Tax is inflicted on state and federal levels in the United States of America. These are entirely separate, and each has its right to charge taxes. Each state’s tax system in the US is distinct from other states. Also, various jurisdictions in each state can levy taxes within a specific place. A primary source of state revenue is sales tax in the United States. Local

and state governments commonly use these taxes, and national sales tax is an exemption in the US. Above the state limit, municipalities contain the right to increase the sales tax on a state. So, managing sales tax is burdensome for most companies, and an ERP installation avoids your worries about tax configuration.

This blog reveals the Ohio(US) Sales Tax calculation within the Odoo 16 Accounting.

In Odoo 16 Accounting application, we can configure bank accounts, journal groups, currencies, analytic accounts, and more. Users can analyze a company’s audit and tax reports with the Reporting feature of Odoo 16. We can see Ohio’s (US) sales tax calculation in the Odoo 16 Accounting.

Ohio(US) Sales Tax Information for Users

Ohio State covers a sales tax of 5.75%, and the local government takes a tax of up to 2.25%. We can also see the highest sales tax rates of 8% in several cities such as Cleveland and more. A nexus is

essential to collect sales tax in Ohio. Physical and economic nexus exists in the specific state. Most products and services are taxable in Ohio, with few exceptions on foods, building materials, and drugs.

Users can register for Ohio sales tax permits through Ohio Business Gateway. Before registration, you must focus on details, including locations, dates, business identification numbers, entities, etc. A product delivery charge is imposed on Ohio apart from the sale price.

To Formulate Ohio(US) Company Data in Odoo 16

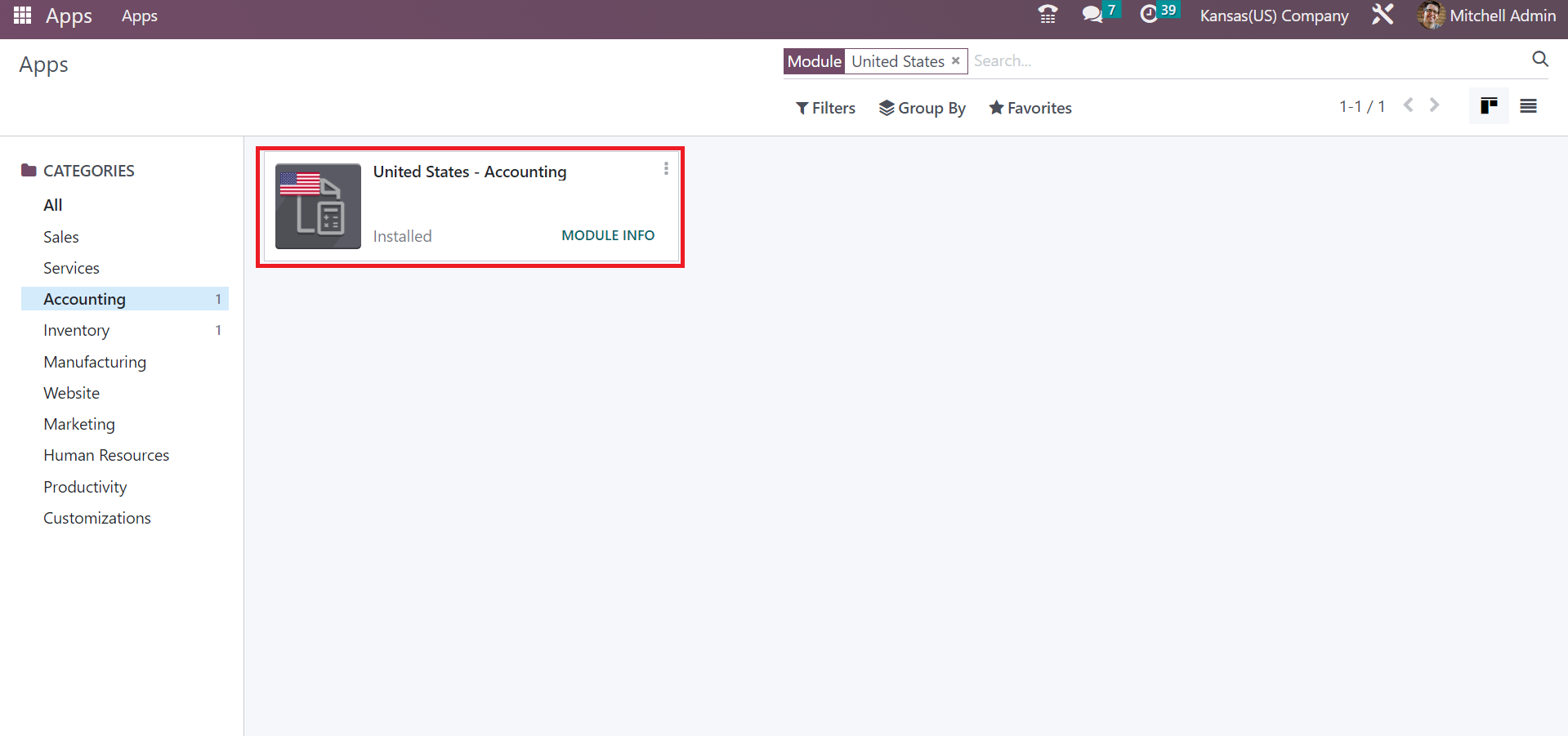

It is easy to install localization of your country from Odoo 16 Apps. Users can download the United States – Accounting app in the Accounting apps mentioned in the screenshot below.

