Most states in the US charge sales tax on business based on nexus in their territory or local permanent initiation. Colorado has applied a sales tax of 2.9% since 1935 for various goods and services. According to each state, sales tax configuration is the most demanding task for most companies. We can manage the sales tax for a particular state by imparting ERP software. Odoo 16 Accounting module provides users to check out the taxes and evaluate the reports in an organization relying on a specific country.

This blog gives an idea about sales tax configuration in Colorado(US) with the help of Odoo 16 Accounting.

We can easily acquire the statement report related to taxes, sales list, cash flow, balance sheet, and more within the Accounting application. Additionally, you can specify individual tax rates on various products according to unique locations. Next, we can view the detailed steps to configure sales tax in Colorado(US) in the Odoo 16 Accounting.

Analysis of Colorado(US) Sales Tax

The sales tax rate of Colorado(US) is recently 2.9%, reaching 11.2% depending on local municipalities. A local sales tax ranges between 0 to 8.3% collected by municipal governments in Colorado. Most states have a special tax rate applied to goods purchased or services. Colorado’s sales tax rate is complicated and varies as per the jurisdiction. Services in Colorado are not taxable. In contrast, tangible commodities are taxable in the specific state.

Numerous Colorado cities are home rule cities, which gather their own taxes. The Colorado Department of Revenue collects these taxes on behalf of various cities and countries. Apart from countries or cities, other local government institutions also charge local sales tax. According to location, multiple sales tax rates are applied to different buyers in the state.

To Apply Colorado(US) Company Data in Odoo 16

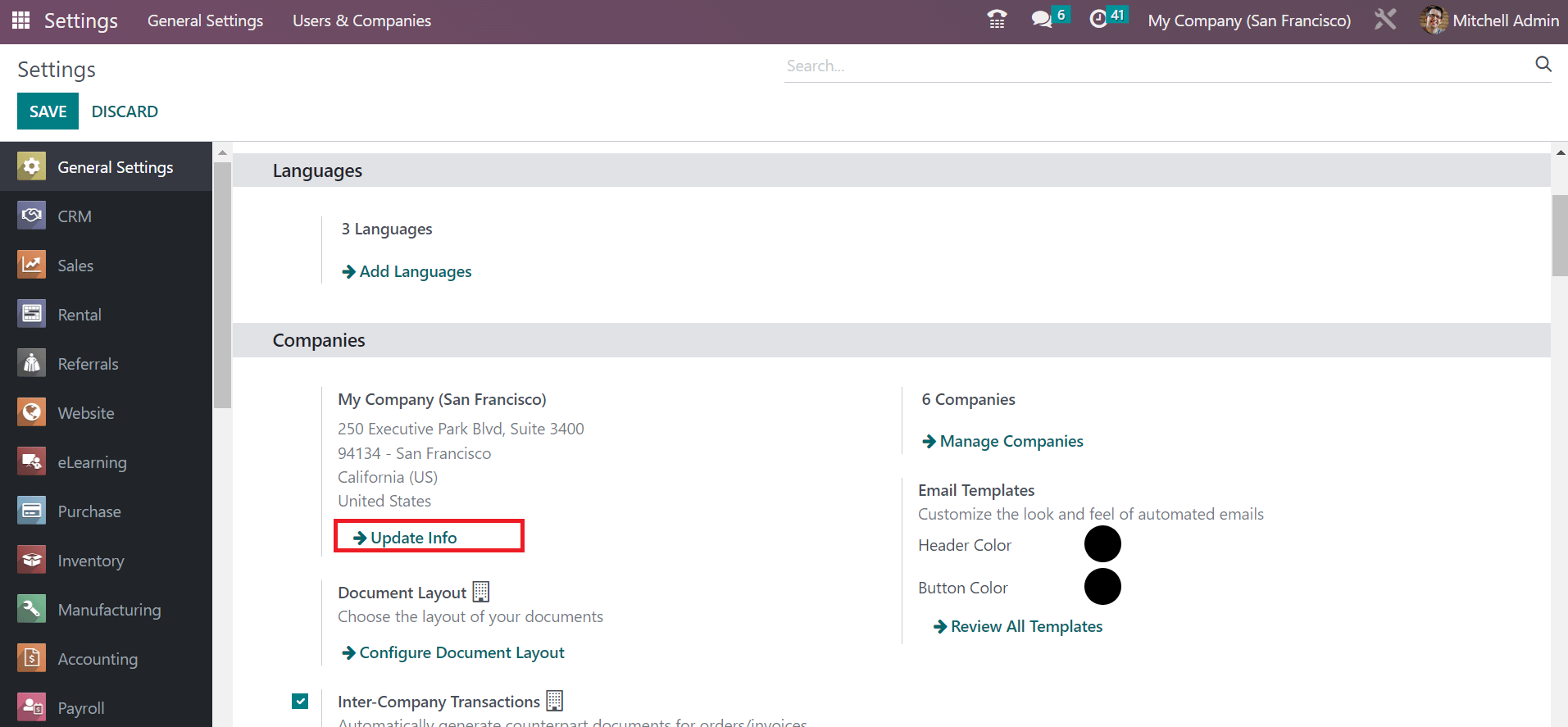

We must set the company details in Colorado before applying the tax rates. You can obtain the Settings window from the Odoo 16 Settings and press the Update Info option, as mentioned in the screenshot below.

