The United States is a developed country that uses conventional sales tax based on each state and locality. A percentage of sold goods price taken by a sales tax. The sales tax depends on several factors such as nexus, products/services in the product catalog, and pay tax in states. Most companies face risks in computing sales taxes based on each state. By installing ERP software, we can simplify tax management in every firm. Sales and Use taxes are applied in most states of a country. Odoo 16 Accounting application assists you in configuring tax rates and specifying customer invoices.

This blog pointed out the Lowa(US) Sales tax configuration using Odoo 16 Accounting module.

Customer invoices, fiscal periods, payments, reporting, taxes, and more are administered easily within Odoo 16 Accounting. Tax computation based on Avatax and Taxcloud is made possible through the Accounting application of Odoo. Let’s access the steps for configuring Lowa Sales tax rates in Odoo 16.

Brief of Lowa(US) Sales Tax

Use and sales tax is applied to Lowa law with an average rate of 6%. Sales tax is applied on the sale of digital products, tangible personal property, and taxable services. This sales tax is collected and remitted by the seller of specific services/goods. In contrast, a use tax is imposed after occurring the sales transactions. A purchaser is responsible for paying the use tax when he/she takes control of goods/services.

Lowa is a member of the Streamlined Sales Tax Governing Board helps to remit and collect sales tax in each state for a business. A permanent tax permit assists you in performing taxable sales or services in Lowa. To get a sales tax permit, you must register online at the Lowa Department of Revenue. Some of the vital information for registration are products/services type, personal identification info, date, business entity, and kind.

To Define Lowa(US) Sales Tax in Odoo 16

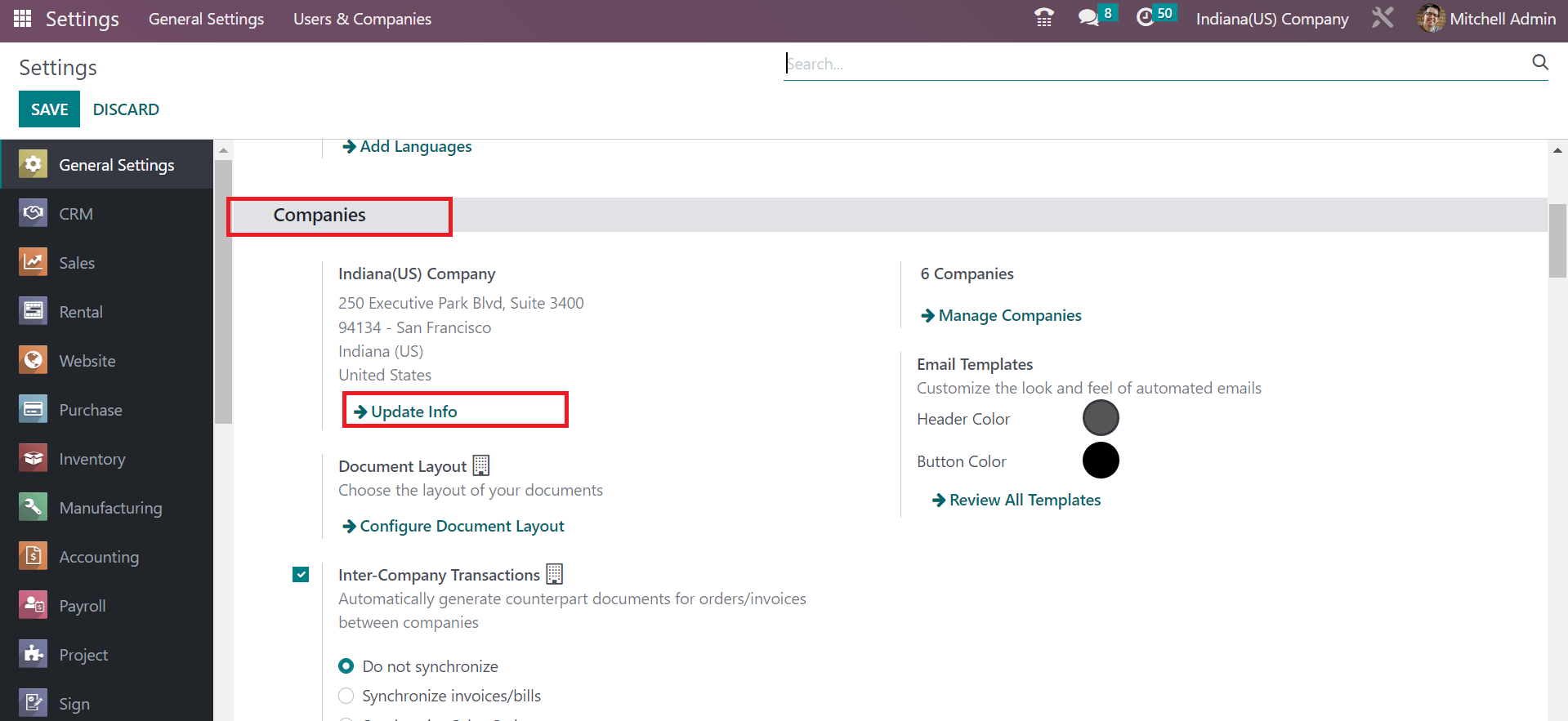

Users can renew the existing company data from the Odoo 16 Accounting module. Select the Update info option below the Companies section in the Settings window, as indicated in the screenshot below.