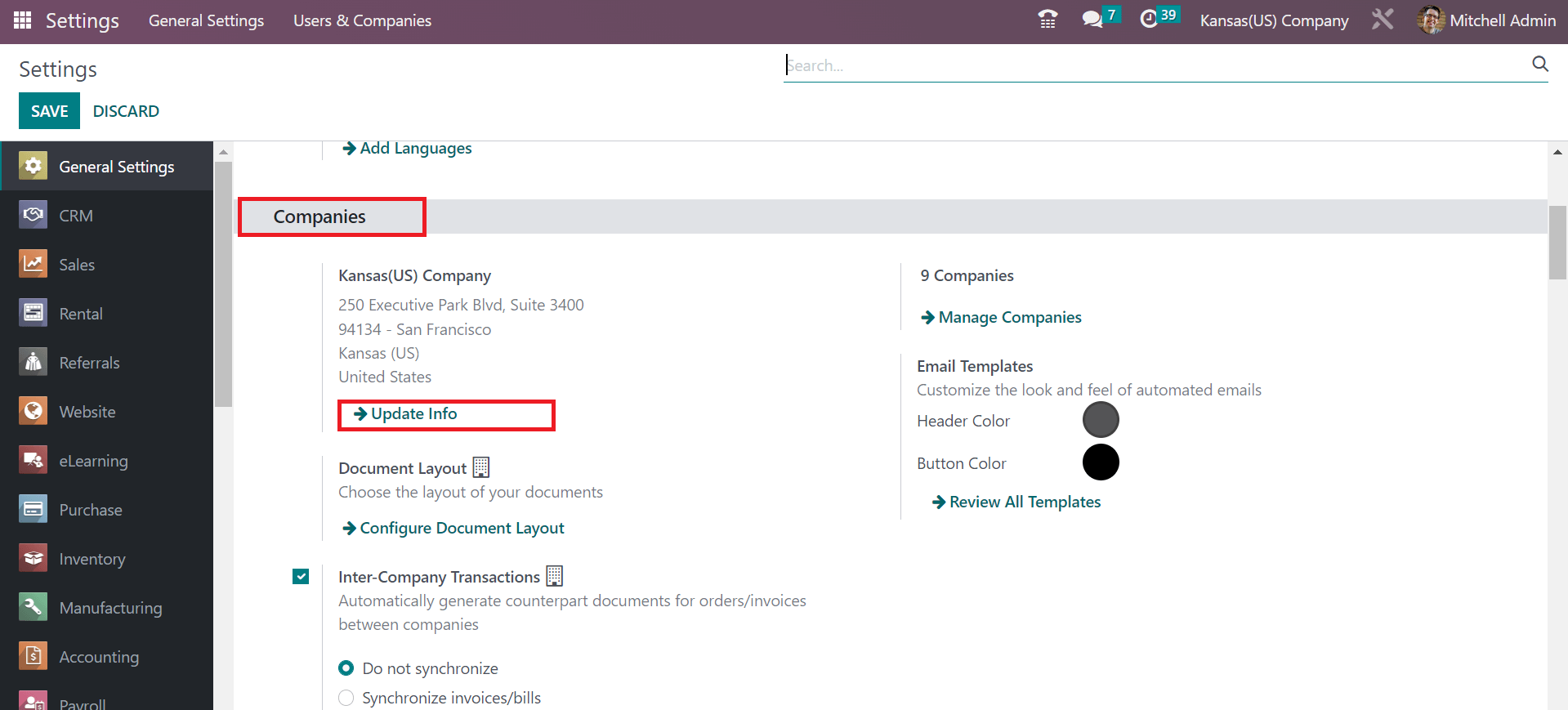

After the installation, we can specify company data in the Odoo Settings. Users must produce company details in Odoo 16 before developing tax for a particular state. Click the Update Info below the Companies section in the Settings window to alter your recent firm data.

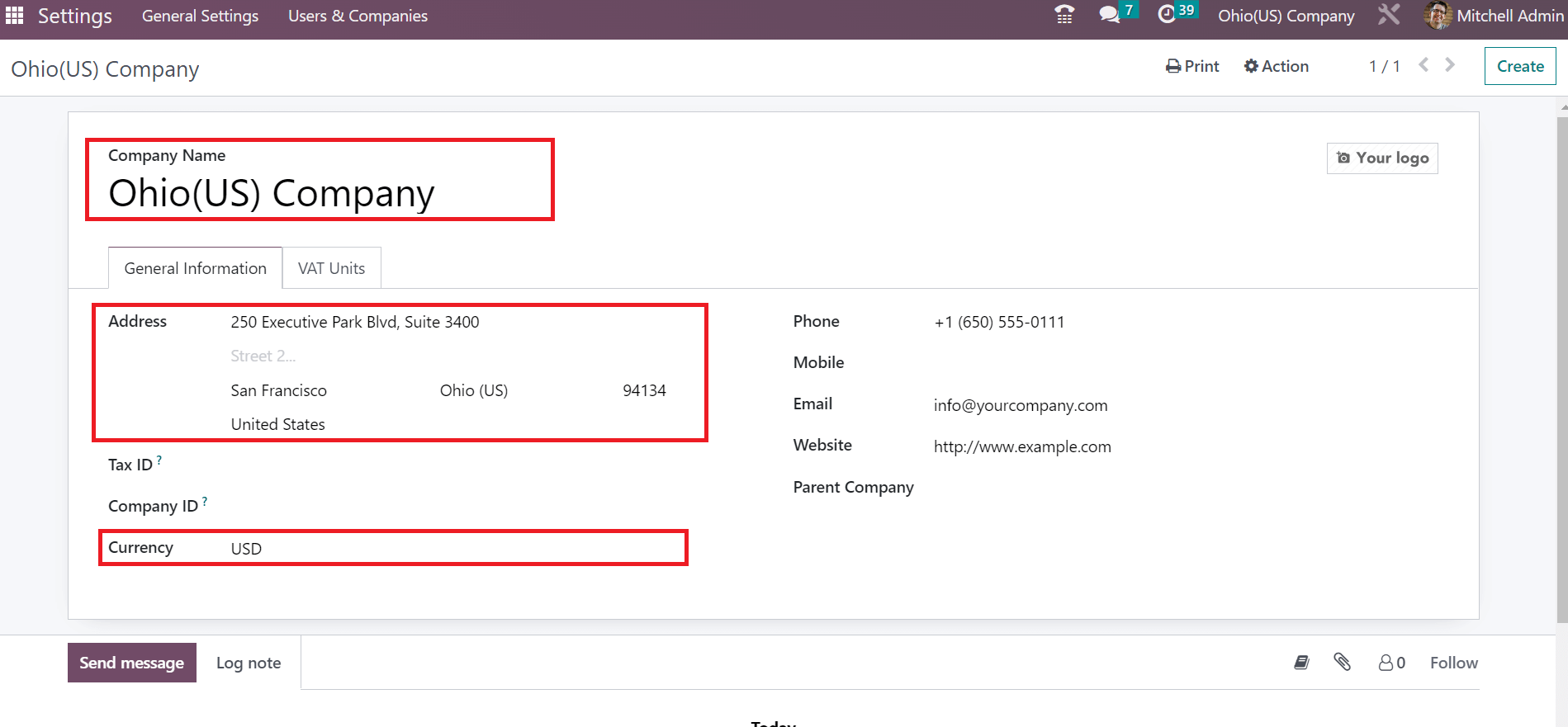

Enter Ohio(US) Company as Company Name in the open screen. Later, you need to add an Address and Currency related to your company, as described in the screenshot below.