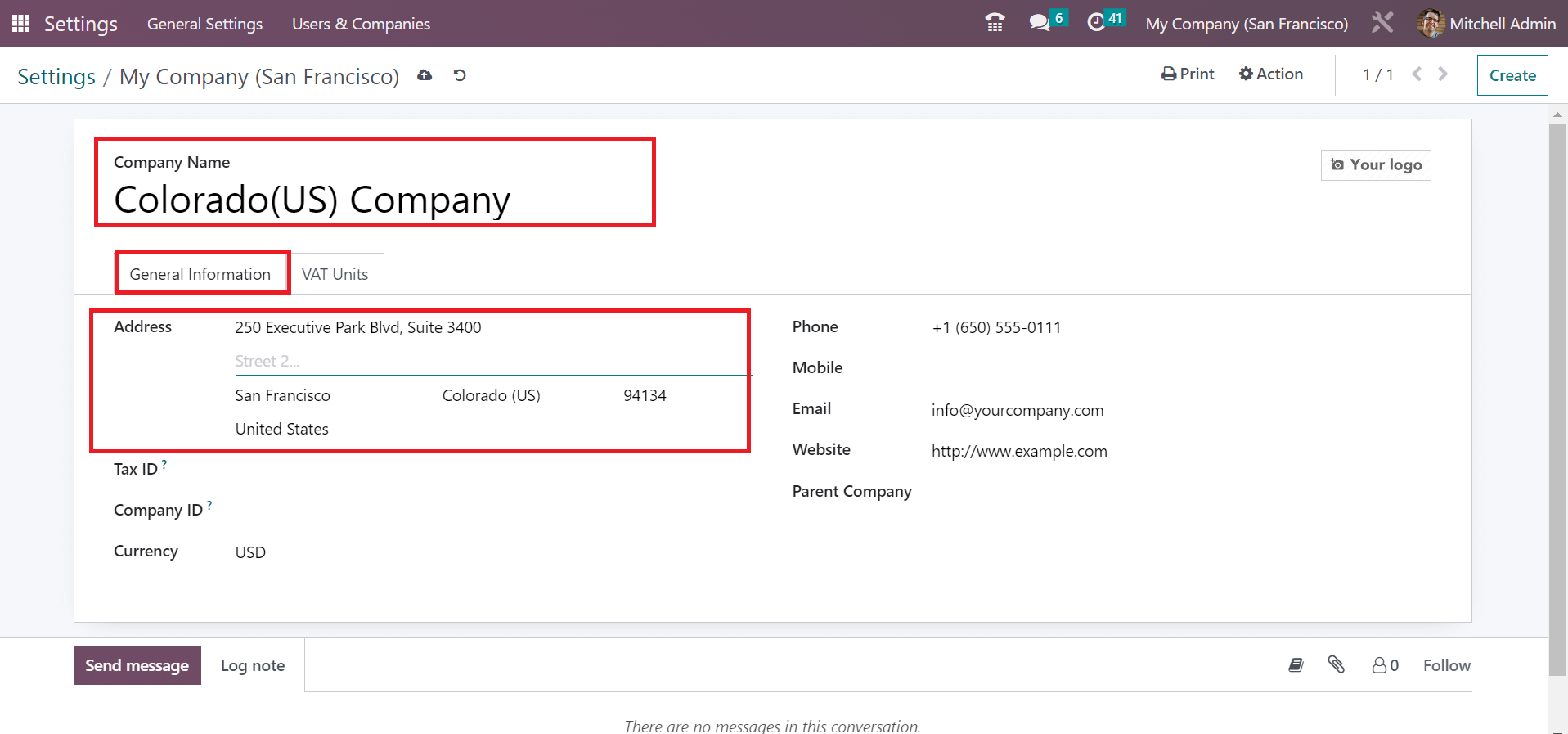

On the new page, apply the Company Name as Colorado(US) Company. Below the General Information, the user can specify the company address. In the Address field, set State as Colorado(US) and US in the Country option described in the screenshot below

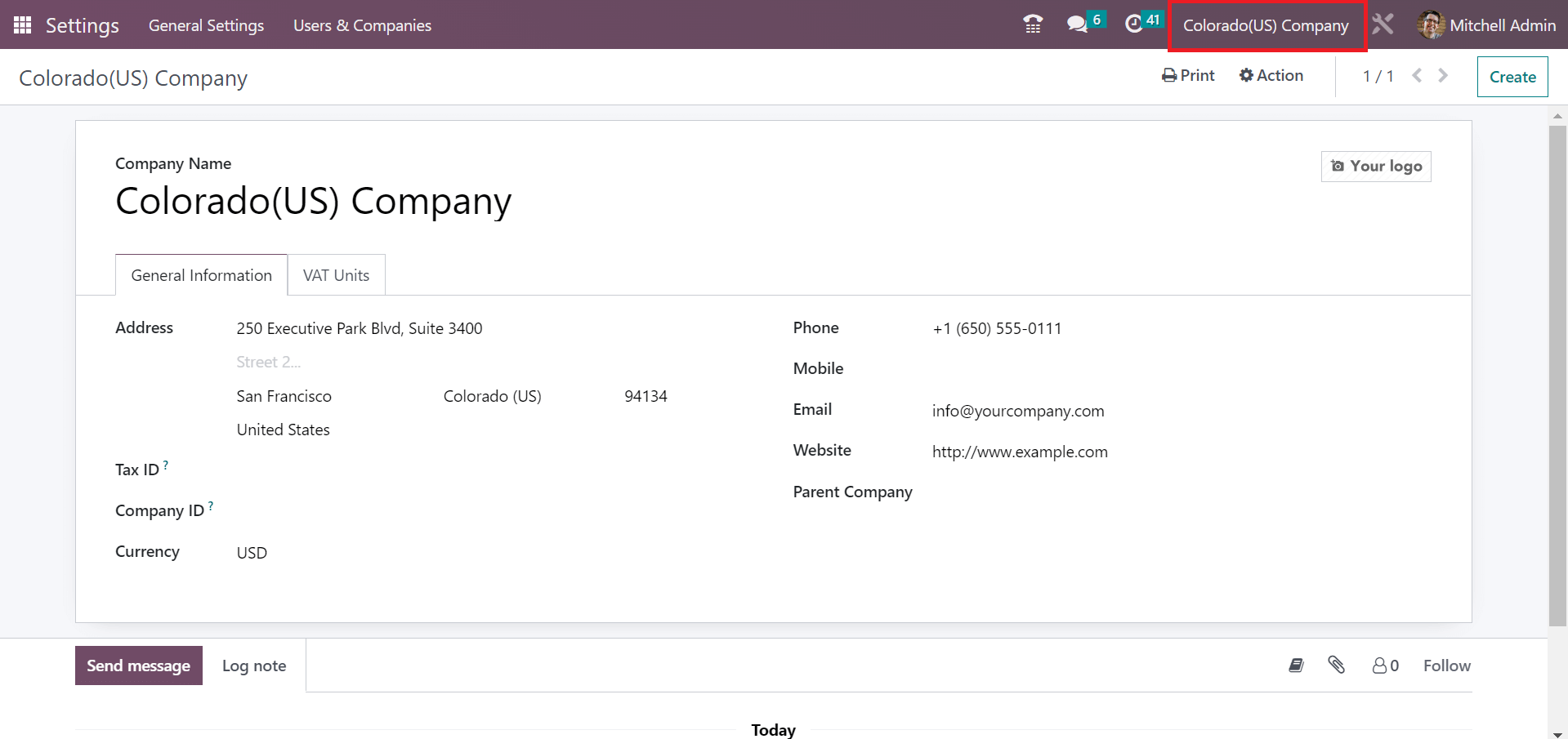

After saving the information, the user can view the company name on the top bar of Odoo 16, as defined in the screenshot below.

