A sales tax is a blend of all local, home rule/non-home rule occupations, state, public safety, business district tax, mass transit, and more. Based on consumption or use, sales tax is imposed on merchant receipts from personal property sales. Most of the states in the US cover divergent tax rates for products and services. In some instances, firms face strain on tax management per each country’s state. After implementing ERP software in your business, sales tax complications removes easily. Odoo 16 Accounting is the best result to solve your tax hurdle according to each state or locality.

This blog specifies the Illinois(US) Sales tax computation in Odoo 16 Accounting.

We can organize several journals such as Cash, Customer Invoice, Vendor bills, Salaries, Point of Sales, Bank, and more in your company advance through the Odoo 16 Accounting dashboard. Furthermore, users can analyze reports, including audits, statements, and partner with the Reporting feature of Odoo 16. Let’s examine the procedure of Illinois sales tax computation in Odoo 16.

Illinois(US) Sales Tax Outline for Users

The state sales tax of Illinois is 6.25% for general merchandise, such as commodities registered under Illinois State Government Agency. A local sales tax option of up to 4.75% also exists in Illinois by the local government, apart from regular sales tax. Moreover, a use tax rate of 1% is imposed on drugs, medical instruments, and qualified foods. The excessive sale tax in Illinois is 11.5% in cities such as Harwood Heights and Harvey. A seller should have physical and economic nexus to collect taxes in Illinois.

Vendors can register the sales tax easily through the My Taxillinois online site. Some of the necessary details for registration include business type, description of business activities, Illinois location address, business type, etc. As per Illinois or out-of-state, state sales tax rate is collected in Illinois, and shipping is taxable primarily.

To Define Illinois(US) Company Information in Odoo 16

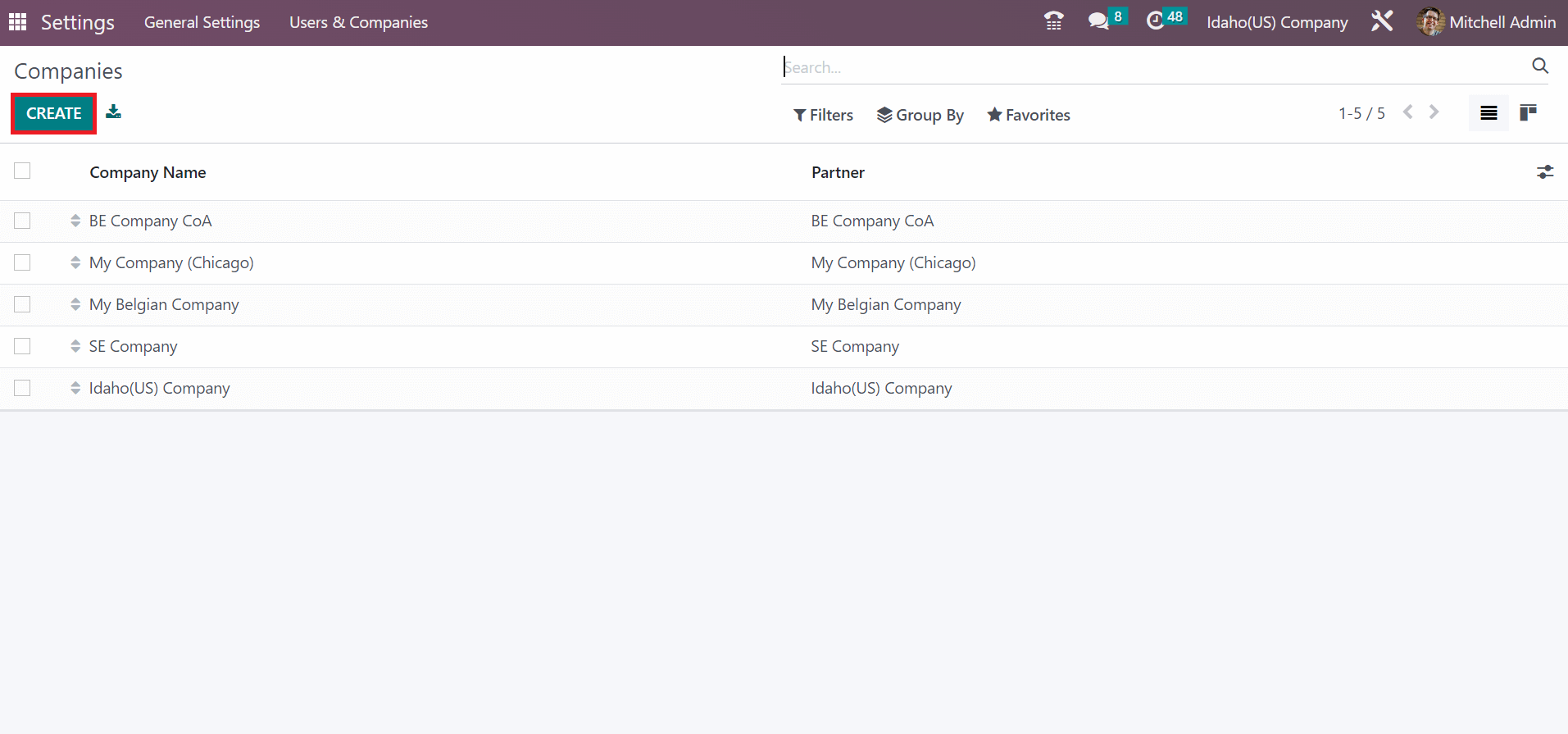

Odoo ERP software assists you in defining several company data exiting in various locations. Users can quickly manage the localization feature of an organization in Odoo 16. Select the Companies menu in Odoo 16 Settings for applying new company data. Data concerning all registered companies are acquirable in the open window. You can choose the CREATE button in the Companies page, as displayed in the screenshot below.

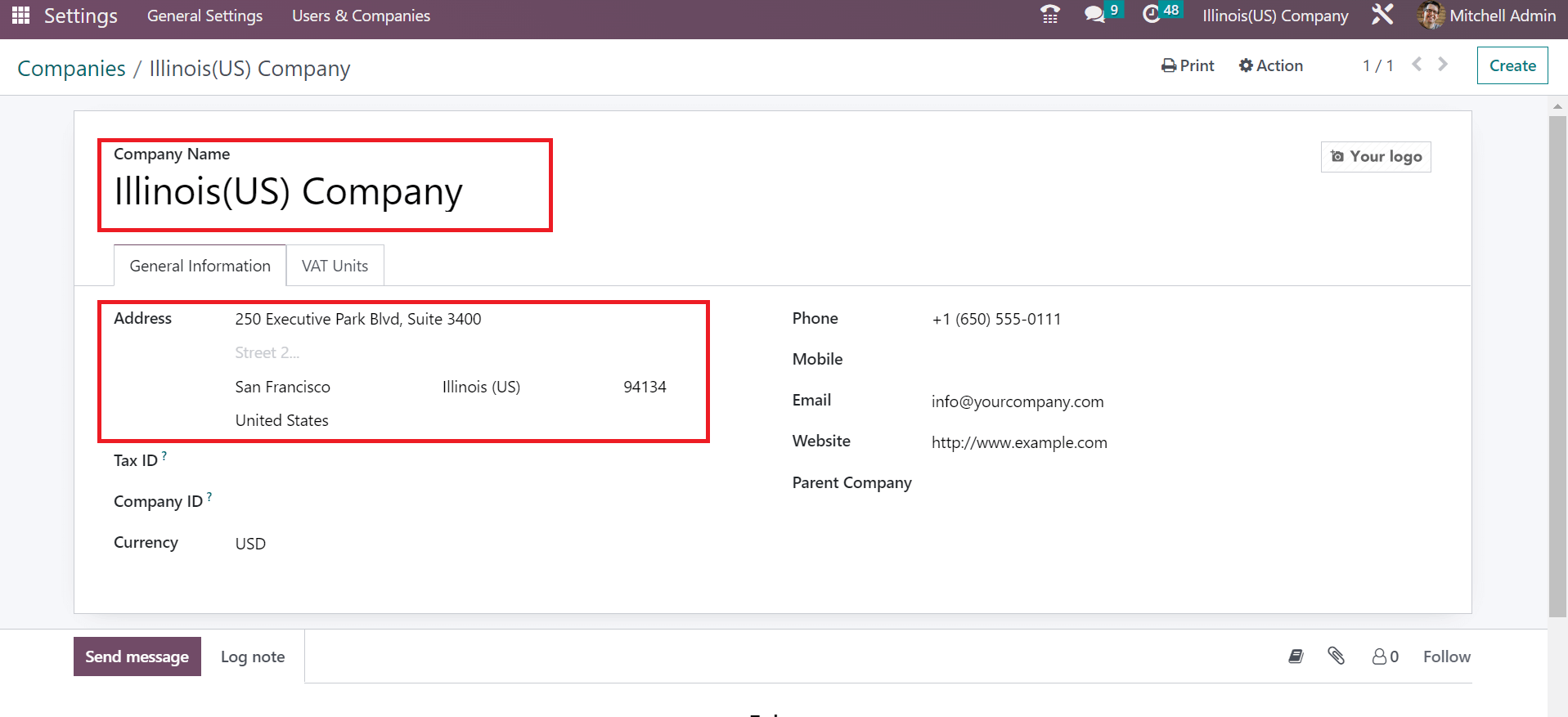

Users can add the Company Name as Illinois(US) Company. Also, other company features are managed under the General Information tab. You can specify the country as United States or Illinois(US) in the state field and more data in the Address field, as defined in the screenshot below.