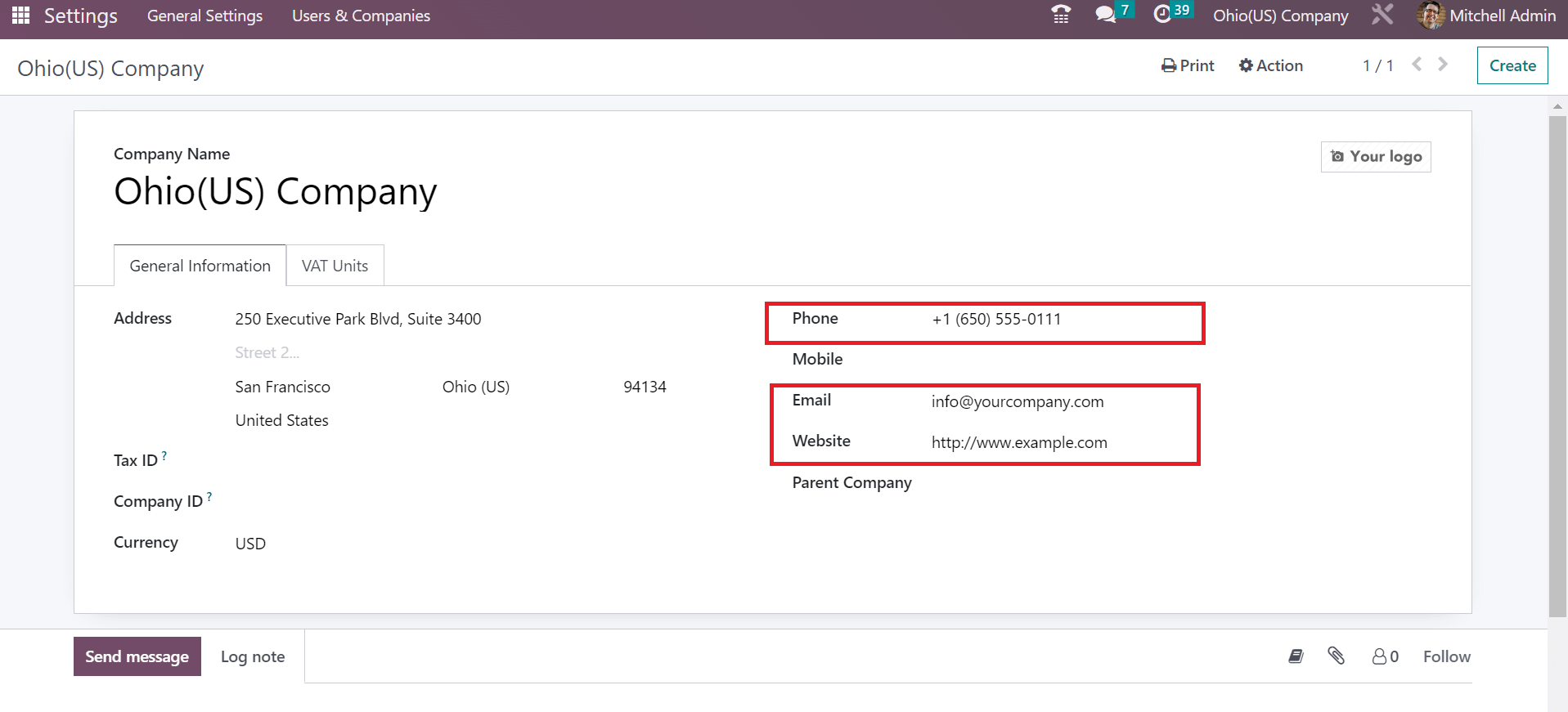

Users can mention the contact number of the company in the Phone field. Additionally, set the official email id of a firm in the Email option. You must add the company website link on the Website field, as demonstrated in the screenshot below.

Each detail is manually saved in Odoo 16 after entering every entry on specific fields.

How to Define Ohio(US) Sales Tax in the Odoo 16 Accounting?

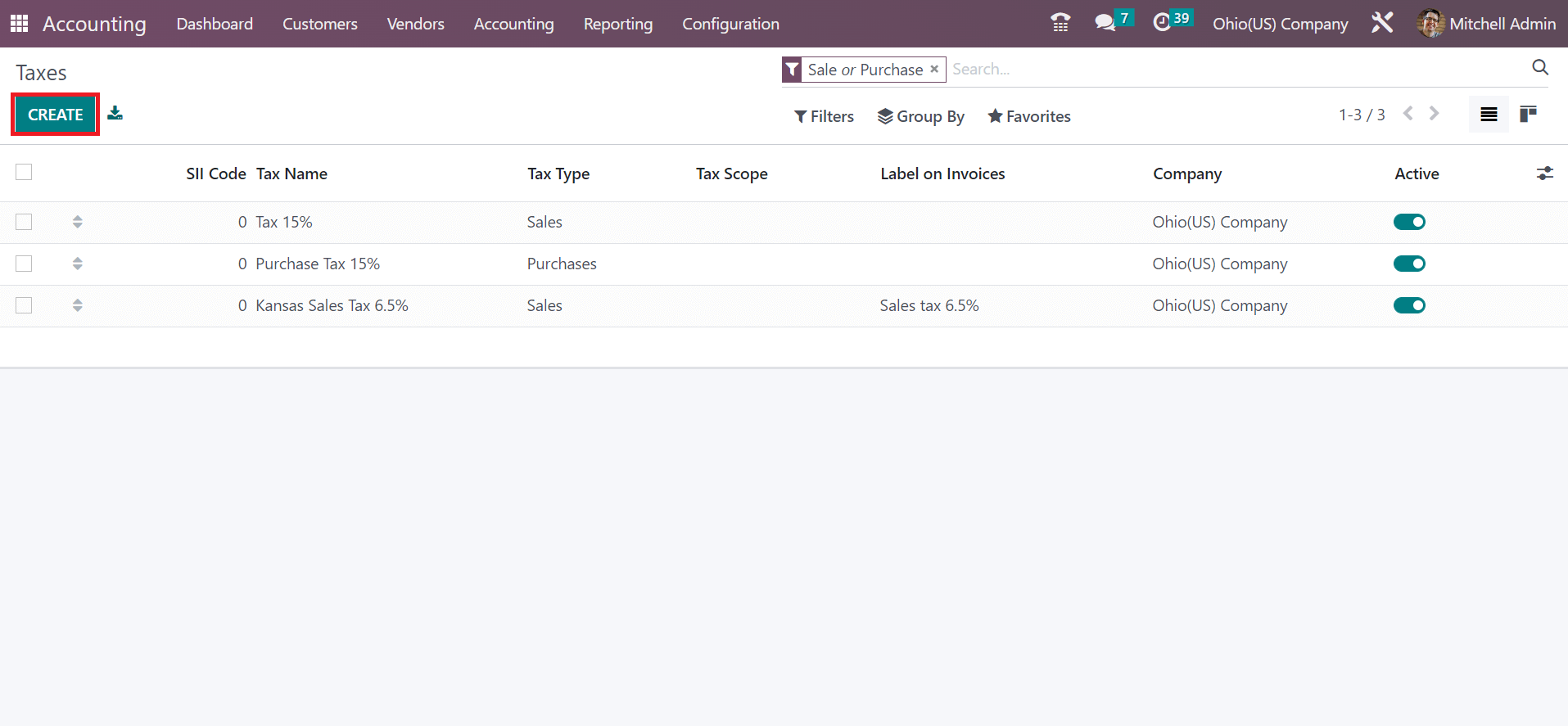

Users can configure taxes from the Odoo 16 Accounting module. The Taxes page describes the record of each tax separately for users and selects CREATE option to develop a new one, as cited in the screenshot below.

