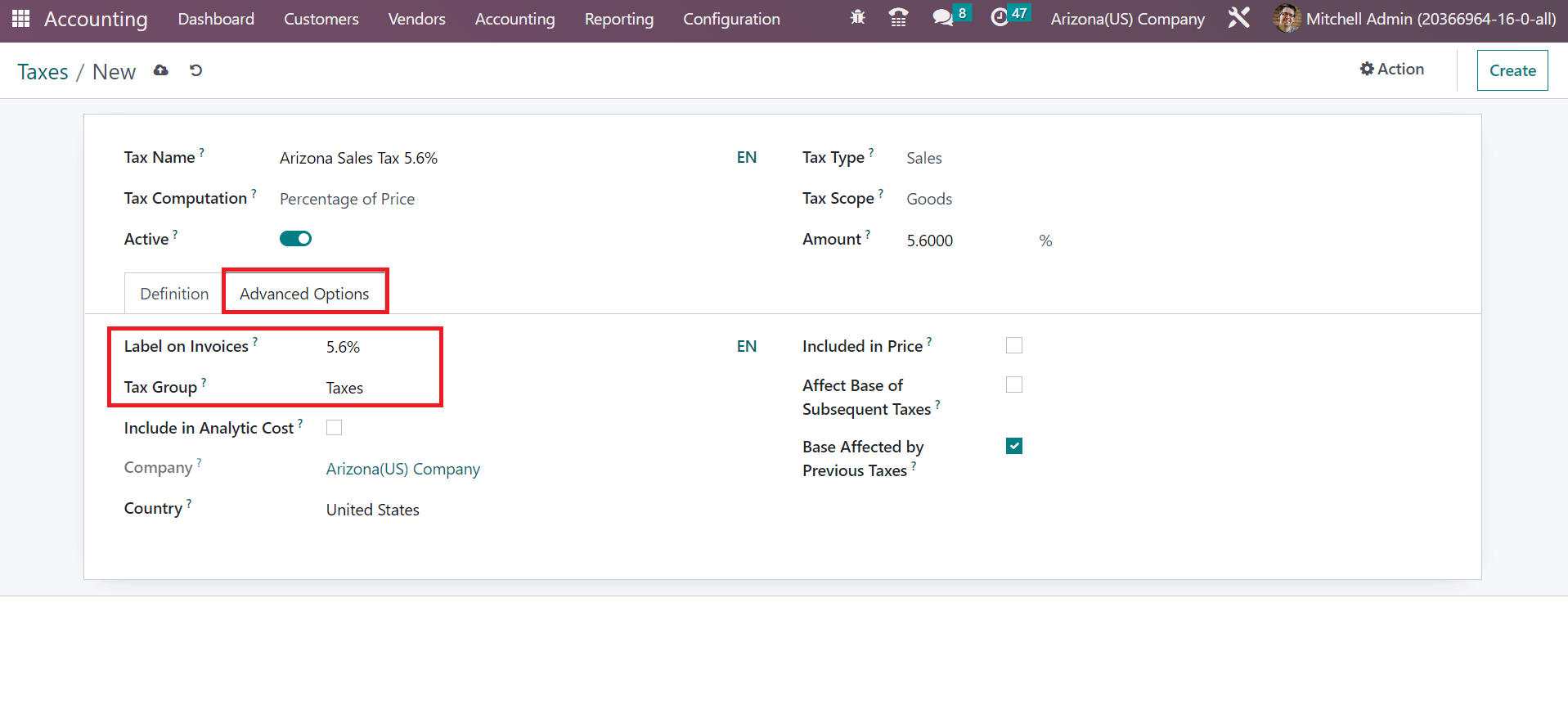

Below the Advanced Options, the user can apply the tax label displayed on the invoice line within the Label on Invoice field. Also, choose the group to which your tax belongs in the Tax Group field, as shown in the screenshot below.

