Fiscal localization is the feature of a company’s finance management, which installs charts of accounts, taxes, fiscal positions and more. In this blog, we discuss the UK Accounting localization in Odoo 15. For a new database, Odoo will automatically take the generic accounting package for the database while installing the accounting module. This localization package can also change.

For an organization, it may have multiple companies at different locations. The finance management followed in one company may differ from another. Thus for each company, we have to set the correct accounting localization package to adapt the accounting standards for their respective country.

Let us see how the localization package can be set to a company. As the first step, create a new company.

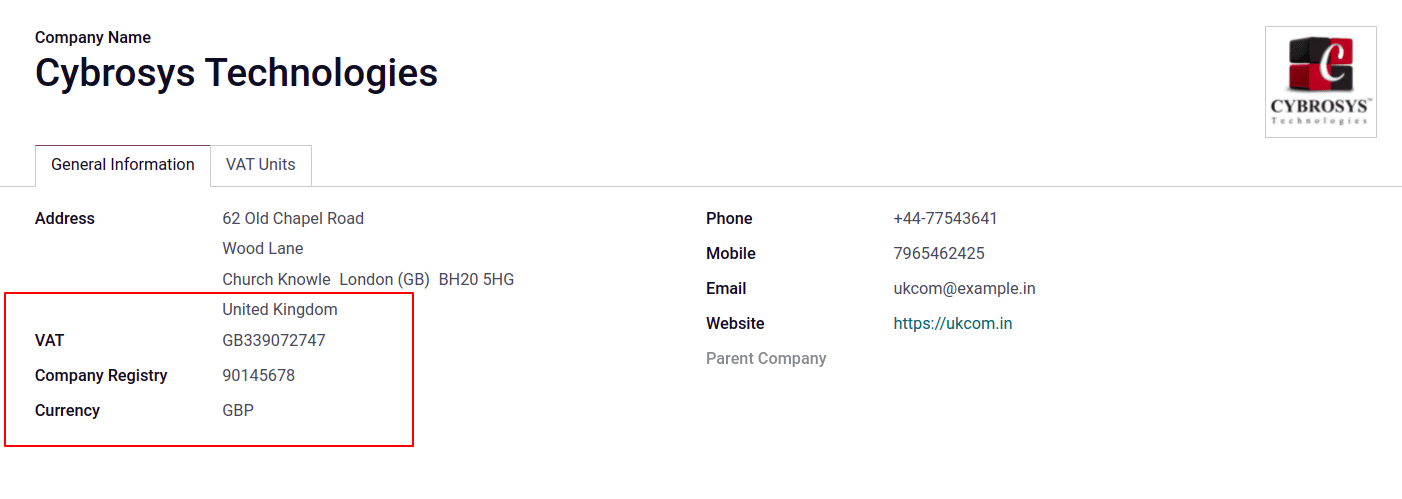

For our new company, set the name and other company information like address of the company, VAT number, company Registry, Currency, contact details including phone and mobile number, Email, Website link etc. If the new company is the child company of some other company, one can mention it in the parent company. For UK Accounting, HRMC issues a VAT number to all companies registered for value-added tax having nine digits, sometimes having the’ GB’ prefix.

HMRC, short for ‘Her Majesty’s Revenue and Customs, HMRC is the UK government’s tax authority in charge of collecting taxes, issuing child benefits, enforcing tax and customs rules, and ensuring that employers pay the minimum wage. Also responsible for all direct and indirect taxes and ensures that the implemented and followed taxation system is as efficient as possible. It also ensures that cash for public-sector support is readily available. Another function of HMRC’s tax-related business is to educate and inform the people about their tax-paying obligations. HMRC is also in charge of the Government Banking Service, which provides information to HM Treasury to help with cash management. HMRC provides the VAT number for the company, and every three months, the VAT obligation reports are sent to the authority.

The company registration number is the company’s registration number, a unique eight-digit number to identify the company and verify that the company is registered with the company’s house. Companies House is the registrar of companies in the United Kingdom. One of its primary functions is to incorporate and dissolve limited companies, examine and store company information collected under the Companies Act and related regulations, and make it publicly available. They provide information regarding company type, business status whether it is life or dissolve, Company registered address, details of directors and secretaries like name, nationality, private lessons and details of corporate if they are corporate directors, change of company name and registered address etc.

Don’t confuse HRMC and Companies’ houses. All companies registered in the United Kingdom have to submit all accounts in the company’s house. At the same time, all business (not only the company) has to register in HMRC and file their tax return.