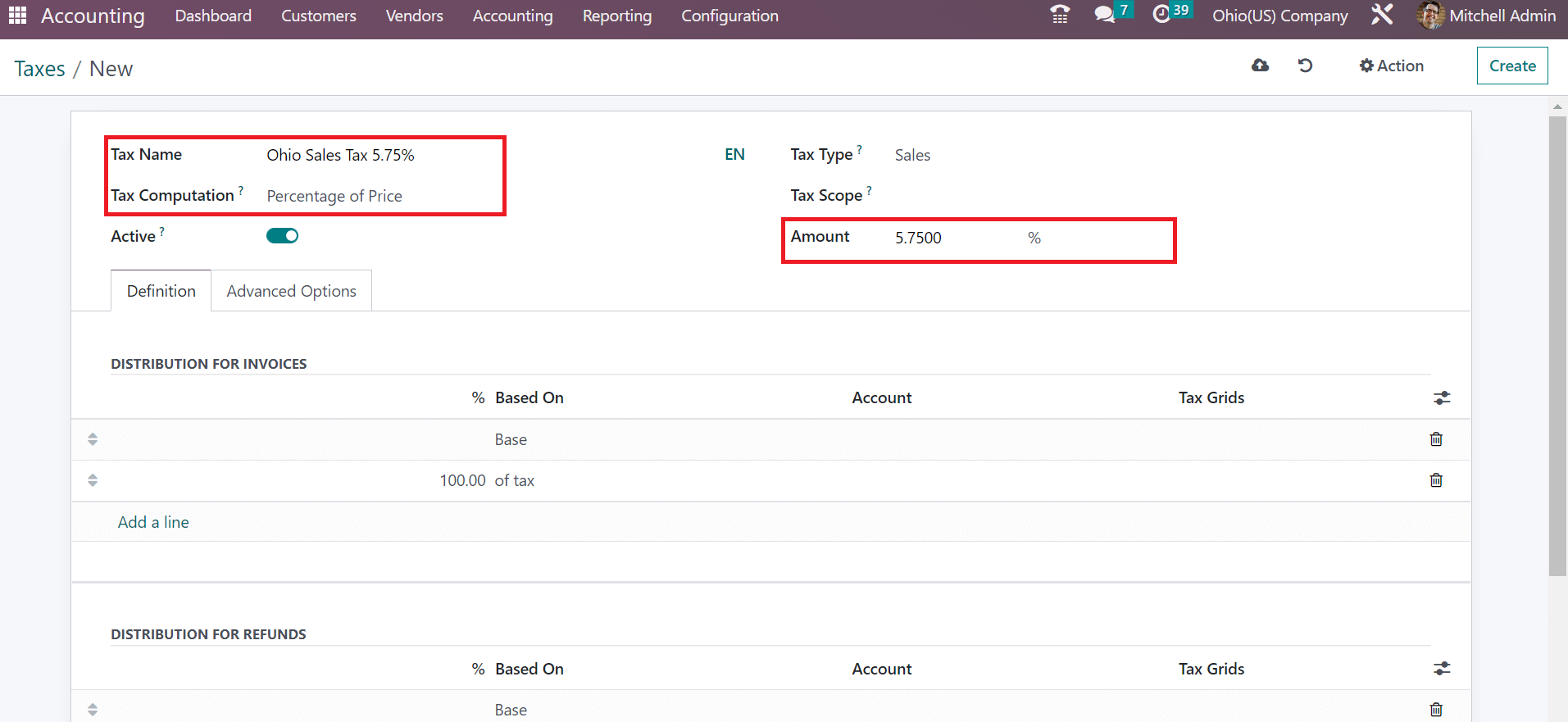

Apply Ohio Sales Tax 5.75% in the Tax Name and pick a computation method for your tax. We choose calculation as per price percentage for Ohio sales tax. After selecting your computation method, enter the percentage on the Amount option as 5.75%.

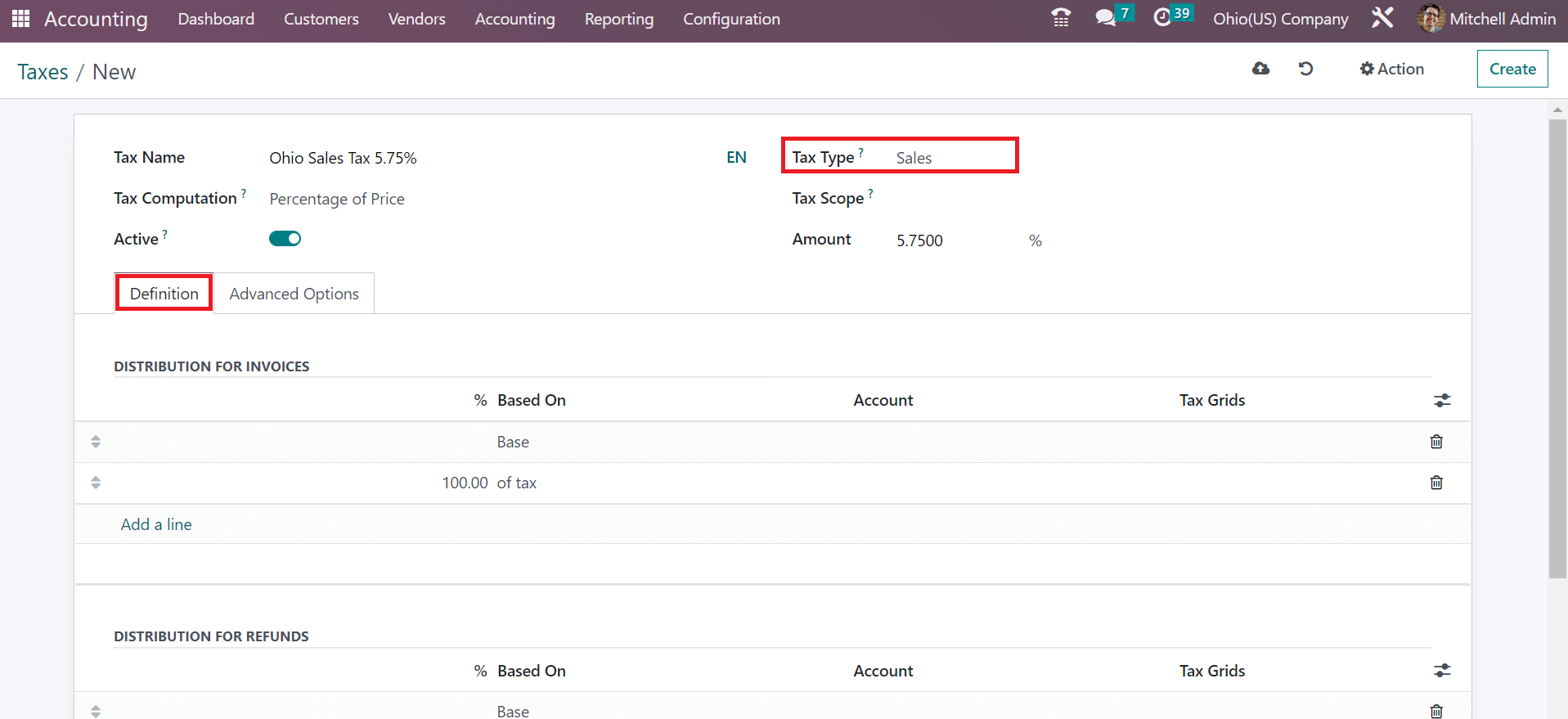

It is easy to set the tax type as Sales or Purchase in the Taxes window. As mentioned in the screenshot below, we set Sales for the Ohio sales tax at 5.75%.

