The lowest denomination of the smallest coin is greater than the minimum account unit is cash rounding. In some cases, transactions become difficult due to the low denomination. When coins are unavailable to transact the correct price, firms rely on cash rounding in these instances. With the assistance of ERP software, you can handle daily cash rounding in various transactions. It increases the speed and accuracy of the cash rounding procedures. The cash rounding feature of the Odoo 15 Accounting module enables users to manage business firms.

This blog ensures users manage cash rounding in the Odoo 15 Accounting module.

You can configure accounting periods, review taxes and add a bank account using Odoo 15 Accounting. Cash rounding assists vendors in rounding off costs after making a cash installment. We can quickly manage cash rounding for various countries using the Odoo 15 Accounting module. For example, some companies in a specific country round up the invoice amount to five cents after the payment is made in cash. Now, let’s see how to configure cash rounding in a US company with the support of Odoo ERP.

To Activate Cash Rounding from Odoo 15 Accounting Settings

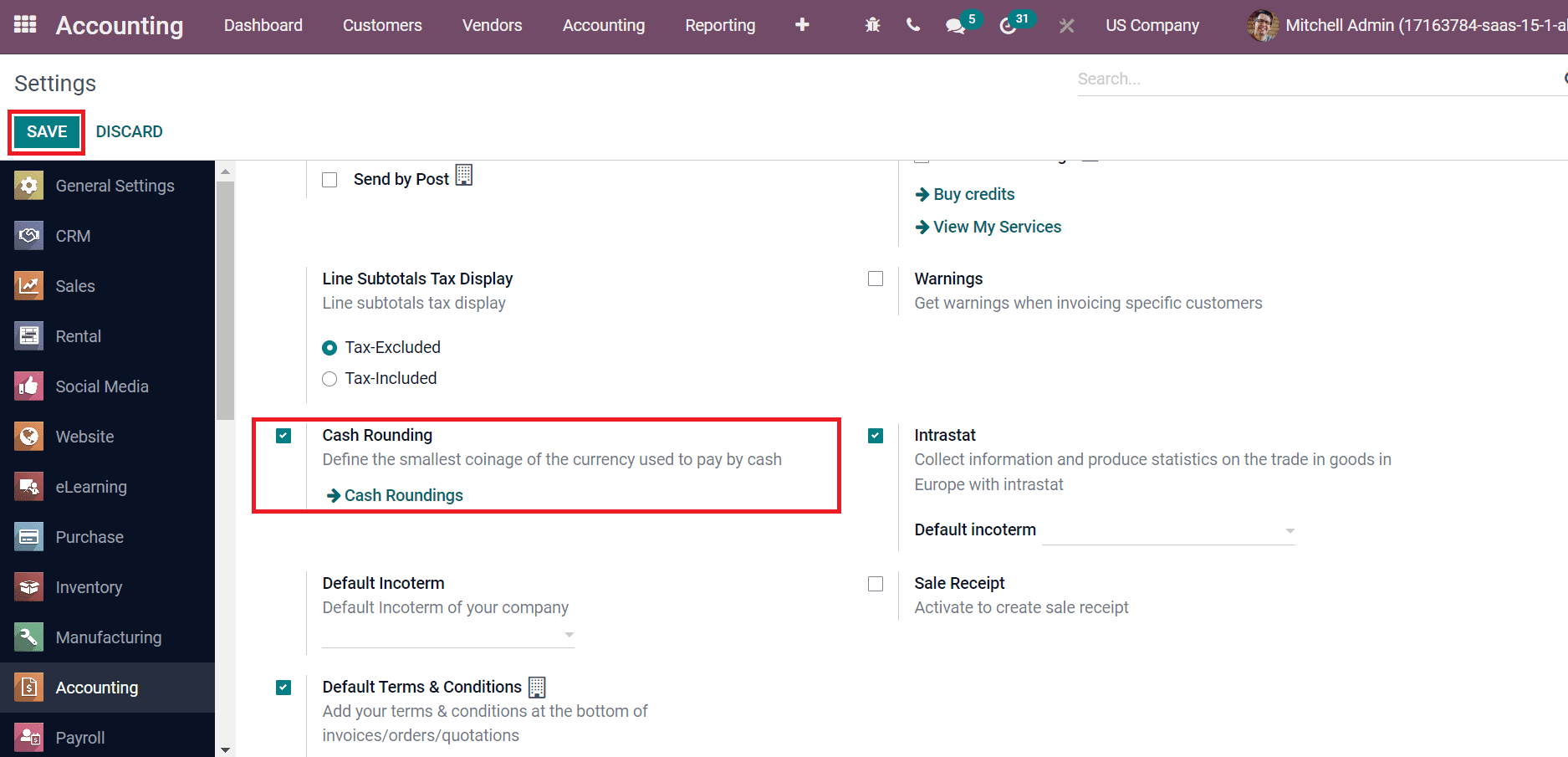

Cash rounding assists users in rounding the total bill amount of a company using the Odoo database. We need to activate this feature from the settings window of the Accounting module. Users can access the Settings menu from the Configuration tab and check out the Customer Invoices section. Enable the Cash Rounding option to consider the smallest currency coin to pay by cash, as mentioned in the screenshot below.

Click the SAVE icon to activate the cash rounding feature in Odoo 15 Accounting. Next, we can generate a cash rounding for a specific case.

Rounding Strategies in Odoo 15

Odoo supports two types of rounding strategies adding a rounding line and modifying tax amount. A rounding line applied on an invoice is Add a Rounding Line strategy, and you need to specify cash roundings for particular account records in this case. Another one is to Modify the Tax amount on a rounding applied to the taxes section. Now, let’s view details about each strategy.

Add a Rounding Line

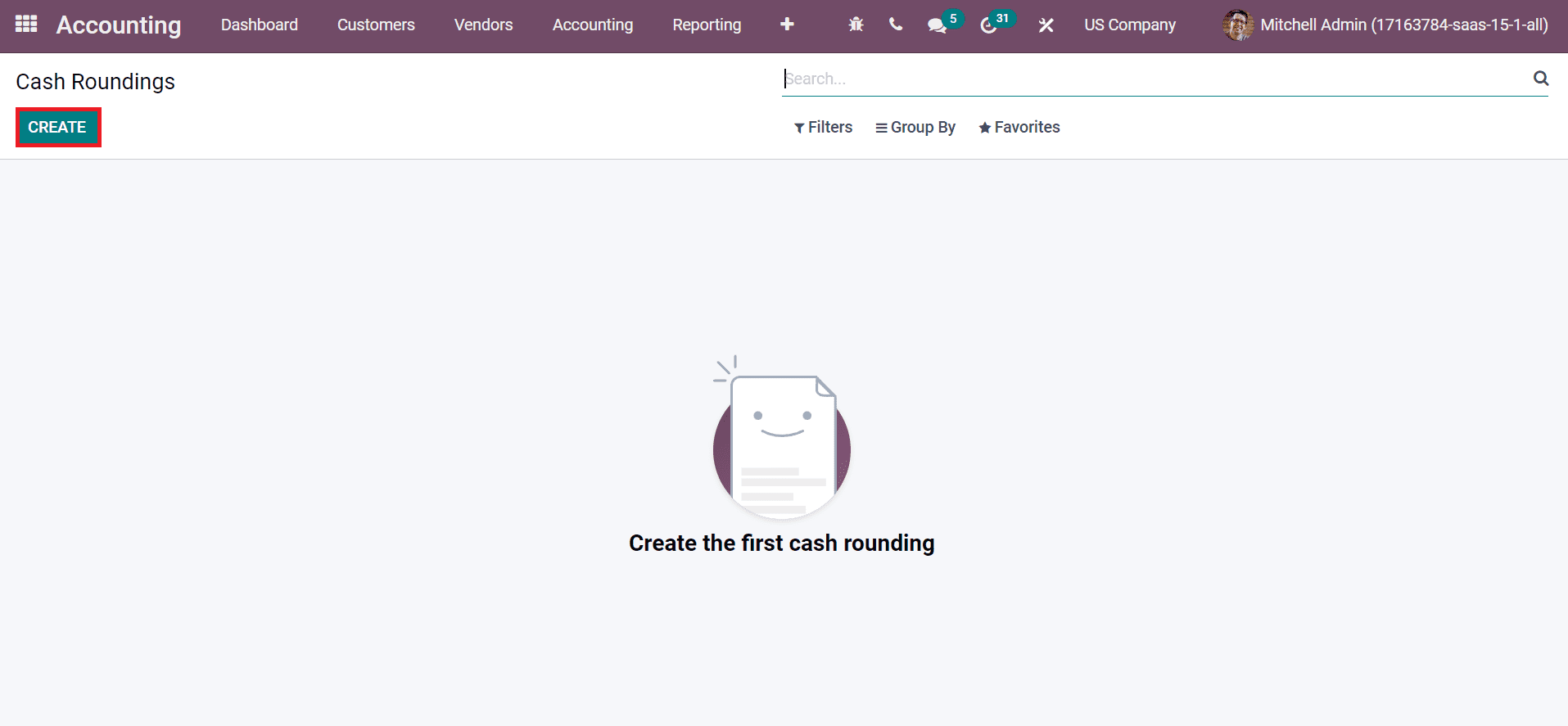

We need to formulate a cash rounding before using the add a rounding line strategy. Choose the Cash Roundings menu in the Configuration tab and select the CREATE button as specified in the screenshot below.