To Formulate a Sales Tax for Colorado(US) Company in Odoo 16 Accounting

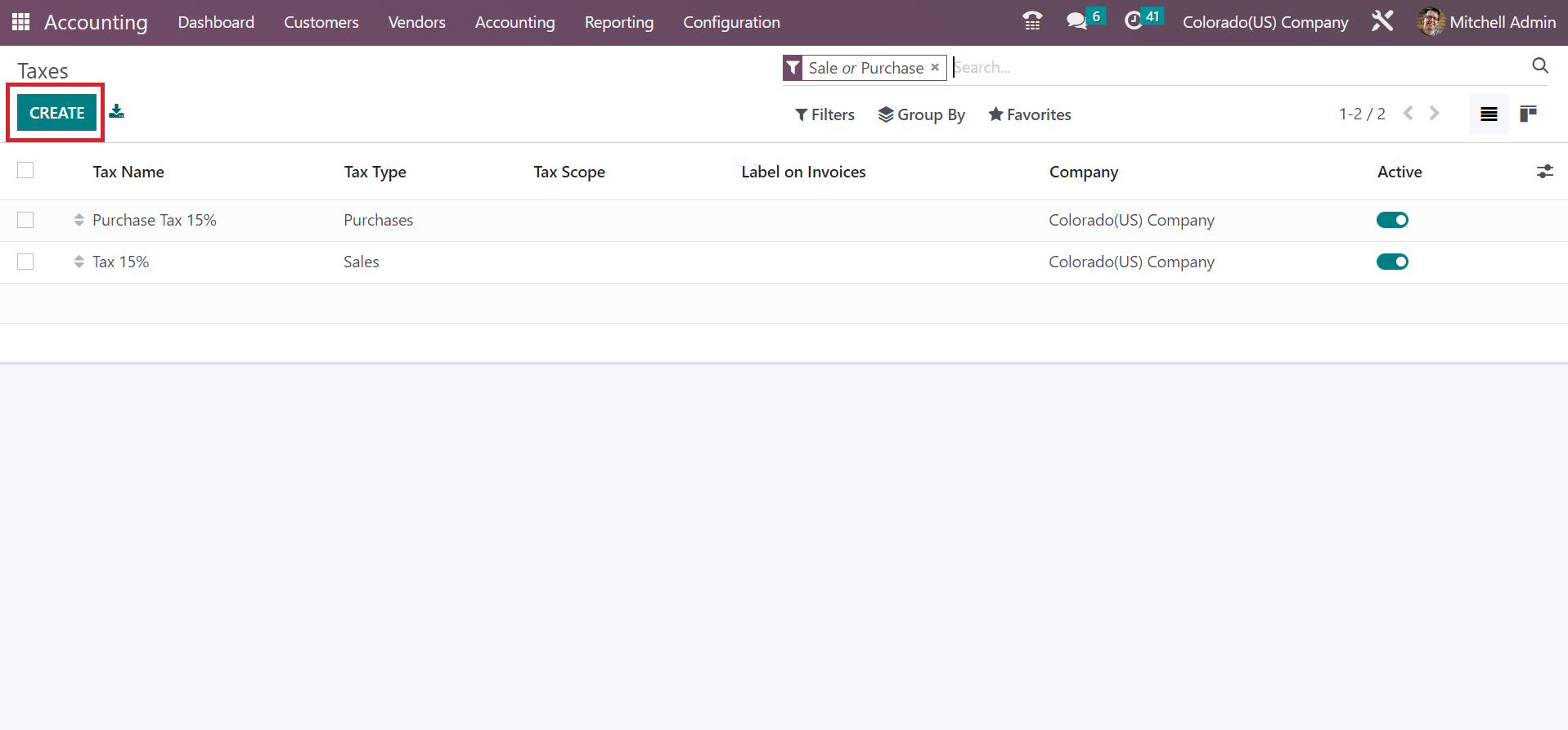

After setting the company information, we can quickly produce a sales tax for the firm. You can obtain the Taxes menu from the Configuration, and the report of all created taxes is accessible to a user. The Taxes screen shows details of a company, tax type, scope, and name that are acquirable to you. To define a new tax, click the CREATE icon in the Taxes window, as pointed out in the screenshot below.

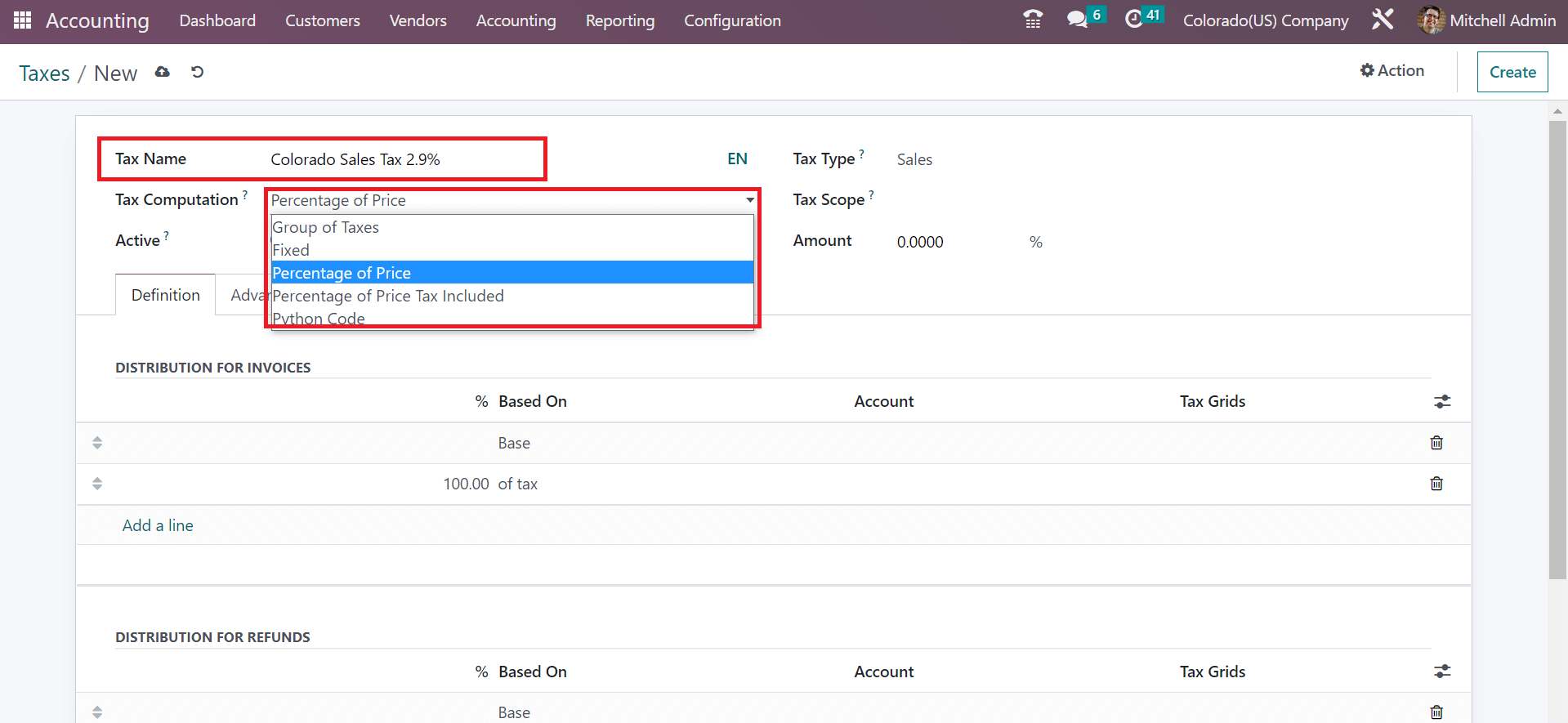

A new window appears before the user, and we can generate the sales tax. Colorado, sales tax rate is considered 2.9%. So, let’s add the Tax Name as Colorado Sales Tax 2.9%. Later, pick a calculation method for your tax within the Tax Computation field divided into Python code, Groups, etc.