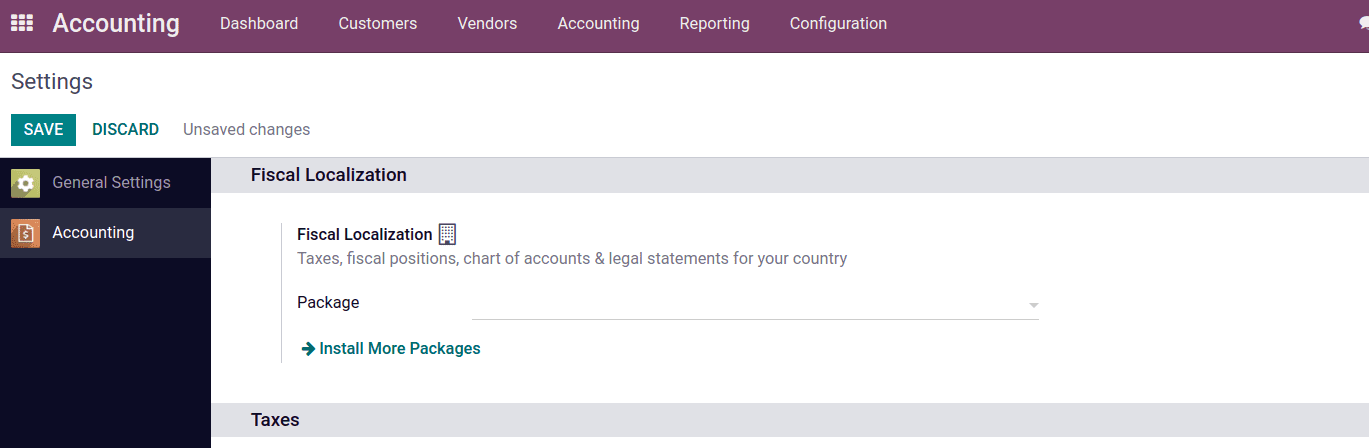

Once the company country is added, the currency will be automatically taken according to the country. Now we have to set the UK localization package for the company. So go to Accounting module > Configuration > Settings.