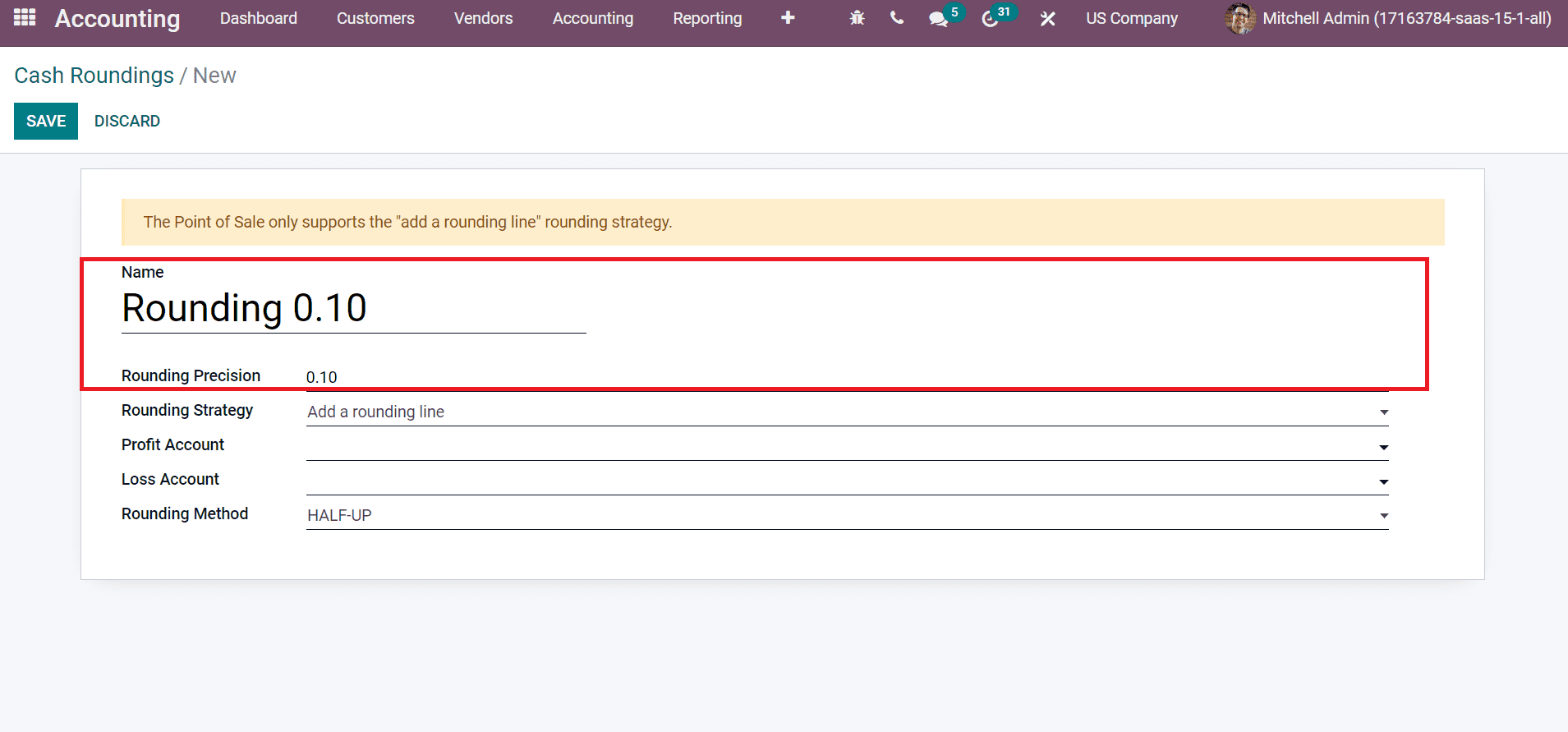

In the new window, enter the rounding name as Rounding 0.10 in the Name field, and Rounding Precision is a non-zero value of the smallest coin as described in the screenshot below.

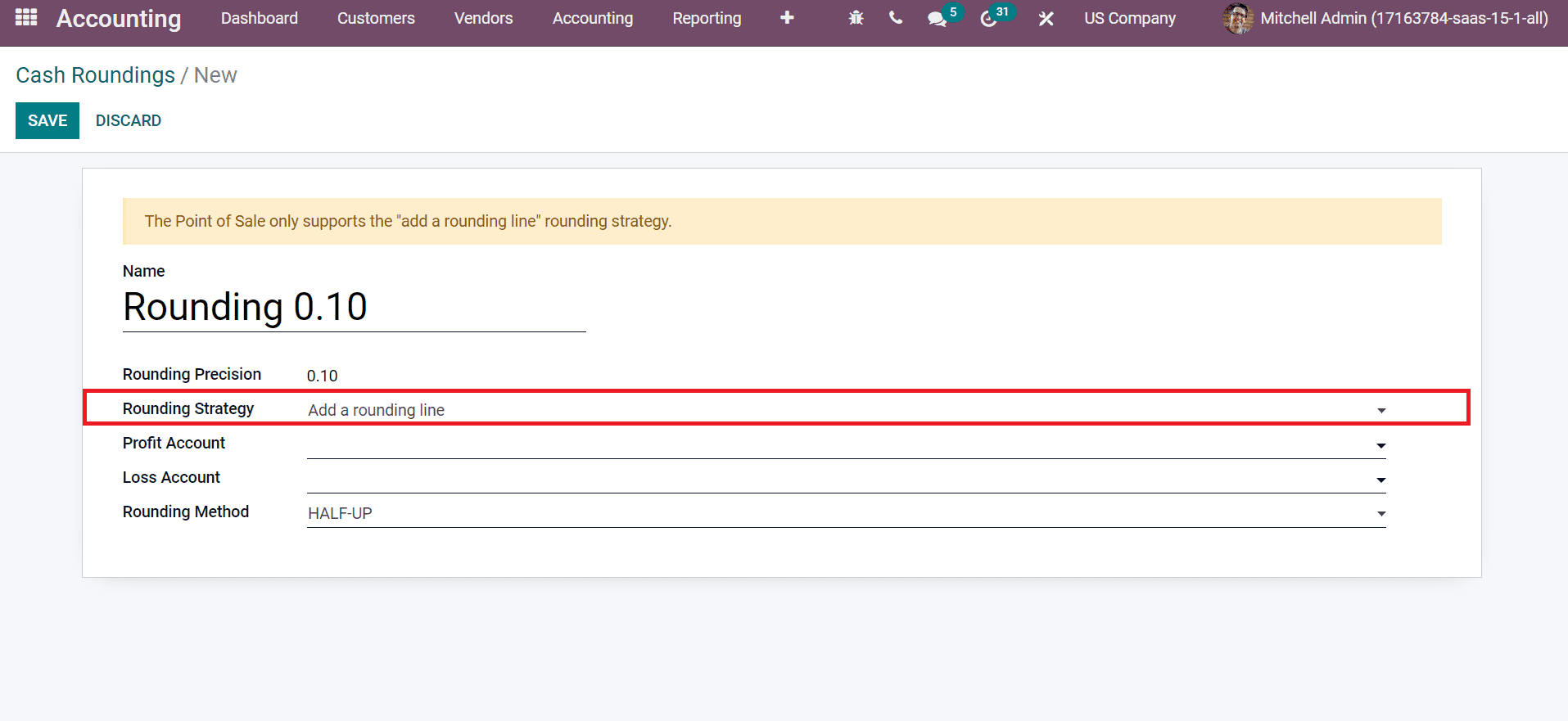

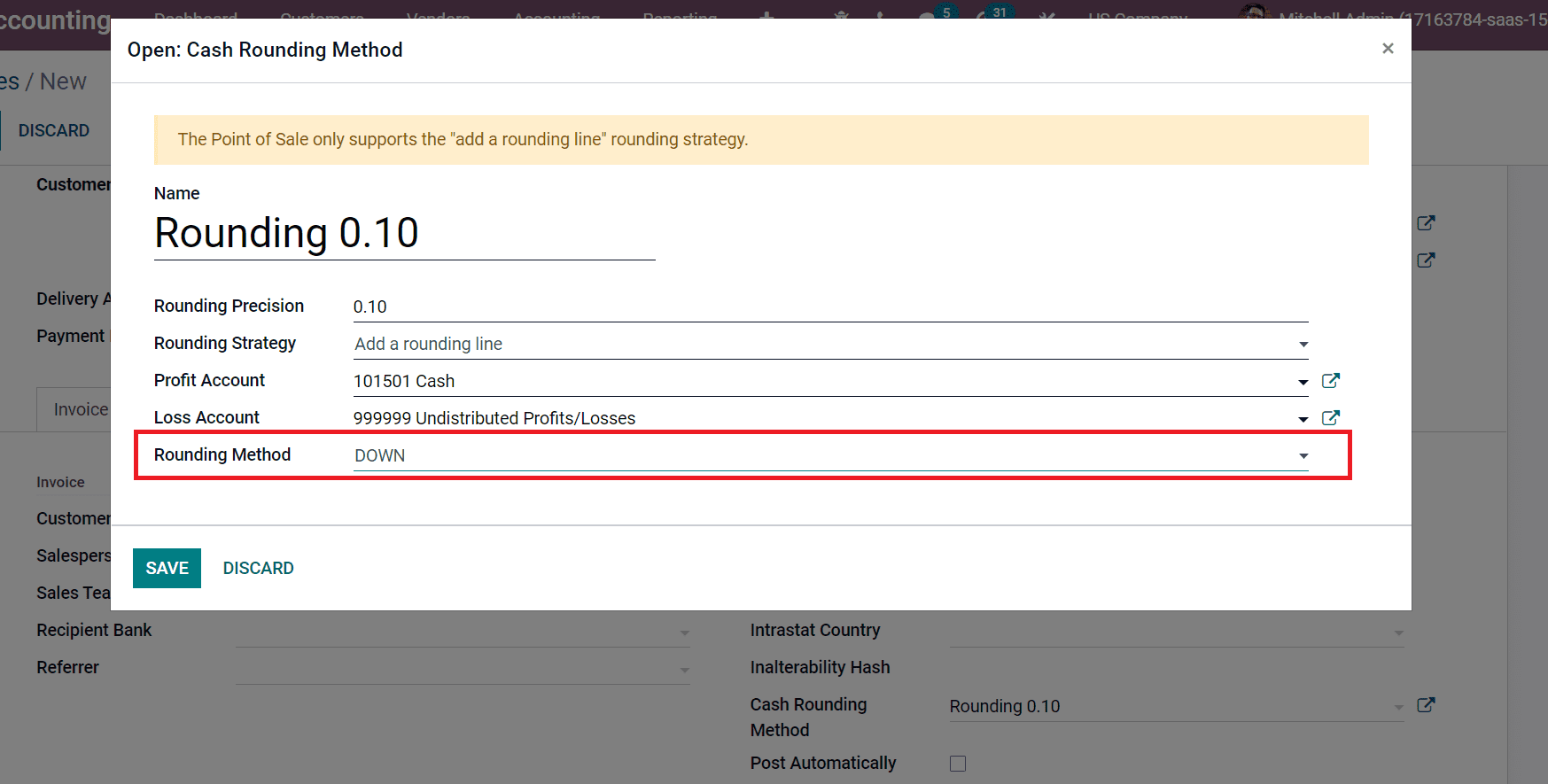

A numerical value denotes a digit number is a precision, and the digits include the right and left of any decimal points. We can do the cash rounding in two ways: Modify the tax amount and Add a rounding line. Next, you can set any of these methods inside the Rounding Strategy field and assist you in rounding the invoice amounts by Add a rounding line option as marked in the screenshot below.

