Tax charged to consumers as per price of services or goods refers to a sales tax in the US. One of the indispensable authorship of income for the US government is revenues from sales tax rates. Most states charge taxes to facilitate revenue once you purchase services or products. Few states exempt sales taxes for foods and other items. The tracking of sales tax from shoppers is important to retail entrepreneurship. Based on a recurring basis, they must pay the tax amount to the state government later. Management of several tax rates is the most demanding task for an organization. A firm can configure different taxes by utilizing the Odoo 16 Accounting app.

This blog specifies Kentucky(US) Tax Rate Management in the Odoo 16 Accounting module.

Configuration of taxes becomes simple using the Odoo 16 Accounting application. Additionally, user can follow-up reports, employee expenses, reconciliation models, and more in Odoo 16. Next, let’s view how to manage the tax rate of Kentucky(US).

Brief of Kentucky(US) Sales Tax

6% of states’ sales tax exists in Kentucky(US), and local sales tax is not relying on this state. This tax is levied on the maximum price of goods and services sold at retail. A sales tax nexus is necessary to collect taxes in Kentucky. We can view some exceptions on farm equipment, prescription medicine, and construction equipment. It is easy to register for a Kentucky sales tax license through the Kentucky Business portal online. Information required for registration includes ownership type, business name, social security number, account number, and effective dates.

To Generate Kentucky(US) Company Details in Odoo 16

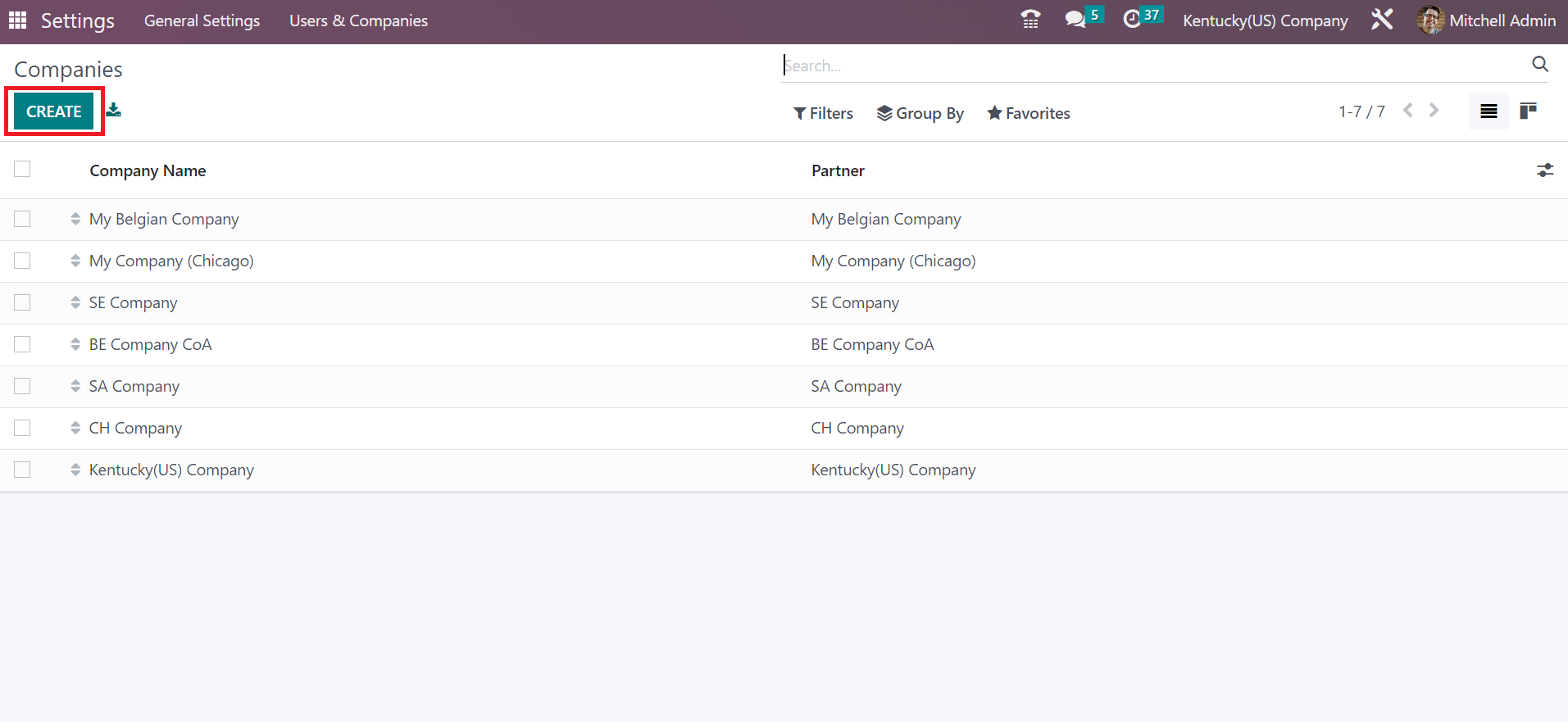

Users can update the company details from the Odoo 16 Settings. From the Settings window, you will get the Companies menu from the Users & Companies tab. A Company Name and Partner list are acquirable to you in the Companies window. By picking the CREATE icon, we can compose new firm information in Odoo.

