The Fiscal Localization Packages that Odoo offers will benefit your company by ensuring advanced performance based on a specific region of operations. These are country-specific modules that encompass pre-configured taxes, chart of accounts, fiscal positions, legal statements, and several additional features which are necessary for the smooth functioning of the ERP in the selected county. The user can install a specific localization module to their database, which will bring necessary changes in operations by following the fiscal administration demands of the company. Based on the country you selected at the time of the creation of the database, the appropriate package for your company will be automatically installed.

Now let’s see how Austria localization works in Odoo 15.

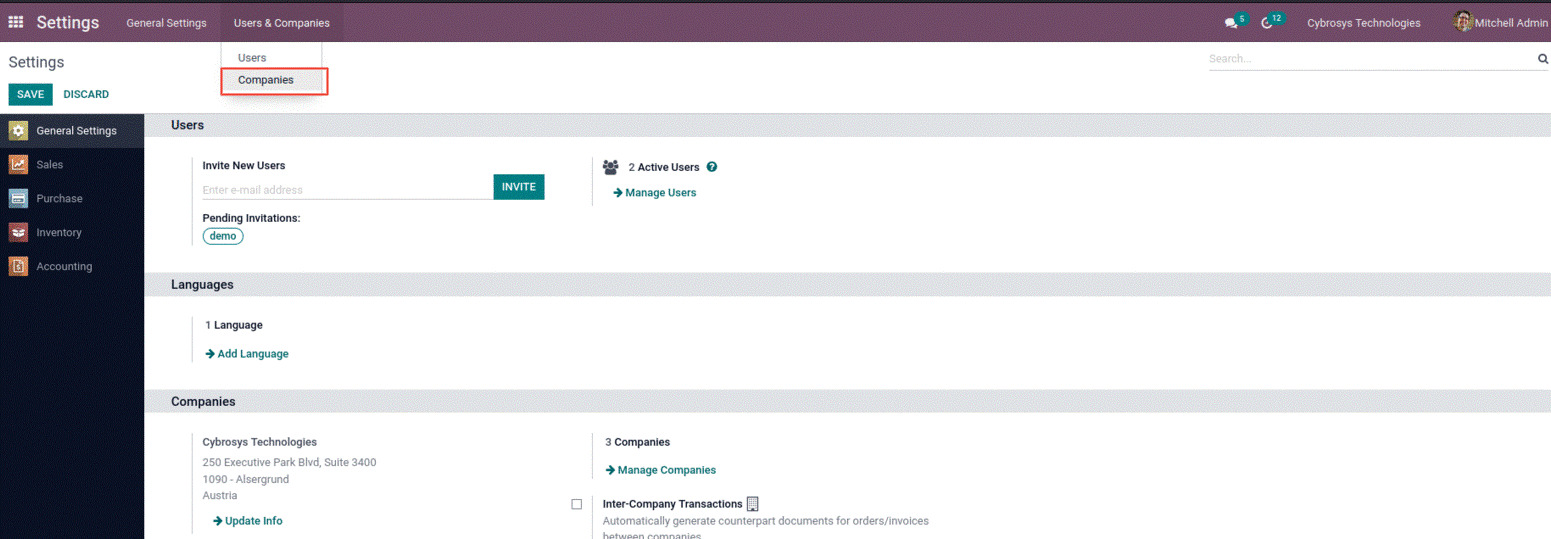

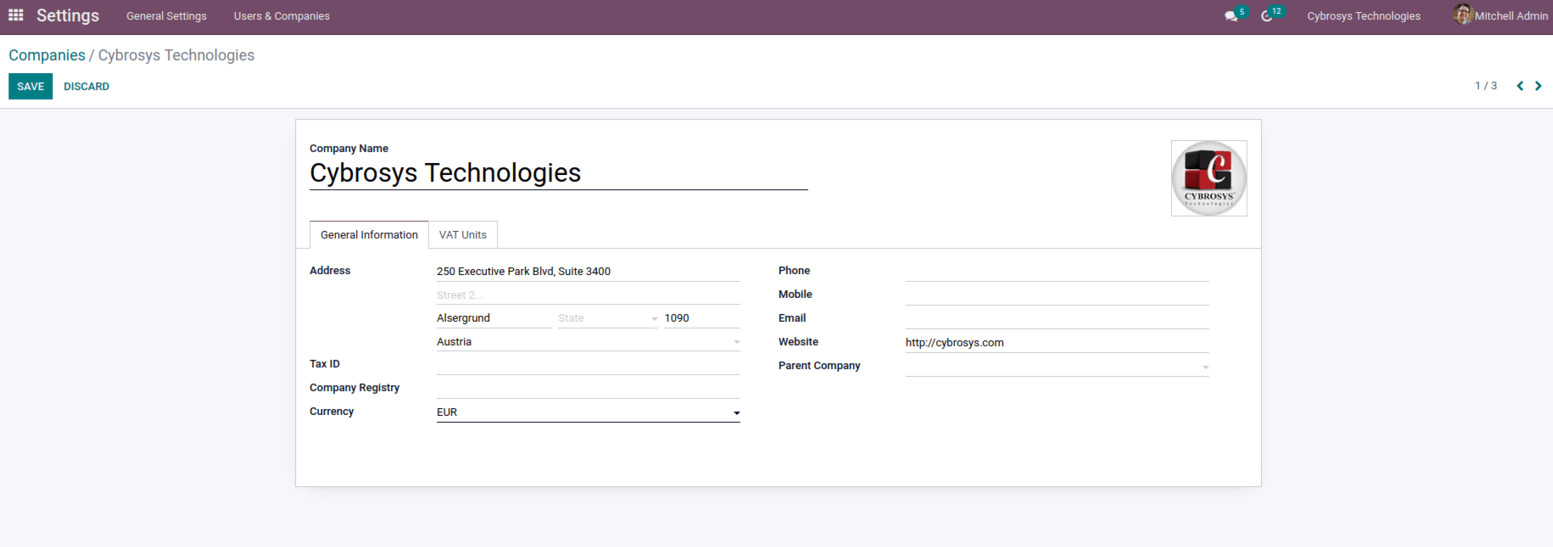

For every user to work with Odoo, the first and foremost thing is to set up the company and company details. In Odoo, the user can set up the company from the General settings of Odoo. The user can find the option to configure the company under the Users and Companies menu.

Odoo Company form includes information Address of the company, Tax id, Company registry, Currency, Mobile number, website, Email, and other details.

