Financial balance is regarded as the backbone of an organization. When a firm deals with sales or purchases, practical accounting is required. As a result, customers can make a variety of payments. Customers can pay the billed amount in cash or via bank transfer. Dealing with cheques is not as simple as dealing with other forms of payment. If the consumer sends a cheque, the payment is only applied to our company’s account on the cheque date. As a result, handling such inspections in accounting is a challenge.

The Odoo assists in the effective management of these operations. If a consumer writes a cheque to us for a future date, the cheque is referred to as a Post Dated cheque (PDC). Before the date indicated on the cheque, it can be cashed or deposited.

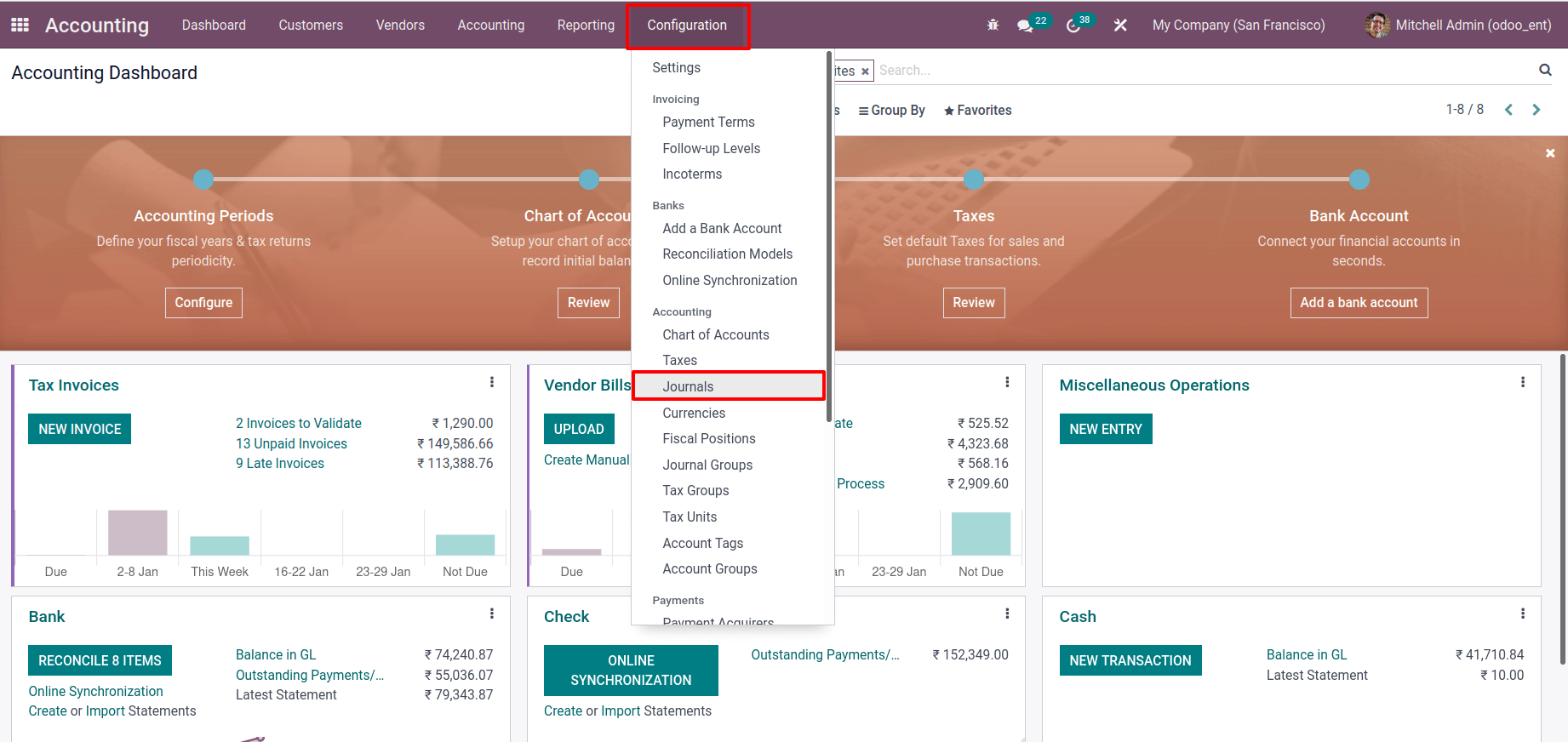

Let us look at how PDC can be handled in Odoo V15 using default features. For post-dated cheque transactions, we can build a new Journal. Go to the Configuration tab and select the Journal option to create a journal.

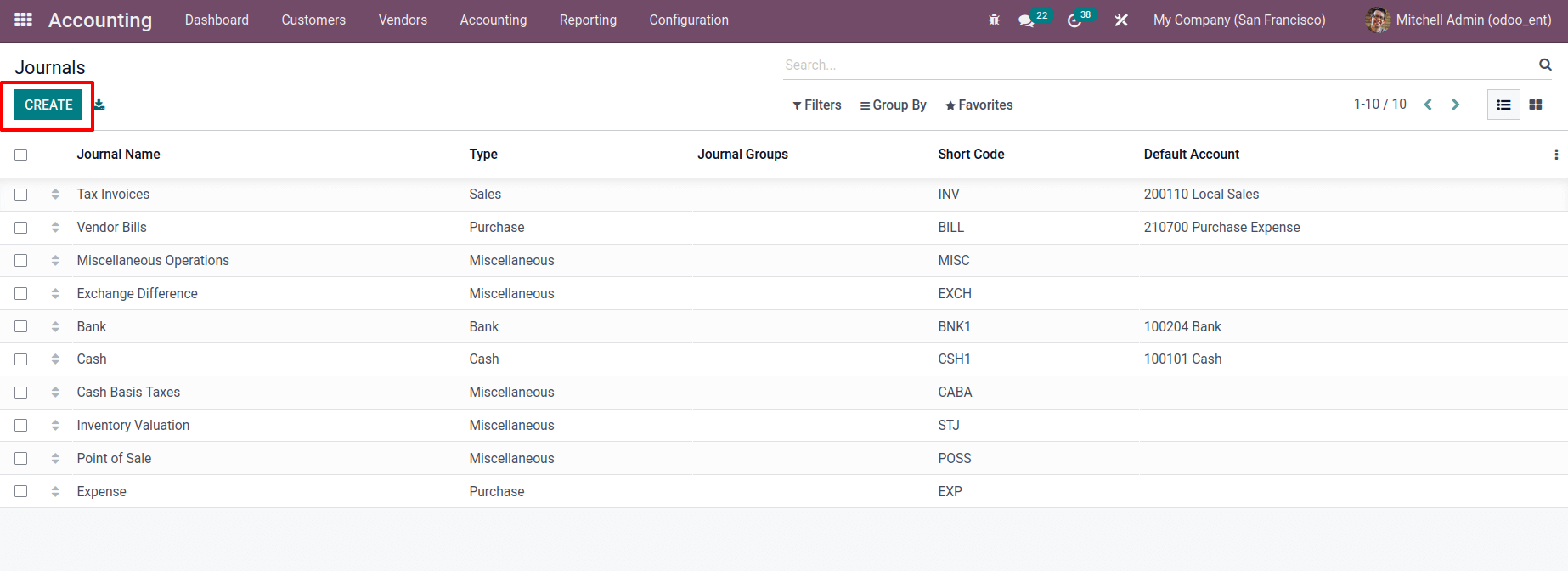

We may see the previously created journals and create a new one by clicking the

Create button.