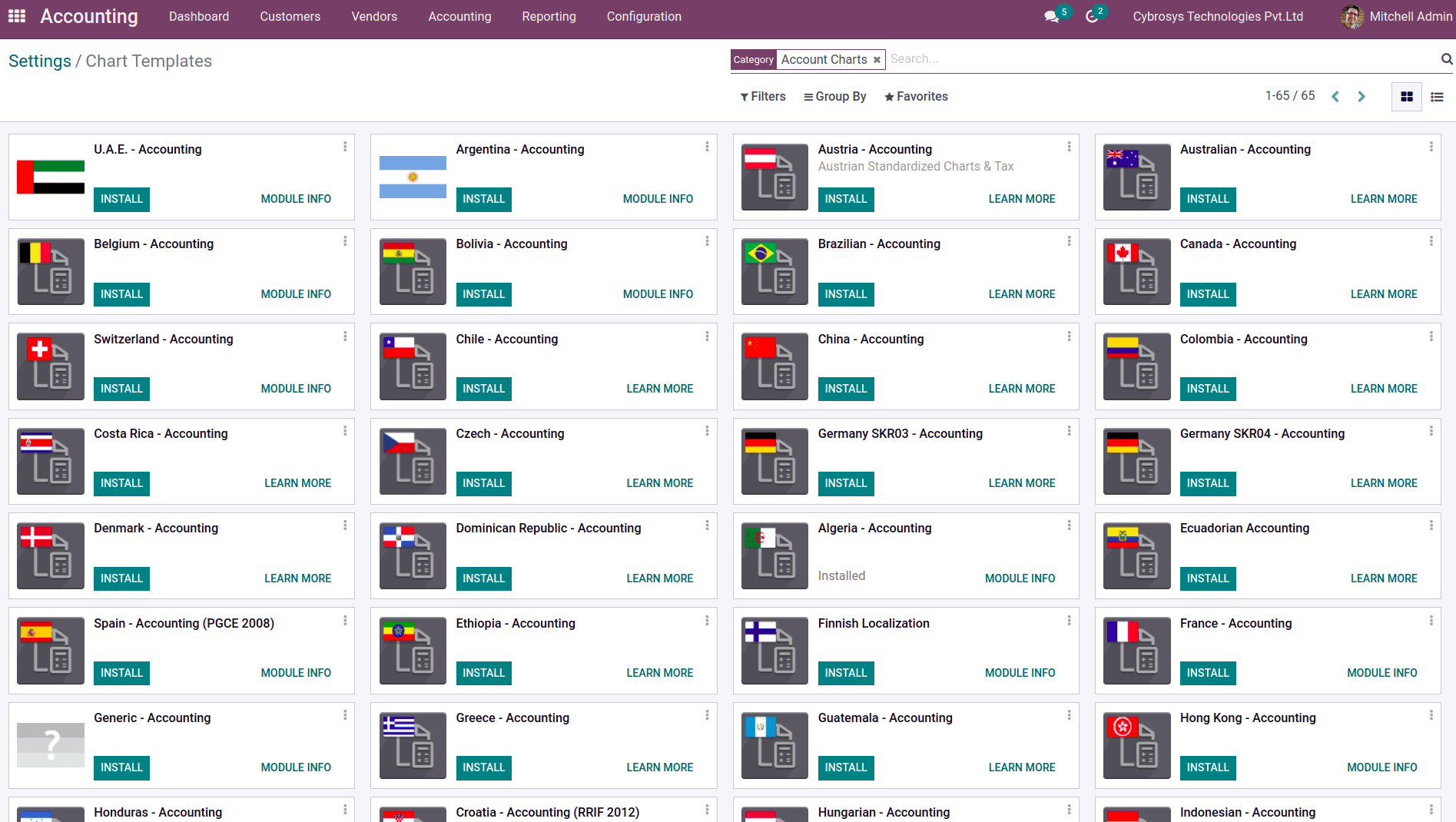

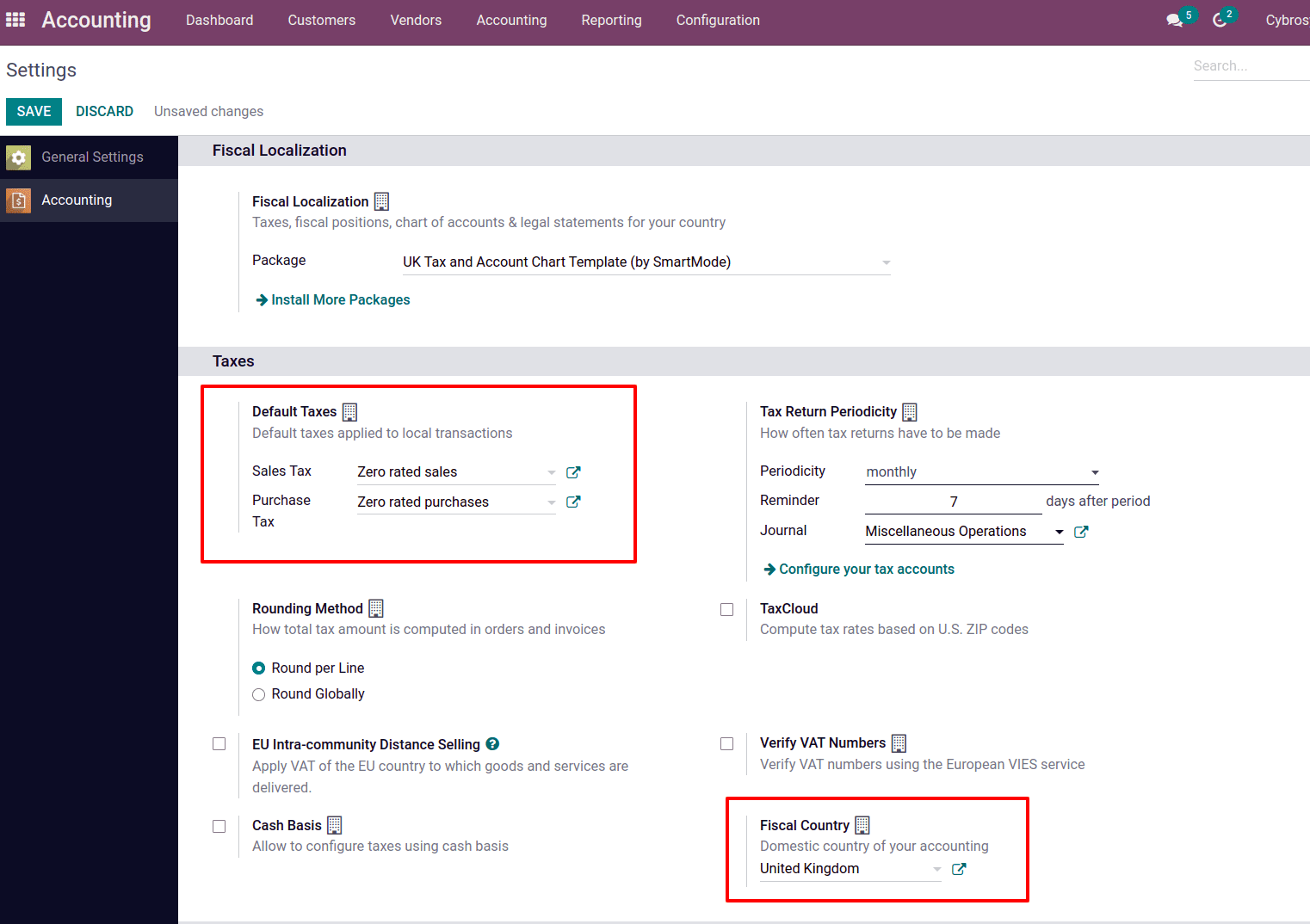

To set the localization package under section ‘Fiscal Localization’, add the package from the drop-down. If localization packages are not available in the drop-down, click on ‘install more packages’. So you will be redirected to accounting packages where one can find all localization packages available in Odoo 15.