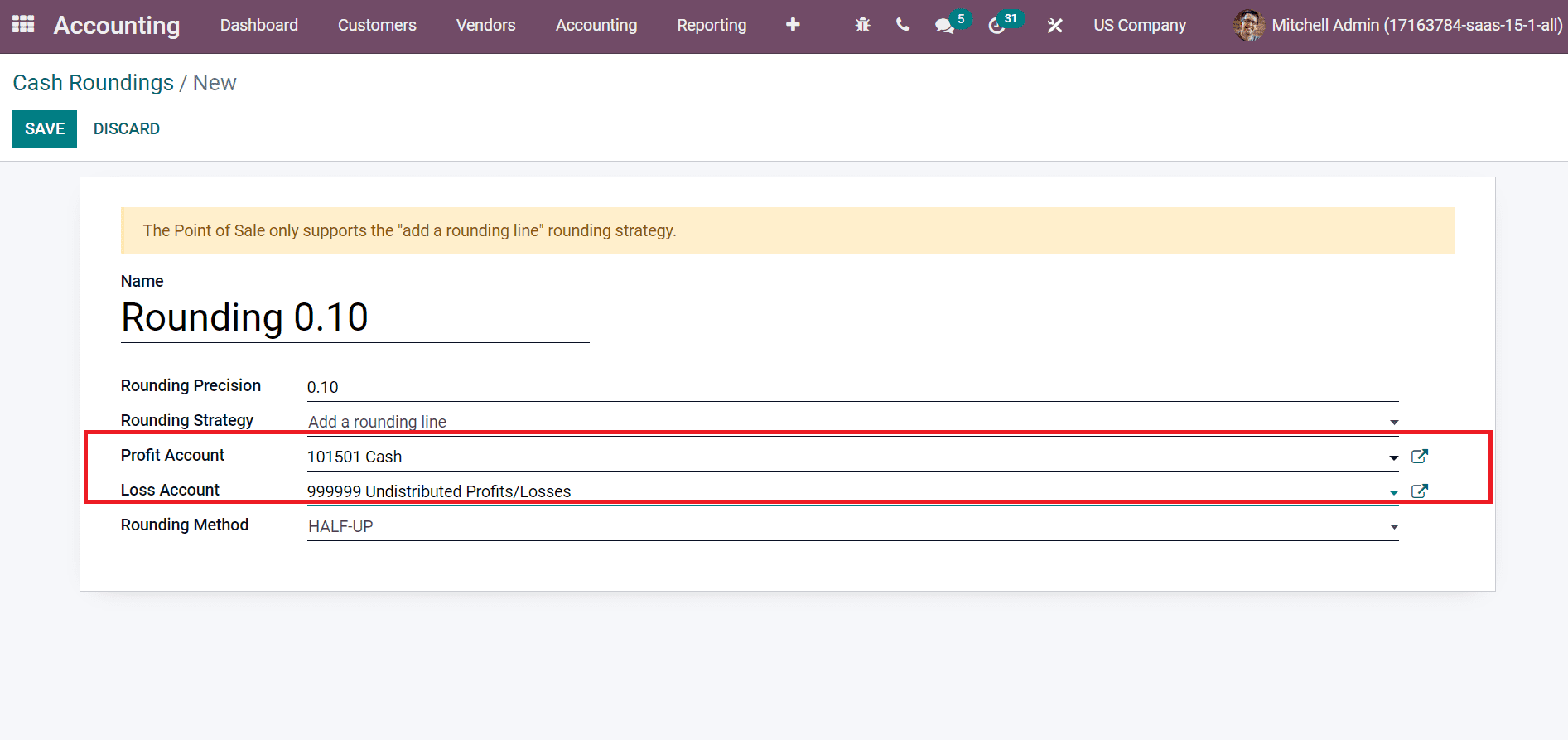

We can choose a Profit Account and Loss Account for the Cash Roundings of a company. The values set for these accounts are company-specific, as demonstrated in the screenshot below.

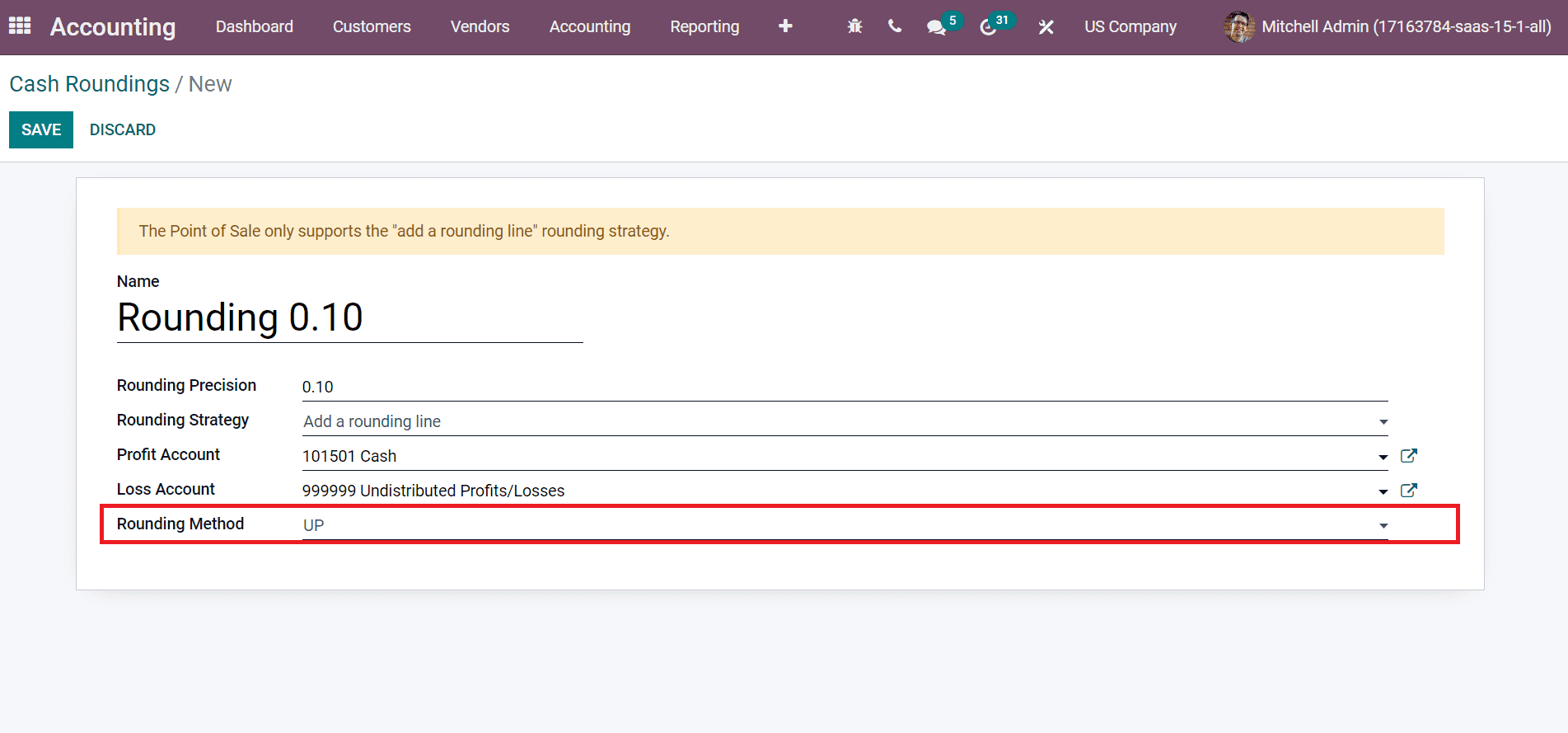

Three types of rounding methods for cash rounding are available in Odoo. Firstly, the round value for plus infinity as per the rounding precision is a UP method. The second one is DOWN, a minimum value rounded based on the accuracy of rounding. Finally, HALF-UP is a value greater than or equal to 0.5. We set the Rounding Method as UP for the specific cash rounding presented in the screenshot below.

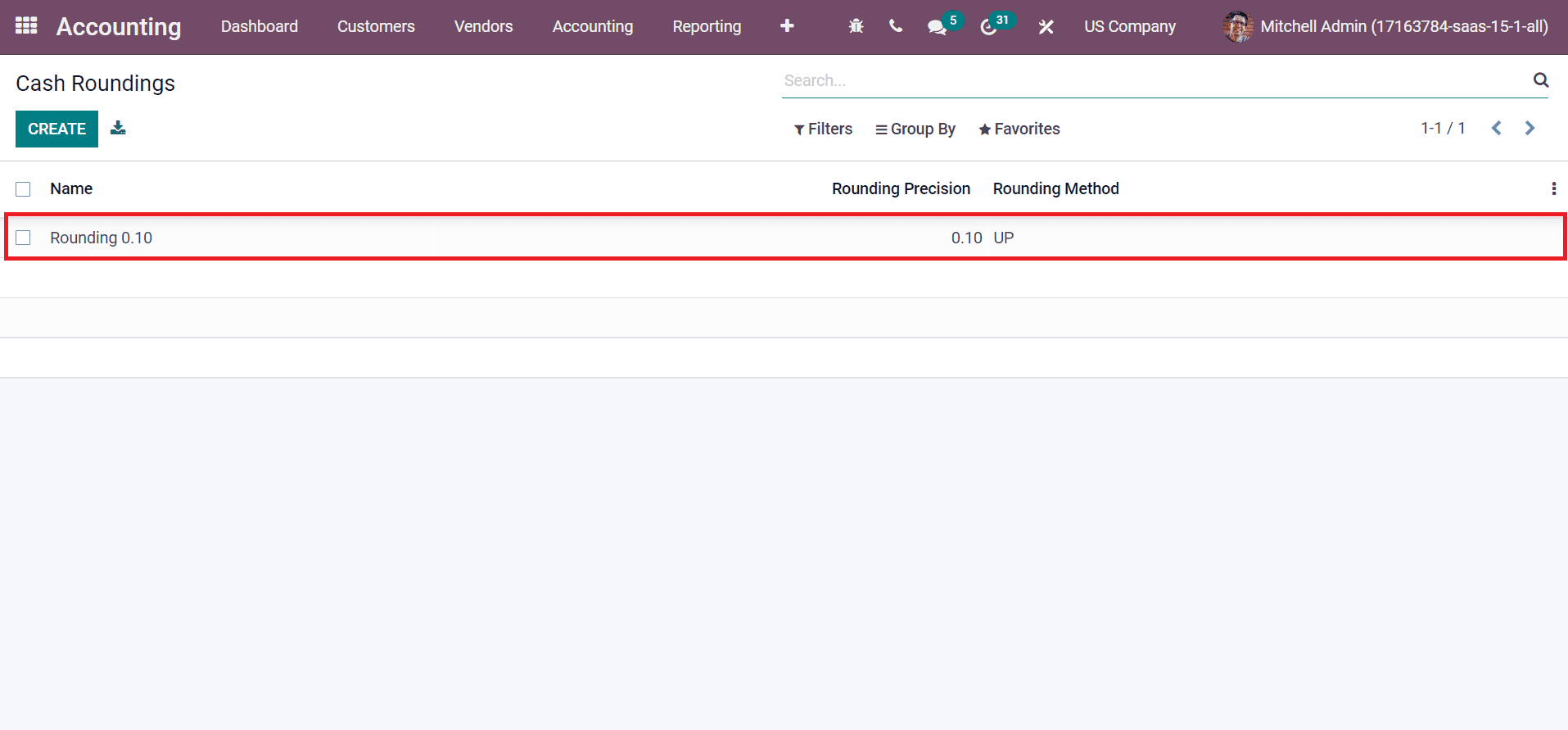

After saving the data, you can access created rounding from the Cash Roundings window, which denotes the details such as Name, Rounding Method, or Rounding Precision.