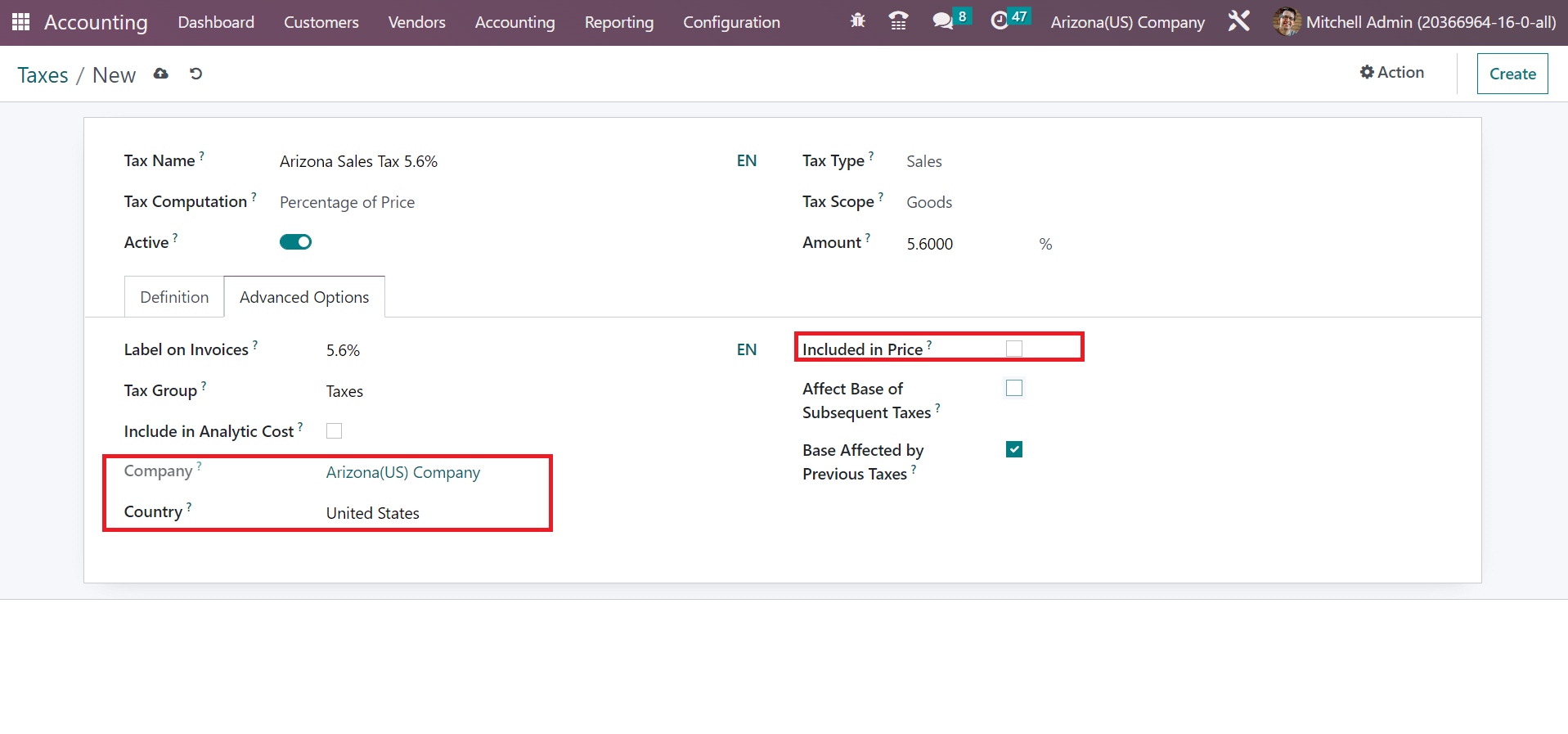

The information about your Company and Country is also accessible inside the Advanced Options tab. Furthermore, the sales price becomes equal to the total tax amount after activtaing the Included in Price option.

The information related to your added tax is saved automatically. Next, we can specify the created tax on a customer invoice in the Odoo 16.

How to Add Arizona(US) Sales Tax on Customer Invoice?