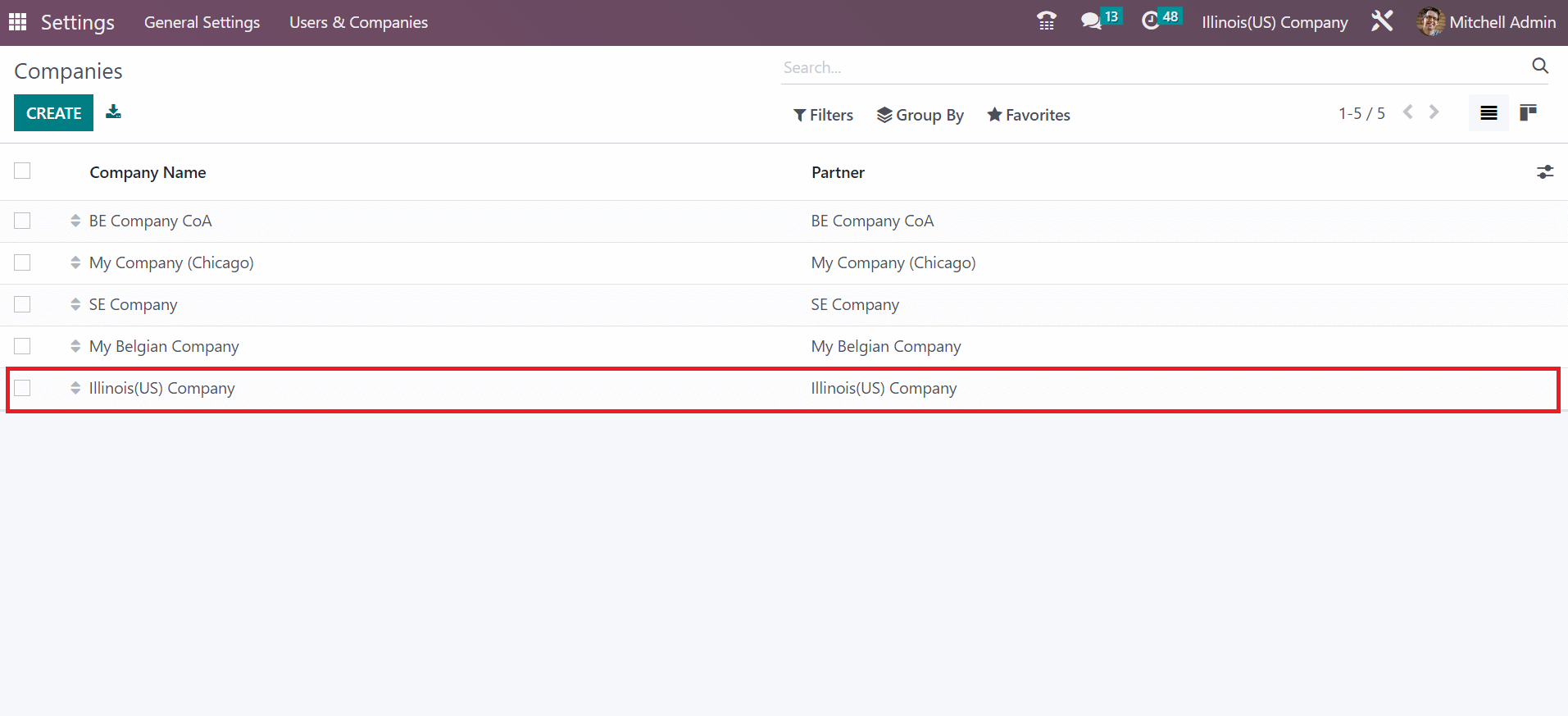

After applying essential information about a company, all details are saved manually. Your created company data is viewable in the main Companies window, as specified in the screenshot below.

How to Apply Sales Tax of Illinois in Odoo 16 Accounting?

