Laws and regulations issues must be taken into account when running a company on a global scale. An organization should be able to modify its processes across regional borders and at the same time allow its subsidiaries or branches to change business processes on the basis of the particular laws and legal guidelines of the area where they belong. Here comes the importance of localization.

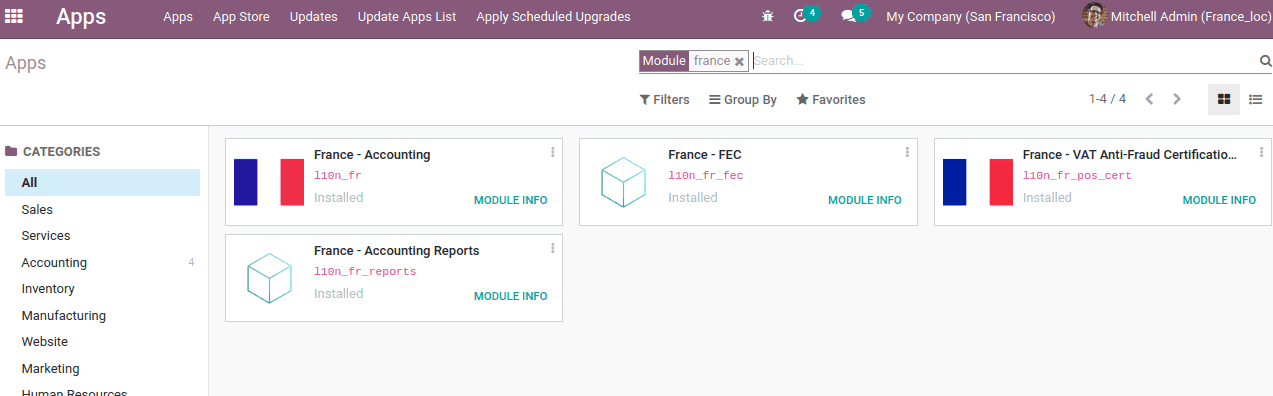

As seen in other localisations, France accounting package has some group of modules that work along with an accounting base module to provide the localization specific reports along with the basic accounting features.

Install the ‘France accounting’ from Odoo apps. If you have already chosen the country as France at the time of database creation, France’s accounting package will be automatically installed and hence the chart of accounts, tax, and other accounting features related to the localization.

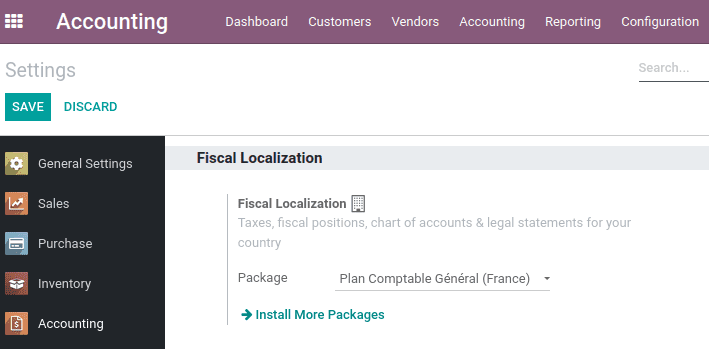

On installing the France accounting package, the package can be viewed in accounting configuration settings, under the fiscal localization.

One can choose the localization package from here (if multiple localization installed) before making an accounting entry.

This package includes the following submodule:

l10n_fr: This module applies to companies based on the French mainland.

This localization module creates the VAT taxes of type ‘tax included’ for purchases

l10n_fr_fec: This module provides an FEC report specific to localization

l10n_fr_pos_cert: This add-on brings the technical requirements of the French regulation CGI art. 286, which stipulates certain criteria concerning the inalterability, security, storage, and archiving of data related to sales to private individuals (B2C). We recommend you install this module if you are using POS.

l10n_fr_reports: Provides accounting reports for France.