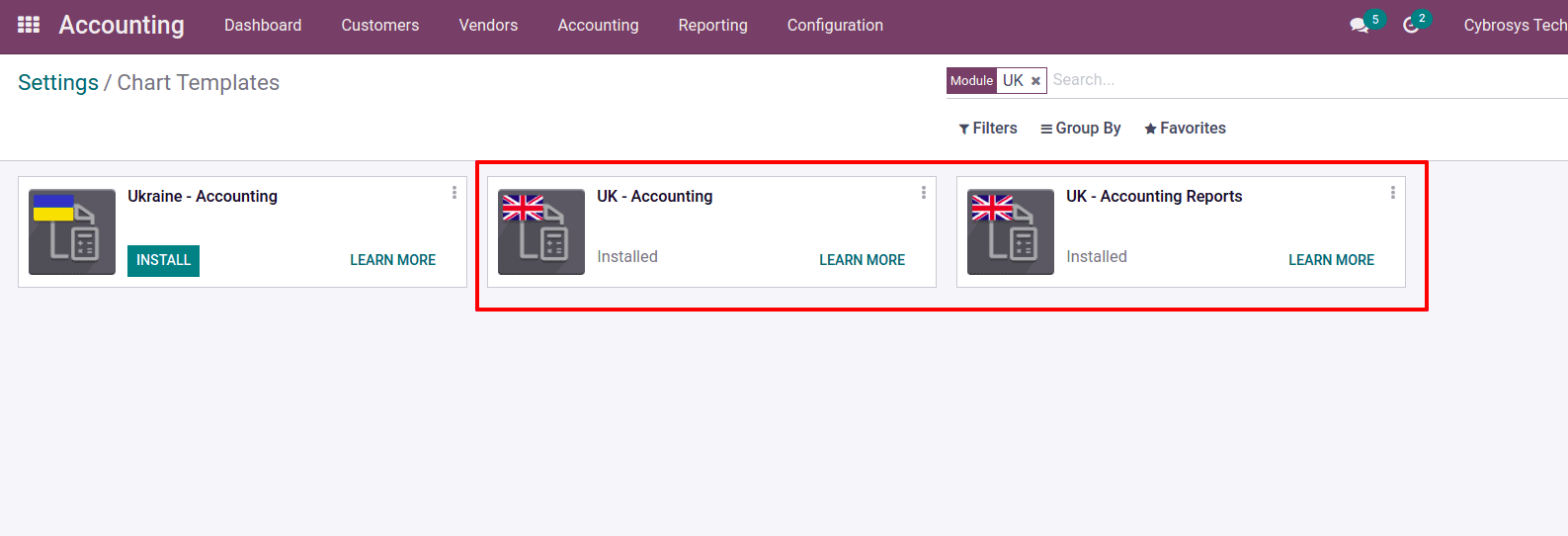

Now searching for UK localization will result in the localization modules required for UK accounting.

Install the UK-Accounting module. The two modules UK-Accounting and UK- Accounting Reports, will give the complete UK accounting features, which install the predefined chart of accounts, taxes, fiscal positions and reports for UK accounting.

The UK-Accounting module contains the most recent UK Odoo localization required to run Odoo accounting for UK SMEs, including:

– a CT600-ready chart of accounts

– VAT100-ready tax structure

– InfoLogic UK counties listing

– a few other adaptations

The UK-Accounting Reports provides accounting reports for the UK and allows sending the tax report via the MTD-VAT API to HMRC.

Once the module is installed, choose the package in the accounting settings and save.

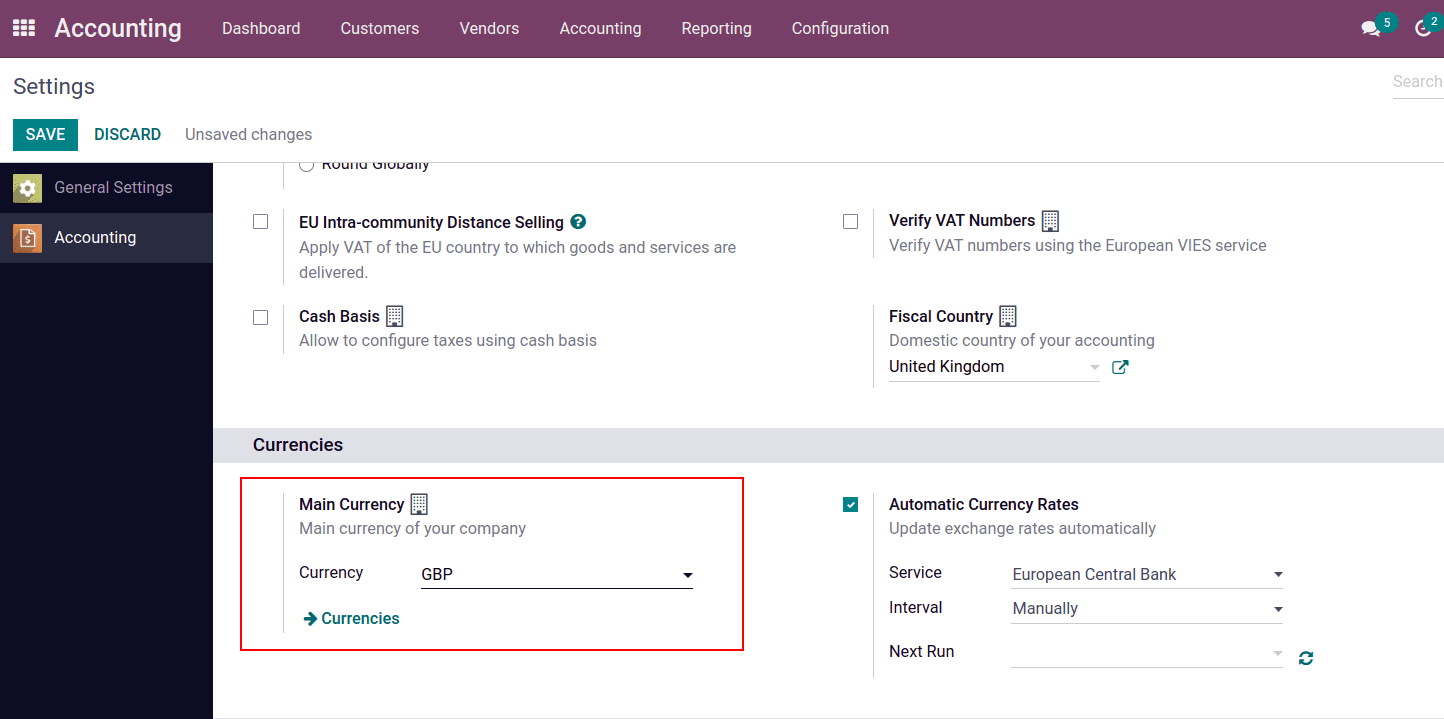

So here, one can see that default sales tax and purchase are set after saving the localization package. In the Fiscal country, the domestic country of your accounting will be taken, the United Kingdom. Also, when scrolling down the settings, one can see the company currency is updated as GBP.