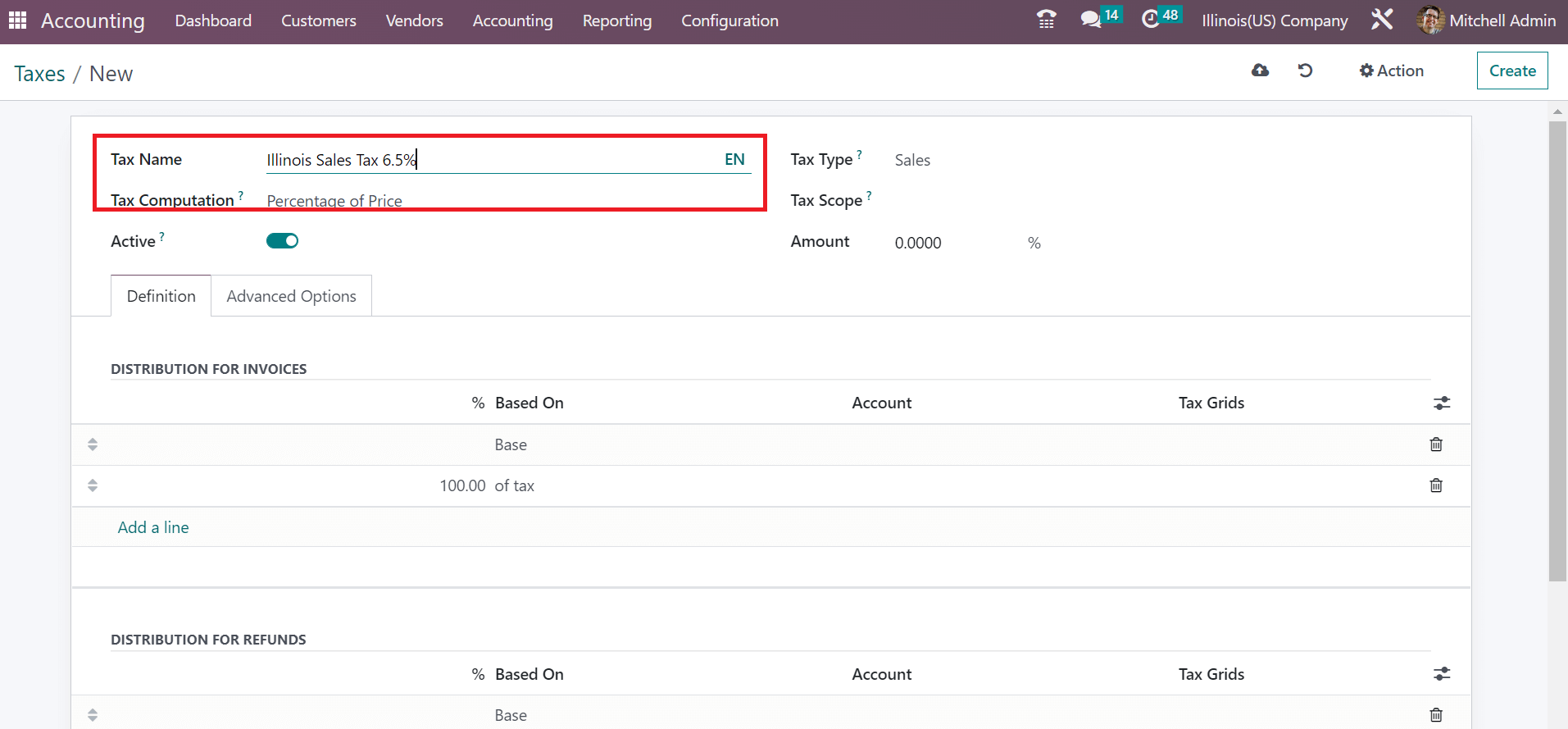

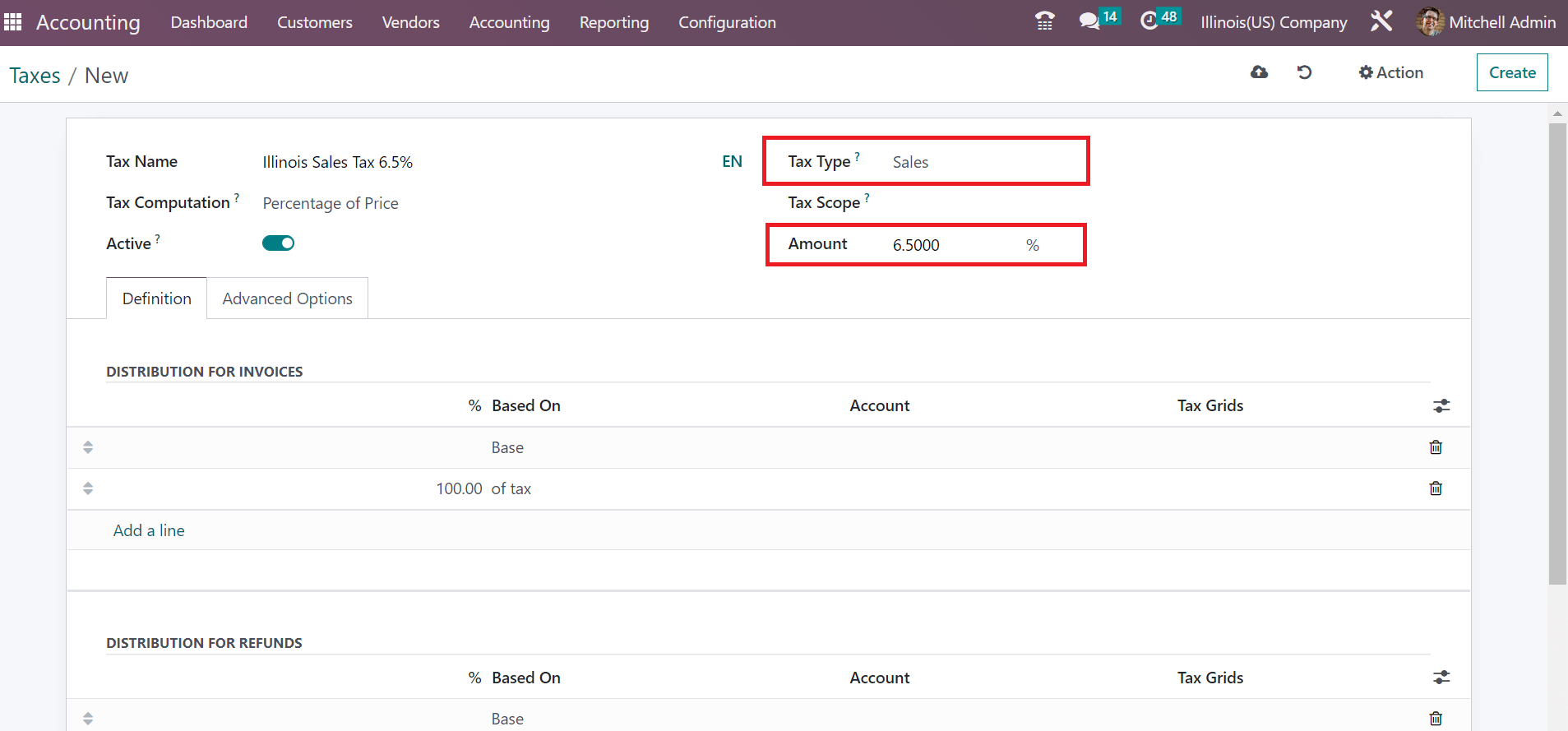

We can manage Illinois’s highest and lowest sales tax by selecting the Taxes menu in Configuration. All your created tax list is visible in the Taxes window. You can click the CREATE icon to develop the lowest sales tax in Illinois. Afterward, a new tax window appears before you. The minimum sales tax rate in Illinois state is 6.25%. So, let’s add the Tax Name as Illinois Sales Tax 6.25% in Tax Name and select the calculation method for your Tax in the Tax Computation option.

Here, we chose the Percentage of Price option under the Tax Computation, and it is possible to bring up the tax percentage of Illinois in the Amount option, as marked in the screenshot below.