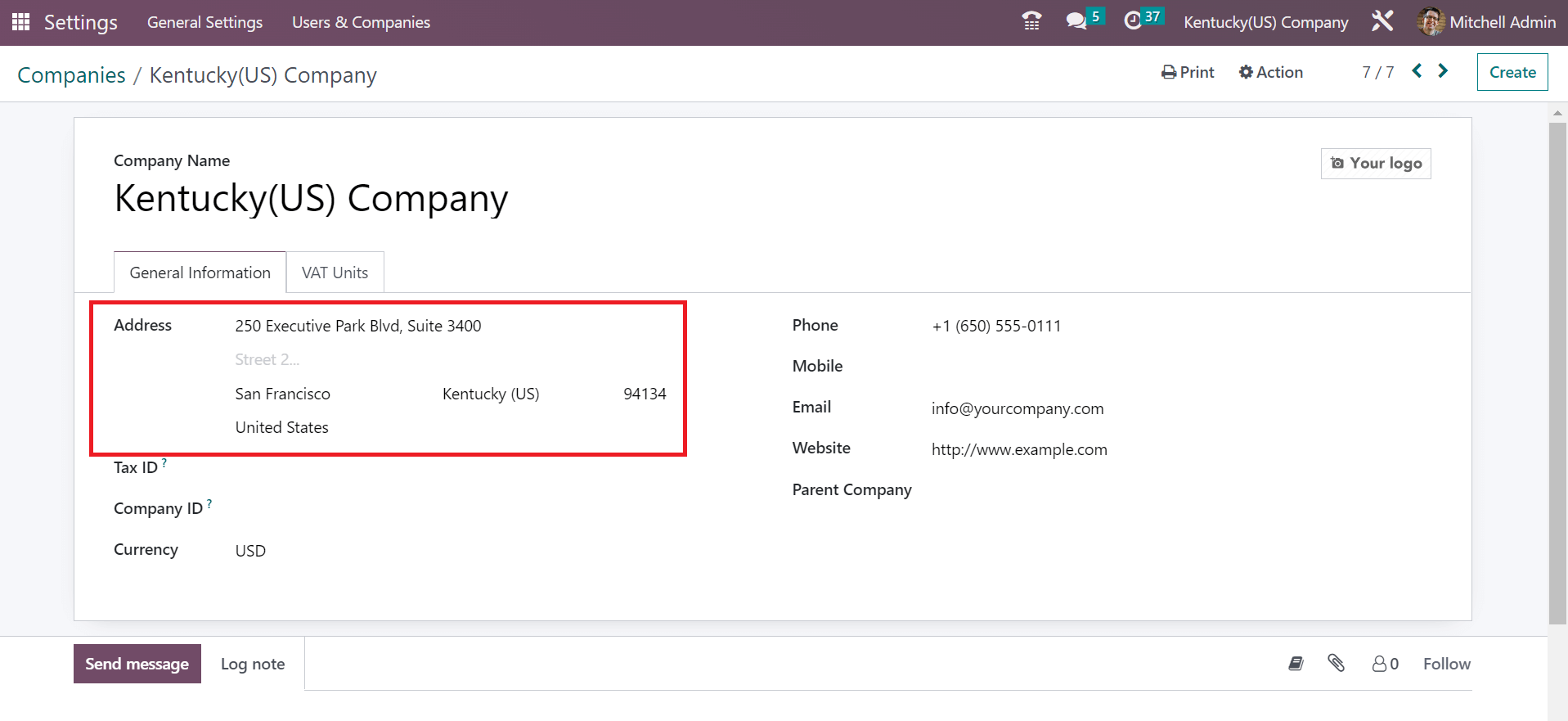

In the Companies window, add Kentucky(US) Company in the Company Name. Later, specify the description of your company under the General Information section, as specified in the screenshot below.

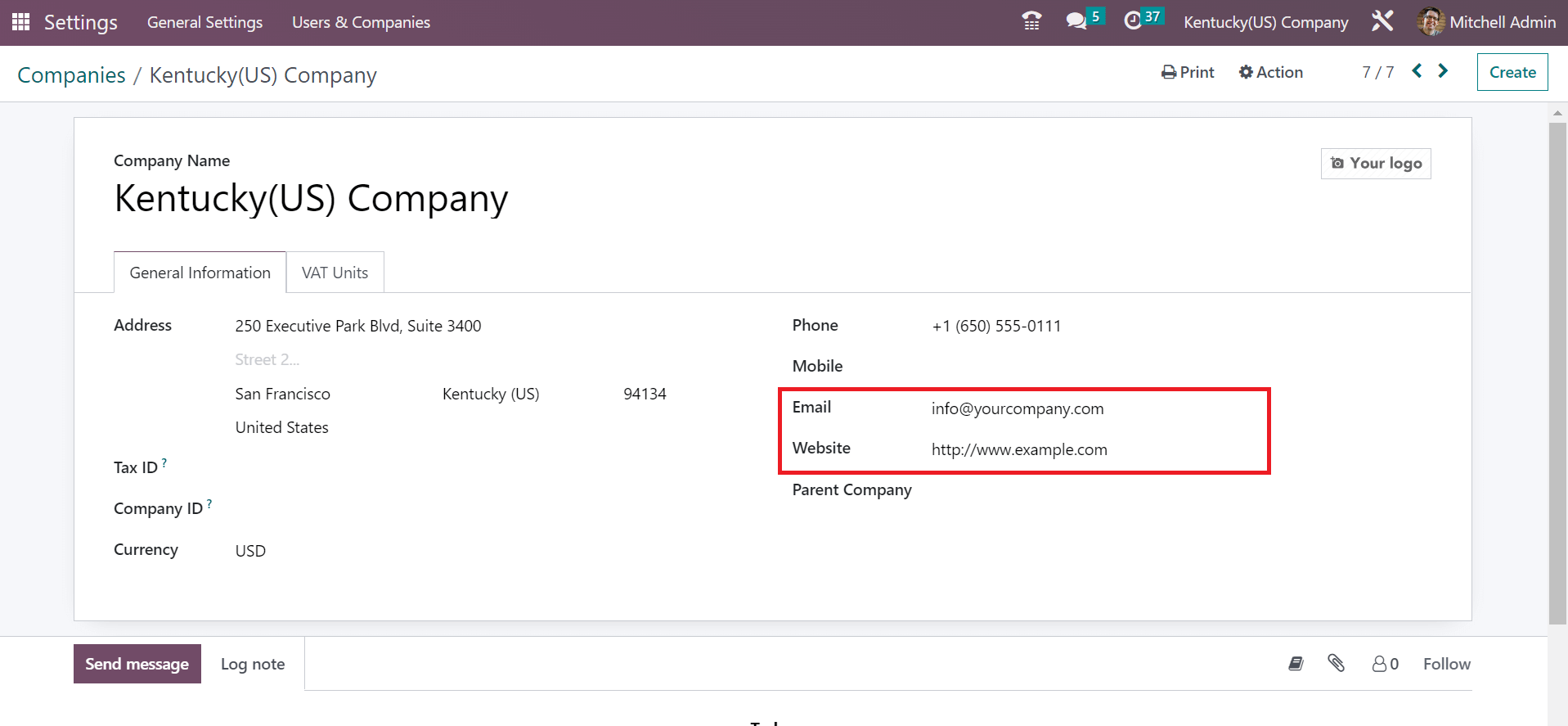

Here, we apply Kentucky(US) as a state and the United States in the Country field. Afterward, enter your firm’s Email, Website, and Phone number, as denoted in the screenshot below.

Added details of Kentucky(US) company saved automatically in the Odoo 16.