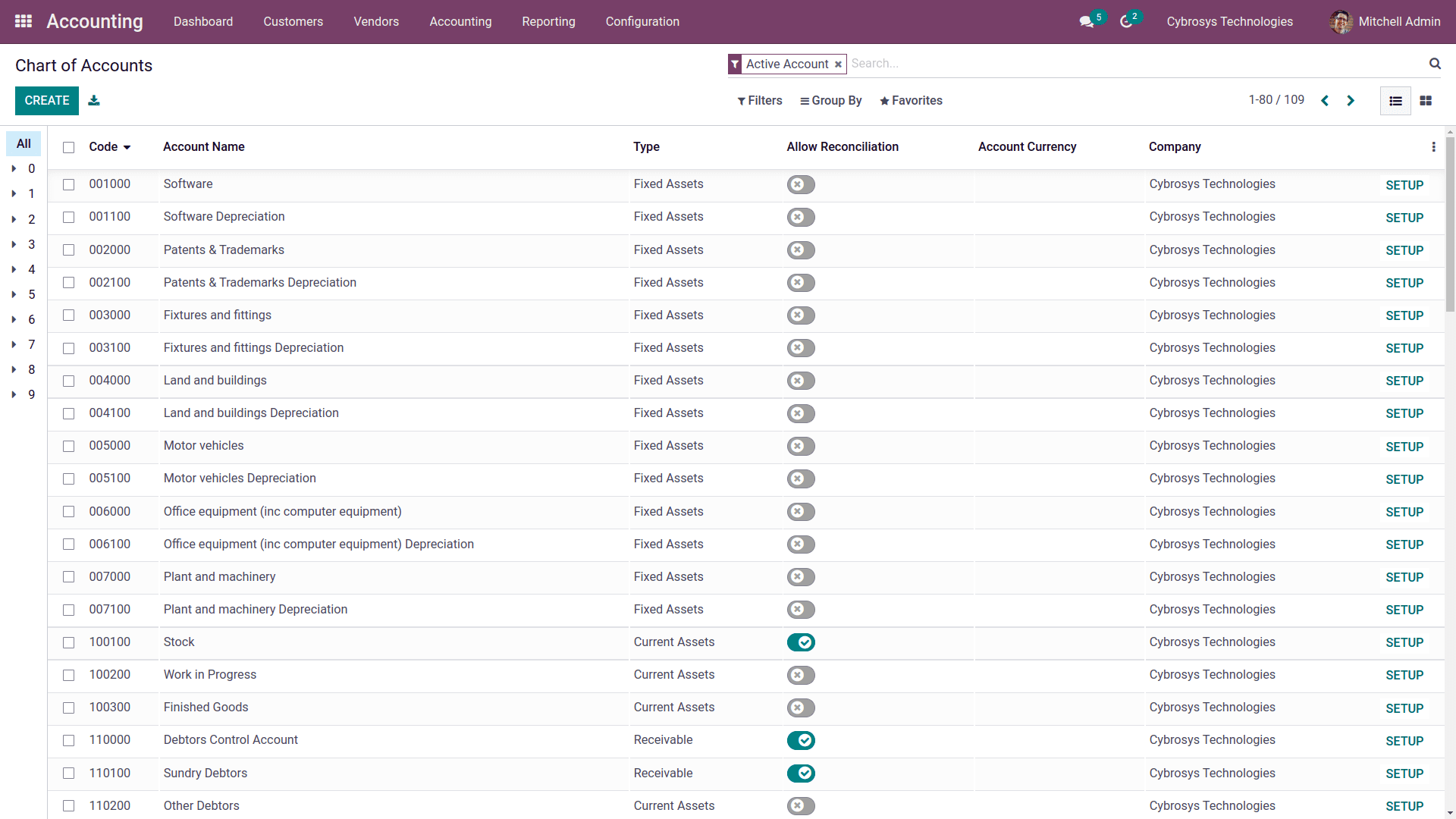

Let’s look at the Chart of Accounts that came with the UK accounting package. Go to the Accounting module > Configuration > Chart of Accounts.

One can use the default chart of accounts for the company’s operation. Sometimes companies may have specific accounts configured for their business operation. So for that case, these preconfigured accounts can be deleted and import the chart of accounts required for the company.