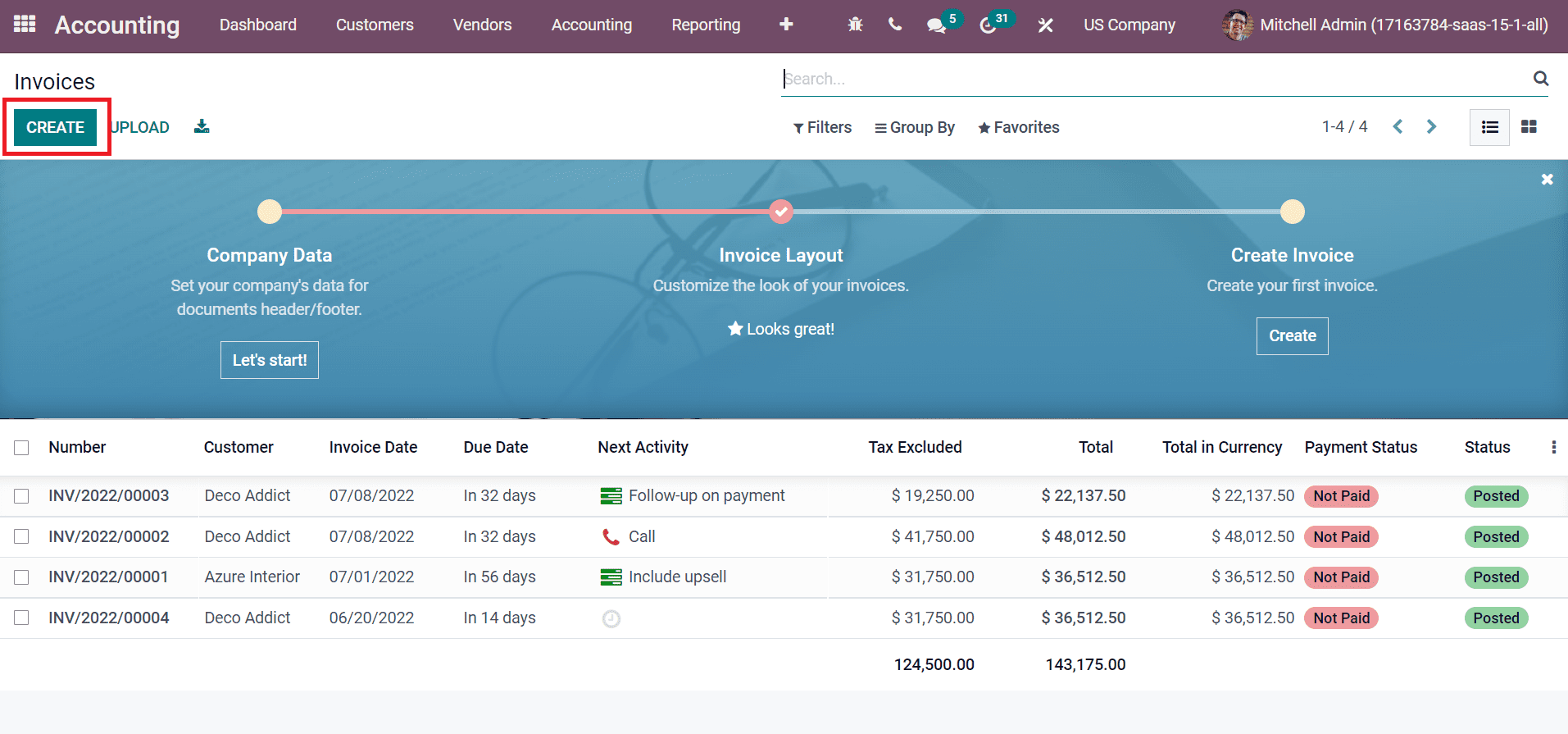

Now, let’s generate a customer invoice for the Add a rounding line strategy in Odoo 15. Choose the Invoices menu in the Customers tab, and all your company invoices are accessible here, as portrayed in the screenshot below.

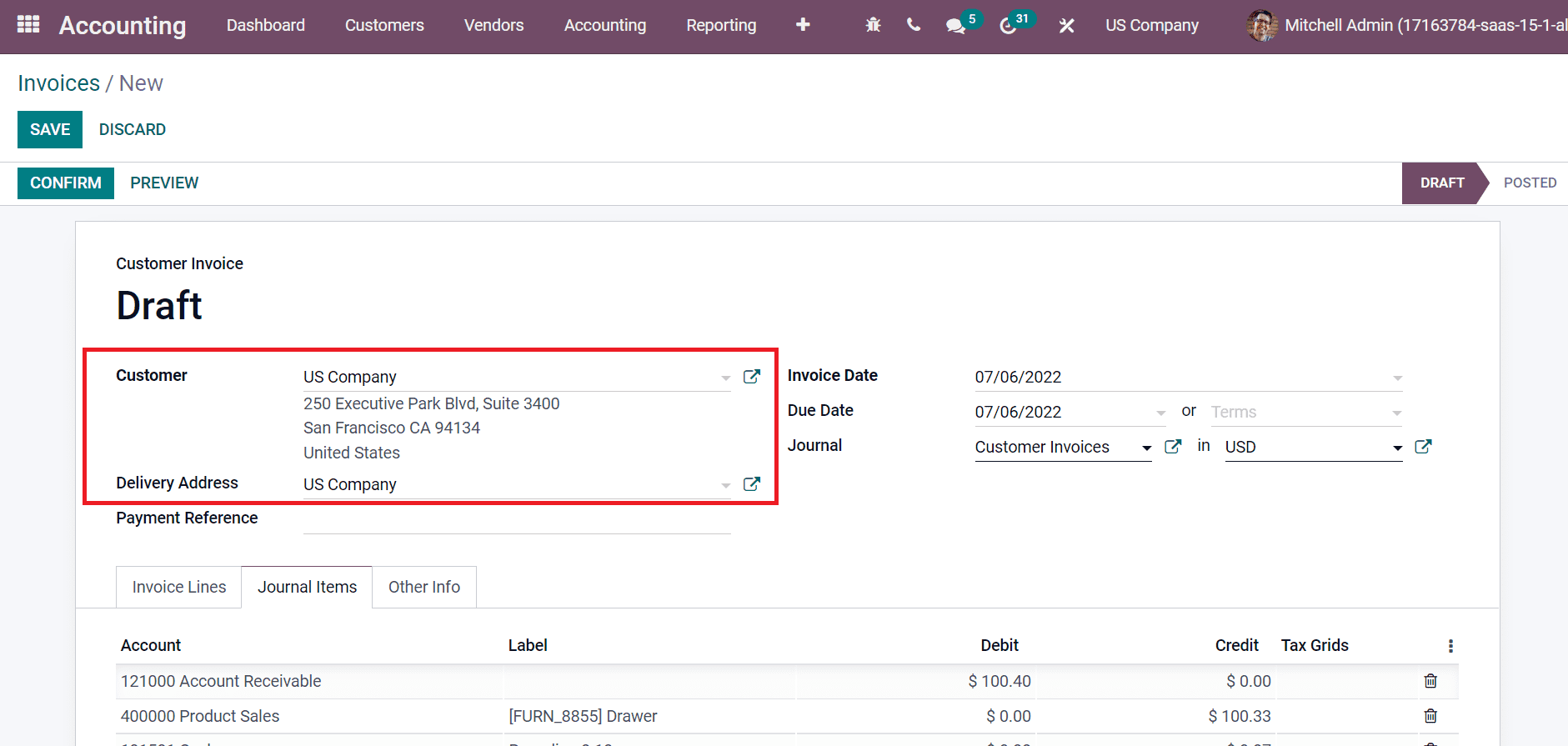

The invoices window shows the details of each invoice, including Customer, Tax Excluded, Total, Status, Invoice Date, and more. You can apply a new invoice for a customer by clicking the CREATE button, as shown in the screenshot above. In the new Invoices window, enter your customer as a US Company, and the address for your recent customer is automatically visible in the Delivery Address field, as marked in the screenshot below.

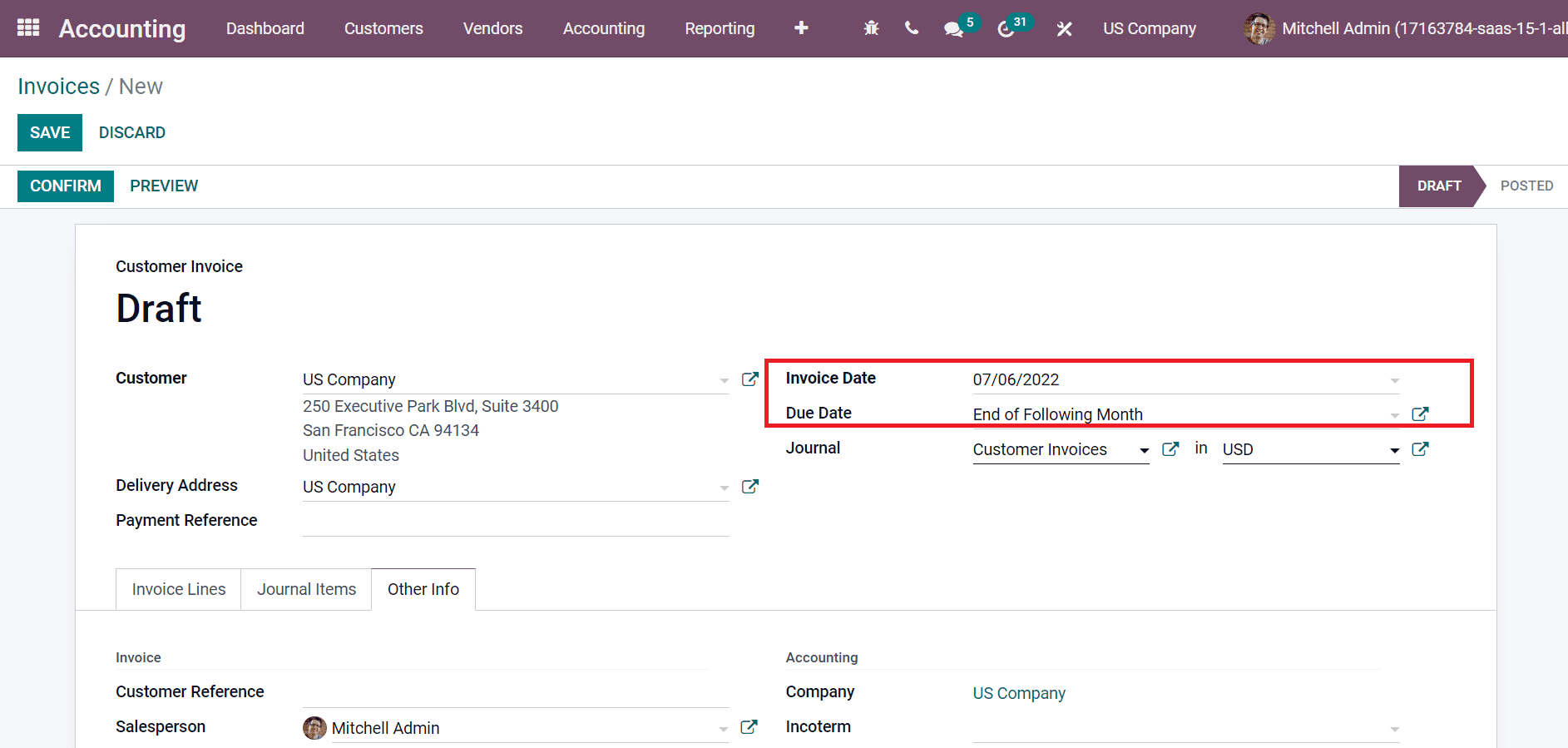

Later, pick your official record date of the transaction in an Invoice Date field and your expected bill date in the Due Date field.