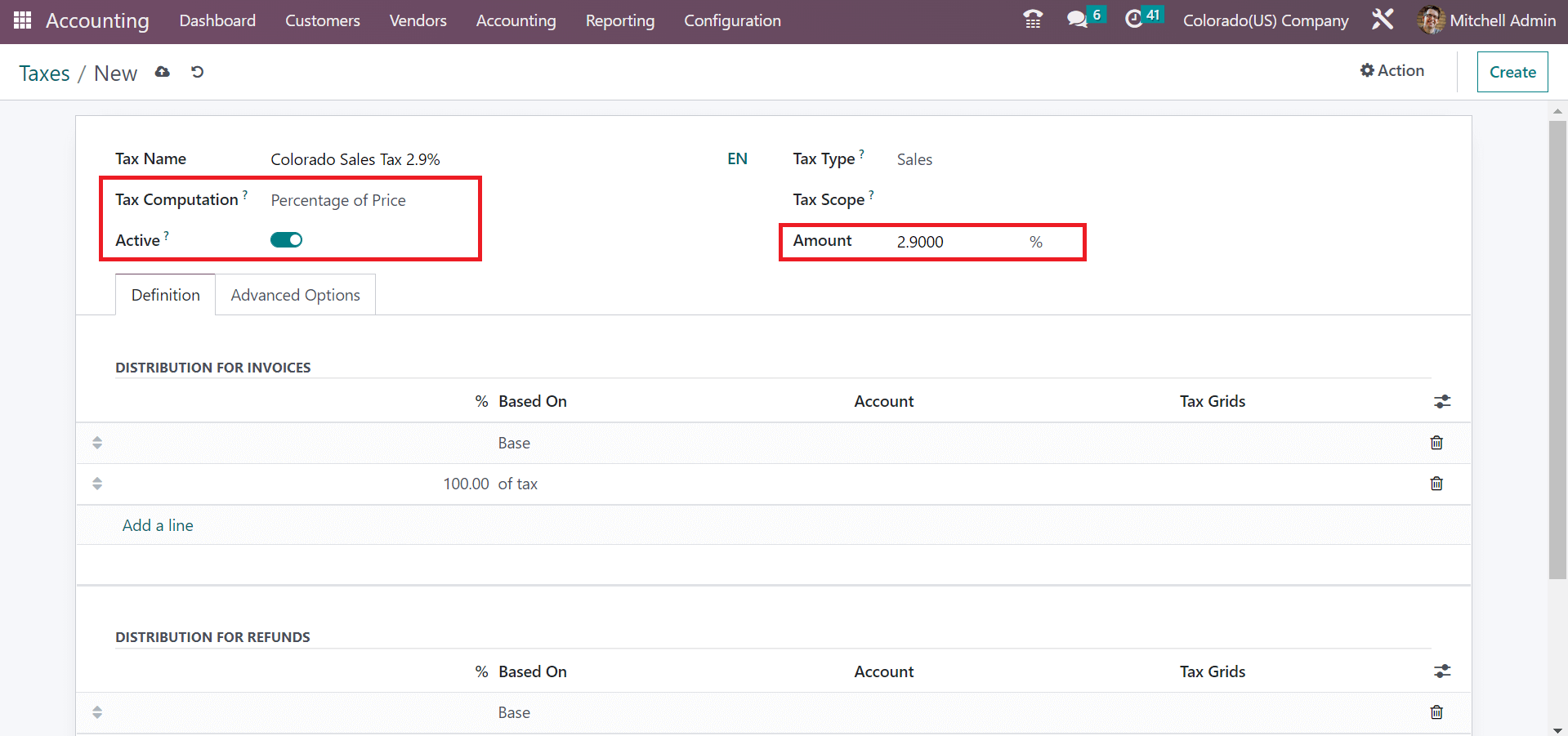

Select the Tax Computation method as a Percentage of the price and apply the percentage in the Amount field. We added the Amount of 2.9% allocated as sales tax of Colorado, as indicated in the screenshot below.

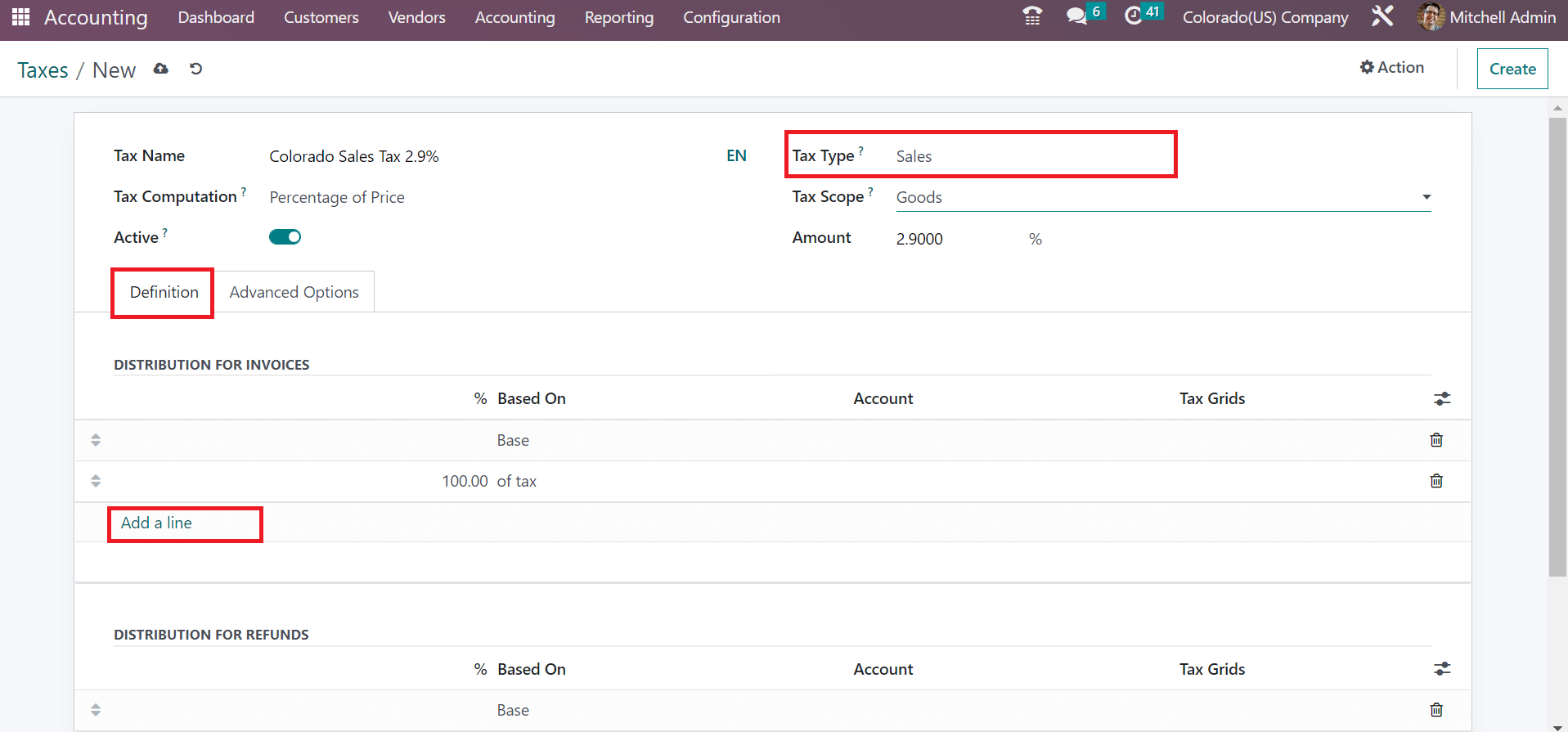

Activate the Active field to enable the sales tax on various products. Moreover, users can choose the Tax Type as Sales due to the Colorado sales tax rate application. Under the Definition section, it is possible to apply invoice and refund data after pressing the Add a line option.