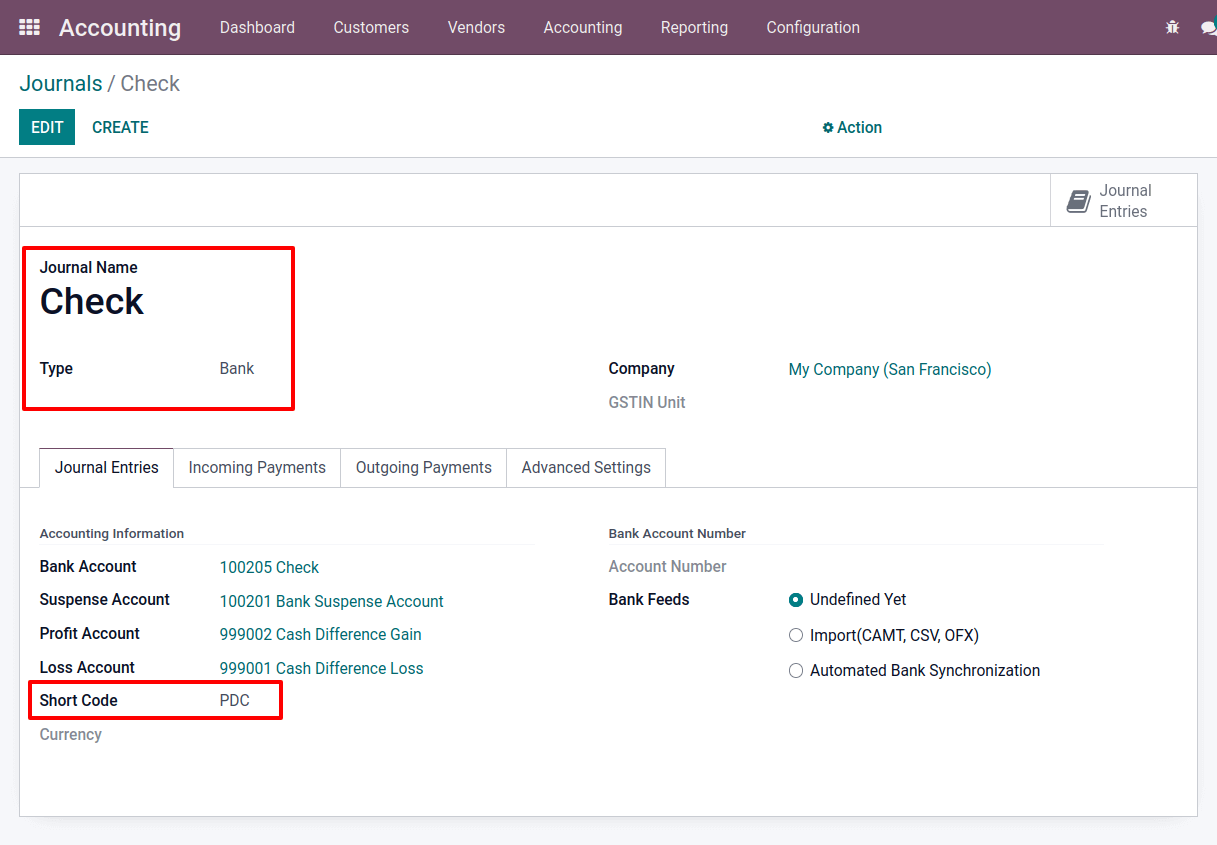

To create a new journal, enter the journal’s name, type, company, shortcode, and account information, among other things. The journal was given the name cheque and shortcode as PDC in this case.

There are different types of journals here, Sales, Purchase, Cash, Bank, Miscellaneous type.

The four categories are sales for customer invoice journals, purchase for vendor bill journals, cash, bank for customer or vendor payment journals, and miscellaneous operations journals.

This journal is used when a consumer pays his bill with a cheque; hence the type is set to the bank.