Kentucky Sales Tax Management in the Odoo 16 Accounting

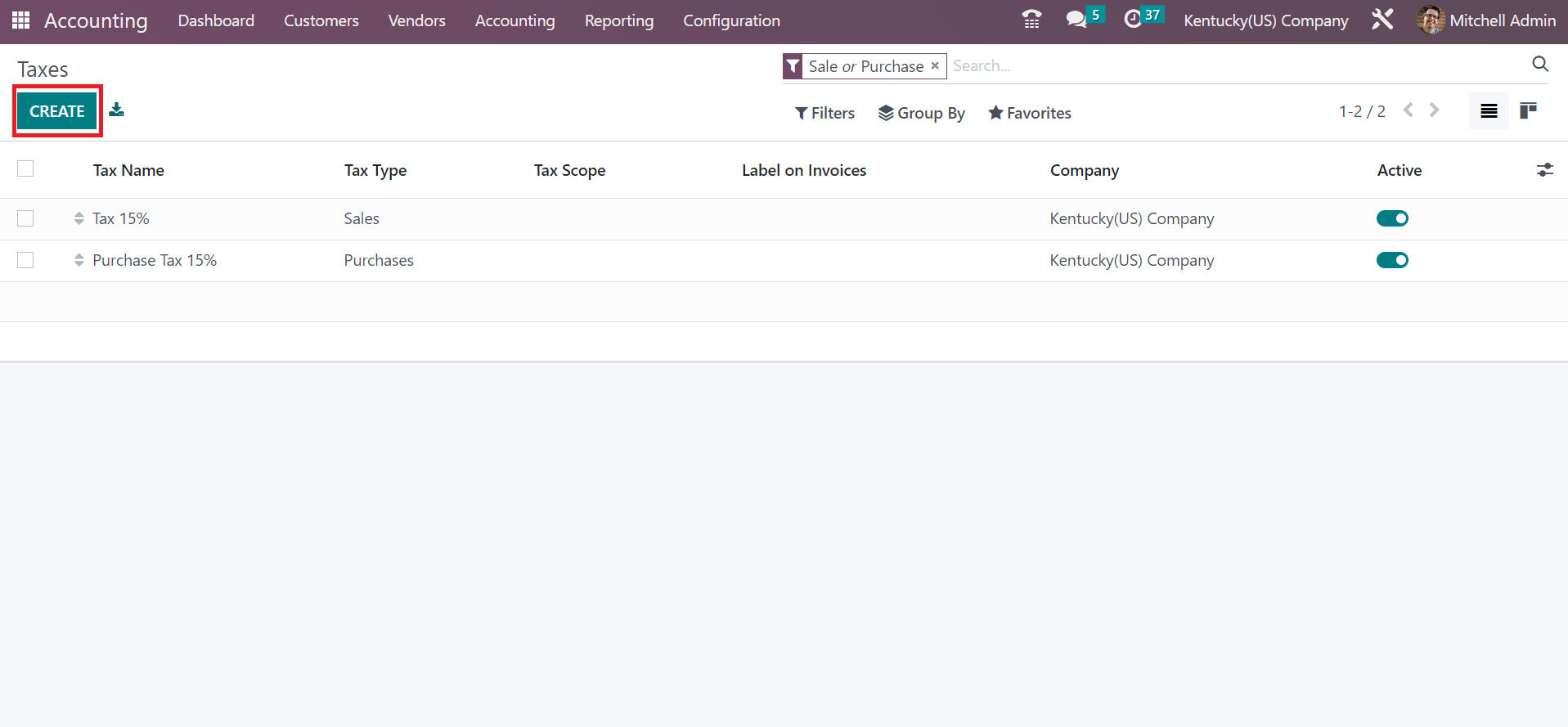

Tax configuration in the accounting section of a firm becomes simple by installing ERP software in your business. The List view of Taxes window shows details about each tax distinctly. You can click the CREATE icon to develop new tax details, as portrayed in the screenshot below.

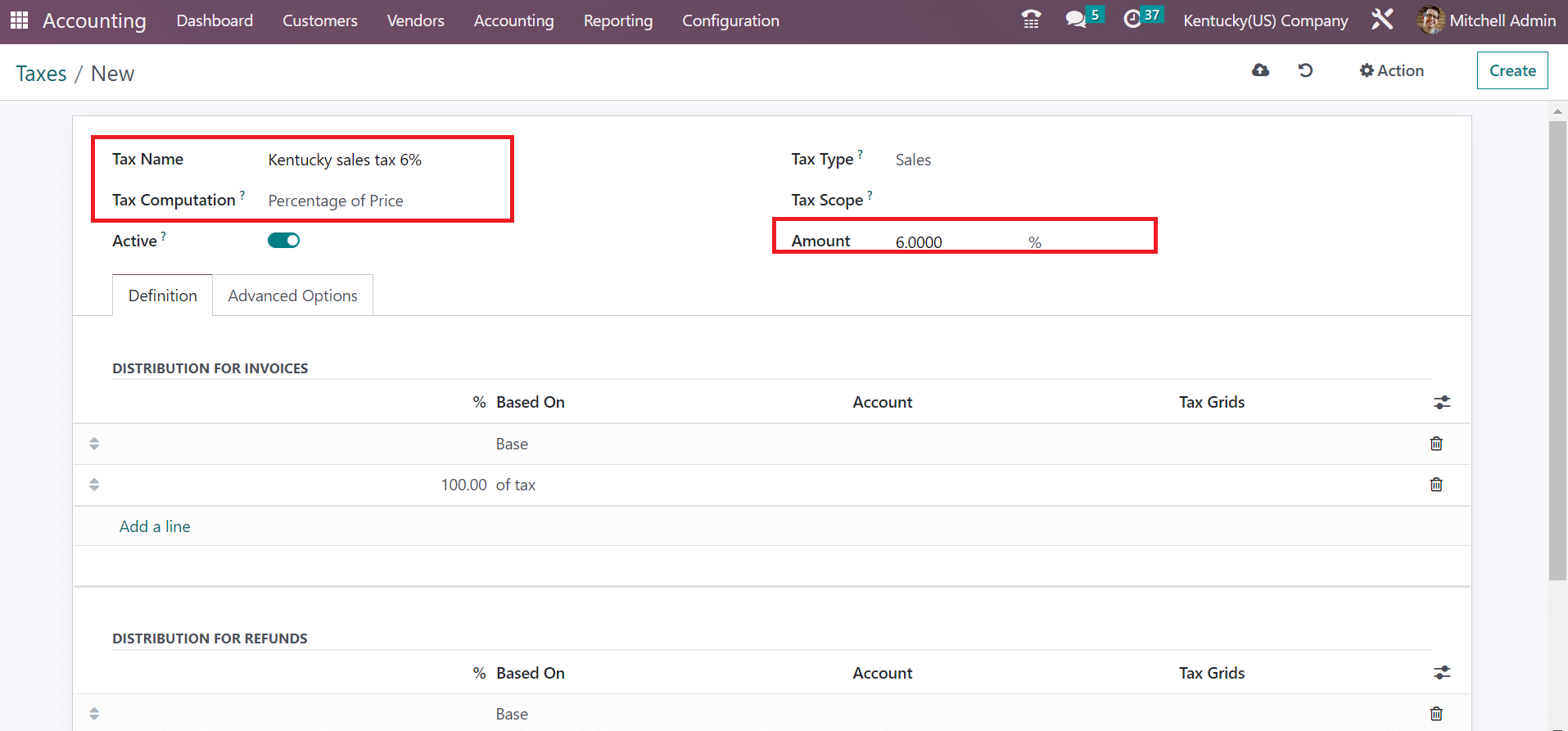

You can add the Tax Name as Kentucky sales tax 6% on the new page. We can set tariff cost as price percent after choosing the Percentage of Price option as the computation method.