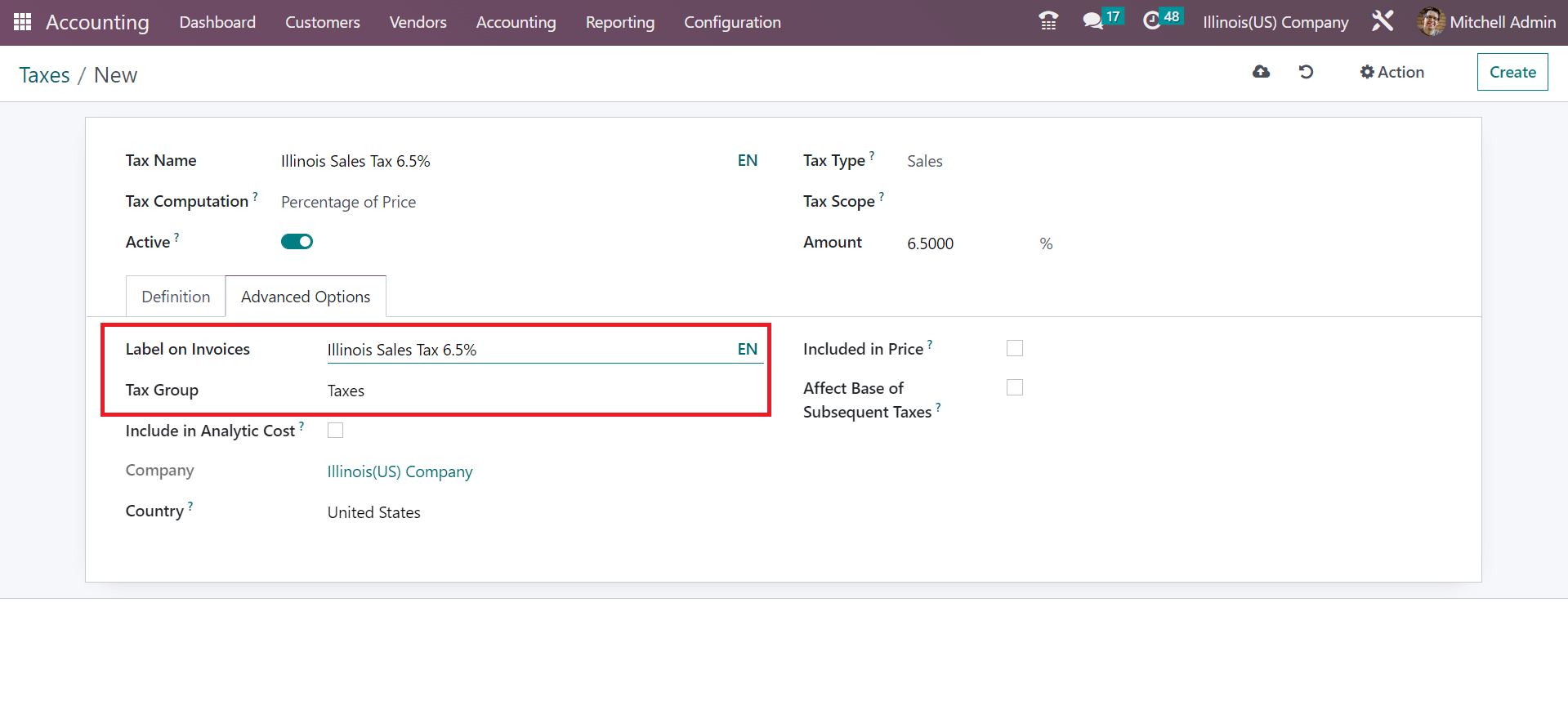

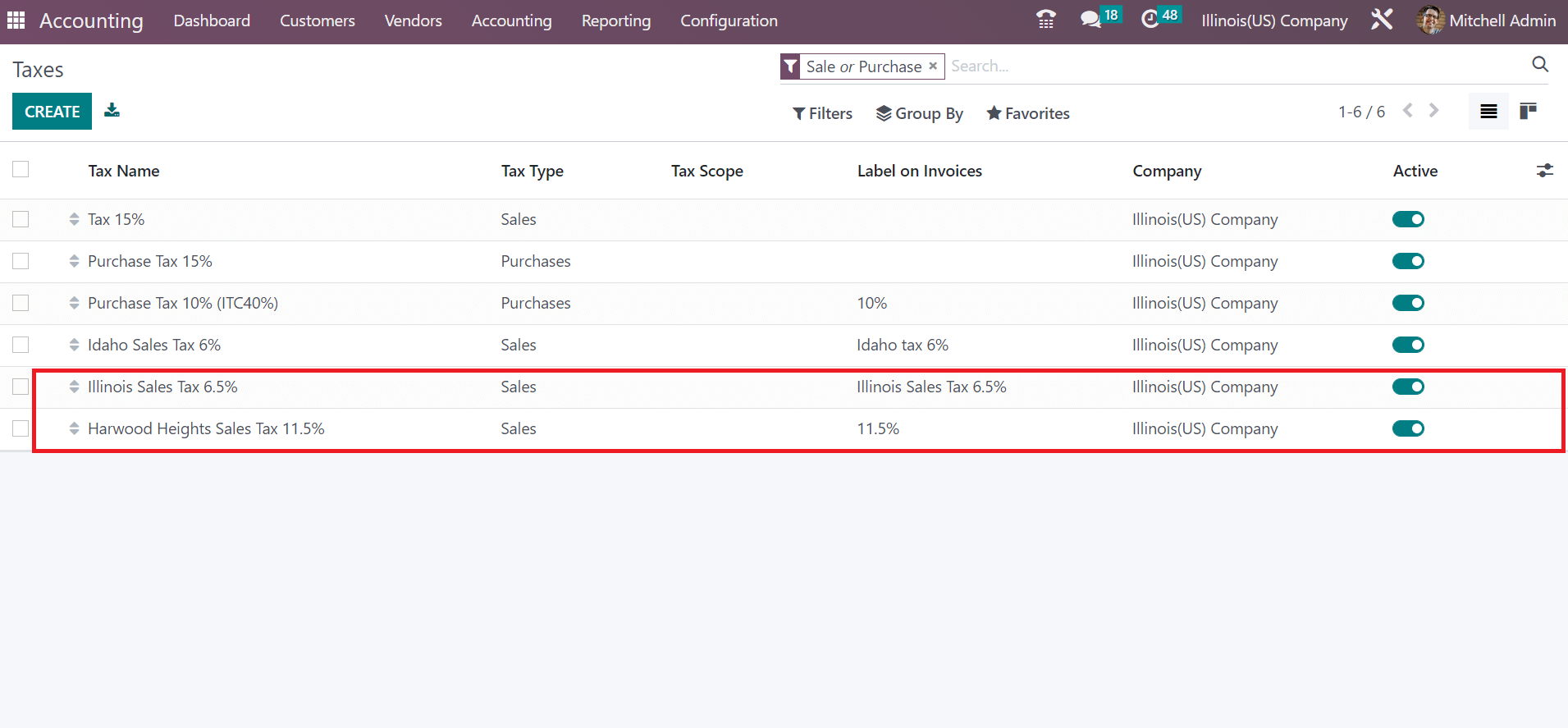

Users can also select the Sales option in the Tax Type field, as shown in the screenshot above. Below the Definition section, we can distribute tax rates for invoices and refunds based on your requirements. Additionally, users can manage the advanced options under the Advanced Options tab. Set the Label on Invoices as Illinois Sales Tax 6.5% and Taxes option under Taxes as described in the screenshot below.

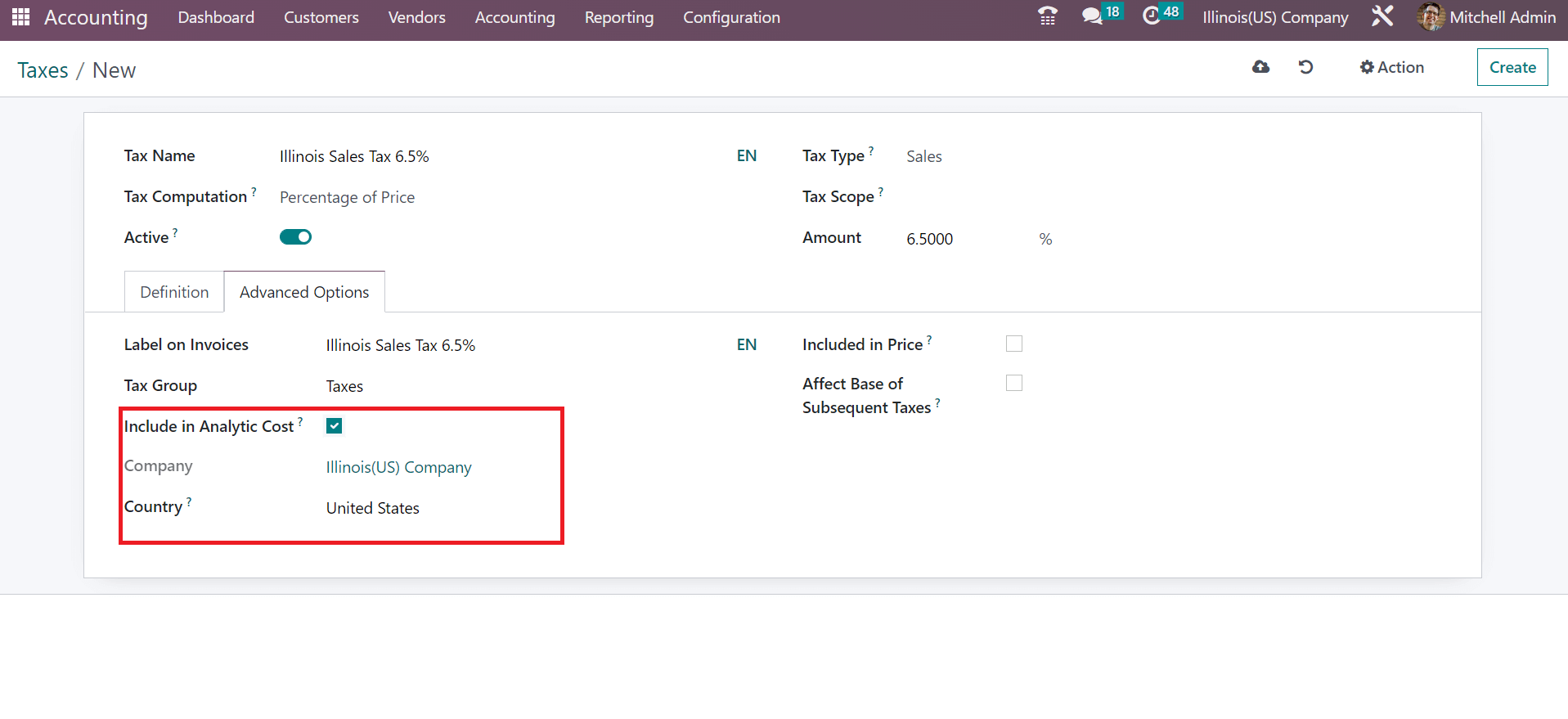

To assign invoice lines to the same analytic account, you must activate Include in the Analytic Cost field. Information related to Company and Country is automatically visible to the user below the Advanced Options section, as illustrated in the screenshot below.