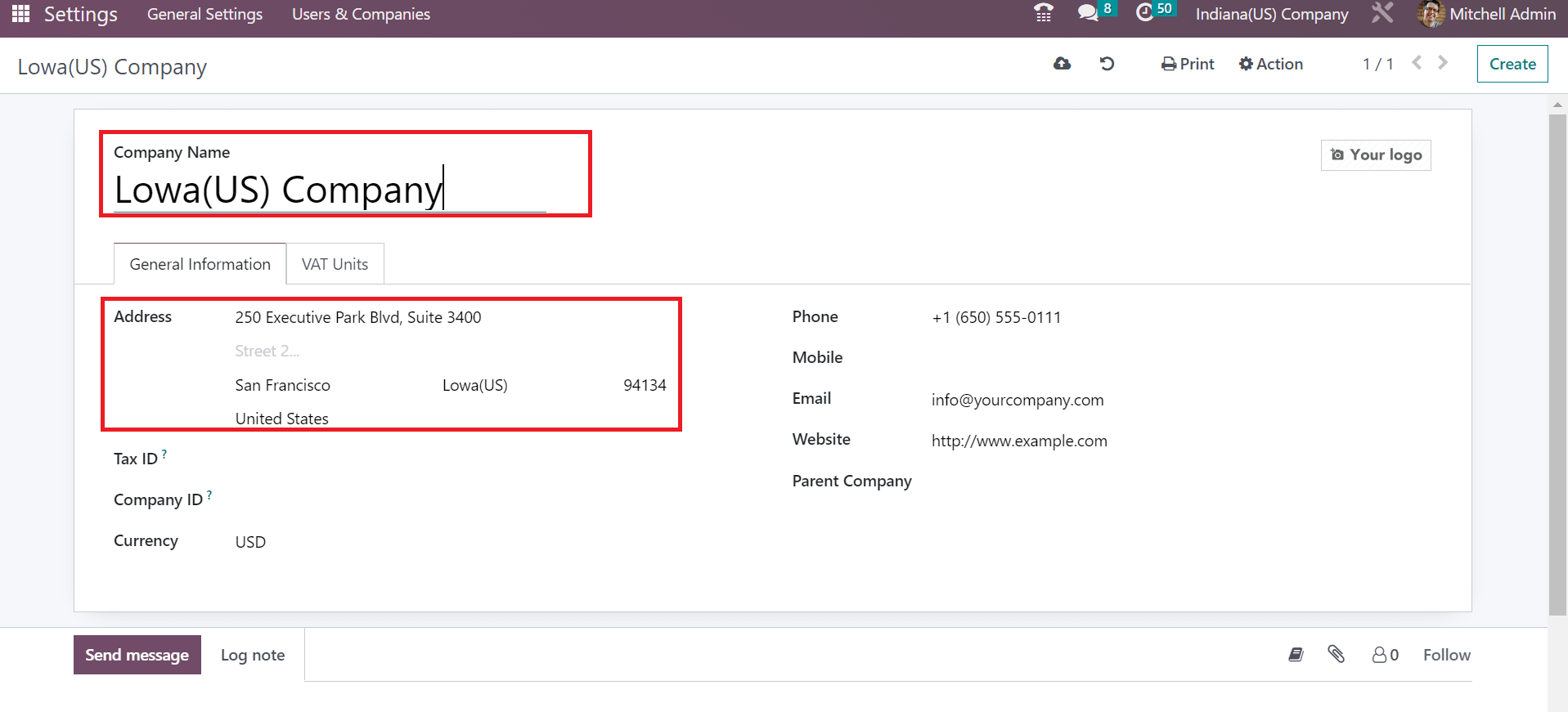

In the open screen, you can mention Lowa(US) Company in the Company Name field. Inside the Address option, the user can specify the street name, state as Lowa(US), the country as United States, and Pincode, as described in the screenshot below.

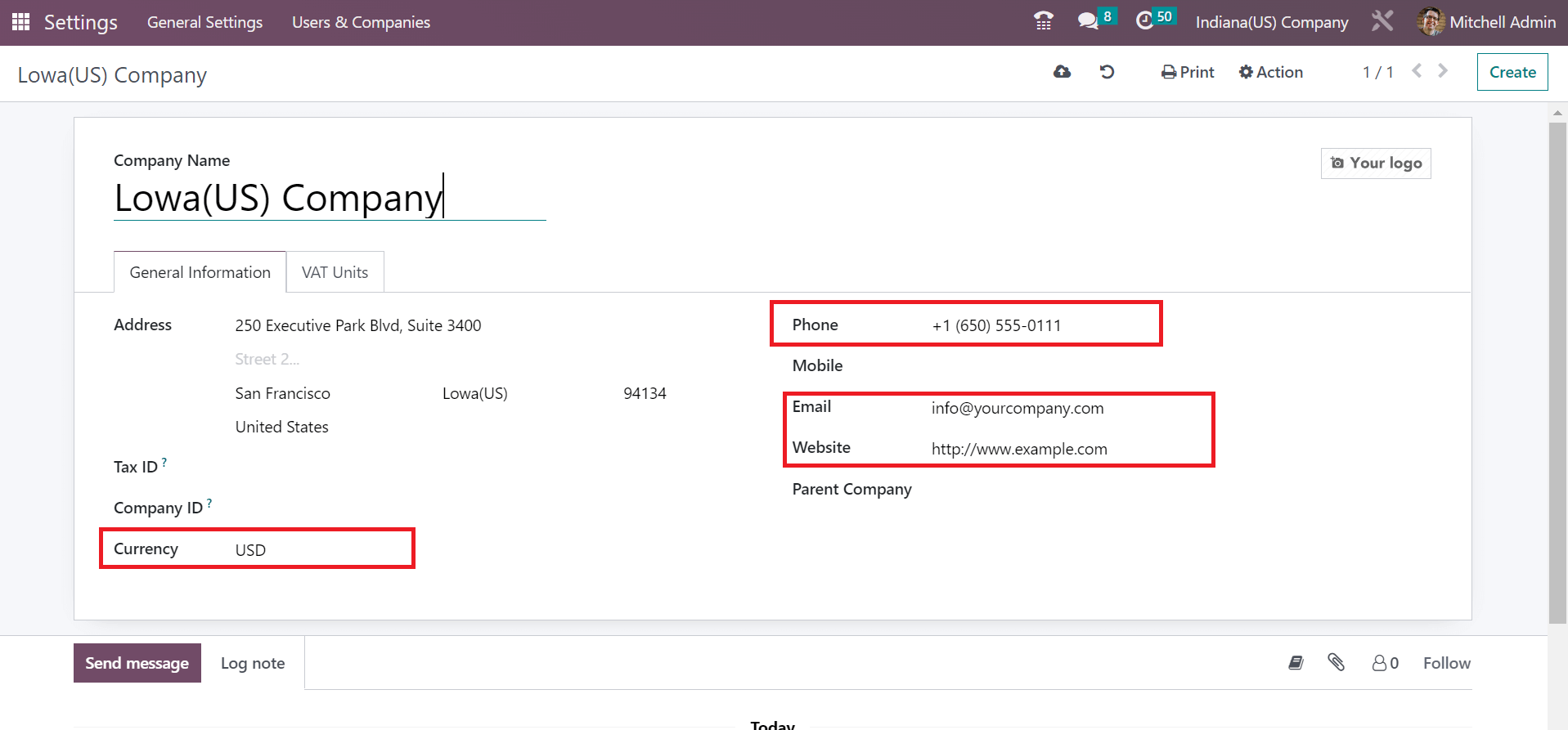

We can choose the state’s currency in the Currency field and enter the contact number in the Phone option. Moreover, users can add the Website and Email of Lowa(US) Company under the General Information tab.