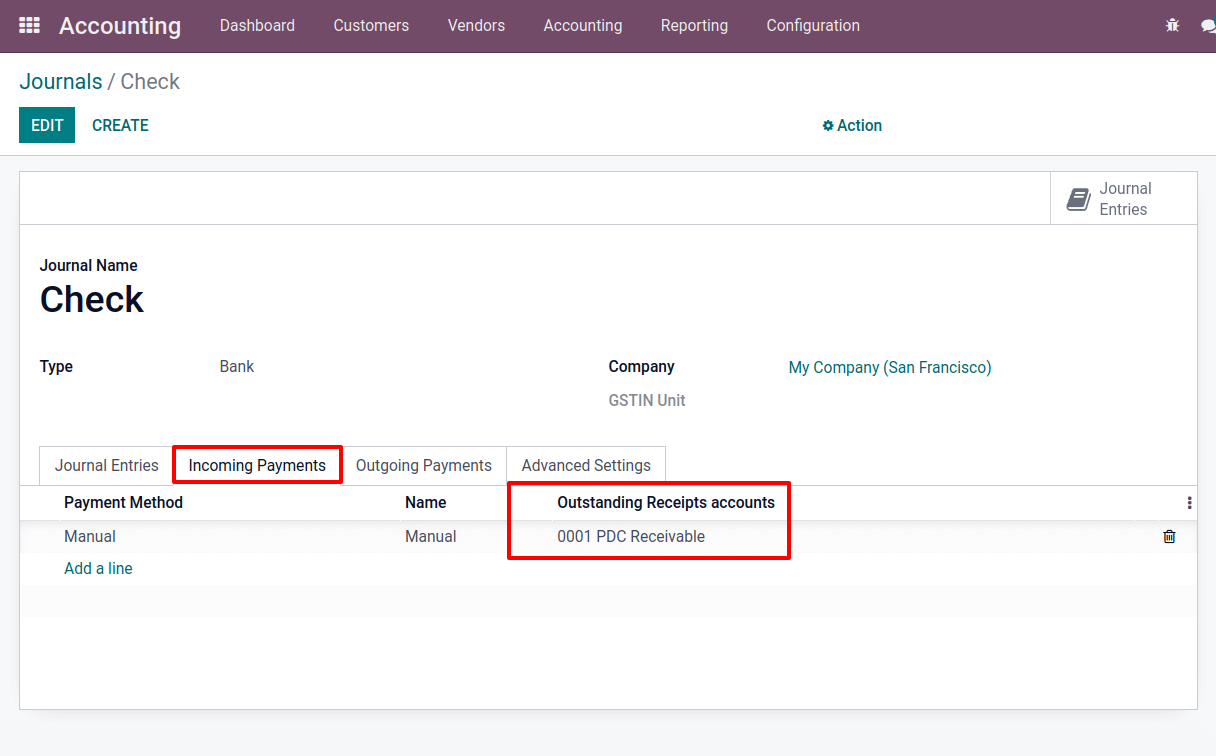

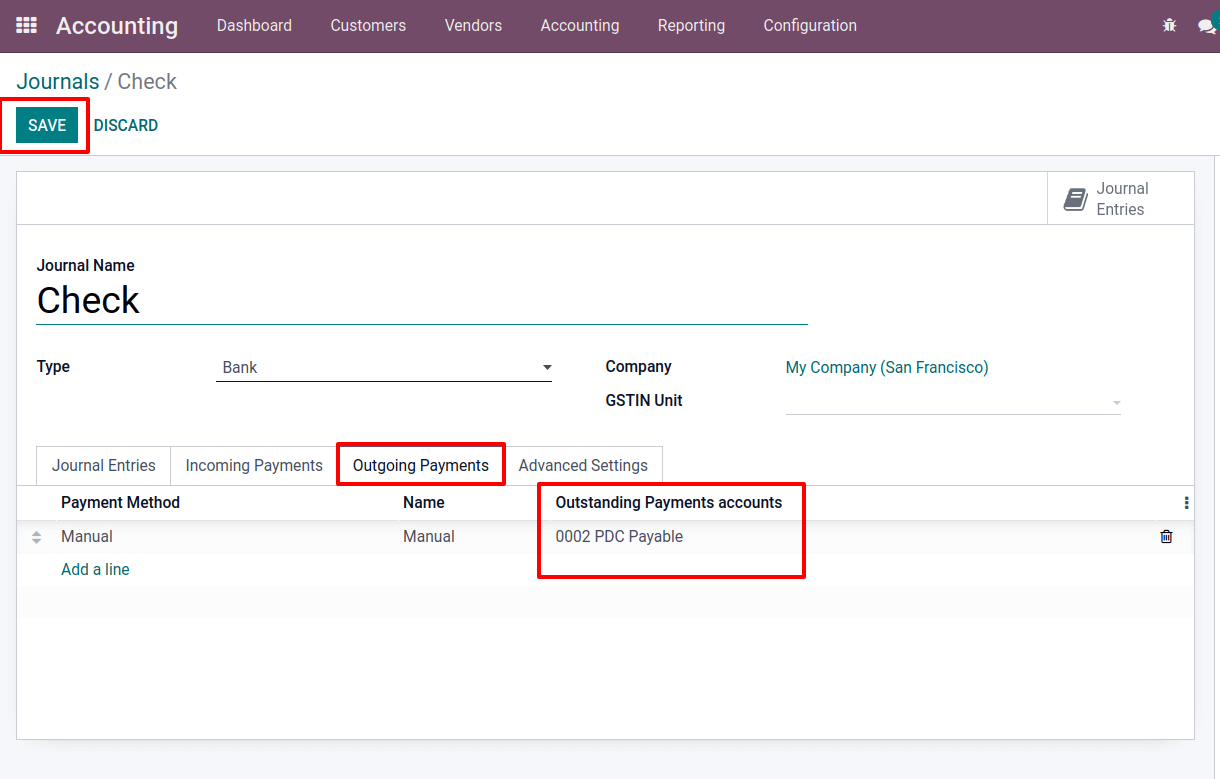

We need to mention the Payment Method and Outstanding Payment Accounts on the incoming and outgoing tabs. As Outstanding Payment Accounts, add 0001 PDC Receivable to the incoming payment tab and 0002 PDC Payable to the outgoing payment tab.

During processing, outstanding receipt accounts are used as temporary accounts.

It assists us in avoiding the possibility of directly involving the receivable account in the bank reconciliation process.

Incoming payment entries generated by invoices or cash will be sent to this account. Transactions will be reconciled with entries on the outstanding receipt account rather than the receivable account during the reconciliation process. Then save the page and the journal has now been created.