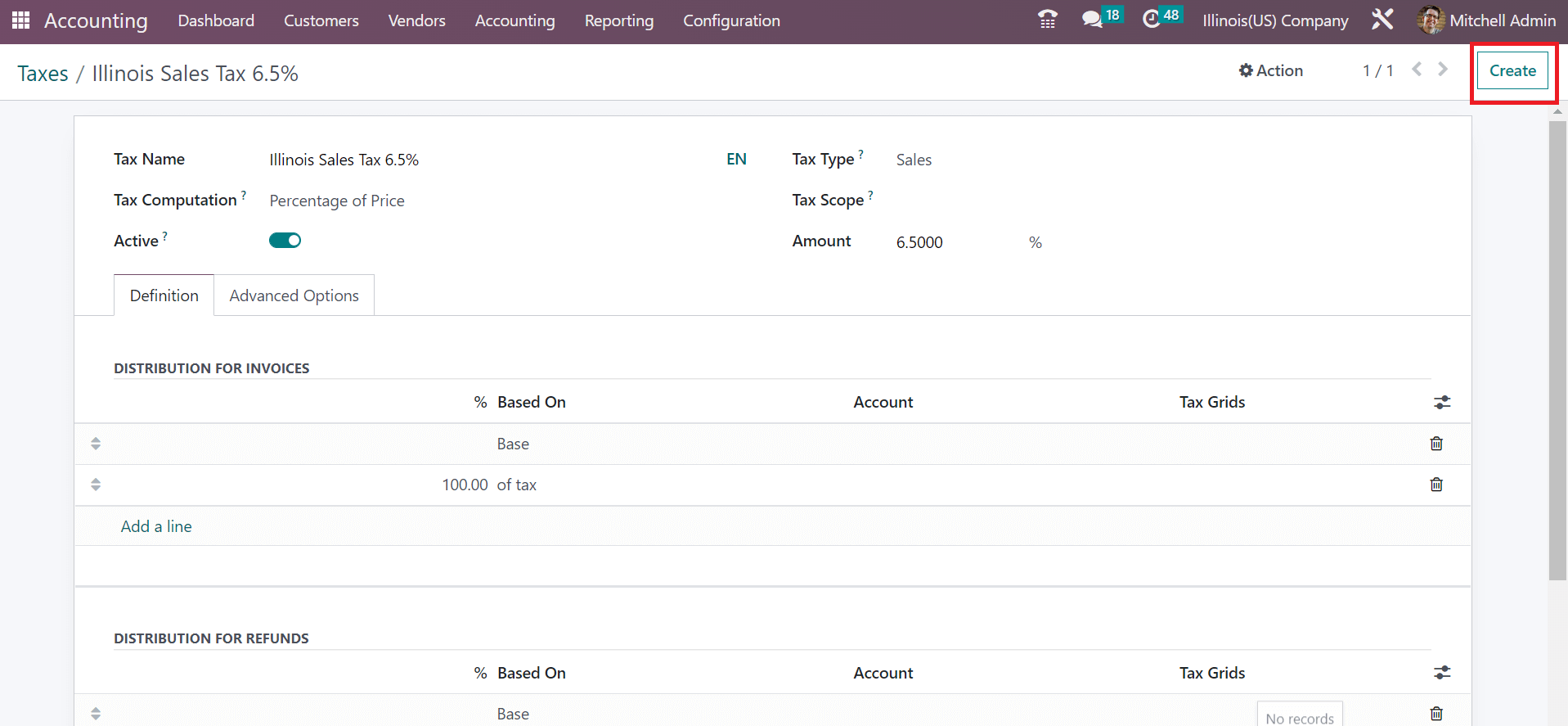

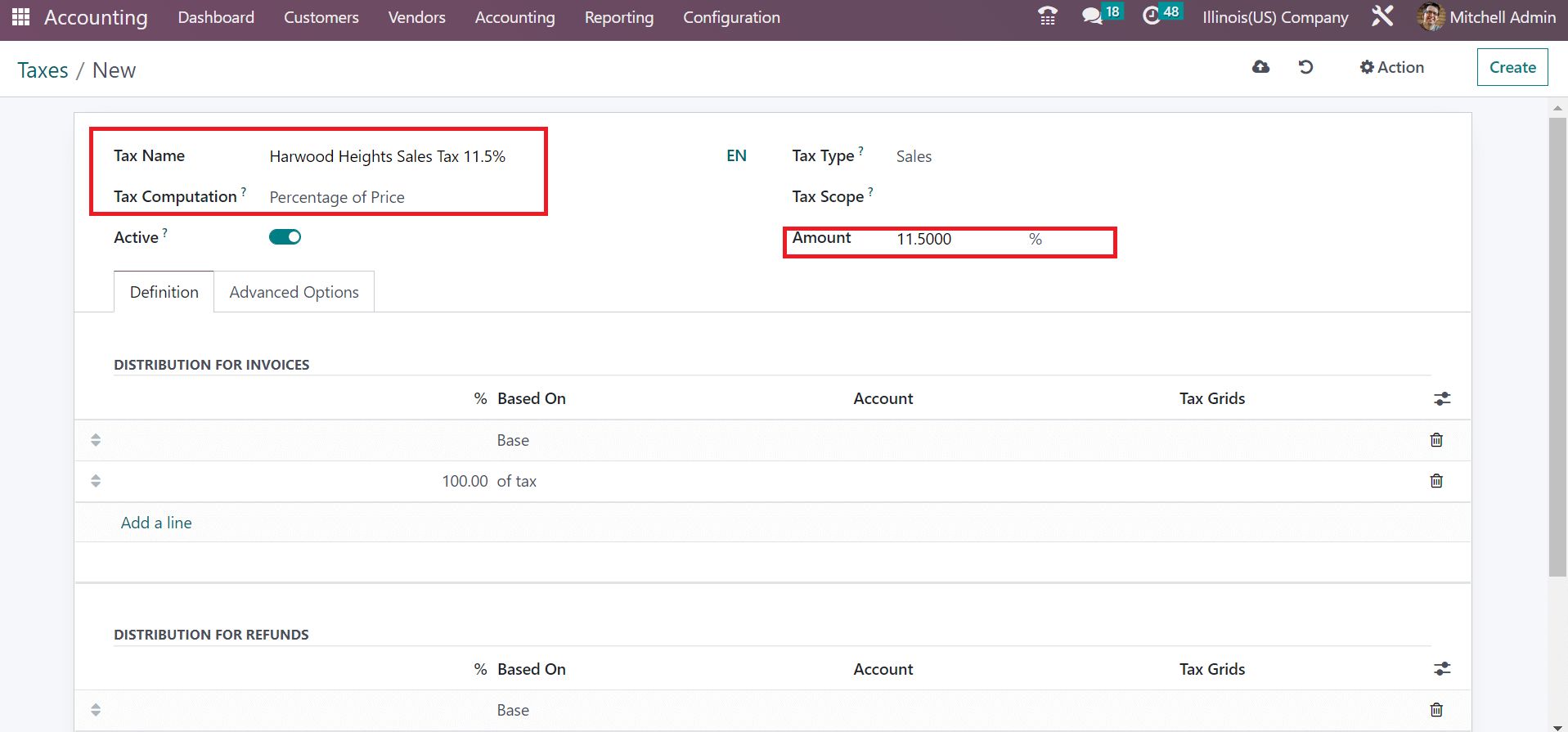

Illinois sales tax facts are saved automatically in the Odoo 16 Accounting module. As discussed, Harwood Heights, Illinois, has the highest sales tax rate of 11.5%. If you want to mention a new tax rate for Harwood Heights, choose the CREATE button at the right end of the Taxes window, as noted in the screenshot below.

In the open screen, you must apply Harwood Heights Sales Tax 11.5% on the Tax Name field. Set the computation method as a price percentage and enter 11.5% as the Amount, as presented in the screenshot below.

Users can save the details manually after entering sales tax information. Each created Tax is available in the Taxes window, as signified in the screenshot below.

Steps to Configure Illinois Sales Tax on a Customer Invoice in Odoo 16 Accounting