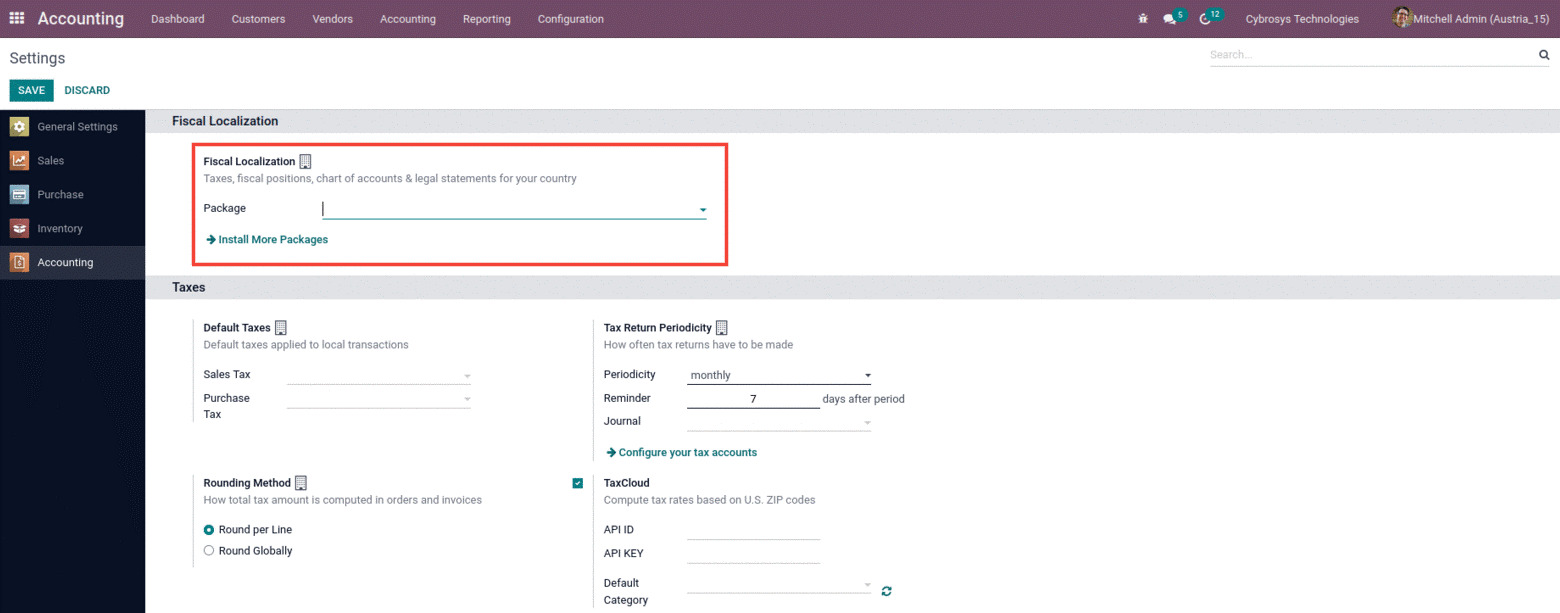

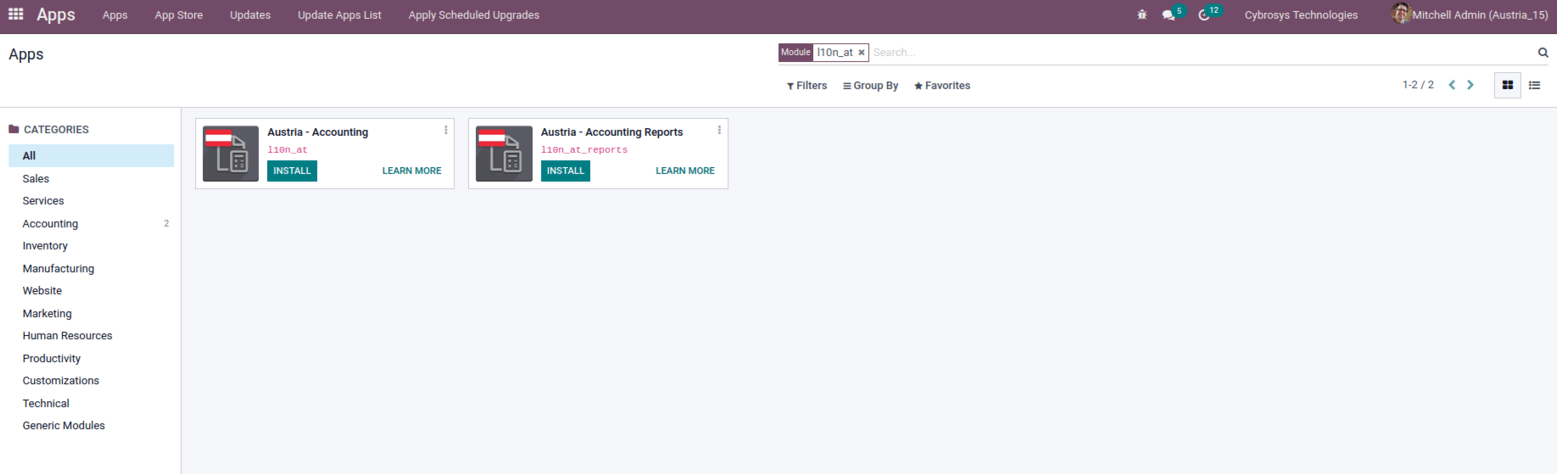

Once the company is for corresponding localization, the next is to set up the chart of accounts for corresponding localization. To set up a Chart of Accounts for a definite localization, the user needs to install the corresponding accounting from the Odoo Apps store or select the localization package in the Fiscal Localization option under the accounting settings.

Austria localization includes two modules, ie. Austria Accounting (l10n_at) and Austria Accounting Report (l10n_at_reports).

Austria Accounting (l10n_at) module:

