The management of employee payroll is all about maintaining the accounting statements for workers. That is nothing more than the employer’s benefits accrued to an employee in the form of salary, promotions, bonuses, and deductions. It is provided over a particular period of time for the job that an employee performs.

Odoo Human Resource Management software can easily perform the employee payroll process. The program has all the capabilities to handle a company’s entire payroll estimation process, no matter how large or small the size of the employees.

Odoo comes with a wide variety of business-related software and applications such as CRM, Marketing, Purchasing, Human Resources, E-Commerce, Production, etc. All of these modules together transform Odoo ERP into a complete framework for business management.

The high-end simplicity and ease of use makes the open-source ERP extremely important and influential in the market community. In addition to the 30 core base components, Odoo provides more than 16,000 + third party Apps / Software packages providing broad options to different market needs. Every module is tailor-built to satisfy every consumer’s needs. And the fascinating thing is these projects are advanced in time and most effectively meet any market condition.

Presently Odoo has 4+ million subscribers in various countries which includes prominent companies like Toyota, Hyundai and so on.

Odoo ERP’s error-free payroll processing will easily push the operation of the company’s human capital to the next level. Automated and streamlined monitoring guarantees that there are no missing or misinterpreted data. Through Odoo Payroll, the organization will substantially reduce the need for manpower in determining employee salaries, thus reducing its resources and turning its attention to more strategic growth and the company’s core tasks.

Let’s see if Odoo fits to handle Indian Payroll. Once it comes to the Indian aspect, wages, incentives, allowances, gross and net compensation joins the calculation of payroll administration. thereby Factors such as Employee Holidays, Workplace Attendances, Workplace Timesheets, and Staff Expenses come into play. Odoo has different modules to account for all of the elements listed above.

There are different measures to take in order to finish a payroll operation. At first, the salary rule, salary scale, and category of salaries will be charted according to the company policy. then, the creation of employee contracts with the correct pay scale and salary rule. Then, the payslip generation depends on salary rule and the structure of salaries.

We are able to create more than one employee contract but the one which is active only will be considered while making payslips.

We can see the configuration.