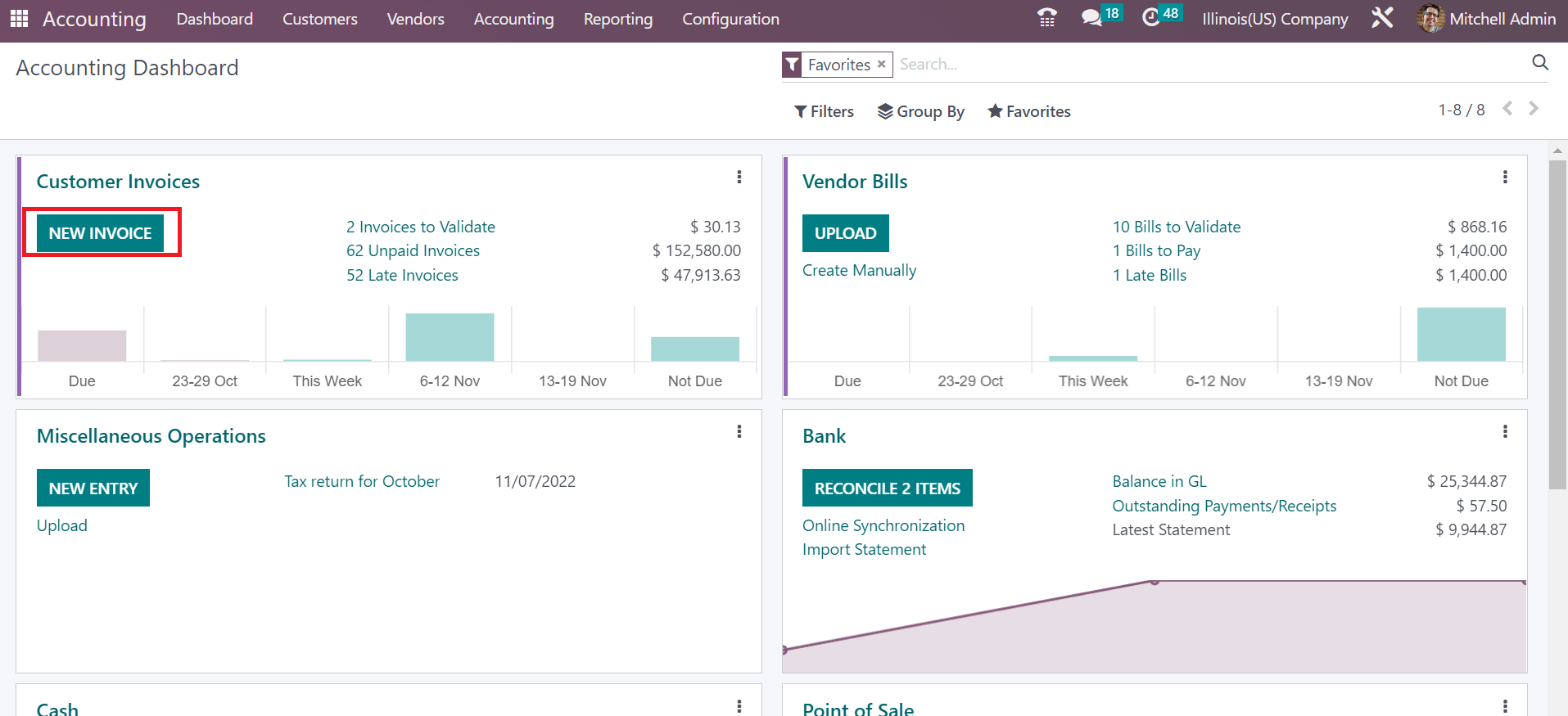

Users can easily specify Illinois’s created sales tax rates on a customer invoice in Odoo 16. You can obtain the NEW INVOICE icon below the Customer Invoices Journal of Accounting dashboard.

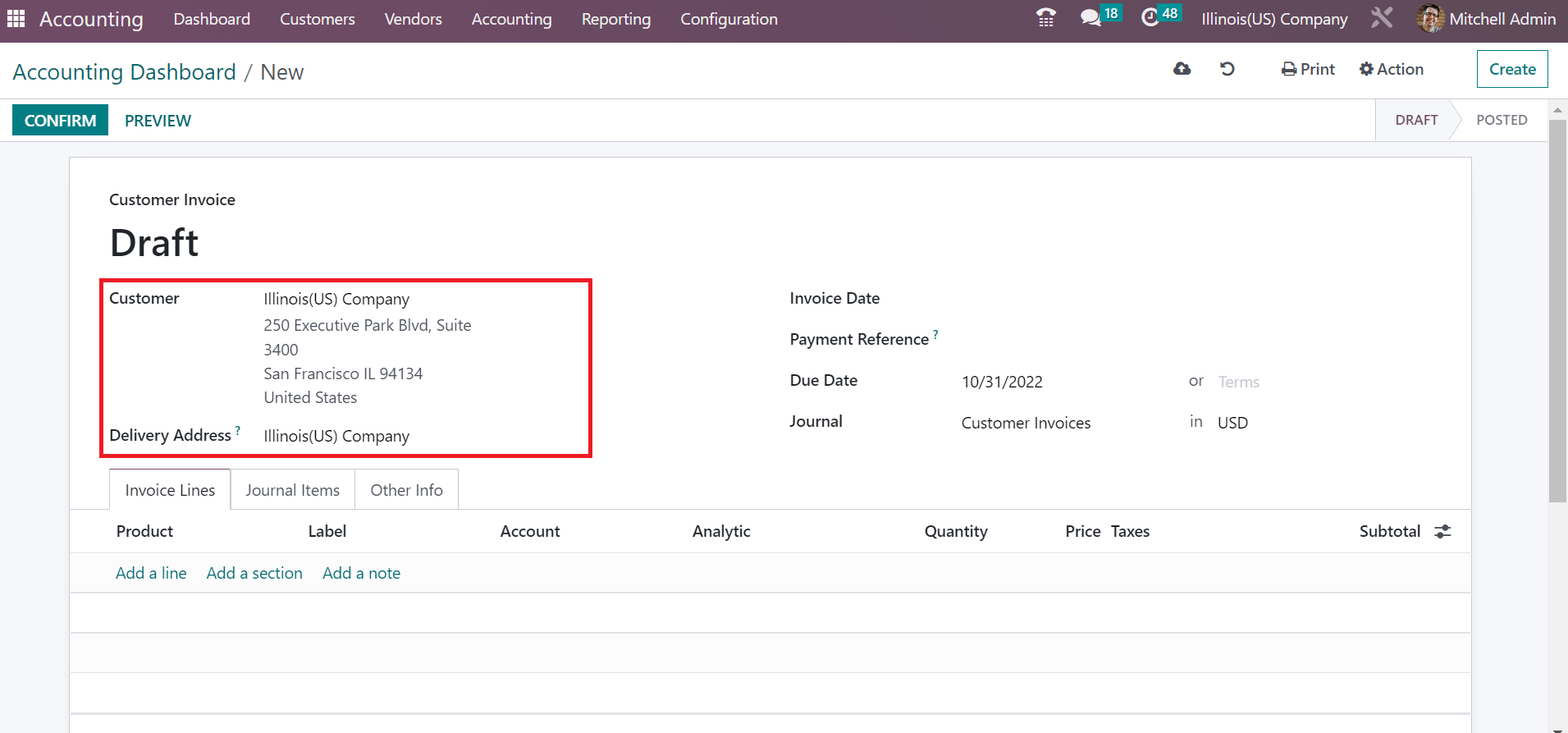

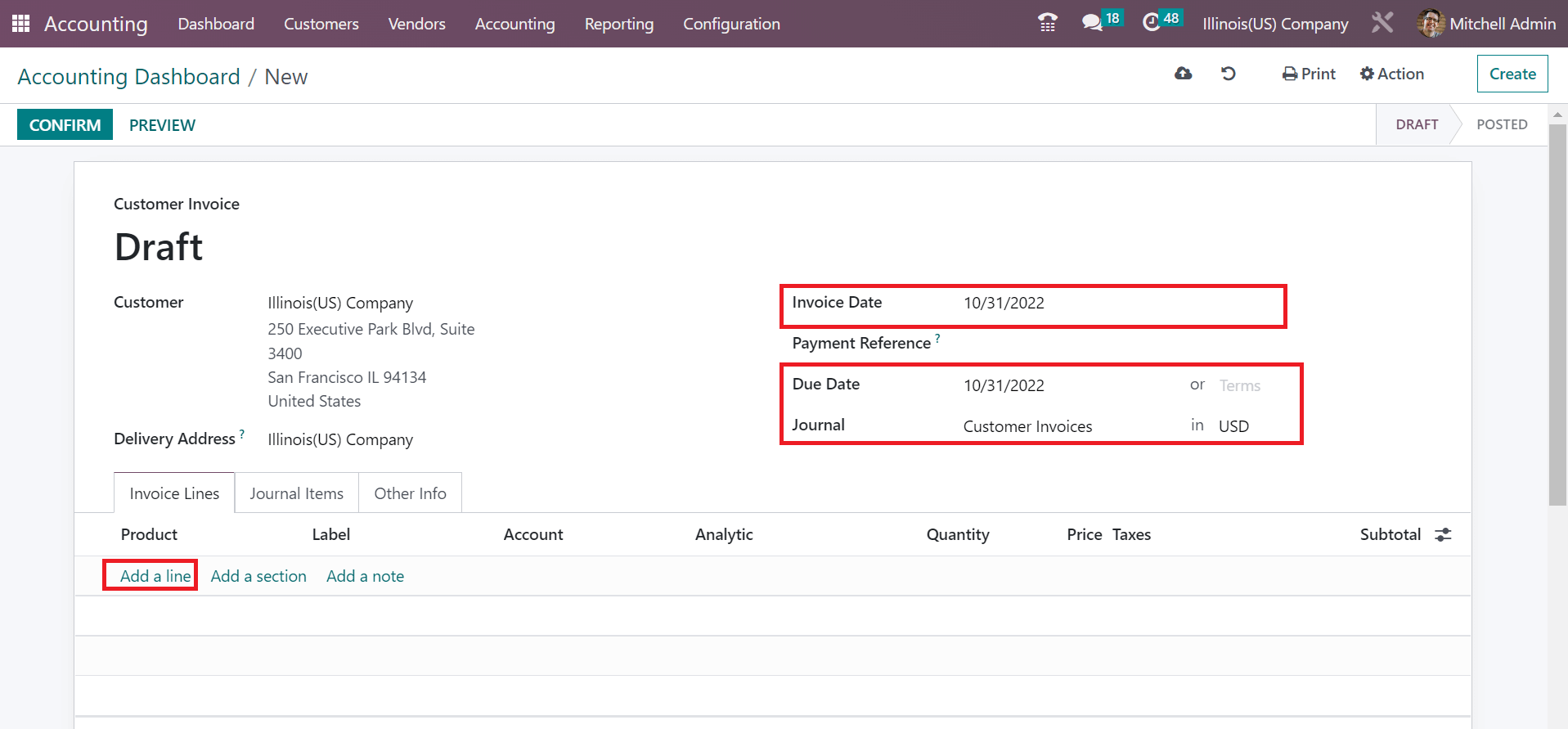

After clicking the NEW INVOICE button, a new screen appears to the user. It is easy to choose Illinois(US) Company as a Customer, and the customer’s address is visible to you.

