Odoo Accounting is an open-source business management software that offers a suite of applications, including accounting modules, to help businesses manage their financial processes. An organization that gets funds in advance for products or services that have not yet been provided or earned is said to have delayed income in Odoo. Due to the outstanding commitment to supply the specified products or services, this prepayment results in a liability on the balance sheet of the business. This results in a liability on the balance sheet, signifying that the company has yet to fulfill its obligation to deliver the specified goods or services.

In the world of accounting, managing deferred income is a crucial aspect that businesses need to address for accurate financial reporting. Odoo 17, a comprehensive business management software, offers robust accounting features, including tools for handling deferred income. In this blog post, we will explore the steps to calculate deferred income in Odoo 17 accounting, providing businesses with a clear understanding of this process.

Understanding Deferred Income

The Odoo accounting module is specifically crafted to manage deferred income, also known as unearned or prepaid revenue. Begin by setting up a specific account for deferred income in Odoo. This account will be used to track the funds received in advance until the corresponding goods or services are delivered. It offers a systematic approach to addressing this issue through its versatile accounting features. Instead of recognizing the revenue immediately, businesses must defer it to a future period when the goods or services are provided. Ensuring that income is recognized at the time it is earned is crucial for accurate financial reporting.

Configuring and Managing Deferred Revenues

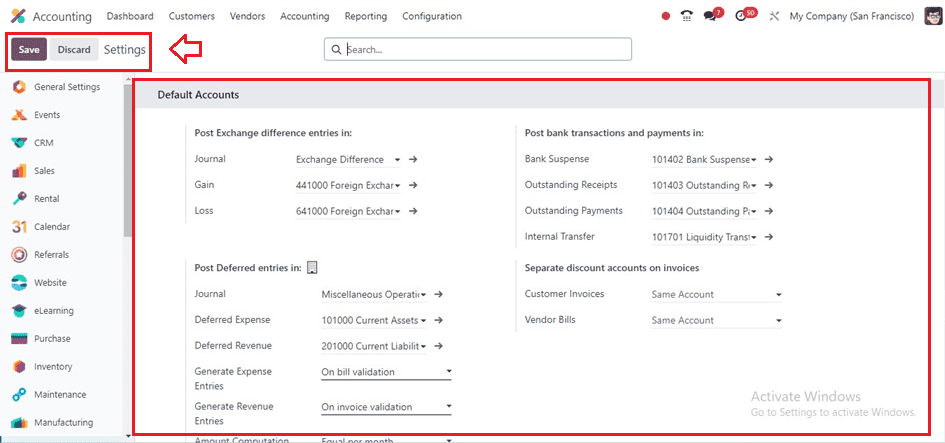

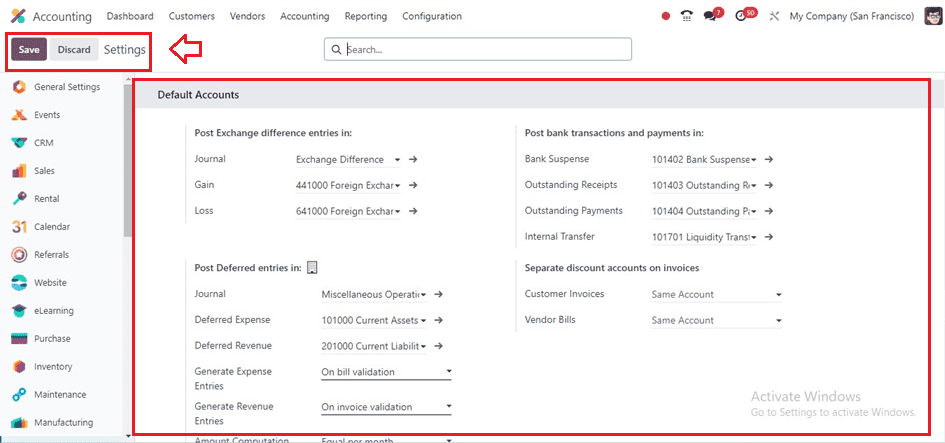

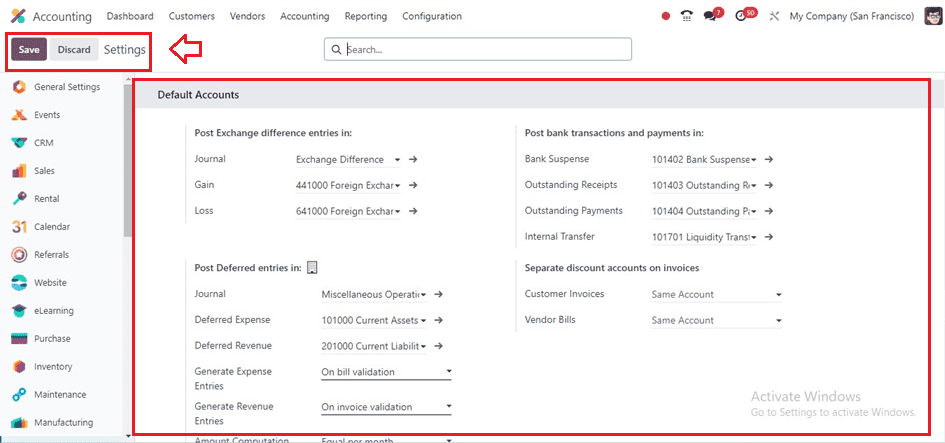

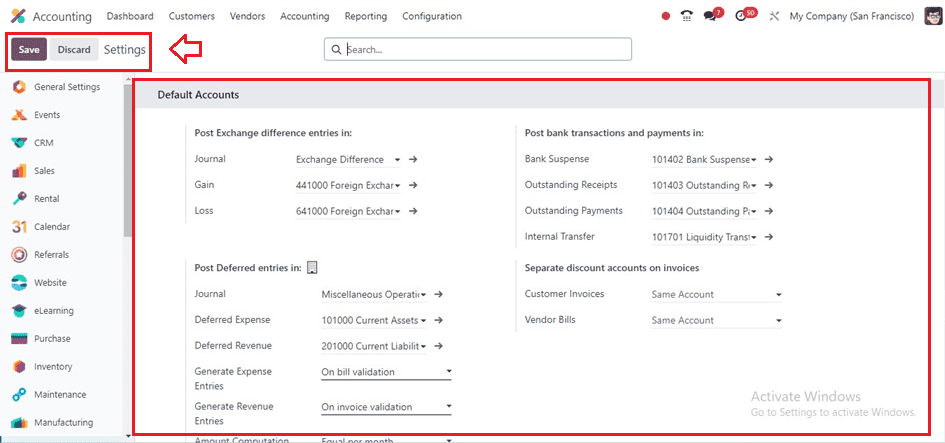

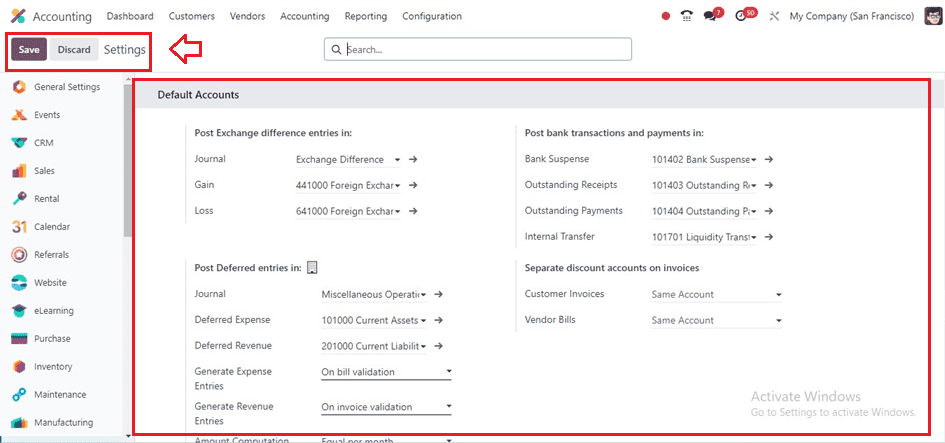

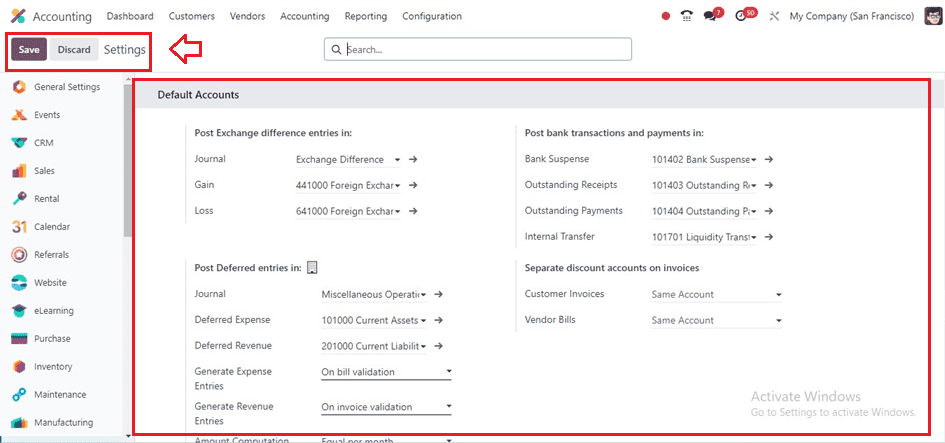

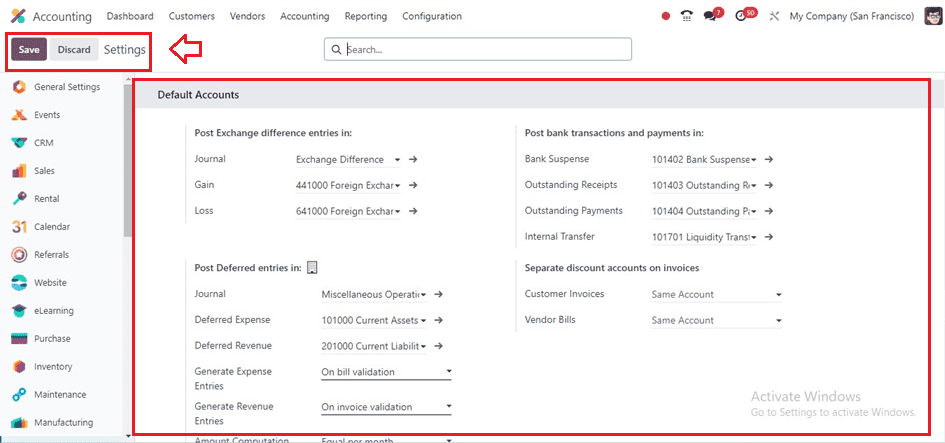