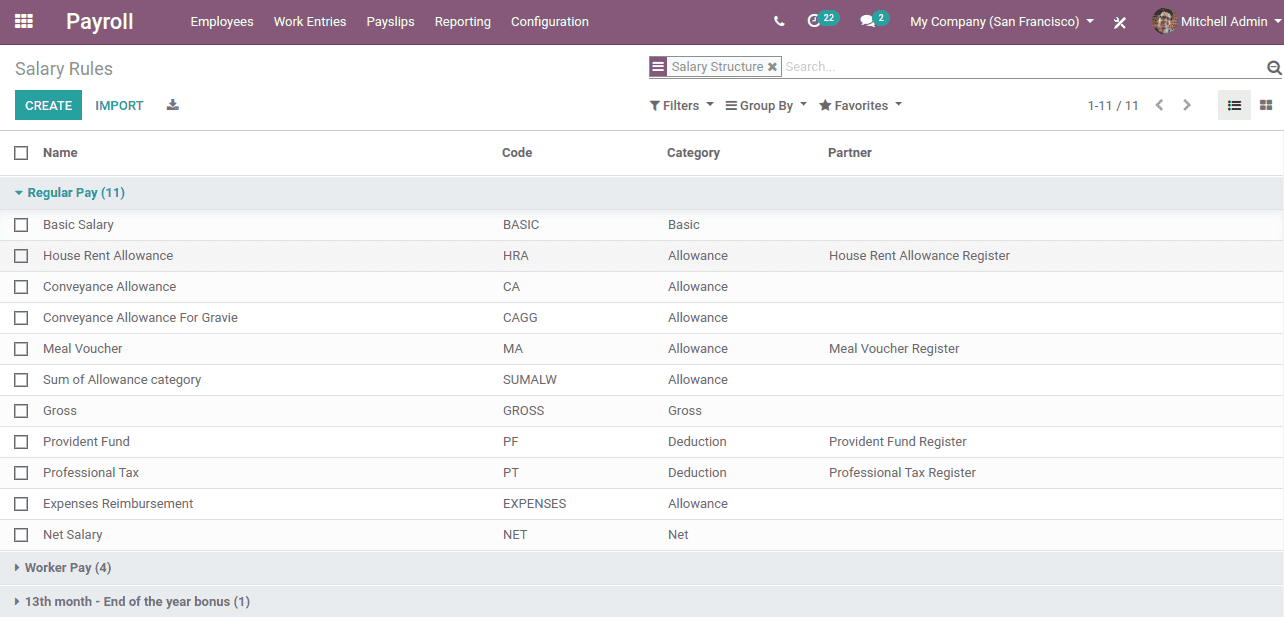

Salary Rule

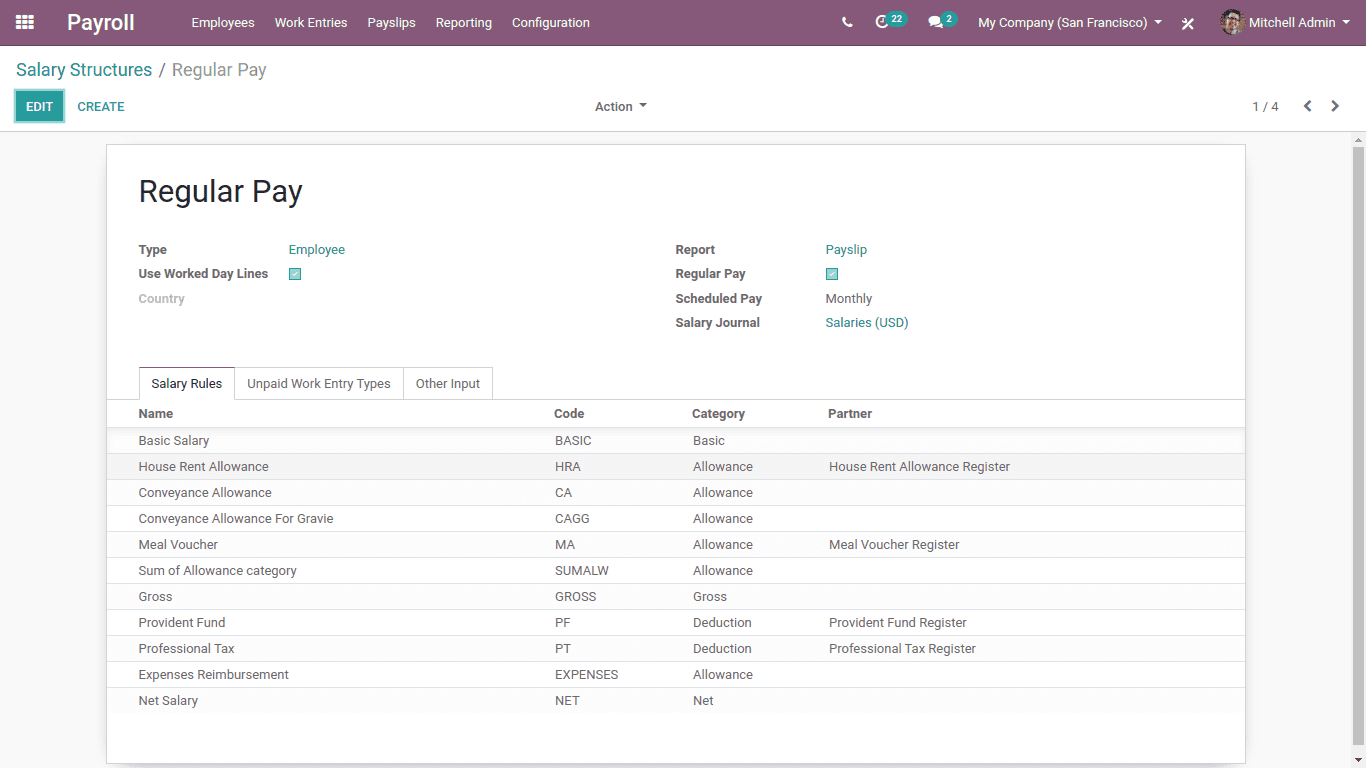

A salary structure is a combination of various salary rules. There are different categories under which the salary rules are made like, basic, allowance, gross and so on.