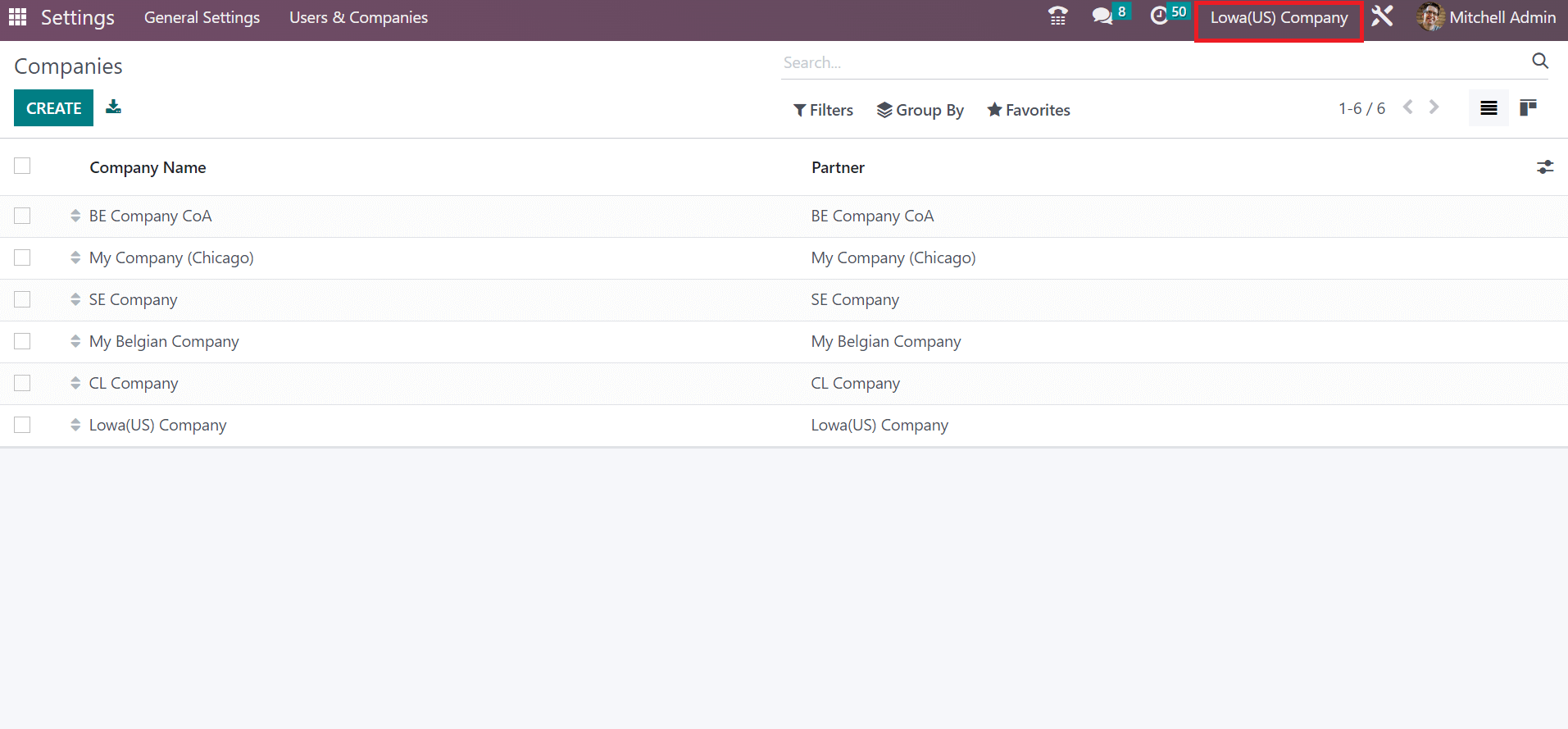

After saving manually, we can figure out the firm name at the top end as illustrated in the screenshot below.

To Configure Lowa(US) Sales Tax in the Odoo 16 Accounting

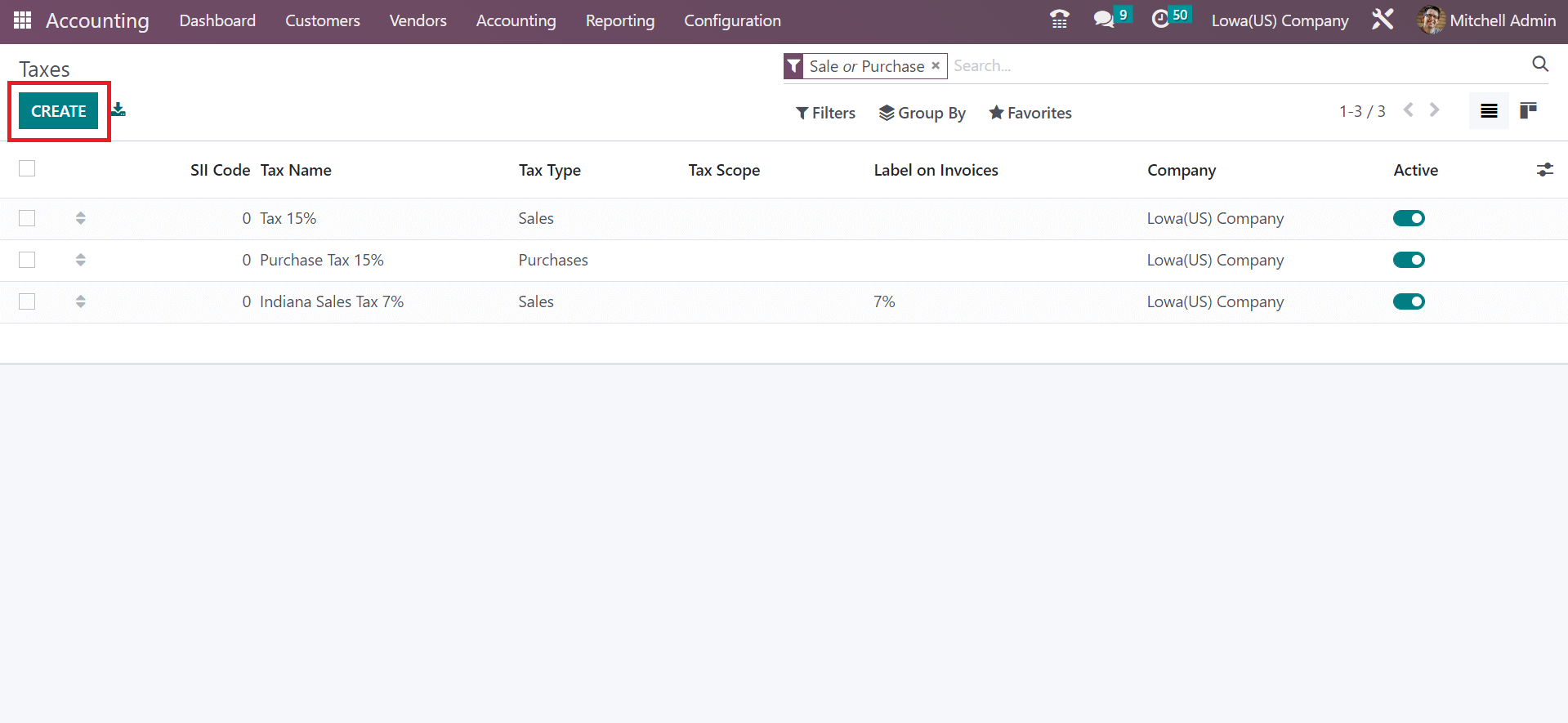

Users can provide the sales tax rate of Lowa(US) after choosing the Taxes menu within the Configuration tab. In the List view of Taxes window, you can acquire information about each tax, such as Tax Name, Company, Active, SII Code, and more. To generate a new tariff, you can select the CREATE option on the Taxes page, as marked in the screenshot below.

