The minimum price an employee receives for their work in a company is a basic wage. It acts as an income for a worker before accessing benefits, taxes, modifications, and other bonuses. Based on profession and industry, the basic pay for each individual varies in the US. It entirely depends on the job position, experience, living cost, and geographic access. Basic pay is a vital part of the employee payslip in a company. Most companies need help calculating the basic wage of laborers in the payslip. Odoo ERP software helps to manage the payslip quickly after specifying the basic salary, net, gross, and more data. Using Odoo 16 Payroll, the user can obtain the payslip document for each individual separately.

This blog depicts the management of basic wage details on employee payslips in US companies.

We can manage the work entries, rules, job positions, time off, and more within the Odoo 16 Payroll module. The creation of salary slips is a simple task with the help of Odoo 16. Now, let’s see the process of managing employees’ basic salaries in a Payslip.

How to Add Basic Wage of Employee in a Payslip?

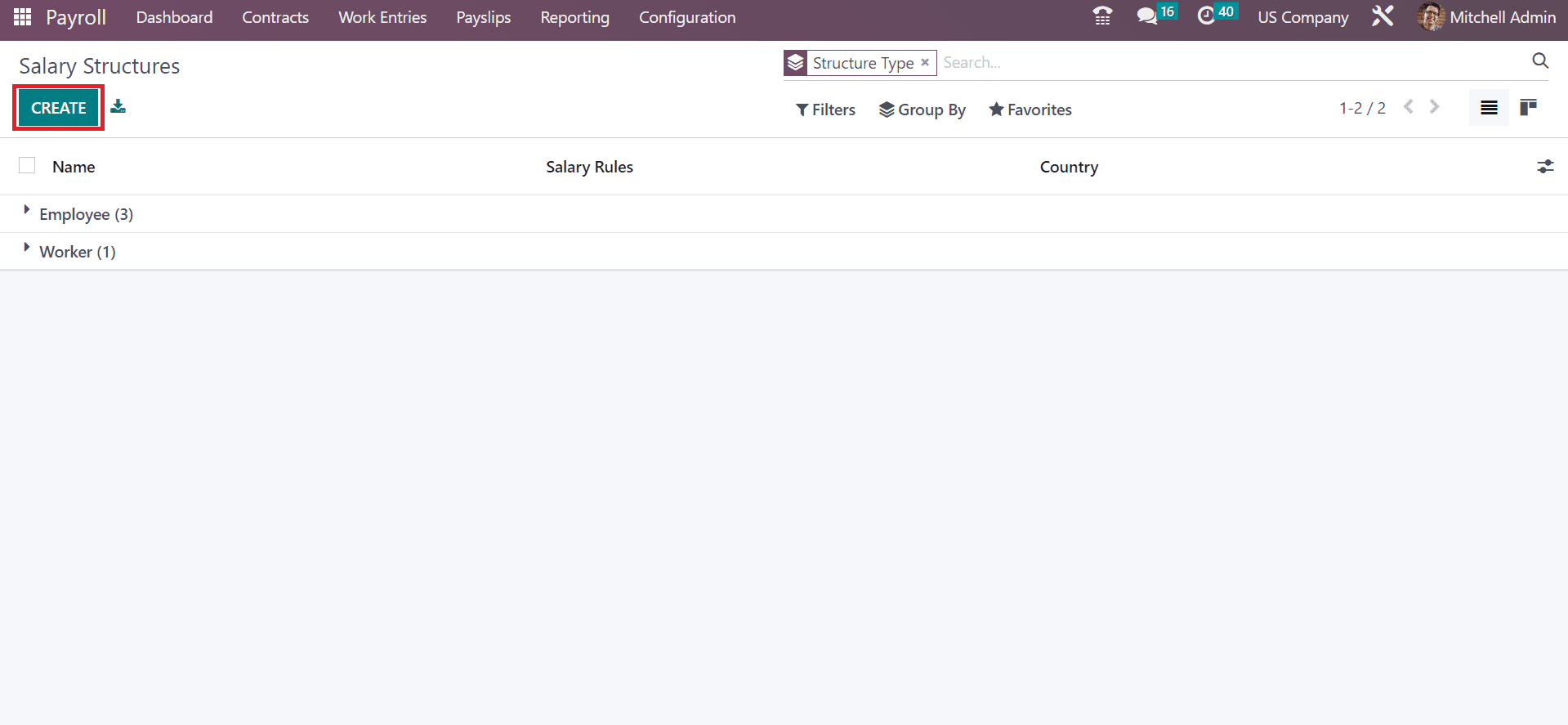

The minimum earnings sum received by an employee is basic pay. It is less than the gross salary, and deductions are not included in a basic wage. We must develop a salary structure before developing a payslip for an employee. Choose the Structure menu inside the Configuration, and you can view the details of each salary structure. To formulate a new one, press the CREATE icon in the Salary Structures window, as defined in the screenshot below.