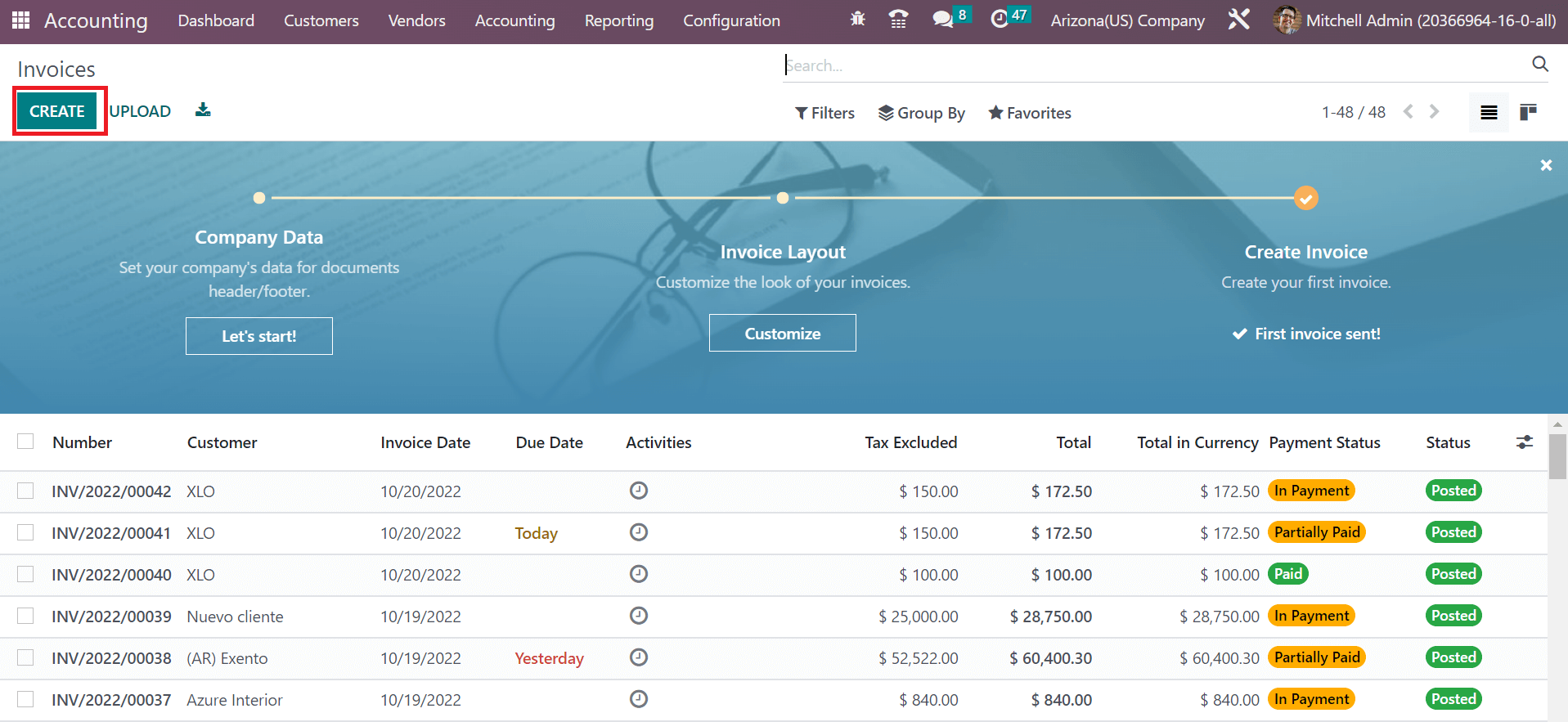

Odoo ERP software assists users in applying different formats of tax in a customer invoice. You can obtain the Invoices menu within the Customers tab to develop an invoice. In the List view, the user can acquire details of each invoice separately and click the CREATE button to produce a new one.