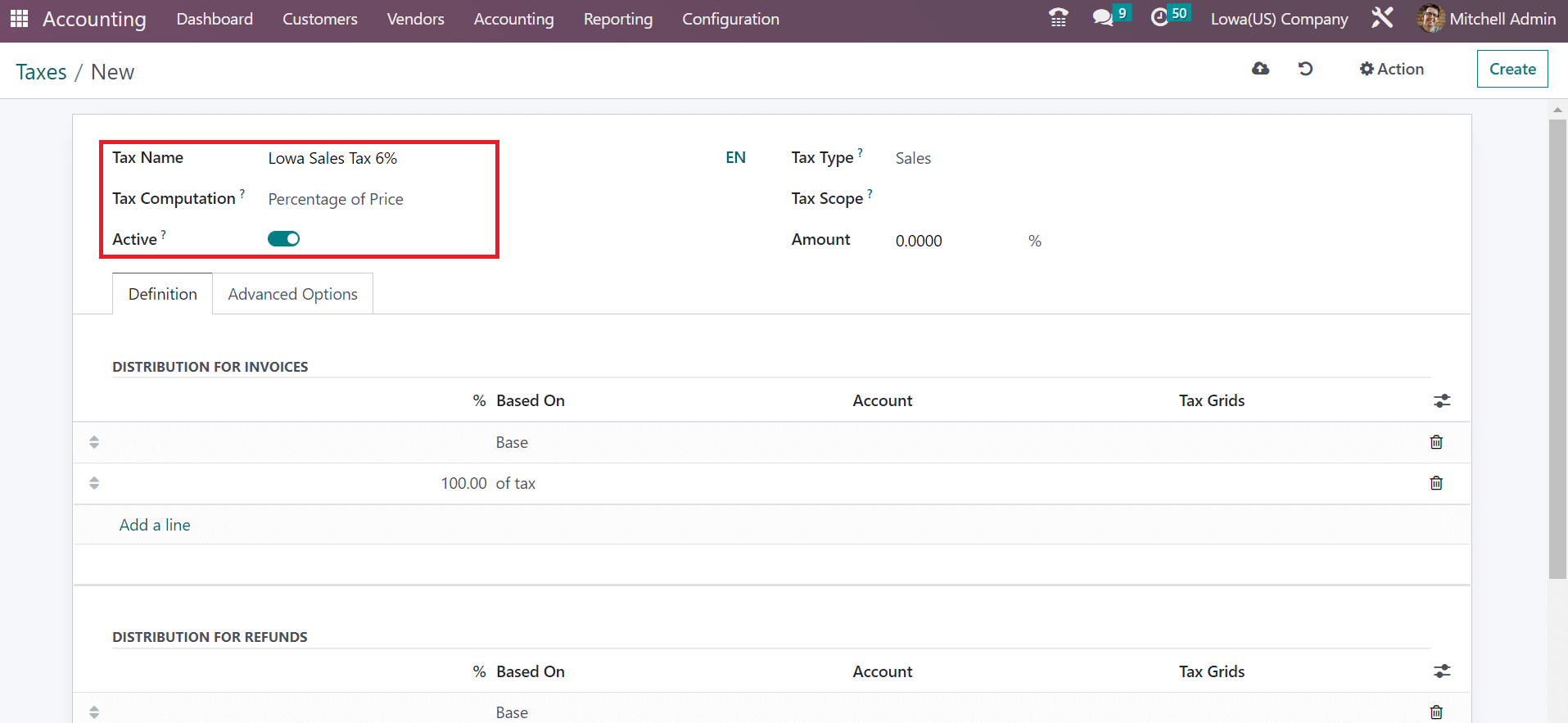

On the new page, apply Tax Name as Lowa Sales Tax 6% and Percentage of Price as Tax Computation method. To enable the specific tax feature, you must activate the Active option, as portrayed in the screenshot below

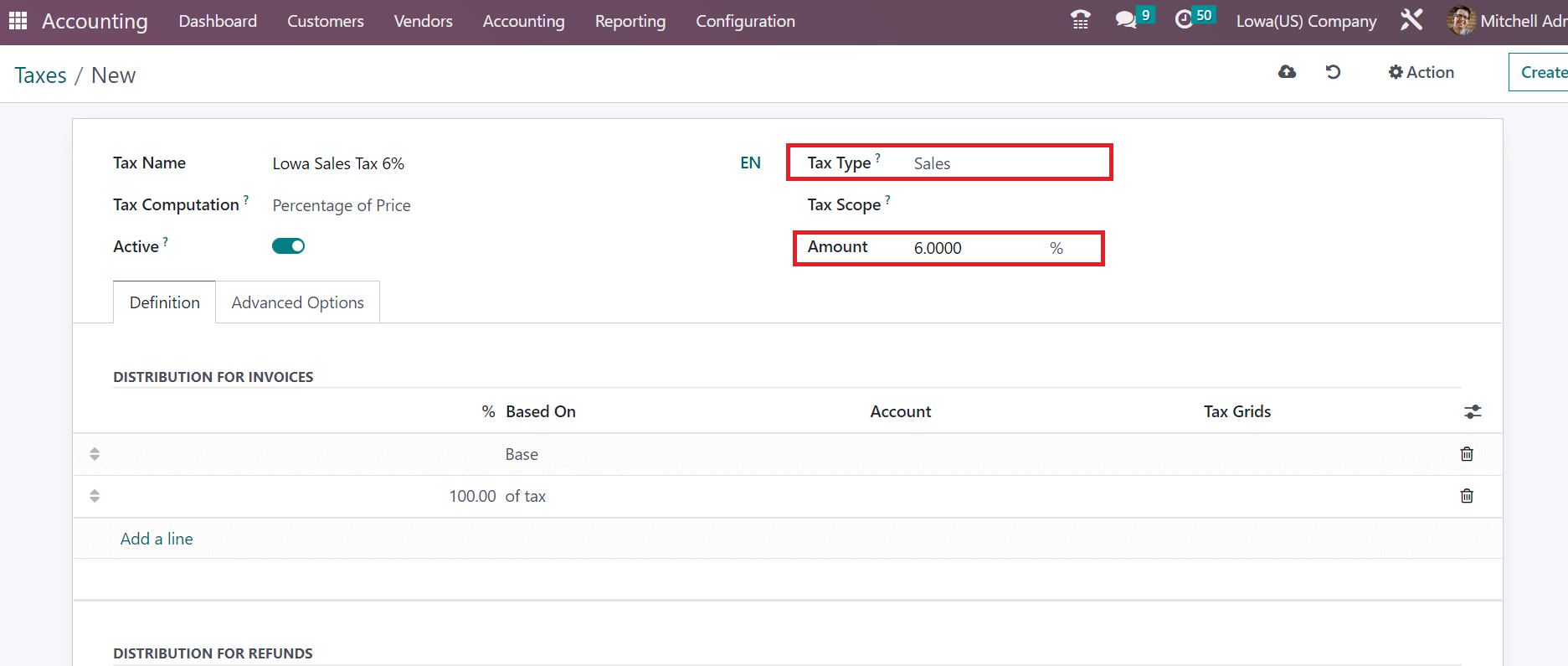

Set the percentage of Lowa Sales Tax in the Amount field. Also, make sure to choose the type of tax as Sales in the Tax Type field, as revealed in the screenshot below.