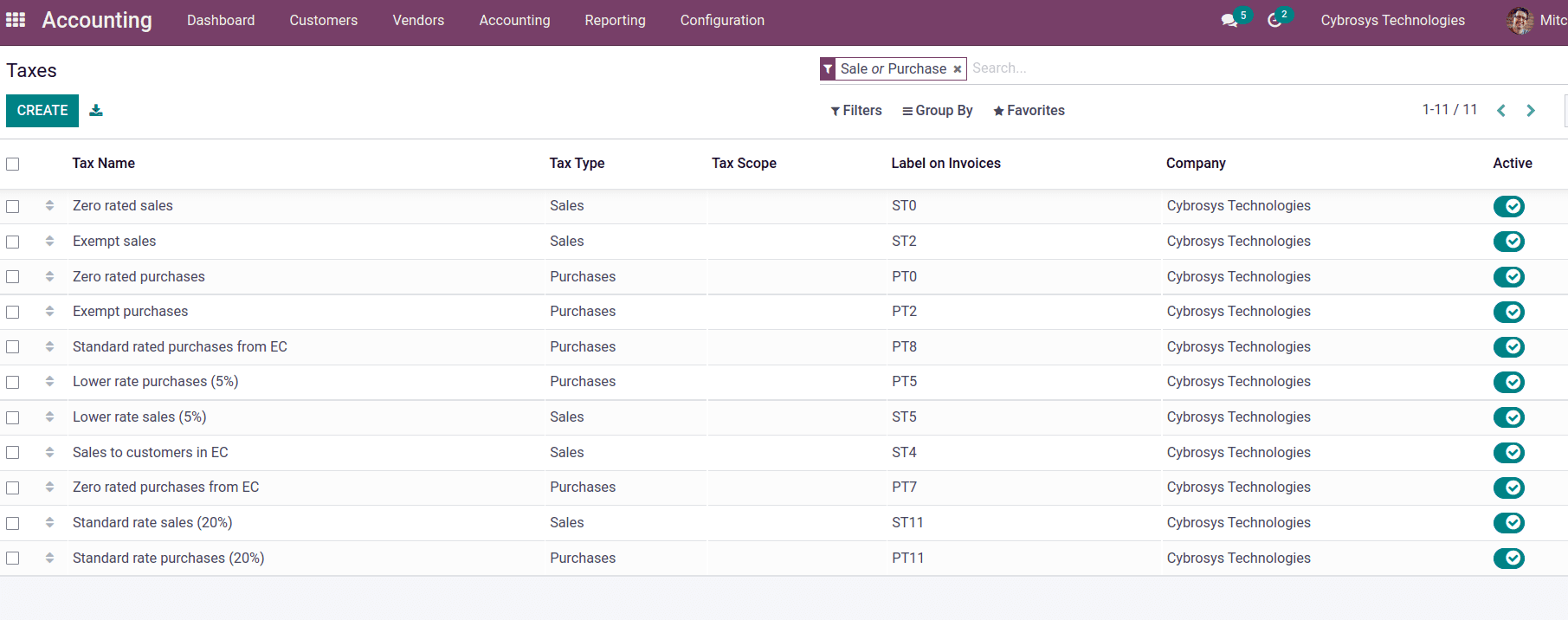

Next, look at the taxes; go to Accounting module > Configuration > Taxes.

These are the default taxes provided in Odoo, and if needed, more taxes can be created. The sales tax rate in the United Kingdom is the tax levied on consumers depending on the price of goods and services. The UK government’s most important source of revenue is sales tax revenue.