Localization Reports

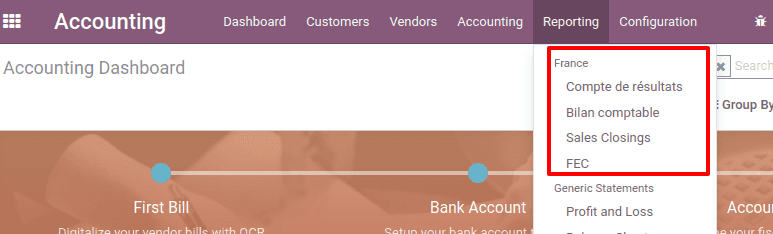

This localization provides us with some France accounting specific reports. One can view the report from Accounting Module> Reporting> France

Reports include:

a. Compte de résultats (Income statement)

b. Bilan comptable (Balance sheet)

c. Sales closings

d. FEC (Accounting Entries File)

FEC report

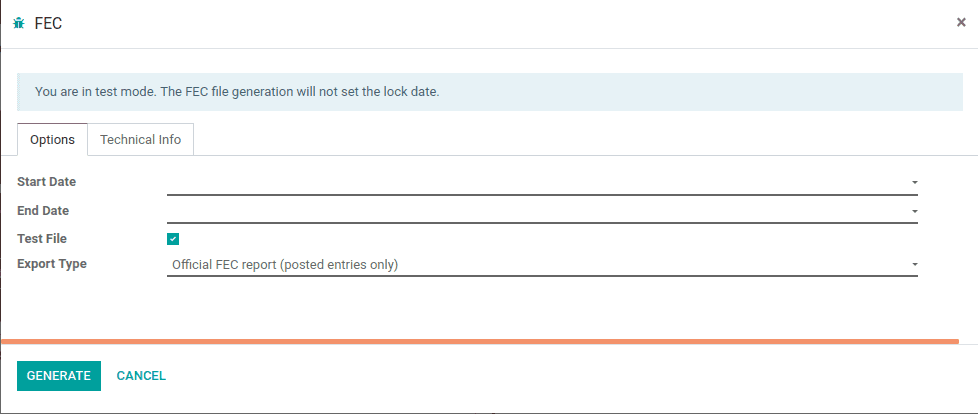

FEC is one of the localization specific reports. Its purpose is to put together all the accounting data and all the entries that are recorded during the fiscal year. The FEC report will be available in the reporting menu of the accounting module, only if the module ‘France-FEC’ (l10n_fr_fec) is installed. So make sure whether this module is installed at the time of installing the localization package. If not, one can manually do it from Odoo apps.

The new tax legislation has modified the criteria of the French tax audit procedure. At the beginning of every tax audit, one “FEC” file must be given to the tax auditor.

This rule points out the responsibility for businesses with computerized accounts to be able to provide the tax authorities with a file containing all the accounting entries for the year.

The format of this file, called FEC, is specified in the rule. This module implements the FEC file in text format, not in XML format. Hence, the text format is easily readable and verifiable by the accountant using a spreadsheet.

GoTo Accounting Module> Reporting> France> FEC

Usually, FEC reports are taken at the end of the fiscal period. The fiscal period can be set from the accounting configuration settings or from the accounting dashboard (This has to be configured at the beginning of setup). Here, we can add the start date and end date. For test file generation one can enable the Test file option. It is also possible to choose the export type from the dropdown. It will help us to decide whether we want an FEC report of posted entries or unposted entries. This will also help to generate the report based on the selection.

VAT anti-fraud certification with Odoo

Since 1st JAN 2018, a new anti-fraud system came into effect in France and other DOM-TOM. This new law sets out certain requirements for the inalterability, security, storage and archiving of sales data. These legal specifications are included in Odoo from V9, through a module and a certificate of compliance with standards to be downloaded.