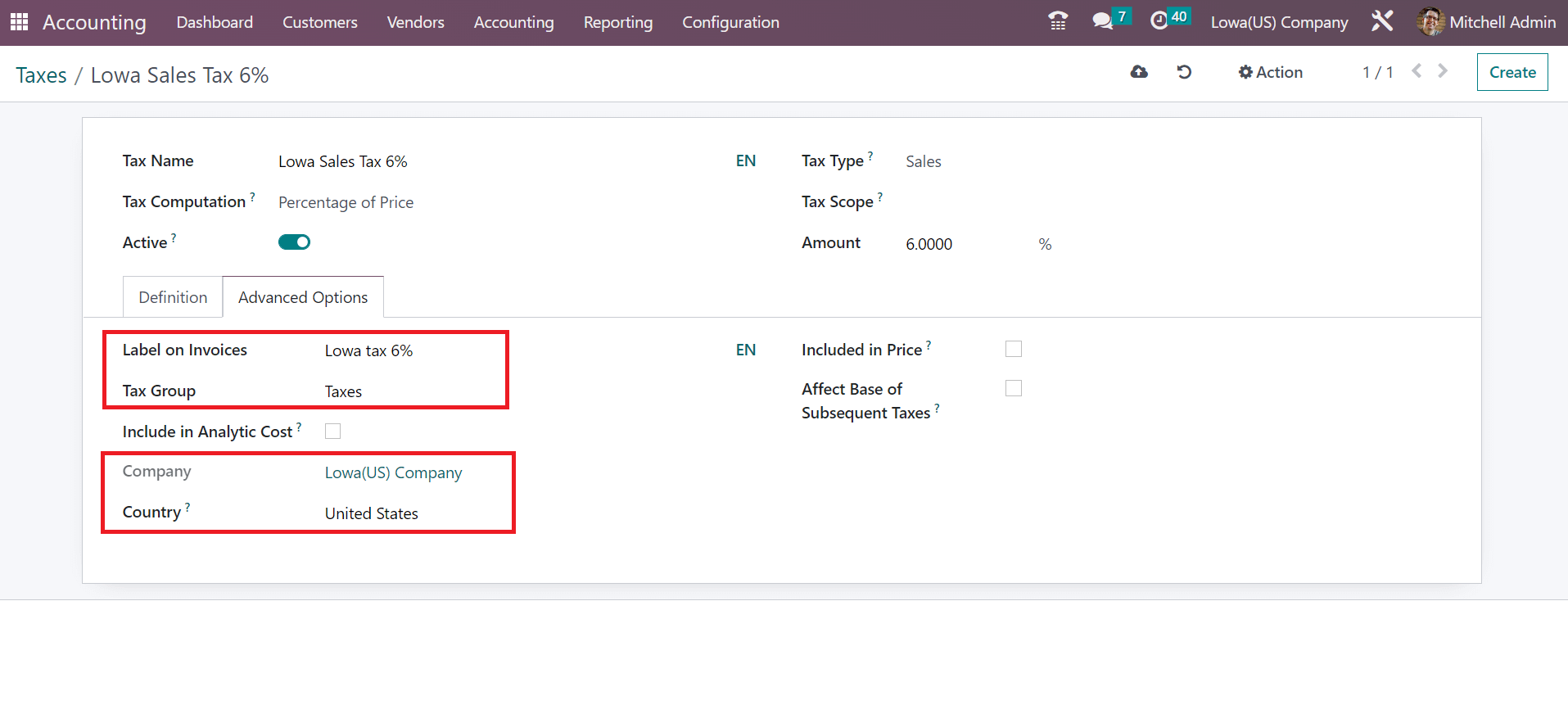

Users can enter the text visible on the invoice within the Label on Invoice field. Next, choose the class for your created tax in the Tax Group field. Country and Company information are manually viewable at the end of the Advanced Options section.

Now, we can produce a customer invoice with a Lowa sales tax of 6% in Odoo 16.

How to Formulate Customer Invoice with Lowa Sales Tax in Odoo 16?

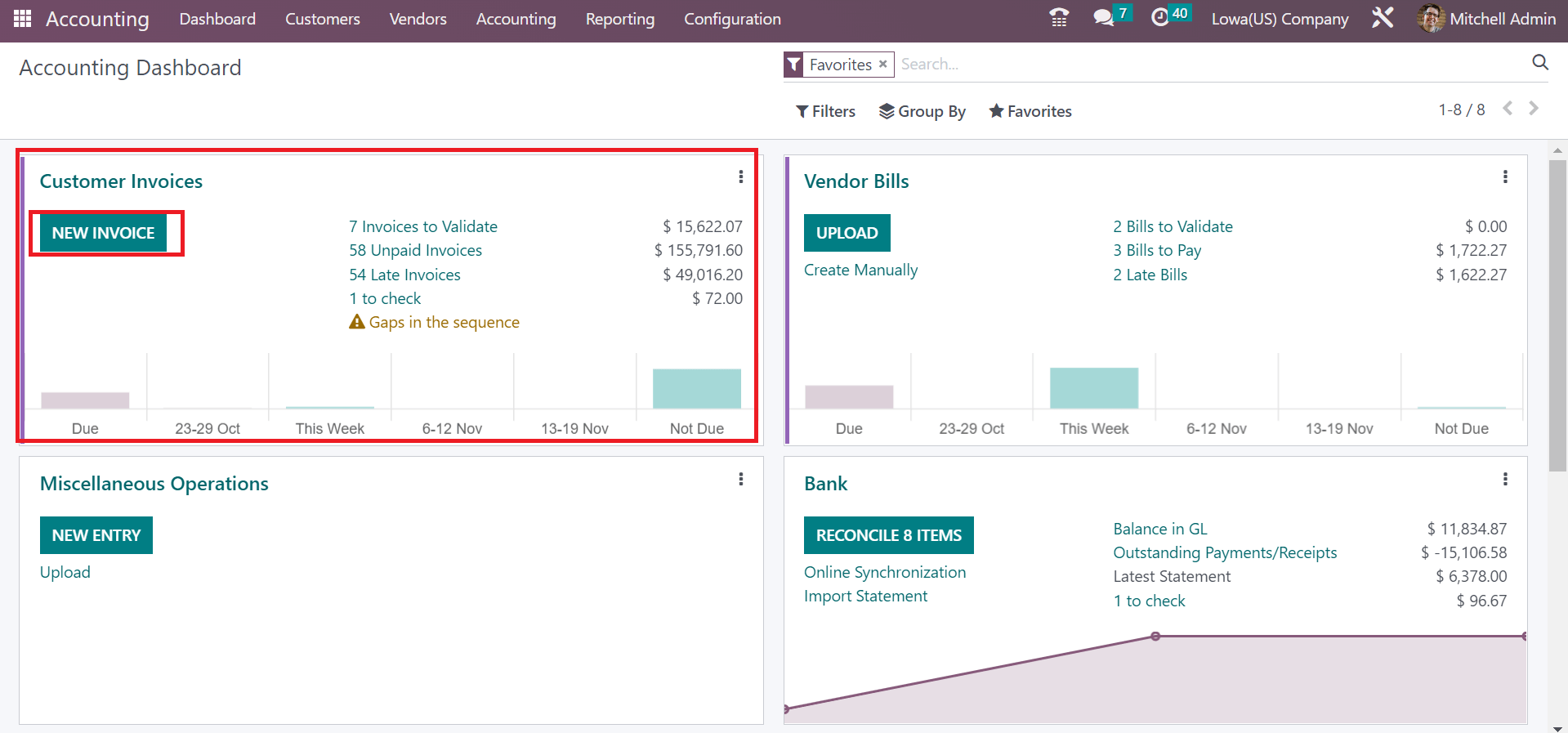

In the Accounting dashboard, users can access several journals such as Vendor Bills, Cash, Expenses, Bank, Customer Invoices, and more. We can see the count of invoices to validate, late invoices, unpaid ones, etc., inside the Customer Invoices journal. For developing an invoice, click the NEW INVOICE button under the Customer Invoices journal, as presented in the screenshot below.