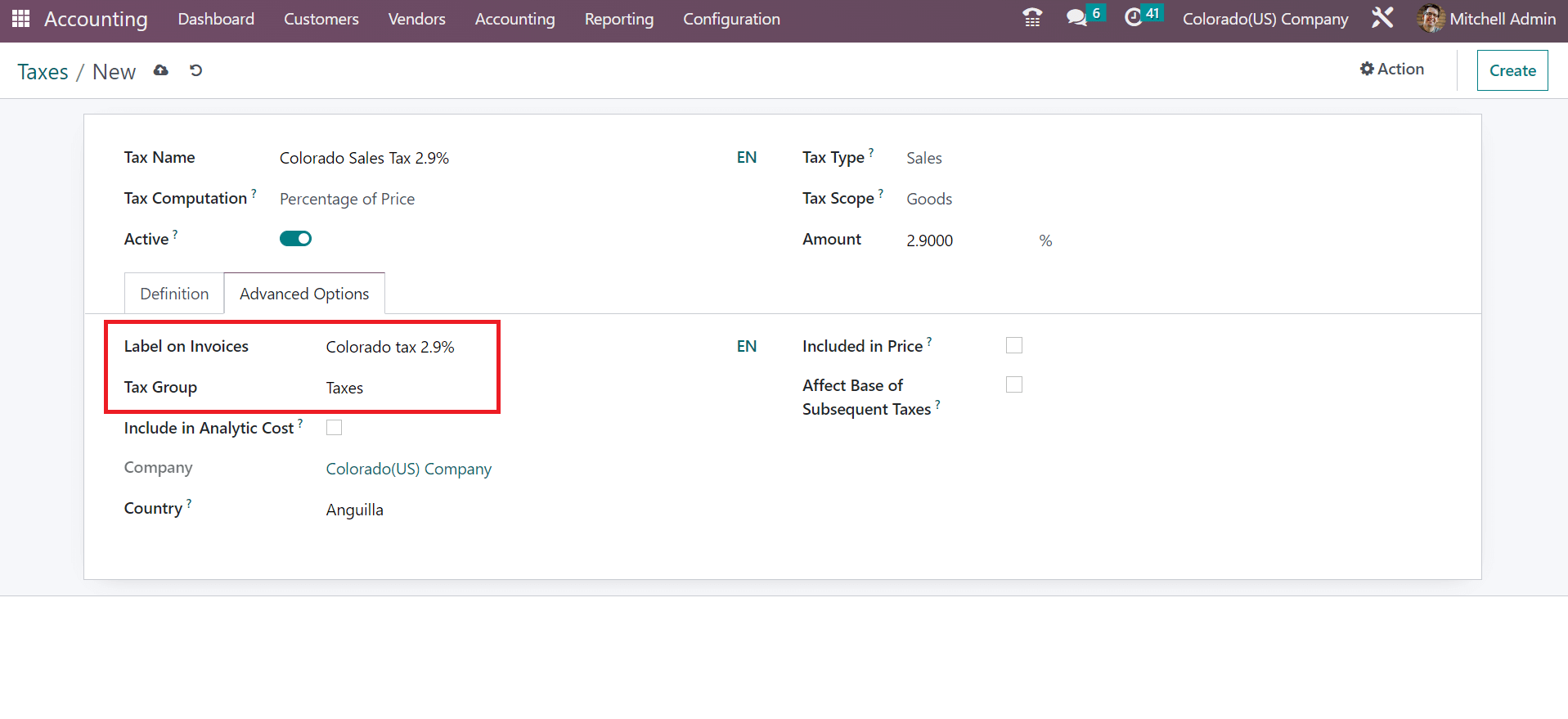

Inside the Advanced option, enter the label visible on invoices within the Label on Invoices field. Next, you can pick up a group for tax in the Tax Group field. We select the Taxes option inside the Tax Group field, as cited in the screenshot below.

Each of the data concerning sales tax is saved manually. Now, we can see the process of applying a specific sales tax on an invoice.