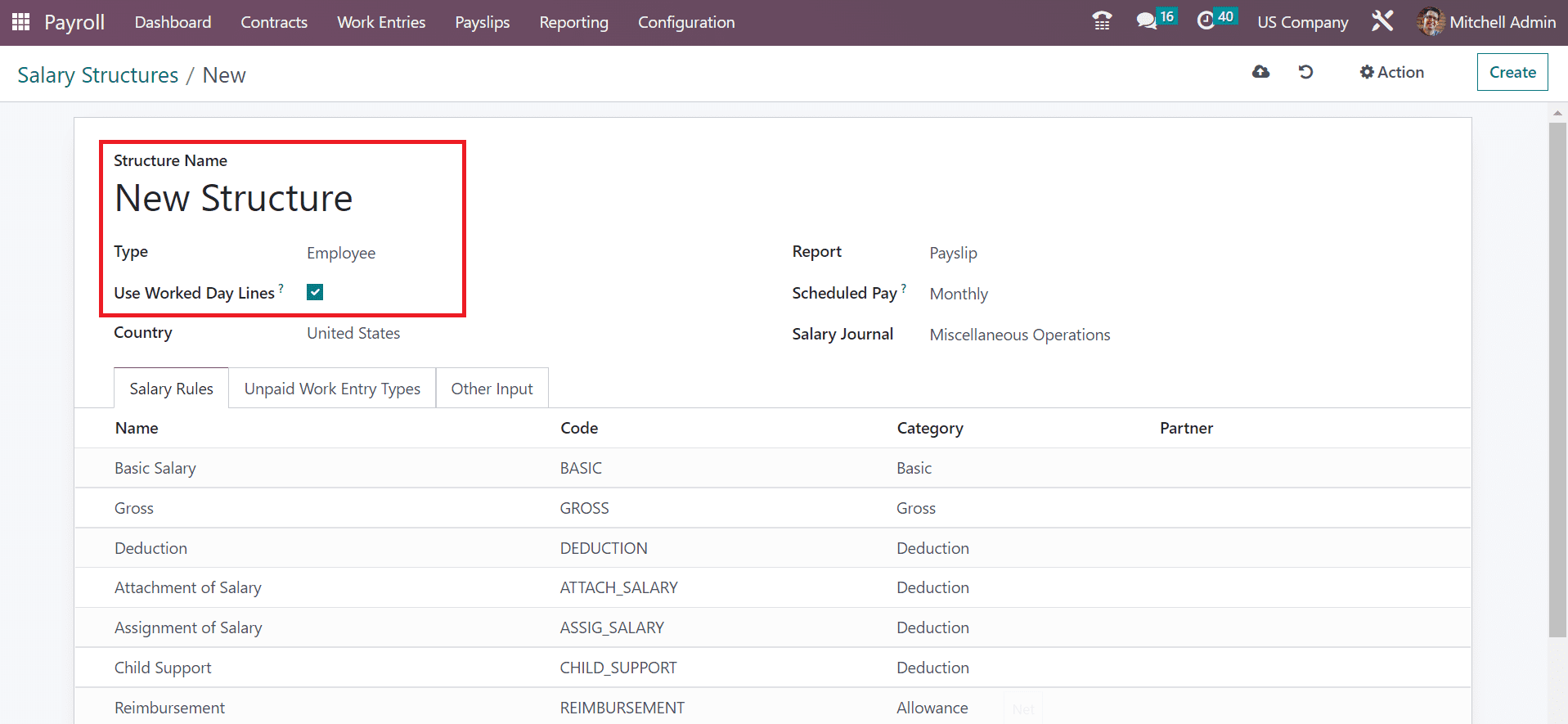

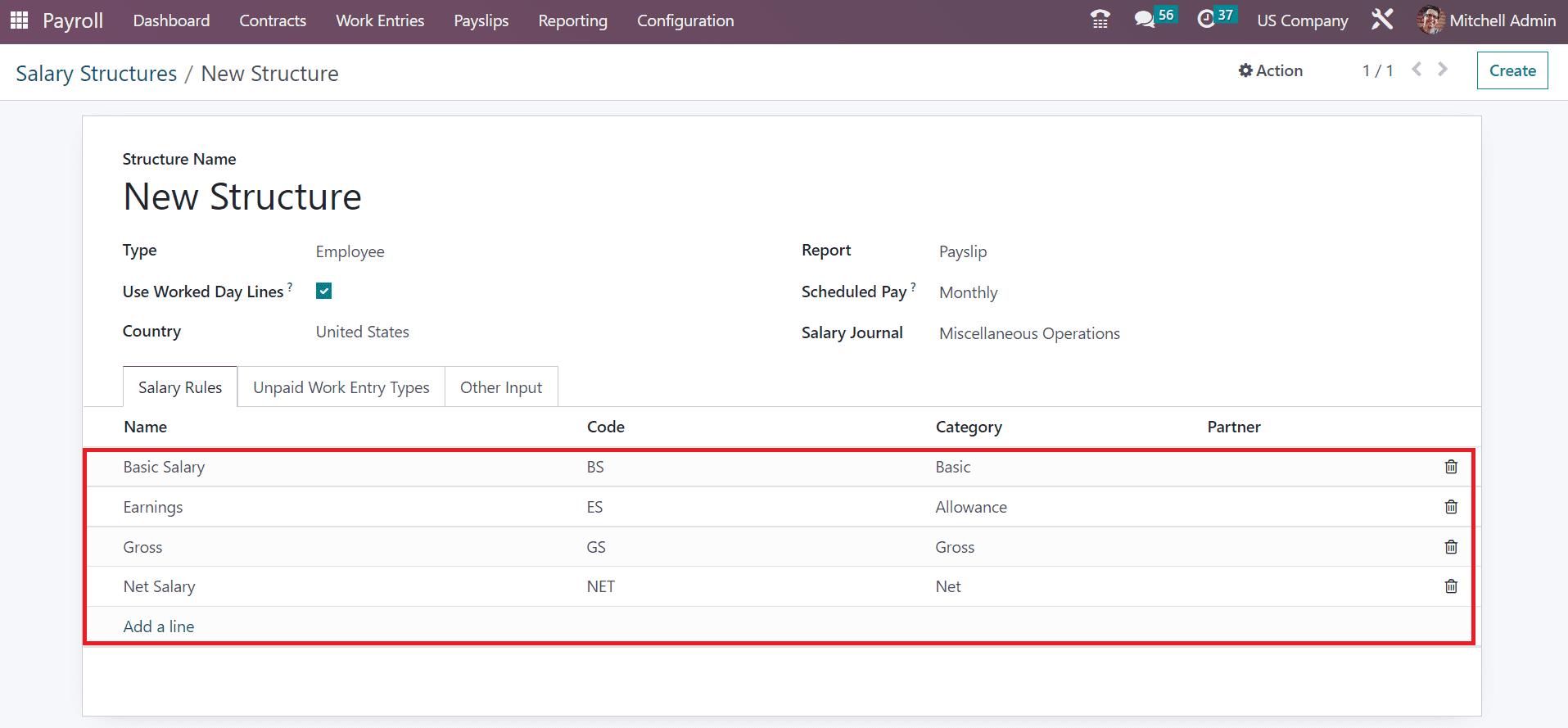

Users can mention the structure name as New Structure and Type as Employee. Later, enable the Use Worked Day Lines option for the viewability of employee work days in a payslip, as cited in the screenshot below.

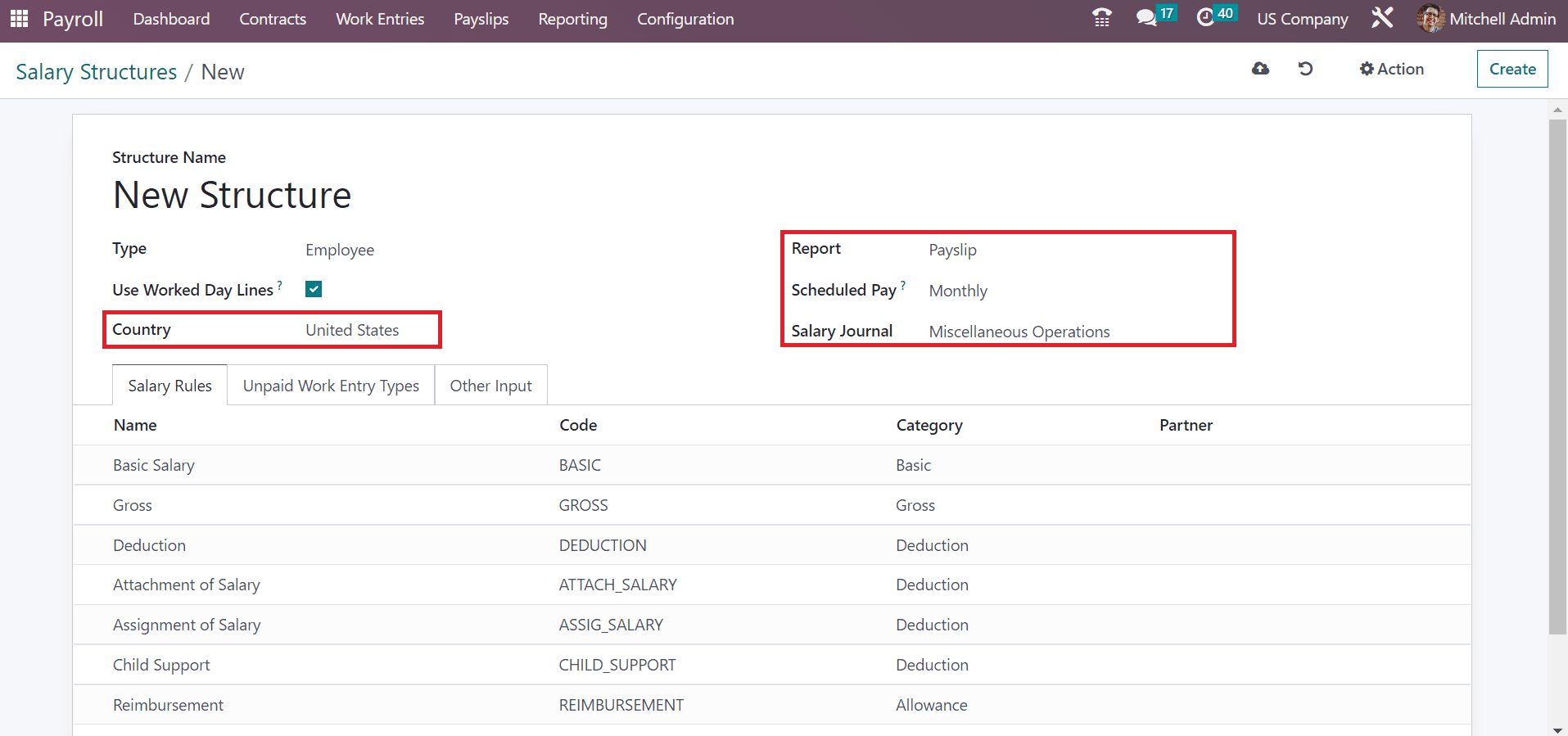

Next, choose your Country as the United States and the Payslip option in the Report field. We can select a monthly Scheduled Pay for the Salary Structure and pick Miscellaneous Operations in the Salary Journal field.