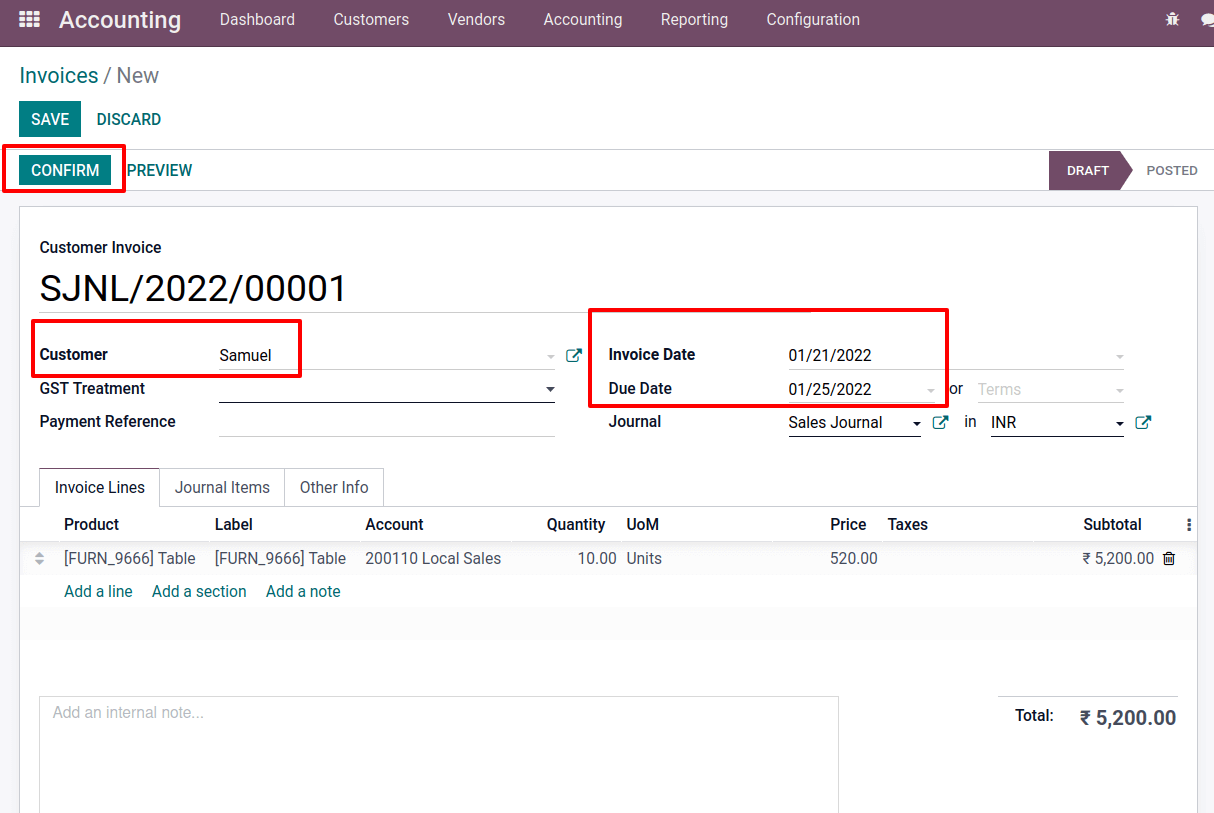

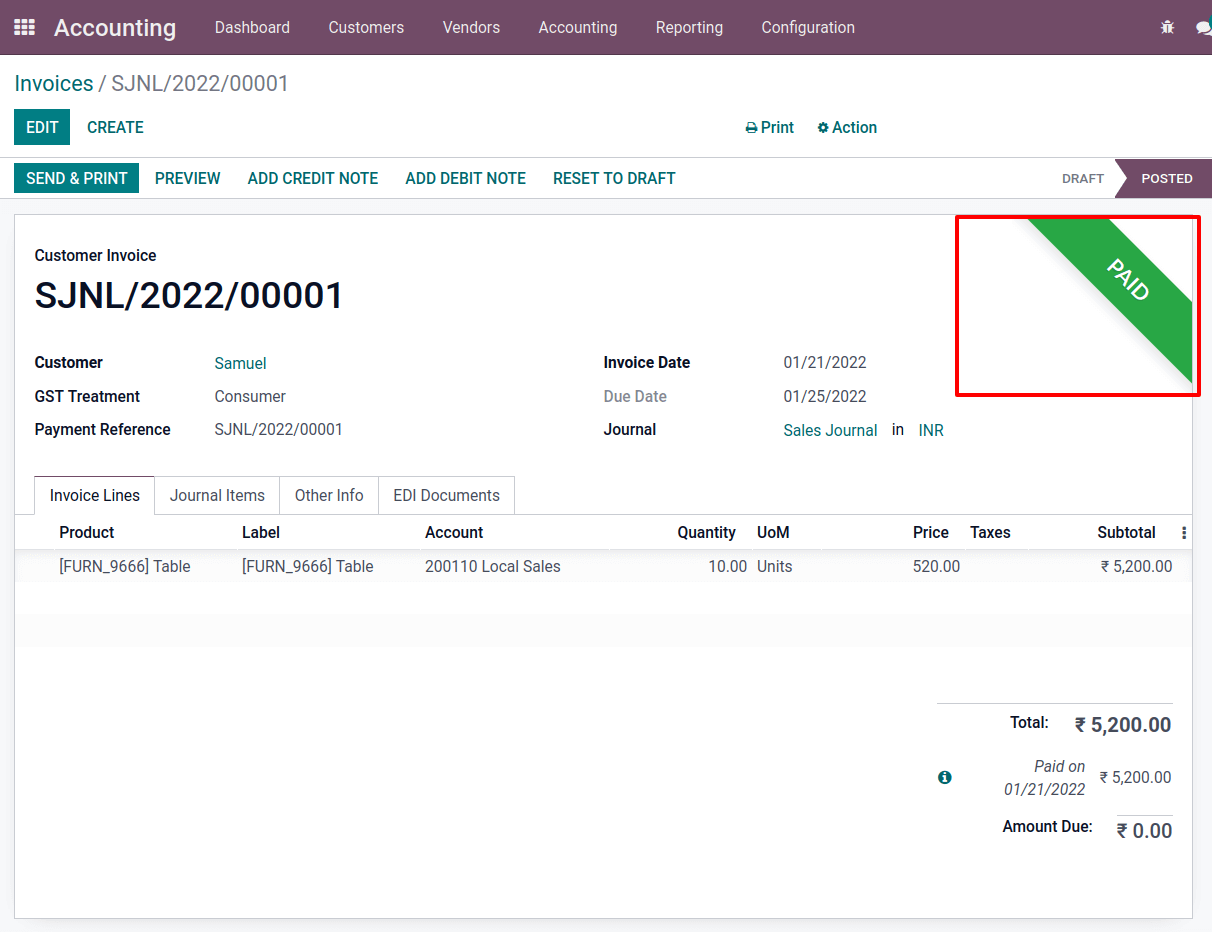

A customer named Samuel generated an invoice for $5200.After five days from the invoice date, the payment date was set. In the invoice line, enter the product, quantity, and price.

The invoice will then be confirmed.

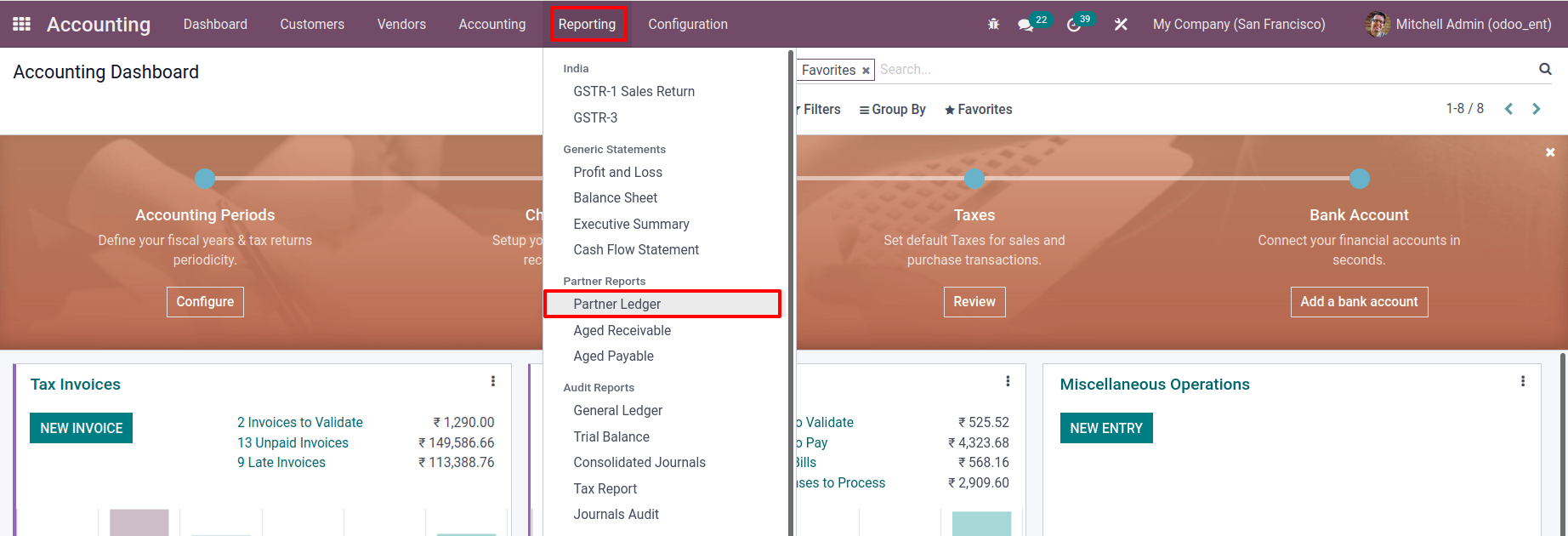

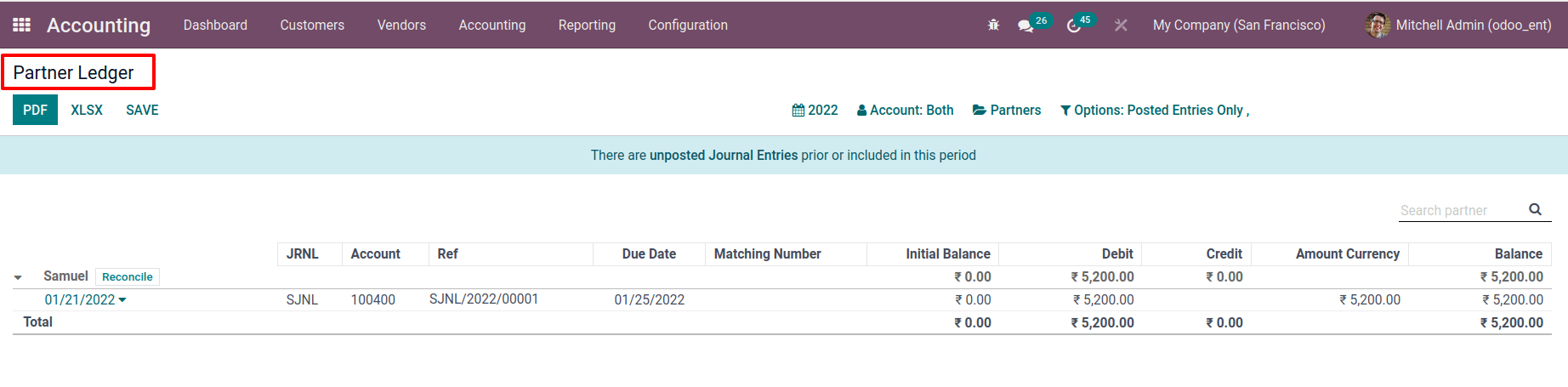

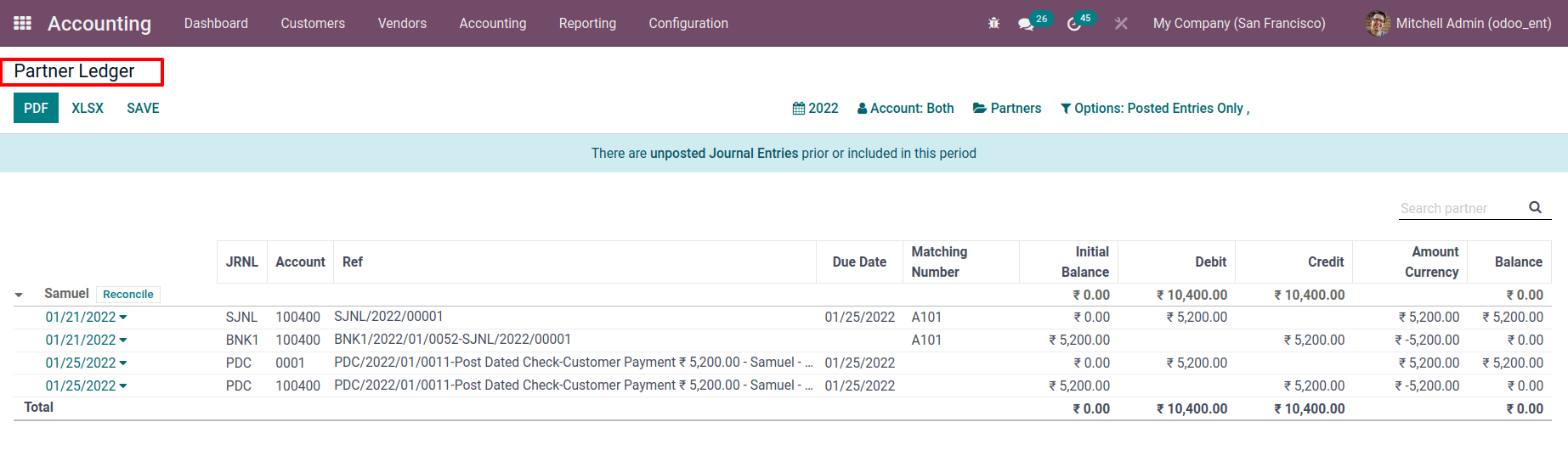

Let’s look at the transaction in the partner ledger. Select Partner Ledger from the reporting tab.