Setting or managing Deferred Entries and accounts is quite an easy process inside the Odoo 17 Accounting Module. So, Navigate to the ‘Configuration’ menu and open the ‘Settings’ page to configure your company’s accounting settings. You can set different default accounts for various journals inside this window. Deferred Expense Account, Deferred Revenue Account, and Journal are the three alternatives.

* Journal: Journal for posting deferral entries.

* Deferred Expense Account: Expenses deferred on Current Assets until recognized.

* Deferred Revenue Account: Revenues deferred on Current Liability until recognized.

Generate Entries: Odoo automatically generates deferral entries when posting a customer invoice, but users can manually generate them by selecting the Manually & Grouped option.

* Amount Computation: you can compute the invoice based on different computation methods and defer over certain durations, such as the ‘Equal per-month’ computation and the ‘Based on days’ computation, accounting for varying amounts based on the number of days.

If the Generate Entries field is set to On invoice/bill validation, Odoo automatically generates deferral entries upon invoice validation. After setting the required information, save the settings and move on to the next step.

Create a New Invoice

To check the functionality of calculating deferred income computations, we can start creating a new customer invoice from the ‘Invoice’ window of the ‘Customers’ menu.

From the invoices dashboard, open a new invoice configuration form and start editing the form fields such as Customer Name and Invoice Date. then the other fields including Delivery Address, Due Date, Journal, etc will be automatically filled out according to the customer’s data and invoicing date as shown below.

Next, ensure the ‘Start Date’ and ‘End Date’ fields are visible in the ‘Invoice Lines’ tab, usually in the same month as the Invoice Date.

Then, by selecting the “Add a line” option, you may include the invoice goods in the “Invoice Lines” tab. Adding the invoice products will show the journal items in the ‘Journal Items’ tab, and also you can set any other invoice details inside the ‘Other Info’ tab. Finally, save the form data and confirm the invoice using the ‘Confirm’ button.