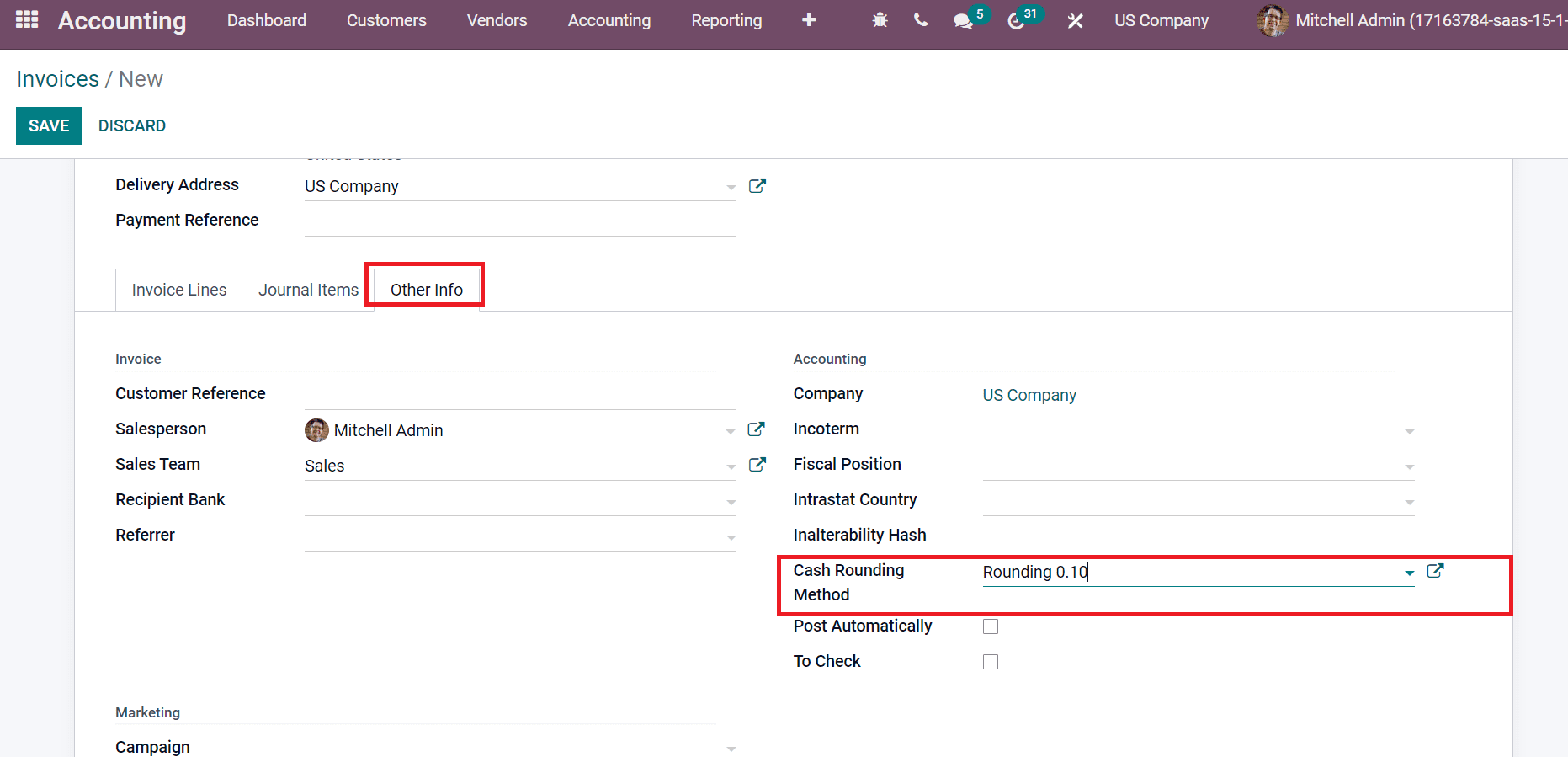

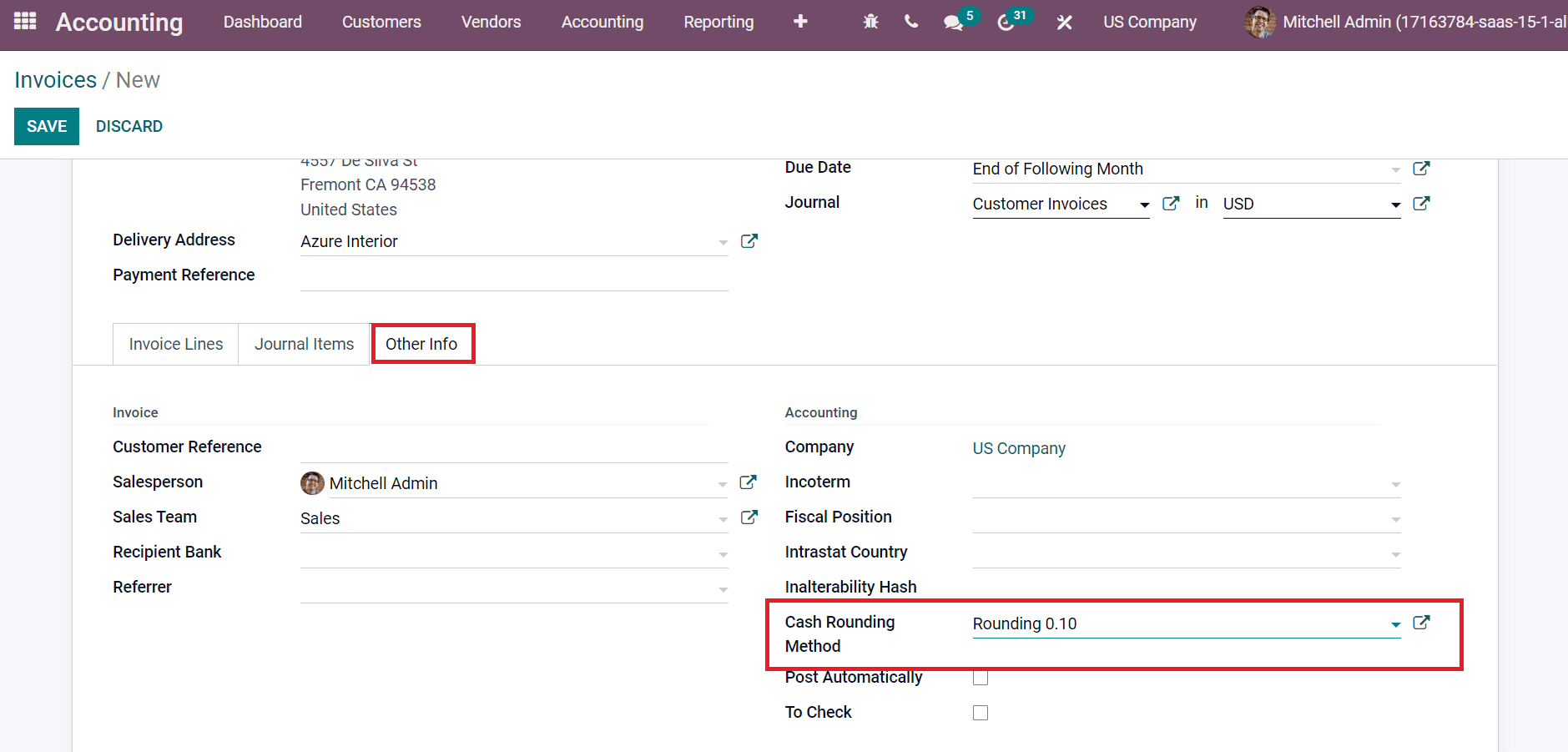

Next, we can select the cash rounding method below the Other Info tab. Choose the Rounding 0.10 inside the Cash Rounding Method field inside the Accounting section, as illustrated in the screenshot below.