Later, you can set the Due Date means the last invoice date; the Invoice Date refers to the start day and the Journal of your customer invoice. After applying all details, press the Add a line option in the Invoice Lines section to use the data of a specific item.

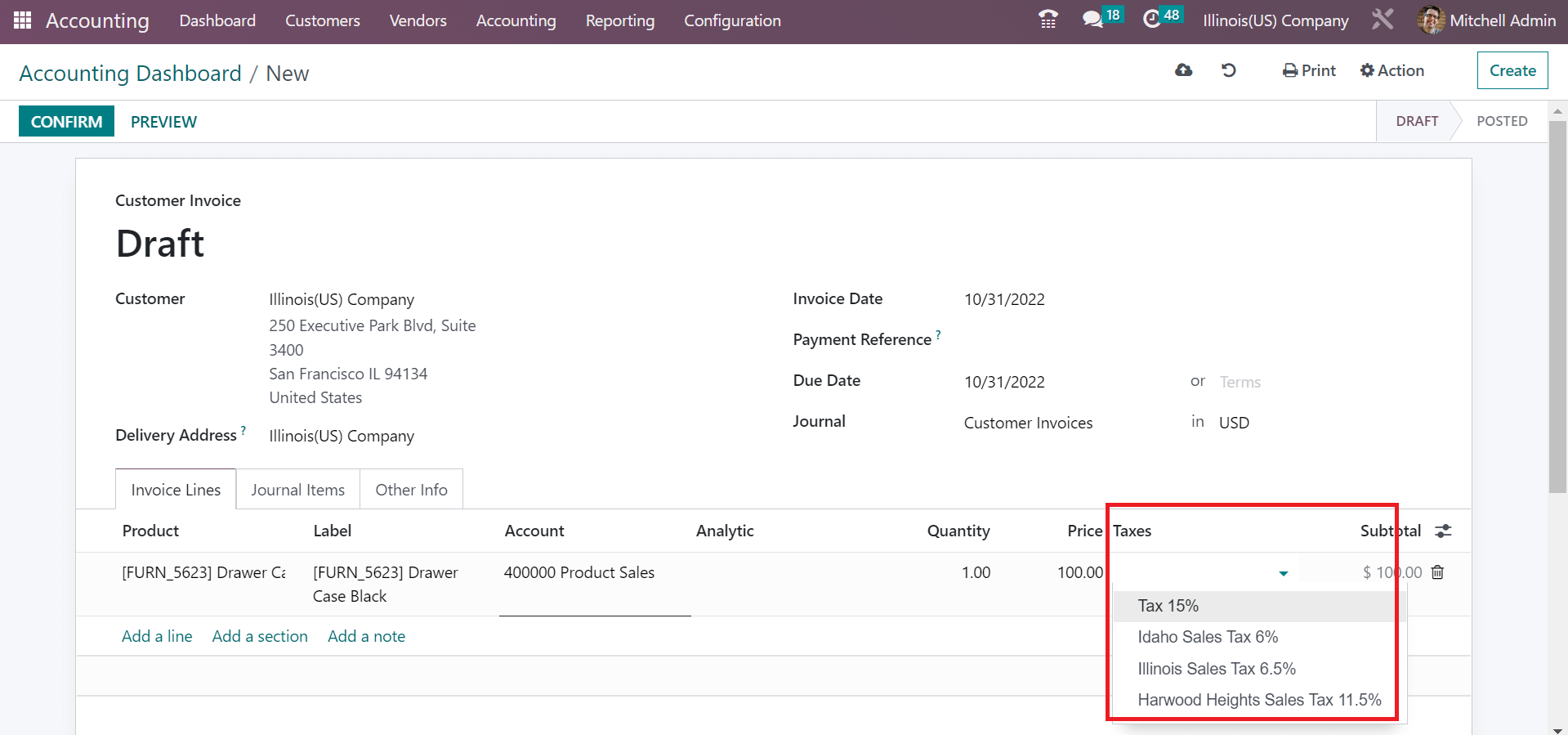

We select one quantity of drawer case black with a price of 100. Under the Taxes section, the user can see created taxes such as Illinois Sales Tax of 6.5% and Harwood Height Sales Tax of 11.5%

