What is the importance of bank reconciliation? This process helps the user to match the cash account information of an individual or a firm with the bank details. Bank reconciliation helps a person to check if there are any differences in the accounts by comparing them. This also helps to take immediate corrective measures on noticing any differences.

On noticing any difference in accounts, the ERP will help to reconcile the difference. Odoo 14 has an updated software support tool to assist you to reconcile the accounts. We all know that all the cash transactions will be recorded in the bank when a person is running a business. The user will have to ensure that the bank account matches with the cash account to ensure that all transactions are being recorded in both the accounts and sync regularly. This will ensure transparency in the management of business revenue and expenditure. This will help the user to easily identify if any check has been bounced or any payment is due.

What does Odoo 14 offer?

It helps to link invoices and other payment details with the bank statements and reconcile it. Let’s look at how it works with Odoo 14.

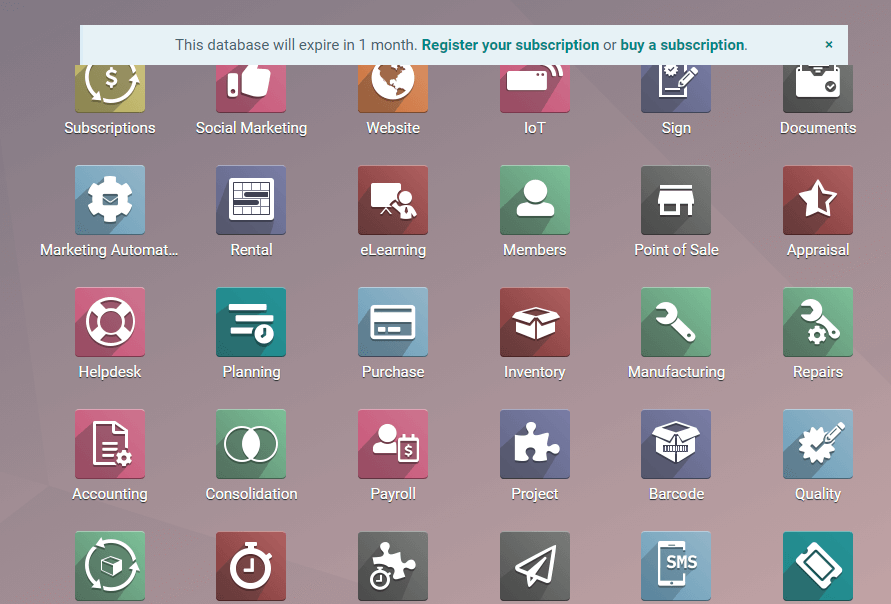

First Install the Accounting Module.