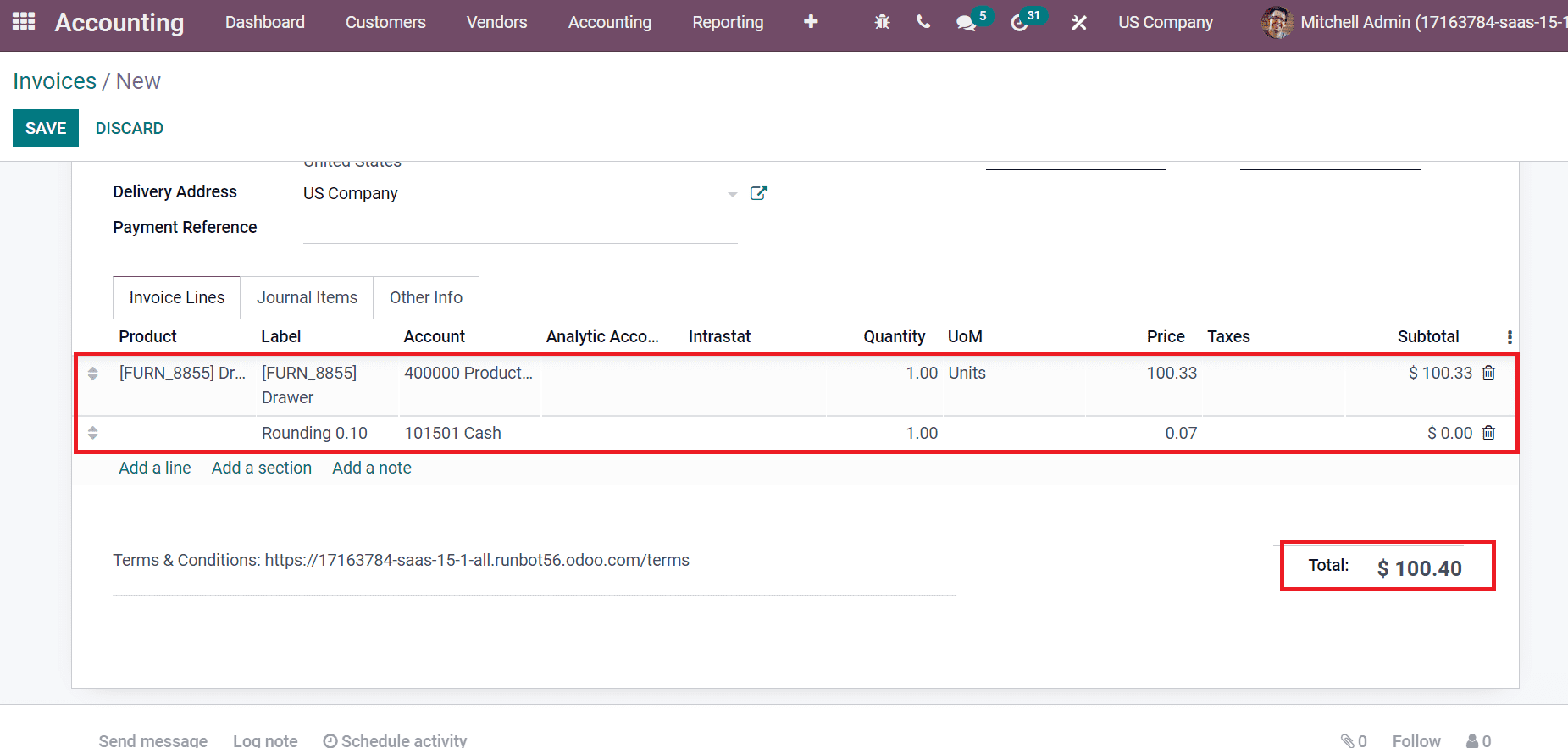

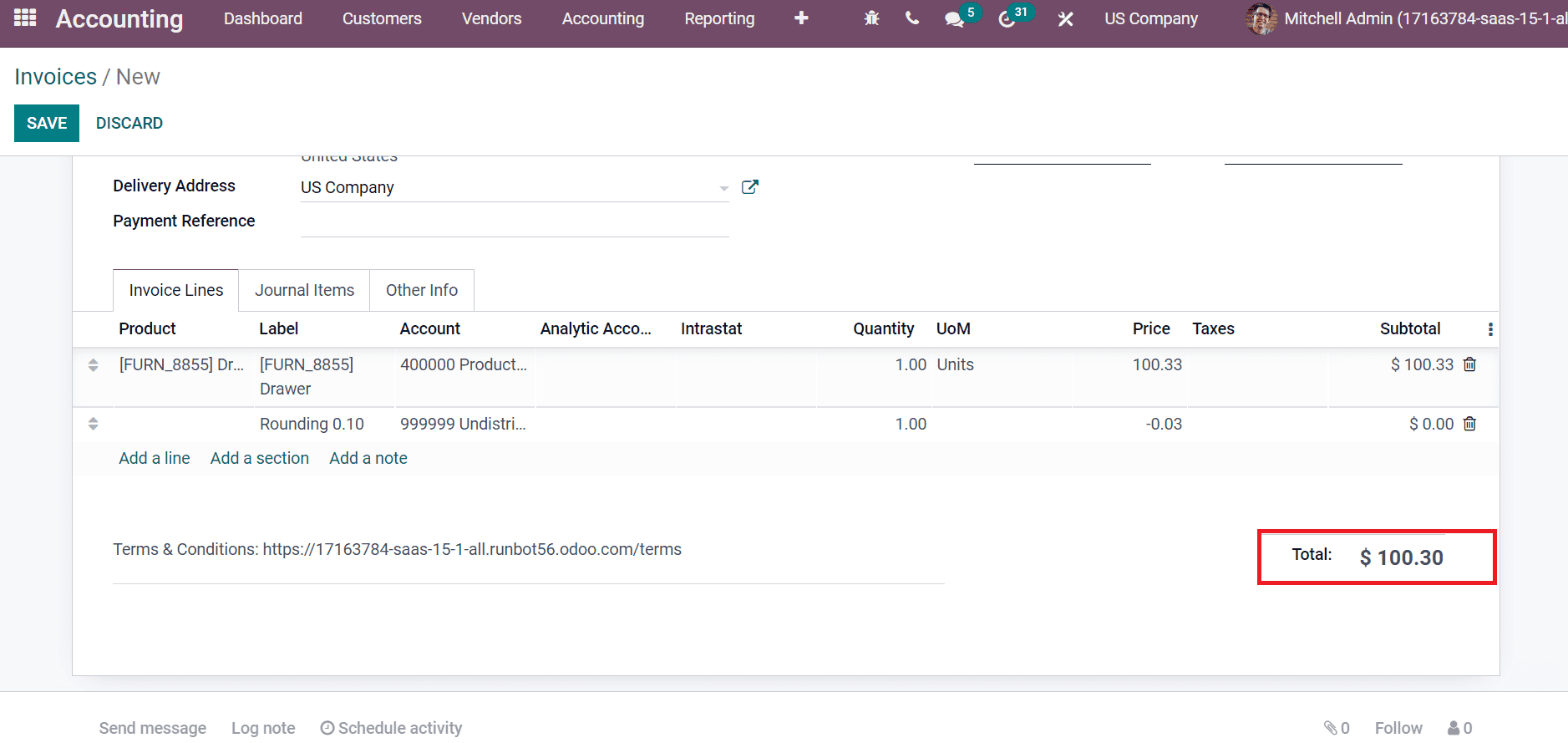

Users can also add products for customer invoicing below the Invoice Lines tab. By clicking on Add a line button inside the Invoice Lines tab, you can quickly apply new commodity information for the invoice. We choose the product Drawer below the Invoice Lines tab, and the Rounding method is manually visible, as in the screenshot below.

The above screenshot shows that the Untaxed amount of $100.33 rounded up to $100.40. We can change the Rounding Method as DOWN to see the amount of difference. Set the Rounding Method as Down in the Cash Rounding Method window.

After saving the method, look at your total amount below the Invoice Lines tab, and you can see a negative infinity on rounding added for the product.

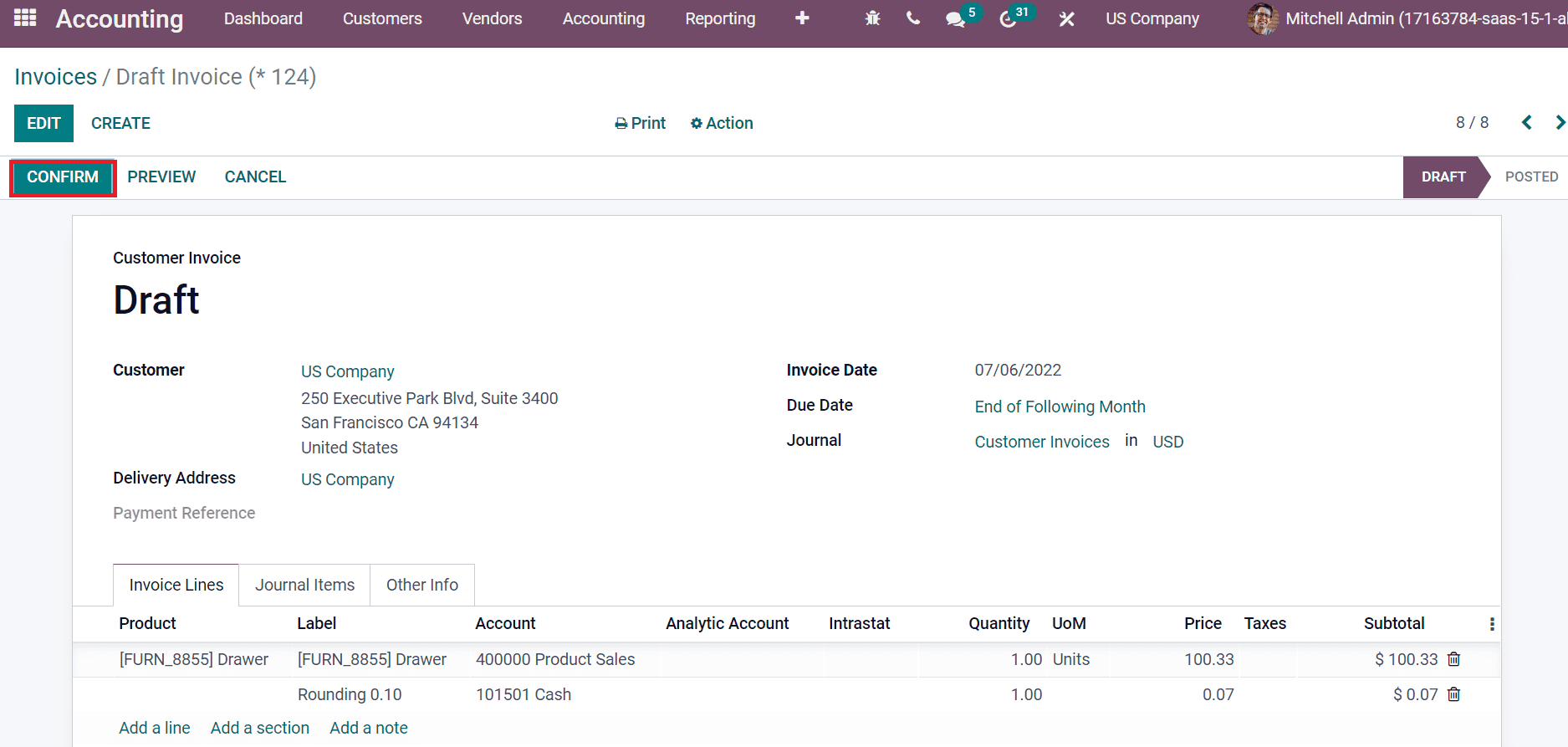

Here, the total price rounded from $100.33 to $100.30 when we choose the DOWN method. After choosing your specific rounding method, you can save the invoice for a customer. We select the UP rounding method for a particular customer US company and verify it by selecting CONFIRM icon in the Invoices window.

Hence, it is easy to round up an invoice amount and confirm the invoices based on the cash rounding method. It is beneficial for a business to manage the number of decimal currency units.