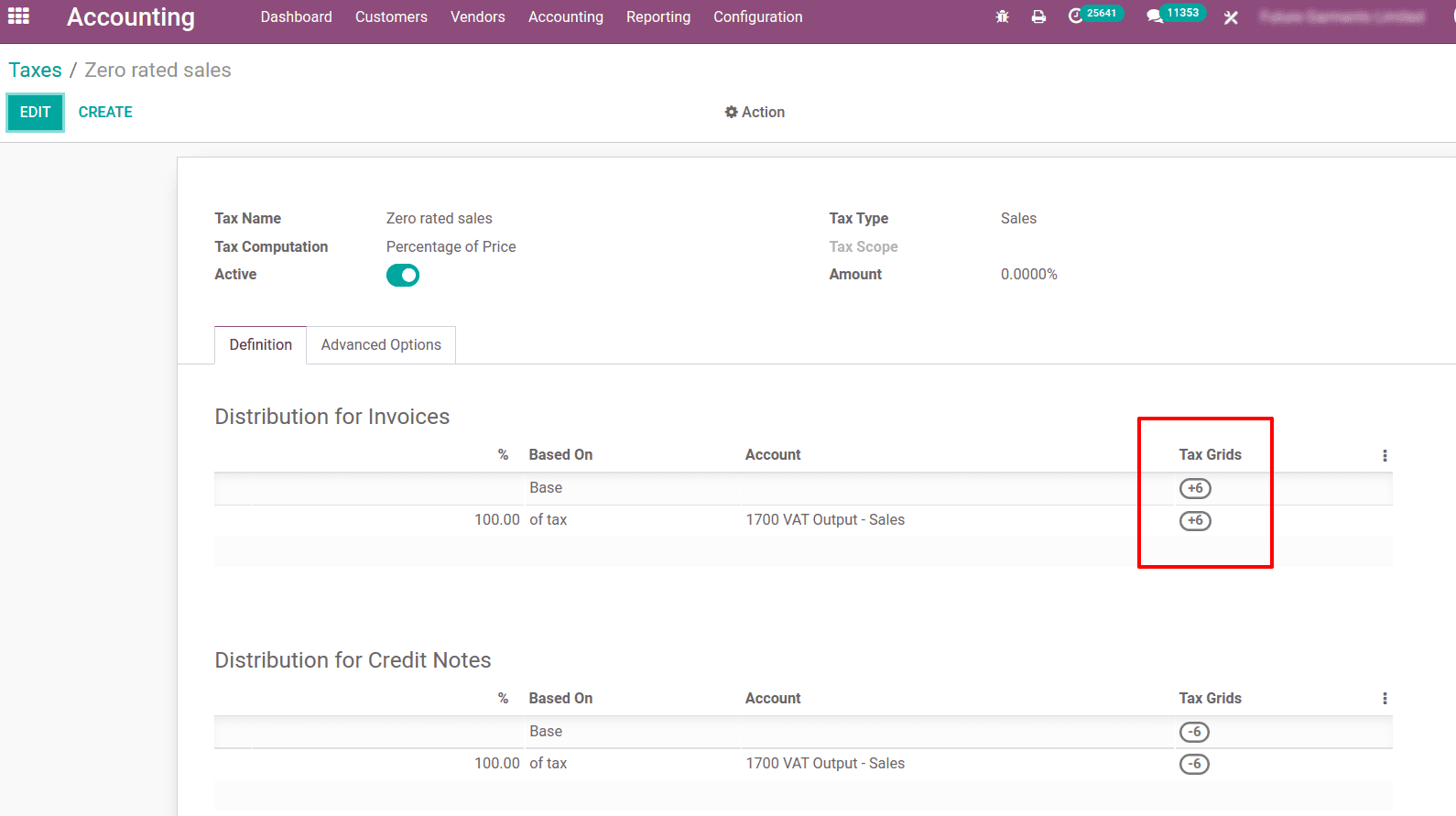

Here is one of the tax configurations for zero-rated sales tax. Zero-rated items are still VAT-taxable, but the rate of VAT that the business must charge its customers is 0%. The company must still account for them in its VAT books and disclose them on its VAT return. Here, the tax grid has been introduced, which aids in recording the tax report in line with the company’s country’s rules.

Now let us move to the tax report; a hierarchical structure of applying tax can be seen based on the tax grid.