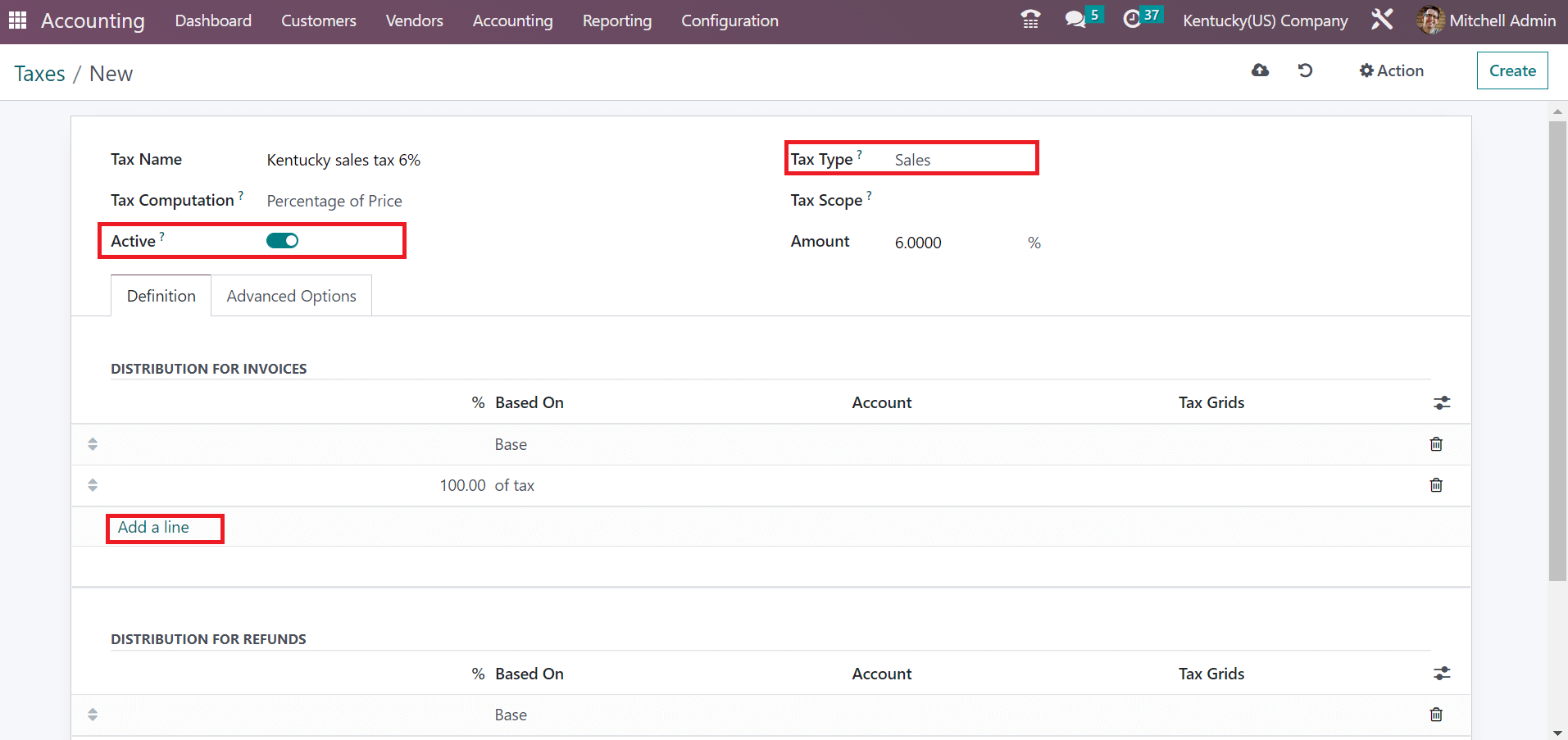

Here, we add 6% within the Amount field is the sales tax rate of Kentucky. Users can also enable the Active option to run the specific sales tax on orders and other invoices. Make sure to choose Tax Type as Sales for Kentucky sales tax 6%, as presented in the screenshot below.

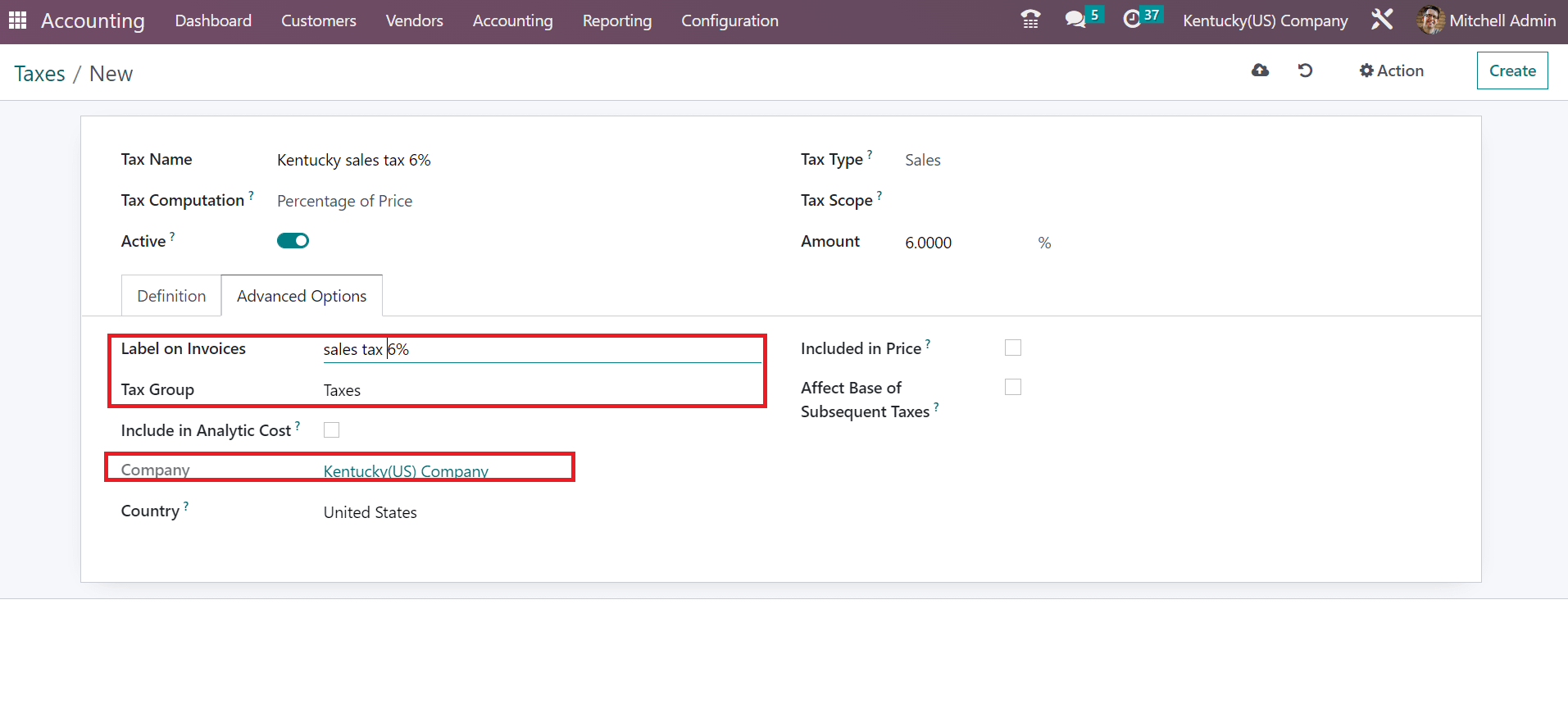

Press the Add a line option below the Definition tab to divide your tax for invoices and refunds. Under the Advanced Options tab, set the title viewable on an invoice in the Lable on Invoices option. Moreover, you can select a group for your tax, and company data is visible automatically, as described in the screenshot below.