In Odoo we have default salary rules but as per company needs and policies, we can create different salary rules.

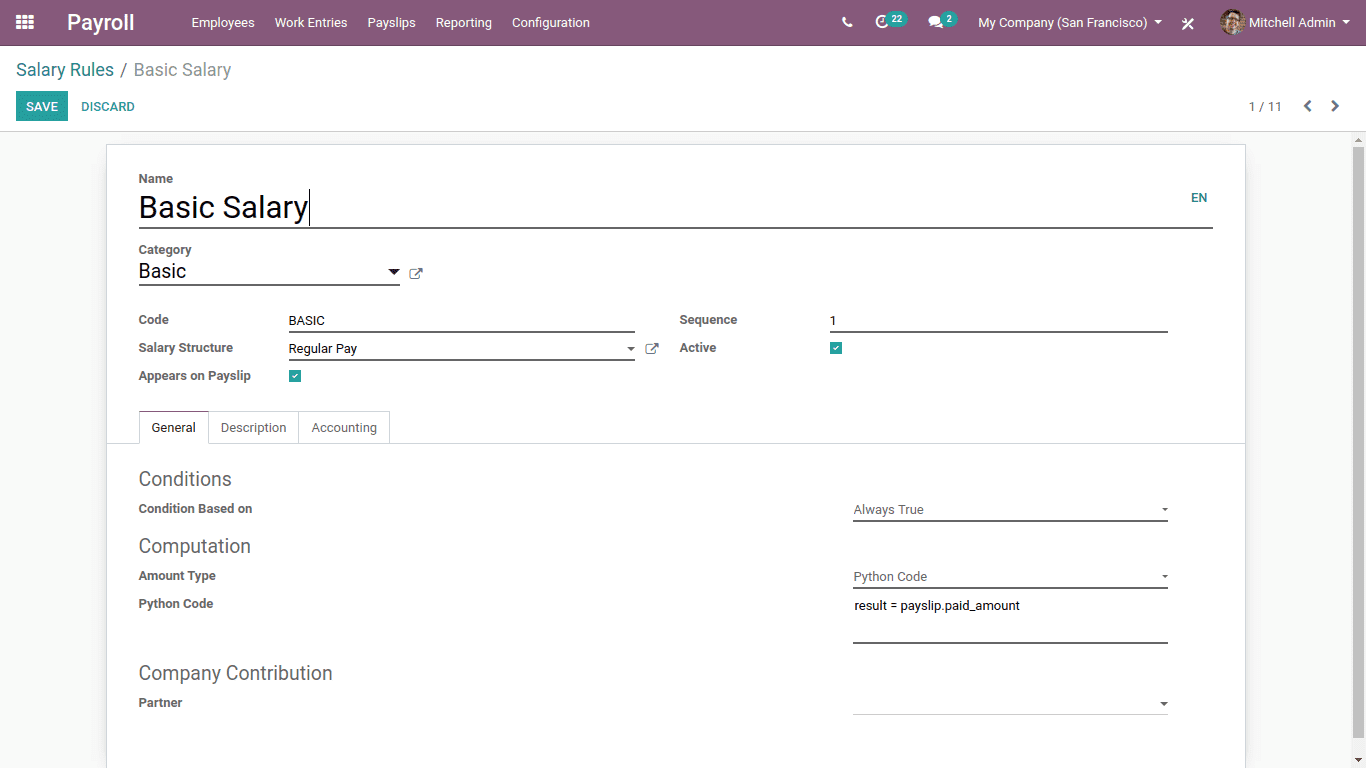

Here we have to mention the name for this rule.