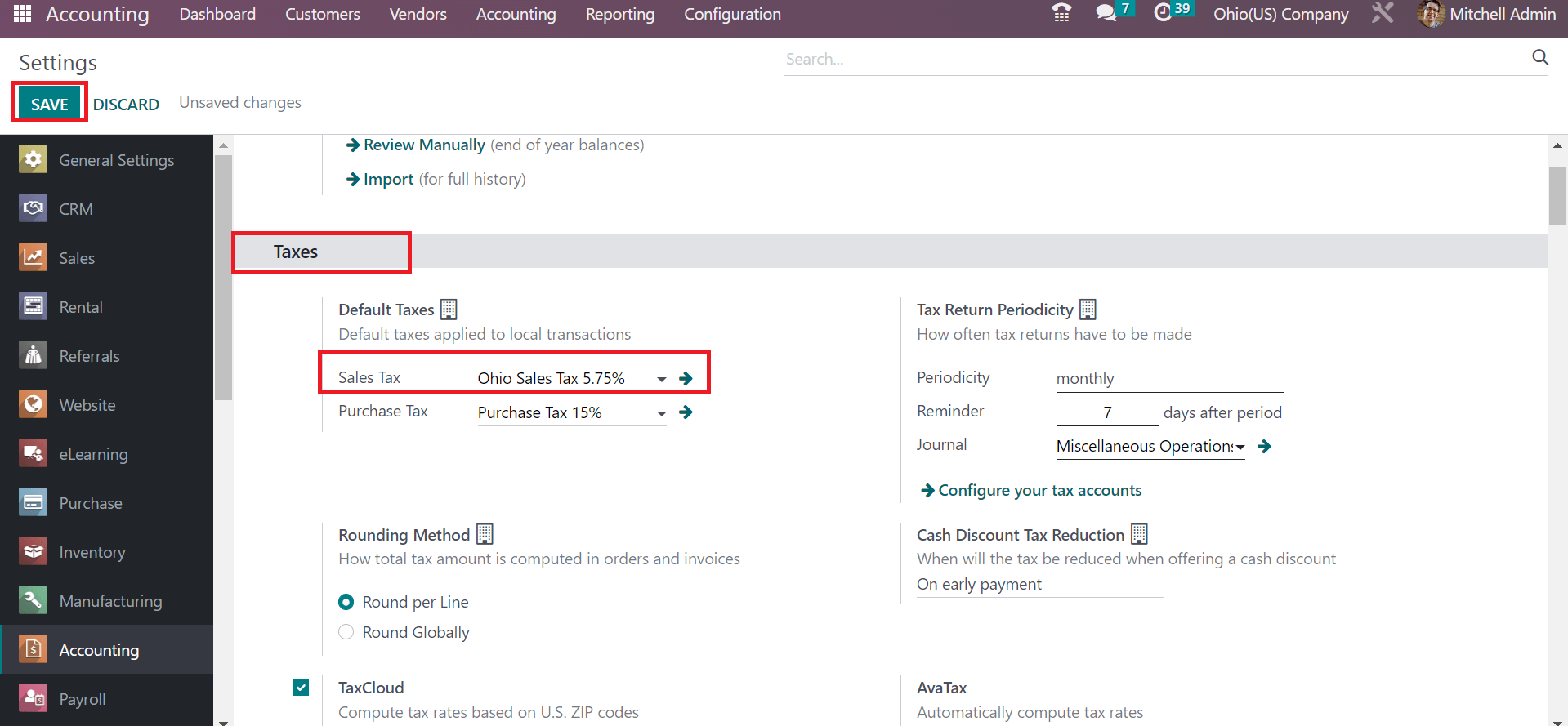

Tax distribution based on percentage, account, and tax grids is possible within the Definition tab. After specifying the necessary details, all data is saved manually in the Odoo 16. We can default the sales tax by moving to the Odoo 16 Accounting settings. Below the Taxes section, choose Ohio Sales Tax 5.75% in the Sales Tax option under Default taxes and click the SAVE button.

After saving the details, the Ohio Sales Tax of 5.75% becomes the default tax for all transactions. Next, apply the created Ohio sales tax to a customer invoice.