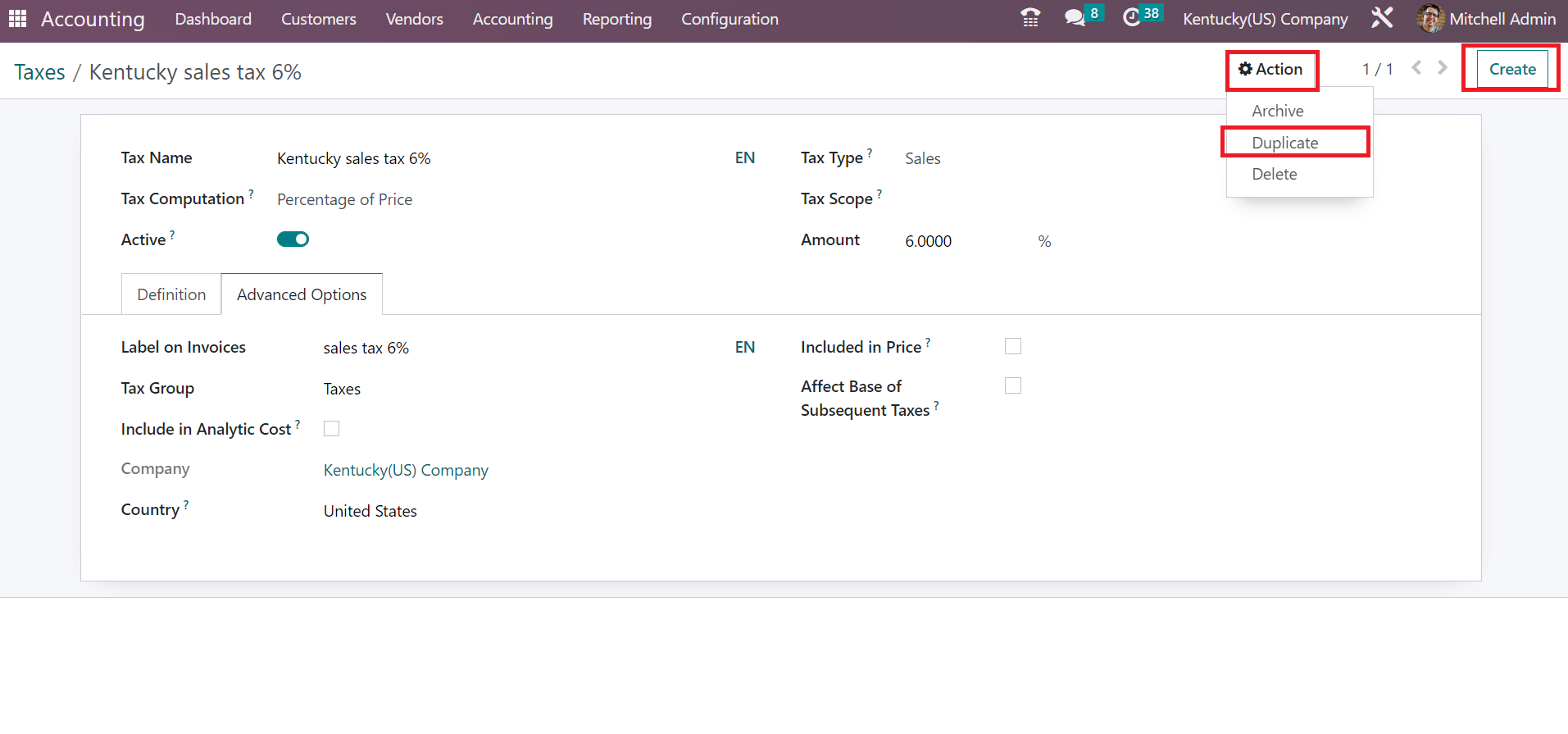

Users can save the details manually about the Kentucky sales tax of 6%. To take a copy of the created sales tax, click the Duplicate menu under the Action tab, as noted in the screenshot below.