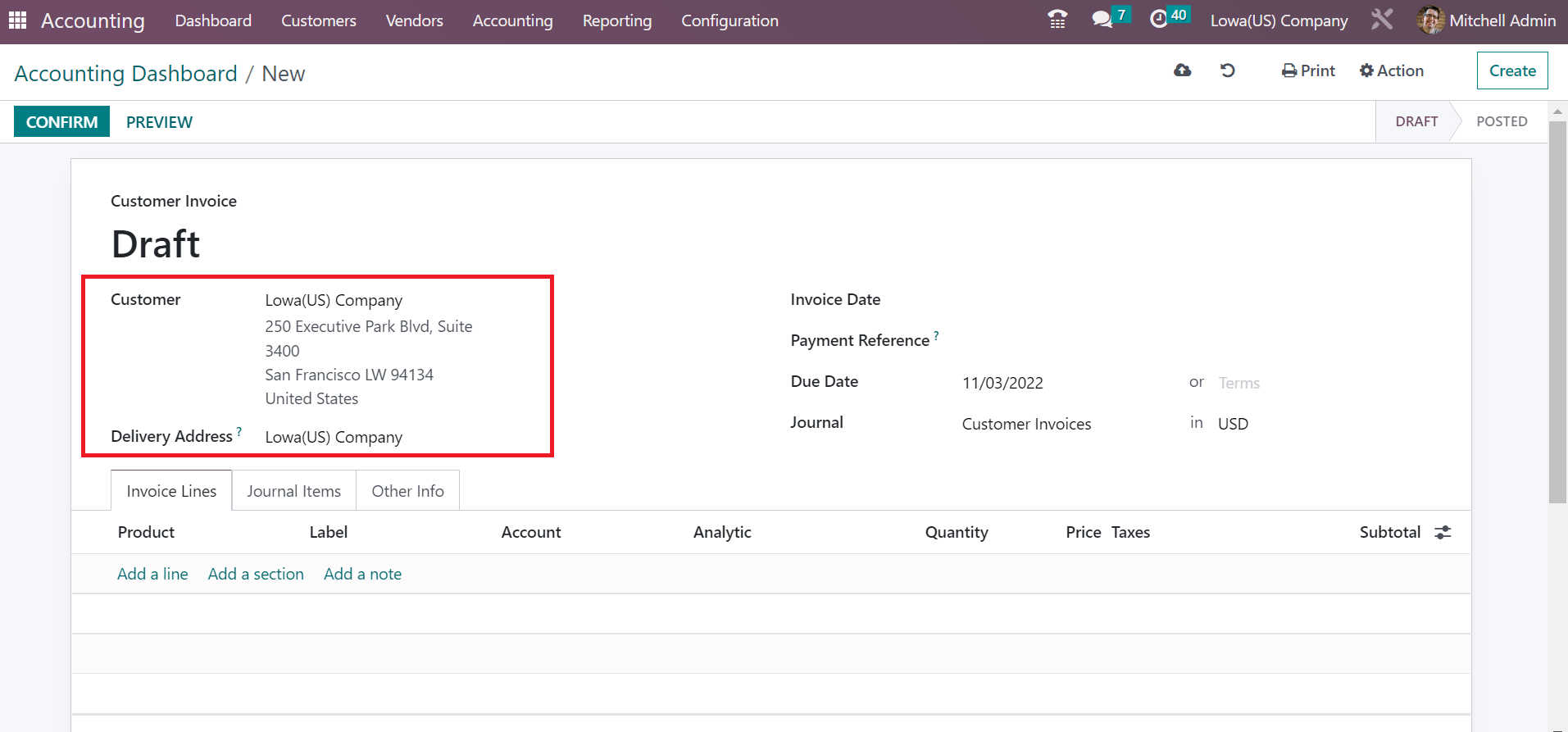

Select Lowa(US) Company within the Customer field on the open screen. All the details of your chosen firm, such as street name, city, state, etc., are acquirable easily. Additionally, the delivery address of your customer is also obtainable to you.

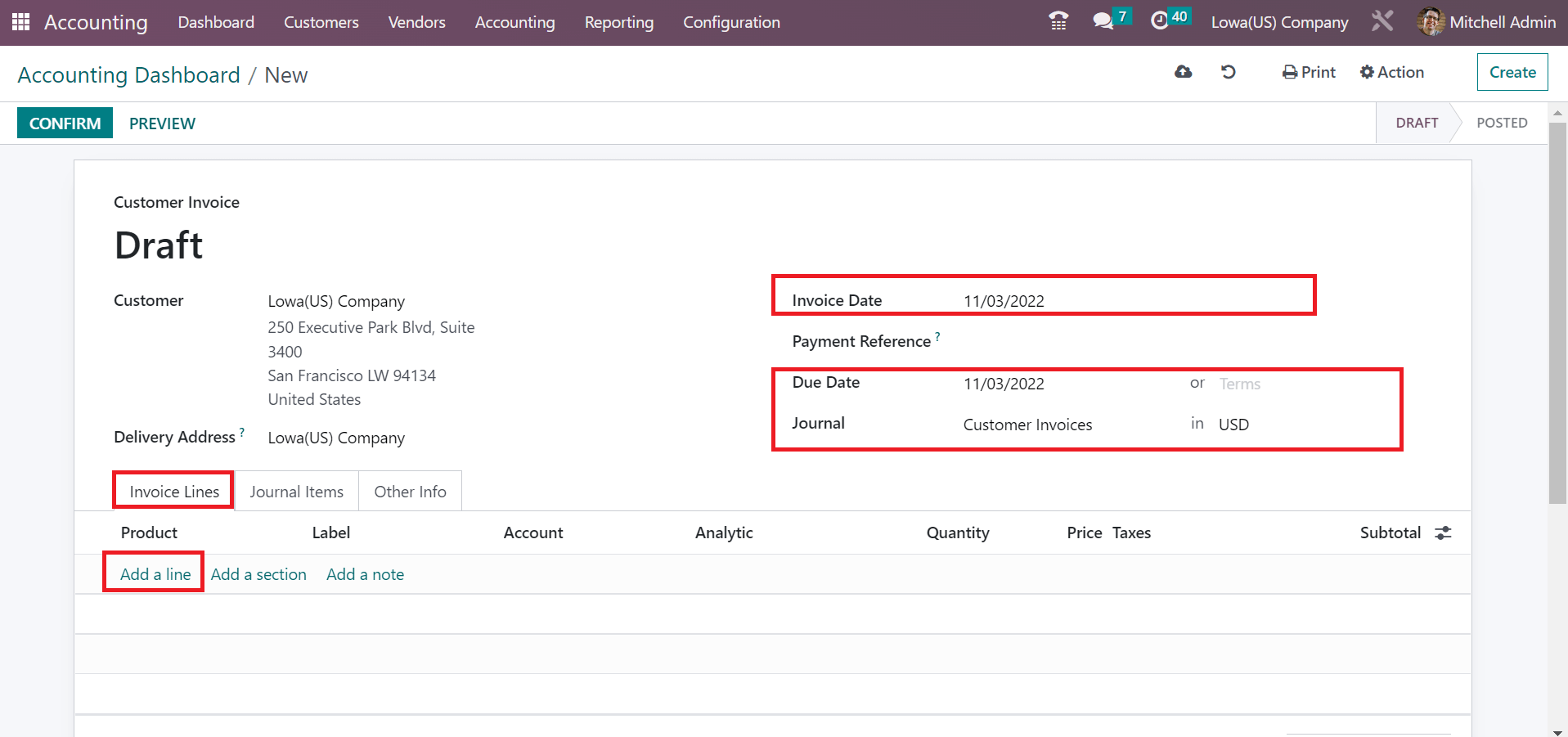

You must specify the Invoice Date, Due Date, and Journal regarding your customer invoice. To enter the product date, select the Add a line icon within the Invoice Lines section, as outlined in the screenshot below