Modify Tax Amount

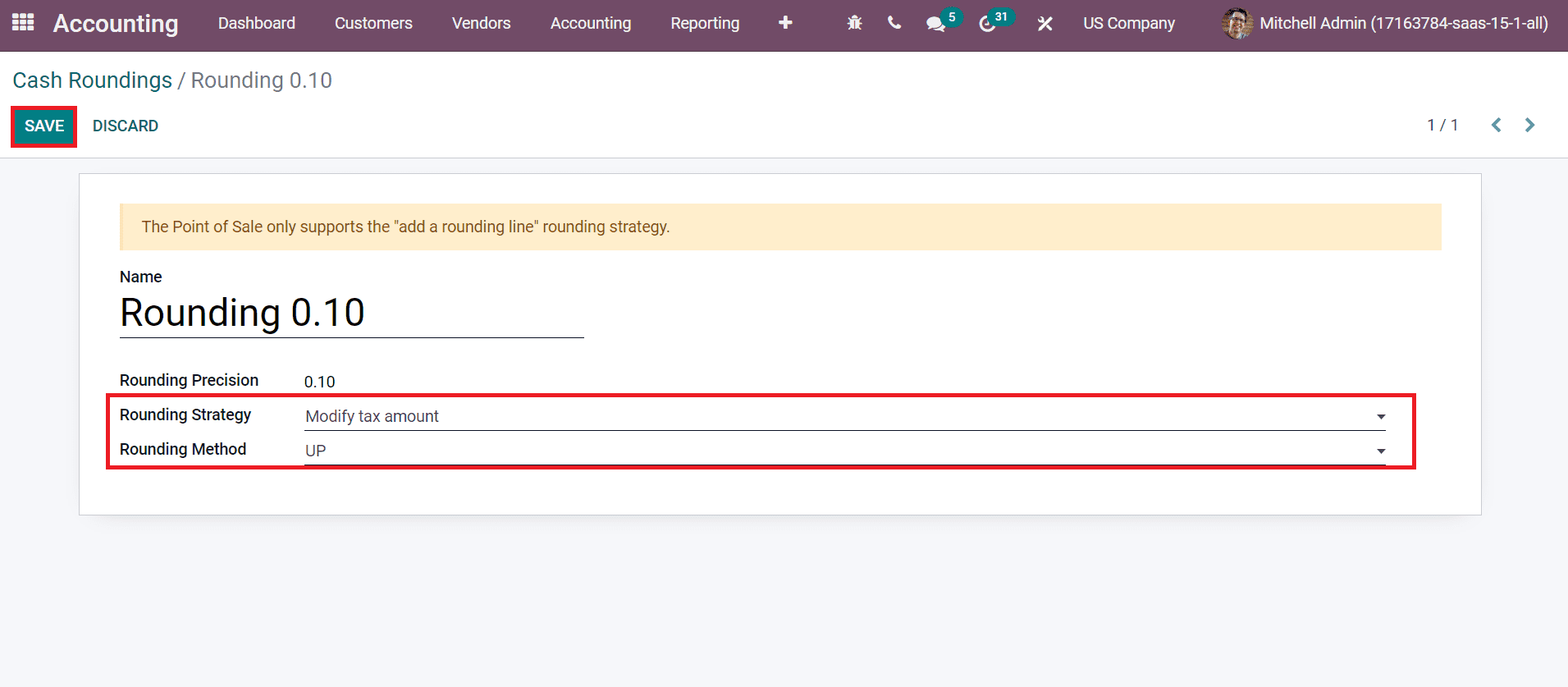

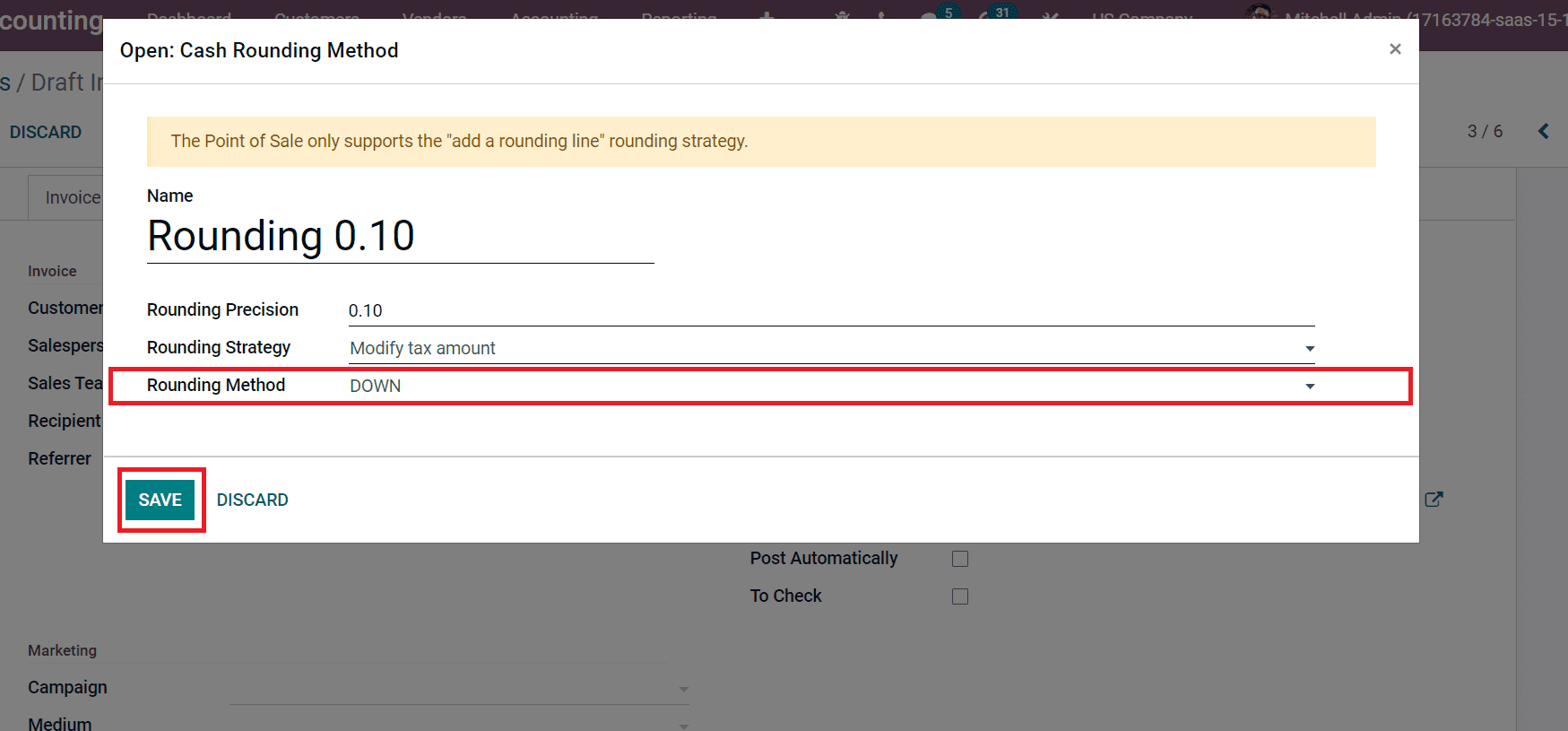

Rounding applied for a tax section is a Modify Tax Amount considered a cash rounding strategy. Users need to generate a cash rounding as Modify Tax Amount method from the Cash Roundings window. Choose your Rounding Strategy as Modify Tax Amount and Rounding Method as UP.

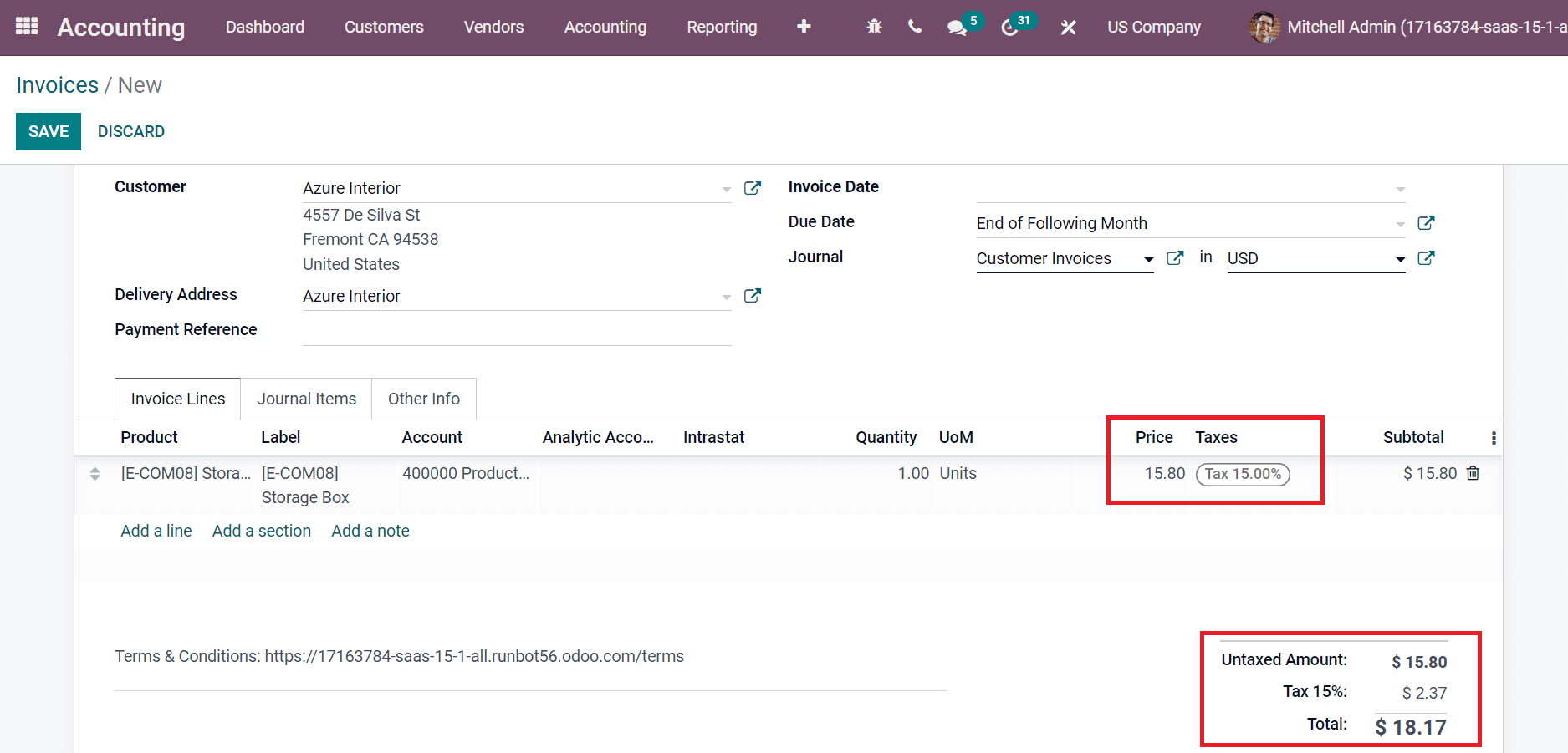

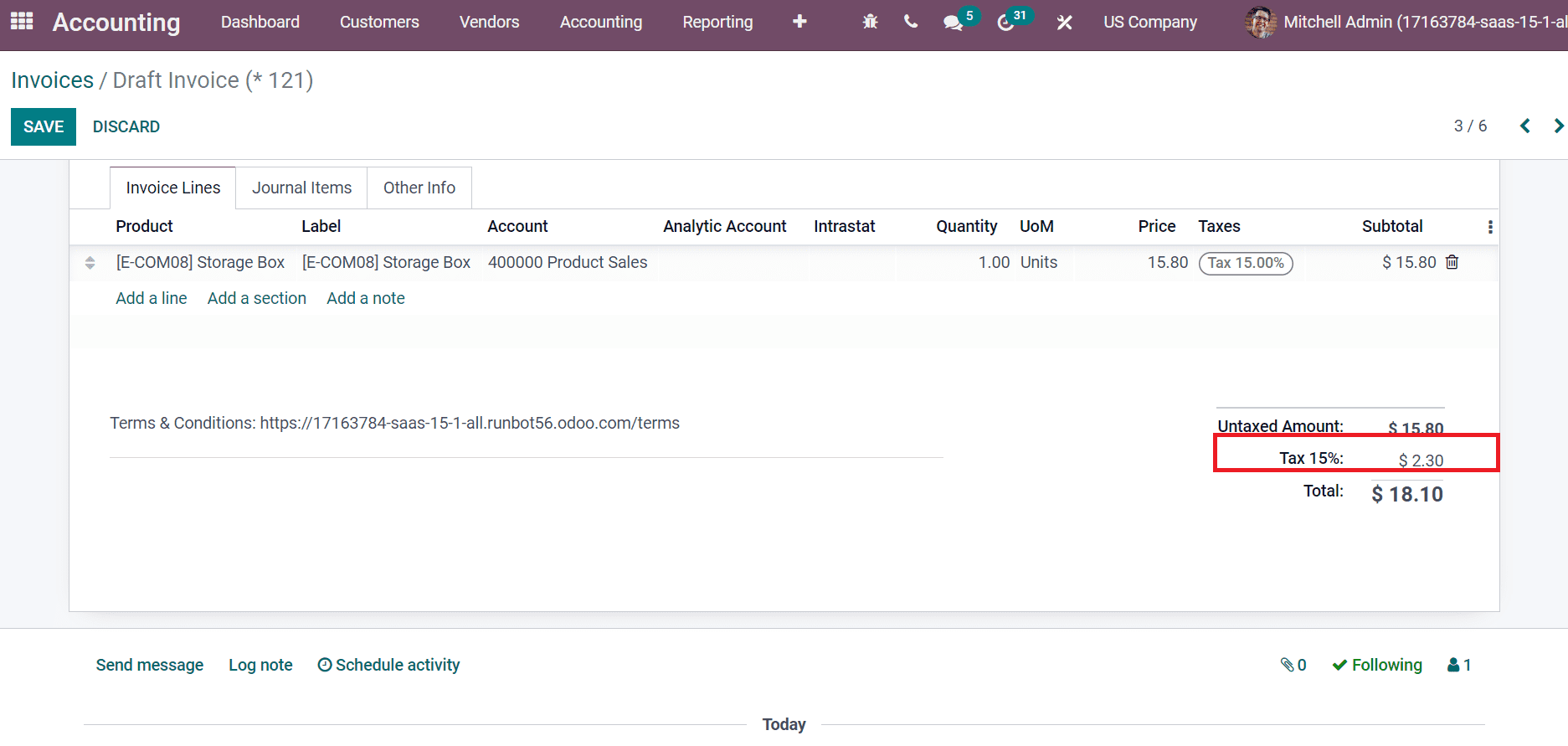

Select the SAVE icon to access Modify Tax amount rounding strategy for cash rounding in your company. Now, we can process a customer invoice with a tax from the Customers tab. Before adding the rounding method, you can select a product and view its tax.

After that, choose your cash rounding method below the Other Info tab.