To Develop a Customer Invoice based on Ohio Sales Tax in Odoo 16

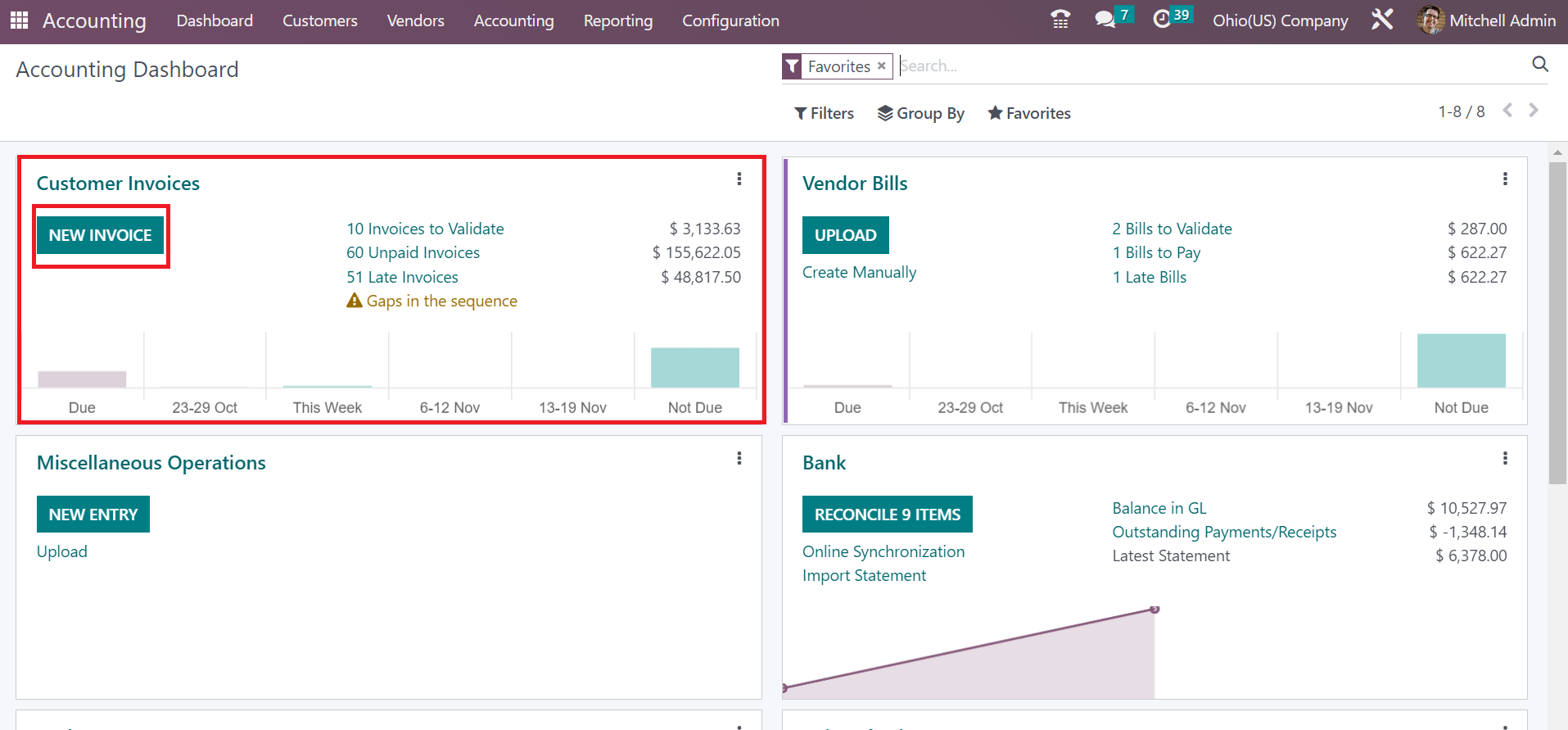

Move to the Odoo 16 Accounting dashboard, and various journals are visible to the user. Select the NEW INVOICE icon below the Customer Invoice journal to produce a new one.

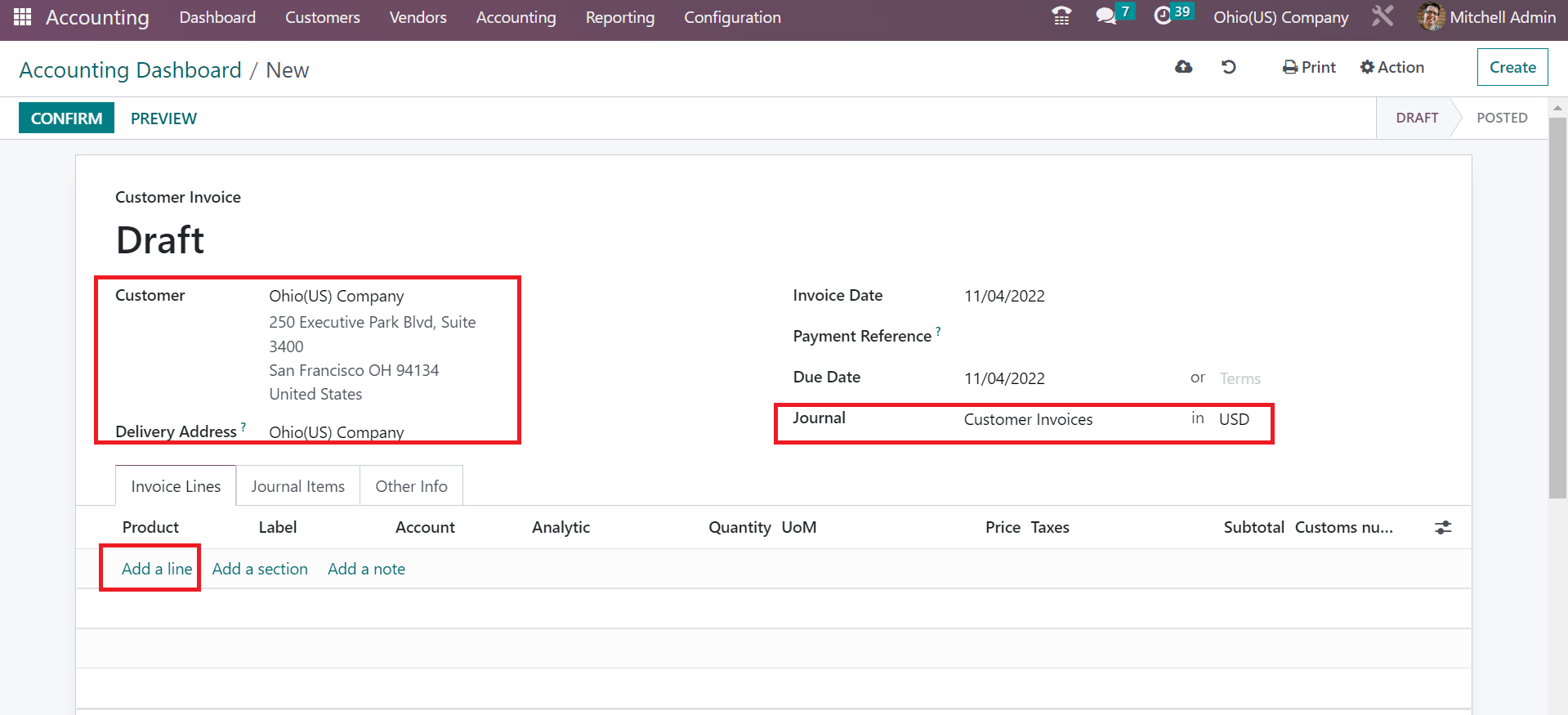

In the new window, choose Ohio(US) Company as your customer, and the delivery address is acquirable to you. We can also mention the Journal and other dates concerning your customer invoice.