Customer Invoice as per Colorado(US) Sales Tax in Odoo 16

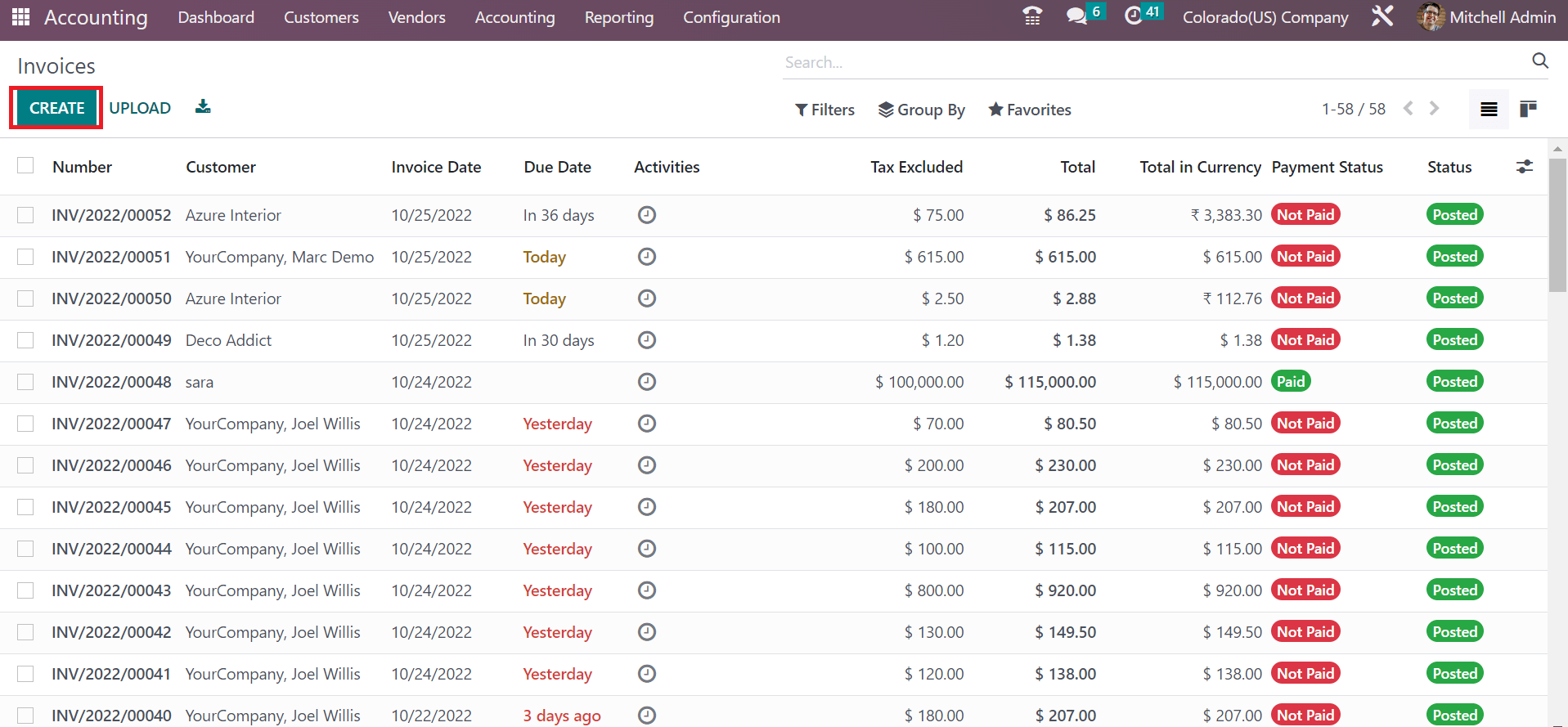

Users can create a customer invoice after generating a sales tax for Colorado(US). Choose the Invoices menu within the Customers tab, and a list of all invoices is acquirable in the list view. In the List view, we can view information about each invoice, such as Number, Activities, Total, Status, and more, as illustrated in the screenshot below.

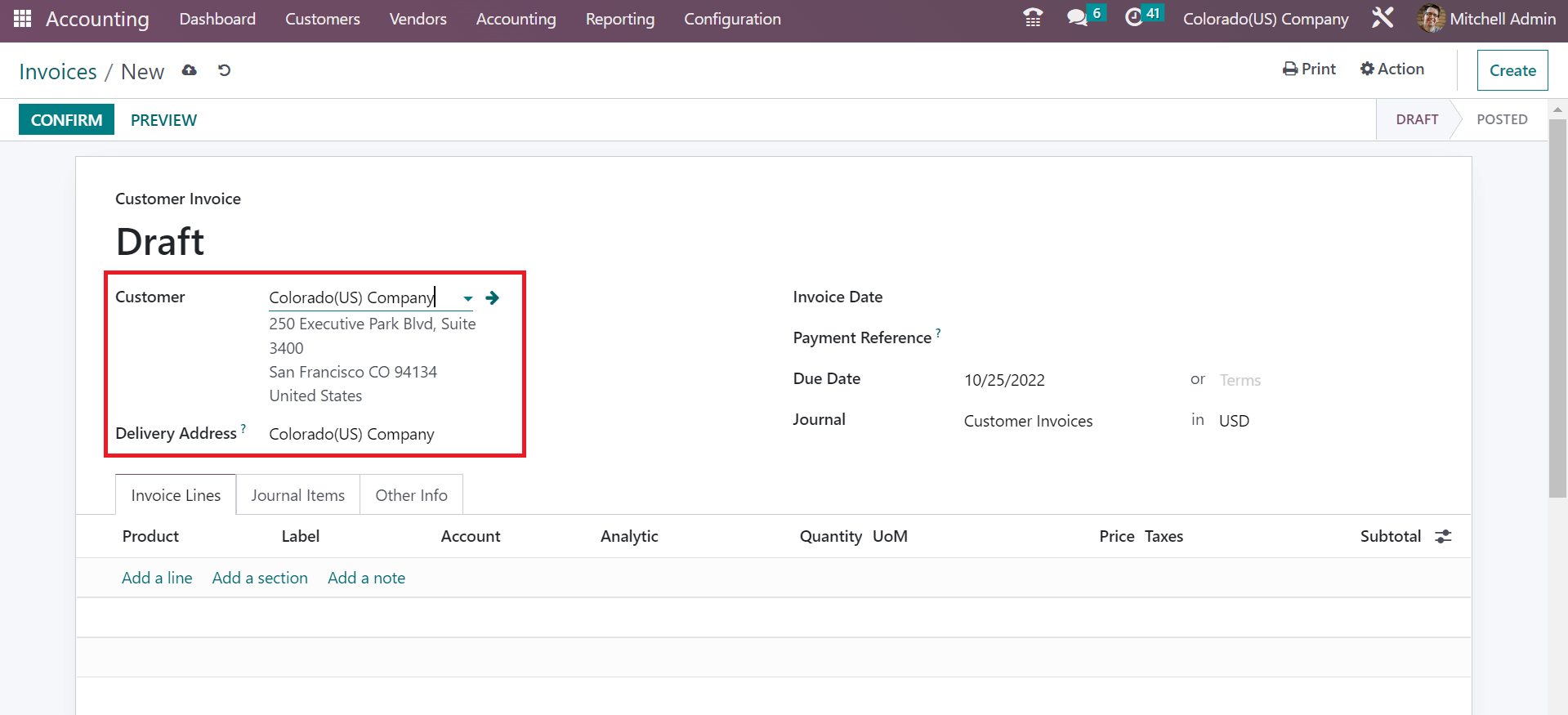

To define a new invoice, click the CREATE button in the Invoices window, as shown in the screenshot above. On the new screen, pick the Customer as Colorado(US) Company. The Delivery Address related to the chosen company is manually visible to the user, as portrayed in the screenshot below.