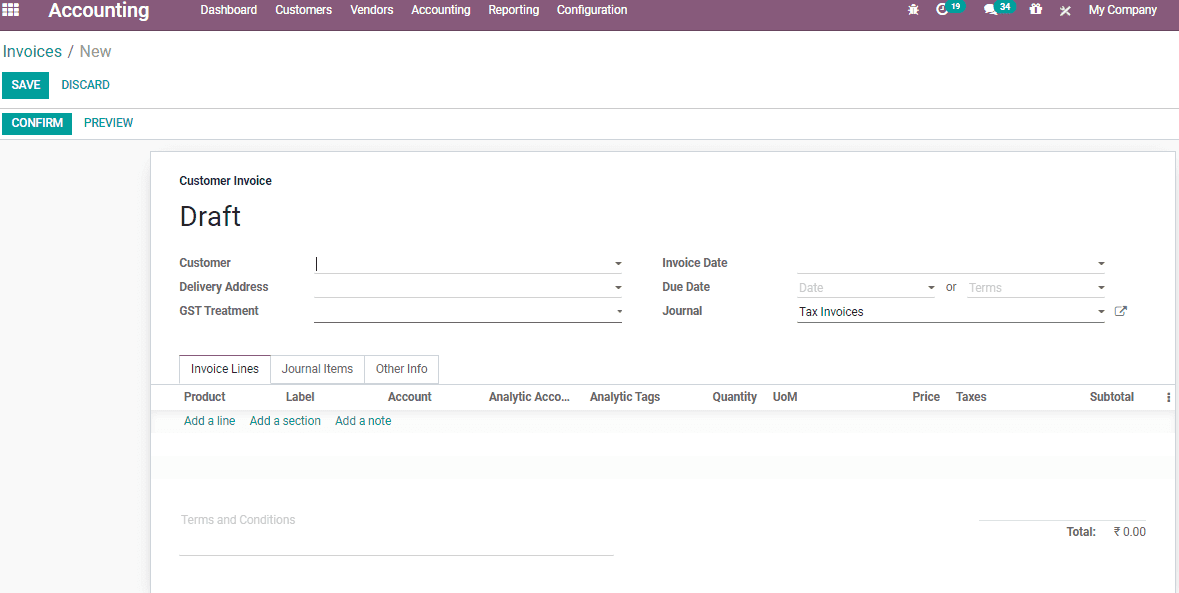

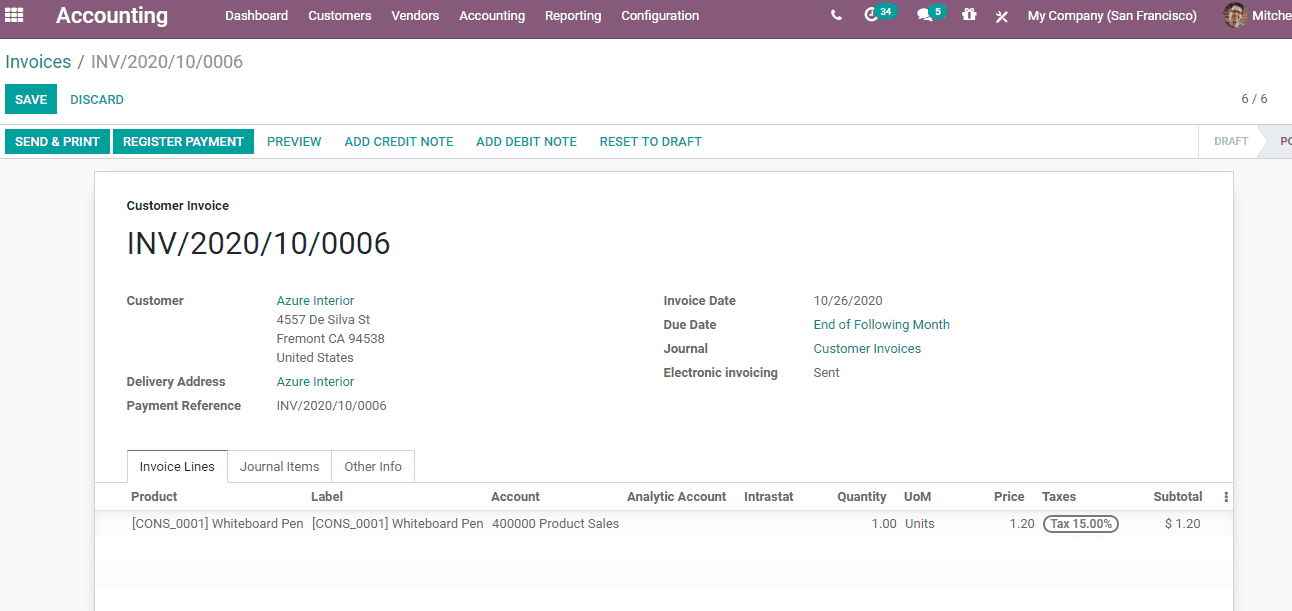

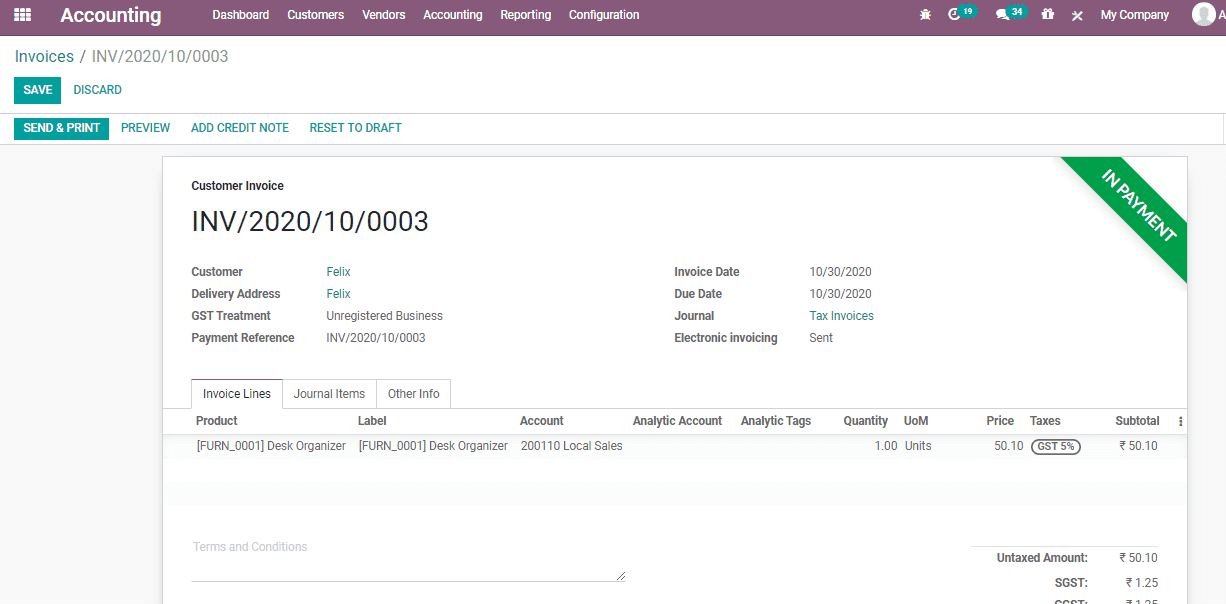

After installing the accounting module lets create an register payment for an invoice for that go to Accounting -> Customer -> Invoices.