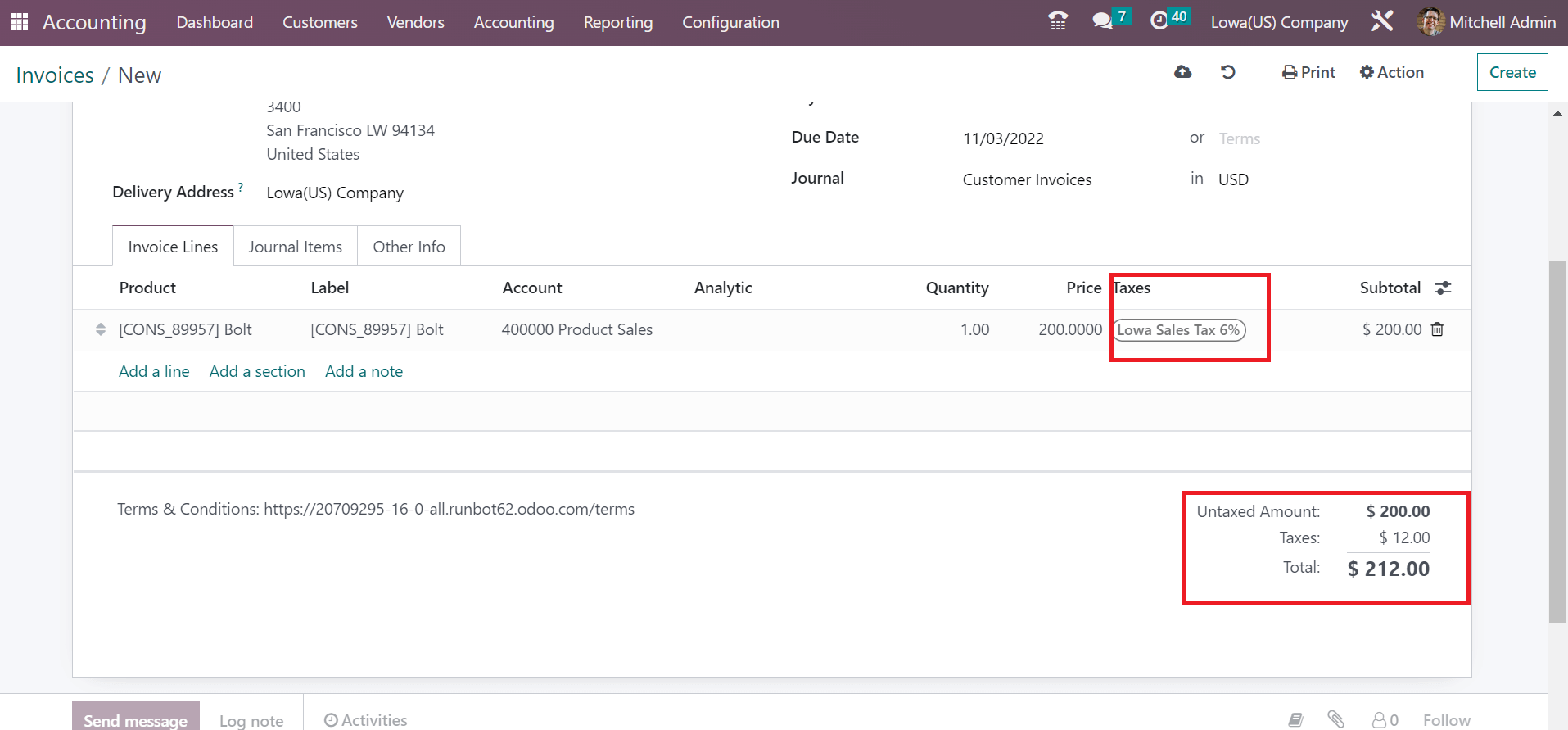

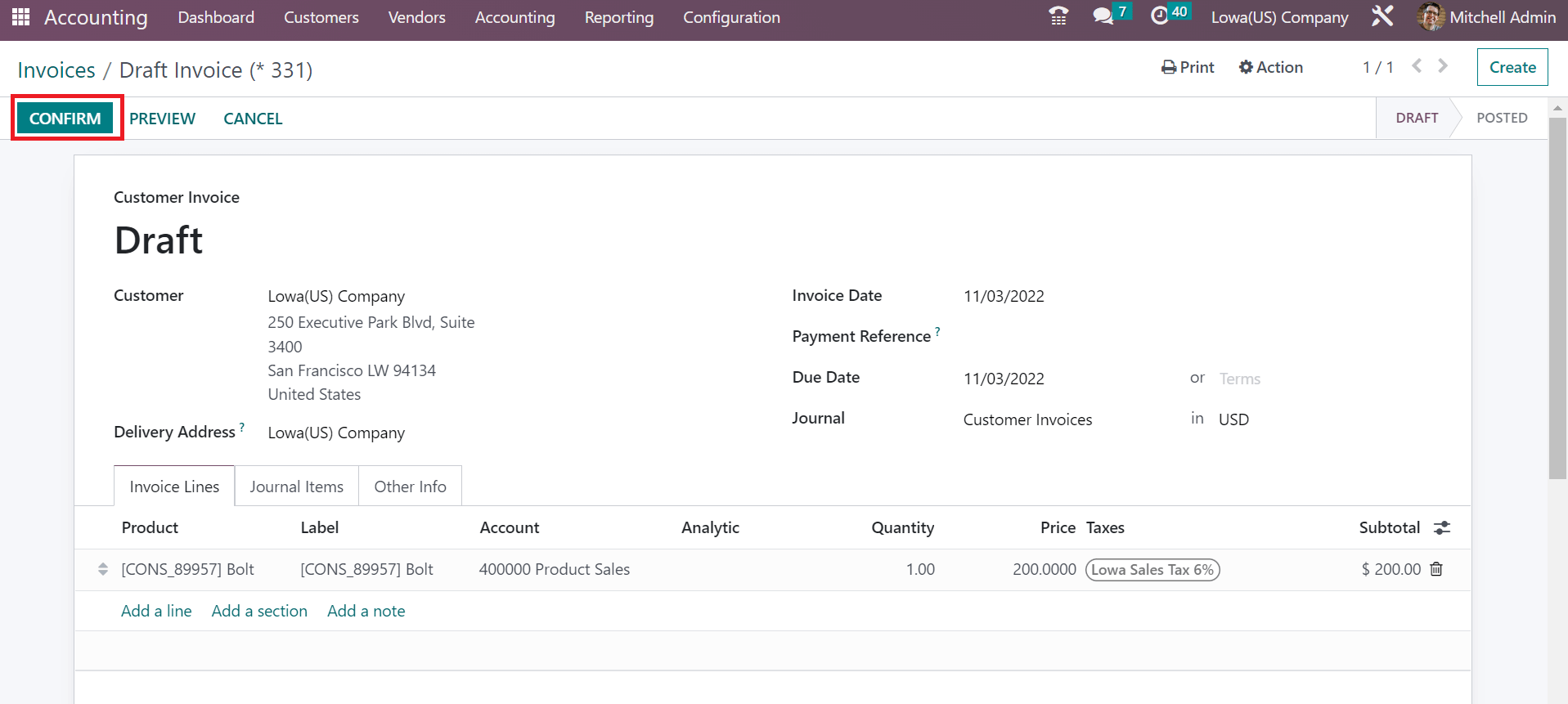

In the open space, we choose one quantity of Bolt with a price of 200. After selecting your product, pick Lowa Sales Tax 6% under the Taxes section. Later, the user can access the commodity’s total cost with applied tax for the untaxed amount, as portrayed in the screenshot below.