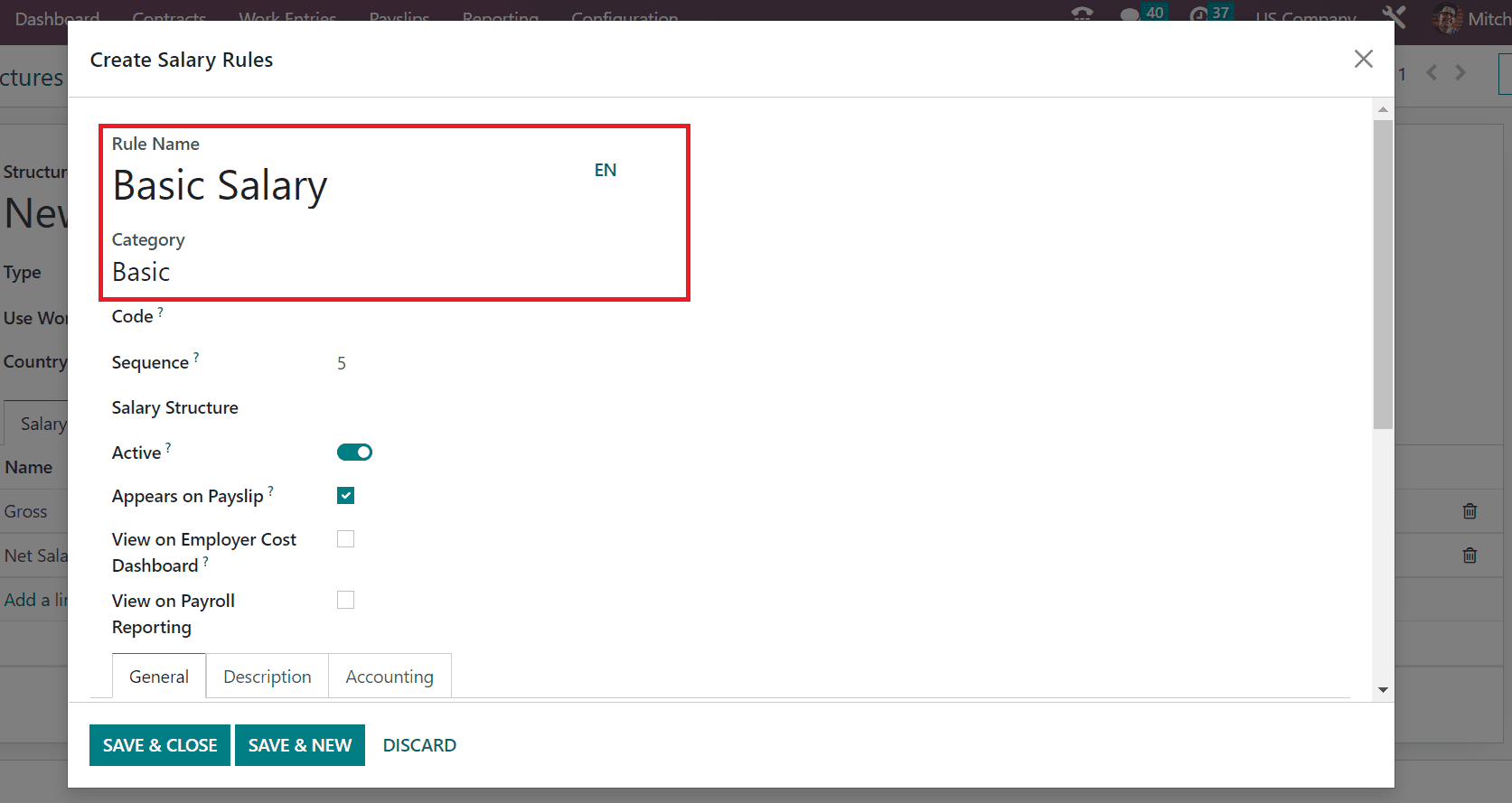

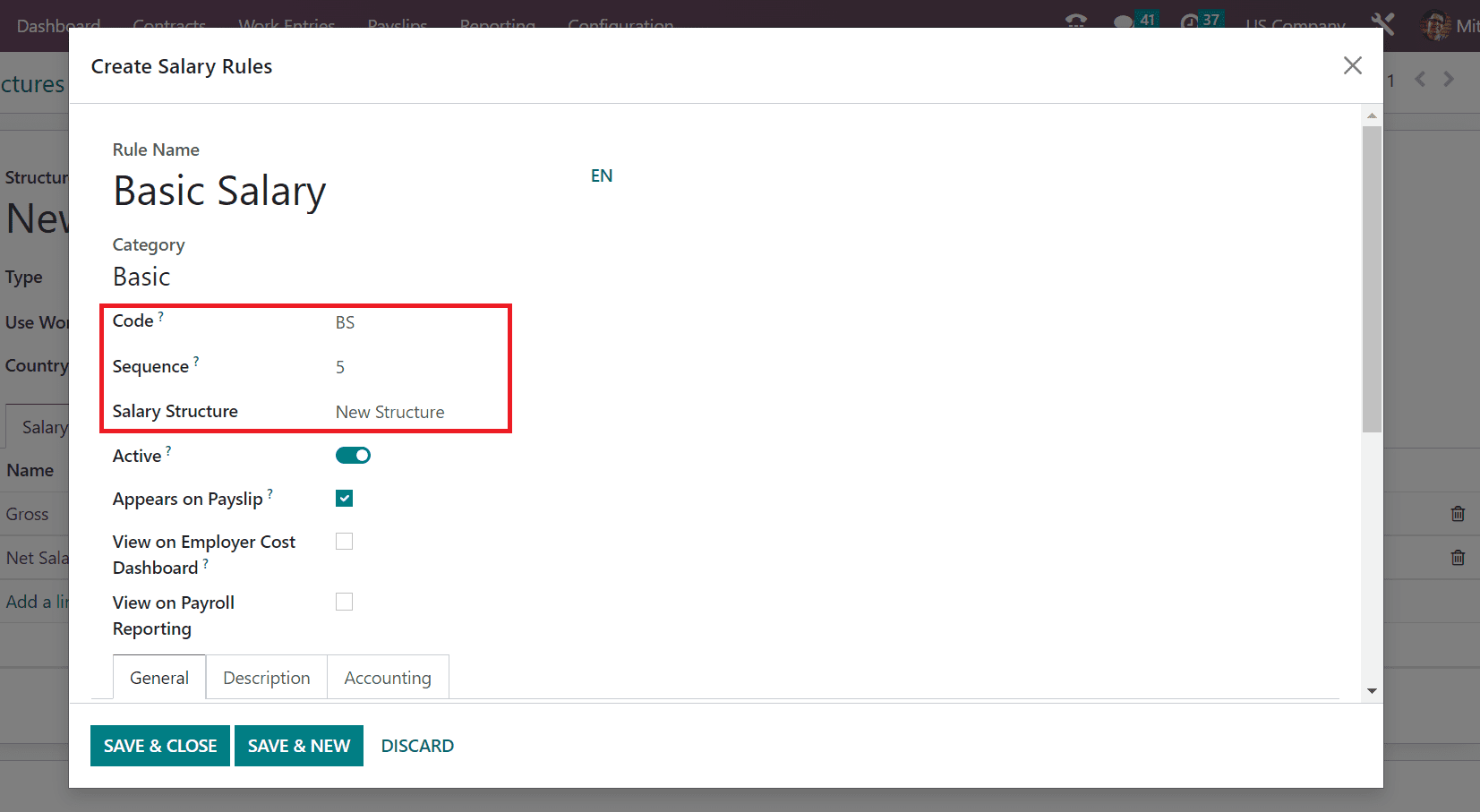

To apply the basic salary, as a rule, click the Add a line option inside the Salary Rules window. In the new window, we can mention the primary wages of a worker. Add Basicsalary in the Rule Name field and set Basic within the Category field assigned in the screenshot below.

Apply the Code for Basic Salary as BS and enter a sequence number to arrange calculation in the Sequence field. You can select your created salary structure New Structure as spotted in the screenshot below.

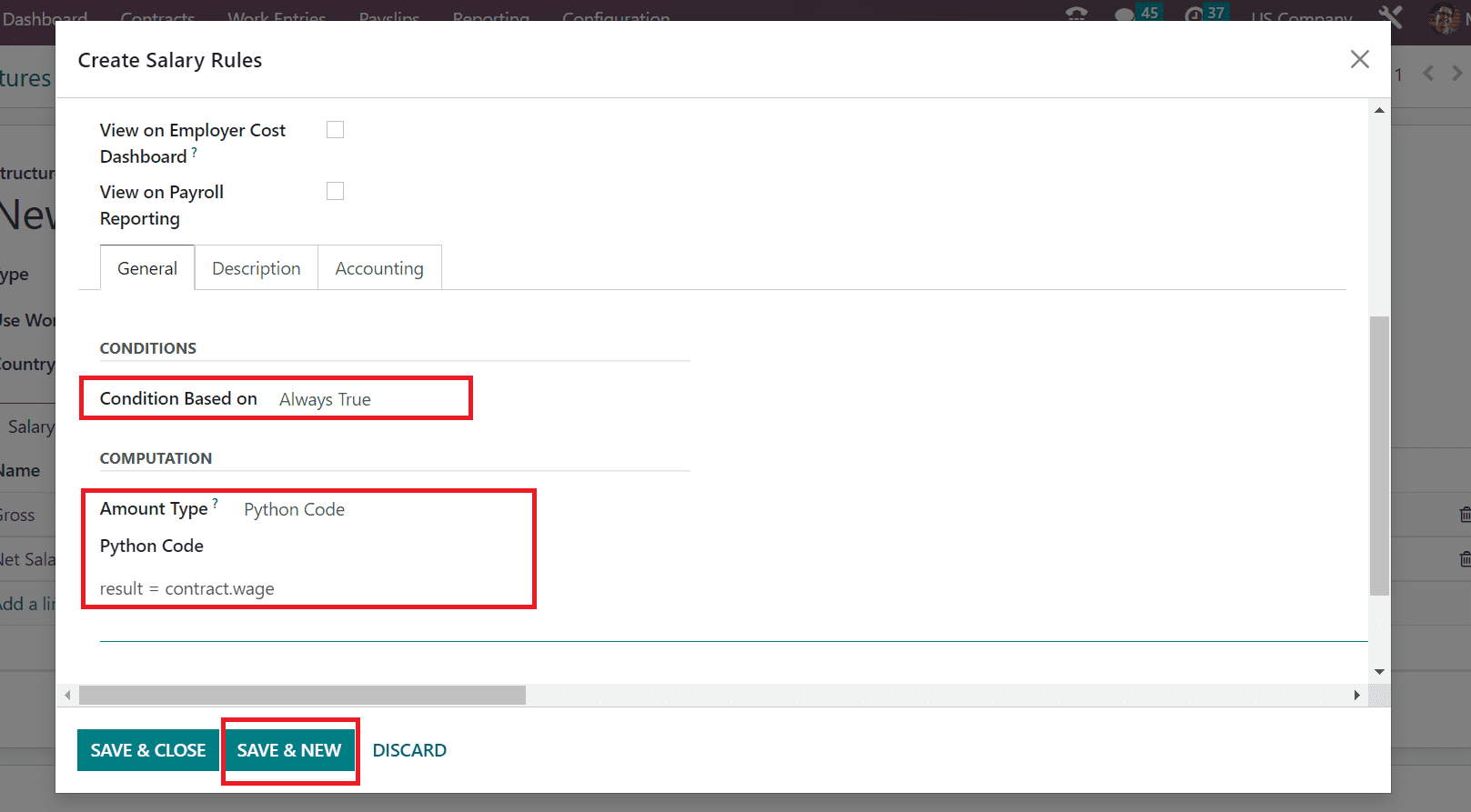

Next, enable the Appears on Payslip option and manage computation under the General section. It is possible to set the Condition as Always True within the Condition Based on the field. After selecting your Condition, we can configure the calculation under the COMPUTATION section. You can choose Python Code for computation in the Amount Type field and add the code in the Python Code field, as demonstrated in the screenshot below.

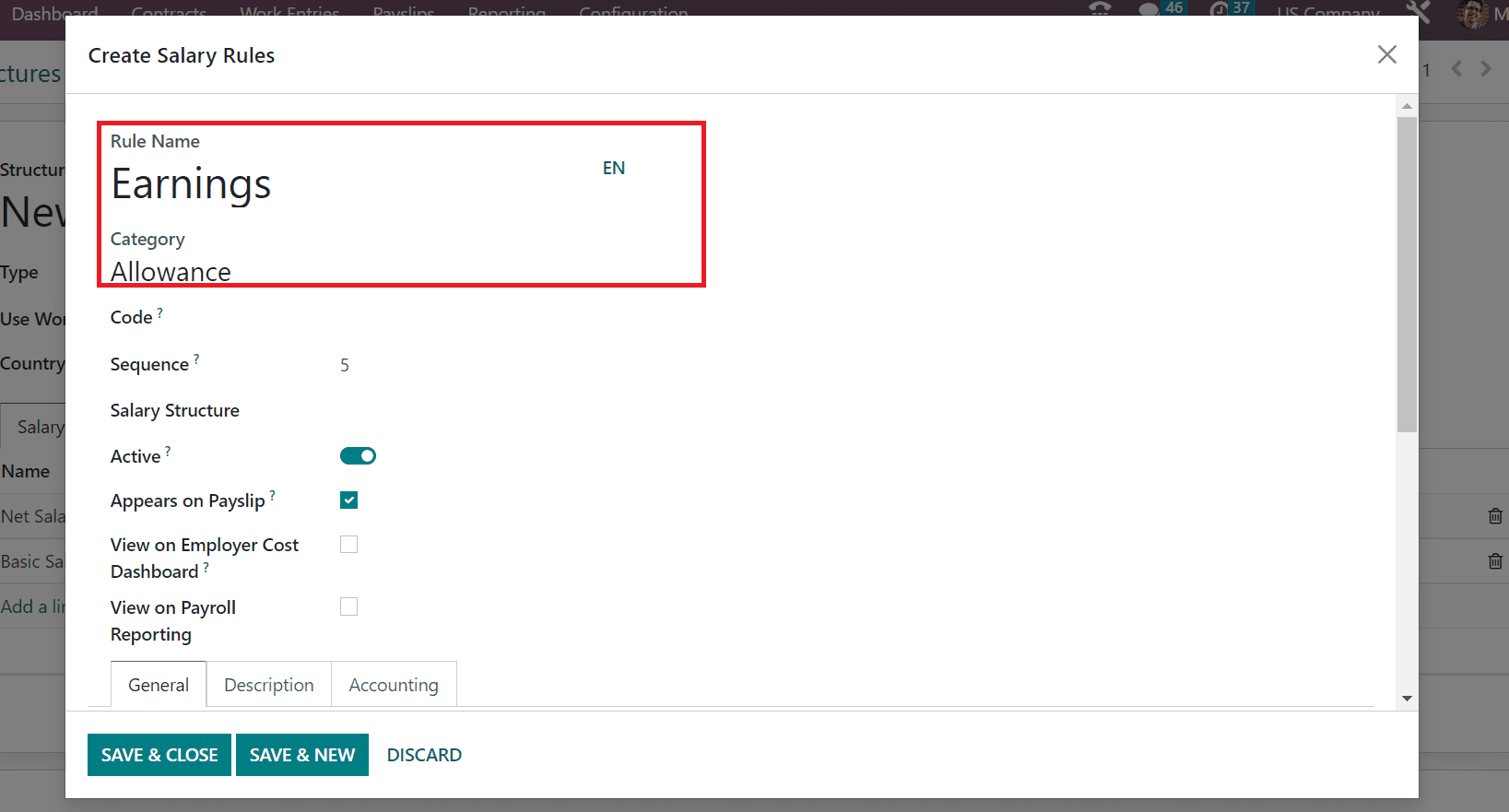

Press the SAVE & NEW icon to secure the changes about the Basic Salary. Now, we can develop a rule for the allowances of an employee. So, apply Earnings in the Rule Name of Create Salary Rule window and Category as Allowance as portrayed in the screenshot below.