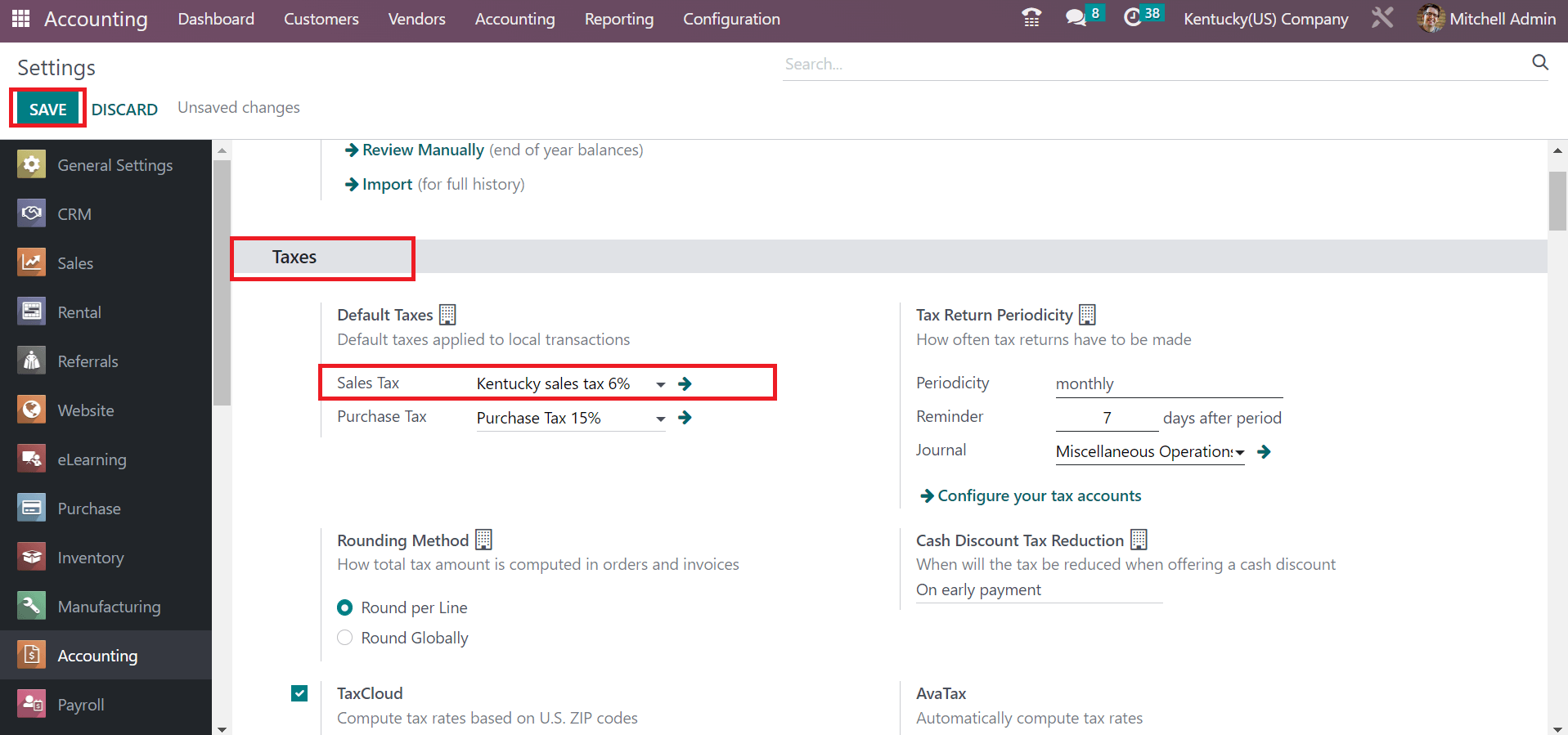

By choosing the CREATE icon on the right end, we can develop new tax data in Odoo 16. Setting your created sales tax as the default one from the Settings window is easy. Users can choose Kentucky sales tax of 6% in the Sales Tax field under the Taxes section in the Settings window, as presented in the screenshot below.

Select the SAVE button after choosing your sales tax in Odoo 16 Settings. Hence, we can efficiently run the specific feature in the Odoo 16.

Customer Invoice Creation using Kentucky Sales Tax in the Odoo 16

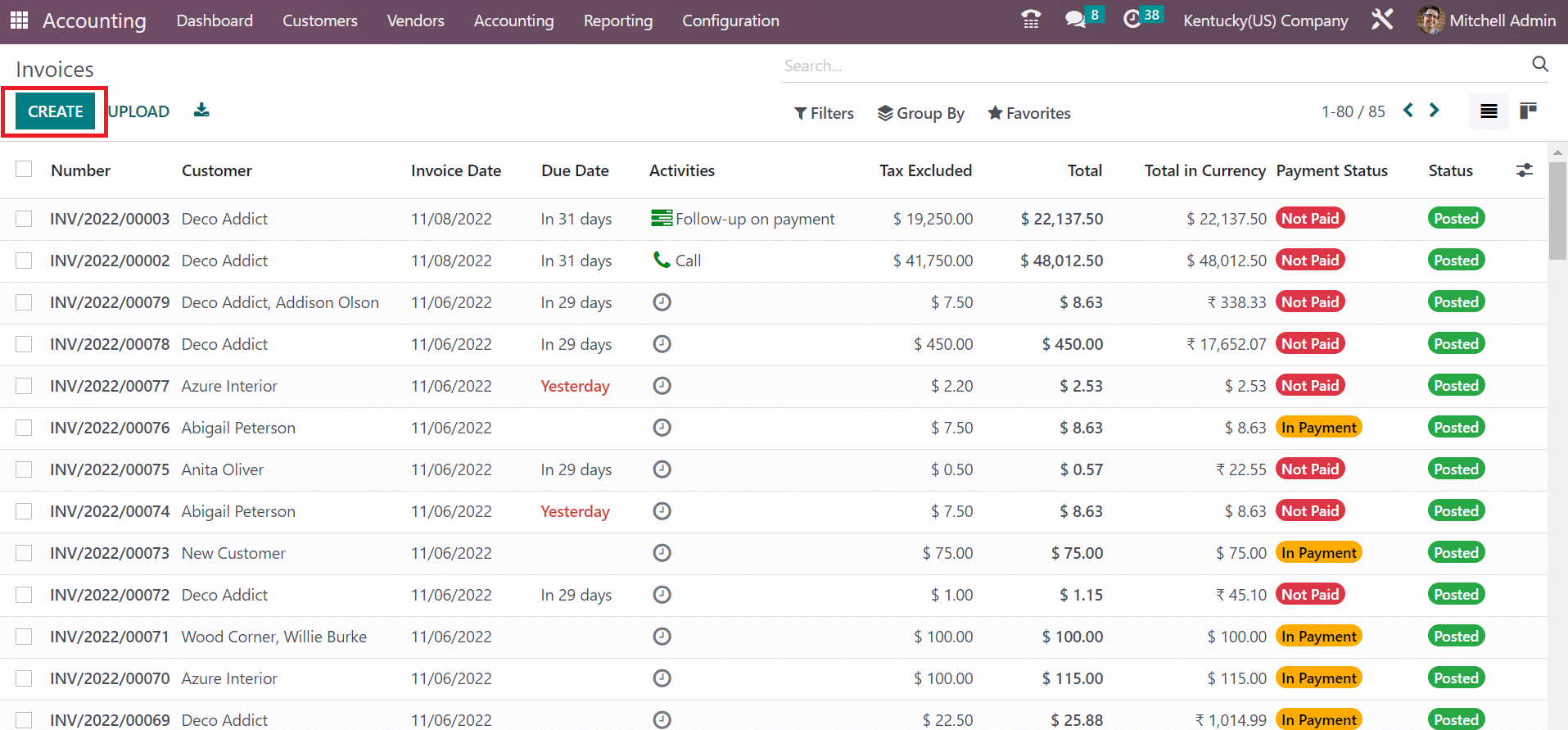

A list of each invoice for the customer is accessible by selecting the Invoices menu in the Customers tab. In the Invoices window, we can obtain records of all invoices, such as Total in Currency, Number, Activities, Due Date, and more. You can produce the latest invoice by clicking on CREATE button in the Invoices window, as cited in the screenshot below.