a) Defines the following chart of account templates

b) Defines templates for VAT on sales and purchases

c) Defines tax templates

d) Defines fiscal positions for Austrian fiscal legislation

e) Defines tax reports U1/U30

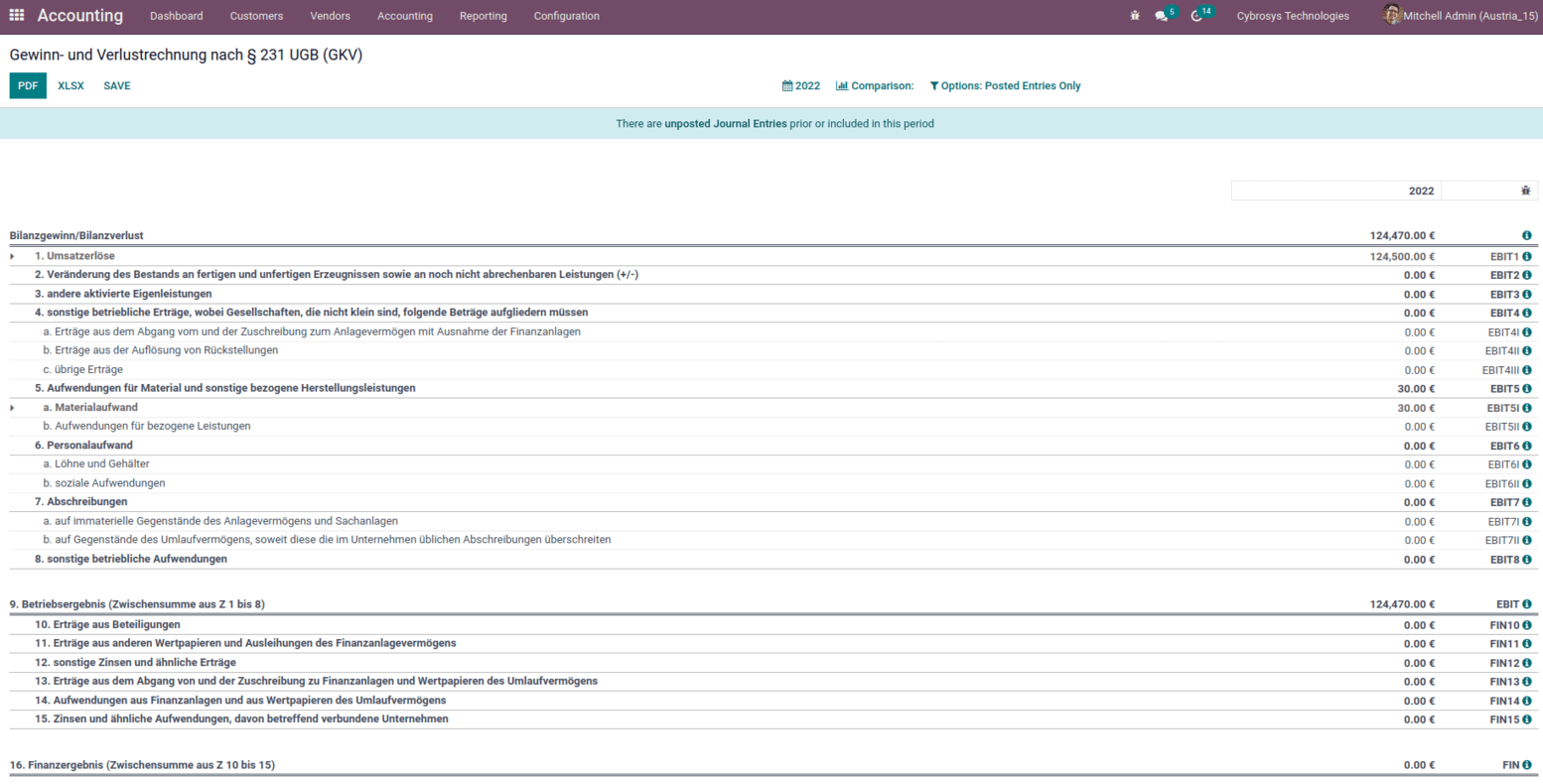

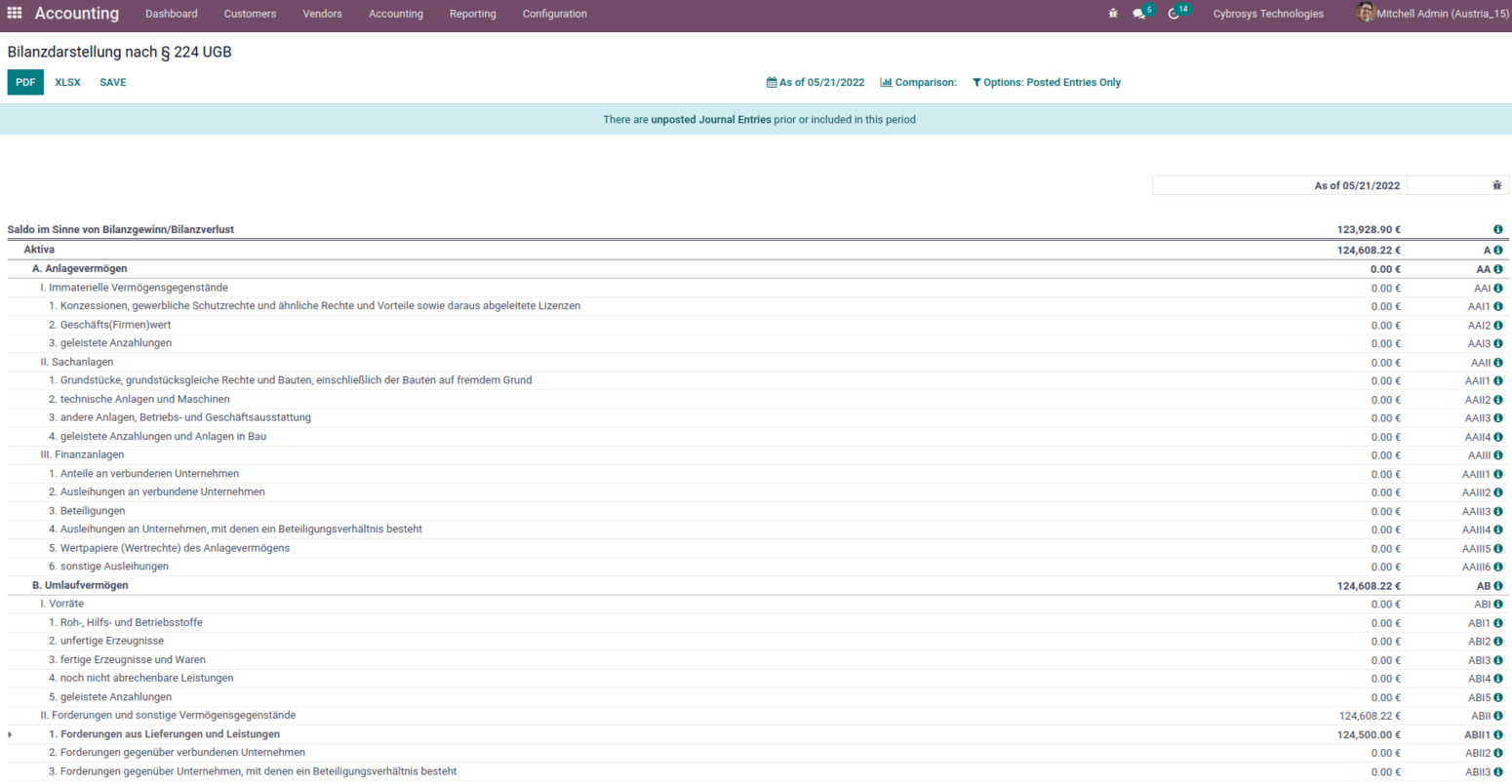

Austria Accounting Report (l10n_at_reports)

a) Defines the following reports:

b) Profit/Loss (§ 231 UGB Gesamtkostenverfahren)

c) Balance Sheet (§ 224 UGB)