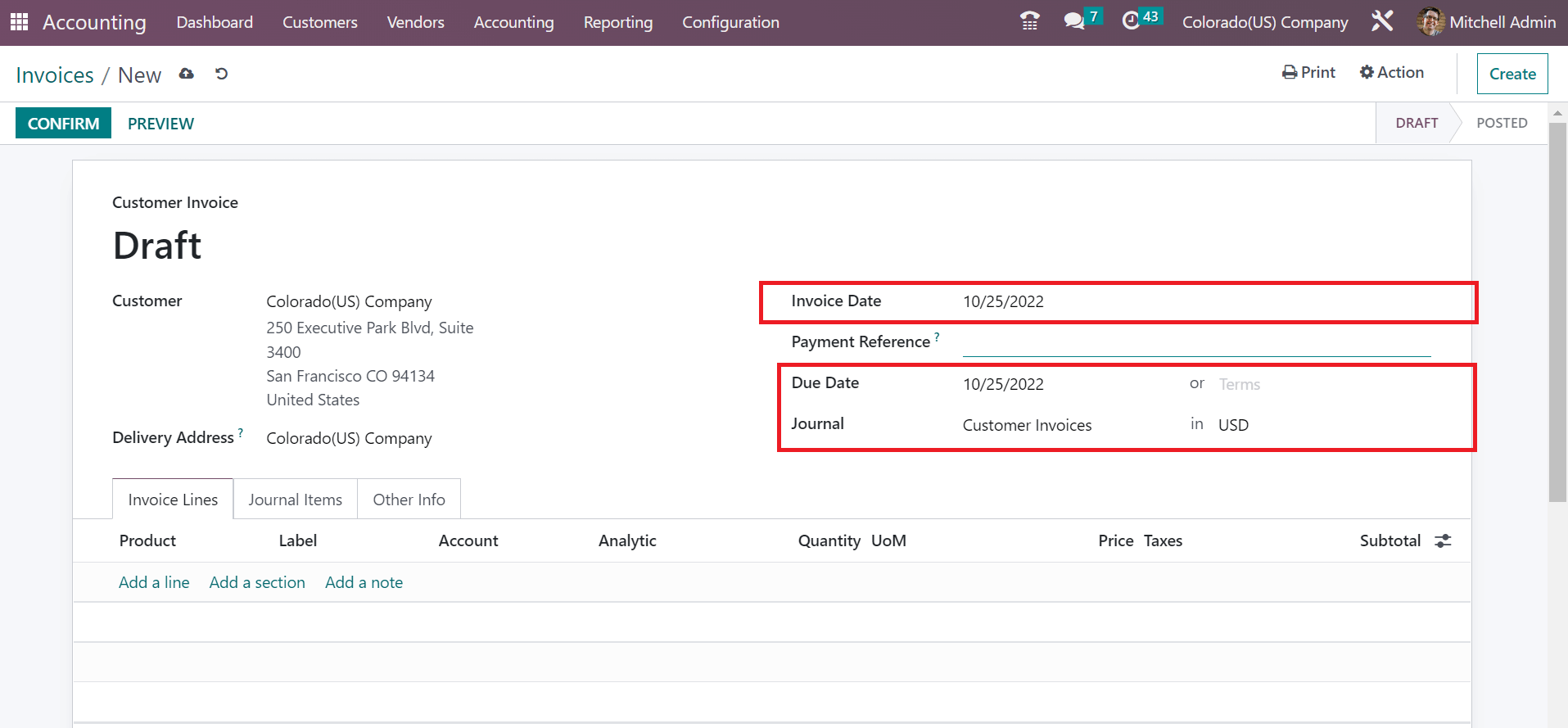

Mention the beginning invoice date inside the Invoice Date field and the end date within the Due Date option. Furthermore, pick the journal for your customer invoice inside the Journal field as specified in the screenshot below.