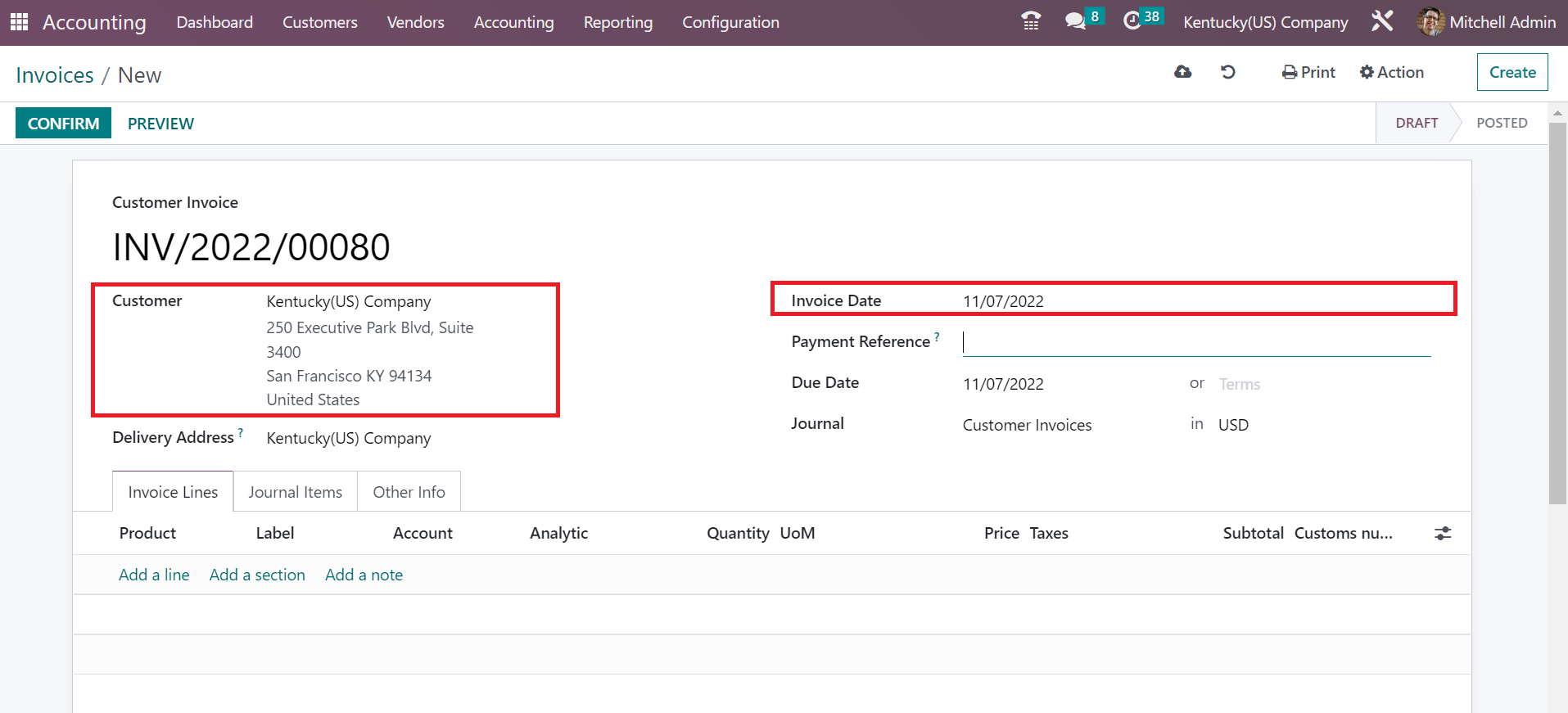

Select the Kentucky(US) Company in the Customer field, and the address related to your partner is obtainable in the Delivery Address field. Next, the user can specify the invoice start date in the Invoices window.

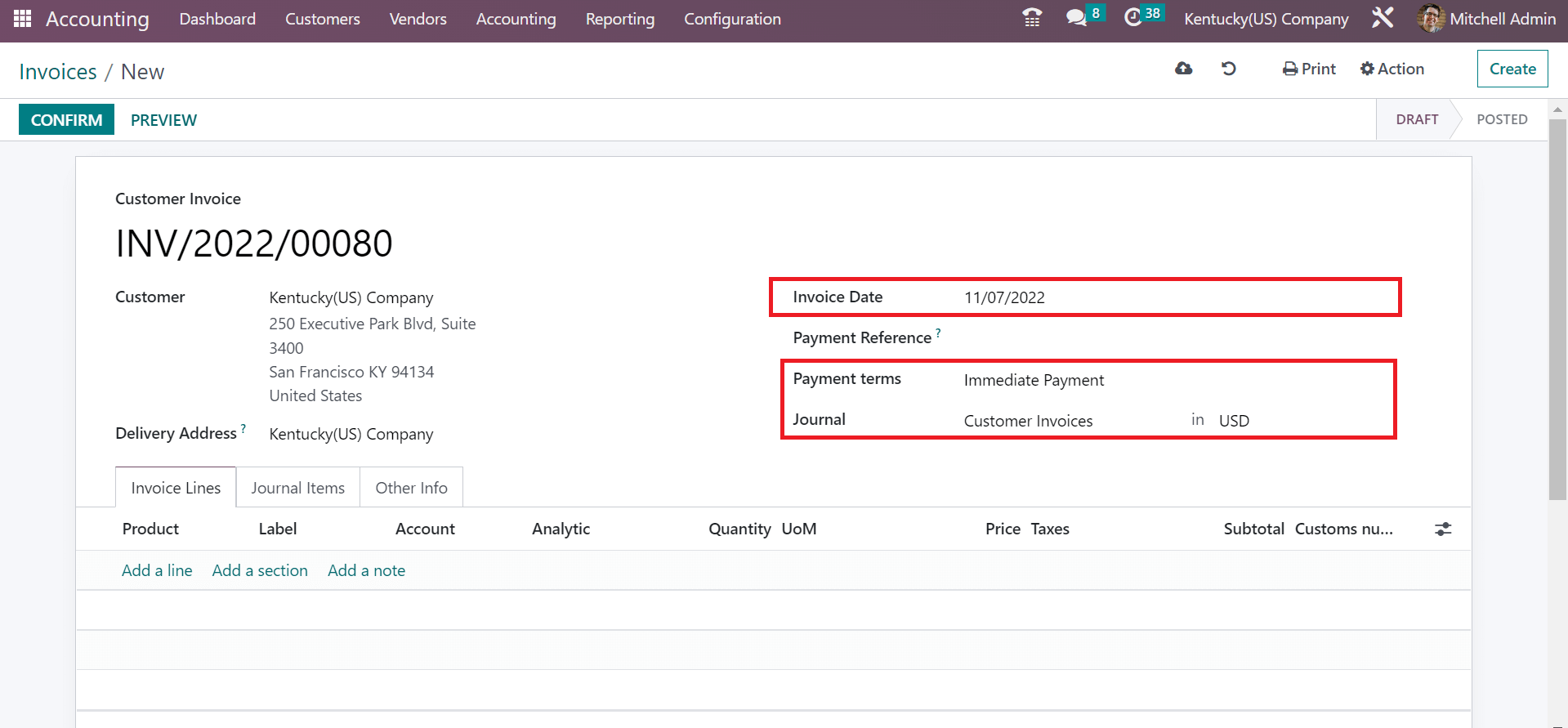

Users can set the Payment Terms as 15 days, two months, Immediate Payment, and more. We selected Immediate Payment under the Payment Terms option and picked a journal for the customer invoice, as demonstrated in the screenshot below.