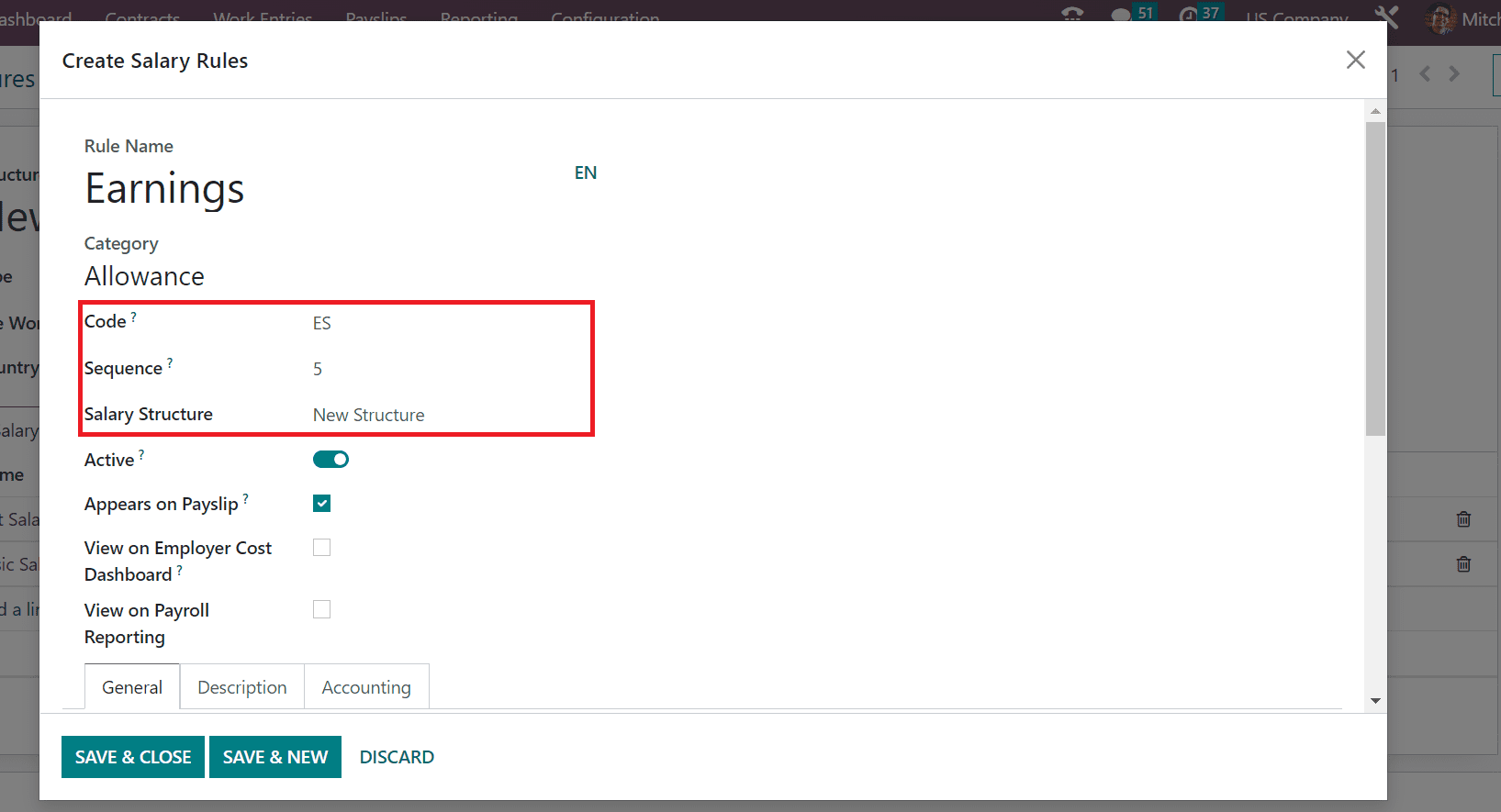

Enter the Code for Earnings as ES and select New structure as the Salary Structure. Later, you can enable the Appears on Payslip option to view the salary rules information on the payslip.

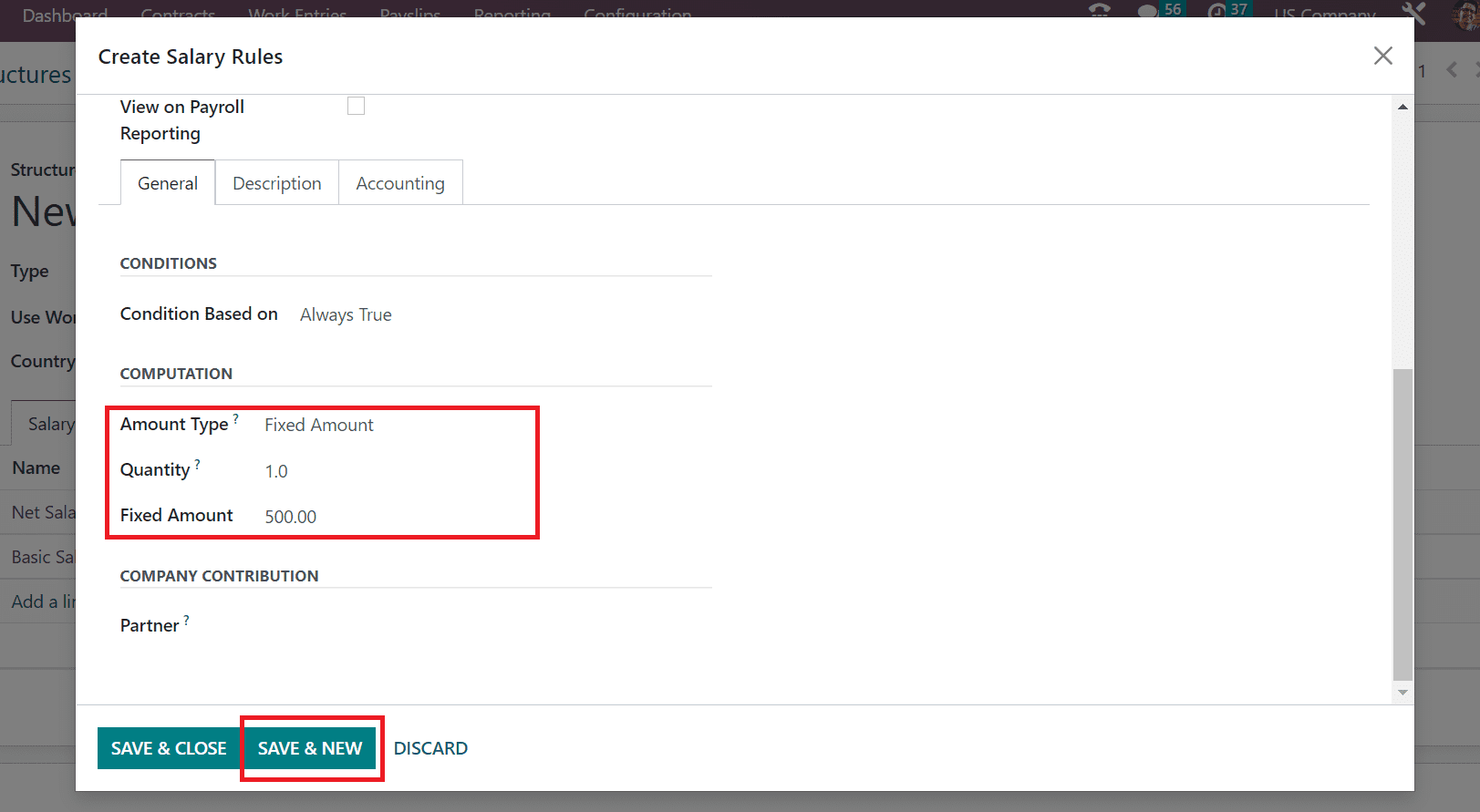

We can mention the computation of earnings for an employee below the General tab. After setting the Always True option under the CONDITIONS section, select Fixed Amount as the Amount Type. Next, you can specify the Quantity and total cost of employee earnings in the Fixed Amount option, as illustrated in the screenshot below.