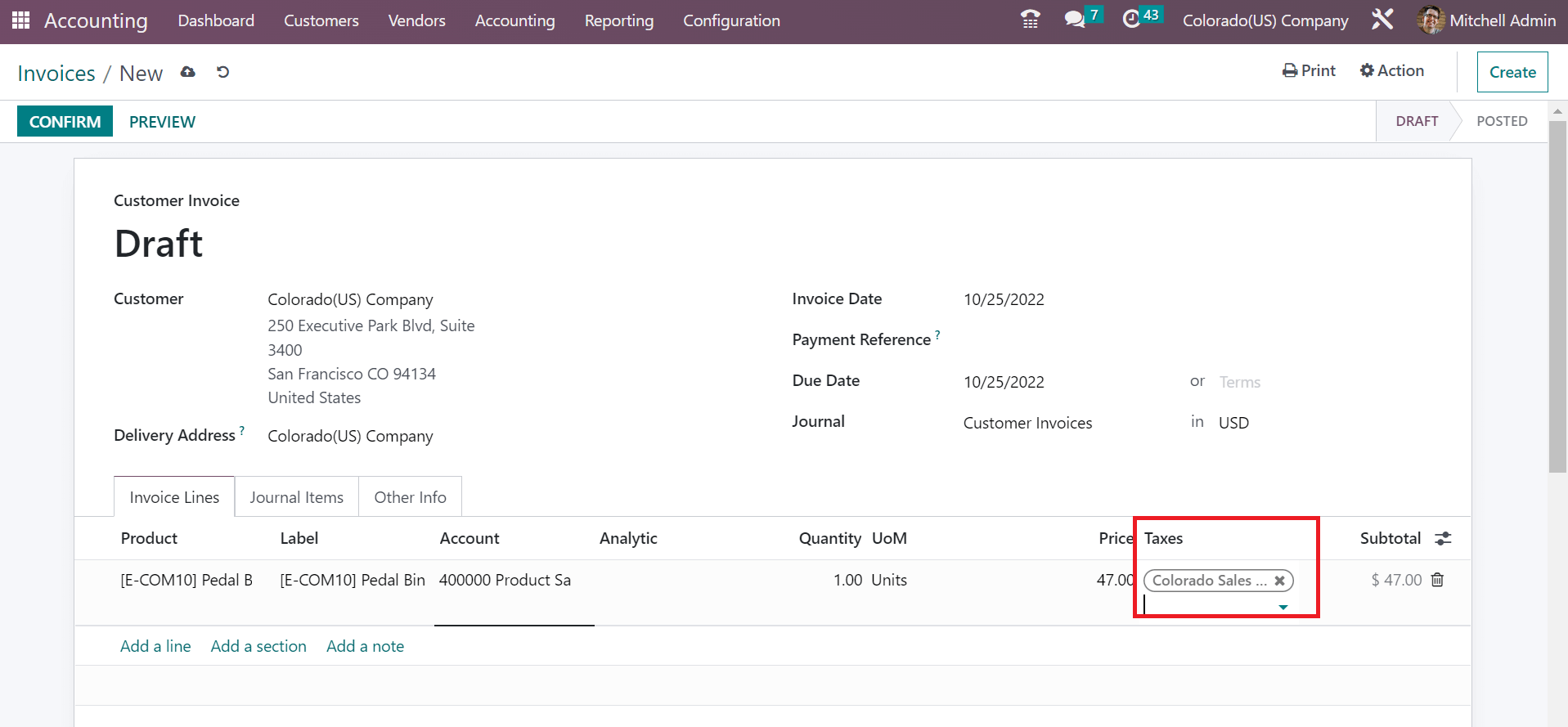

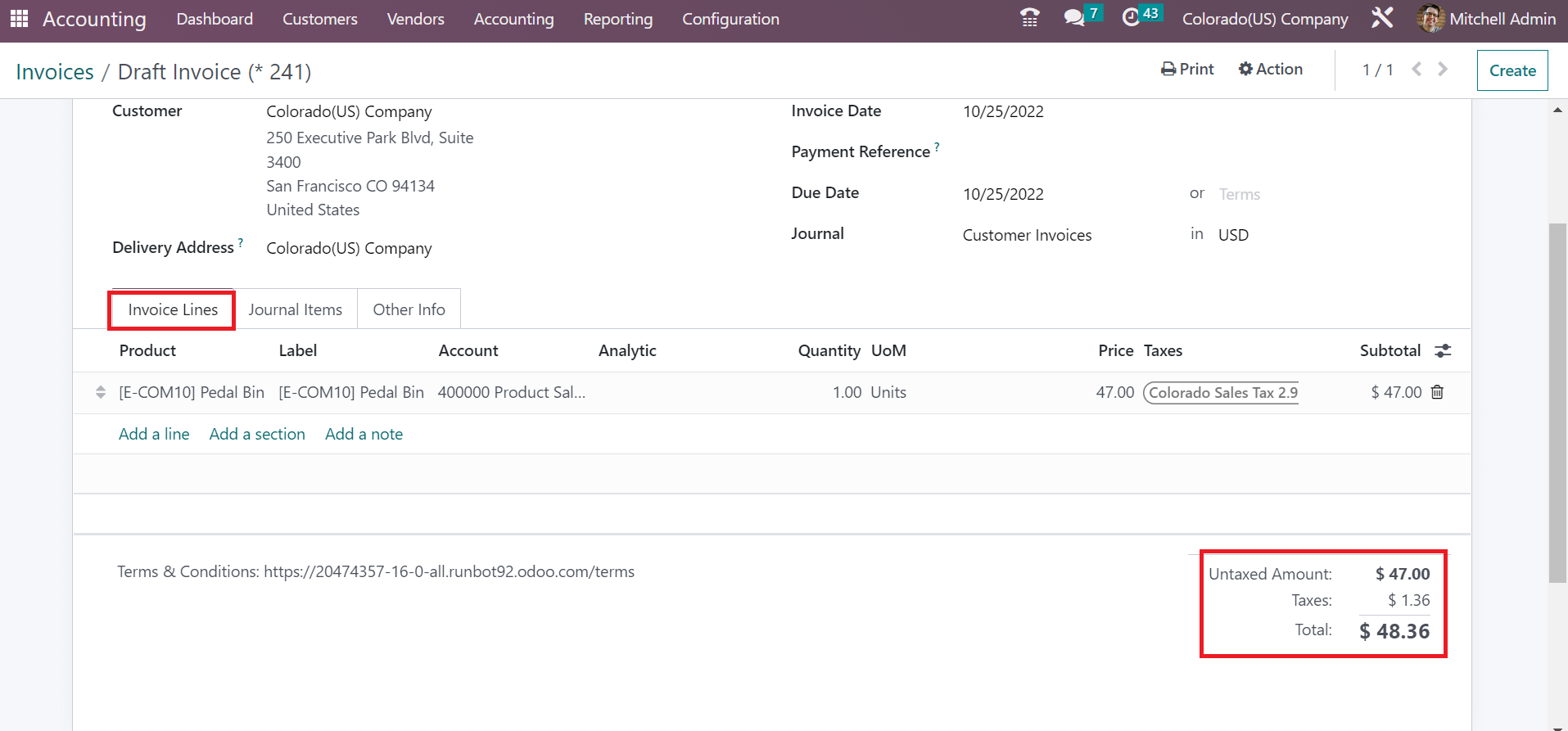

Users can add the information on items for customer invoices under the Invoice Lines tab. After clicking on Add a line option, a new space opens for you. Pick your product and choose Colorado Sales Tax 2.9% below the Taxes section, as depicted in the screenshot below.

Here, we select one quantity of Pedal Bin with a price of 47. At the Invoice Lines tab end, we can identify the total commodity price, including the tax amount.

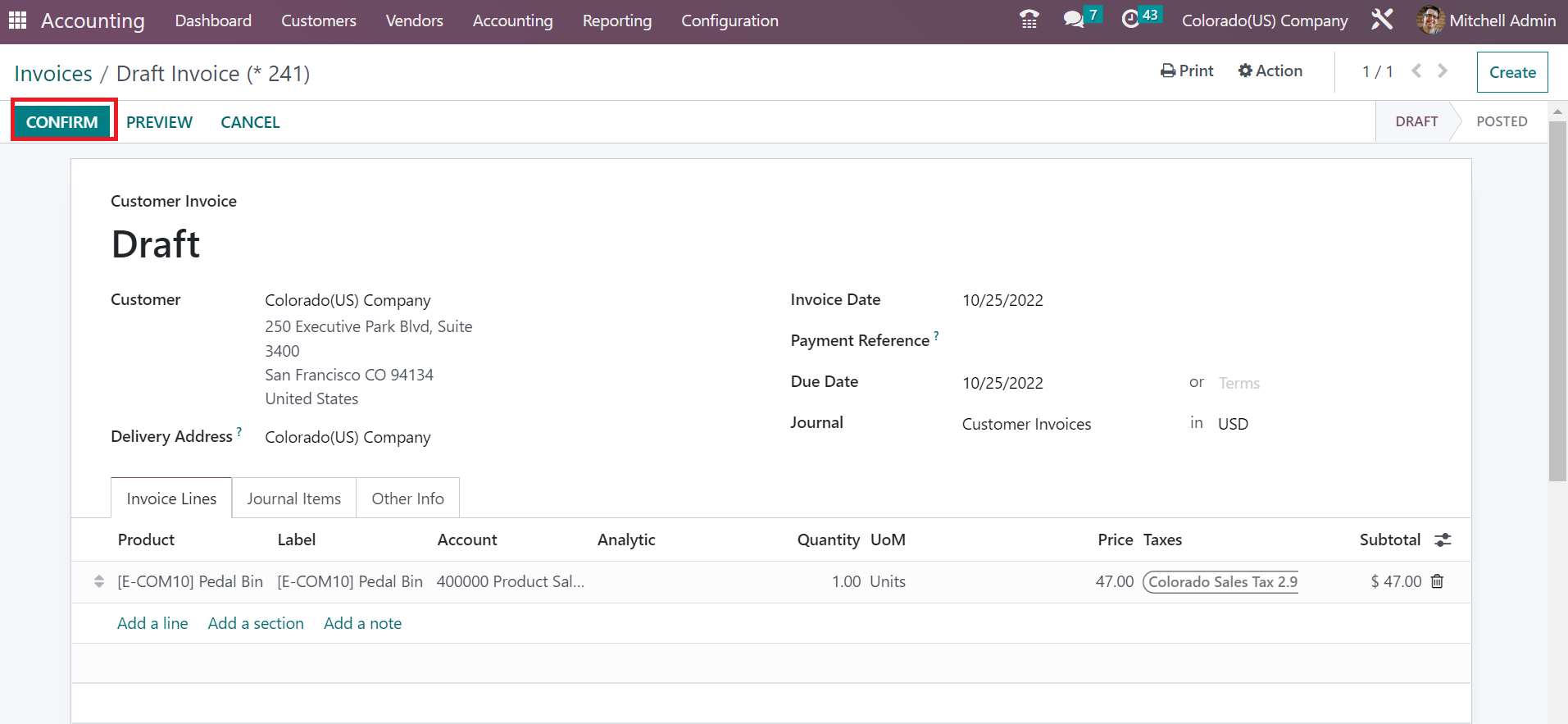

Here, you can see Total Amount is based on the sum of the Untaxed Amount and Taxes for the product pedal bin. Next, we can validate the invoice by selecting the CONFIRM icon in the Invoices window.

So, the invoice is posted for the customer after the confirmation. Users can quickly formulate a customer invoice based on the specific sales tax of a state.

Paying sales tax for companies doing business in Colorado state is vital. Also, several municipalities need local registration to collect sales tax. Odoo 16 Accounting module assists you in configuring sales tax rates in Colorado(US) efficiently. A business owned in Colorado can achieve profit by calculating the sales tax by running an ERP software.