There, we can view our customer’s transactions.

The Initial Balance is zero, and an amount of $5200 is debited, the Balance at $5200, which means the customer has to pay an amount of $5200

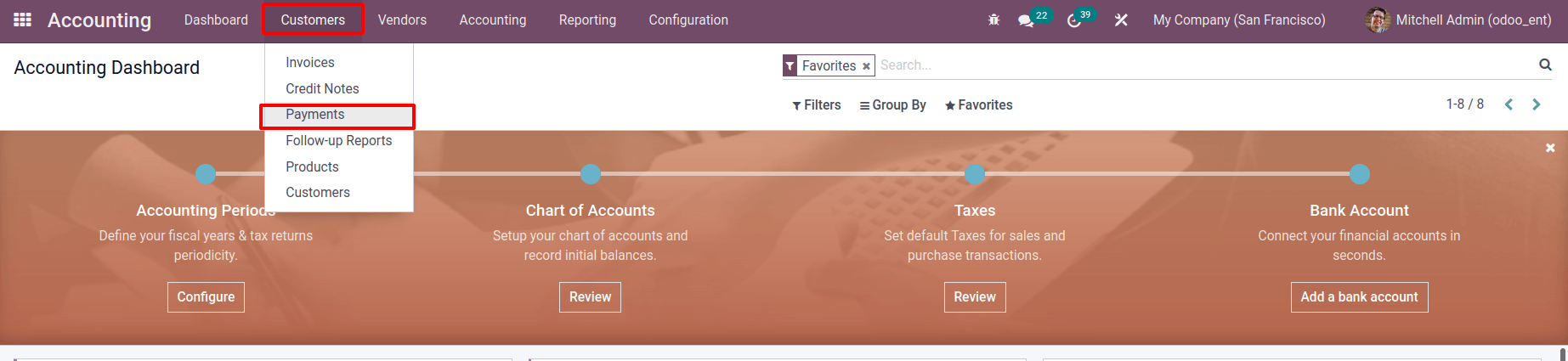

Then consider the customer had made a cheque payment. To do so, go to the customer tab and then to payments.

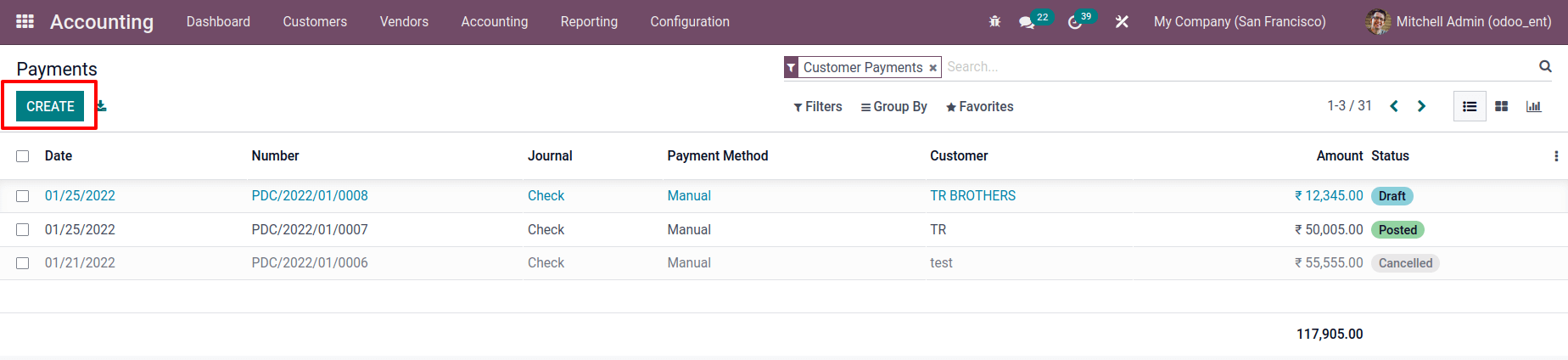

There, we can see all of the payments within different Statuses like Draft, Posted, Canceled that have been made. By clicking the create button, one may make a new payment.

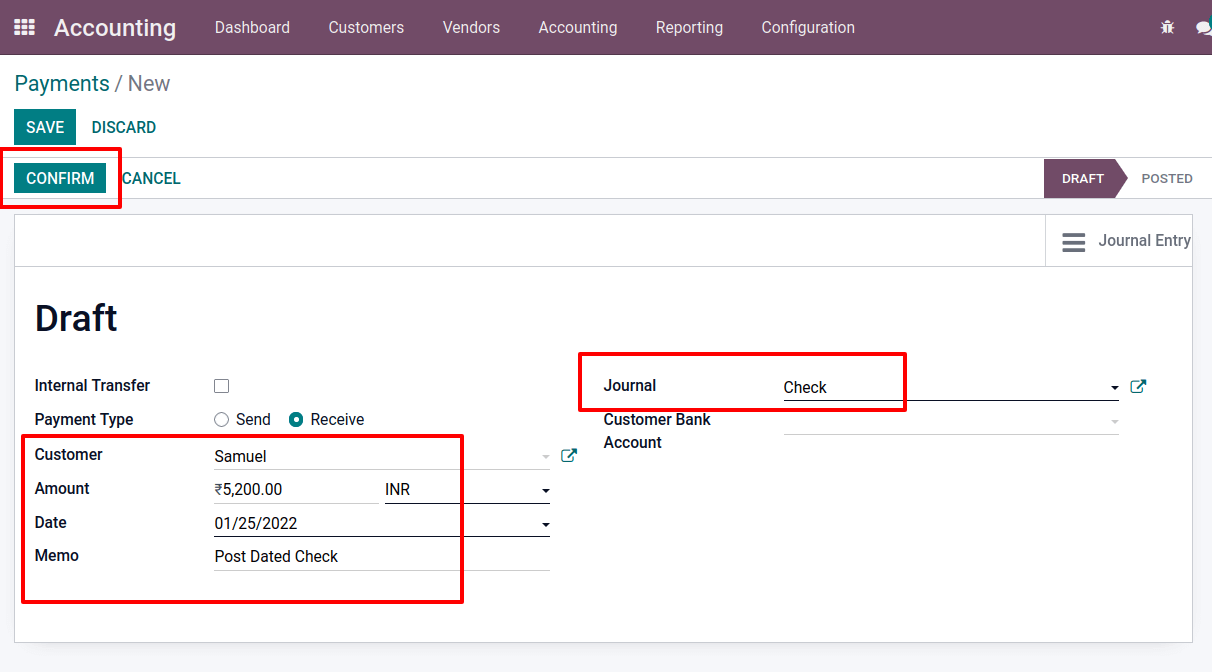

There, you can enter information such as the customer, payment amount, cheque date, etc.