From this form the user can create an invoice for a customer and can make register payment for that particular.

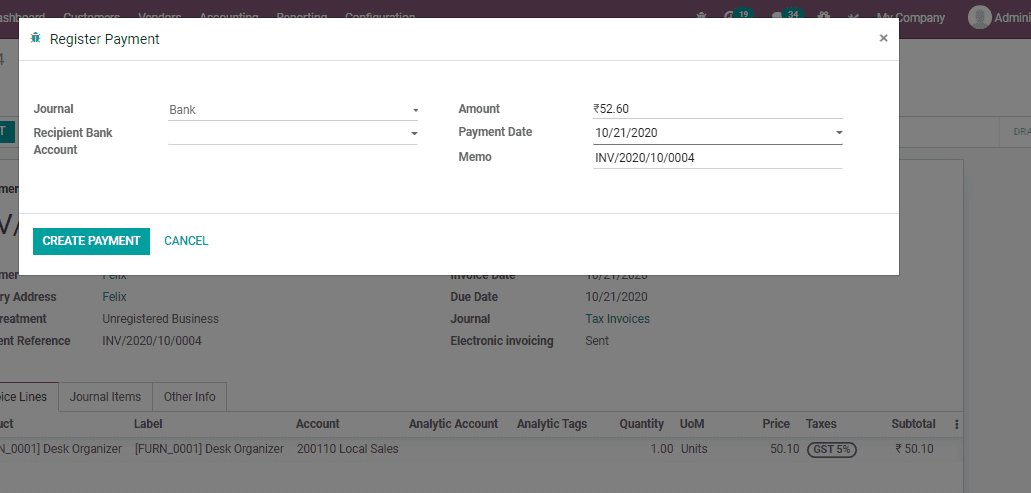

On clicking the Register Payment tab, a new window will appear to make Register Payment.