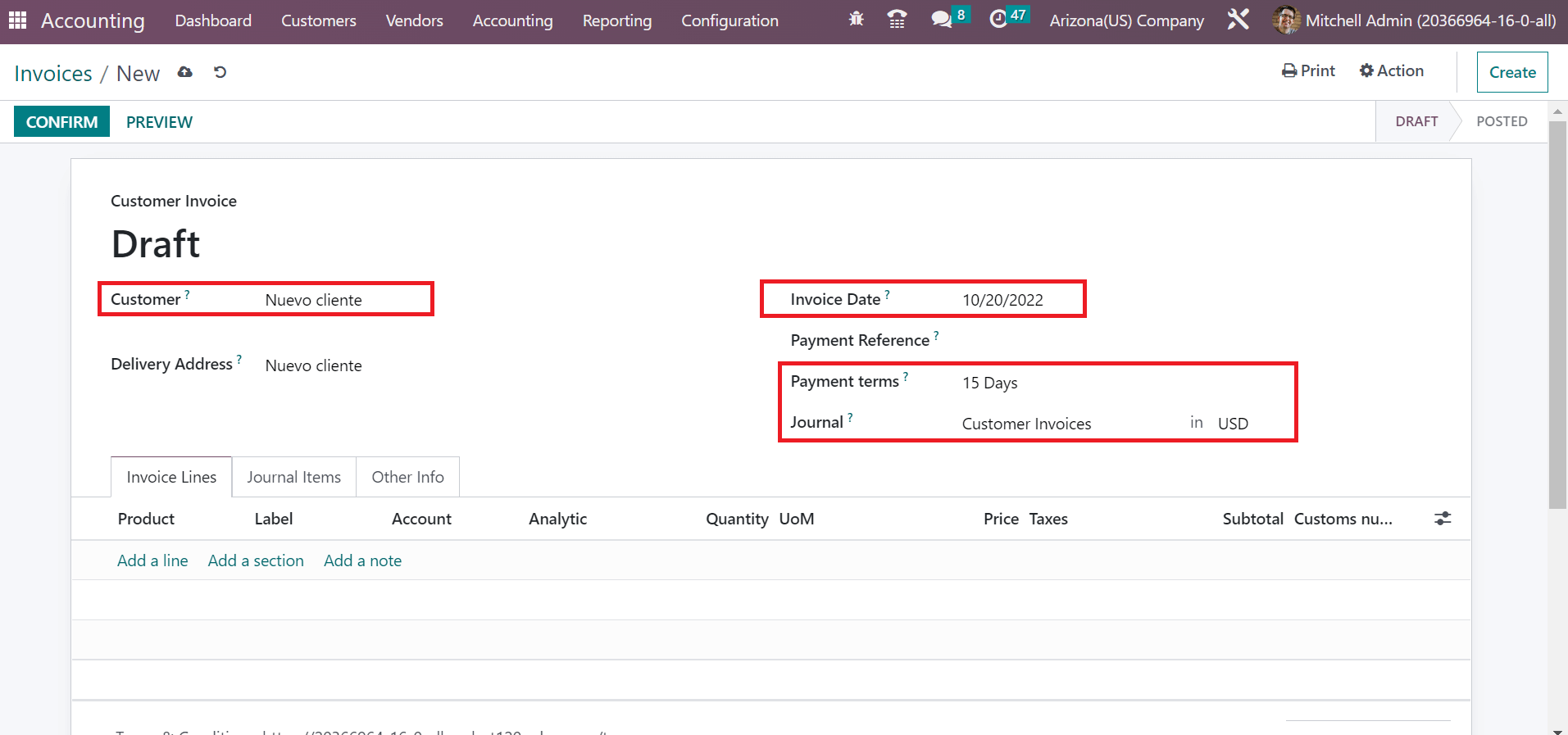

Select the details of a partner in the Customer field and set the start date in the Invoice Date option. Next, you can set invoice payment terms in the Payment Terms field. The payment terms occur in various methods, such as immediate payment, 15 days, one month, and more. We selected Immediate Payment for the customer invoice, as indicated in the screenshot below.