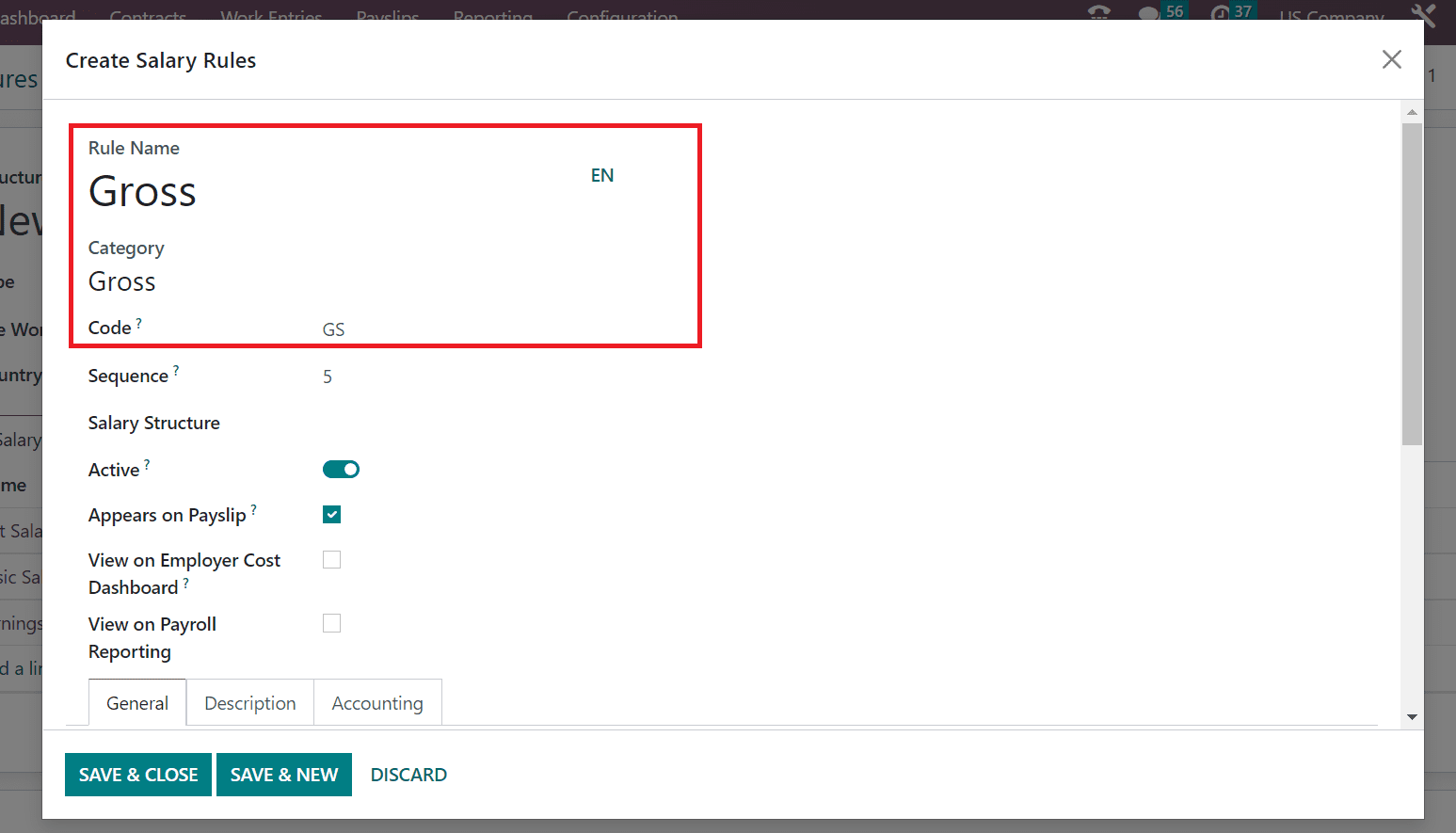

Press the SAVE & NEW button once you change the salary rules. Finally, let’s apply the gross pay for an employee as a salary rule. Enter Rule Name as the GROSS for your salary rule and specify Gross as Category. Moreover, the user can allow the GS code for the GROSS rule of a laborer working in a US Company, as described in the screenshot below.

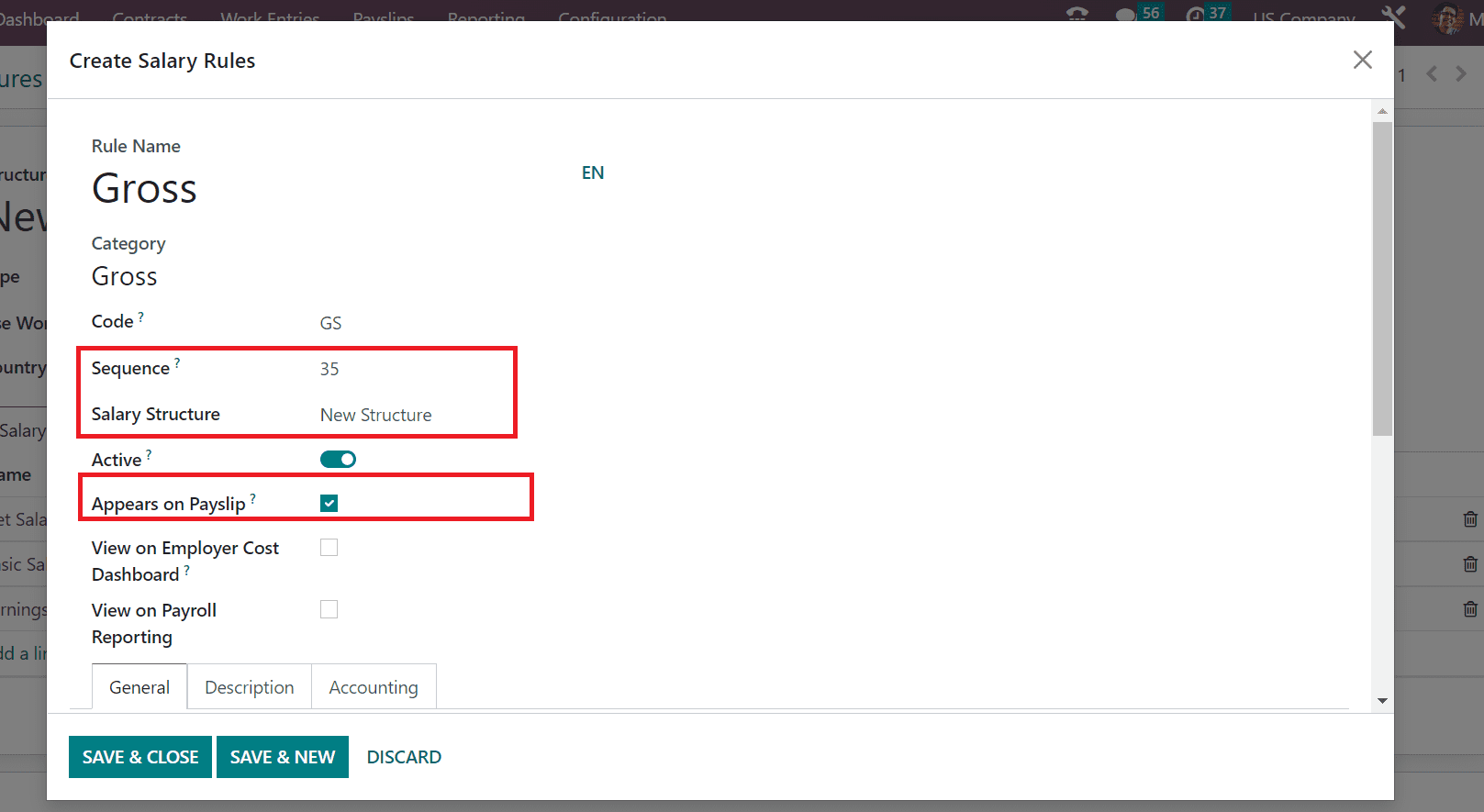

You can add the Sequence number as 35 for the Gross salary rule and set the New Structure option inside the Salary Structure field. For viewability of the salary rule on a payslip, you must enable the Appears on Payslip option, as presented in the screenshot below.

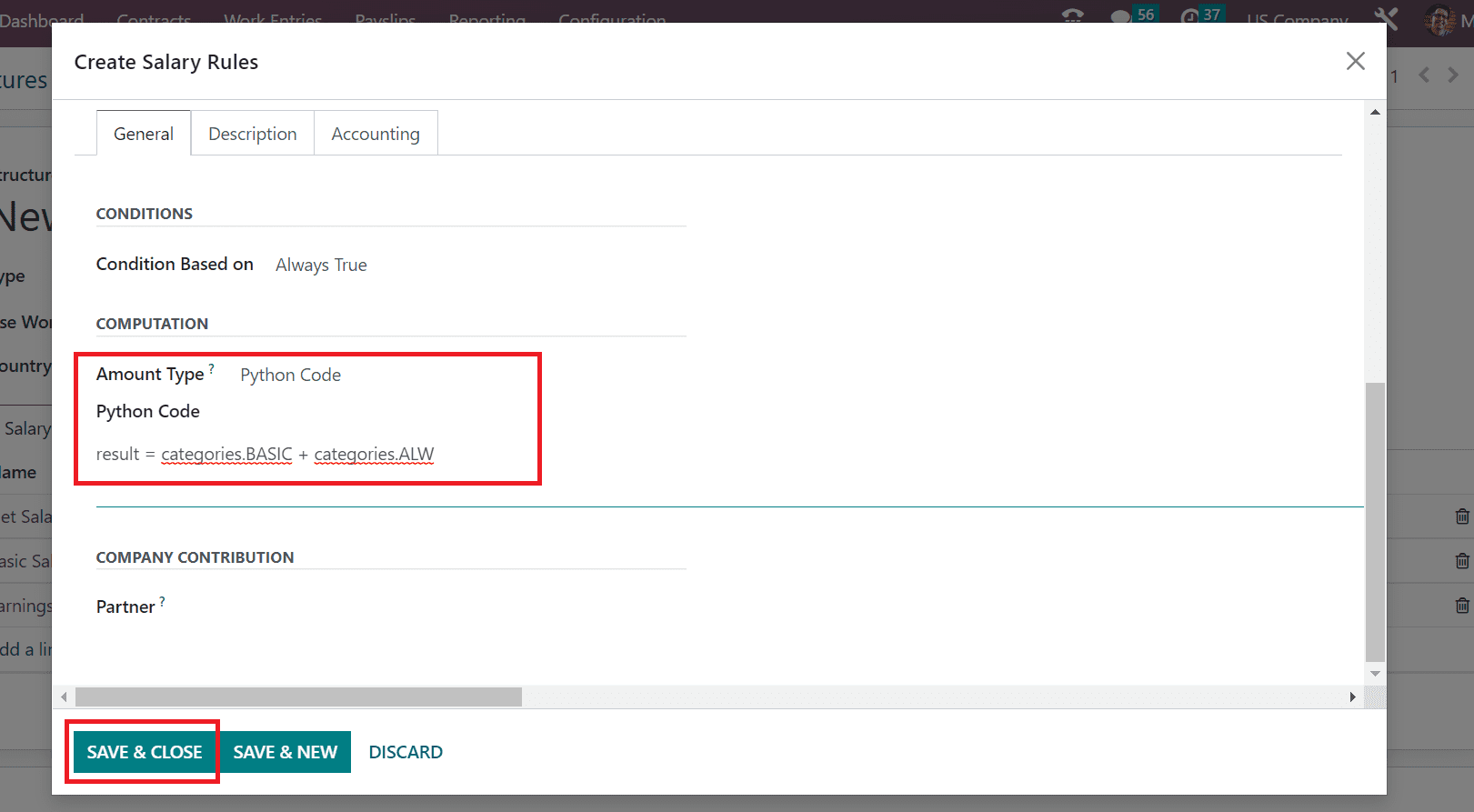

After adding allowances and essentials, we can calculate the gross pay easily. Non-taxable and taxable earnings are considered allowances in the United States. Below the COMPUTATION section, select Python Code in the Amount Type field and apply the particular code of your Gross rule as represented in the screenshot below.