Click on the Create Payment button and then you can see that the account status of that invoice will be changed to In Payment as given below.

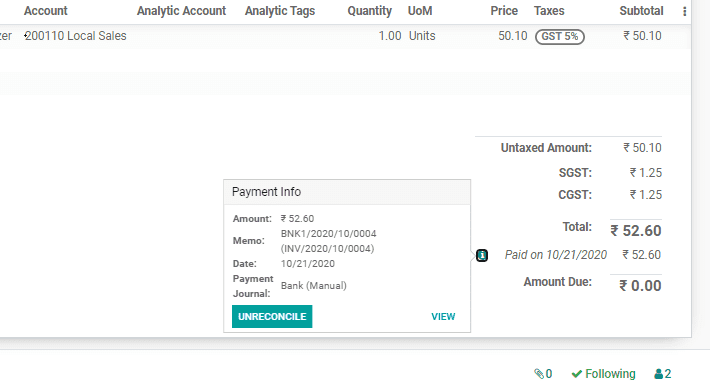

And when to scroll down to the total amount, here you can see the feature that helps the user to access payment details from the invoice. Near the amount, you can spot a small green icon near the payment made date. On clicking on the icon the user will get the payment information as shown below and from this you can see that here the payment is getting reconciled with this automatically but it is not reconciling with the bank that why the payment status is showing as In Payment state.

As we can see that the payment status is changed to In Payment state rather than the paid state so it is another new change brought up in Odoo 14 where you can see the payment is not yet reconciled with the bank account that’s why the status is in In Payment state.