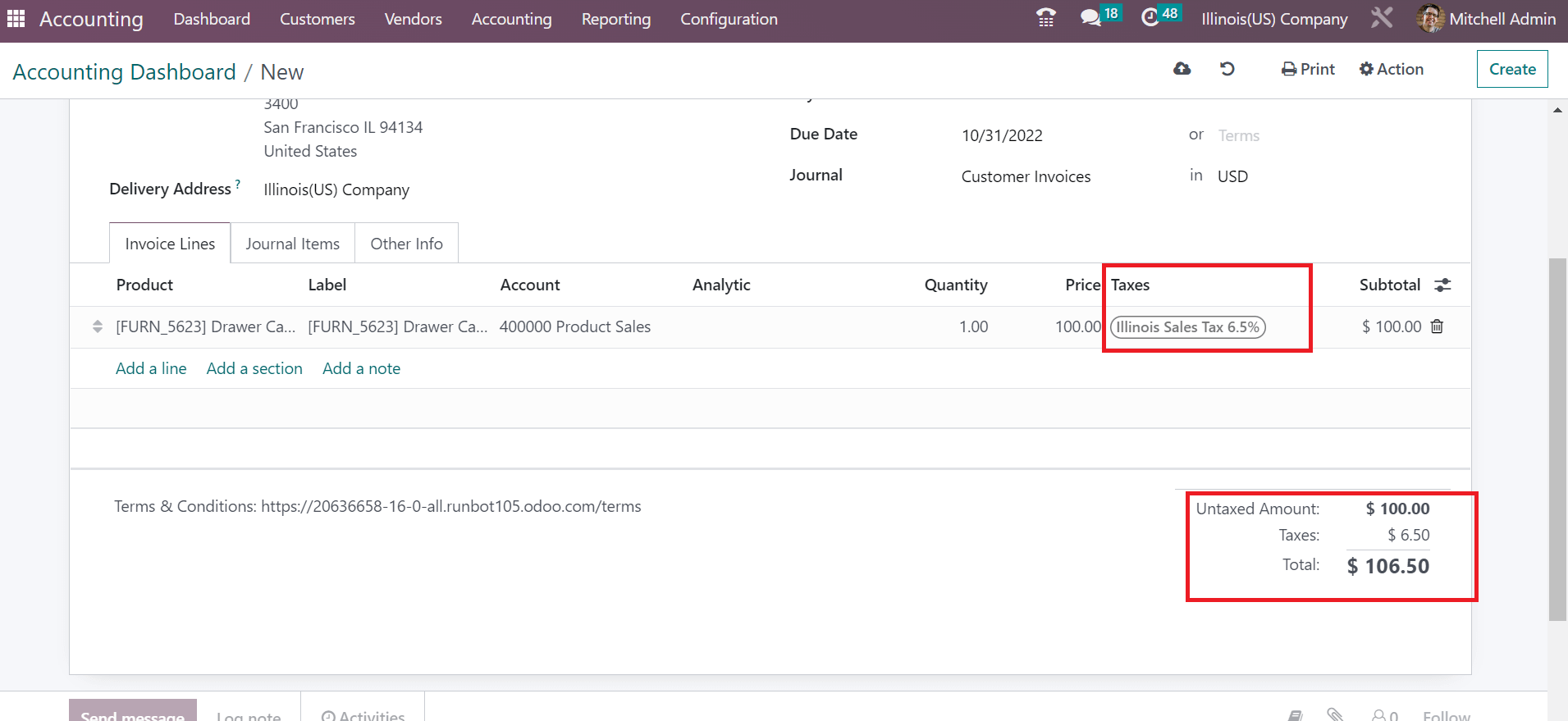

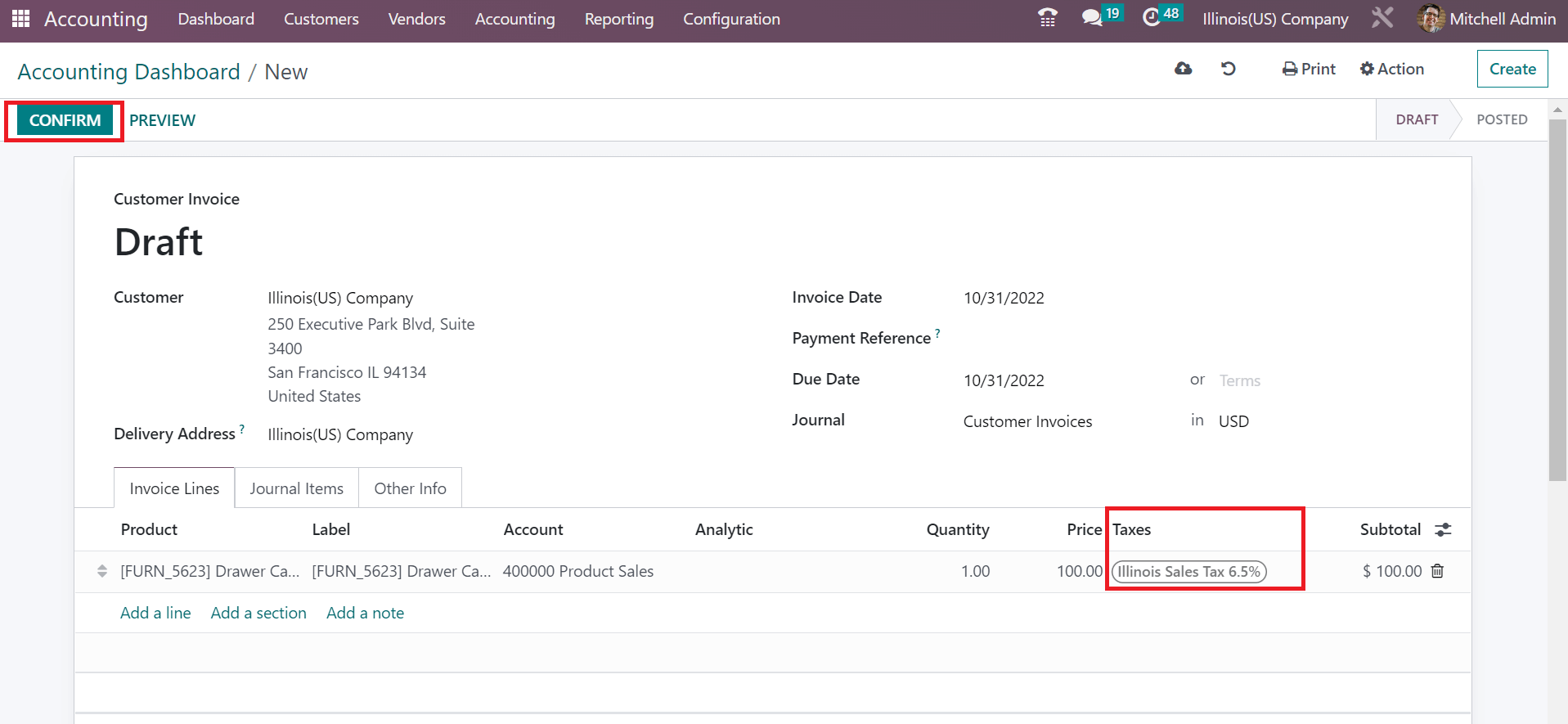

Firstly, we can choose the Illinois Sales Tax 6.5% in the Taxes section under the Invoice Lines tab. After selecting Illinois Sales Tax 6.5%, your total cost for a product is visible at the right end, along with the applied Tax of 6.5%, as described in the screenshot below.

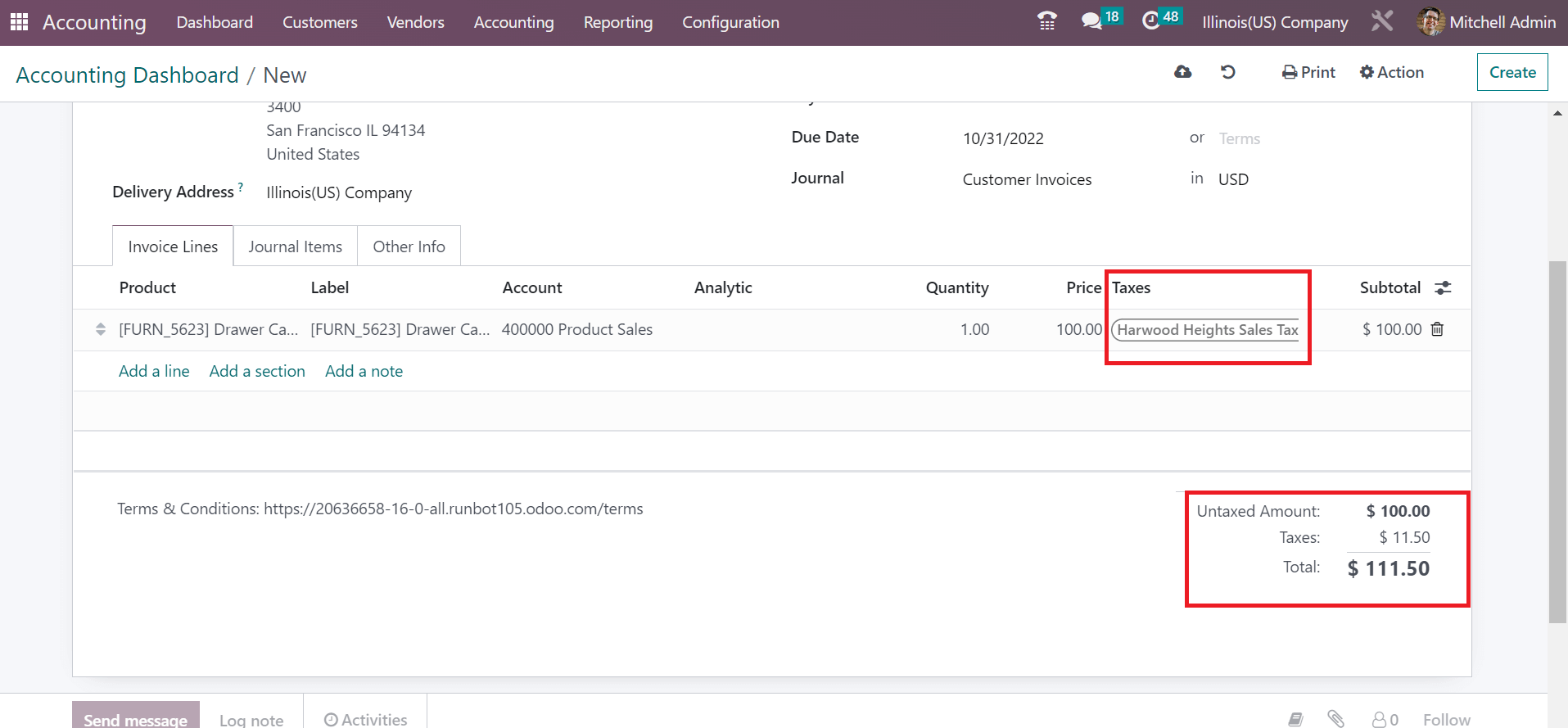

If you choose the Harwood Heights Sales Tax of 11.5% below the Taxes section, you can see an 11.5% tax rate with the Untaxed Amount for drawer case black.

Hence, it is easy to apply Illinois’s minimum and maximum tax rates on a customer invoice using Odoo 16 Accounting. All data is saved automatically after choosing your specific tax rate in the Customer Invoices window. We selected Illinois Sales Tax 6.5% in the Customer Invoice and pressed the CONFIRM button to proceed with the invoice.

So, the user can make the customer invoice according to their desired state tax rate in Odoo 16.

Illinois Sales tax compliance simplify by an organization with the Odoo ERP software. We provide the steps to configure tax rates for a business and manage the localization by implementing Odoo 16 Accounting module in your industry.