Then we have to mention the category, code, sequence, salary structure and so on.

Under the general information tab, we have some options,

Conditions based on

– Always True

– Range

– Python expressions

Computation

– Percentage

– Fixed amount

– Python code

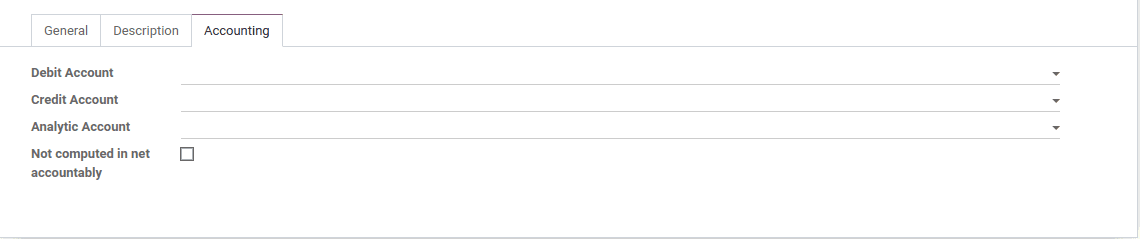

Now under Accounting Tab, we can mention the debit and credit amount for the salary rule which makes the process smoother.

We also have a description tab, where we can mention anything special about the rule.

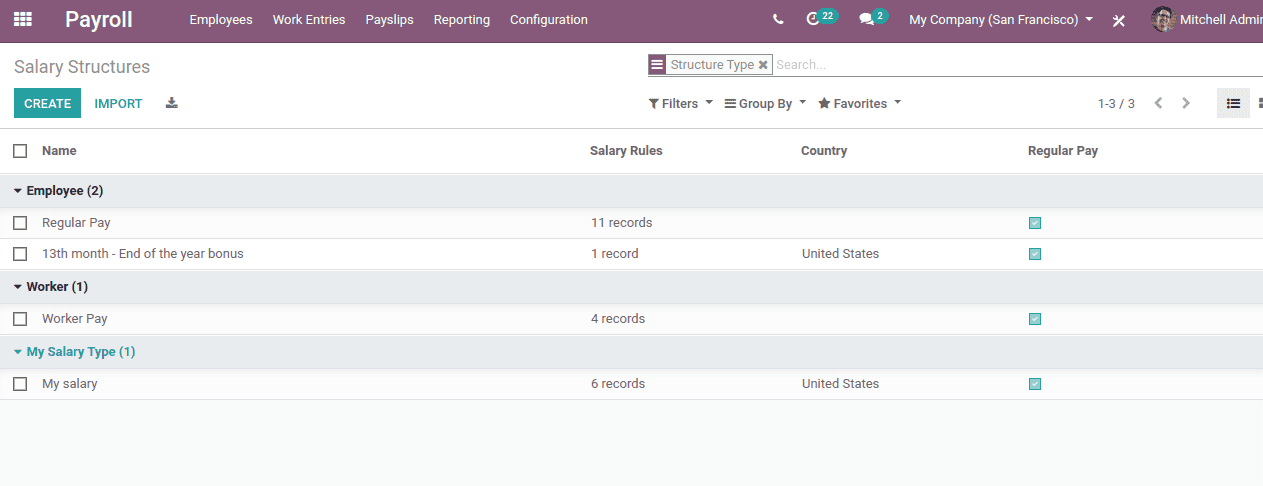

Salary Structure

Salary structure is also essential for calculating a payslip. The salary structure is established in the combined effect of chosen salary rules. It could be labeled as Head of Marketing, Sales Manager, and so on of each individual. The position, context, and organization must be defined within the salary structure collection of pay rules. There is also a base framework of salary and it combines Basic, Gross, and Net.