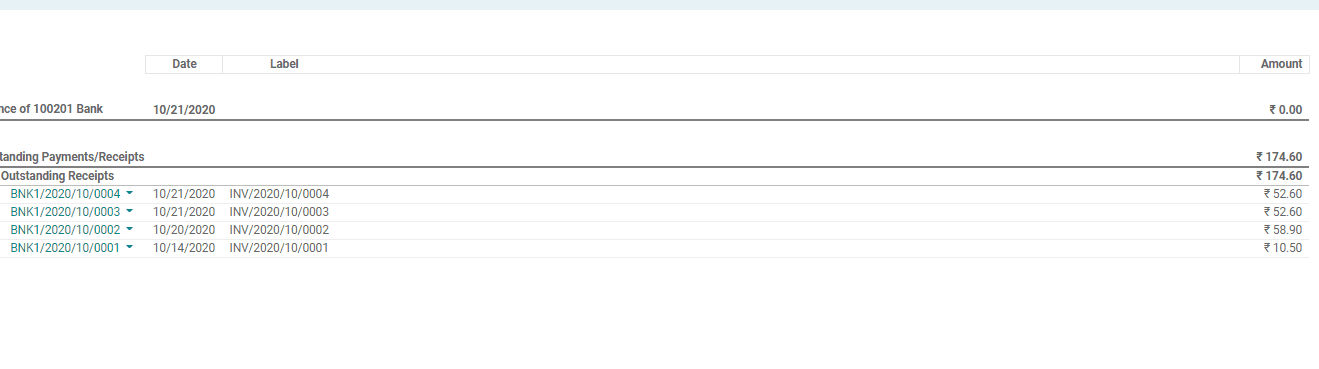

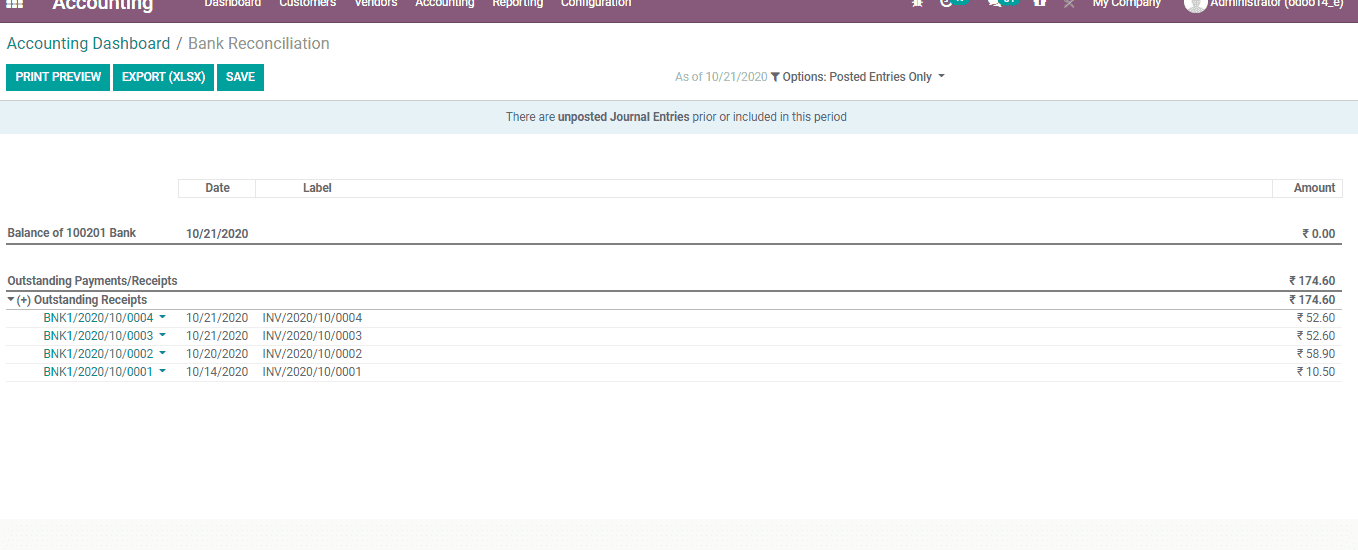

Let’s see how we can make the status Paid and reconcile it. For that one needs to create the bank statement for that particular invoice created and then validate it as shown below.

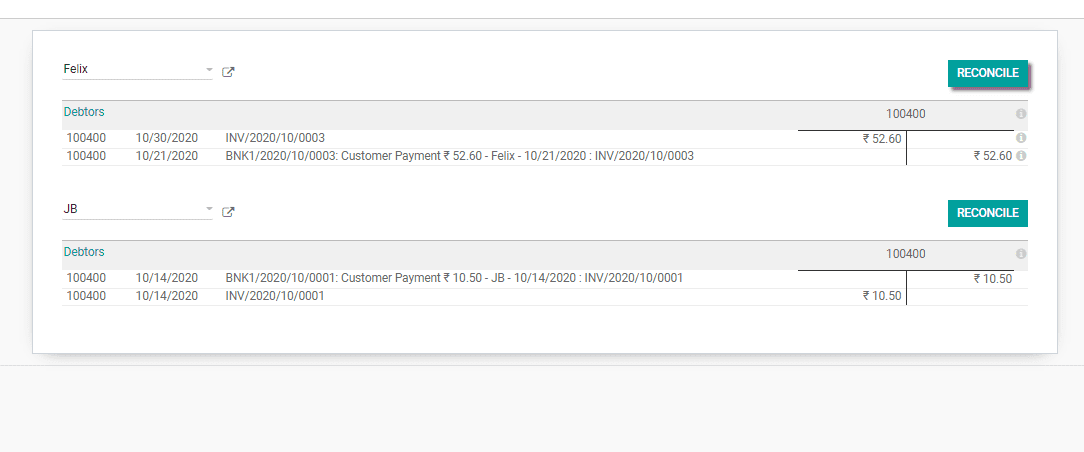

Once you click on the reconcile button it will take you to the next page where you can see the counter parts for the invoice created and on reconciliation it will be matched with the bank account and validated.