The invoice amounts are moved from the Deferred Account to the Income Account on the same day as the invoice, with subsequent deferral entries moving the invoice amounts monthly to recognize revenue.

The Generate Entries field in Odoo is automatically set to On invoice/bill validation inside the configuration settings, which triggers the generation of deferral entries smart button at the top of the form. Press the ‘Deferred Entries’ smart button to see these entries.

This deferred entries window will show the detailed dashboard of all the deferred journal entries with their Date, Journal Entry, Partner, Label, Taxes, Debit, Credit, etc, as shown below.

You can choose any deferred journal entries, reconcile them, and create assets using the Reconcile and Create Asset buttons, respectively. The ‘Action’ menu can be used to export, duplicate, delete, unreconciled, change period, etc.

Deferred Revenue Reports

Odoo provides various reporting tools inside its ‘Reporting‘ menu. So, we can access or generate reports such as profit and loss statements or balance sheets to view the impact of deferred income on your financials using the ‘Deferred Revenue’ reporting window.

We can generate deferred revenues based on Last Month, Last Quarter, Last Financial Year, This Month, This Quarter, and This Financial Year. Regularly review deferred income entries to ensure accurate financial reporting. We can also make adjustments as needed, especially if there are changes in the expected delivery date of goods or services, using the various filtering buttons provided at the top of the page.

Clicking on the ‘Settings’ icon provided on the right side of the page can be used to configure or generate new reports using the displayed Deferred Revenue Reports configuration form, as shown below.

Upholding accounting rules and keeping correct financial records depend on the efficient management of delayed revenue. Odoo 17’s accounting module streamlines this process, offering businesses the tools they need to handle deferred income seamlessly. By following the steps outlined in this guide, businesses can ensure that their financial reports reflect the true state of their revenue, contributing to better decision-making and financial management.