Click the SAVE & CLOSE icon after adding all data related to your salary rules. All the developed salary rules are visible in the New structure window.

To Develop a Salary Structure based on Salary Rules in the Odoo 16

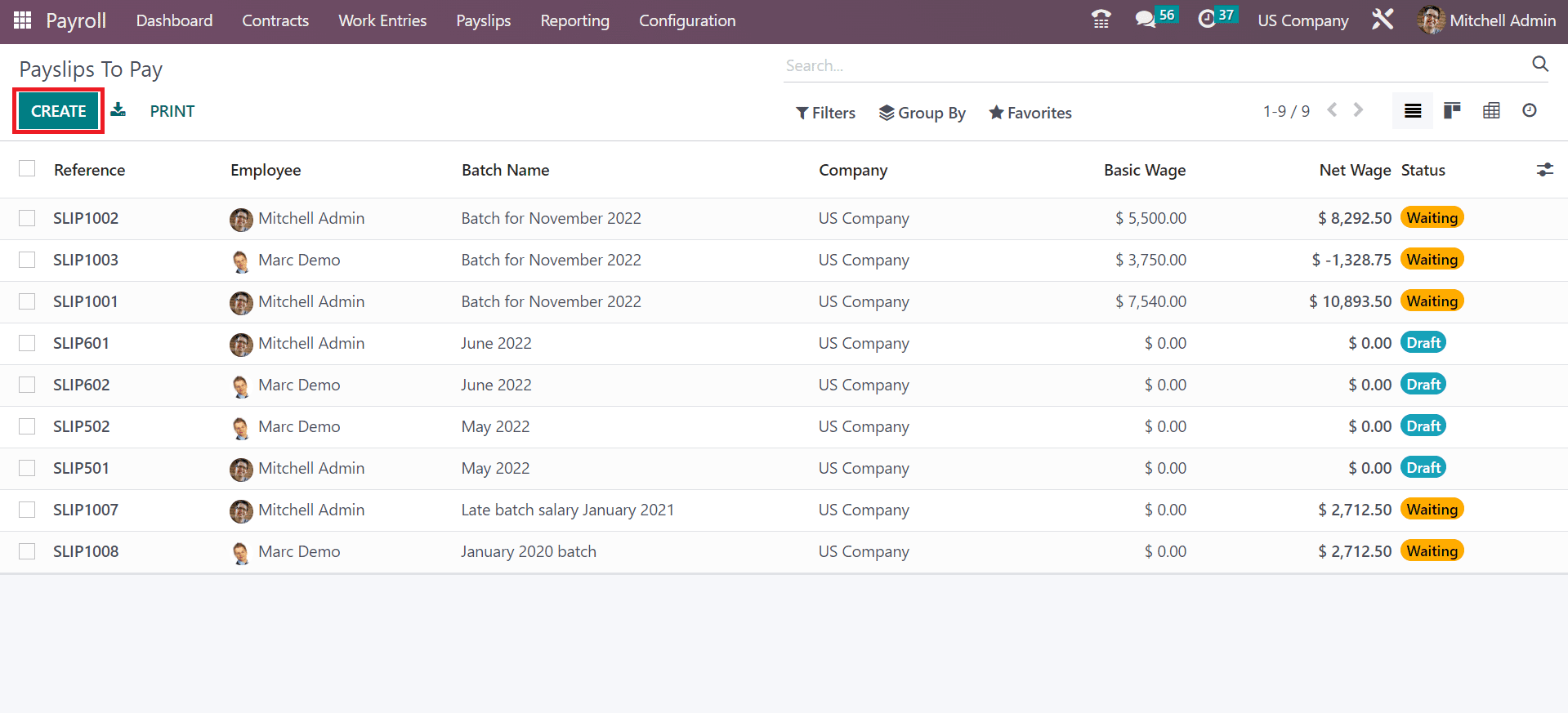

To generate a new payslip, click the To Pay menu in Odoo 16 Payroll module. Information about each payslip, including Employee, Company, Net wage, Status, and more, are accessible to a user. Press the CREATE icon to define a new payslip for an employee working in a US Company.

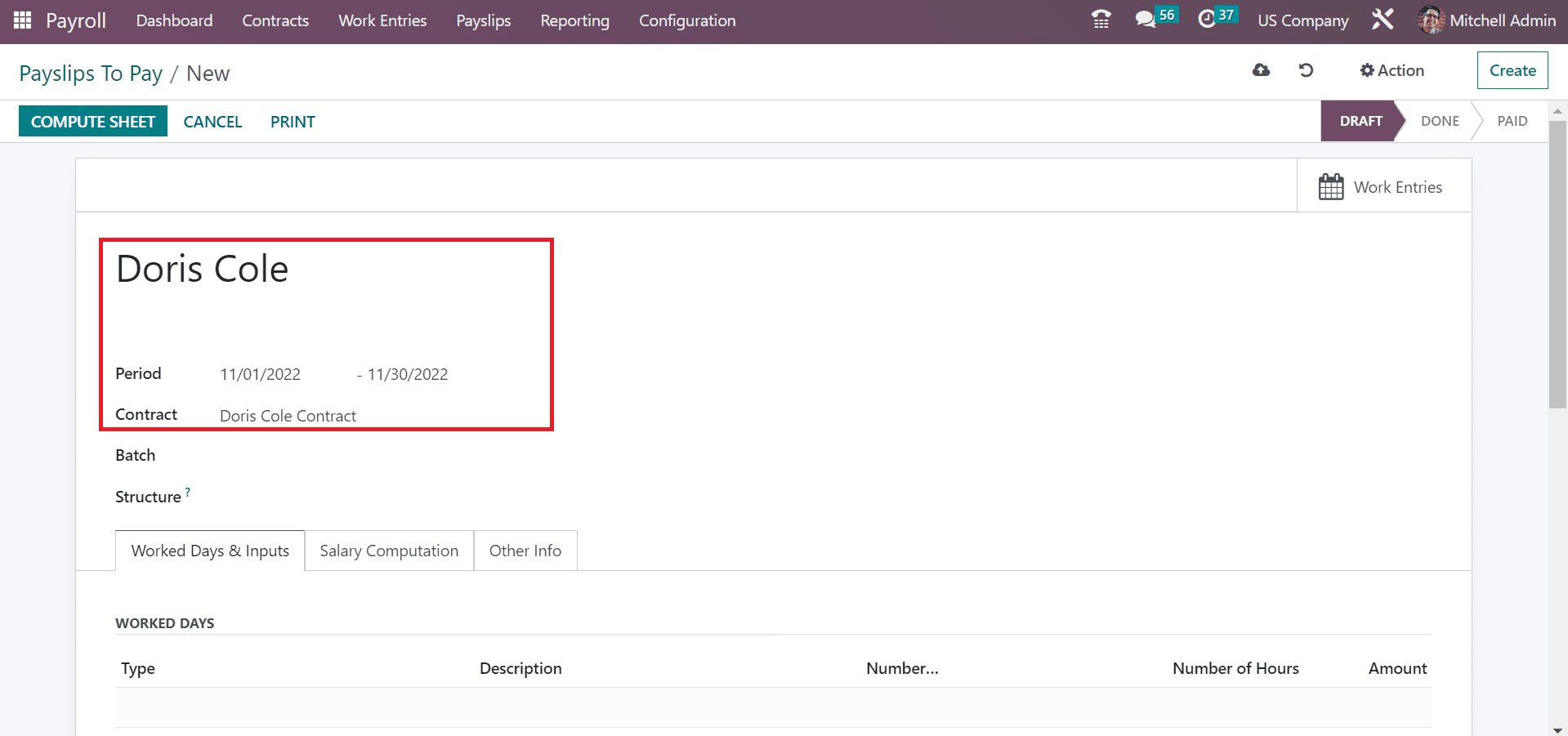

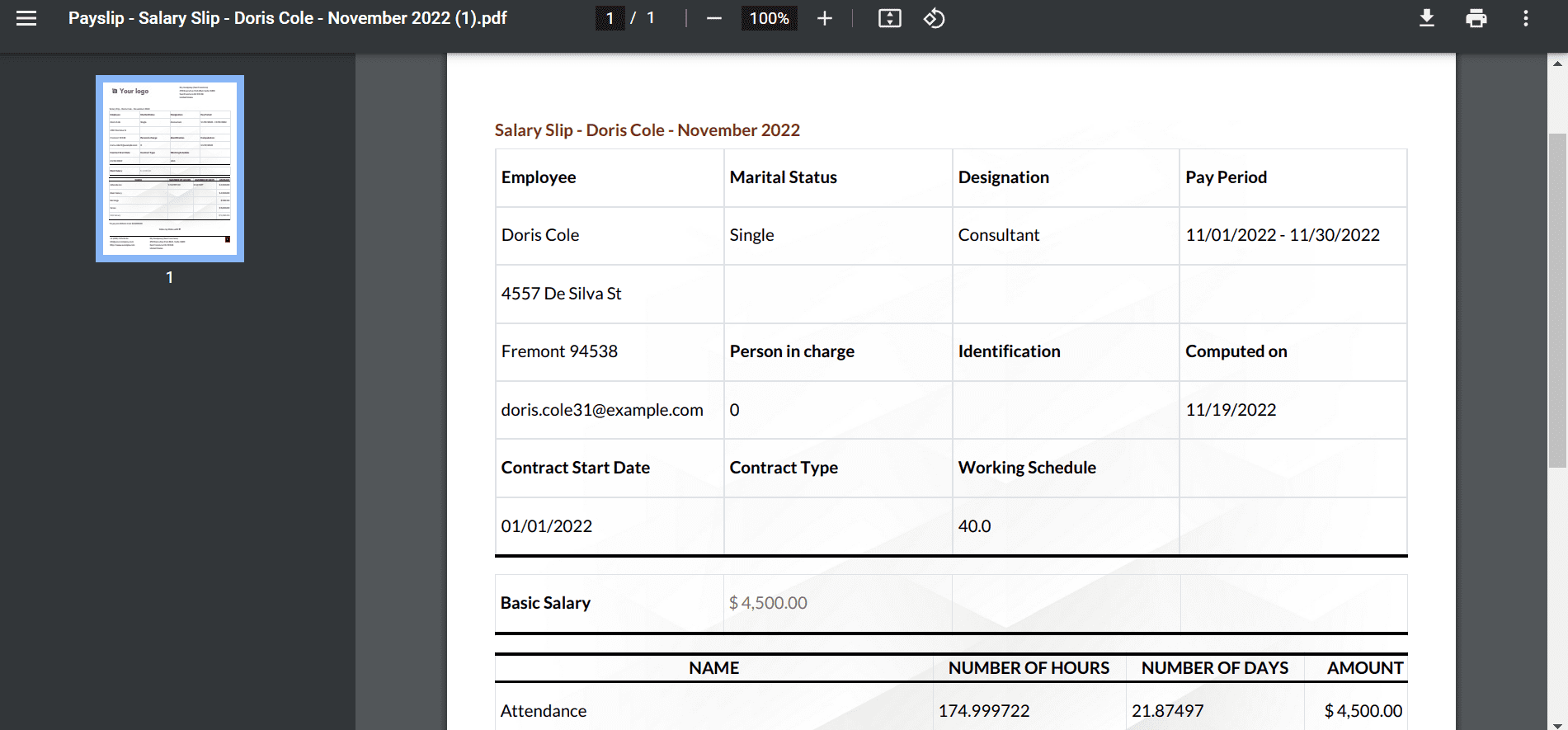

Users can select the Employee Name as Doris Cole in the Employee option. In the Period field, add months for the employee payslips. Also, it is easy to add the contract related to employees in the Contract field.