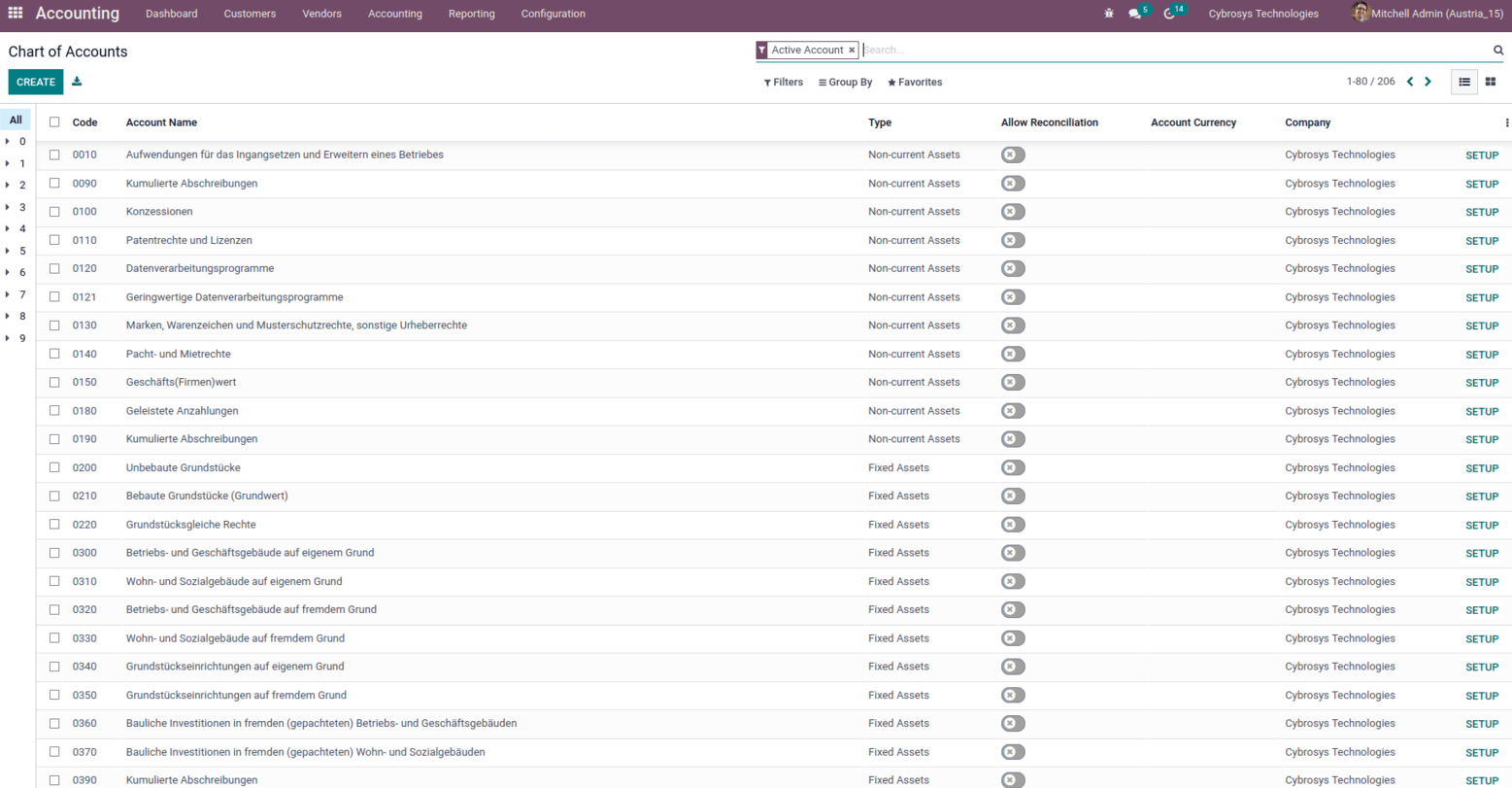

After installing the Austria localization package, the user can view changes in certain areas. With Austria localization, the chart of accounts of the corresponding country is installed, and to view the chart of accounts go to Accounting > Configuration > Chart of accounts, as shown below.