Specify the method of payment, either send or receive. Change the journal to ‘cheque’ that we configured previously.

Because this is a post-dated cheque, the cheque date must be future. The payment is currently in the draft stage; add details, save, and confirm it. The payment then moves to the stage posted. There is a smart tab, Reconciled Entries, open it.

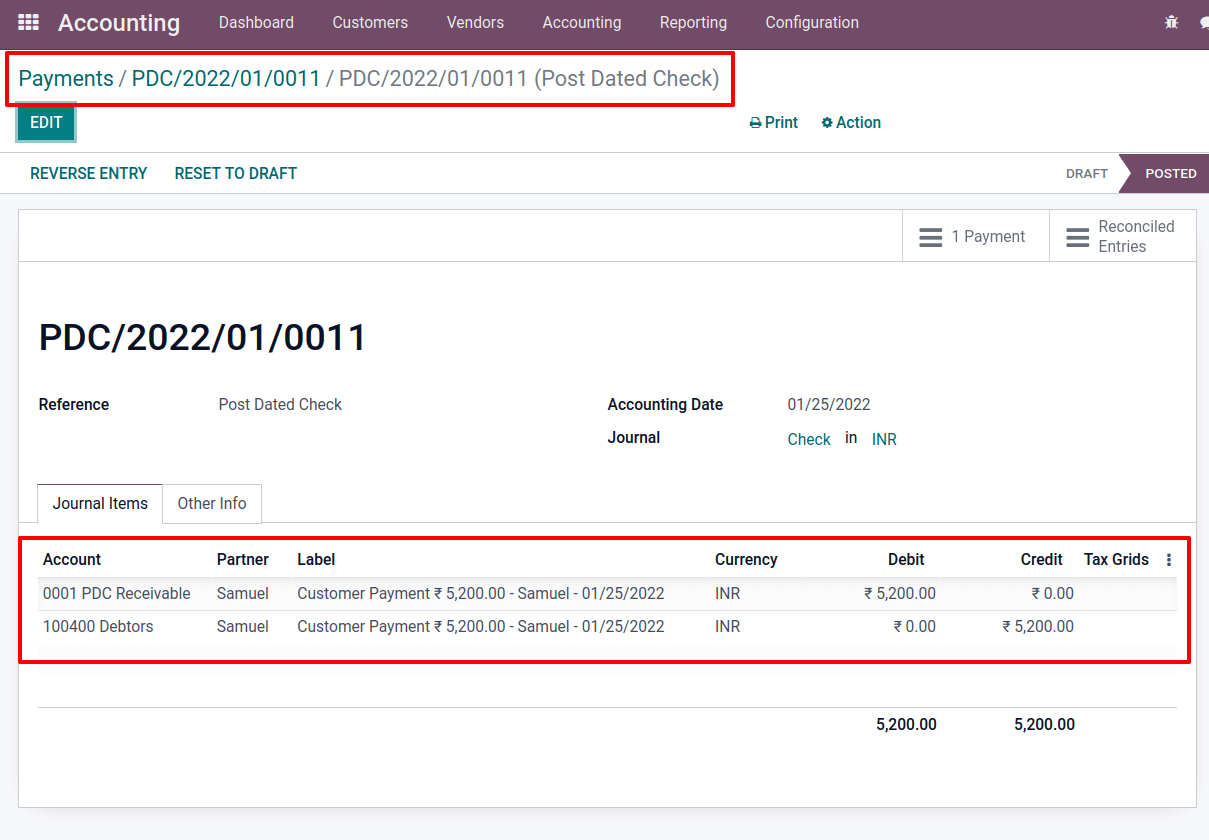

The amount is debited from the PDC Receivable Account and credited to the Debtors account, which is the Receivable Account.

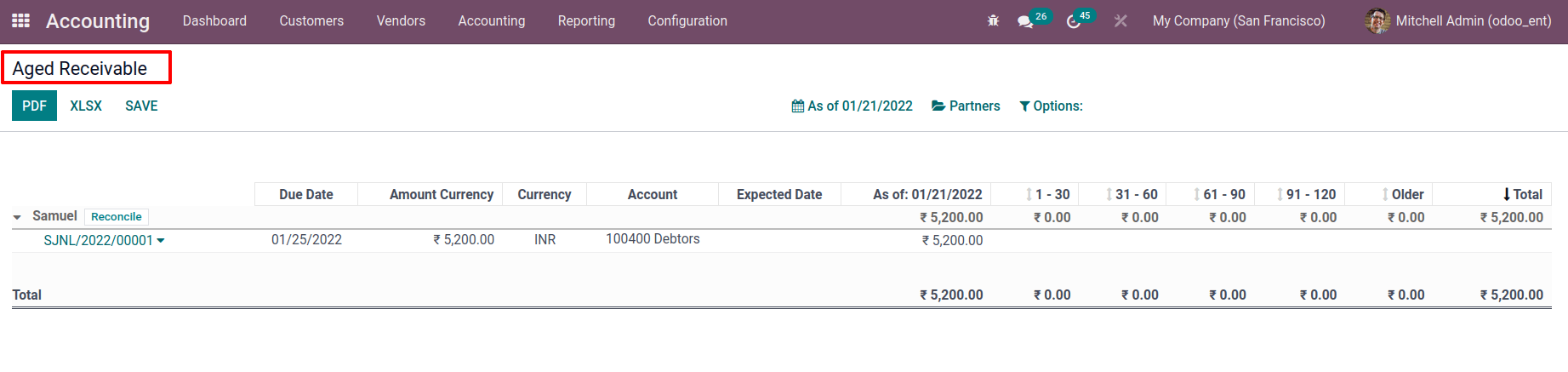

Take the Aged Receivables Report from the Report tab, and you’ll see an entry for the invoice just created. Since the bank entry has not yet been established.

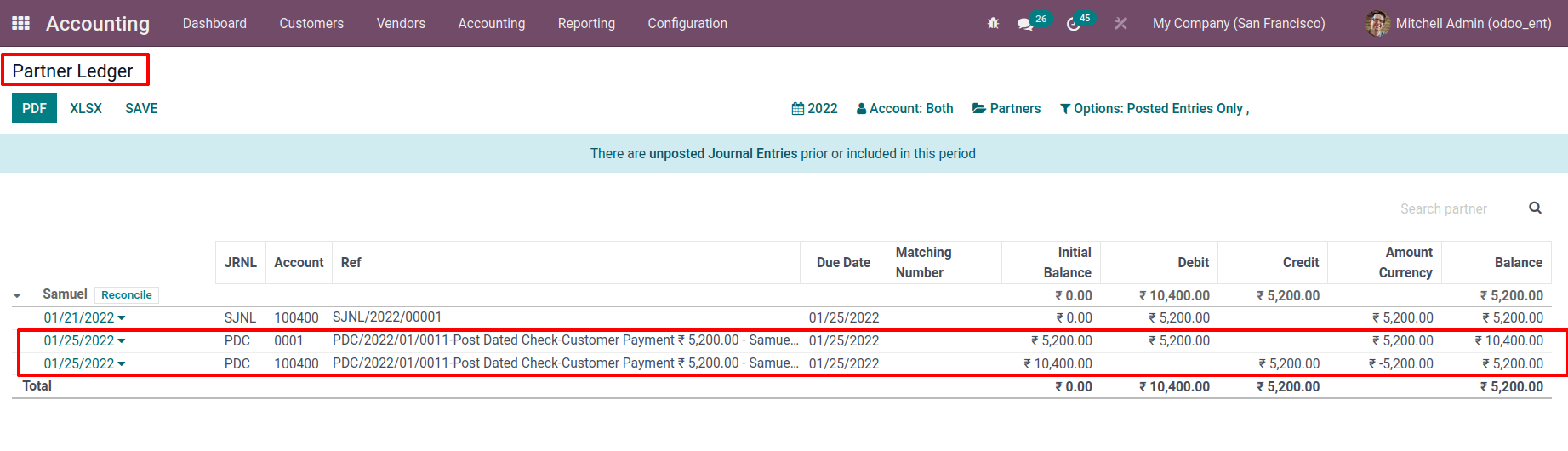

Because the company receives payment by cheque, which is not recognized in the bank, the cheque will be sent at a later date. However, the money has yet to be credited to the company’s account. Check the Partner ledger once more. Because of the payment, two entries have been inserted.