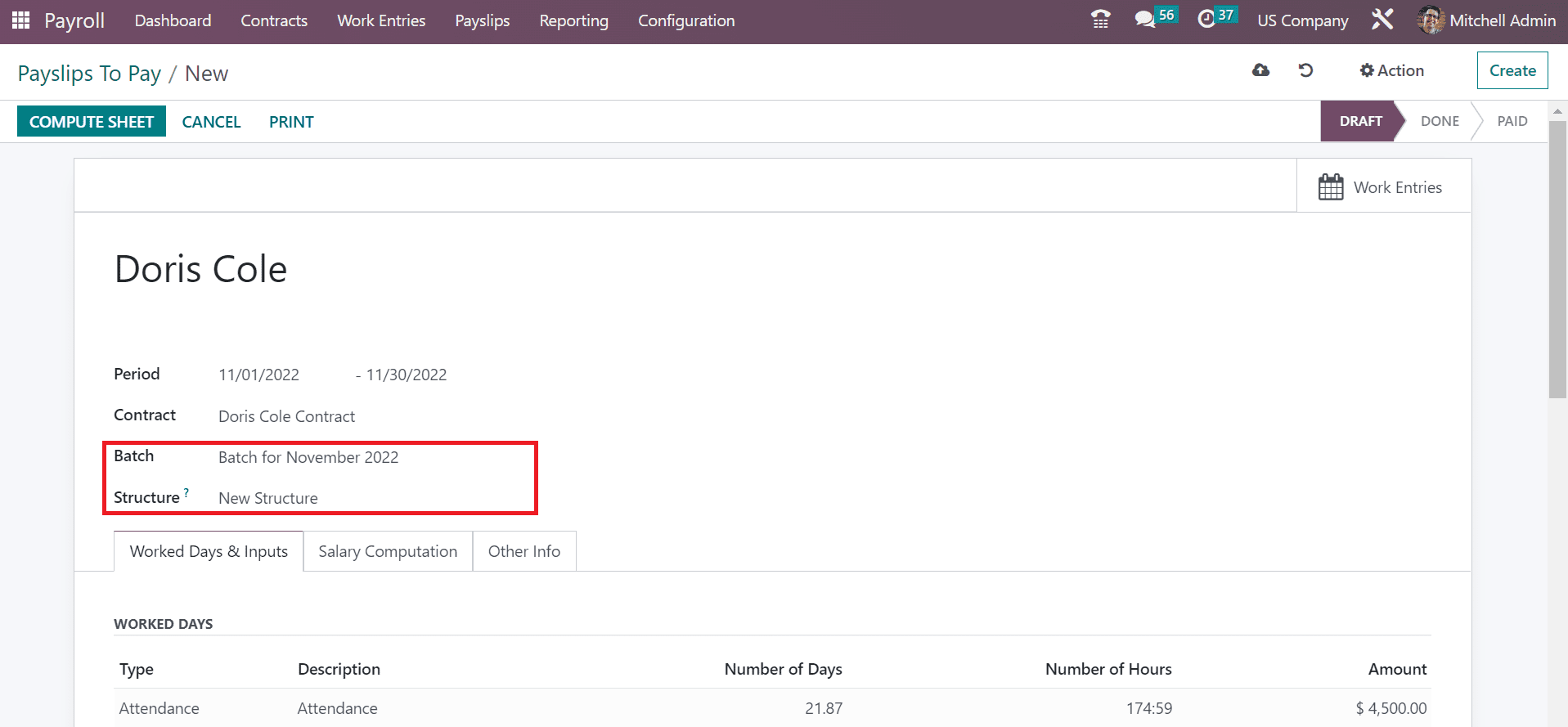

Describe your created structure as New Structure in the Structure option. Later, pick the batch for Doris Cole regarding the payslip, as denoted in the screenshot below.

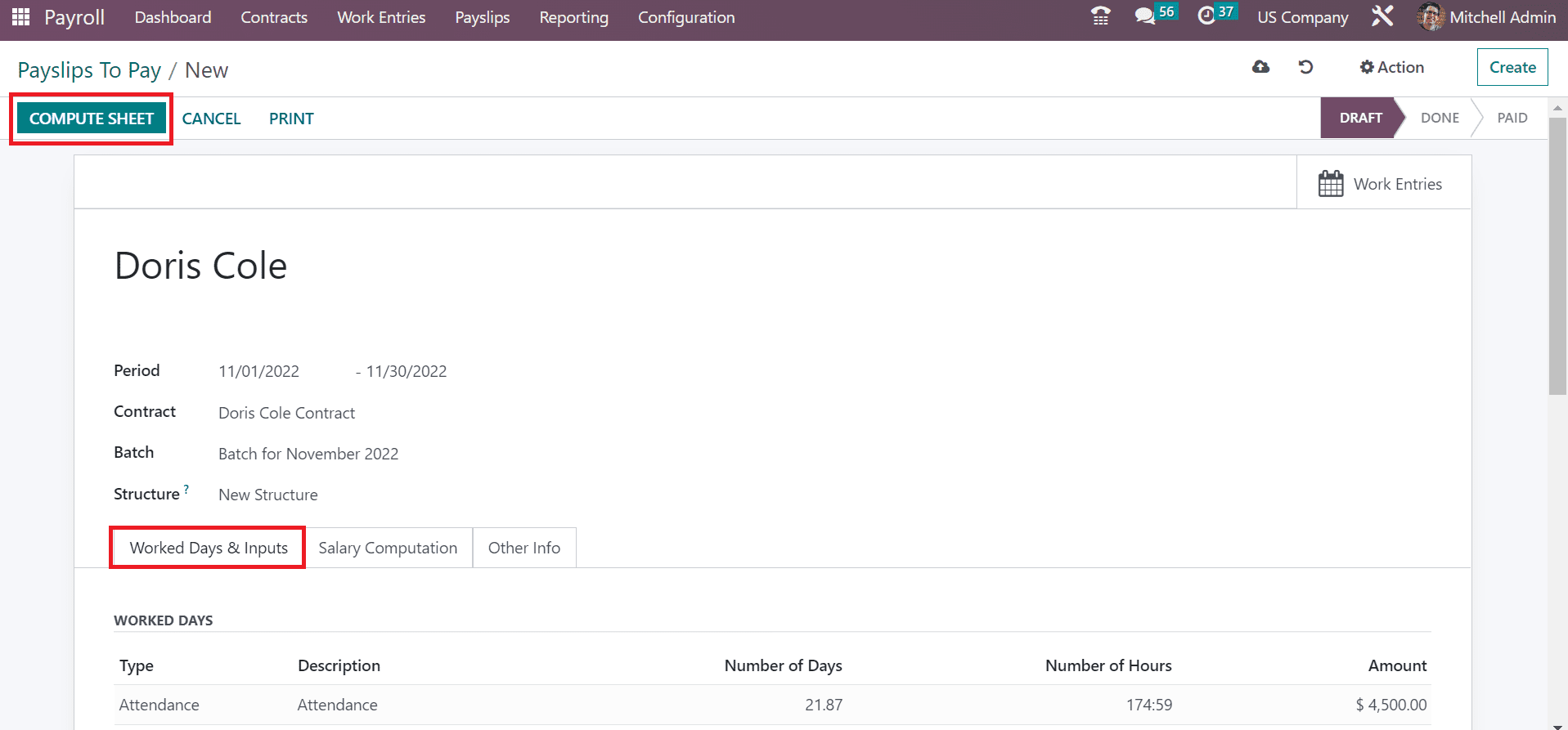

The work days details of employees, such as Number of Days, Hours, and Type, are visible to the user under Work Days & Inputs. For the sheet computation, click the COMPUTE SHEET button in the Payslips to Pay field, as shown in the screenshot below.