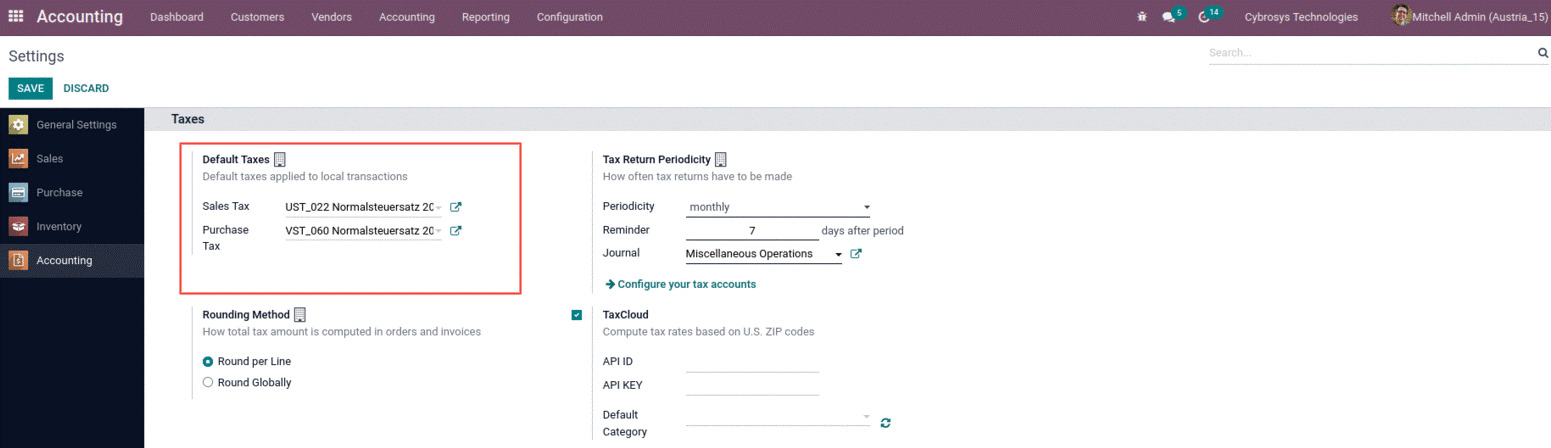

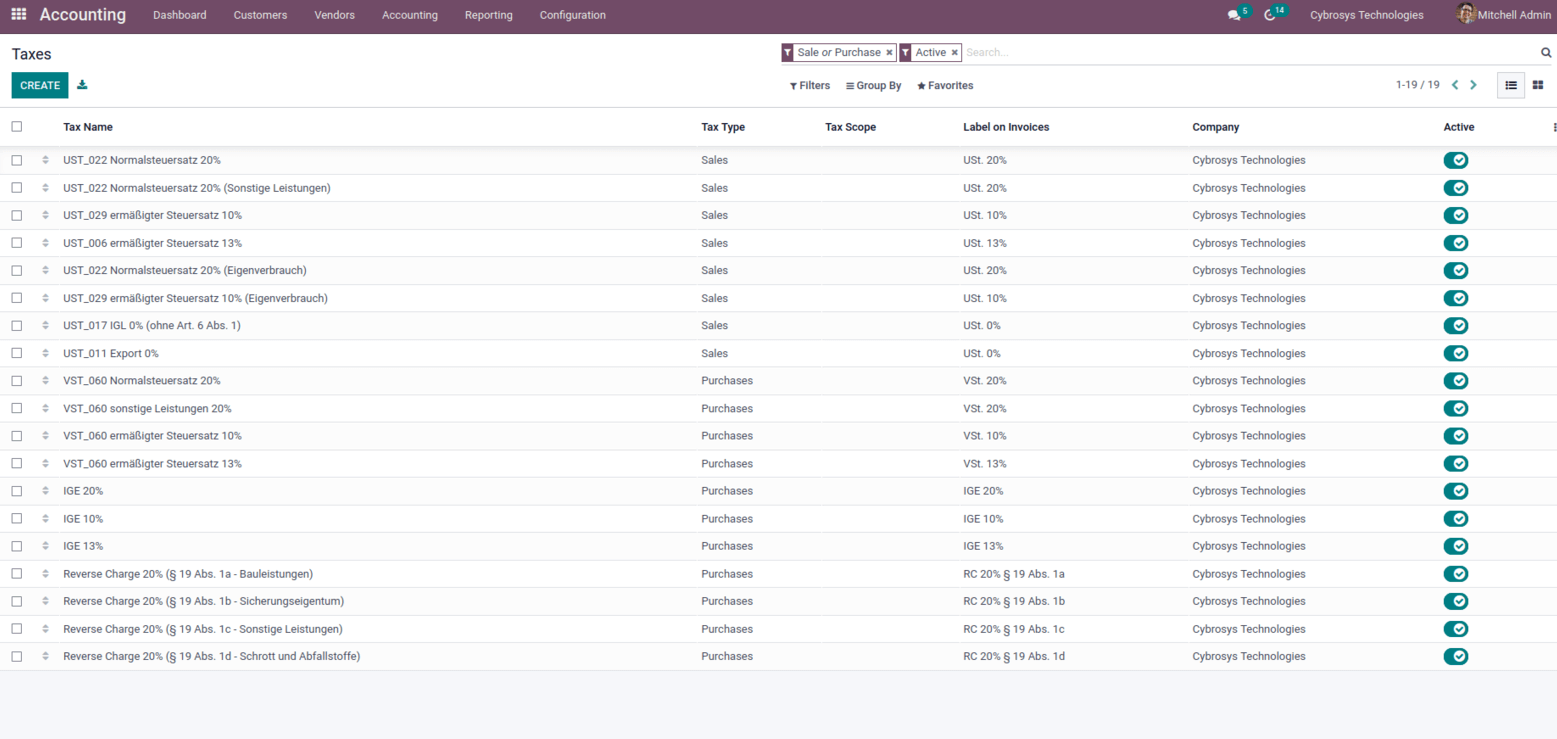

Along with the Chart of accounts, upon installation of Austria localization the default taxes ie, the sales tax, and purchase taxes are automatically installed with the installation of Austria localization as shown below.