Your organization is recommended to use anti-fraud cash register software such as Odoo as per CGI Art.286 if,

– Company is taxable in France or any DOM-TOM

– Clients are private people (B2C)

How to get certified with Odoo

The company has to request the tax administration to include a certificate of compliance attesting that the software agrees with the anti-fraud legislation. This certificate is given to Odoo Enterprise users by Odoo SA. For community users, the version should upgrade to enterprise or should contact the service provider. In case of dissent, the company is liable to pay a fine of € 7,500

Steps to get certification:

– Install the anti-fraud module from Odoo apps

– Install the submodule l10n_fr_pos_cert if you are using point of sale. This module provides anti fraud certification for France-VAT (as per 286 CGI)

– Country for your company is mandatory. So ensure that the country is set for your company from Setting -> Users & Companies -> Company and select country.

– Download the required certificate of conformity provided by Odoo SA

Anti-fraud features

Anti-fraud features include inalterability, security, and storage.

1. Inalterability

This will disable all methods of canceling or altering key data of POS orders, invoices, and journal entries for companies whose country is in France or any DOM-TOM. For a multi-company environment, documents of those companies only get affected.

2. Security

The journal entries are encrypted on validation to ensure inalterability. The hash number generated is dependent on the document and the previous documents as well.

If any data is changed on a document after it is validated, the test will fail. Then the algorithm recomputes all the hashes and compares them to the original hashes and the system finds the first altered document captured in the system on failure.

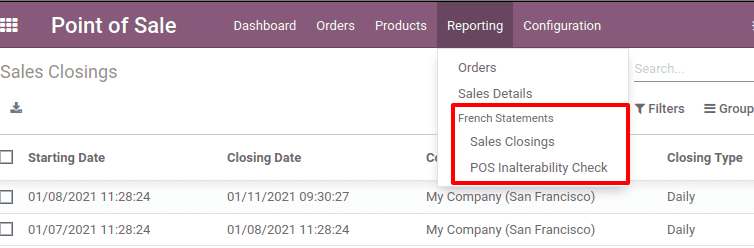

In POS under the reporting menu, french statements are available.

3. Storage

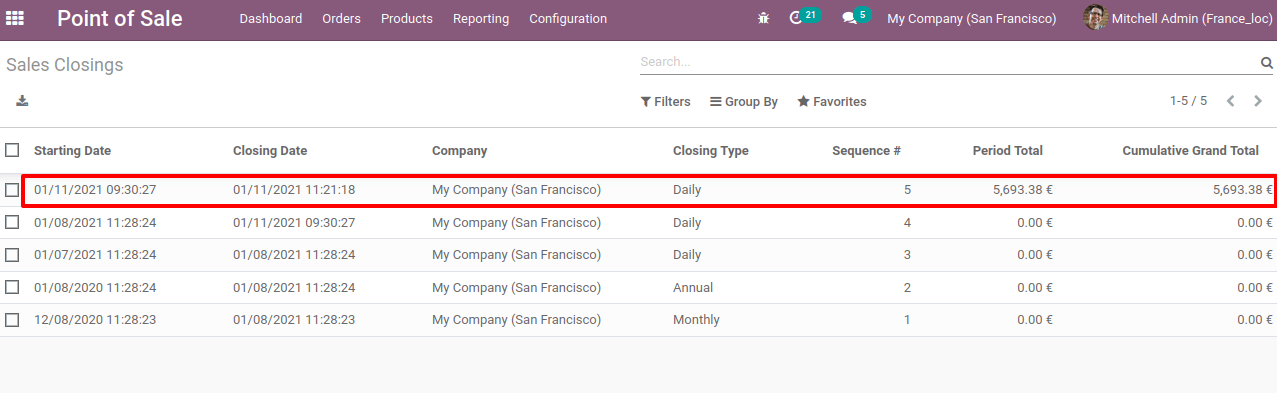

Sales closing can be done automatically by the system on a daily, monthly, or annual basis. Reports can also be taken from Reporting -> Sales closings.

This report on sales closings accurately details the closing date, closing type, the actual sales revenue of the time, and cumulative grand total (Total from the beginning).

The closings can also be generated manually for testing. To activate developer mode and then go to Settings> Technical> Automation> Scheduled Actions, from there one can run manually.