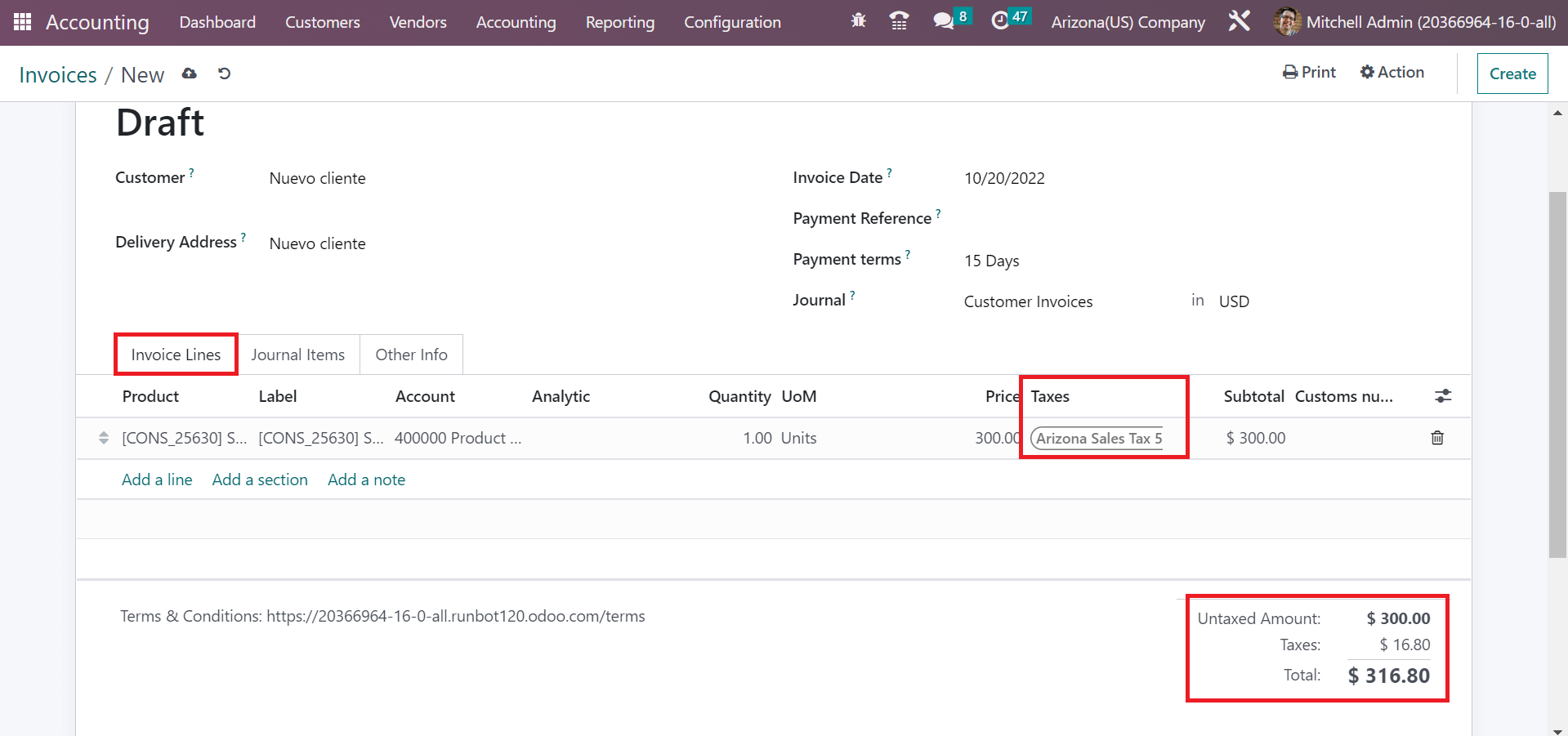

As shown in the screenshot above, select a specific journal related to the invoice and currency in the Journal field. To mention the items for customers, click the Add a line option below the Invoice Lines tab. Choose your product in the open space, and you can apply the created Arizona sales tax of 5.6% in the Taxes section

Here, we can identify the total cost for a product, including the tax price at the right end. So, it is easy to produce customer invoices according to particular sales tax in a state within the Odoo ERP.

Tax application on a product line in a customer invoice based on a specific state becomes an easy task for a company by imparting an Odoo ERP. The Accounting application of Odoo 16 helps configure the tax of any state in the United States. It assists in improvising business productivity in tax computation of sales in a firm. Check out the given below link to know more about Alabama(US) sales tax settings In Odoo 16.