When examining the entries, one is 5200, and the other is -5200, indicating a negative value.

As a result, the net effect is zero.

The amount has been credited; however, in the transaction tab, since zero. It’s because our customer sent us a cheque, it is a post-dated cheque, and the funds have not been credited to our account.

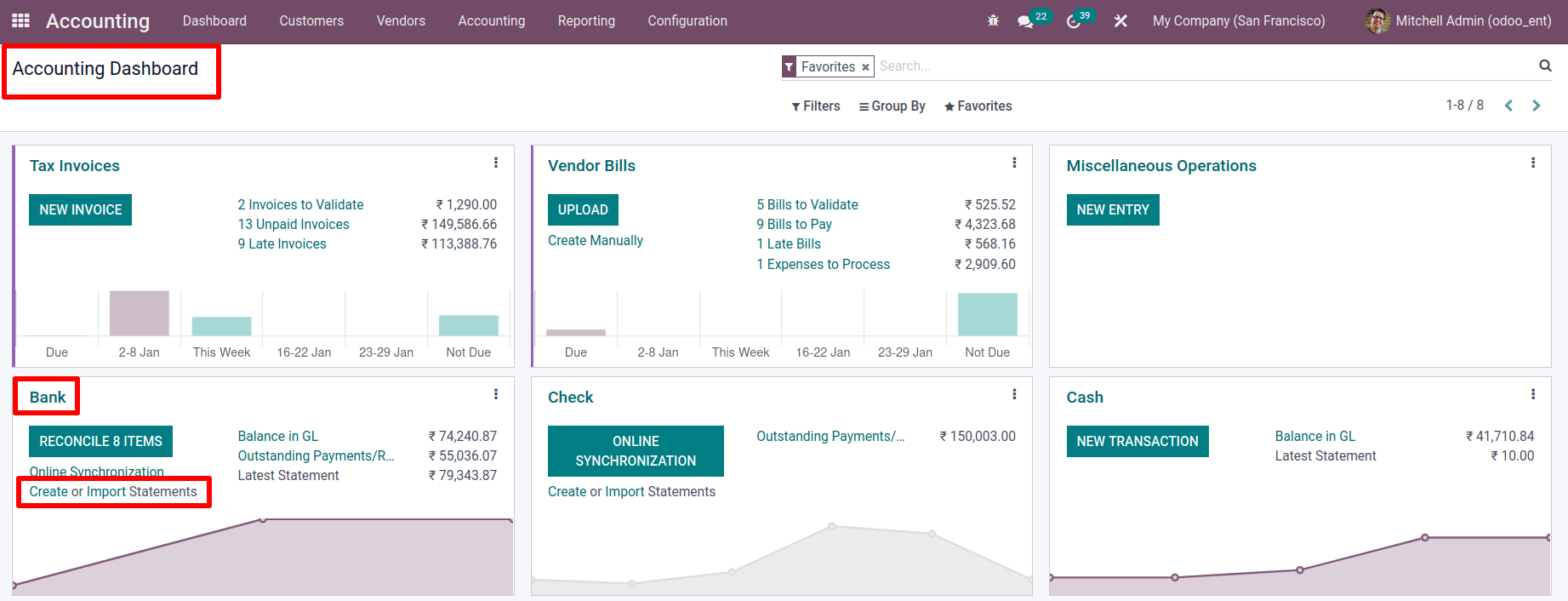

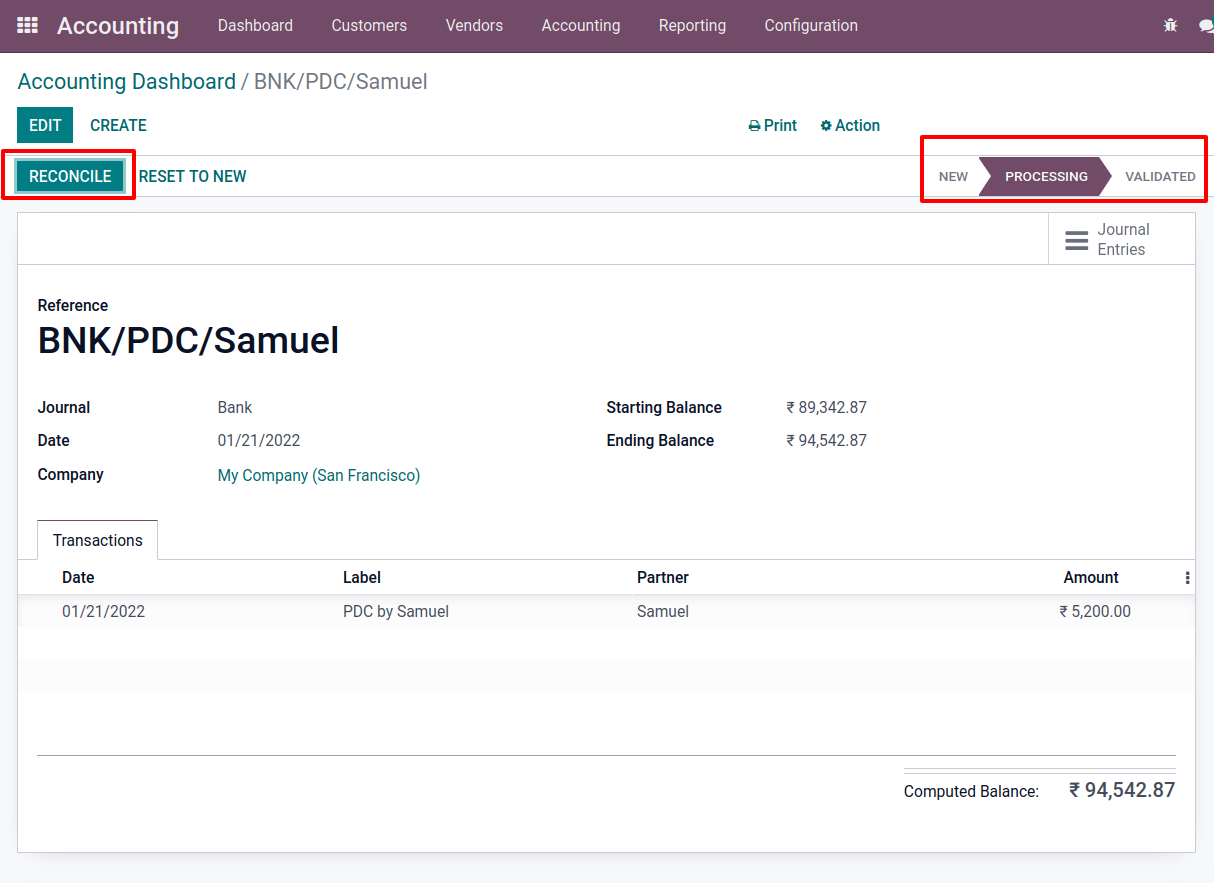

Let’s make a bank statement for the payment we just made. Select the Bank option to create a statement from the dashboard. Create a new statement after that.