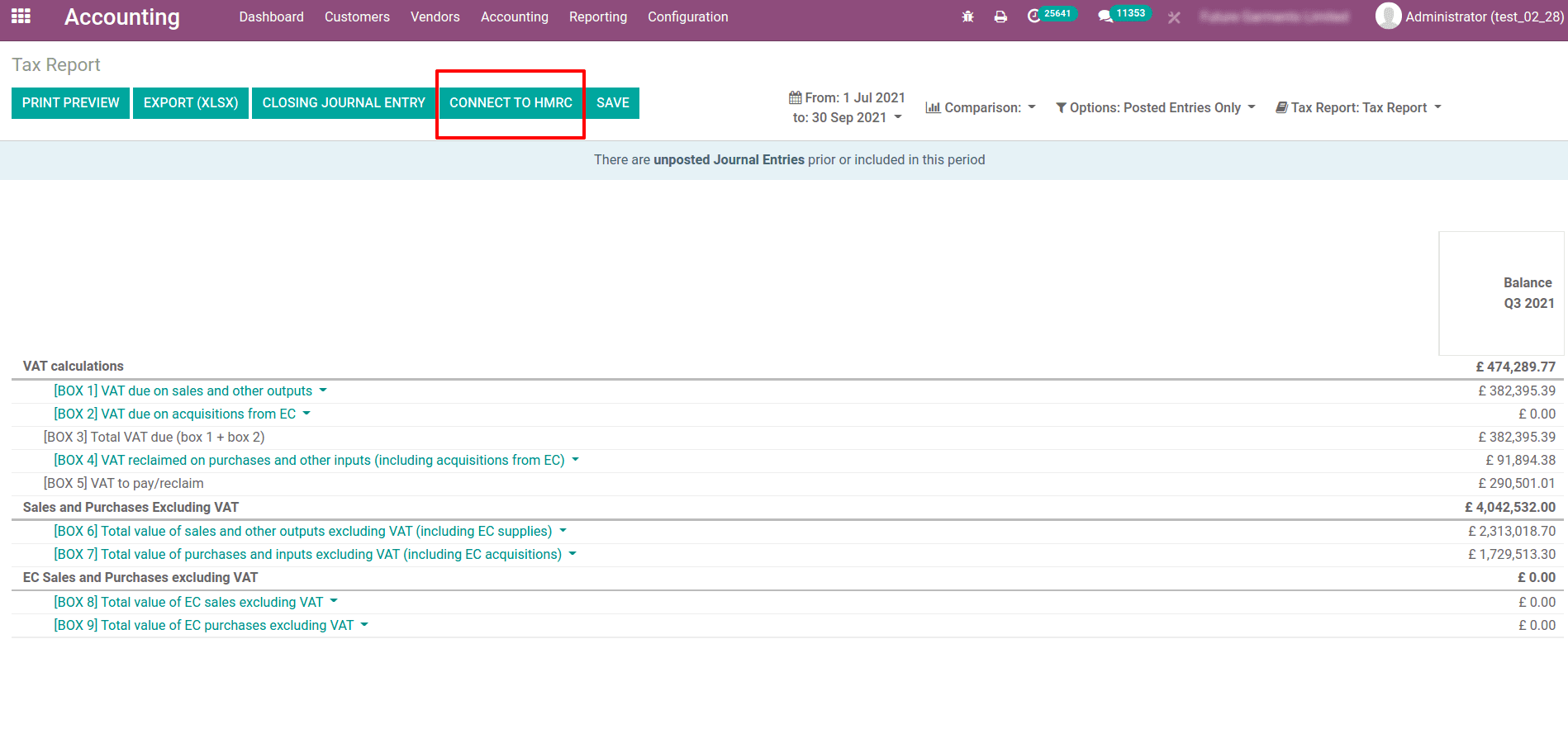

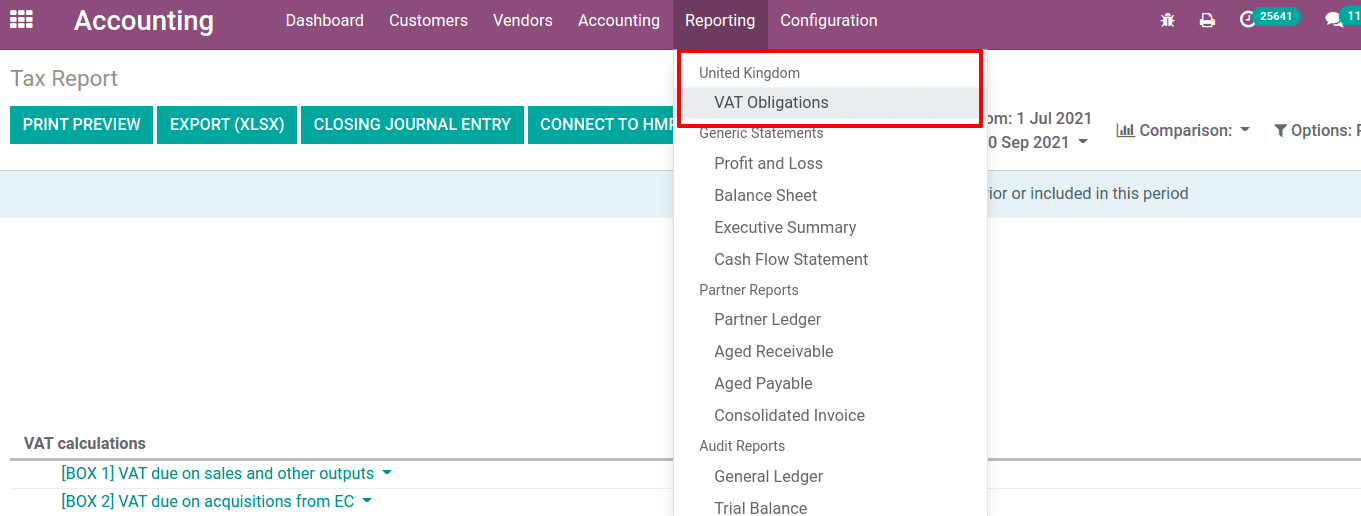

The ‘CONNECT TO HMRC’ button will connect the Odoo database with the HMRC and send the VAT return to HMRC. VAT obligations can be seen below the reporting menu.

Now open one of the VAT obligations.

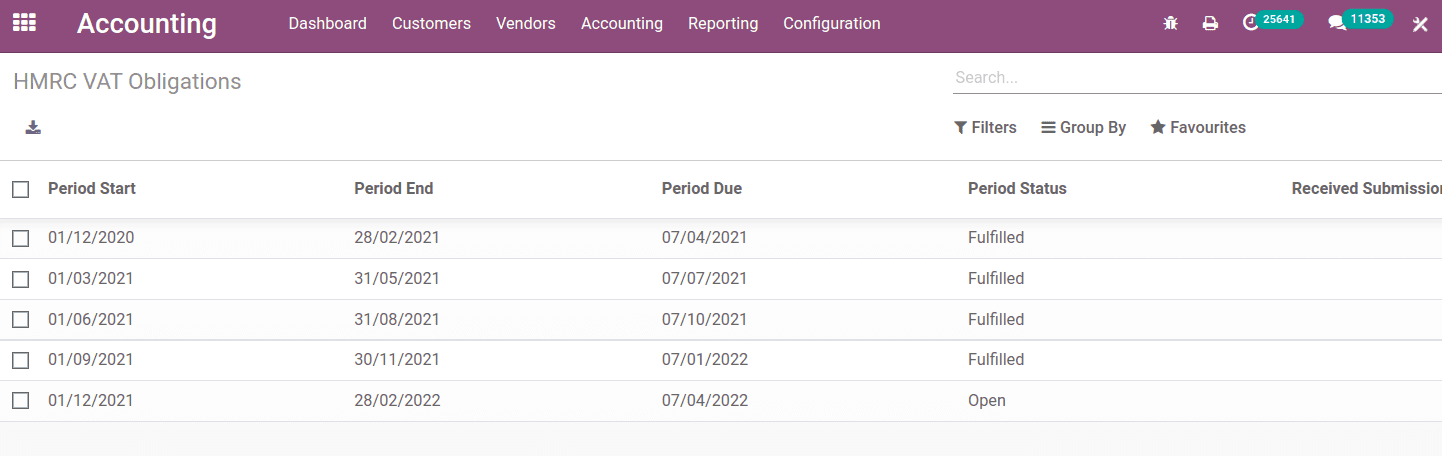

Here one can find submitted HMRC VAT obligations. Details like start, end, and period status can be seen, like whether it is fulfilled or open.

Companies in the United Kingdom need to send the VAT return to HMRC every three months. The VAT return includes information like company total sales and purchases, the amount of VAT the company has to pay, the amount of VAT the company is eligible to claim and how much the company’s HMRC VAT refund is. Even if the company has no VAT to pay or refund, the company must file a VAT Return. When a business cancels its VAT registration, it must file a final VAT return. If your company’s registration is cancelled due to insolvency, HMRC will give you a paper version to fill out.

Apart from this, generic statements like Profit and Loss Statement, Balance Sheet, Executive summary, and cash flow statement, which are significant legal statements required for every company, are available in every accounting package.