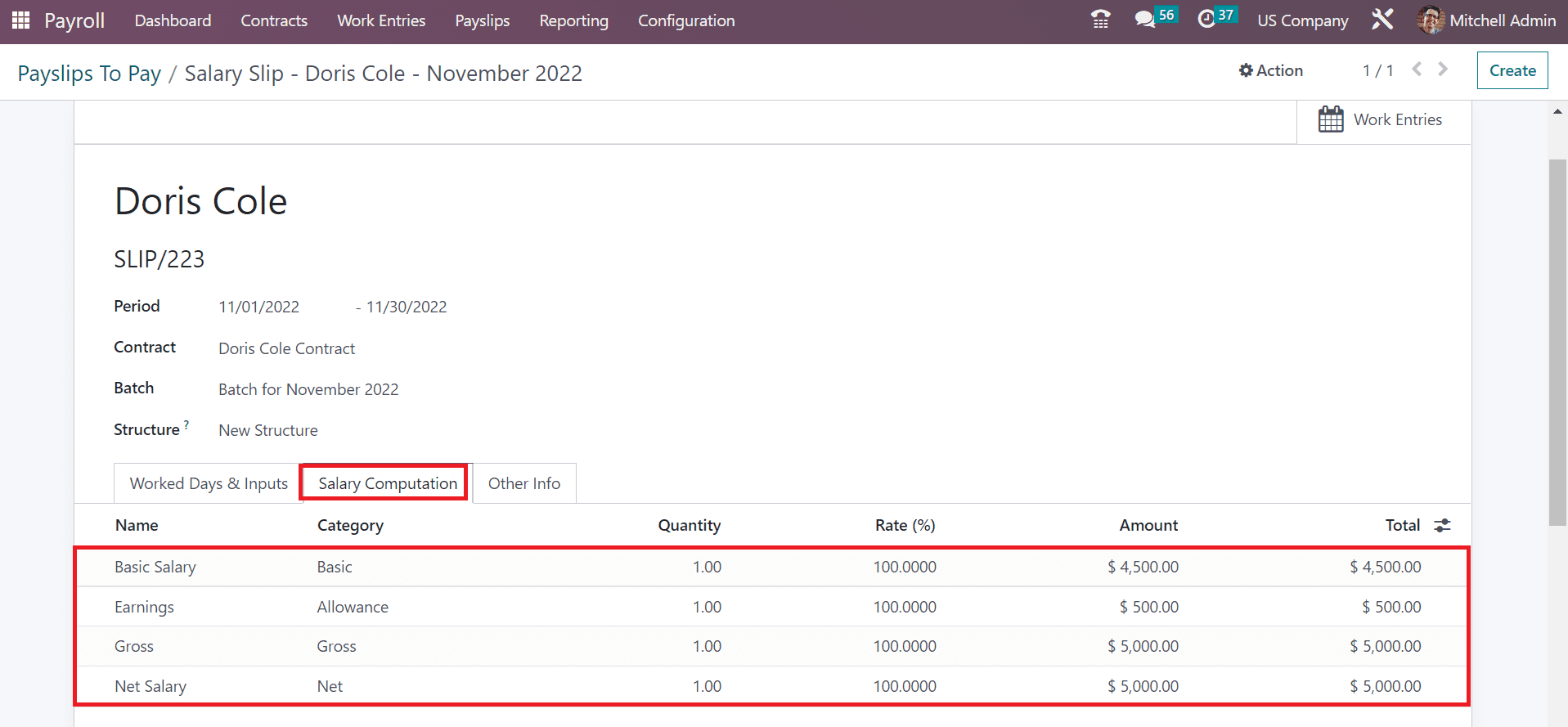

The computation regarding each salary rule is viewable in the Salary Computation tab. We can access the Name, Quantity, Rate, Total, and more concerning each salary rule as defined in the screenshot below.

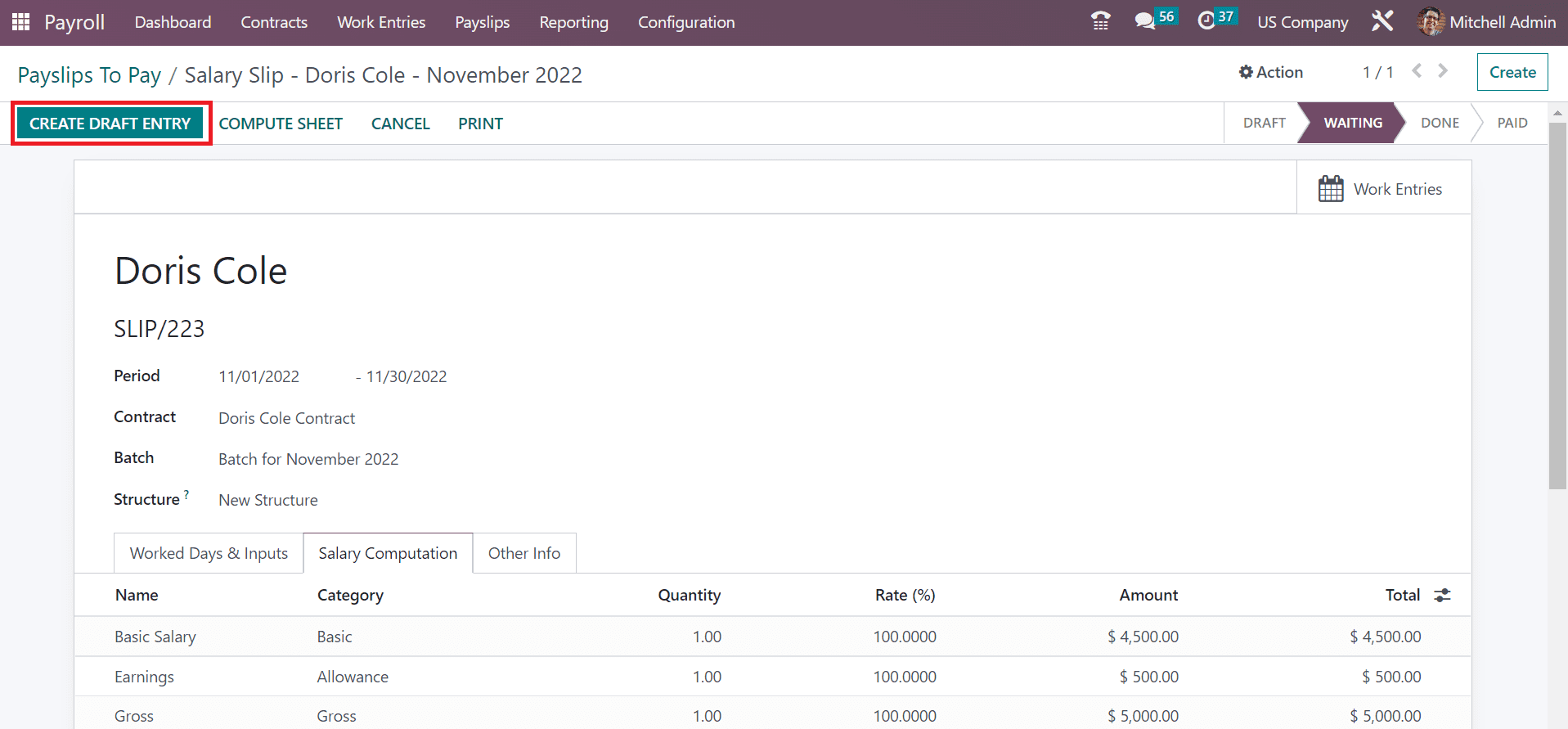

We can now develop a draft entry for the payslip by selecting the CREATE DRAFT ENTRY icon.

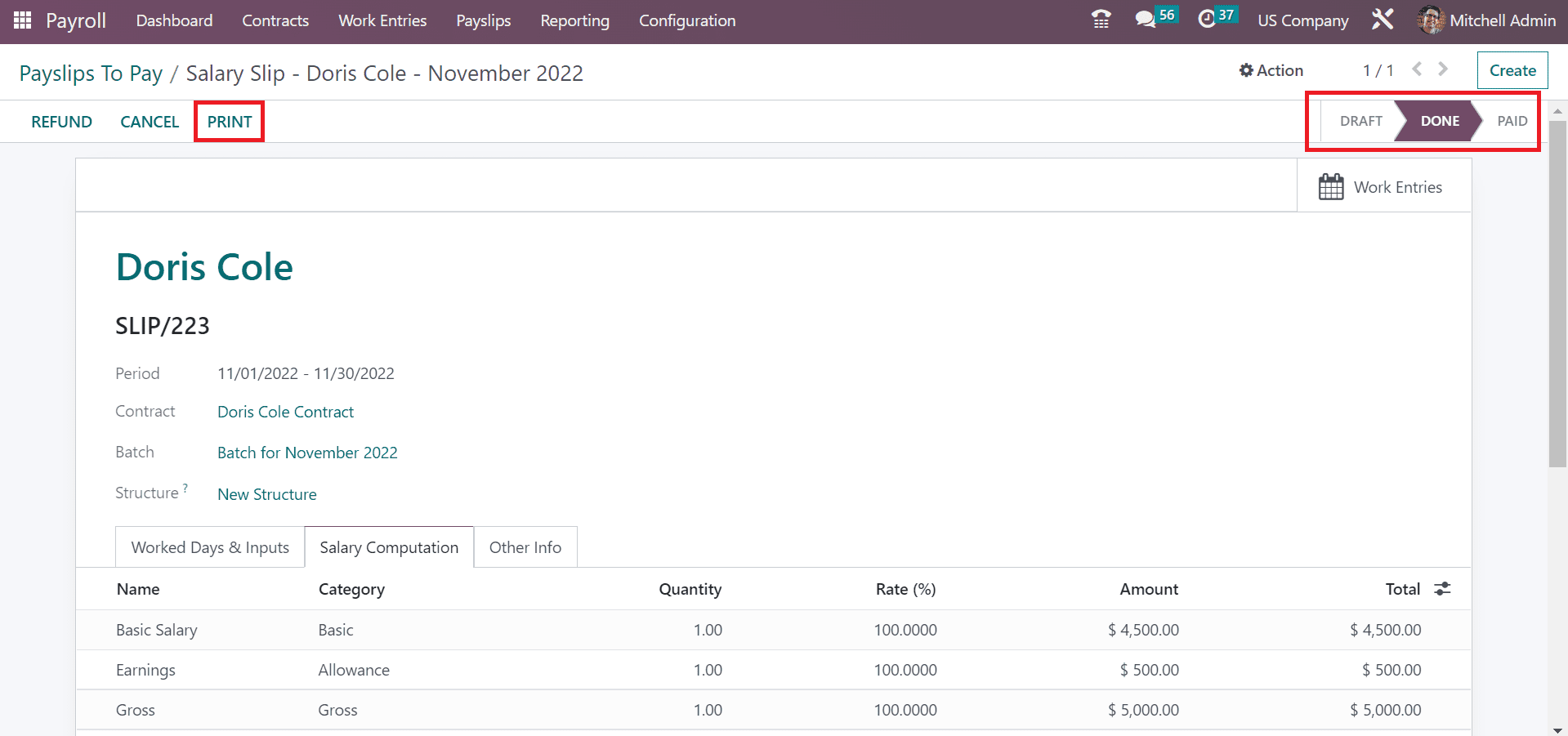

We can generate employee payslips quickly, and the stage changes to DONE. Click the PRINT icon to get the salary slip of Doris Cole into your system.

So you can quickly obtain a copy of the employee payslip into your system.

Odoo 16 Payroll module assists in managing payslips for companies consisting of large employees size. Configuration of the basic salary of each worker becomes simpler within the Paylsip feature of the Payroll module.