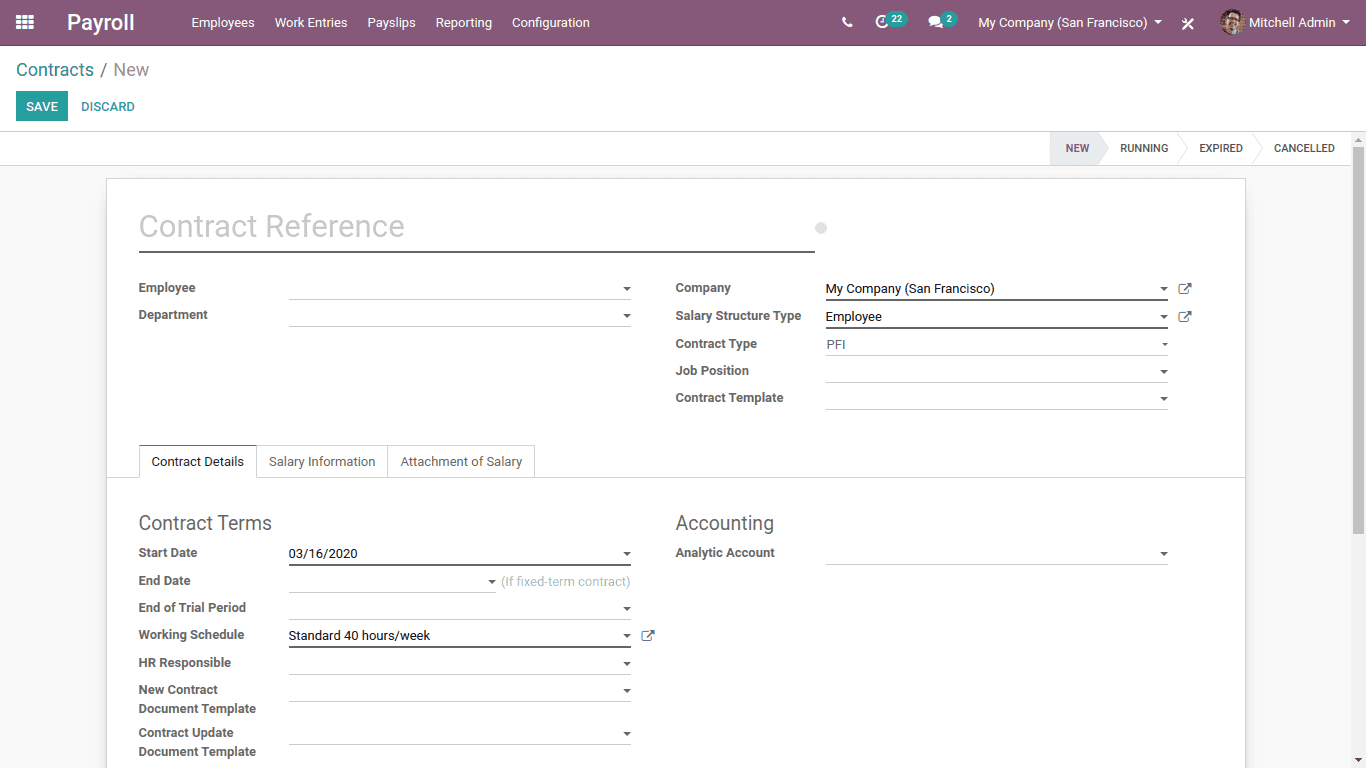

Contract

Employee compensation is determined depending on the contract that an employee is assigned. The active contract should be taken into account when determining the wage of the employee, as it includes the pay structure and once again comprises the salary rules.

Here we have to mention the contract reference, which is the employee, his or her department, salary structure type, start date, and work schedule.

Then under the salary information tab, we have to mention all the necessary information. When we create a new contract it will be active.