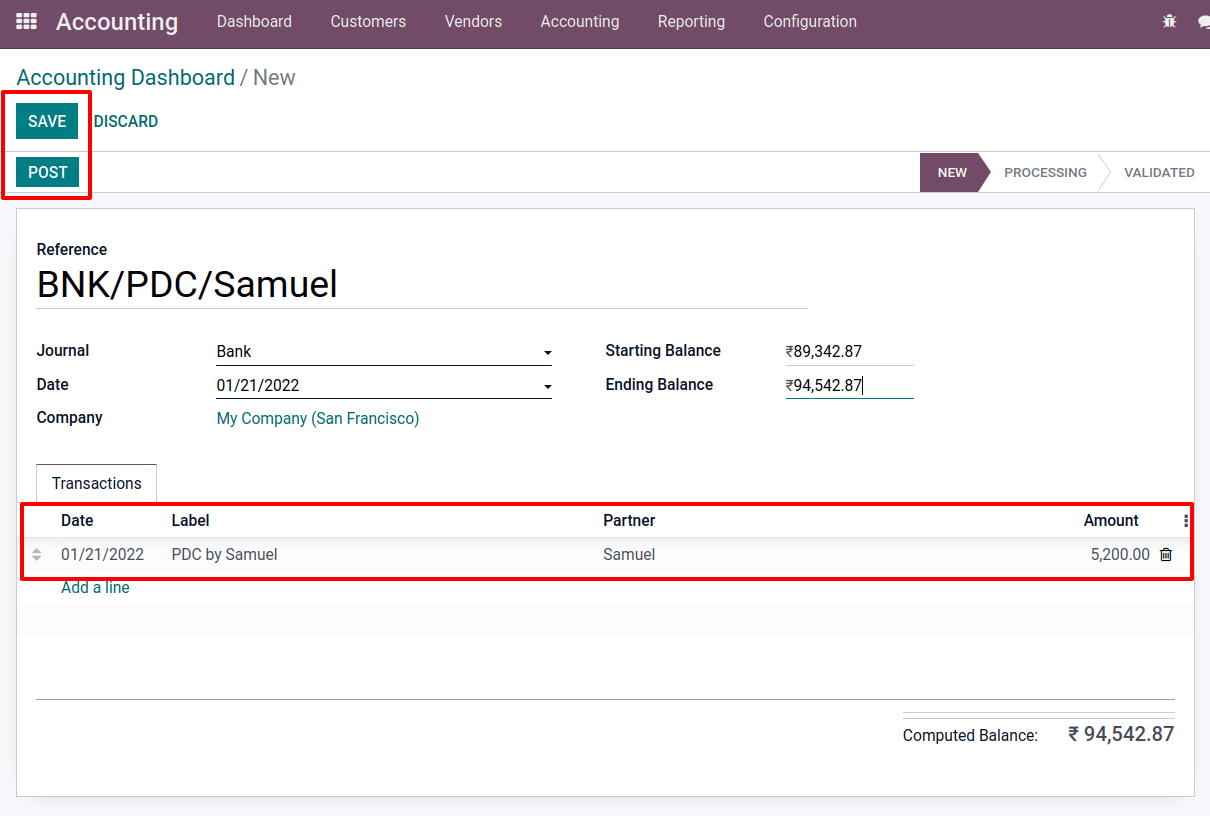

Include the bank reference, journal date, and so on. Add the payment information to the transaction tab.

In the transaction tab, enter the Date, Label, Partner, and Amount. Then, as the calculated Computed Balance, update the ending balance. After that, save the changes and post the statement.

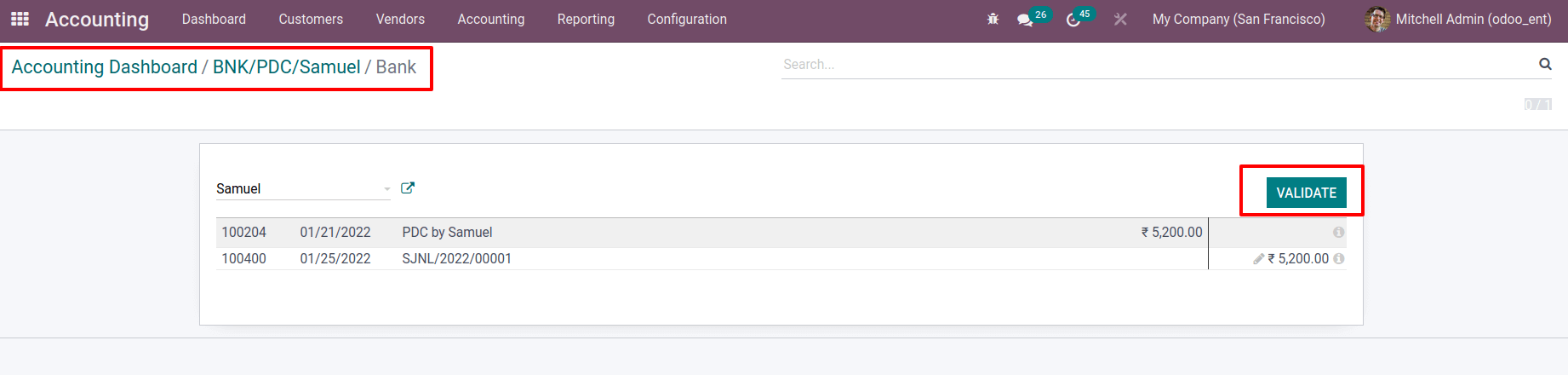

Then simply match the payment to the statement. To do so, press the Reconcile button.

We can see that the payment and bank statement have been gathered together. Then select Validate from the drop-down menu.

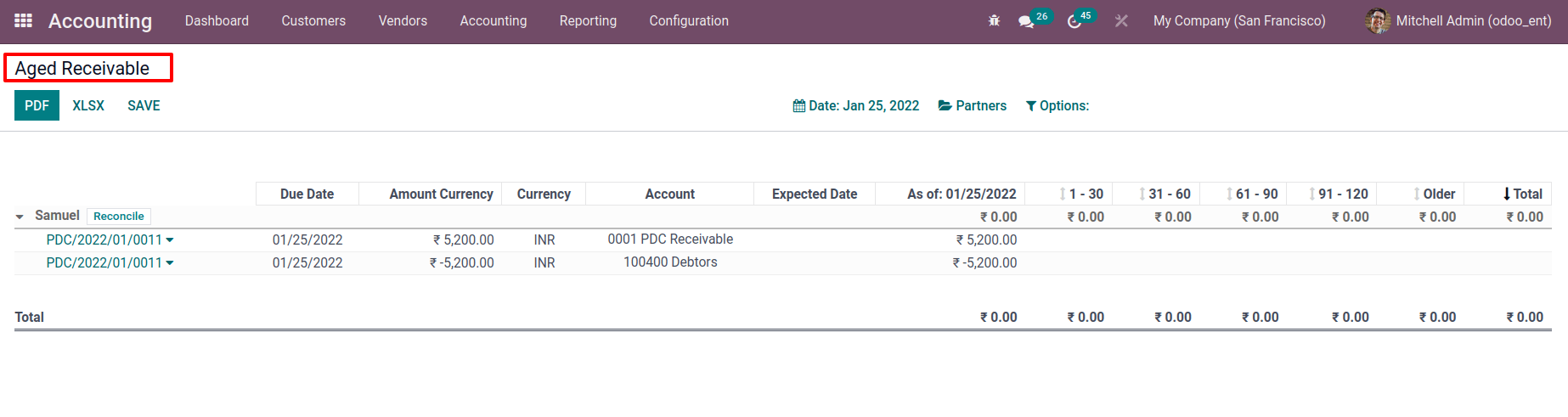

Re-examine the Aged Receivables Report. There are currently two entries for the customer.

Since the funds have been credited to the company’s bank account.

Re-examine the aged receivables report. There are currently entries for the customer.

Since the funds have been credited to the company’s bank account

Return to the previously created invoice, which is now in the paid condition.

When the payment mode is cheque, the payment is completed after receiving the cheque, but the amount is not deposited into our account. As a result, a ledger balance is shown. Payment credit to the company account until the balance changes only after the bank reconciliation is completed.