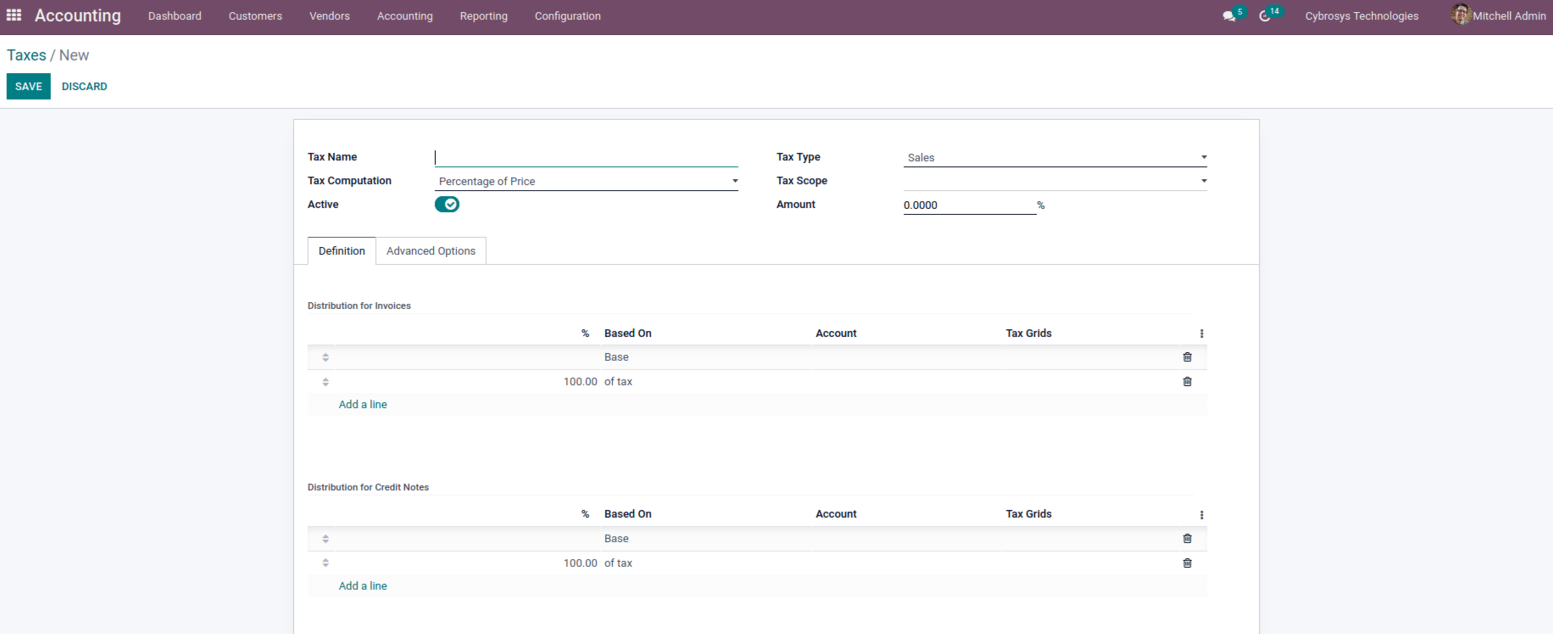

Along with it, if the user needs to create a new set of taxes, then can create it from the Accounting module under the Configuration menu.

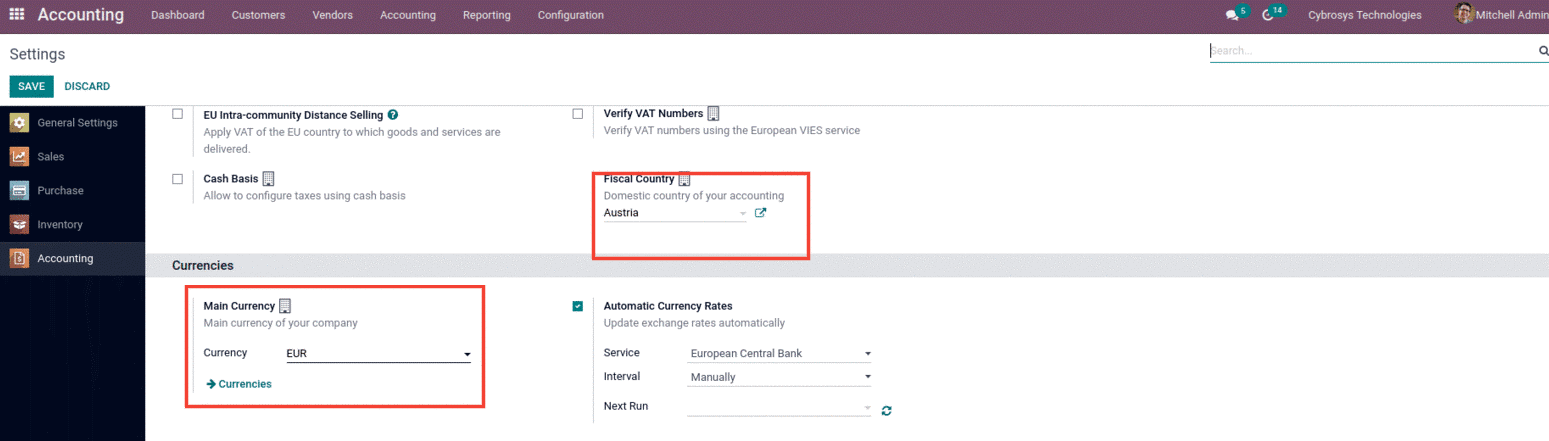

With the installation of Austria localization, the currency and the fiscal country are also automatically set.