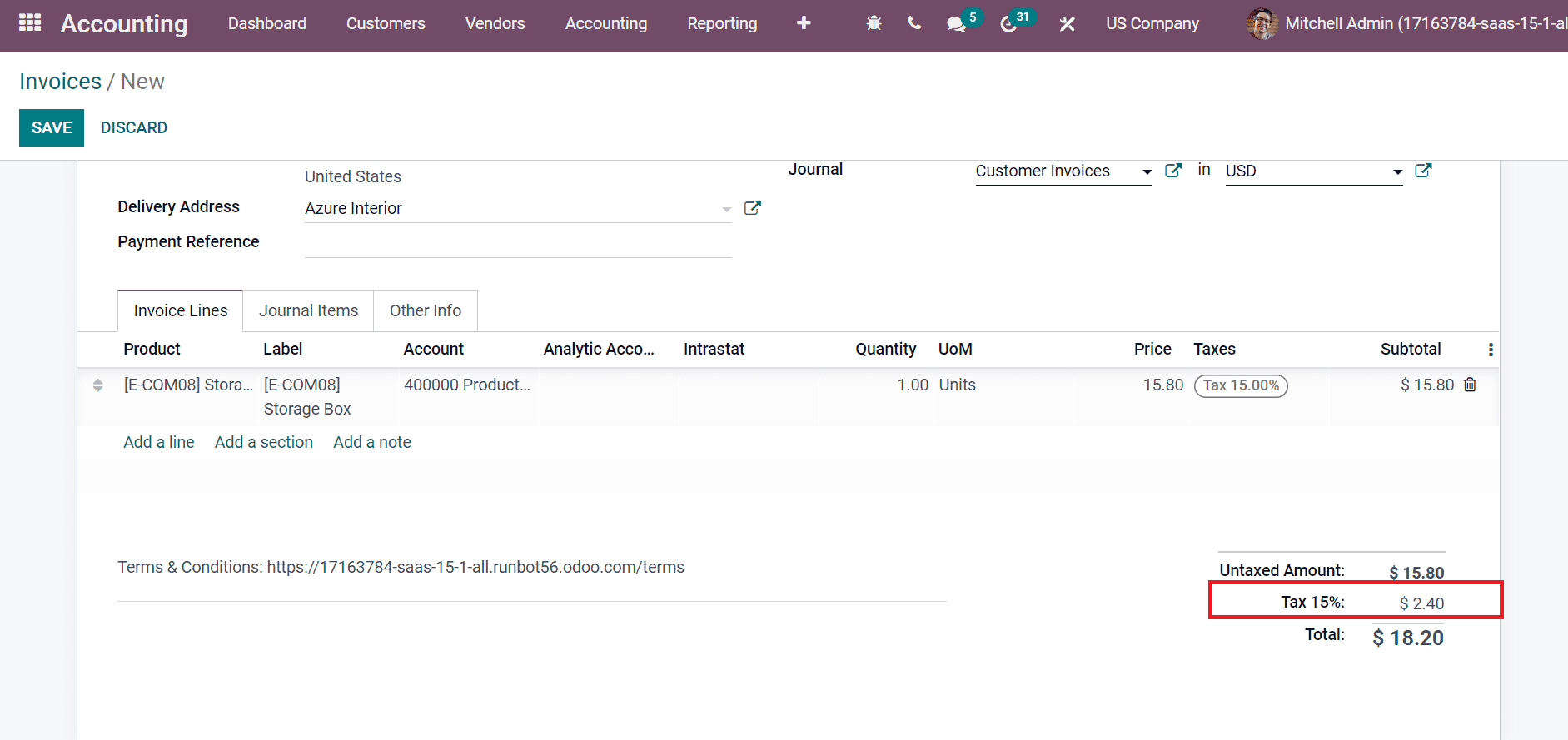

Next, you can move to the Invoice Lines tab and analyze cash rounding. The user can see that the tax amount of 2.37 changes into 2.40 after choosing the cash rounding method.

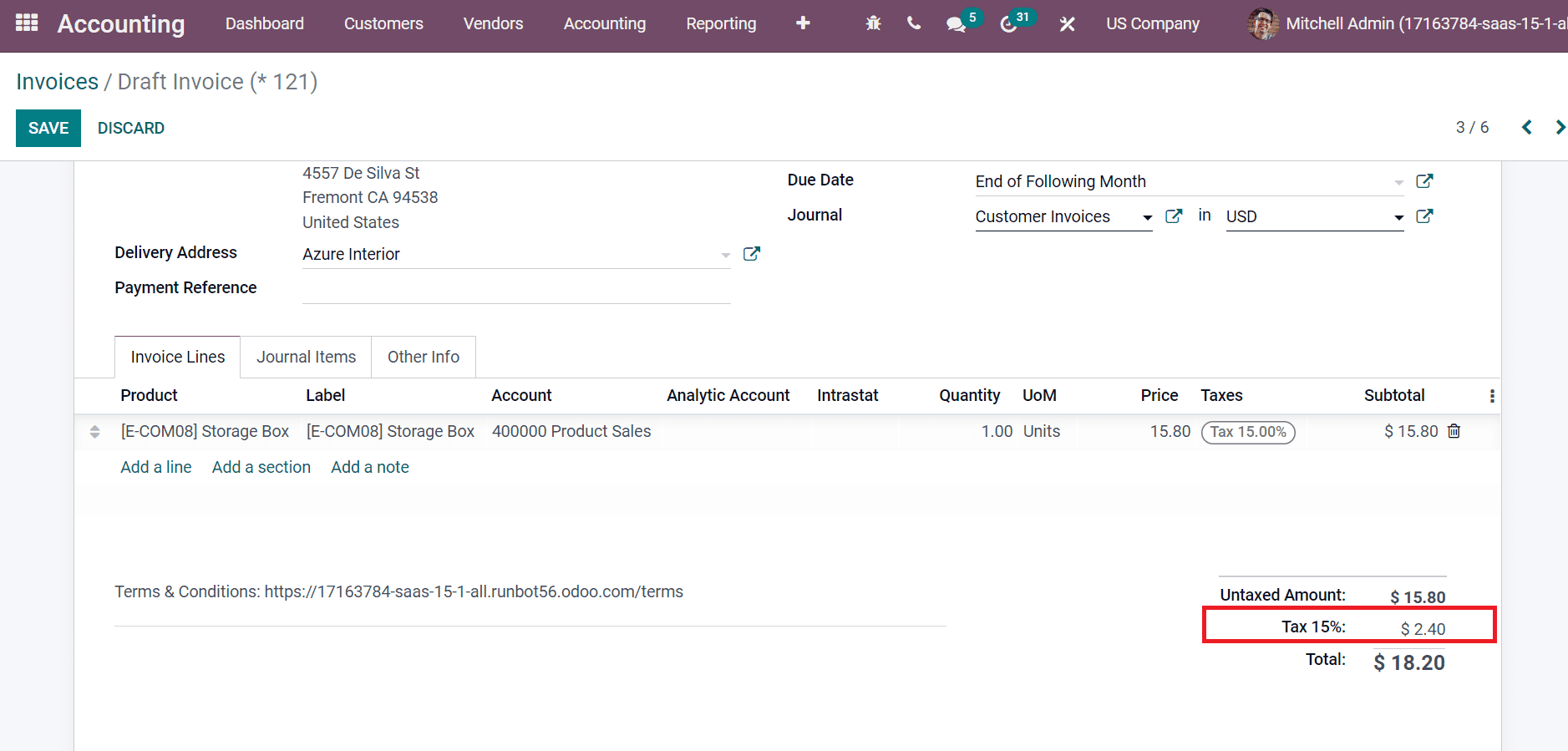

Now, we can change the rounding method to the DOWN method to see a difference. For that purpose, change your Rounding Method to DOWN and click on the SAVE icon.

By checking the Invoice Lines tab, you can see that the tax percentage of $2.37 changes to $2.30, as represented in the screenshot below.

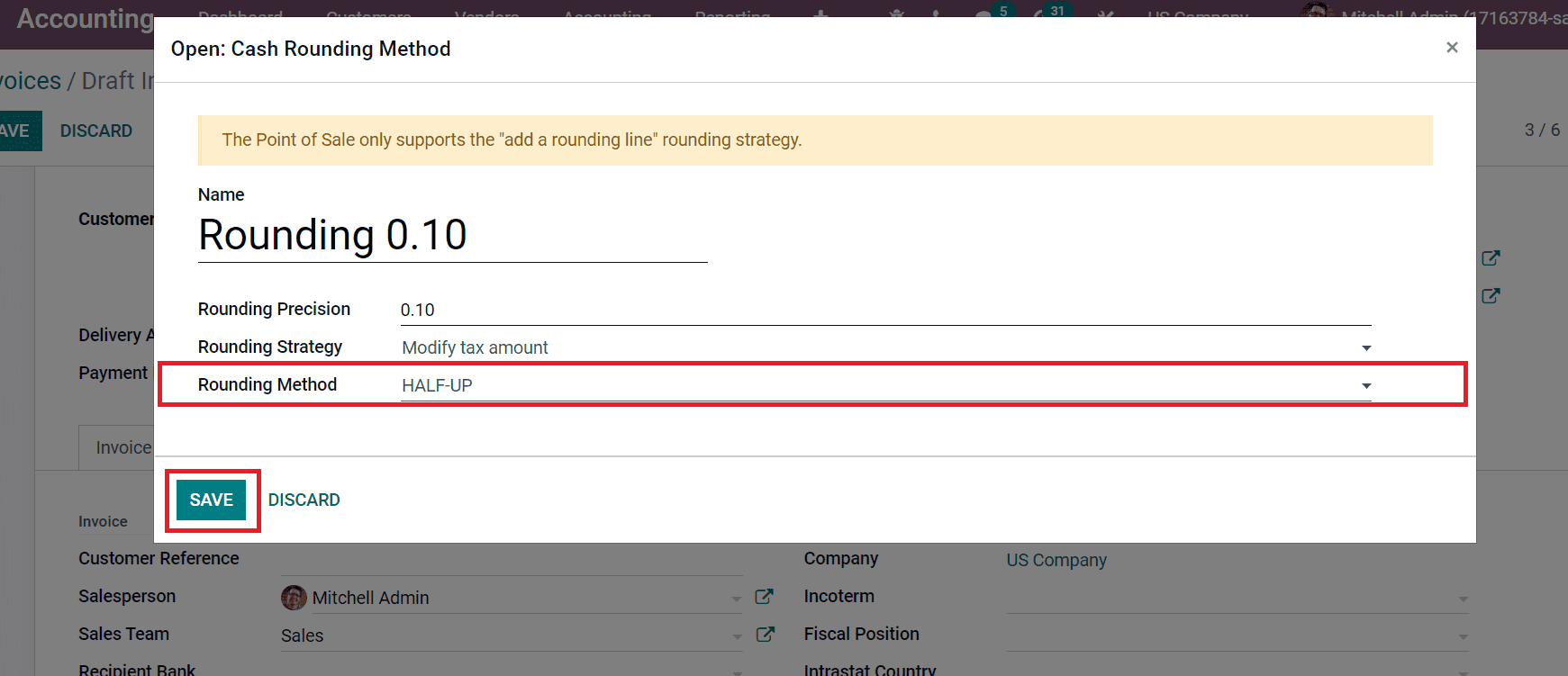

Next, we can apply the HALF-UP round-up method for your specific cash rounding. Pick up the HALF-UP option inside the Rounding Method field of the Cash Rounding Method page.

After checking inside the Invoice Lines tab, you can see that the tax rate is rounded up now.

Here, the invoice tax amount is rounded up as the highest tax-based amount on your particular rounding method.

Odoo 15 Accounting module assists you in configuring cash rounding in your business for various purposes. It is easy to manage cash rounding methods such as UP, DOWN, and HALF-UP for the cash rounding result. Check out the blog link to learn about Asset Management in Odoo 15 Accounting Module