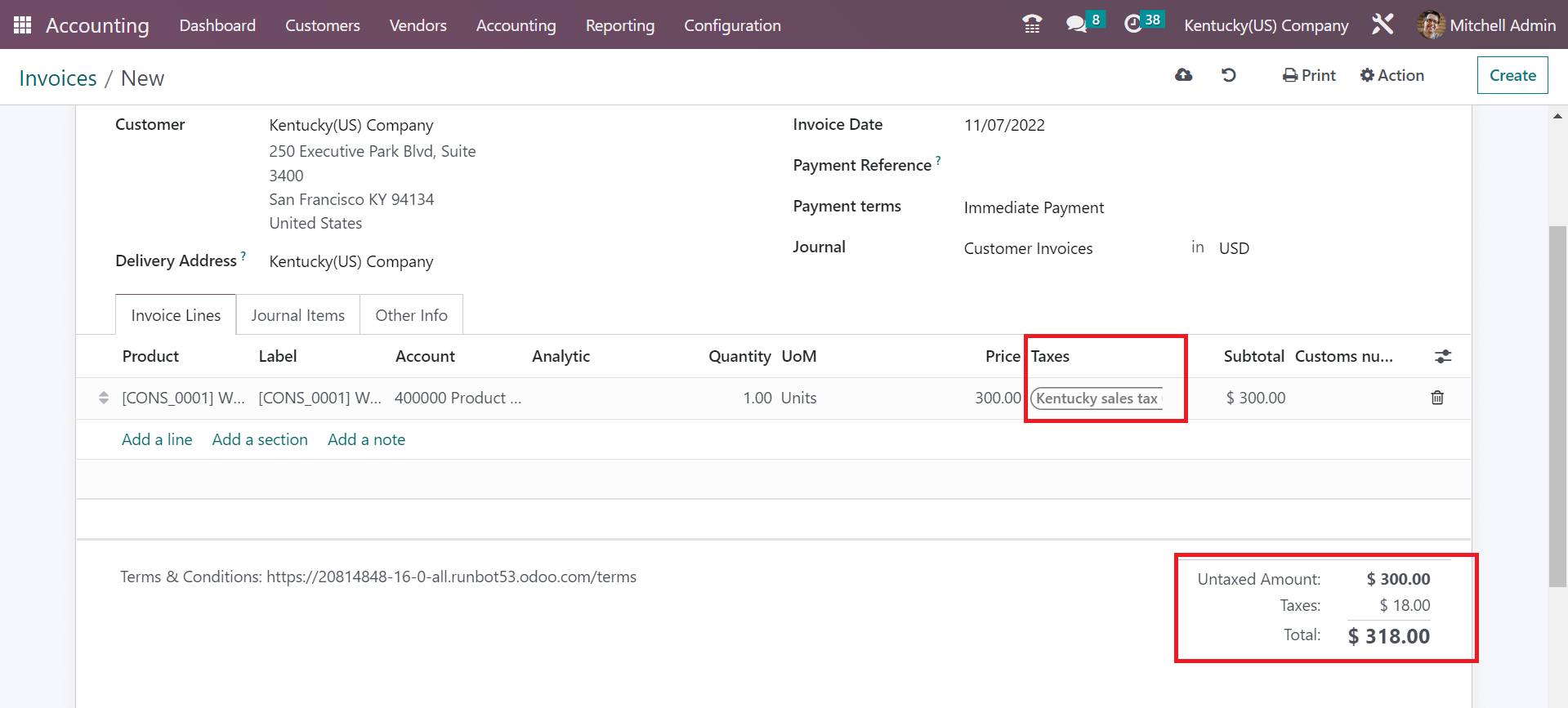

We can apply new product data after pressing the Add a line option. In the open bar, select one count of Whiteboard Pen with a cost of 300. Additionally, you can select Kentucky sales tax 6% under the Taxes section, and the total cost of a commodity is viewable at the right end.

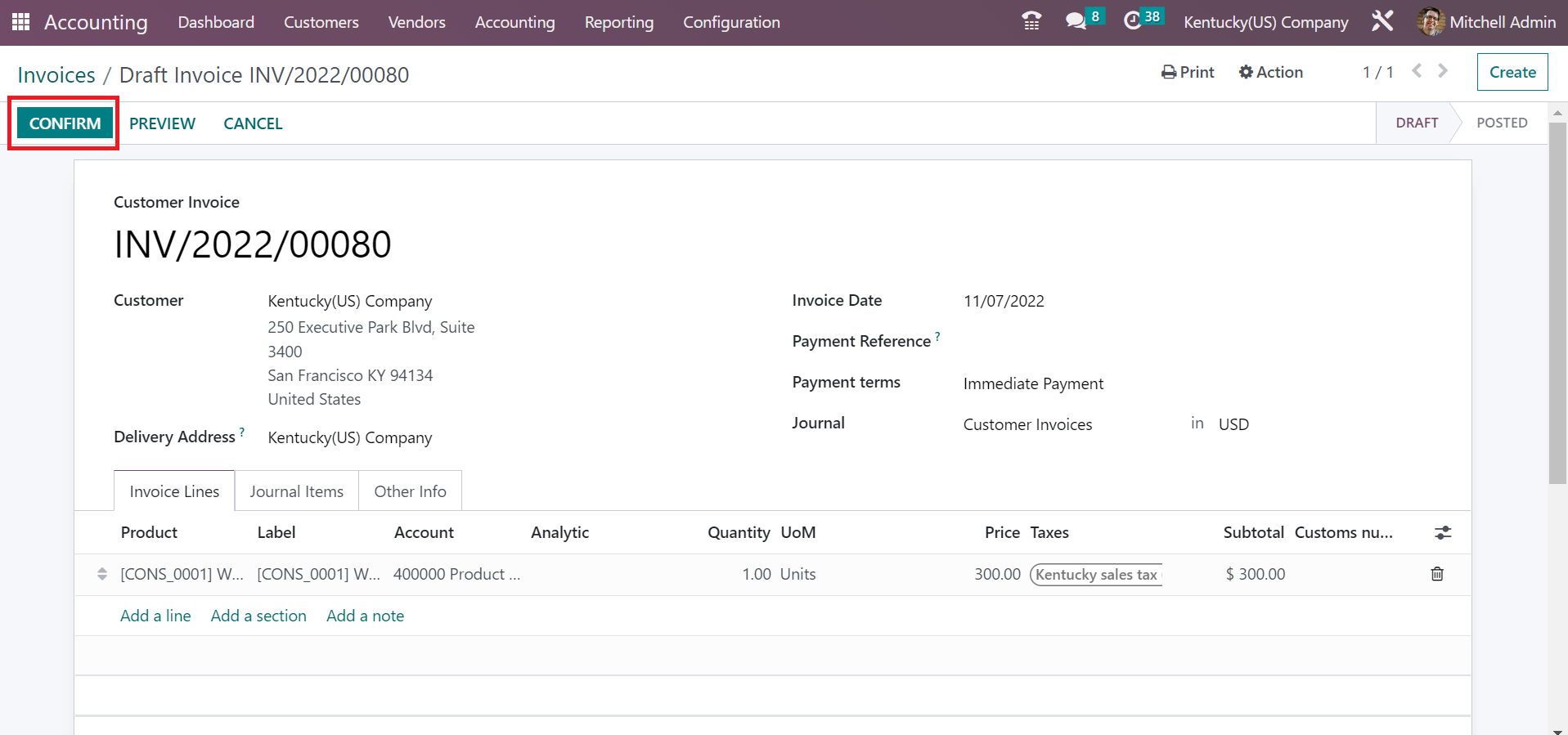

Here, Kentucky sales tax is manually visible because we set it as a default one before. Kentucky sales tax is applied within the rate of the Untaxed Amount, as mentioned in the screenshot above. Users can confirm the draft invoice to be posted after clicking on CONFIRM icon.

After the confirmation, it is easy to move with payment of the customer invoice.

Tax management of accounting sections of an organization is streamlined easily using Odoo 16 Accounting. Customer invoice creation and tax configuration become simple by installing ERP software in your business. Check out the below link to learn more about Arizona sales tax in the Odoo 16.