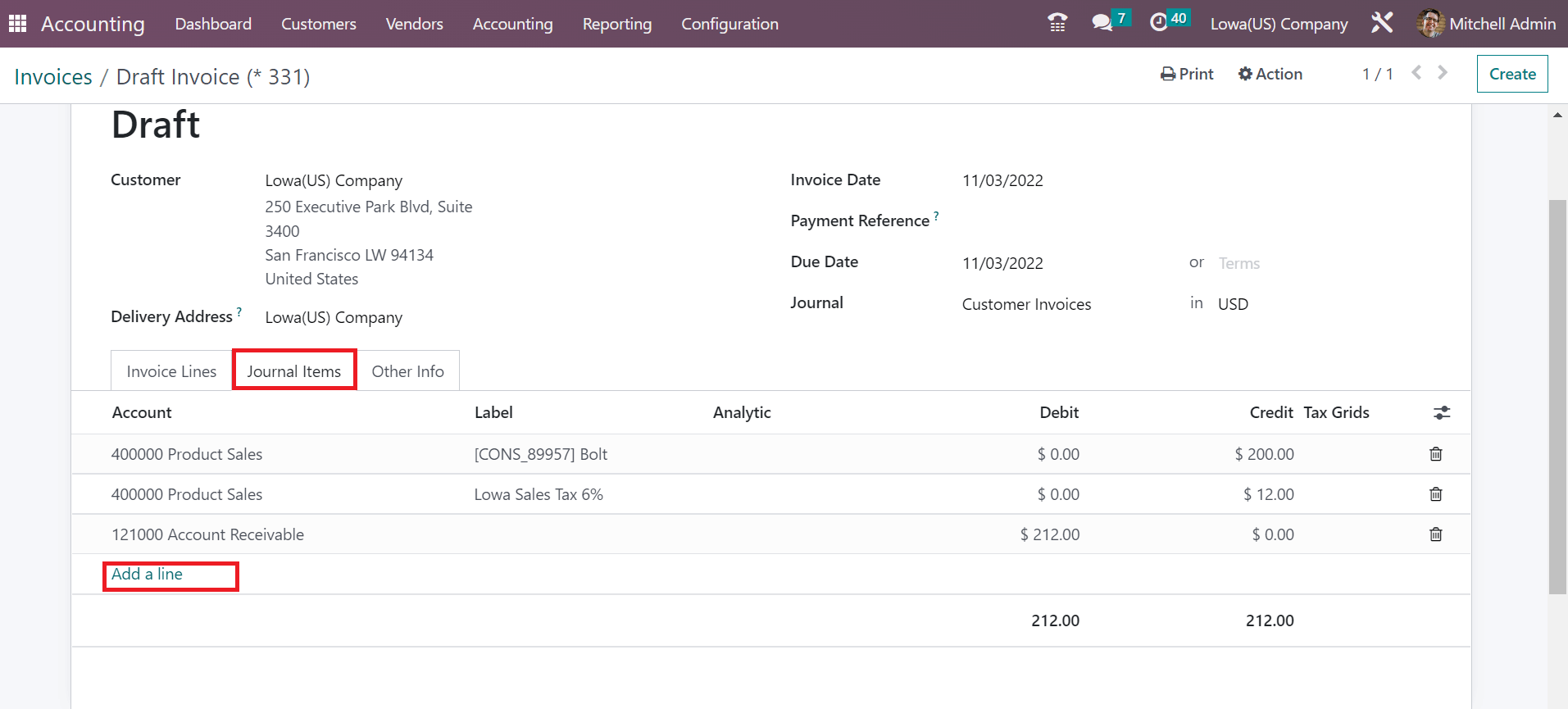

Below the Journal Items tab, all accounts concerning your customer invoice are visible. You can view details of the account, including Label, Credit, Debit, Tax Grids, etc. Select the Add a line option to apply new account data, as cited in the screenshot below.

Next, we can post the invoice by clicking on the CONFIRM icon in the Invoices window.

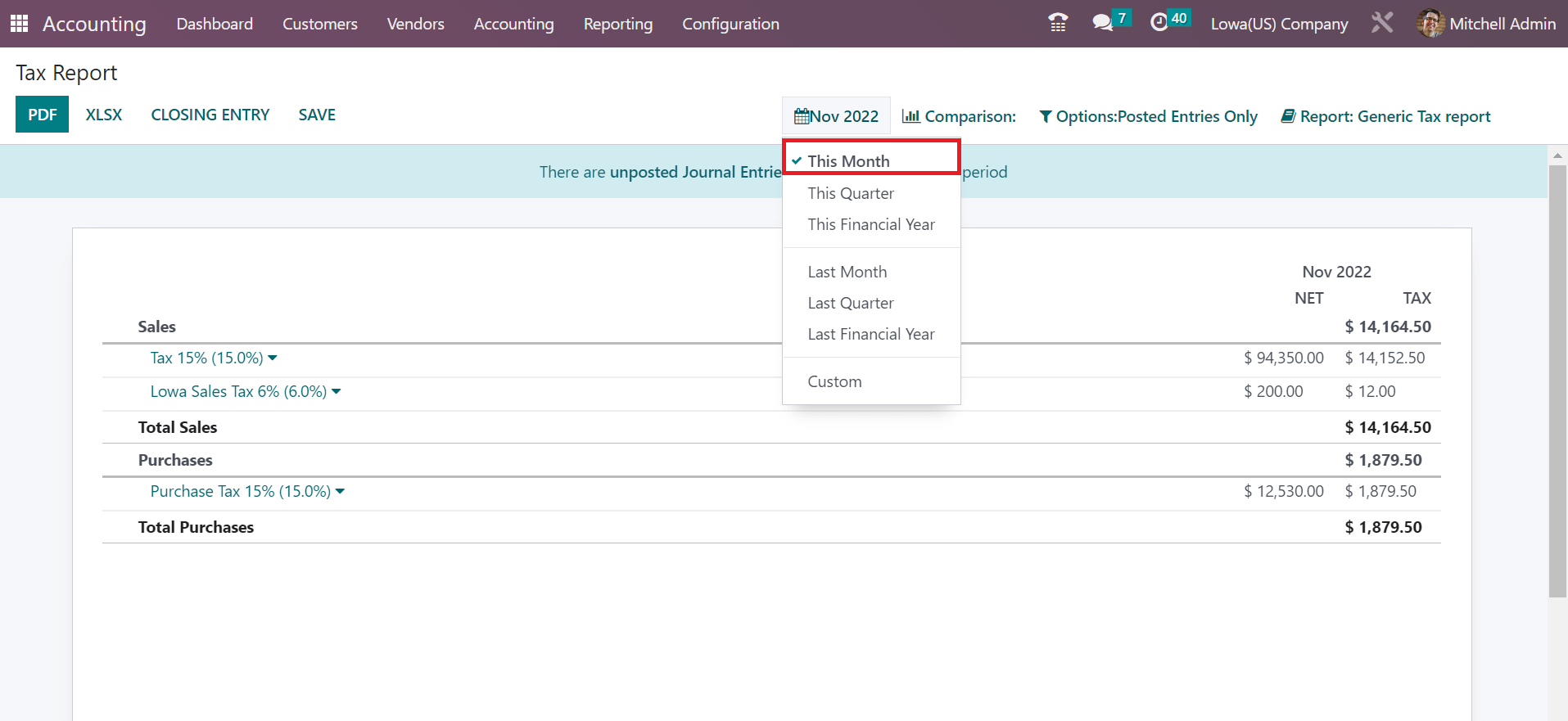

So, it is easy to demand Lowa Sales Tax on a customer invoice in the Odoo 16. It is possible to analyze your tax after choosing the Tax Report menu from Reporting tab. In the Tax Report window, the user can filter the dates based on month, financial year, or quarter to analyze taxes. We choose the This Month option as a filter, and individual results are visible in the window.

Here, the user can see the Net tax rate of Lowa Sales tax 6% below the Sales section. Similarly, a tax rate for purchases is also visible to the user. So, it is simple to evaluate your tax performance by analyzing the Net amount.

Computation of taxes based on each state in the US is made easy through Odoo 16 Accounting module. Users can quickly develop invoices according to created sales tax. A company can make further changes in the upcoming year and increase the workflow by evaluating tax reports.