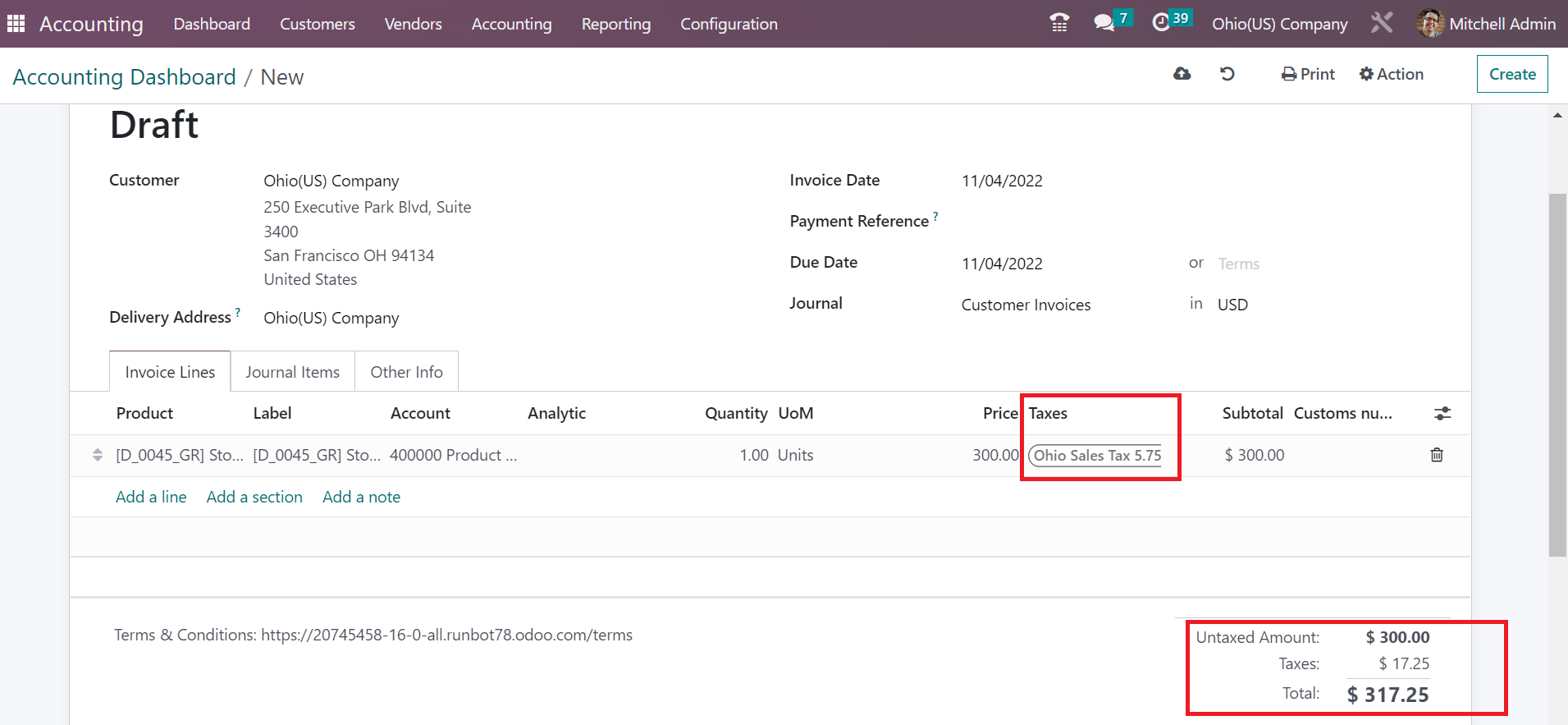

To select the item for your partner, press the Add a line option inside Invoice Lines. After choosing your product, the Ohio sales tax of 5.75% is automatically added under the Taxes section because we set it as the default sales tax.

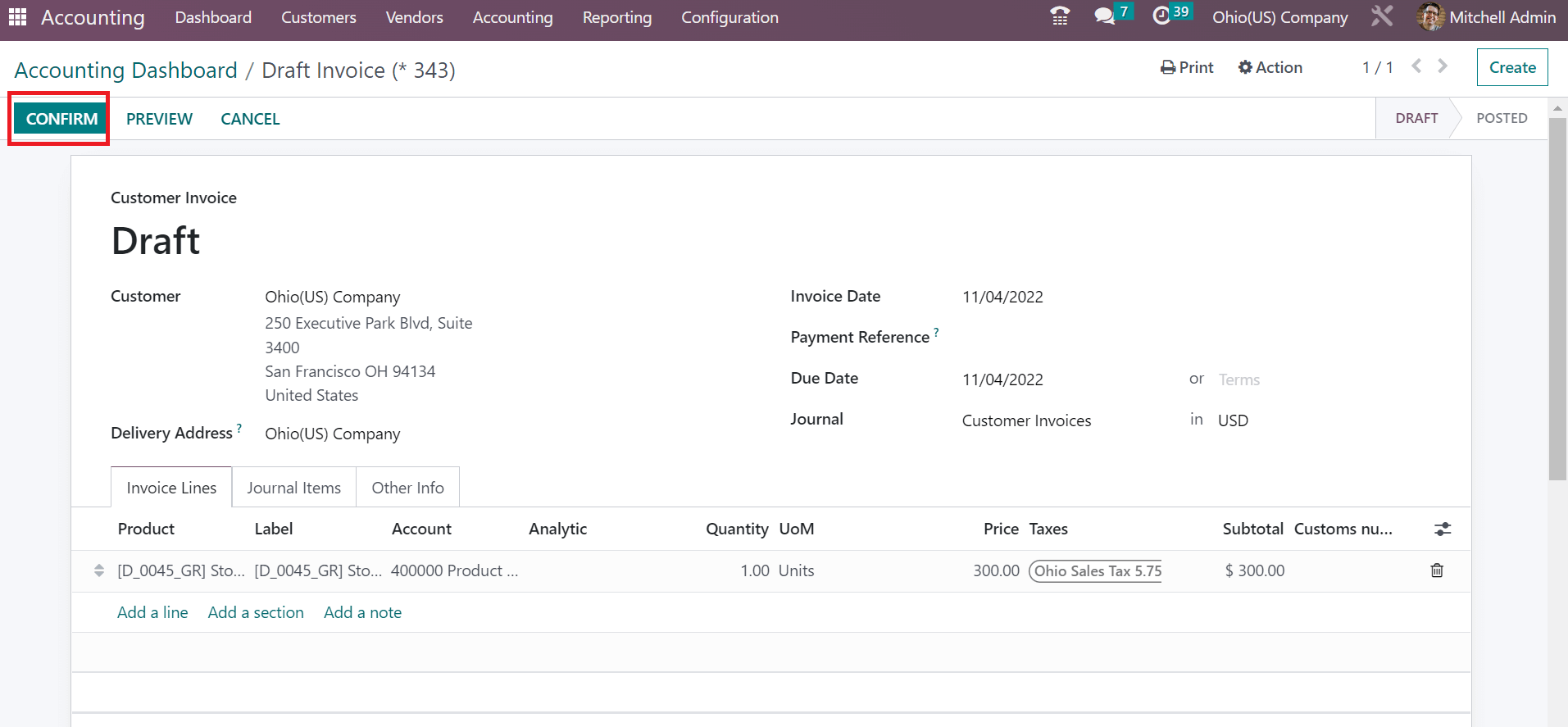

Here, the user can obtain the Total cost of a commodity by summing up the untaxed price and taxes. After manually saving, choose CONFIRM button to validate your invoice for a customer, as portrayed in the screenshot below.