Once the reconciliation is done you can then that particular invoice would change its state form In Payment to Paid state as shown below.

Odoo 14 also enables you to set Reconciliation models for easing reconciliation.

How to Create Reconciliation Models

Go to Accounting> Configuration> Accounting> Reconciliation Models.

To ease and speed up the reconciliation process one can configure reconciliation models which are particularly useful with recurrent entries such as bank fees.

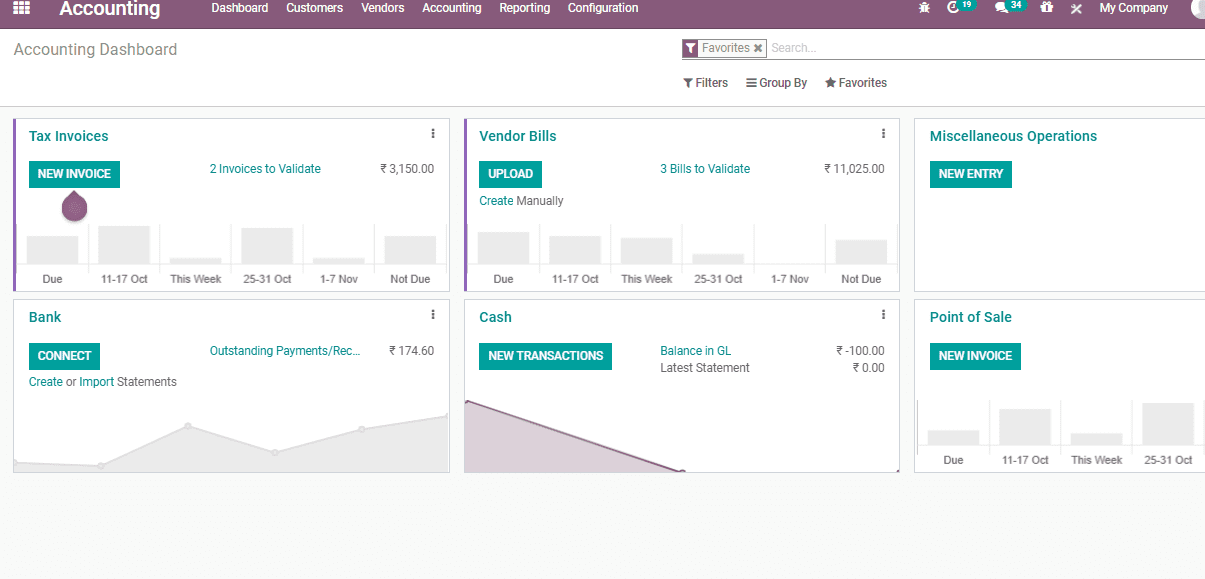

To create a new Reconciliation model go to Accounting -> Configuration -> Reconciliation model or one can also access from the Bank journal under the accounting application dashboard and use the more button to go to Reconciliation Models.

If you want to create a new reconciliation model use Create Button.

Let us take a case now. Suppose a company receives a bank fee cost based on the basis of the balance amount. Then we can find that the fee is variable.

To keep a document of this we can maintain model Bank fees. A new account can be created or an account can be selected to record these fees. It is also possible to mark account type. With Odoo the fee can be taken automatically following the already set parameters.

The Reconciliation model includes certain types such as:

1. Manually create a write-off on the clicked button: So here when you reconcile an entry with an open balance, you can use the button to prefill the value before validating the reconciliation.

2. Suggest counterpart values: here suggest immediately counterpart values that only need to be validated.

3. Match Existing invoices/bills: In this type, it automatically selects the right customer invoice or vendor bill that matches the payment.

After completing all the procedures use the Save button to save the reconciliation model.

This is how Bank Reconciliation and Models works with Odoo 14 accounting module.