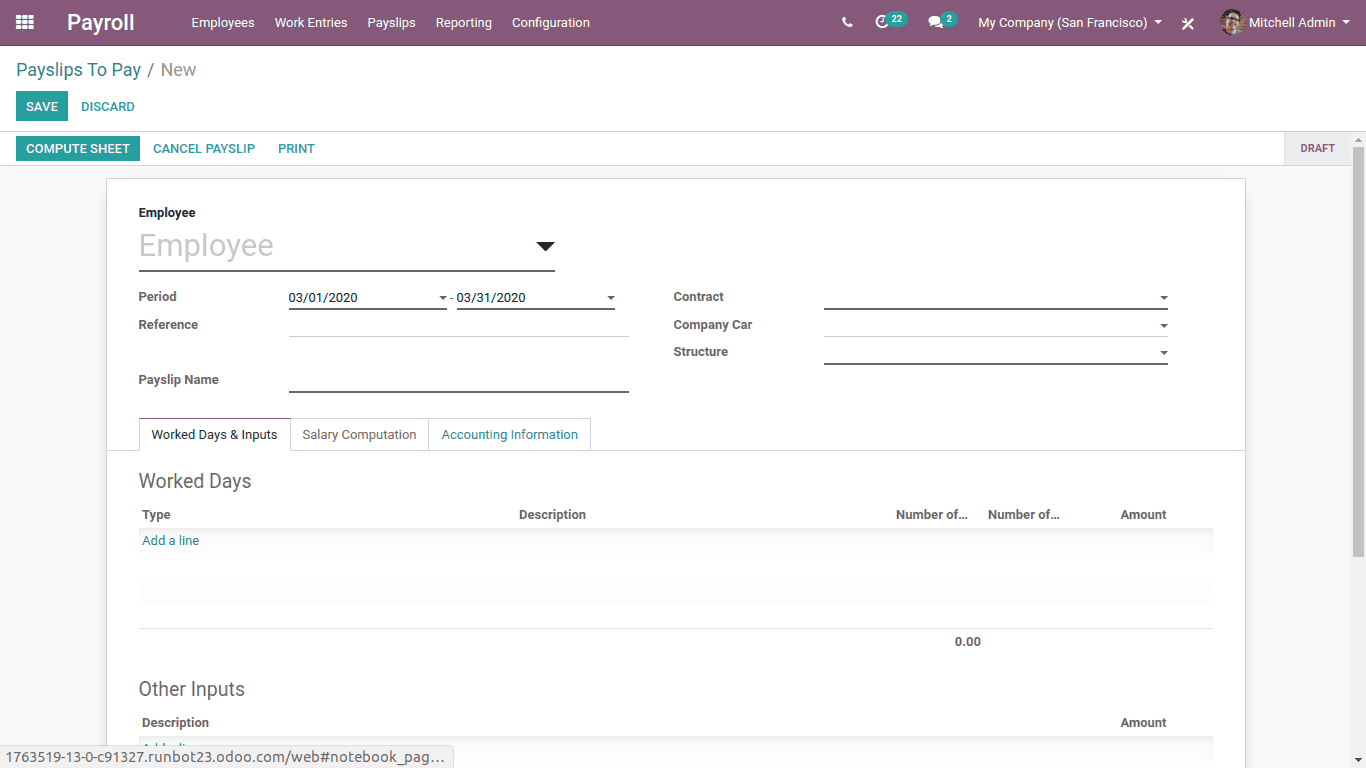

Payslips

For all those staff who are within the active contract, Payslip can be created. Work payslip is calculated by the pay/salary structure given by the employee contract. When the name and contract of the employee are selected, the number of days of work for all the employees will, therefore, be calculated in addition to the working days specified.

Here we have to mention the Employee, period, payslip name, contract, and structure.

If all the necessary fields are filled we can click on the “Compute Sheet”. Then the salary computation will be automatically done. Also, the data like loans, leaves and so on will be mentioned in the payslip.

We are also able to create payslip as a batch.

So this is all about the ‘Indian payroll process in Odoo 13 ERP’.