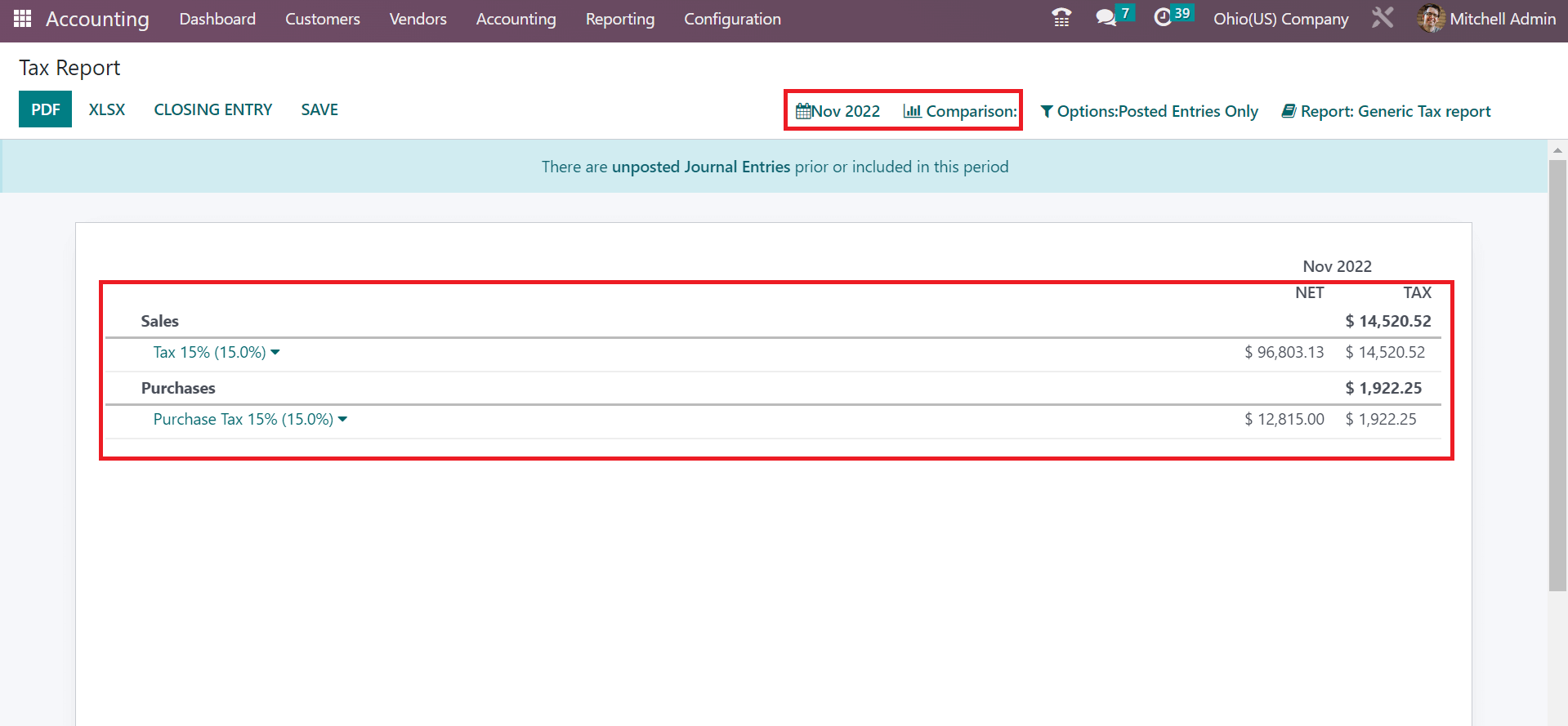

Hence, we can easily apply the Ohio sales tax rate inside invoice data. We can evaluate the tax by choosing the Tax Report menu inside Reporting tab. The user can compare the tariffs in the Tax Report window with the previous year or month. Additionally, it is possible to filter the data to analyze your taxes. We can access the total tax amount related to sales and purchase rax separately in the Tax Report window.

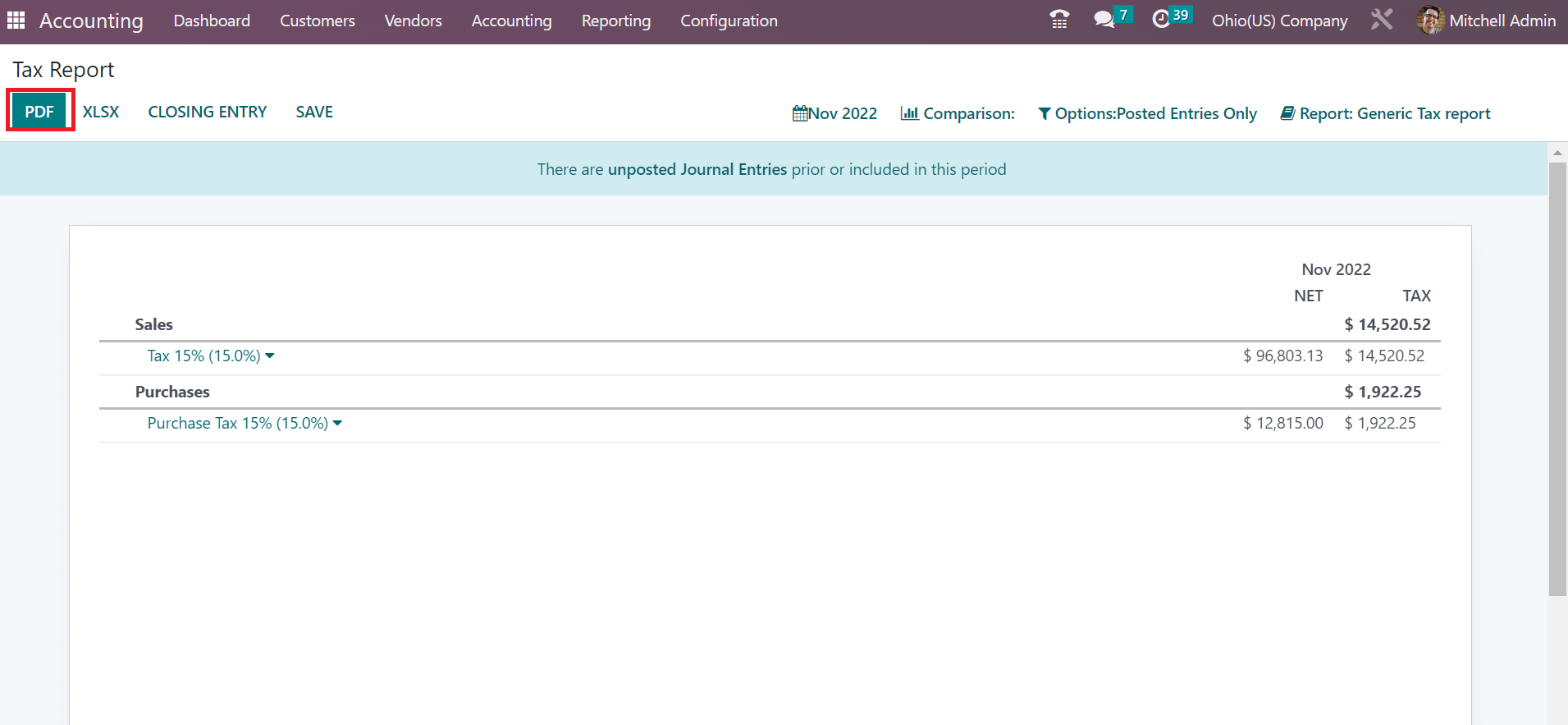

You can download the tax report after clicking on the PDF icon, as noted in the screenshot below.

So, a company can quickly secure the tax information for each year in the database.

Business can manage their sales tax according to each country with Odoo ERP support. We can simplify Ohio sales tax complications by imparting Odoo 16 Accounting application into your system. Refer to the following link to learn about Connecticut sales tax in Odoo 16